Verra Mobility (VRRM)

We see potential in Verra Mobility. Its blend of high growth and outstanding profitability makes for a nice return algorithm.― StockStory Analyst Team

1. News

2. Summary

Why Verra Mobility Is Interesting

Aiming to wrap technology and data around a historically manual and paper-based industry, Verra Mobility (NYSE:VRRM) is a leading provider of smart mobility technology to address tolls and violations, title and registration services, as well as safety and traffic enforcement.

- Annual revenue growth of 20% over the past five years was outstanding, reflecting market share gains this cycle

- Offerings are difficult to replicate at scale and result in a best-in-class gross margin of 61.3%

- On a dimmer note, its estimated sales growth of 4.8% for the next 12 months implies demand will slow from its two-year trend

Verra Mobility shows some promise. If you’ve been itching to buy the stock, the valuation looks fair.

Why Is Now The Time To Buy Verra Mobility?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Verra Mobility?

At $16.71 per share, Verra Mobility trades at 12.5x forward P/E. Many industrials companies may feature a higher valuation multiple, but that doesn’t make Verra Mobility a great deal. We think the current multiple fairly reflects the revenue characteristics.

Now could be a good time to invest if you believe in the story.

3. Verra Mobility (VRRM) Research Report: Q4 CY2025 Update

Traffic solutions company Verra Mobility (NYSE:VRRM) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 16.4% year on year to $257.9 million. The company expects the full year’s revenue to be around $1.03 billion, close to analysts’ estimates. Its non-GAAP profit of $0.30 per share was 4.1% below analysts’ consensus estimates.

Verra Mobility (VRRM) Q4 CY2025 Highlights:

- Revenue: $257.9 million vs analyst estimates of $241.7 million (16.4% year-on-year growth, 6.7% beat)

- Adjusted EPS: $0.30 vs analyst expectations of $0.31 (4.1% miss)

- Adjusted EBITDA: $101.8 million vs analyst estimates of $102.4 million (39.5% margin, 0.6% miss)

- Adjusted EPS guidance for the upcoming financial year 2026 is $1.35 at the midpoint, missing analyst estimates by 0.6%

- EBITDA guidance for the upcoming financial year 2026 is $410 million at the midpoint, below analyst estimates of $415.8 million

- Operating Margin: 16.7%, up from -19.6% in the same quarter last year

- Free Cash Flow Margin: 2.2%, down from 9.8% in the same quarter last year

- Market Capitalization: $2.96 billion

Company Overview

Aiming to wrap technology and data around a historically manual and paper-based industry, Verra Mobility (NYSE:VRRM) is a leading provider of smart mobility technology to address tolls and violations, title and registration services, as well as safety and traffic enforcement.

Verra Mobility was originally established as a traffic enforcement technology business. Today, it offers products addressing smart mobility technology including a wider range of services such as automated government systems and parking solutions.

Specifically, the company provides automated toll and violations management services to rental car companies, direct commercial fleets, and fleet management companies in North America and Europe. It also manages regional toll transponder installations and ensures transponders are correctly linked to specific vehicles. In the realm of government services, Verra Mobility supplies automated safety solutions, including road safety cameras. These systems are capable of detecting various traffic violations such as red-light infractions and speeding. Verra Mobility’s end-to-end solutions support government agencies by installing and maintaining equipment, processing violation data, and managing citation issuance and other administrative functions.

Following the acquisition of T2 Systems in December 2021, Verra Mobility expanded into parking management. T2 Systems is recognized for delivering end-to-end parking solutions, particularly to universities, municipalities, and healthcare facilities. Its parking technologies include software and hardware for managing parking access and revenue, such as multi-space pay stations and mobile payment platforms. One specific product, UNIFI Mobile integrates various parking-related transactions into a unified mobile-first platform, enhancing operational efficiency for parking operators and convenience for end-users.

The company's revenue is generated by fees and contracts from the services mentioned above.

4. Electrical Systems

Like many equipment and component manufacturers, electrical systems companies are buoyed by secular trends such as connectivity and industrial automation. More specific pockets of strong demand include Internet of Things (IoT) connectivity and the 5G telecom upgrade cycle, which can benefit companies whose cables and conduits fit those needs. But like the broader industrials sector, these companies are also at the whim of economic cycles. Interest rates, for example, can greatly impact projects that drive demand for these products.

Competitors of Verra Mobility include Conduent Transportation (NASDAQ:CNDT), Cubic (private, acquired by Veritas Capital), and European competitor Kapsch TrafficCom AG (OTCMKTS:KPSHF).

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Verra Mobility’s 20% annualized revenue growth over the last five years was incredible. Its growth beat the average industrials company and shows its offerings resonate with customers, a helpful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Verra Mobility’s annualized revenue growth of 9.4% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Verra Mobility reported year-on-year revenue growth of 16.4%, and its $257.9 million of revenue exceeded Wall Street’s estimates by 6.7%.

Looking ahead, sell-side analysts expect revenue to grow 4.5% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

6. Gross Margin & Pricing Power

Cost of sales for an industrials business is usually comprised of the direct labor, raw materials, and supplies needed to offer a product or service. These costs can be impacted by inflation and supply chain dynamics.

Verra Mobility has best-in-class unit economics for an industrials company, enabling it to invest in areas such as research and development. Its margin also signals it sells differentiated products, not commodities. As you can see below, it averaged an elite 61.3% gross margin over the last five years. That means Verra Mobility only paid its suppliers $38.71 for every $100 in revenue.

Verra Mobility’s gross profit margin came in at 54.4% this quarter , marking a 6.1 percentage point decrease from 60.6% in the same quarter last year. Verra Mobility’s full-year margin has also been trending down over the past 12 months, decreasing by 2.9 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as raw materials and manufacturing expenses).

7. Operating Margin

Verra Mobility has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 21.2%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Verra Mobility’s operating margin rose by 4 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Verra Mobility generated an operating margin profit margin of 16.7%, up 36.3 percentage points year on year. The increase was solid, and because its gross margin actually decreased, we can assume it was more efficient because its operating expenses like marketing, R&D, and administrative overhead grew slower than its revenue.

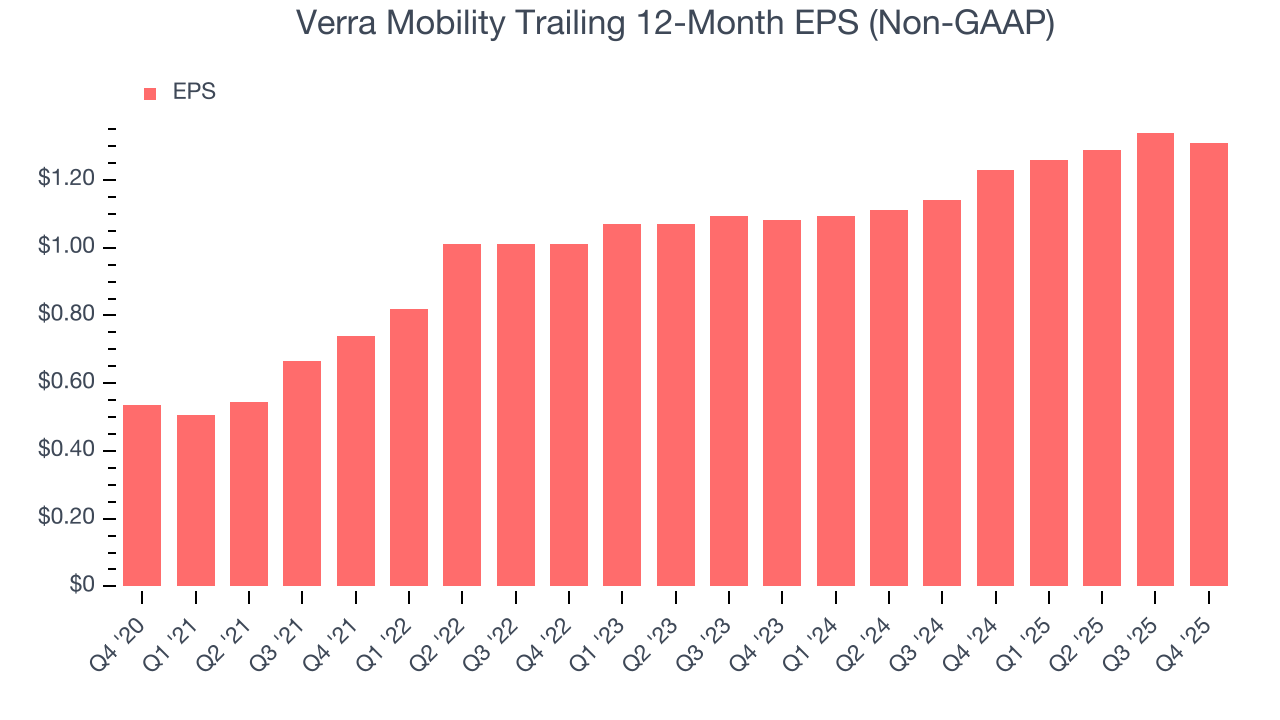

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Verra Mobility’s astounding 19.6% annual EPS growth over the last five years aligns with its revenue performance. This tells us its incremental sales were profitable.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Verra Mobility, its two-year annual EPS growth of 10% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.

In Q4, Verra Mobility reported adjusted EPS of $0.30, down from $0.33 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term adjusted EPS growth than short-term movements. Over the next 12 months, Wall Street expects Verra Mobility’s full-year EPS of $1.31 to grow 3.8%.

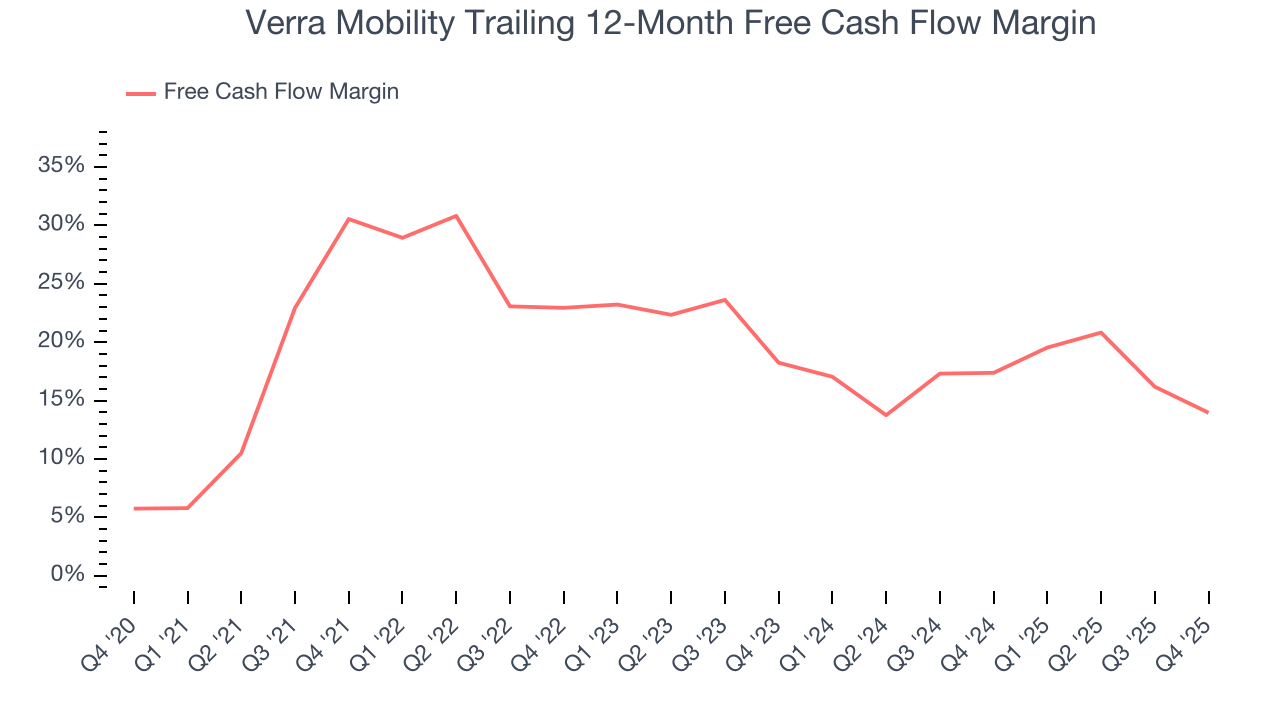

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Verra Mobility has shown terrific cash profitability, putting it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the industrials sector, averaging 19.6% over the last five years.

Taking a step back, we can see that Verra Mobility’s margin dropped by 16.6 percentage points during that time. If its declines continue, it could signal increasing investment needs and capital intensity.

Verra Mobility’s free cash flow clocked in at $5.75 million in Q4, equivalent to a 2.2% margin. The company’s cash profitability regressed as it was 7.5 percentage points lower than in the same quarter last year, which isn’t ideal considering its longer-term trend.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although Verra Mobility has shown solid fundamentals lately, it historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 10%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Verra Mobility’s ROIC averaged 2 percentage point increases each year. its rising ROIC is a good sign and could suggest its competitive advantage or profitable growth opportunities are expanding.

11. Balance Sheet Assessment

Verra Mobility reported $68.32 million of cash and $1.05 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $415.9 million of EBITDA over the last 12 months, we view Verra Mobility’s 2.4× net-debt-to-EBITDA ratio as safe. We also see its $34.64 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Verra Mobility’s Q4 Results

We were impressed by how significantly Verra Mobility blew past analysts’ revenue expectations this quarter. On the other hand, its EPS missed and its full-year EBITDA guidance fell slightly short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 6.7% to $17.47 immediately following the results.

13. Is Now The Time To Buy Verra Mobility?

Updated: February 28, 2026 at 11:33 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

Verra Mobility possesses a number of positive attributes. First off, its revenue growth was exceptional over the last five years. And while its cash profitability fell over the last five years, its admirable gross margins indicate the mission-critical nature of its offerings. On top of that, its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits.

Verra Mobility’s P/E ratio based on the next 12 months is 12.5x. Looking at the industrials landscape right now, Verra Mobility trades at a pretty interesting price. If you trust the business and its direction, this is an ideal time to buy.

Wall Street analysts have a consensus one-year price target of $25.57 on the company (compared to the current share price of $16.71), implying they see 53% upside in buying Verra Mobility in the short term.