Alamo (ALG)

We’re wary of Alamo. Its underwhelming revenue growth and failure to generate meaningful free cash flow is a concerning trend.― StockStory Analyst Team

1. News

2. Summary

Why We Think Alamo Will Underperform

Expanding its markets through acquisitions since its founding, Alamo (NSYE:ALG) designs, manufactures, and services vegetation management and infrastructure maintenance equipment for governmental, industrial, and agricultural use.

- Gross margin of 25.5% reflects its high production costs

- Demand will likely be soft over the next 12 months as Wall Street’s estimates imply tepid growth of 5.4%

- The good news is that its performance over the past five years shows its incremental sales were more profitable, as its annual earnings per share growth of 13.2% outpaced its revenue gains

Alamo’s quality is inadequate. Our attention is focused on better businesses.

Why There Are Better Opportunities Than Alamo

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Alamo

Alamo’s stock price of $213.54 implies a valuation ratio of 19.2x forward P/E. Alamo’s valuation may seem like a bargain, especially when stacked up against other industrials companies. We remind you that you often get what you pay for, though.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. Alamo (ALG) Research Report: Q4 CY2025 Update

Specialized equipment manufacturer for infrastructure and vegetation management Alamo Group (NYSE:ALG) fell short of the market’s revenue expectations in Q4 CY2025, with sales falling 3% year on year to $373.7 million. Its non-GAAP profit of $1.70 per share was 25.9% below analysts’ consensus estimates.

Alamo (ALG) Q4 CY2025 Highlights:

- Revenue: $373.7 million vs analyst estimates of $405.2 million (3% year-on-year decline, 7.8% miss)

- Adjusted EPS: $1.70 vs analyst expectations of $2.30 (25.9% miss)

- Adjusted EBITDA: $44.76 million vs analyst estimates of $57.9 million (12% margin, 22.7% miss)

- Operating Margin: 6%, down from 8.9% in the same quarter last year

- Market Capitalization: $2.59 billion

Company Overview

Expanding its markets through acquisitions since its founding, Alamo (NSYE:ALG) designs, manufactures, and services vegetation management and infrastructure maintenance equipment for governmental, industrial, and agricultural use.

Founded in 1969, the company has operations across North America, Europe, and Australia. Alamo Group's product portfolio includes equipment such as mowers, excavators, vacuum trucks, street sweepers, snow removal equipment, and forestry and tree care machinery.

Alamo operates through two primary segments: the Vegetation Management Division and the Industrial Equipment Division. The Vegetation Management Division includes products for agricultural, governmental, and commercial markets, while the Industrial Equipment Division concentrates on specialized trucks and heavy equipment for infrastructure maintenance and construction applications.

The company sells its products through a network of independent dealers, distributors, and directly to end-users in some cases. A significant portion of Alamo's sales comes from governmental agencies and related contractors, particularly for infrastructure maintenance equipment.

Alamo has historically grown via M&A, and one notable acquisition in recent years includes Royal Truck & Equipment, a manufacturer of truck-mounted highway attenuator trucks and other specialty vehicles for traffic control and highway safety. This acquisition expanded its presence in the highway safety equipment market. The company also acquired Morbark, which significantly strengthened its position in the forestry and tree care equipment markets.

4. Agricultural Machinery

Agricultural machinery companies are investing to develop and produce more precise machinery, automated systems, and connected equipment that collects analyzable data to help farmers and other customers improve yields and increase efficiency. On the other hand, agriculture is seasonal and natural disasters or bad weather can impact the entire industry. Additionally, macroeconomic factors such as commodity prices or changes in interest rates–which dictate the willingness of these companies or their customers to invest–can impact demand for agricultural machinery.

Alamo’s peers and competitors include Lindsay (NYSE:LNN) and AGCO (NYSE:AGCO)

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, Alamo’s 6.6% annualized revenue growth over the last five years was mediocre. This fell short of our benchmark for the industrials sector and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Alamo’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 2.6% annually.

This quarter, Alamo missed Wall Street’s estimates and reported a rather uninspiring 3% year-on-year revenue decline, generating $373.7 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 7.9% over the next 12 months, an improvement versus the last two years. This projection is above the sector average and implies its newer products and services will catalyze better top-line performance.

6. Gross Margin & Pricing Power

All else equal, we prefer higher gross margins because they usually indicate that a company sells more differentiated products and commands stronger pricing power.

Alamo has bad unit economics for an industrials company, giving it less room to reinvest and develop new offerings. As you can see below, it averaged a 25.4% gross margin over the last five years. That means Alamo paid its suppliers a lot of money ($74.58 for every $100 in revenue) to run its business.

Alamo’s gross profit margin came in at 22.7% this quarter , marking a 1.1 percentage point decrease from 23.8% in the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

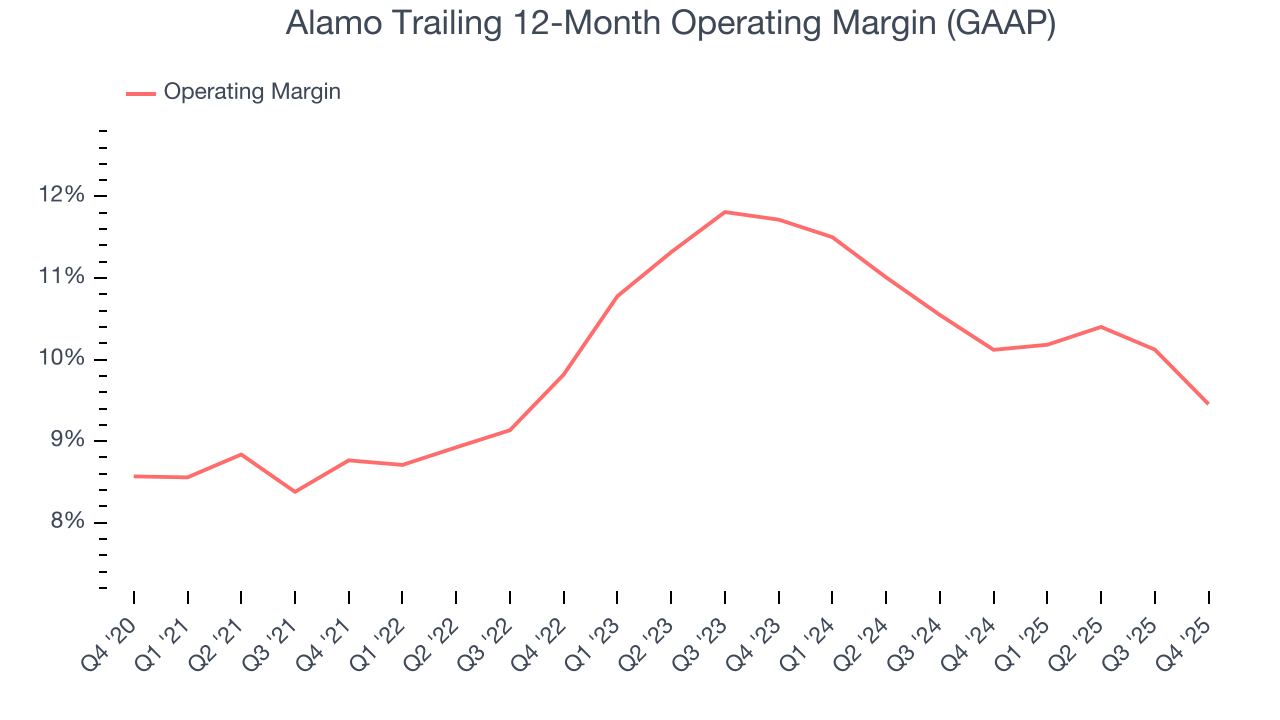

7. Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

Alamo’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 10% over the last five years. This profitability was solid for an industrials business and shows it’s an efficient company that manages its expenses well. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, Alamo’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Alamo generated an operating margin profit margin of 6%, down 2.9 percentage points year on year. Since Alamo’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Alamo’s EPS grew at a remarkable 12.6% compounded annual growth rate over the last five years, higher than its 6.6% annualized revenue growth. However, we take this with a grain of salt because its operating margin didn’t improve and it didn’t repurchase its shares, meaning the delta came from reduced interest expenses or taxes.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Alamo’s two-year annual EPS declines of 9.8% were bad and lower than its two-year revenue losses.

Diving into the nuances of Alamo’s earnings can give us a better understanding of its performance. Alamo’s operating margin has declined over the last two years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Alamo reported adjusted EPS of $1.70, down from $2.39 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term adjusted EPS growth than short-term movements. Over the next 12 months, Wall Street expects Alamo’s full-year EPS of $9.25 to grow 31.7%.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Alamo has shown mediocre cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.9%, subpar for an industrials business.

Taking a step back, an encouraging sign is that Alamo’s margin expanded by 3.4 percentage points during that time. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability was flat.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Alamo’s management team makes decent investment decisions and generates value for shareholders. Its five-year average ROIC was 11.6%, slightly better than typical industrials business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Uneventfully, Alamo’s ROIC has stayed the same over the last few years. Given the company’s underwhelming financial performance in other areas, we’d like to see its returns improve before recommending the stock.

11. Key Takeaways from Alamo’s Q4 Results

We struggled to find many positives in these results. Its revenue missed and its EBITDA fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 5.2% to $206.99 immediately following the results.

12. Is Now The Time To Buy Alamo?

Updated: March 2, 2026 at 4:38 PM EST

Before investing in or passing on Alamo, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

Alamo’s business quality ultimately falls short of our standards. To kick things off, its revenue growth was mediocre over the last five years. While its projected EPS for the next year implies the company’s fundamentals will improve, the downside is its gross margins are lower than its industrials peers. On top of that, its low free cash flow margins give it little breathing room.

Alamo’s P/E ratio based on the next 12 months is 17.9x. This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $219.75 on the company (compared to the current share price of $206.99).