The Real Brokerage (REAX)

We wouldn’t recommend The Real Brokerage. Its growth has decelerated and its failure to generate meaningful free cash flow makes us question its prospects.― StockStory Analyst Team

1. News

2. Summary

Why We Think The Real Brokerage Will Underperform

Founded in Toronto, Canada in 2014, The Real Brokerage (NASDAQ:REAX) is a technology-driven real estate brokerage firm combining a tech-centric model with an agent-centric philosophy.

- Flat earnings per share over the last three years underperformed the sector average

- Historical operating margin losses point to an inefficient cost structure

- Poor free cash flow generation means it has few chances to reinvest for growth, repurchase shares, or distribute capital

The Real Brokerage doesn’t live up to our standards. We’d rather invest in businesses with stronger moats.

Why There Are Better Opportunities Than The Real Brokerage

High Quality

Investable

Underperform

Why There Are Better Opportunities Than The Real Brokerage

At $2.78 per share, The Real Brokerage trades at 6.7x forward EV-to-EBITDA. While valuation is appropriate for the quality you get, we’re still on the sidelines for now.

We’d rather pay up for companies with elite fundamentals than get a decent price on a poor one. High-quality businesses often have more durable earnings power, helping us sleep well at night.

3. The Real Brokerage (REAX) Research Report: Q3 CY2025 Update

Real estate technology company The Real Brokerage (NASDAQ:REAX) reported revenue ahead of Wall Streets expectations in Q3 CY2025, with sales up 52.6% year on year to $568.5 million. Its GAAP loss of $0 per share was in line with analysts’ consensus estimates.

The Real Brokerage (REAX) Q3 CY2025 Highlights:

- Revenue: $568.5 million vs analyst estimates of $533.8 million (52.6% year-on-year growth, 6.5% beat)

- EPS (GAAP): $0 vs analyst estimates of -$0.01 (in line)

- Adjusted EBITDA: $20.37 million vs analyst estimates of $16.56 million (3.6% margin, 23% beat)

- Operating Margin: -0.1%, in line with the same quarter last year

- Free Cash Flow Margin: 1.5%, similar to the same quarter last year

- Market Capitalization: $747.2 million

Company Overview

Founded in Toronto, Canada in 2014, The Real Brokerage (NASDAQ:REAX) is a technology-driven real estate brokerage firm combining a tech-centric model with an agent-centric philosophy.

Unlike traditional brokerages that often rely on physical office spaces, The Real Brokerage operates an online platform. This approach significantly reduces overhead costs and enables the company to offer more competitive commission splits to its agents with equity incentives, fostering a more collaborative and rewarding environment.

The company's platform provides agents with tools and resources to streamline their workflows, from marketing and lead generation to transaction management. These tools facilitate efficient communication and transaction processing, allowing agents to focus more on client service and less on administrative tasks.

The Real Brokerage's growth strategy has been marked by expansion across the United States and Canada. The company places a strong emphasis on providing continuous training, professional development opportunities, and supportive leadership to help agents grow their businesses.

4. Real Estate Services

Technology has been a double-edged sword in real estate services. On the one hand, internet listings are effective at disseminating information far and wide, casting a wide net for buyers and sellers to increase the chances of transactions. On the other hand, digitization in the real estate market could potentially disintermediate key players like agents who use information asymmetries to their advantage.

The Real Brokerage’s primary competitors include eXp World (NASDAQ:EXPI), Redfin (NASDAQ:RDFN), Zillow (NASDAQ:ZG), and Compass (NYSE:COMP).

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, The Real Brokerage grew its sales at an incredible 167% compounded annual growth rate. Its growth beat the average consumer discretionary company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. The Real Brokerage’s annualized revenue growth of 73.3% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, The Real Brokerage reported magnificent year-on-year revenue growth of 52.6%, and its $568.5 million of revenue beat Wall Street’s estimates by 6.5%.

Looking ahead, sell-side analysts expect revenue to grow 18.3% over the next 12 months, a deceleration versus the last two years. Still, this projection is healthy and suggests the market is baking in success for its products and services.

6. Operating Margin

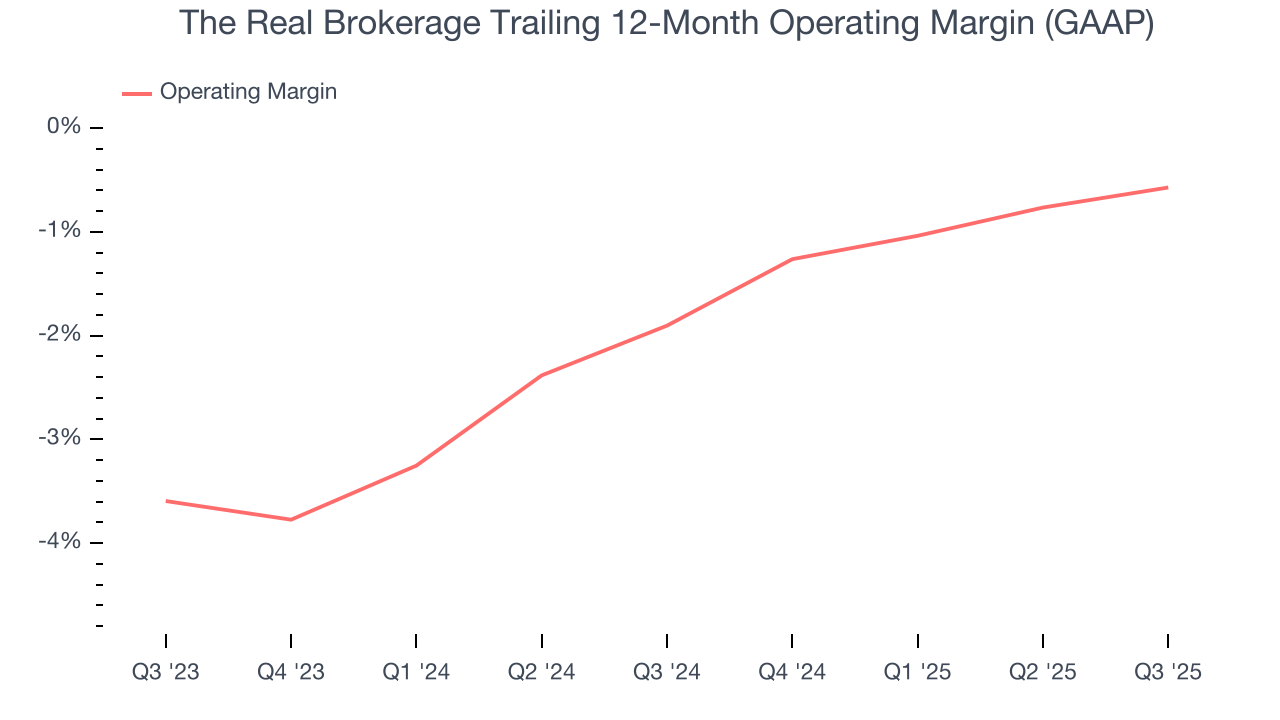

The Real Brokerage’s operating margin has risen over the last 12 months, but it still averaged negative 1.1% over the last two years. This is due to its large expense base and inefficient cost structure.

This quarter, The Real Brokerage generated a negative 0.1% operating margin.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

The Real Brokerage’s earnings losses deepened over the last five years as its EPS dropped 6.2% annually. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends and preferences. Consumer Discretionary companies are particularly exposed to this, and if the tide turns unexpectedly, The Real Brokerage’s low margin of safety could leave its stock price susceptible to large downswings.

In Q3, The Real Brokerage reported EPS of $0, up from negative $0.01 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects The Real Brokerage to improve its earnings losses. Analysts forecast its full-year EPS of negative $0.04 will advance to negative $0.02.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

The Real Brokerage has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.7%, lousy for a consumer discretionary business.

The Real Brokerage’s free cash flow clocked in at $8.41 million in Q3, equivalent to a 1.5% margin. This cash profitability was in line with the comparable period last year but below its two-year average. In a silo, this isn’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

Over the next year, analysts’ consensus estimates show they’re expecting The Real Brokerage’s free cash flow margin of 3.8% for the last 12 months to remain the same.

9. Balance Sheet Assessment

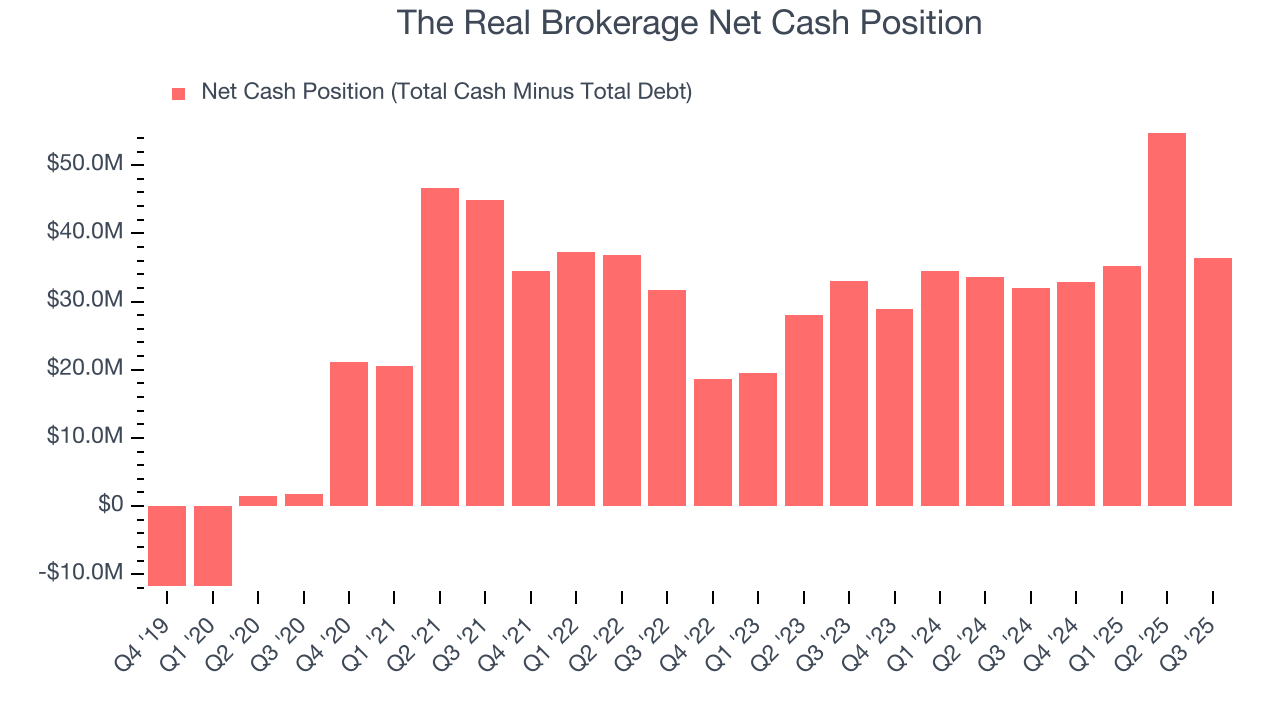

Businesses that maintain a cash surplus face reduced bankruptcy risk.

The Real Brokerage is a well-capitalized company with $36.43 million of cash and no debt. This position is 4.9% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

10. Key Takeaways from The Real Brokerage’s Q3 Results

It was encouraging to see The Real Brokerage meet analysts’ EPS expectations this quarter. We were also glad its EBITDA outperformed Wall Street’s estimates. Zooming out, we think this was a solid print. The stock traded up 5.6% to $3.78 immediately after reporting.

11. Is Now The Time To Buy The Real Brokerage?

Updated: March 3, 2026 at 10:02 PM EST

Are you wondering whether to buy The Real Brokerage or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

The Real Brokerage falls short of our quality standards. Although its revenue growth was exceptional over the last five years, it’s expected to deteriorate over the next 12 months and its Forecasted free cash flow margin for next year suggests the company will fail to improve its cash conversion. On top of that, the company’s weak EPS growth over the last three years shows it’s failed to produce meaningful profits for shareholders.

The Real Brokerage’s EV-to-EBITDA ratio based on the next 12 months is 6.7x. While this valuation is fair, the upside isn’t great compared to the potential downside. There are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $5.93 on the company (compared to the current share price of $2.78).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.