Lam Research (LRCX)

Lam Research is a compelling stock. It repeatedly invests in lucrative growth initiatives, generating robust cash flows and returns on capital.― StockStory Analyst Team

1. News

2. Summary

Why We Like Lam Research

Founded in 1980 by David Lam, the man who pioneered semiconductor etching technology, Lam Research (NASDAQ:LRCX) is one of the leading providers of wafer fabrication equipment used to make semiconductors.

- Market-beating returns on capital illustrate that management has a knack for investing in profitable ventures

- Successful business model is illustrated by its impressive operating margin, and its operating leverage amplified its profits over the last five years

- Strong free cash flow margin of 27.9% gives it the option to reinvest, repurchase shares, or pay dividends, and its growing cash flow gives it even more resources to deploy

Lam Research is a market leader. The valuation looks fair relative to its quality, so this could be a favorable time to buy some shares.

Why Is Now The Time To Buy Lam Research?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Lam Research?

Lam Research is trading at $242.50 per share, or 40.1x forward P/E. Yes, the stock’s seemingly high valuation multiple could mean short-term volatility. But given its business quality, we think the multiple is justified.

By definition, where you buy a stock impacts returns. But according to our work on the topic, business quality is a much bigger determinant of market outperformance over the long term compared to entry price.

3. Lam Research (LRCX) Research Report: Q4 CY2025 Update

Semiconductor equipment maker Lam Research (NASDAQ:LRCX) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 22.1% year on year to $5.34 billion. On top of that, next quarter’s revenue guidance ($5.7 billion at the midpoint) was surprisingly good and 6.2% above what analysts were expecting. Its non-GAAP profit of $1.27 per share was 8.7% above analysts’ consensus estimates.

Lam Research (LRCX) Q4 CY2025 Highlights:

- Revenue: $5.34 billion vs analyst estimates of $5.25 billion (22.1% year-on-year growth, 1.8% beat)

- Adjusted EPS: $1.27 vs analyst estimates of $1.17 (8.7% beat)

- Adjusted Operating Income: $1.83 billion vs analyst estimates of $1.72 billion (34.3% margin, 6.5% beat)

- Revenue Guidance for Q1 CY2026 is $5.7 billion at the midpoint, above analyst estimates of $5.37 billion

- Adjusted EPS guidance for Q1 CY2026 is $1.35 at the midpoint, above analyst estimates of $1.20

- Operating Margin: 33.9%, up from 30.5% in the same quarter last year

- Free Cash Flow Margin: 22.8%, up from 12.7% in the same quarter last year

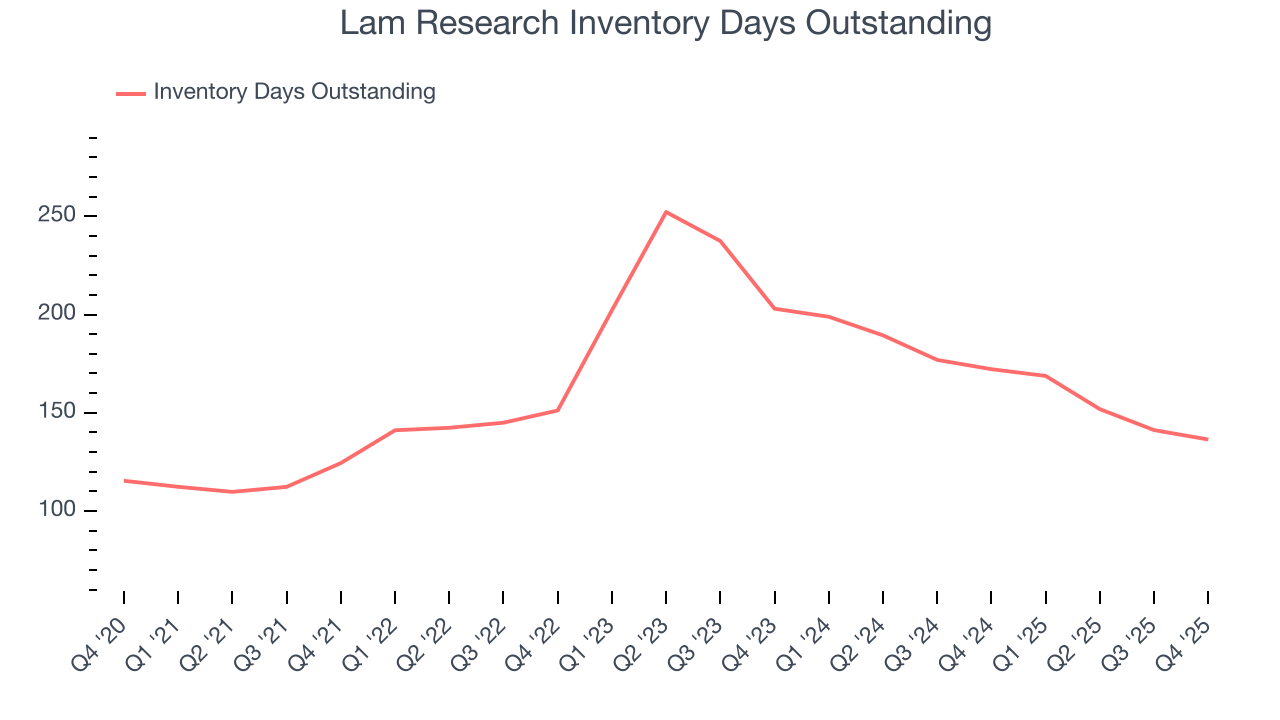

- Inventory Days Outstanding: 136, down from 141 in the previous quarter

- Market Capitalization: $299.5 billion

Company Overview

Founded in 1980 by David Lam, the man who pioneered semiconductor etching technology, Lam Research (NASDAQ:LRCX) is one of the leading providers of wafer fabrication equipment used to make semiconductors.

Lam Research is one of a handful of companies in the world that makes the tools used in deposition, etching, and cleaning wafers. It has a concentrated customer base made up of the biggest chip makers in the world like TSMC, Intel, Samsung and Micron. Its biggest customer base are the producers of memory chips, which have traditionally accounted for about two thirds of Lam’s revenues.

Specifically, Lam’s tools are heavily used in the production of NAND memory, which has evolved into more complex 3D designs over the past few years, requiring more complex tools to etch and deposit more structures on ever shrinking memory chips. In the long run, DRAM will likely shift to 3D designs, providing an opportunity for Lam. Because Lam is so exposed to memory chips, which have the most volatile pricing within semiconductors, Lam’s model tends to be more volatile than its tool maker peers, such as Applied Materials or ASML.

Its primary peers and competitors are Applied Materials, (NASDAQ:AMAT), ASML (NASDAQ:ASML), KLA Corp (NASDAQ:KLAC), and Samsung Electronics (KOSE:005930).

4. Semiconductor Manufacturing

The semiconductor capital (manufacturing) equipment group has become highly concentrated over the past decade. Suppliers have consolidated, and the increasing cost of innovation have made it unaffordable to almost everybody, except the largest companies, to produce leading edge chips. The result of the increased industry concentration has been higher operating margins and free cash generation through the cycle. Despite this structural improvement, the businesses can still be quite volatile, as demand fluctuations for the semiconductor equipment are magnified by the already cyclical nature of underlying semiconductor demand.

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, Lam Research’s sales grew at a solid 11.5% compounded annual growth rate over the last five years. Its growth surpassed the average semiconductor company and shows its offerings resonate with customers, a great starting point for our analysis. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions (which can sometimes offer opportune times to buy).

We at StockStory place the most emphasis on long-term growth, but within semiconductors, a half-decade historical view may miss new demand cycles or industry trends like AI. Lam Research’s annualized revenue growth of 19.8% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, Lam Research reported robust year-on-year revenue growth of 22.1%, and its $5.34 billion of revenue topped Wall Street estimates by 1.8%. Beyond the beat, this marks 7 straight quarters of growth, showing that the current upcycle has had a good run - a typical upcycle usually lasts 8-10 quarters. Company management is currently guiding for a 20.8% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 12.9% over the next 12 months, a deceleration versus the last two years. We still think its growth trajectory is satisfactory given its scale and implies the market is forecasting success for its products and services.

6. Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Lam Research’s DIO came in at 136, which is 27 days below its five-year average. At the moment, these numbers show no indication of an excessive inventory buildup.

7. Gross Margin & Pricing Power

In the semiconductor industry, a company’s gross profit margin is a critical metric to track because it sheds light on its pricing power, complexity of products, and ability to procure raw materials, equipment, and labor.

Lam Research’s unit economics are roughly in line with other semiconductor businesses, pointing to a lack of significant pricing pressure and the effectiveness of its products. As you can see below, it averaged a decent 48.9% gross margin over the last two years. Said differently, Lam Research paid its suppliers $51.11 for every $100 in revenue.

Lam Research’s gross profit margin came in at 49.6% this quarter, marking a 2.2 percentage point increase from 47.4% in the same quarter last year. Lam Research’s full-year margin has also been trending up over the past 12 months, increasing by 2.1 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as manufacturing expenses).

8. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Lam Research has been a well-oiled machine over the last two years. It demonstrated elite profitability for a semiconductor business, boasting an average operating margin of 31.9%.

Analyzing the trend in its profitability, Lam Research’s operating margin rose by 2.2 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Lam Research generated an operating margin profit margin of 33.9%, up 3.4 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

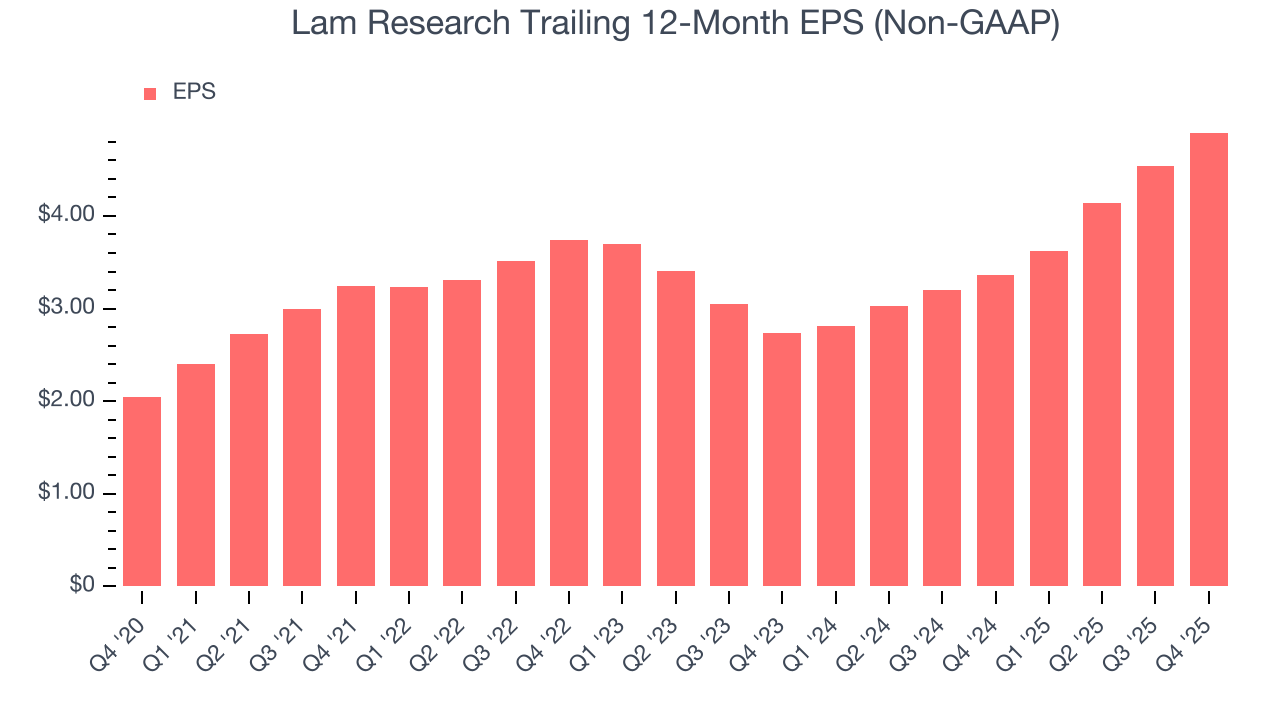

9. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Lam Research’s EPS grew at a solid 19.1% compounded annual growth rate over the last five years, higher than its 11.5% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Lam Research’s earnings to better understand the drivers of its performance. As we mentioned earlier, Lam Research’s operating margin expanded by 2.2 percentage points over the last five years. On top of that, its share count shrank by 13.5%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

In Q4, Lam Research reported adjusted EPS of $1.27, up from $0.91 in the same quarter last year. This print beat analysts’ estimates by 8.7%. Over the next 12 months, Wall Street expects Lam Research’s full-year EPS of $4.90 to grow 9.2%.

10. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Lam Research has shown robust cash profitability, and if it can maintain this level of cash generation, will be in a fine position to ride out cyclical downturns while investing in plenty of new products and returning capital to investors. The company’s free cash flow margin averaged 27.9% over the last two years, quite impressive for a semiconductor business.

Taking a step back, we can see that Lam Research’s margin expanded by 5.8 percentage points over the last five years. This shows the company is heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

Lam Research’s free cash flow clocked in at $1.22 billion in Q4, equivalent to a 22.8% margin. This result was good as its margin was 10.2 percentage points higher than in the same quarter last year, building on its favorable historical trend.

11. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Lam Research’s five-year average ROIC was 65.7%, placing it among the best semiconductor companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

12. Balance Sheet Assessment

Big corporations like Lam Research are attractive to many investors in times of instability thanks to their fortress balance sheets that buffer pockets of soft demand.

Lam Research is a profitable, well-capitalized company with $6.18 billion of cash and $4.48 billion of debt on its balance sheet. This $1.70 billion net cash position gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

13. Key Takeaways from Lam Research’s Q4 Results

It was good to see Lam Research beat analysts’ EPS expectations this quarter. We were also glad its revenue guidance for next quarter exceeded Wall Street’s estimates. Zooming out, we think this was a solid print. The stock remained flat at $240.52 immediately after reporting.

14. Is Now The Time To Buy Lam Research?

Updated: February 23, 2026 at 9:21 PM EST

When considering an investment in Lam Research, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

There are multiple reasons why we think Lam Research is an amazing business. For starters, its revenue growth was solid over the last five years and is expected to accelerate over the next 12 months. On top of that, its stellar ROIC suggests it has been a well-run company historically, and its impressive operating margins show it has a highly efficient business model.

Lam Research’s P/E ratio based on the next 12 months is 40.1x. This valuation may appear high at first glance, but the multiple is deserved because Lam Research’s fundamentals really stand out. We think the stock is attractive here.

Wall Street analysts have a consensus one-year price target of $274.42 on the company (compared to the current share price of $242.50), implying they see 13.2% upside in buying Lam Research in the short term.