Peloton (PTON)

We wouldn’t recommend Peloton. Its inability to grow sales suggests demand is weak and its meager free cash flow margin puts it in a pinch.― StockStory Analyst Team

1. News

2. Summary

Why We Think Peloton Will Underperform

Started as a Kickstarter campaign, Peloton (NASDAQ: PTON) is a fitness technology company known for its at-home exercise equipment and interactive online workout classes.

- Products and services fail to spark excitement with consumers, as seen in its flat sales over the last five years

- Earnings per share fell by 16.5% annually over the last five years while its revenue was flat, showing each sale was less profitable

- Suboptimal cost structure is highlighted by its history of operating margin losses

Peloton doesn’t pass our quality test. More profitable opportunities exist elsewhere.

Why There Are Better Opportunities Than Peloton

Why There Are Better Opportunities Than Peloton

At $6.35 per share, Peloton trades at 43.2x forward P/E. We consider this valuation aggressive considering the weaker revenue growth profile.

We prefer to invest in similarly-priced but higher-quality companies with superior earnings growth.

3. Peloton (PTON) Research Report: Q3 CY2025 Update

Exercise equipment company Peloton (NASDAQ:PTON) announced better-than-expected revenue in Q3 CY2025, but sales fell by 6% year on year to $550.8 million. Guidance for next quarter’s revenue was optimistic at $675 million at the midpoint, 2.2% above analysts’ estimates. Its GAAP profit of $0.03 per share was $0.03 above analysts’ consensus estimates.

Peloton (PTON) Q3 CY2025 Highlights:

- Revenue: $550.8 million vs analyst estimates of $539.6 million (6% year-on-year decline, 2.1% beat)

- EPS (GAAP): $0.03 vs analyst estimates of $0 ($0.03 beat)

- Adjusted EBITDA: $118.3 million vs analyst estimates of $97.38 million (21.5% margin, 21.5% beat)

- The company reconfirmed its revenue guidance for the full year of $2.45 billion at the midpoint

- EBITDA guidance for the full year is $450 million at the midpoint, above analyst estimates of $438.9 million

- Operating Margin: 7.5%, up from 2.1% in the same quarter last year

- Free Cash Flow Margin: 12.2%, up from 1.8% in the same quarter last year

- Connected Fitness Subscribers: 2.73 million, down 168,000 year on year

- Market Capitalization: $2.91 billion

Company Overview

Started as a Kickstarter campaign, Peloton (NASDAQ: PTON) is a fitness technology company known for its at-home exercise equipment and interactive online workout classes.

Launched in 2012, Peloton brings immersive fitness experiences into the home. Its products aim to meet the growing need for a convenient and effective workout regimen.

The company offers a suite of interactive fitness equipment, including stationary bicycles and treadmills, complemented by video streams of live and on-demand workout classes. These solutions seek to bring the community and energy of live studio classes into the user's home.

Peloton's revenue streams are multifaceted, including the initial sale of exercise equipment, ongoing subscriptions for class content, and a range of branded apparel.

4. Consumer Electronics

Consumer electronics companies aim to address the evolving leisure and entertainment needs of consumers, who are increasingly familiar with technology in everyday life. Whether it’s speakers for the home or specialized cameras to document everything from a surfing session to a wedding reception, these businesses are trying to provide innovative, high-quality products that are both useful and cool to own. Adding to the degree of difficulty for these companies is technological change, where the latest smartphone could disintermediate a whole category of consumer electronics. Companies that successfully serve customers and innovate can enjoy high customer loyalty and pricing power, while those that struggle with these may go the way of the VHS tape.

Competitors offering at-home fitness products and online workout classes include Nautilus (NYSE:NLS), Lululemon (NASDAQ:LULU), and Planet Fitness (NYSE:PLNT).

5. Revenue Growth

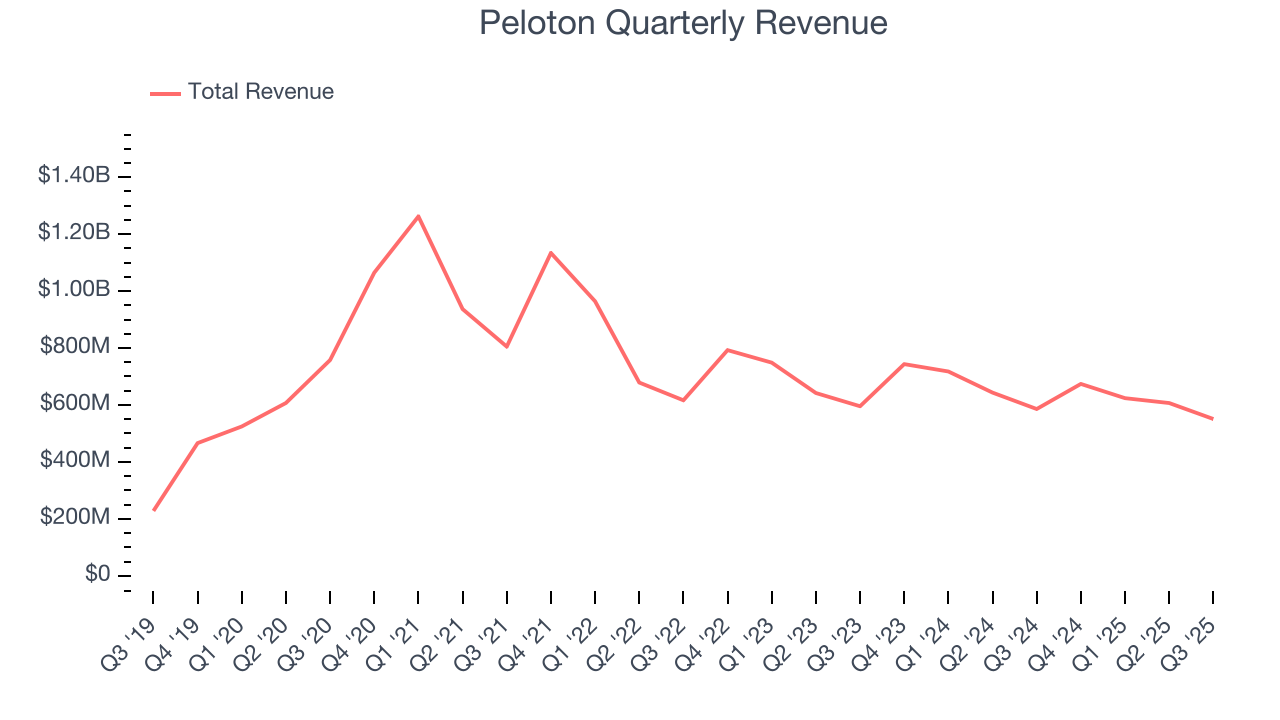

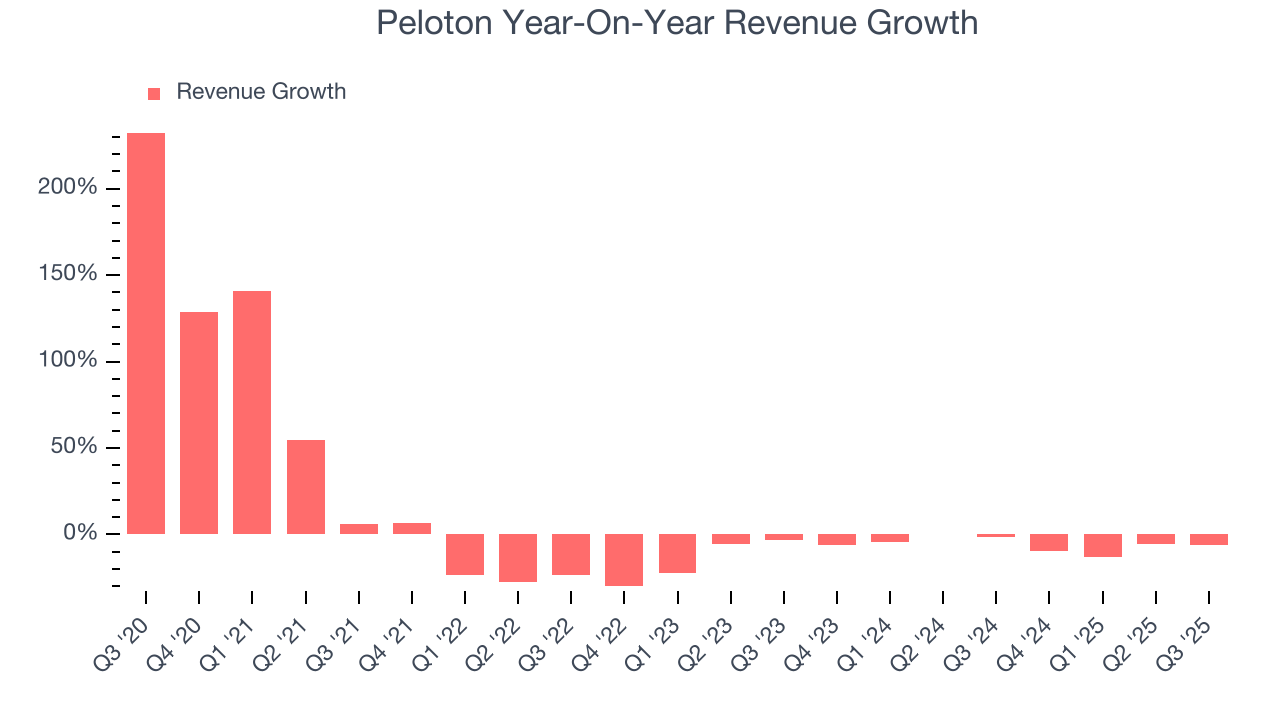

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Peloton struggled to consistently increase demand as its $2.46 billion of sales for the trailing 12 months was close to its revenue five years ago. This wasn’t a great result and is a sign of poor business quality.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Peloton’s recent performance shows its demand remained suppressed as its revenue has declined by 6% annually over the last two years.

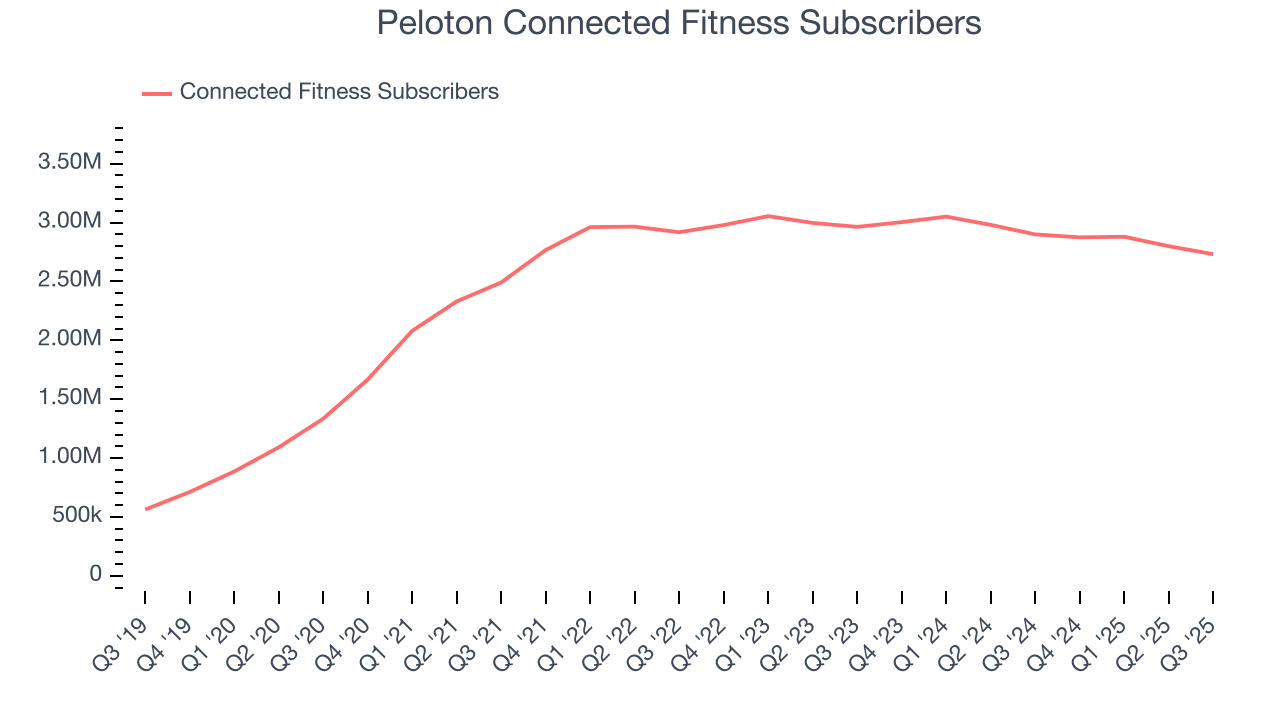

We can dig further into the company’s revenue dynamics by analyzing its number of connected fitness subscribers, which reached 2.73 million in the latest quarter. Over the last two years, Peloton’s connected fitness subscribers averaged 3% year-on-year declines. Because this number is higher than its revenue growth during the same period, we can see the company’s monetization has fallen.

This quarter, Peloton’s revenue fell by 6% year on year to $550.8 million but beat Wall Street’s estimates by 2.1%. Company management is currently guiding for flat sales next quarter.

Looking further ahead, sell-side analysts expect revenue to remain flat over the next 12 months. While this projection implies its newer products and services will fuel better top-line performance, it is still below average for the sector.

6. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

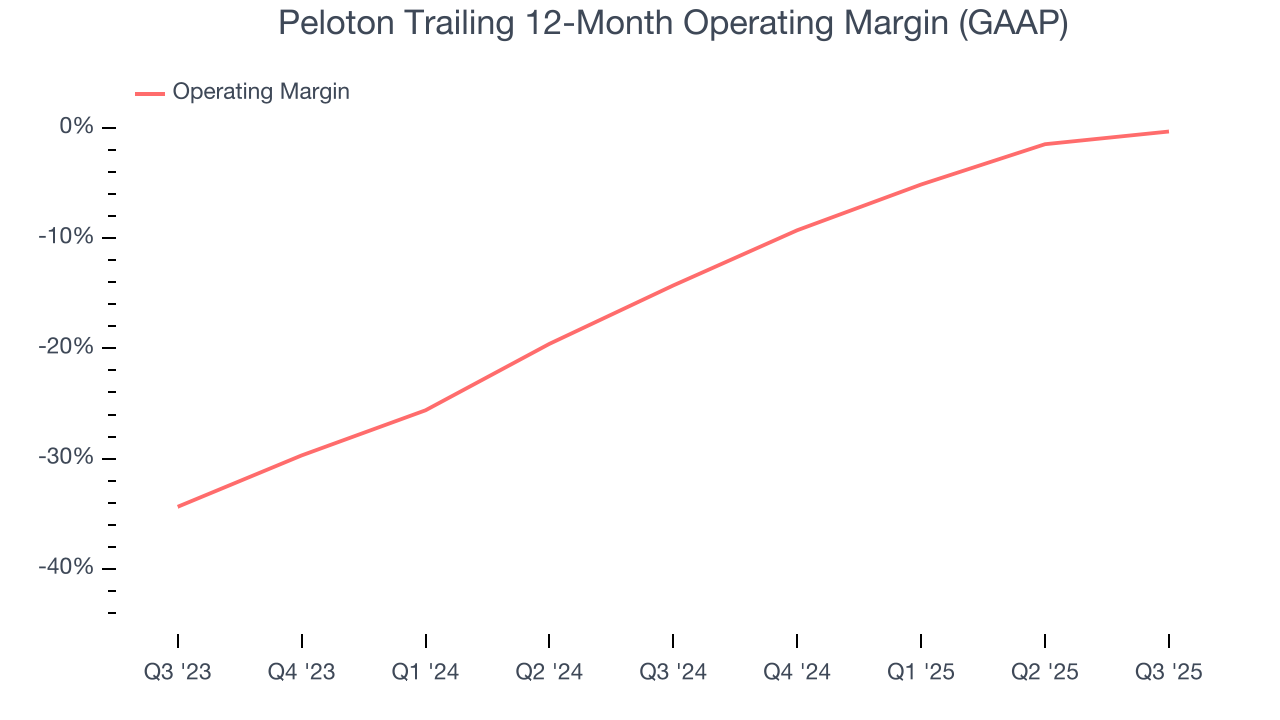

Peloton’s operating margin has risen over the last 12 months, but it still averaged negative 7.6% over the last two years. This is due to its large expense base and inefficient cost structure.

This quarter, Peloton generated an operating margin profit margin of 7.5%, up 5.4 percentage points year on year. This increase was a welcome development, especially since its revenue fell, showing it was more efficient because it scaled down its expenses.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

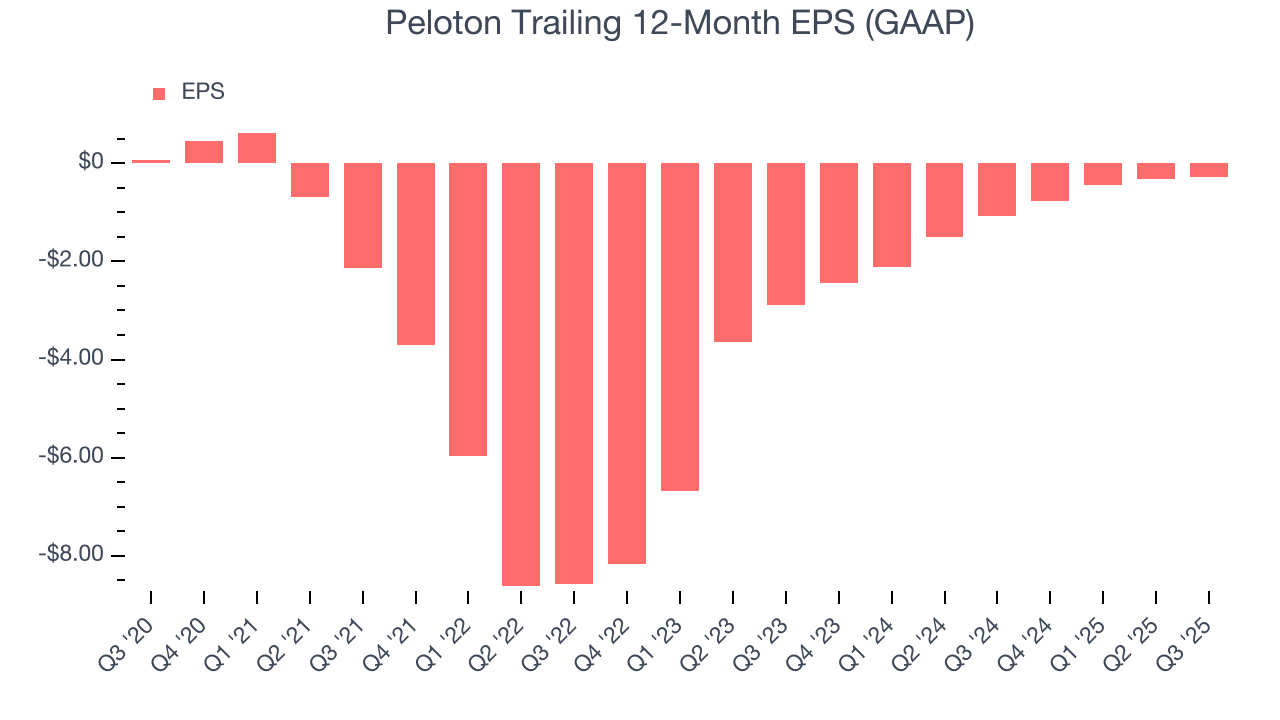

Sadly for Peloton, its EPS declined by 42.5% annually over the last five years while its revenue was flat. This tells us the company struggled because its fixed cost base made it difficult to adjust to choppy demand.

In Q3, Peloton reported EPS of $0.03, up from negative $0 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street is optimistic. Analysts forecast Peloton’s full-year EPS of negative $0.29 will flip to positive $0.17.

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

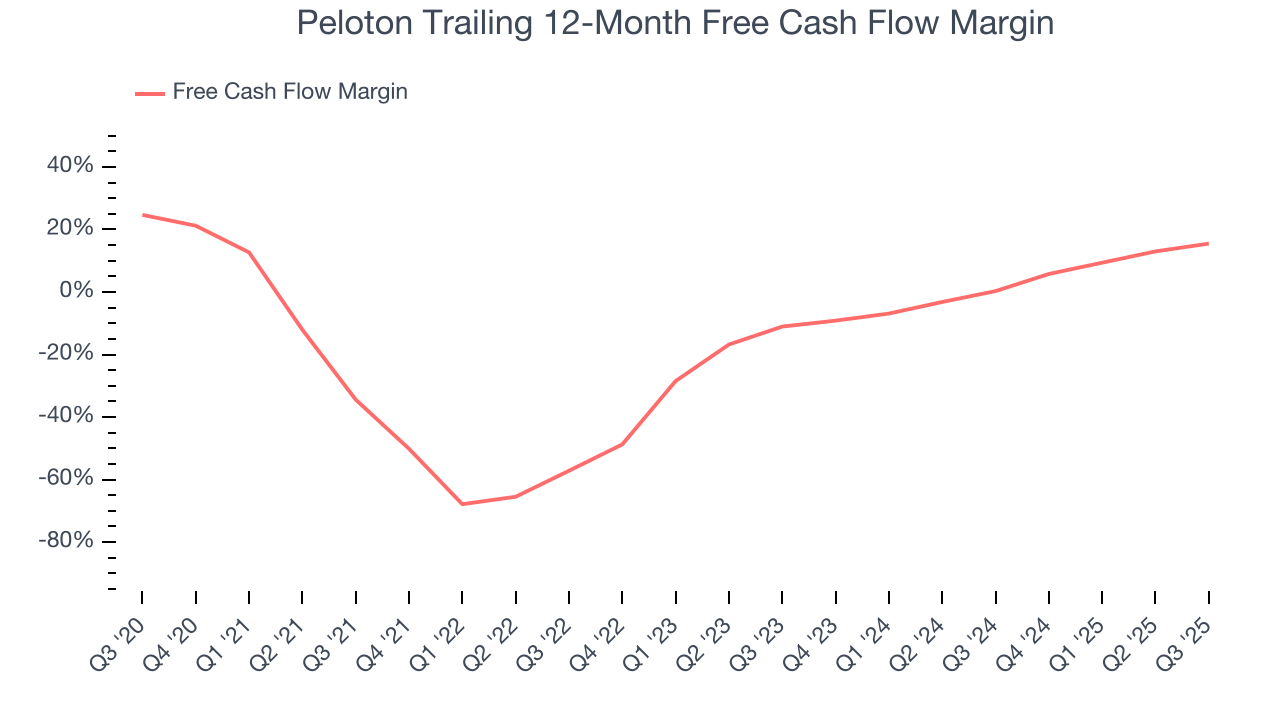

Peloton has shown weak cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 7.5%, subpar for a consumer discretionary business.

Peloton’s free cash flow clocked in at $67.4 million in Q3, equivalent to a 12.2% margin. This result was good as its margin was 10.4 percentage points higher than in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends are more important.

9. Balance Sheet Assessment

One of the best ways to mitigate bankruptcy risk is to hold more cash than debt.

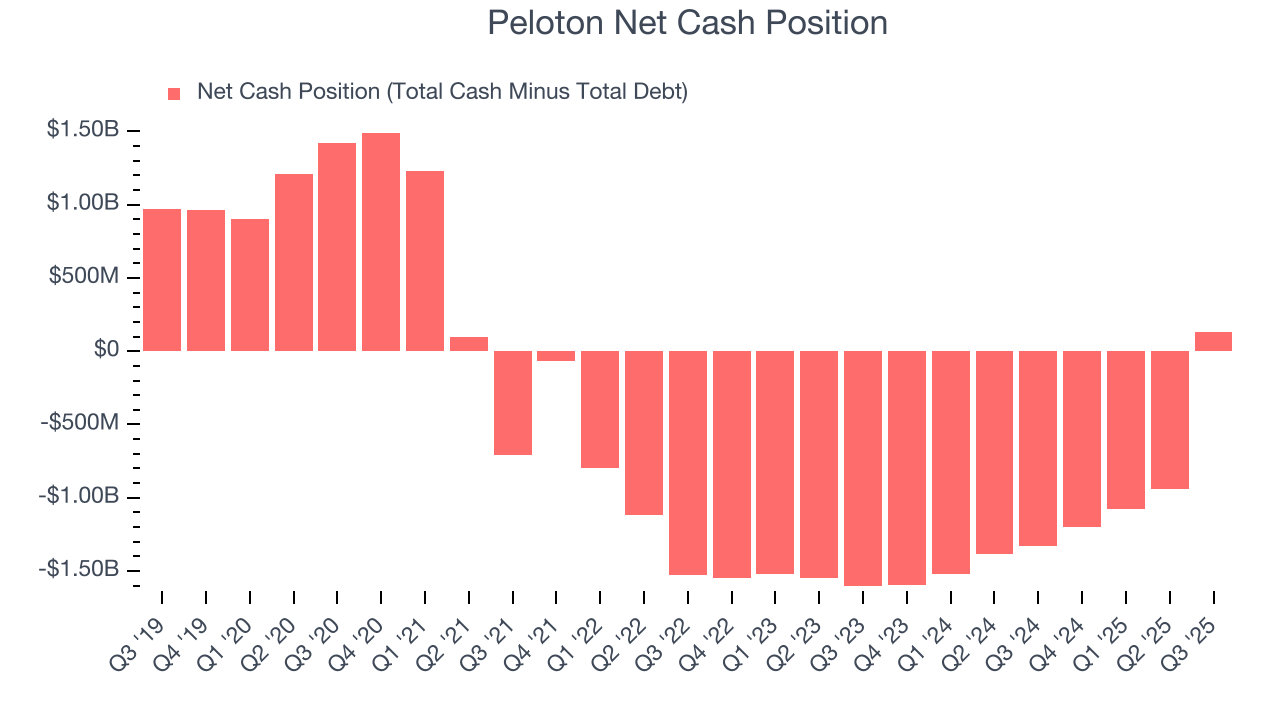

Peloton is a well-capitalized company with $1.15 billion of cash and $1.02 billion of debt on its balance sheet. This $133.1 million net cash position is 4.6% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

10. Key Takeaways from Peloton’s Q3 Results

It was good to see Peloton beat analysts’ EPS expectations this quarter. We were also glad its EBITDA outperformed Wall Street’s estimates. On the other hand, its EBITDA guidance for next quarter missed. Overall, this print had some key positives. The stock traded up 5.7% to $7.11 immediately after reporting.

11. Is Now The Time To Buy Peloton?

Updated: January 19, 2026 at 9:23 PM EST

Before making an investment decision, investors should account for Peloton’s business fundamentals and valuation in addition to what happened in the latest quarter.

We cheer for all companies serving everyday consumers, but in the case of Peloton, we’ll be cheering from the sidelines. To kick things off, its revenue growth was weak over the last five years. And while its projected EPS for the next year implies the company’s fundamentals will improve, the downside is its number of connected fitness subscribers has disappointed. On top of that, its declining EPS over the last five years makes it a less attractive asset to the public markets.

Peloton’s P/E ratio based on the next 12 months is 43.2x. This valuation is reasonable, but the company’s shaky fundamentals present too much downside risk. There are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $10.43 on the company (compared to the current share price of $6.35).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.