Zoom (ZM)

Zoom keeps us up at night. Its growth has been lacking and its cash conversion is projected to decline, a situation we’d avoid.― StockStory Analyst Team

1. News

2. Summary

Why We Think Zoom Will Underperform

Once the verb that defined remote work during the pandemic ("let's Zoom later"), Zoom (NASDAQ:ZM) provides a cloud-based platform for video meetings, phone calls, team chat, and collaboration tools that helps businesses and individuals connect virtually.

- Annual revenue growth of 3.7% over the last two years was well below our standards for the software sector

- Customers were hesitant to make long-term commitments to its software as its 4.3% average ARR growth over the last year was sluggish

- Demand will likely be soft over the next 12 months as Wall Street’s estimates imply tepid growth of 4.2%

Zoom doesn’t measure up to our expectations. We’d search for superior opportunities elsewhere.

Why There Are Better Opportunities Than Zoom

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Zoom

At $78.13 per share, Zoom trades at 4.4x forward price-to-sales. This sure is a cheap multiple, but you get what you pay for.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. Zoom (ZM) Research Report: Q4 CY2025 Update

Video communications platform Zoom (NASDAQ:ZM) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 5.3% year on year to $1.25 billion. The company expects next quarter’s revenue to be around $1.22 billion, close to analysts’ estimates. Its non-GAAP profit of $1.44 per share was 3.1% below analysts’ consensus estimates.

Zoom (ZM) Q4 CY2025 Highlights:

- Revenue: $1.25 billion vs analyst estimates of $1.23 billion (5.3% year-on-year growth, 1.1% beat)

- Adjusted EPS: $1.44 vs analyst expectations of $1.49 (3.1% miss)

- Adjusted Operating Income: $489.7 million vs analyst estimates of $482.1 million (39.3% margin, 1.6% beat)

- Revenue Guidance for Q1 CY2026 is $1.22 billion at the midpoint, roughly in line with what analysts were expecting

- Adjusted EPS guidance for the upcoming financial year 2027 is $5.79 at the midpoint, missing analyst estimates by 4.5%

- Operating Margin: 20%, up from 19% in the same quarter last year

- Free Cash Flow Margin: 27.1%, down from 50% in the previous quarter

- Customers: 4,468 customers paying more than $100,000 annually

- Net Revenue Retention Rate: 98%, in line with the previous quarter

- Market Capitalization: $25.91 billion

Company Overview

Once the verb that defined remote work during the pandemic ("let's Zoom later"), Zoom (NASDAQ:ZM) provides a cloud-based platform for video meetings, phone calls, team chat, and collaboration tools that helps businesses and individuals connect virtually.

The company's flagship product, Zoom Meetings, supports everything from one-on-one conversations to large-scale webinars with up to 100,000 attendees, offering features like screen sharing, virtual backgrounds, breakout rooms, and recording capabilities. Beyond video conferencing, Zoom has expanded into a comprehensive communication platform with Zoom Phone (a cloud-based phone system), Zoom Team Chat, and specialized solutions for various business needs.

Zoom serves customers across all industries and organization sizes, from individual users to Fortune 50 corporations, educational institutions, healthcare providers, and government agencies worldwide. Its business model combines free basic services that drive viral adoption with premium subscription tiers offering advanced features and support for larger enterprises.

The platform has evolved to integrate AI capabilities through Zoom AI Companion, which provides real-time assistance during meetings, and expanded into additional workspace solutions like Zoom Whiteboard, Zoom Docs, and Zoom Contact Center. These tools allow teams to collaborate on projects, manage customer interactions, and streamline workflows within a single ecosystem.

For example, a multinational corporation might use Zoom Meetings for board sessions with executives across different countries, Zoom Phone for their customer service department, and Zoom Contact Center to manage customer inquiries across multiple channels—all while accessing AI-powered meeting summaries and transcriptions.

4. Video Conferencing

Work is becoming more distributed, both across geographies and devices. In order for businesses to keep functioning efficiently, they need to be able to communicate as well as they did when the teams were co-located, which drives the demand for integrated communication platforms.

Zoom's main competitors include Microsoft Teams (NASDAQ:MSFT), Cisco Webex (NASDAQ:CSCO), Google Meet (NASDAQ:GOOGL), and RingCentral (NYSE:RNG). In the contact center space, it competes with Five9 (NASDAQ:FIVN), Genesys, and NICE (NASDAQ:NICE).

5. Revenue Growth

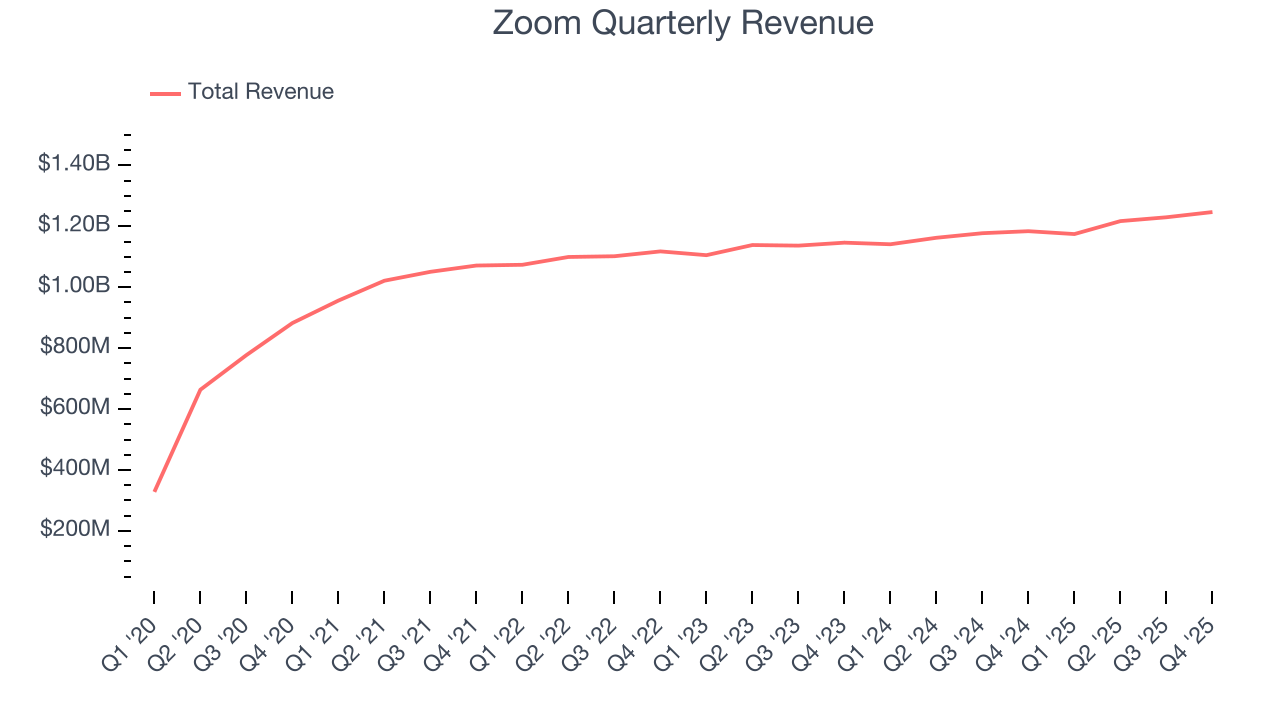

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Zoom grew its sales at a 12.9% annual rate. Though this growth is acceptable on an absolute basis, we need to see more than just topline growth for the software sector, which can display significant earnings volatility. This means our bar for the sector is particularly high, reflecting the non-essential and hit-driven nature of the products and services offered. Additionally, five-year CAGR starts around Covid, when revenue was depressed then rebounded.

Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. Zoom’s recent performance shows its demand has slowed as its annualized revenue growth of 3.7% over the last two years was below its five-year trend. We’re wary when companies in the sector see decelerations in revenue growth, as it could signal changing consumer tastes aided by low switching costs.

This quarter, Zoom reported year-on-year revenue growth of 5.3%, and its $1.25 billion of revenue exceeded Wall Street’s estimates by 1.1%. Company management is currently guiding for a 4.1% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 3.2% over the next 12 months, similar to its two-year rate. This projection is underwhelming and implies its newer products and services will not lead to better top-line performance yet.

6. Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Zoom’s billings came in at $1.23 billion in Q4, and over the last four quarters, its growth was underwhelming as it averaged 4% year-on-year increases. This performance mirrored its total sales and suggests that increasing competition is causing challenges in acquiring/retaining customers.

7. Enterprise Customer Base

This quarter, Zoom reported 4,468 enterprise customers paying more than $100,000 annually, an increase of 105 from the previous quarter. That’s quite a bit more contract wins than last quarter but also quite a bit below what we’ve observed over the previous year. This indicates the company is optimizing its go-to-market strategy to reinvigorate growth.

8. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Zoom is extremely efficient at acquiring new customers, and its CAC payback period checked in at 16 months this quarter. The company’s rapid recovery of its customer acquisition costs means it can attempt to spur growth by increasing its sales and marketing investments.

9. Customer Retention

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

Zoom’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 98% in Q4. This means Zoom’s revenue would’ve decreased by 2% over the last 12 months if it didn’t win any new customers.

Zoom has a weak net retention rate, signaling that some customers aren’t satisfied with its products, leading to lost contracts and revenue streams.

10. Gross Margin & Pricing Power

For software companies like Zoom, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

Zoom’s gross margin is good for a software business and points to its solid unit economics, competitive products and services, and lack of meaningful pricing pressure. As you can see below, it averaged an impressive 77% gross margin over the last year. That means for every $100 in revenue, roughly $77.02 was left to spend on selling, marketing, and R&D.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Zoom has seen gross margins improve by 0.7 percentage points over the last 2 year, which is slightly better than average for software.

This quarter, Zoom’s gross profit margin was 76.3%, in line with the same quarter last year. Zooming out, Zoom’s full-year margin has been trending up over the past 12 months, increasing by 1.2 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as servers).

11. Operating Margin

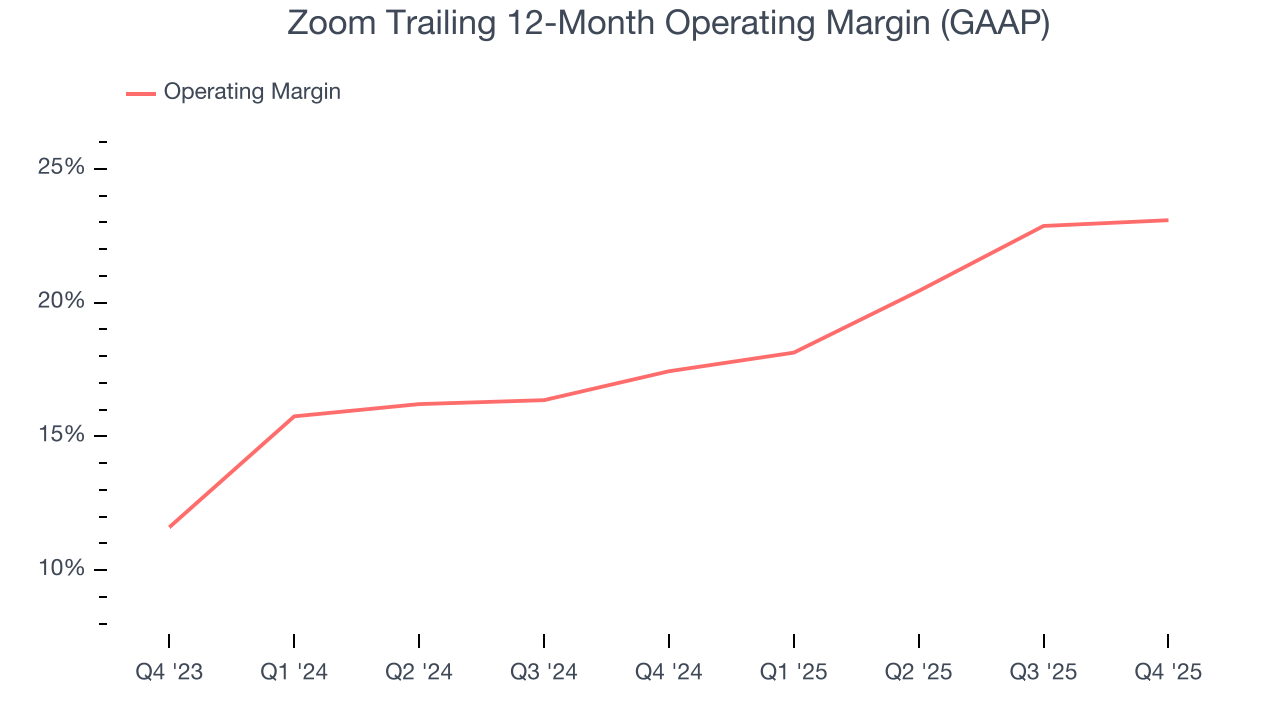

Zoom has been a well-oiled machine over the last year. It demonstrated elite profitability for a software business, boasting an average operating margin of 23.1%. This result isn’t too surprising as its gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Zoom’s operating margin rose by 5.6 percentage points over the last two years, as its sales growth gave it operating leverage.

This quarter, Zoom generated an operating margin profit margin of 20%, up 1 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

12. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Zoom has shown terrific cash profitability, driven by its lucrative business model and cost-effective customer acquisition strategy that enable it to stay ahead of the competition through investments in new products rather than sales and marketing. The company’s free cash flow margin was among the best in the software sector, averaging an eye-popping 39.5% over the last year.

Zoom’s free cash flow clocked in at $338.4 million in Q4, equivalent to a 27.1% margin. The company’s cash profitability regressed as it was 8 percentage points lower than in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

Over the next year, analysts predict Zoom’s cash conversion will slightly fall. Their consensus estimates imply its free cash flow margin of 39.5% for the last 12 months will decrease to 38.7%.

13. Balance Sheet Assessment

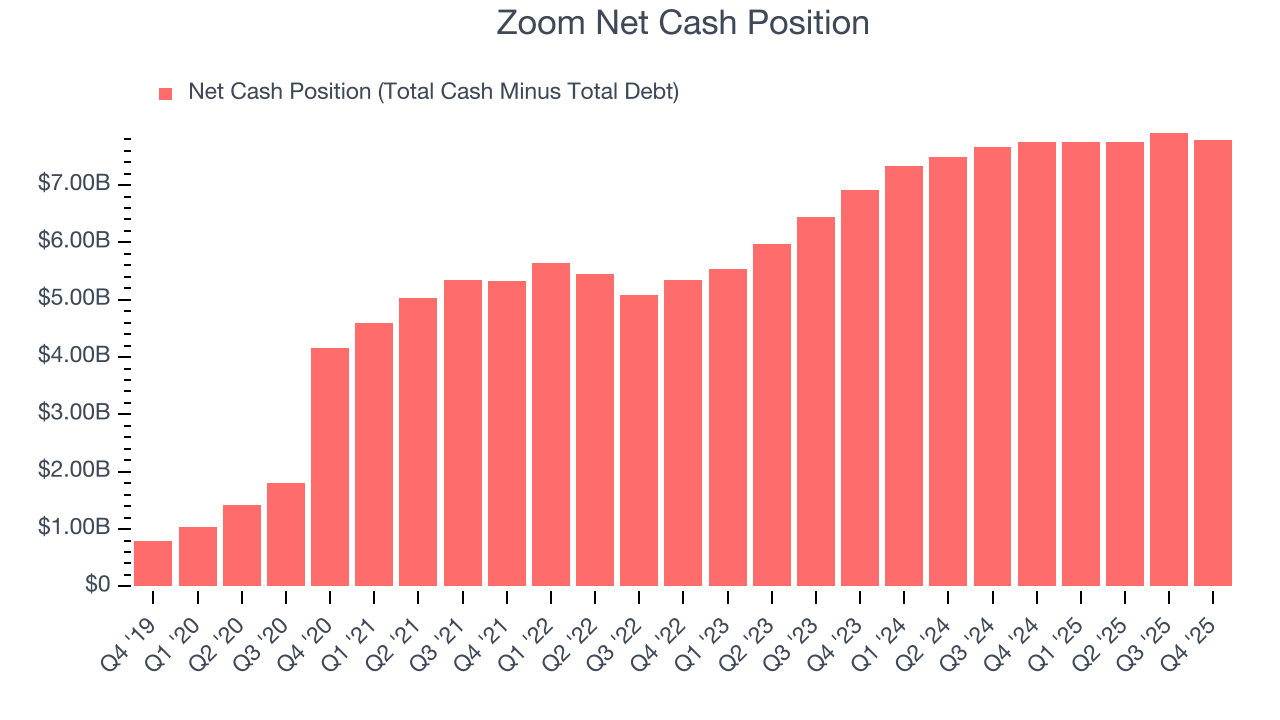

Companies with more cash than debt have lower bankruptcy risk.

Zoom is a profitable, well-capitalized company with $7.82 billion of cash and $30.71 million of debt on its balance sheet. This $7.79 billion net cash position is 30.8% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

14. Key Takeaways from Zoom’s Q4 Results

We enjoyed seeing Zoom’s optimistic revenue guidance for next year. We were also glad it had many new large contract wins. On the other hand, its full-year EPS guidance missed. Overall, this quarter could have been better. The stock traded down 3.6% to $84 immediately following the results.

15. Is Now The Time To Buy Zoom?

Updated: March 4, 2026 at 9:11 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Zoom, you should also grasp the company’s longer-term business quality and valuation.

Zoom falls short of our quality standards. First off, its revenue growth was uninspiring over the last five years, and analysts expect its demand to deteriorate over the next 12 months. While its bountiful generation of free cash flow empowers it to invest in growth initiatives, the downside is its ARR has disappointed and shows the company is having difficulty retaining customers and their spending. On top of that, its software has low switching costs and high turnover.

Zoom’s price-to-sales ratio based on the next 12 months is 4.4x. This multiple tells us a lot of good news is priced in - you can find more timely opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $97.33 on the company (compared to the current share price of $78.13).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.