Photronics (PLAB)

We’re wary of Photronics. Its sales have recently plummeted and its meager cash generation gives it few resources to turn the ship around.― StockStory Analyst Team

1. News

2. Summary

Why Photronics Is Not Exciting

Sporting a global footprint of facilities, Photronics (NASDAQ:PLAB) is a manufacturer of photomasks, templates used to transfer patterns onto semiconductor wafers.

- Estimated sales growth of 3.1% for the next 12 months is soft and implies weaker demand

- Gross margin of 35.7% is below its competitors, leaving less money to invest in areas like marketing and R&D

- One positive is that its earnings per share grew by 33.5% annually over the last five years, outpacing its peers

Photronics doesn’t measure up to our expectations. We’d search for superior opportunities elsewhere.

Why There Are Better Opportunities Than Photronics

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Photronics

At $33.27 per share, Photronics trades at 2.4x trailing 12-month price-to-sales. The market typically values companies like Photronics based on their anticipated profits for the next 12 months, but there aren’t enough published estimates to arrive at a reliable number. You should avoid this stock for now - better opportunities lie elsewhere.

We’d rather pay a premium for quality. Cheap stocks can look like a great deal at first glance, but they can be value traps. Less earnings power means more reliance on a re-rating to generate good returns; this can be an unlikely scenario for low-quality companies.

3. Photronics (PLAB) Research Report: Q4 CY2025 Update

Semiconductor photomask manufacturer Photronics (NASDAQ:PLAB) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 6.1% year on year to $225.1 million. The company expects next quarter’s revenue to be around $216 million, close to analysts’ estimates. Its non-GAAP profit of $0.61 per share was 15.1% above analysts’ consensus estimates.

Photronics (PLAB) Q4 CY2025 Highlights:

- Revenue: $225.1 million vs analyst estimates of $220.1 million (6.1% year-on-year growth, 2.3% beat)

- Adjusted EPS: $0.61 vs analyst estimates of $0.53 (15.1% beat)

- Adjusted EBITDA: $77.51 million (34.4% margin, 39.4% year-on-year growth)

- Revenue Guidance for Q1 CY2026 is $216 million at the midpoint, roughly in line with what analysts were expecting

- Adjusted EPS guidance for Q1 CY2026 is $0.52 at the midpoint, above analyst estimates of $0.50

- Operating Margin: 24.4%, in line with the same quarter last year

- Free Cash Flow Margin: 22%, up from 20.4% in the same quarter last year

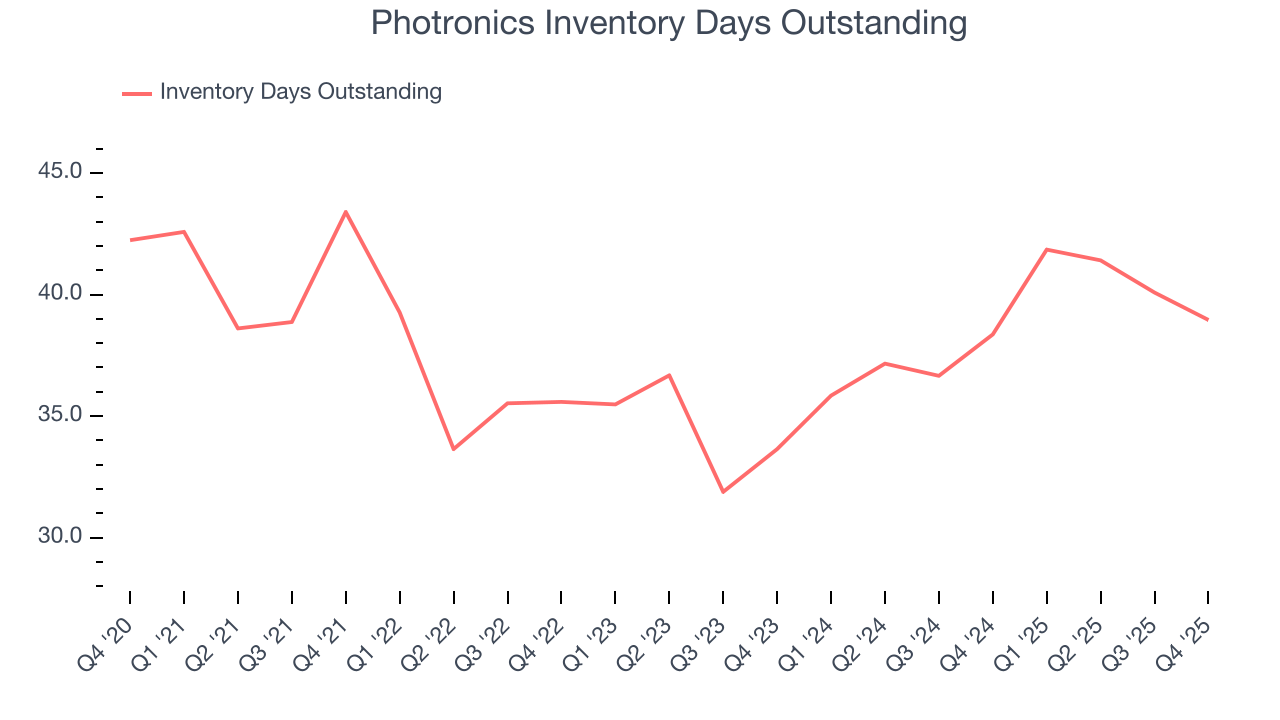

- Inventory Days Outstanding: 39, down from 40 in the previous quarter

- Market Capitalization: $2.2 billion

Company Overview

Sporting a global footprint of facilities, Photronics (NASDAQ:PLAB) is a manufacturer of photomasks, templates used to transfer patterns onto semiconductor wafers.

Photronics was founded in 1969 by Constantine S. MacRicostas, who was previously an engineering manager for semiconductor company Qualitron Corporation. Photronics went public in 1987 with a NASDAQ listing.

Semiconductor manufacturing begins with a silicon wafer upon which precise circuit patterns are transferred. This manipulation of thin layers of film results in conductor, semiconductor, or insulator properties on the wafer. It is a complex process requiring precision tools, specific temperatures at various stages, and ideal environments. Photomasks, which are quartz or glass plates containing microscopic images of electronic circuits, are a key precision tool for this transfer of circuit patterns onto silicon wafers.

Photronics’ customers are largely semiconductor foundries (manufacturers) as well as fabless semiconductor companies (designers who outsource manufacturing). The company manufactures photomasks that reflect circuit designs provided by these customers. The typical manufacturing process for a photomask first involves receiving circuit design data from the customer and converting these to manufacturing pattern data. Photronics’ lithography systems, which use electron beams and lasers, then etch the circuit patterns onto photomask blanks. Once the final products pass rigorous testing and assessments, they are shipped to the customer.

Photomask manufacturers that compete with Photonics include Compugraphics, Dai Nippon Printing (TSE:7912), Hoya Corporation (TSE:7741), LG Innotek (KOSE:A011070), and Shenzhen Newway Photomask (SHSE:688401).

4. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Thankfully, Photronics’s 7.4% annualized revenue growth over the last five years was decent. Its growth was slightly above the average semiconductor company and shows its offerings resonate with customers. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

We at StockStory place the most emphasis on long-term growth, but within semiconductors, a half-decade historical view may miss new demand cycles or industry trends like AI. Photronics’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 2% over the last two years.

This quarter, Photronics reported year-on-year revenue growth of 6.1%, and its $225.1 million of revenue exceeded Wall Street’s estimates by 2.3%. Adding to the positive news, Photronics’s growth inflected positively this quarter, news that will likely give some shareholders hope. Company management is currently guiding for a 2.4% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 4.3% over the next 12 months. While this projection suggests its newer products and services will spur better top-line performance, it is still below average for the sector.

5. Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Photronics’s DIO came in at 39, which is one day above its five-year average. At the moment, these numbers show no indication of an excessive inventory buildup.

6. Gross Margin & Pricing Power

In the semiconductor industry, a company’s gross profit margin is a critical metric to track because it sheds light on its pricing power, complexity of products, and ability to procure raw materials, equipment, and labor.

Photronics’s gross margin is one of the worst in the semiconductor industry, signaling it operates in a competitive market and lacks pricing power. As you can see below, it averaged a 35.7% gross margin over the last two years. Said differently, Photronics had to pay a chunky $64.33 to its suppliers for every $100 in revenue.

Photronics produced a 35% gross profit margin in Q4, in line with the same quarter last year. On a wider time horizon, Photronics’s full-year margin has been trending down over the past 12 months, decreasing by 1 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as raw materials and manufacturing expenses).

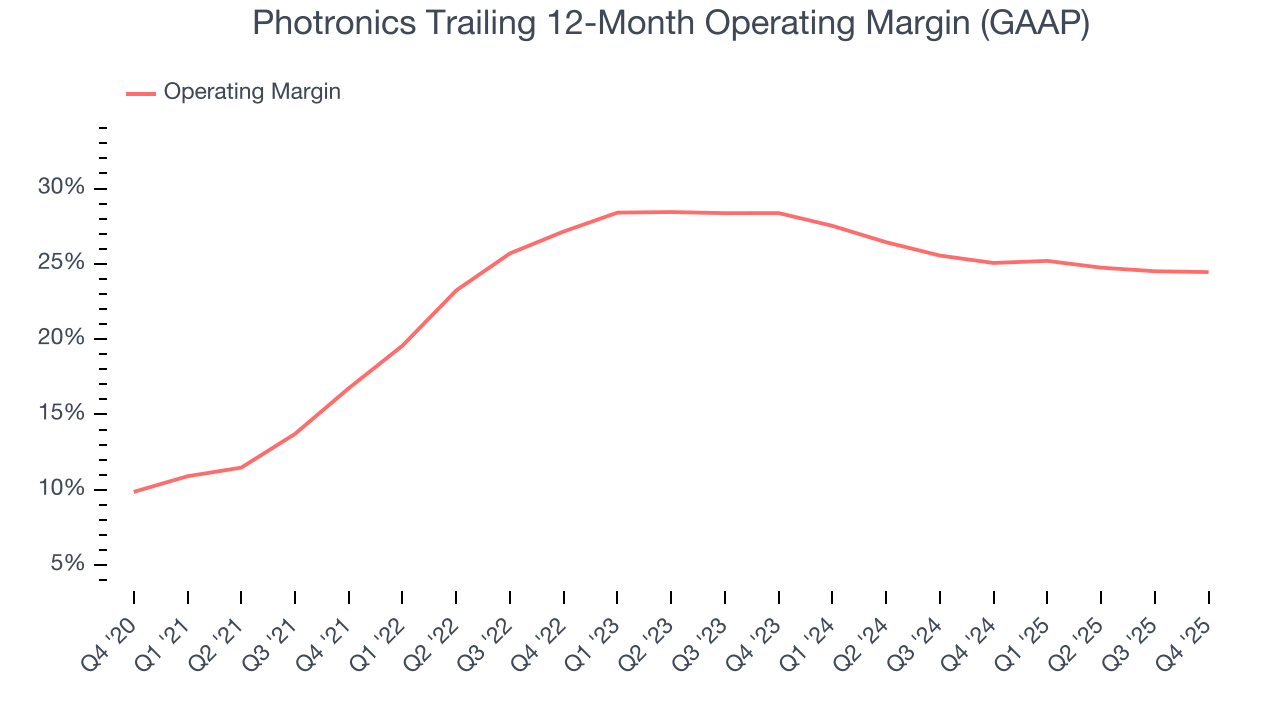

7. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Photronics has been an efficient company over the last two years. It was one of the more profitable businesses in the semiconductor sector, boasting an average operating margin of 24.8%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Looking at the trend in its profitability, Photronics’s operating margin rose by 7.7 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q4, Photronics generated an operating margin profit margin of 24.4%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Photronics’s EPS grew at an astounding 33.5% compounded annual growth rate over the last five years, higher than its 7.4% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into the nuances of Photronics’s earnings can give us a better understanding of its performance. As we mentioned earlier, Photronics’s operating margin was flat this quarter but expanded by 7.7 percentage points over the last five years. On top of that, its share count shrank by 7.3%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

In Q4, Photronics reported adjusted EPS of $0.61, up from $0.52 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Photronics has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 14%, subpar for a semiconductor business. The divergence from its good operating margin stems from its capital-intensive business model, which requires Photronics to make large cash investments in working capital and capital expenditures.

Photronics’s free cash flow clocked in at $49.62 million in Q4, equivalent to a 22% margin. This result was good as its margin was 1.7 percentage points higher than in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends trump fluctuations.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although Photronics hasn’t been the highest-quality company lately, it historically found a few growth initiatives that worked out well. Its five-year average ROIC was 28.8%, impressive for a semiconductor business.

11. Balance Sheet Assessment

One of the best ways to mitigate bankruptcy risk is to hold more cash than debt.

Photronics is a profitable, well-capitalized company with $636.9 million of cash and $21,000 of debt on its balance sheet. This $636.9 million net cash position is 28.9% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Photronics’s Q4 Results

It was good to see Photronics beat analysts’ EPS expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 6.8% to $40.56 immediately following the results.

13. Is Now The Time To Buy Photronics?

Updated: March 6, 2026 at 9:35 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Photronics.

Photronics isn’t a terrible business, but it doesn’t pass our bar. Although its revenue growth was decent over the last five years, it’s expected to deteriorate over the next 12 months and its projected EPS for the next year is lacking. And while the company’s astounding EPS growth over the last five years shows its profits are trickling down to shareholders, the downside is its low gross margins indicate some combination of pricing pressures or rising production costs.

Photronics’s price-to-sales ratio based on the trailing 12 months is 2.4x. The market typically values companies like Photronics based on their anticipated profits for the next 12 months, but there aren’t enough published estimates to arrive at a reliable number. You should avoid this stock for now - better opportunities lie elsewhere.

Wall Street analysts have a consensus one-year price target of $48 on the company (compared to the current share price of $33.27).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.