8x8 (EGHT)

We wouldn’t recommend 8x8. Its underwhelming revenue growth and failure to generate meaningful free cash flow is a concerning trend.― StockStory Analyst Team

1. News

2. Summary

Why We Think 8x8 Will Underperform

Named after its founding year (1987) with "8x8" representing binary code for communications, 8x8 (NASDAQ:EGHT) provides cloud-based contact center and unified communications solutions that enable businesses to manage customer interactions and internal communications through a single platform.

- Customers had second thoughts about committing to its platform over the last year as its average billings growth of 2.4% underwhelmed

- Projected sales for the next 12 months are flat and suggest demand will be subdued

- Operating margin improved by 2.1 percentage points over the last year as it eliminated redundant costs

8x8 is in the penalty box. We’ve identified better opportunities elsewhere.

Why There Are Better Opportunities Than 8x8

High Quality

Investable

Underperform

Why There Are Better Opportunities Than 8x8

At $2.14 per share, 8x8 trades at 0.4x forward price-to-sales. This certainly seems like a cheap stock, but we think there are valid reasons why it trades this way.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. 8x8 (EGHT) Research Report: Q4 CY2025 Update

Cloud communications provider 8x8 (NASDAQ:EGHT) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 3.4% year on year to $185.1 million. On top of that, next quarter’s revenue guidance ($181 million at the midpoint) was surprisingly good and 3.2% above what analysts were expecting. Its non-GAAP profit of $0.12 per share was 37.1% above analysts’ consensus estimates.

8x8 (EGHT) Q4 CY2025 Highlights:

- Revenue: $185.1 million vs analyst estimates of $179.7 million (3.4% year-on-year growth, 2.9% beat)

- Adjusted EPS: $0.12 vs analyst estimates of $0.09 (37.1% beat)

- Adjusted Operating Income: $21.66 million vs analyst estimates of $16.61 million (11.7% margin, 30.4% beat)

- "Demand for AI-driven customer experience tools continued to accelerate in Q3 FY26, with significant growth in both adoption and usage across 8x8 Intelligent Customer Assistant solutions"

- Revenue Guidance for Q1 CY2026 is $181 million at the midpoint, above analyst estimates of $175.5 million

- Operating Margin: 5.2%, in line with the same quarter last year

- Free Cash Flow Margin: 8.9%, up from 4.2% in the previous quarter

- Billings: $178.1 million at quarter end, up 2.9% year on year

- Market Capitalization: $238.5 million

Company Overview

Named after its founding year (1987) with "8x8" representing binary code for communications, 8x8 (NASDAQ:EGHT) provides cloud-based contact center and unified communications solutions that enable businesses to manage customer interactions and internal communications through a single platform.

8x8's XCaaS (Experience Communications as a Service) platform combines contact center capabilities, voice services, video meetings, and team messaging in an integrated cloud solution. The platform serves organizations ranging from small businesses to large enterprises, allowing them to replace traditional on-premises phone systems and disjointed communication tools with a unified approach.

The company's core offerings include 8x8 Work for unified communications, 8x8 Contact Center for customer engagement, and 8x8 Engage for employees outside formal contact centers. Its CPaaS (Communications Platform as a Service) capabilities allow developers to embed communication features directly into applications and websites. 8x8 also offers specialized integrations with Microsoft Teams, enabling businesses in the Microsoft ecosystem to leverage 8x8's global voice services.

A mid-sized business might deploy 8x8 to replace separate phone systems, video conferencing applications, and chat tools with a single platform that connects their customer service teams with the rest of the organization. This integration allows customer data to flow seamlessly between departments, creating more personalized experiences.

8x8 generates revenue through subscription-based service plans, with pricing tiers based on features and functionality. The company sells both directly to customers and through channel partners, including value-added resellers, system integrators, and master agents. With data centers around the world and a global network operations center, 8x8 provides service in over 160 countries, supporting multinational businesses with compliance and localization requirements.

4. Video Conferencing

Work is becoming more distributed, both across geographies and devices. In order for businesses to keep functioning efficiently, they need to be able to communicate as well as they did when the teams were co-located, which drives the demand for integrated communication platforms.

8x8 competes with other cloud communications providers such as RingCentral (NYSE:RNG), Zoom (NASDAQ:ZM), Vonage (acquired by Ericsson), Five9 (NASDAQ:FIVN), NICE (NASDAQ:NICE), Twilio (NYSE:TWLO), as well as legacy communications providers like Cisco (NASDAQ:CSCO), Avaya, and tech giants including Microsoft (NASDAQ:MSFT) and Google (NASDAQ:GOOGL).

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, 8x8’s 7.4% annualized revenue growth over the last five years was weak. This fell short of our benchmark for the software sector and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. 8x8’s recent performance shows its demand has slowed as its revenue was flat over the last two years.

This quarter, 8x8 reported modest year-on-year revenue growth of 3.4% but beat Wall Street’s estimates by 2.9%. Company management is currently guiding for a 2.2% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 1.1% over the next 12 months, similar to its two-year rate. This projection is underwhelming and suggests its newer products and services will not catalyze better top-line performance yet.

6. Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

8x8’s billings came in at $178.1 million in Q4, and over the last four quarters, its growth was underwhelming as it averaged 2.4% year-on-year increases. This performance mirrored its total sales and suggests that increasing competition is causing challenges in acquiring/retaining customers.

7. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

It’s relatively expensive for 8x8 to acquire new customers as its CAC payback period checked in at 85.3 months this quarter. The company’s slow recovery of its sales and marketing expenses indicates it operates in a highly competitive market and must invest to stand out, even if the return on that investment is low.

8. Gross Margin & Pricing Power

For software companies like 8x8, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

8x8’s gross margin is substantially worse than most software businesses, signaling it has relatively high infrastructure costs compared to asset-lite businesses like ServiceNow. As you can see below, it averaged a 65.7% gross margin over the last year. Said differently, 8x8 had to pay a chunky $34.29 to its service providers for every $100 in revenue.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. 8x8 has seen gross margins decline by 3.9 percentage points over the last 2 year, which is among the worst in the software space.

8x8’s gross profit margin came in at 63.9% this quarter, marking a 3.8 percentage point decrease from 67.7% in the same quarter last year. 8x8’s full-year margin has also been trending down over the past 12 months, decreasing by 2.3 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs.

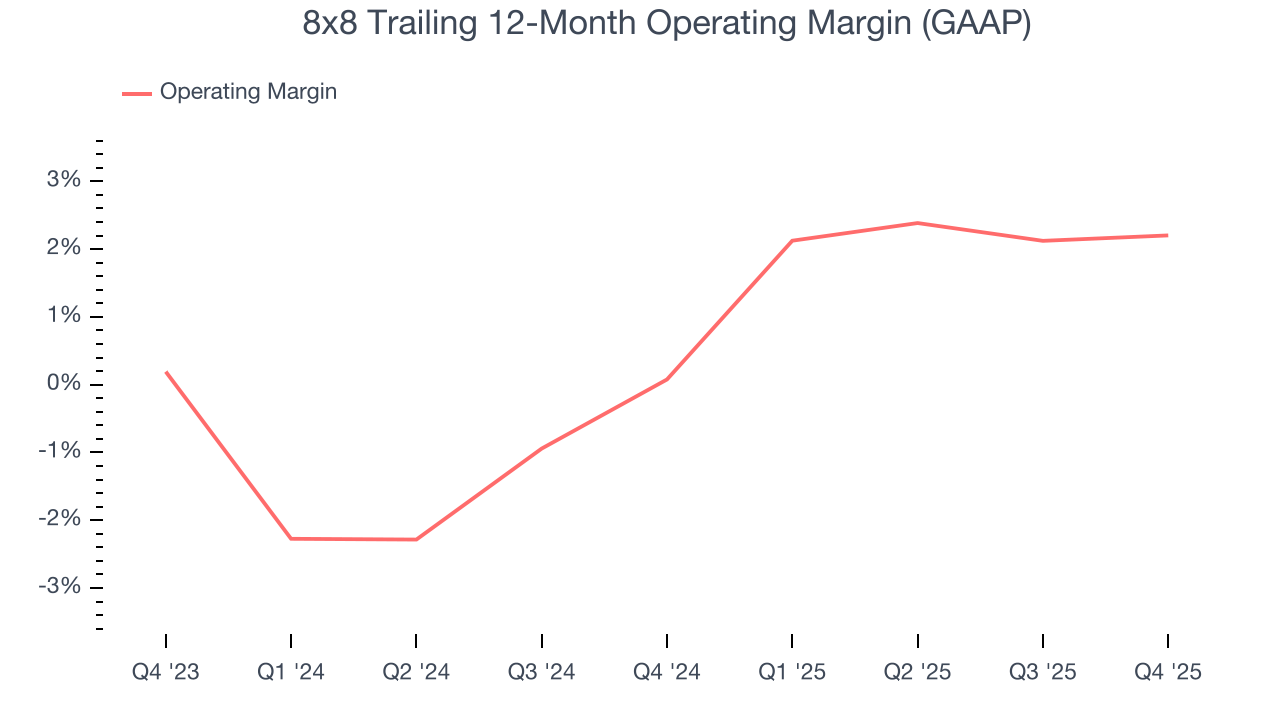

9. Operating Margin

Many software businesses adjust their profits for stock-based compensation (SBC), but we prioritize GAAP operating margin because SBC is a real expense used to attract and retain engineering and sales talent. This metric shows how much revenue remains after accounting for all core expenses – everything from the cost of goods sold to sales and R&D.

8x8 has done a decent job managing its cost base over the last year. The company has produced an average operating margin of 2.2%, higher than the broader software sector.

Looking at the trend in its profitability, 8x8’s operating margin rose by 2.1 percentage points over the last two years, as its sales growth gave it operating leverage.

In Q4, 8x8 generated an operating margin profit margin of 5.2%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

10. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

8x8 has shown weak cash profitability over the last year, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 5.1%, subpar for a software business.

8x8’s free cash flow clocked in at $16.54 million in Q4, equivalent to a 8.9% margin. The company’s cash profitability regressed as it was 6 percentage points lower than in the same quarter last year, but it’s still above its one-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends are more important.

Over the next year, analysts’ consensus estimates show they’re expecting 8x8’s free cash flow margin of 5.1% for the last 12 months to remain the same.

11. Balance Sheet Assessment

8x8 reported $88.2 million of cash and $373.6 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $91.22 million of EBITDA over the last 12 months, we view 8x8’s 3.1× net-debt-to-EBITDA ratio as safe. We also see its $17.05 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from 8x8’s Q4 Results

We were impressed by how significantly 8x8 blew past analysts’ EBITDA expectations this quarter. We were also glad its revenue guidance for next quarter exceeded Wall Street’s estimates. Management added some very positive commentary regarding AI as a tailwind to the business as well. Zooming out, we think this was a solid print. The stock traded up 35.9% to $2.33 immediately after reporting.

13. Is Now The Time To Buy 8x8?

Updated: February 28, 2026 at 9:25 PM EST

When considering an investment in 8x8, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

We see the value of companies addressing major business pain points, but in the case of 8x8, we’re out. First off, its revenue growth was weak over the last five years, and analysts expect its demand to deteriorate over the next 12 months. While its operating margins are in line with the overall software sector, the downside is its expanding operating margin shows it’s becoming more efficient at building and selling its software. On top of that, its gross margins show its business model is much less lucrative than other companies.

8x8’s price-to-sales ratio based on the next 12 months is 0.4x. While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $2.31 on the company (compared to the current share price of $2.14).