Microsoft (MSFT)

Microsoft is a great business. Its ability to balance growth and profitability while maintaining a bright outlook makes it a gem.― StockStory Analyst Team

1. News

2. Summary

Why We Like Microsoft

Originally named "Micro-soft" for microcomputer software when founded in 1975, Microsoft (NASDAQ:MSFT) is a global technology company that develops software, cloud services, devices, and AI solutions for consumers, businesses, and organizations worldwide.

- Microsoft is one of the great brands not just in tech but all of business. It produces mission-critical software and bundles it together, resulting in cream-of-the-crop gross margins.

- The company's elite unit economics lead to robust profit margins that improve over time. This speaks to the scale advantages and operating efficiency across its diverse portfolio, which spans everything from Office and Azure to Minecraft.

- Microsoft has a virtuous cycle of returns. Its dominant market position enables it to generate strong free cash flow, and it reinvests these funds into promising ventures that further strengthen its competitive moat.

Microsoft is a standout company. The valuation seems reasonable relative to its quality, so this might be a good time to invest in some shares.

Why Is Now The Time To Buy Microsoft?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Microsoft?

Microsoft is trading at $407.40 per share, or 23.4x forward price-to-earnings. Valuation is lower than most companies in the software space, and we believe Microsoft is attractively-priced for its quality.

Our work shows, time and again, that buying high-quality companies and holding them routinely leads to market outperformance. If you can get an attractive entry price, that’s icing on the cake.

3. Microsoft (MSFT) Research Report: Q4 CY2025 Update

Technology giant Microsoft (NASDAQ:MSFT) reported revenue ahead of Wall Streets expectations in Q4 CY2025, with sales up 16.7% year on year to $81.27 billion. Its GAAP profit of $5.16 per share was 34.1% above analysts’ consensus estimates.

Microsoft (MSFT) Q4 CY2025 Highlights:

- Revenue: $81.27 billion vs analyst estimates of $80.32 billion (1.2% beat)

- Operating Profit (GAAP): $38.28 billion vs analyst estimates of $36.62 billion (4.5% beat)

- EPS (GAAP): $5.16 vs analyst estimates of $3.85 (34.1% beat, non-GAAP EPS was $4.14 excluding OpenAI impacts)

- Intelligent Cloud Revenue: $0.02 vs analyst estimates of $32.34 billion (1.8% beat, Azure constant-current growth of 38% year-on-year)

- Business Software Revenue: $34.12 billion vs analyst estimates of $33.46 billion (2% beat)

- Personal Computing Revenue: $14.25 billion vs analyst estimates of $15.77 billion (9.7% miss)

- Gross Margin: 68%, in line with the same quarter last year

- Operating Margin: 47.1%, up from 45.5% in the same quarter last year

- Free Cash Flow Margin: 7.2%, down from 9.3% in the same quarter last year

- Market Capitalization: $3.57 trillion

Key Topics & Areas Of Debate

AI is probably the hottest topic in the world of investing today, and the debate for Microsoft is simple. How big is the AI benefit, when will we see it flow into revenue, and how much will it cost from an operating expense and capital expenditure perspective?

Customers who pay for Microsoft’s products and services to enable their own GenAI goals will likely be buying infrastructure, developer tools, and data analytics platforms. Azure sits at the center of Microsoft’s AI ambitions, and it allows enterprise customers to do everything from accessing large language models (LLMs) to analyzing large volumes of data in real-time.

Aside from Azure, Copilot is a suite of AI-powered integrations into various Microsoft products to enhance productivity and streamline tasks. Microsoft 365 Copilot automates writing in Word, modeling in Excel, and email management in Outlook while GitHub Copilot, developed via a collaboration with OpenAI, automates code completion.

Despite its scale, Microsoft doesn’t operate in a vacuum. Alphabet (NASDAQ:GOOGL) competes against Azure with Google Cloud Platform and in productivity tools with G Suite and Google Workspace. Apple’s (NASDAQ:AAPL) macOS operating system also goes head to head against Microsoft’s Windows, and its iPhone and iPad products have been a thorn in its side. Lastly, IBM (NYSE:IBM), Oracle (NYSE:ORCL), SAP (XTRA:SAP), and many others compete with at least some subset of Microsoft’s product portfolio.

4. Company Overview

Originally named "Micro-soft" for microcomputer software when founded in 1975, Microsoft (NASDAQ:MSFT) is a global technology company that develops software, cloud services, devices, and AI solutions for consumers, businesses, and organizations worldwide.

Microsoft organizes its operations into three main segments. The Productivity and Business Processes segment includes Office products, LinkedIn, and Dynamics business applications. The Intelligent Cloud segment encompasses Azure cloud services, server products, GitHub, and Nuance AI solutions. The More Personal Computing segment contains Windows, Surface devices, Xbox gaming, and Bing search with Copilot.

The company has transformed from primarily selling packaged software to offering cloud-based subscription services. Microsoft 365 delivers Office applications, communication tools like Teams, and security features to businesses and consumers. Azure provides infrastructure and platform services for organizations to build, deploy, and manage applications. The company's gaming division offers Xbox consoles, game subscriptions through Game Pass, and a portfolio of game studios including Activision Blizzard.

Microsoft's AI strategy centers around Copilot, its AI assistant integrated across products from Office to Windows to Bing. A business might use Copilot to automatically generate reports from data, summarize lengthy documents, or create presentation slides from simple prompts. The company generates revenue through software licenses, subscriptions, cloud service usage, hardware sales, advertising, and gaming content.

5. Revenue Growth

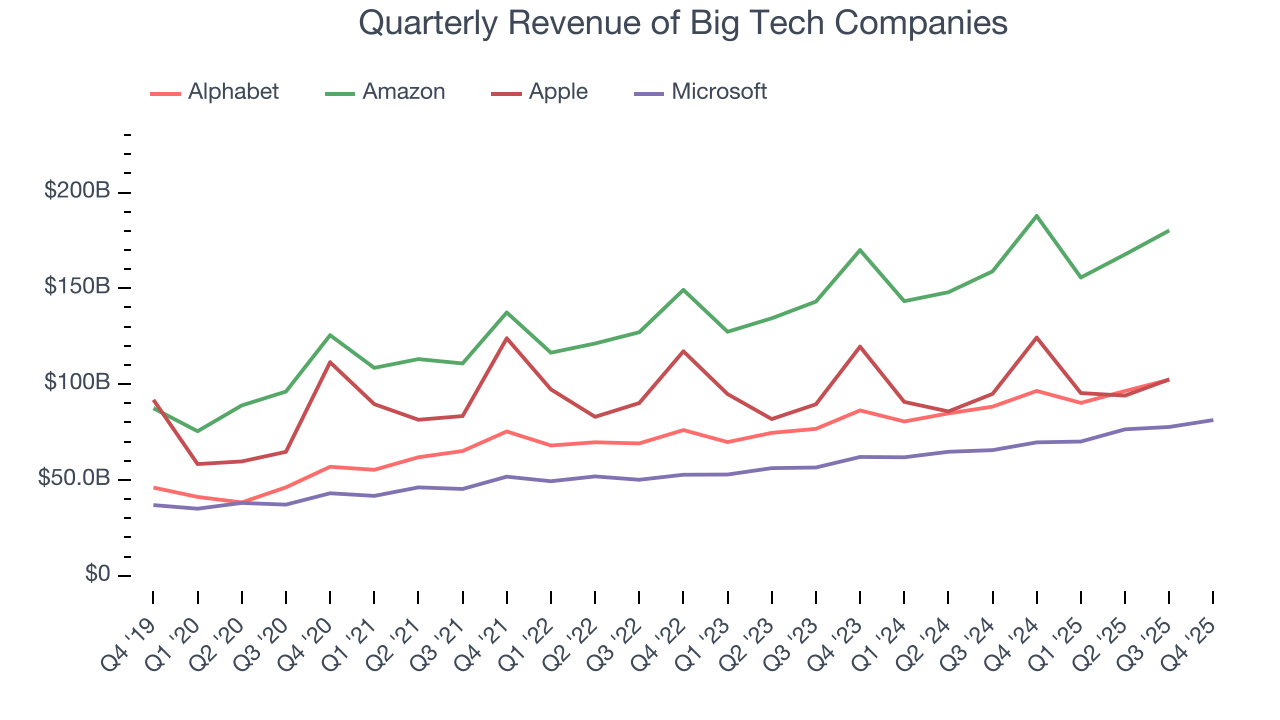

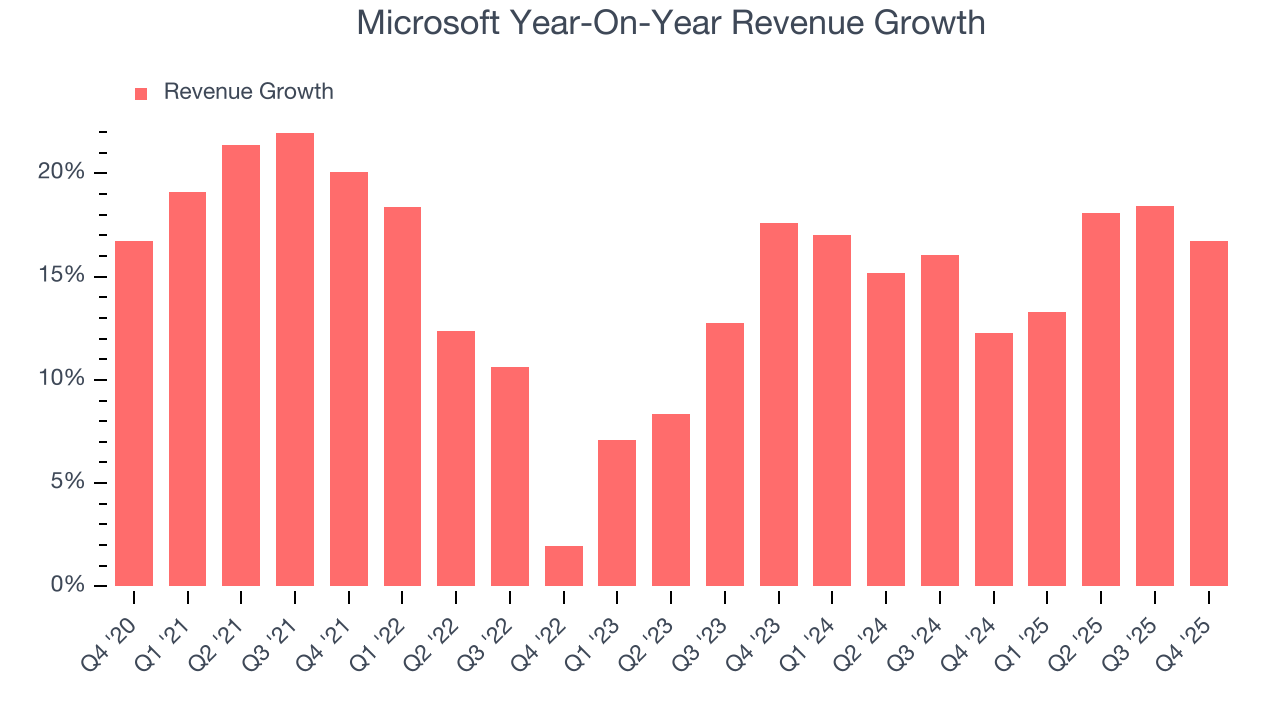

Microsoft shows that fast growth and massive scale can coexist despite conventional wisdom. The company’s revenue base of $153.3 billion five years ago has nearly doubled to $305.5 billion in the last year, translating into an exceptional 14.8% annualized growth rate.

Over the same period, Microsoft’s big tech peers Amazon, Alphabet, and Apple put up annualized growth rates of 14.1%, 18.1%, and 9.8%, respectively. This is an important consideration because investors often use the comparisons as a starting point for their valuations. With these benchmarks in mind, we think Microsoft’s price is attractive.

Long-term growth reigns supreme in fundamentals, but for big tech companies, a half-decade historical view may miss emerging trends in AI. Microsoft’s annualized revenue growth of 15.9% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, Microsoft reported year-on-year revenue growth of 16.7%, and its $81.27 billion of revenue exceeded Wall Street’s estimates by 1.2%. Looking ahead, sell-side This projection is admirable for a company of its scale and illustrates the market sees some success for its newer AI-enabling products.

6. Intelligent Cloud: Azure & Cloud Computing

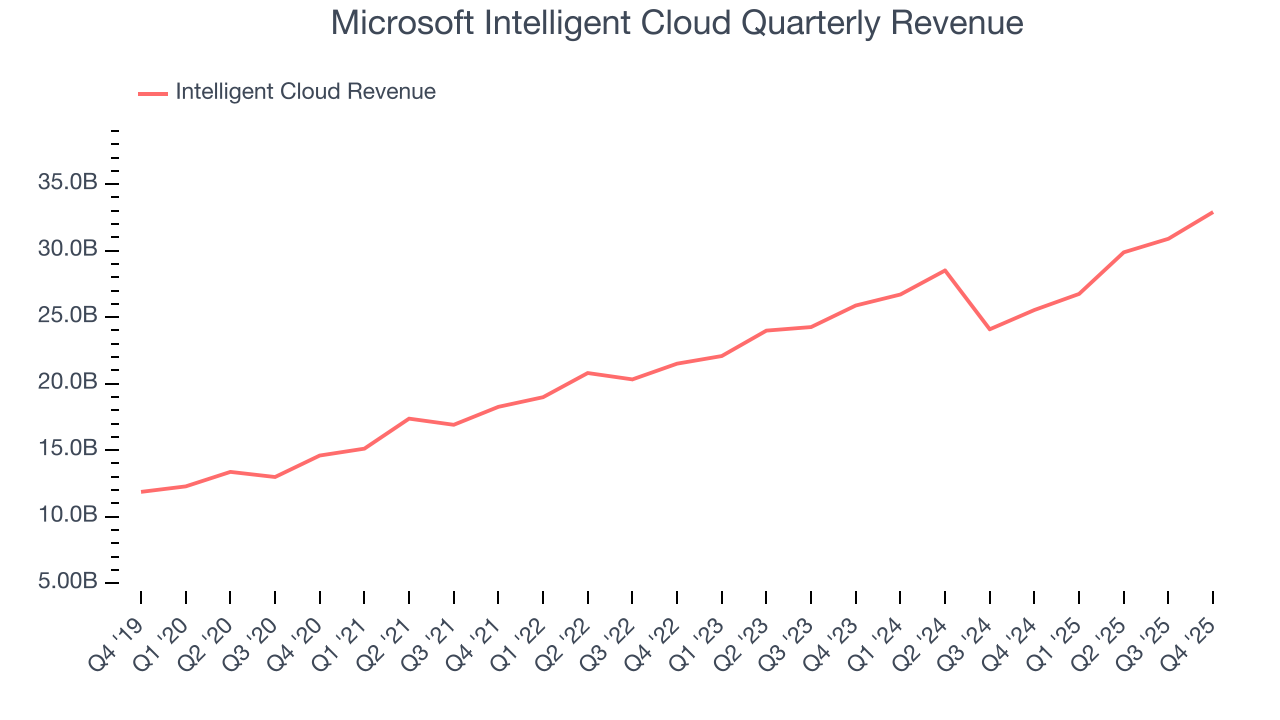

The most pressing question about Microsoft’s business is how much AI can boost its revenues. The company's cloud computing division, Intelligent Cloud, is one we watch carefully because its Azure platform and server/database offerings could be the biggest beneficiaries of the AI megatrend.

Intelligent Cloud is 39.4% of Microsoft’s total sales and grew at a 17.7% annualized rate over the last five years, faster than its consolidated revenues. The previous two years saw deceleration as it grew by 11.9% annually.

Intelligent Cloud’s 28.8% year-on-year revenue growth exceeded expectations in Q4, beating Wall Street’s estimates by 1.8%.

In terms of market share, Azure is a close second as its run-rate revenue (current quarter’s sales times four) is around $150 billion versus roughly $150 billion and $60 billion for AWS and Google Cloud. If Azure wants to catch up to AWS in the coming years, growth will have to accelerate beyond its current levels.

7. Business Software: The Ultimate Bundle

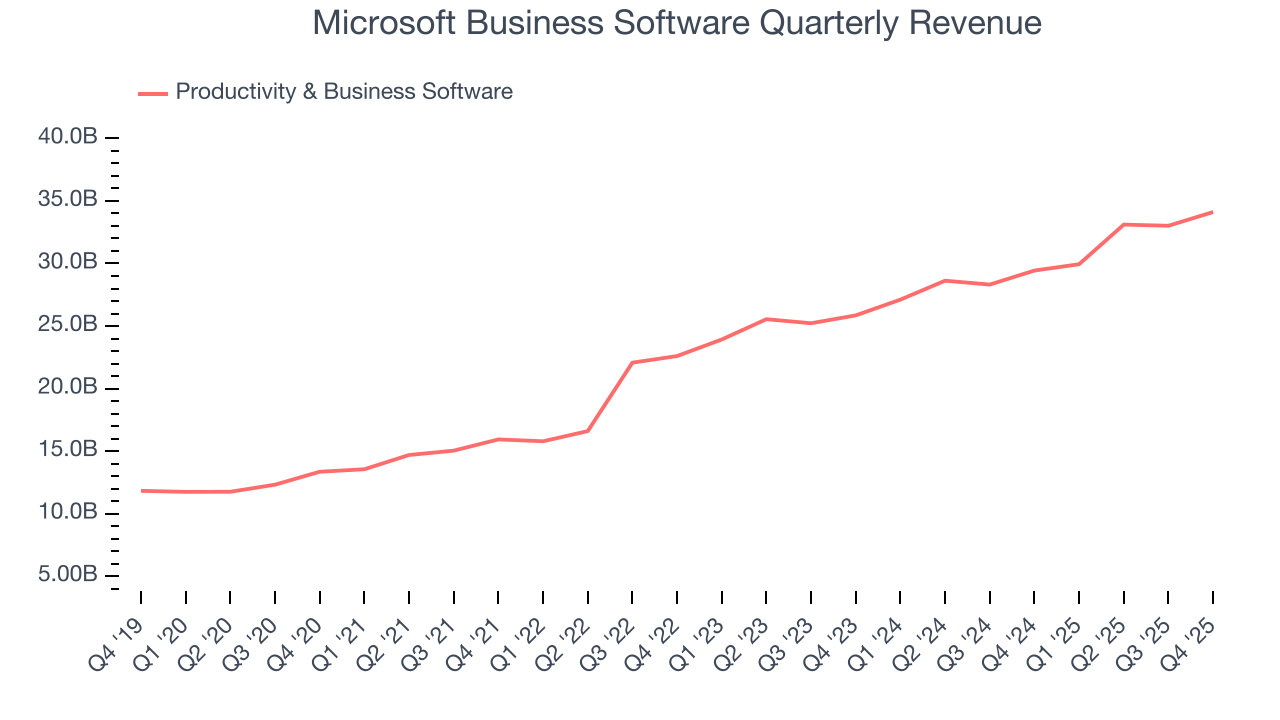

Microsoft is injecting AI capabilities into its Office Suite and Dynamics platforms, which include Excel, PowerPoint, and Power BI. Our question is if Microsoft can successfully upsell its AI software like Copilot+ and how long it would take to contribute meaningfully to revenues.

Business Software is the biggest chunk of Microsoft’s revenue at 42.6% of total sales and grew at a robust pace over the last five years, clocking in at 21.5% annualized. On a two-year basis, growth was 13.8% and below its five-year trend. This deceleration was a factor of its highly penetrated market and large customer base. If Microsoft wants to accelerate growth, it must successfully upsell its newer products.

This quarter, segment revenue grew by 15.9%, beating expectations by 2%. The quarterly print was higher than its two-year result, hinting that its AI products and services are supercharging sales for its software.

8. Personal Computing: Bing, Windows, & Gaming

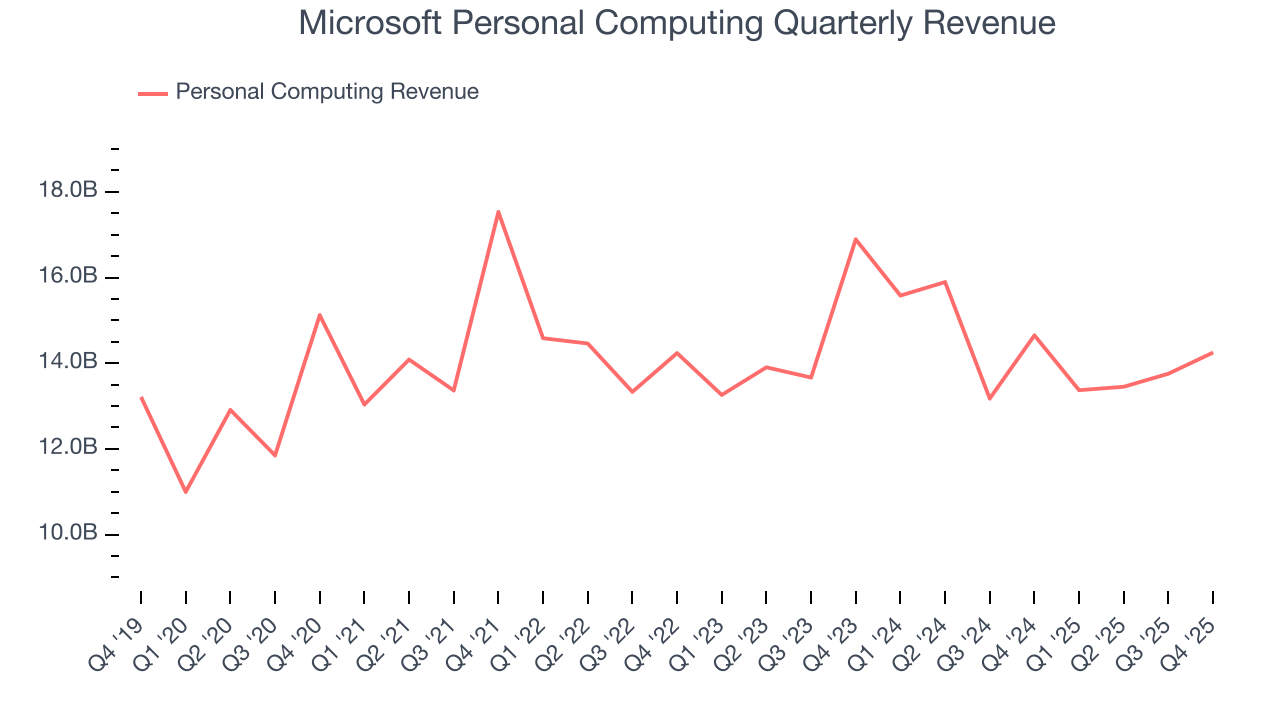

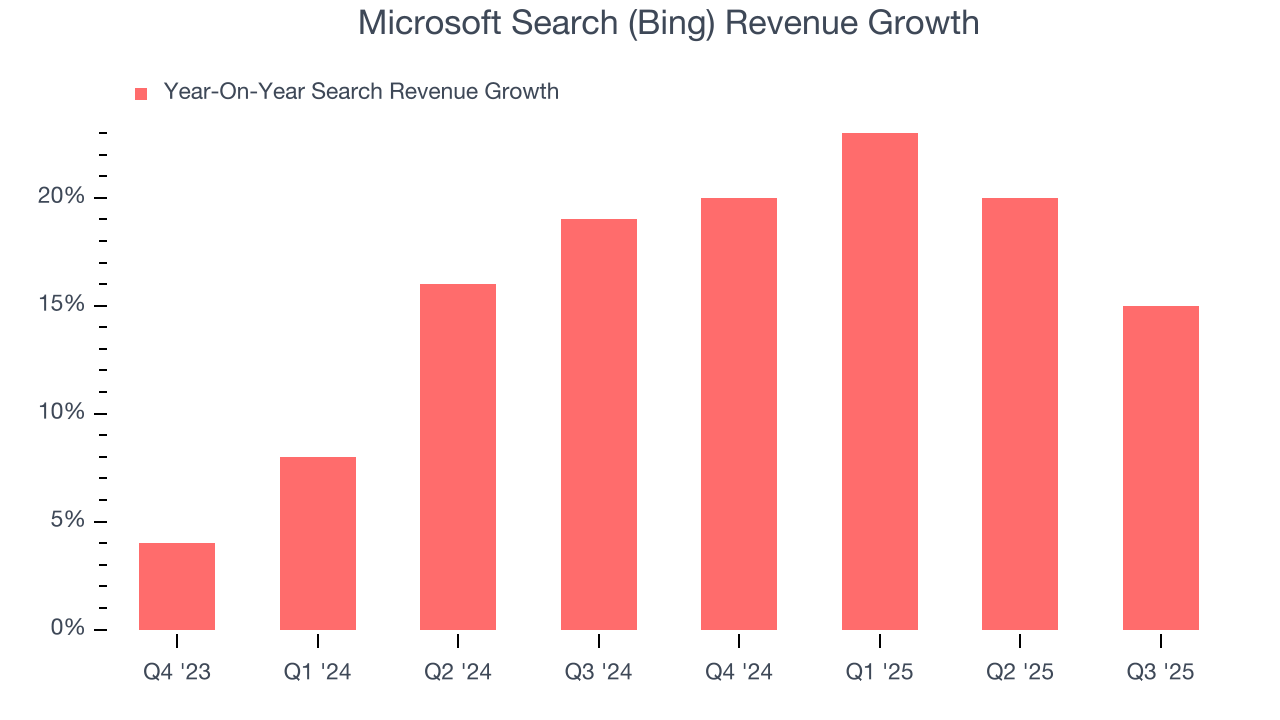

Personal Computing includes the renowned Windows operating system along with Gaming (Activision, Minecraft, Xbox) and Bing, its search engine. This segment is the least levered to AI, though the technology is shaking things up in its search business, which is attempting to chip away at Google’s 80%+ market share.

Microsoft’s Personal Computing performance was uninspiring over the last five years as its top line grew at a 1.5% annual rate. Its momentum has deteriorated even further, as its sales dropped by 2.5% annually over the last two years.

In Q4, Personal Computing revenue fell by 2.7%, missing expectations by 9.7%.

Bing lost market share to Google Search this quarter as the latter recorded a higher 14.5% growth rate, showing it still has a long way to for relevance.

9. Profitability

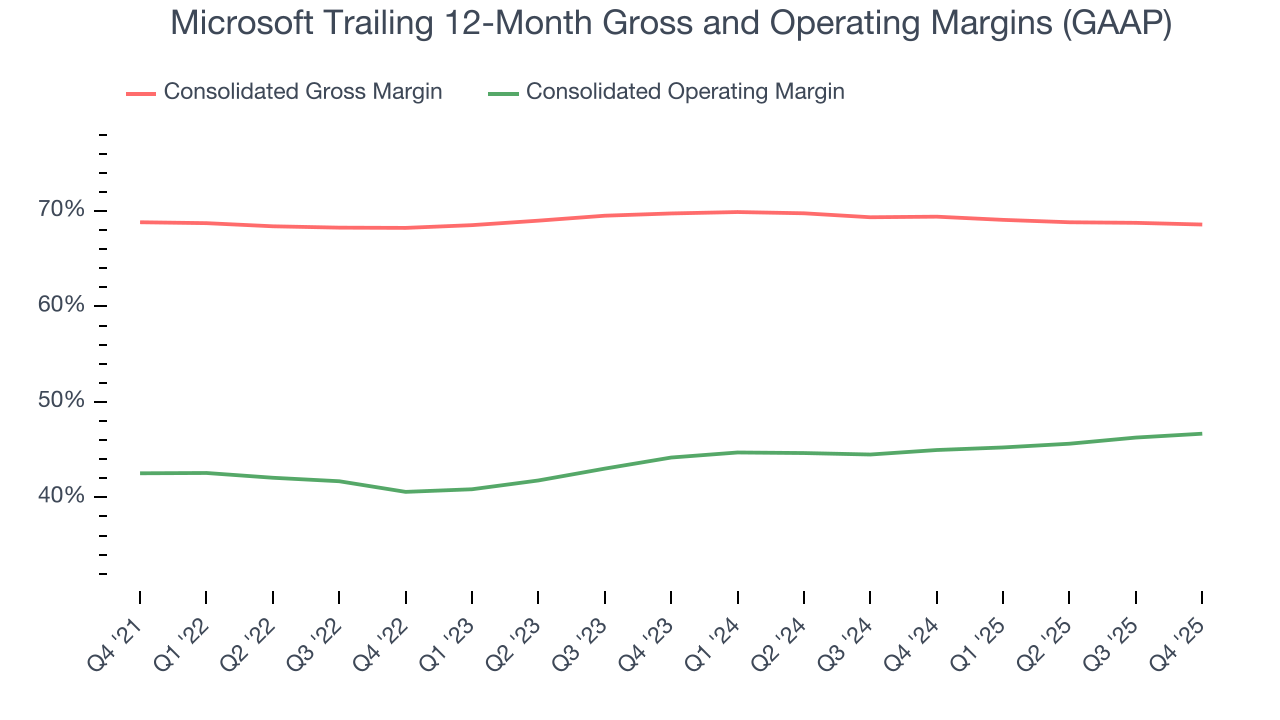

Microsoft is a special business because its focus on software, bundling, and upselling leads to robust unit economics and vendor lock-in. The company’s elite business model and pricing power can be seen in its high gross margin, which averaged 69% over the last five years.

However, this dynamic is not new. A good way to have a more differentiated view on Microsoft’s profitability is through its operating margin, a metric that represents how much revenue is left after accounting for all operating expenses – everything from hiring engineers and IT infrastructure to selling, product development, and administrative overhead.

Microsoft has been a well-oiled machine over the last five years. It demonstrated elite profitability for a software business, boasting an average operating of 44.1%. This was one of the best results across all public companies because every one of its segments sells high-margin software (unlike its big tech peers Amazon and Apple, which partly depend on sales of lower-margin physical products).

Analyzing the trend in its profitability, Microsoft’s operating rose by 4.1 percentage points over the last five years, as its sales growth gave it operating leverage. If its customer base embraces its AI offerings, this figure could rise again as incremental software sold to existing buyers flows nicely into the bottom line.

This quarter, Microsoft generated an operating profit margin of 47.1%, up 1.6 percentage points year on year. The increase was encouraging, and because its operating rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

In the coming year, Wall Street expects Microsoft to maintain its trailing 12-month operating of 46.7%.

10. Earnings Per Share

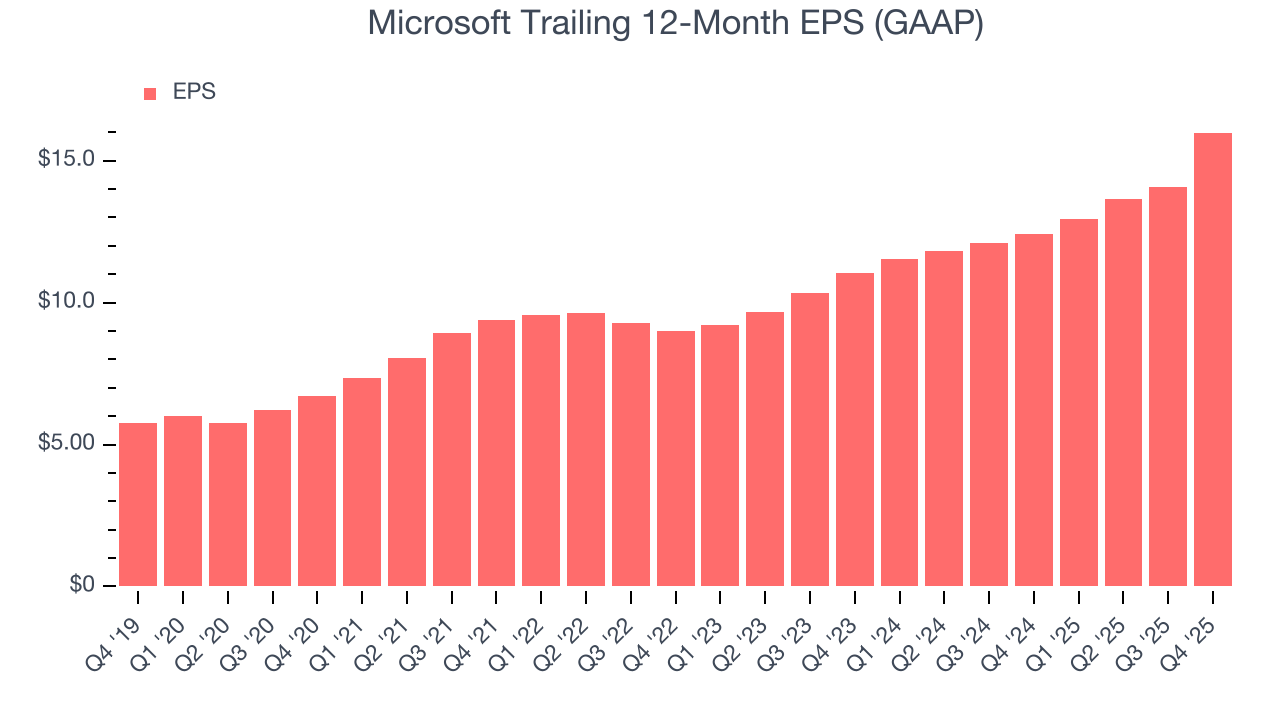

We track the long-term change in earnings per share (EPS) alongside revenue and margins because it shows whether a company’s growth is profitable and what else affects shareholder returns.

Microsoft’s EPS grew at an astounding 18.9% compounded annual growth rate over the last five years, higher than its 14.8% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

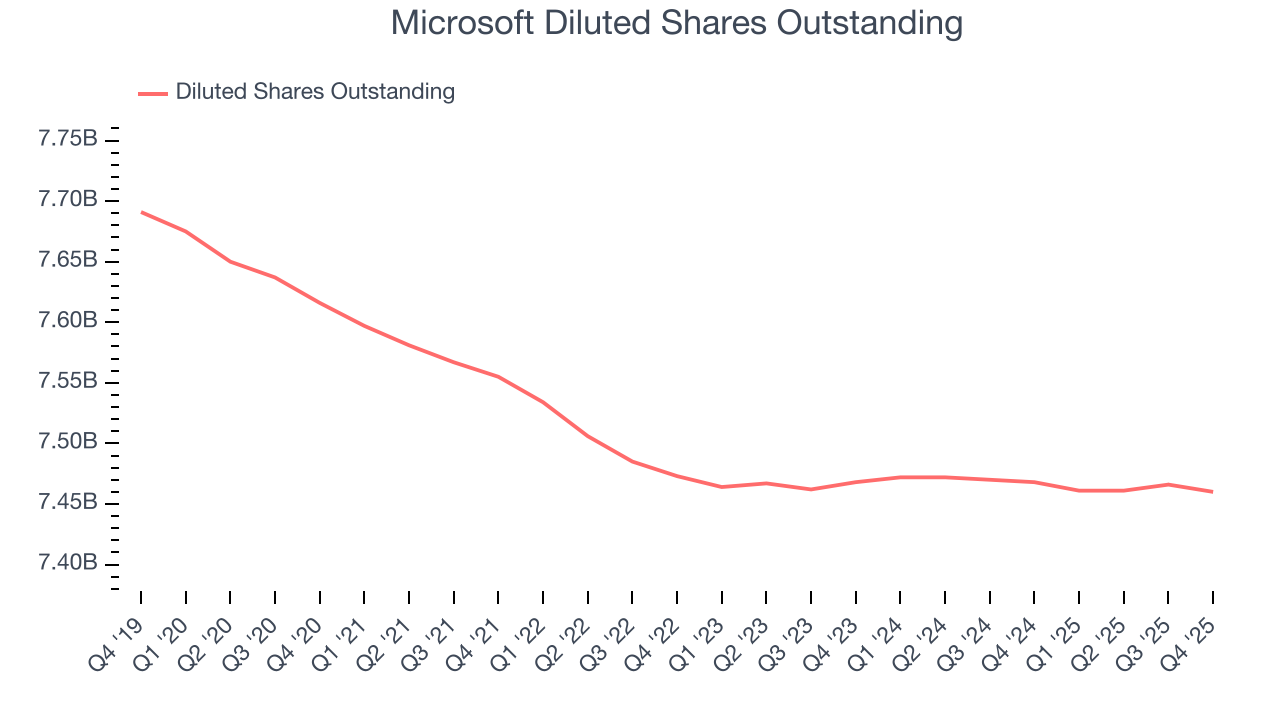

We can take a deeper look into Microsoft’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, Microsoft’s operating expanded by 4.1 percentage points over the last five years. On top of that, its share count shrank by 2%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Microsoft, its two-year annual EPS growth of 20.3% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, Microsoft reported EPS of $5.16, up from $3.23 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Microsoft’s full-year EPS of $15.99 to grow 6.3%.

11. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills or invest for the future.

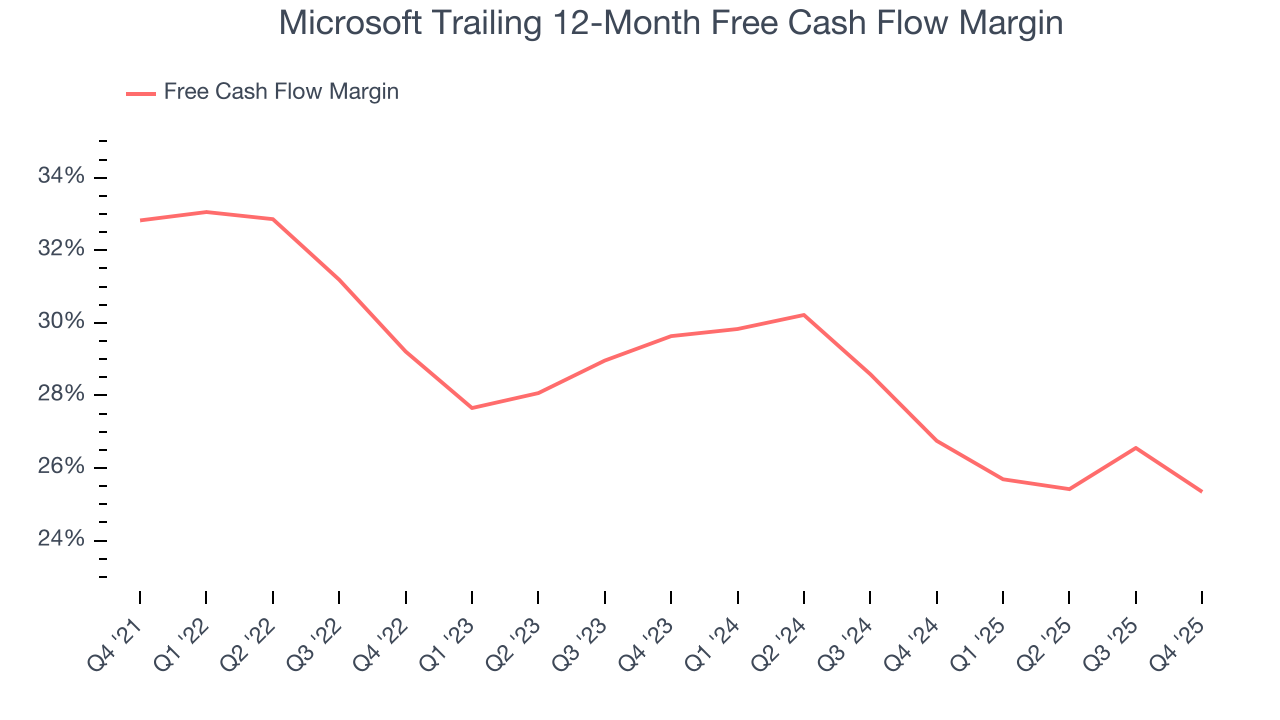

Microsoft has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the software sector, averaging 28.3% over the last five years.

Taking a step back, we can see that Microsoft’s margin dropped by 7.5 percentage points during that time. Continued declines could signal it is in the middle of an investment cycle as it competes for the best AI chips to power its products.

Microsoft’s free cash flow clocked in at $5.88 billion in Q4, equivalent to a 7.2% margin. The company’s cash profitability regressed as it was 2.1 percentage points lower than in the same quarter last year, which isn’t ideal considering its longer-term trend.

Over the next year, analysts predict Microsoft’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 25.3% for the last 12 months will decrease to 21.8%.

12. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Microsoft’s five-year average ROIC was 56.2%, placing it among the best software companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Microsoft’s ROIC has unfortunately decreased significantly. This is because it’s investing aggressively to capture the AI opportunity. Only time will tell if these investments bear fruit in higher long-term ROICs.

13. Balance Sheet Assessment

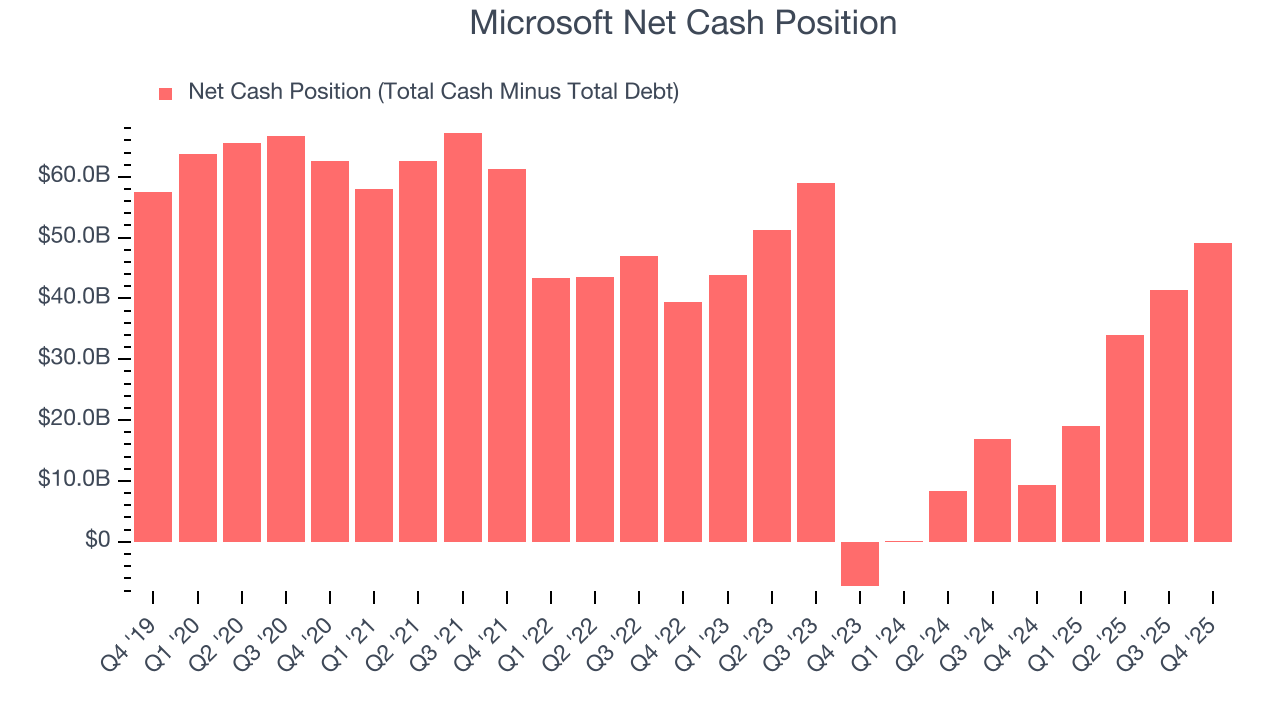

Big corporations like Microsoft are attractive to many investors in times of instability thanks to their fortress balance sheets that buffer pockets of soft demand.

Microsoft has an eye-popping $89.46 billion of cash on its balance sheet (that’s no typo) compared to $40.26 billion of debt. This $49.2 billion net cash position is 1.4% of its market cap and shockingly larger than the value of most public companies, giving it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

14. Key Takeaways from Microsoft’s Q4 Results

Business Services and Intelligent Cloud revenue beat, but Personal Computing missed. EPS, even after removing the impacts of OpenAI, also beat expectations. However, the magnitude of the beat in Intelligent Cloud and Azure's growth rate could be called into question by some investors hoping for stronger results, aided by AI products and services. Zooming out, we think this was still a good print with some key areas of upside. The stock remained flat at $460.92 immediately after reporting.

15. Is Now The Time To Buy Microsoft?

Updated: January 28, 2026 at 9:22 PM EST

Are you wondering whether to buy Microsoft or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

Microsoft is an amazing business ranking highly on our list. First of all, the company’s superb long-term revenue growth driven by the Intelligent Cloud segment suggests Azure is catching up to AWS. And while its falling returns show it may be getting harder to find good investments, its exceptional two-year revenue growth, which punched in above its five-year trend, shows it’s been wildly successful in bundling more products to its existing customers. On top of that, Microsoft’s outstanding free cash flow generation enables it to make bold bets, like a $10+ billion investment into ChatGPT’s Open AI.

Microsoft’s price-to-earnings ratio based on the next 12 months is 27.8x. Scanning the software space today, Microsoft’s fundamentals really stand out, and we like it at this price.

Wall Street analysts have a consensus one-year price target of $616.13 on the company (compared to the current share price of $452.03), implying they see 36.3% upside in buying Microsoft in the short term.