Federal Signal (FSS)

Federal Signal is a great business. Its strong sales growth and returns on capital show it’s capable of quick and profitable expansion.― StockStory Analyst Team

1. News

2. Summary

Why We Like Federal Signal

Developing sirens that warned of air raid attacks or fallout during the Cold War, Federal Signal (NYSE:FSS) provides safety and emergency equipment for government agencies, municipalities, and industrial companies.

- Incremental sales significantly boosted profitability as its annual earnings per share growth of 18.2% over the last five years outstripped its revenue performance

- Projected revenue growth of 15.6% for the next 12 months is above its two-year trend, pointing to accelerating demand

- Annual revenue growth of 12.3% over the last five years was superb and indicates its market share increased during this cycle

We expect great things from Federal Signal. The price looks fair in light of its quality, so this might be a prudent time to buy some shares.

Why Is Now The Time To Buy Federal Signal?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Federal Signal?

Federal Signal is trading at $120.49 per share, or 26.6x forward P/E. Scanning the industrials landscape, we think this multiple is reasonable - arguably even attractive - for the quality you get.

Where you buy a stock impacts returns. Our analysis shows that business quality is a much bigger determinant of market outperformance over the long term compared to entry price, but getting a good deal on a stock certainly isn’t a bad thing.

3. Federal Signal (FSS) Research Report: Q3 CY2025 Update

Safety and security company Federal Signal (NYSE:FSS) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 17% year on year to $555 million. The company expects the full year’s revenue to be around $2.12 billion, close to analysts’ estimates. Its non-GAAP profit of $1.14 per share was 5.6% above analysts’ consensus estimates.

Federal Signal (FSS) Q3 CY2025 Highlights:

- Revenue: $555 million vs analyst estimates of $544.8 million (17% year-on-year growth, 1.9% beat)

- Adjusted EPS: $1.14 vs analyst estimates of $1.08 (5.6% beat)

- Adjusted EBITDA: $116.2 million vs analyst estimates of $112.7 million (20.9% margin, 3.1% beat)

- The company slightly lifted its revenue guidance for the full year to $2.12 billion at the midpoint from $2.1 billion

- Management raised its full-year Adjusted EPS guidance to $4.13 at the midpoint, a 3% increase

- Operating Margin: 16.9%, in line with the same quarter last year

- Free Cash Flow Margin: 9.7%, down from 12.8% in the same quarter last year

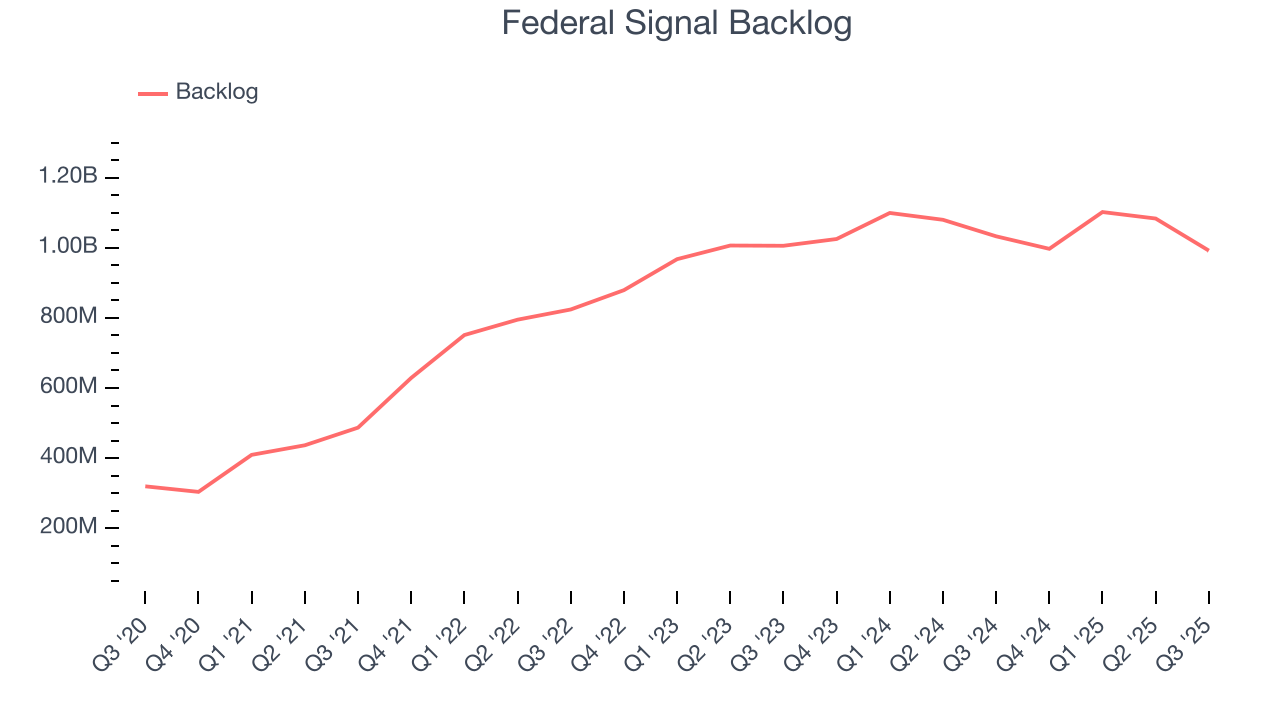

- Backlog: $992 million at quarter end, down 4% year on year (<1% beat)

- Market Capitalization: $7.89 billion

Company Overview

Developing sirens that warned of air raid attacks or fallout during the Cold War, Federal Signal (NYSE:FSS) provides safety and emergency equipment for government agencies, municipalities, and industrial companies.

Federal Signal Corporation was founded in 1901 manufacturing and selling store signs lit by incandescent lamps and soon produced electric sirens. Over the decades, the company evolved its product offerings to include a wide range of safety and emergency equipment. Specifically, key acquisitions such as Joe Johnson Equipment in 2016 and Truck Bodies and Equipment in 2017 opened doors for its current selection of outdoor warning systems and emergency vehicle equipment.

Its emergency vehicle lighting systems are used for police cars and ambulances to ensure visibility during emergencies. In manufacturing settings, Federal Signal industrial signaling products facilitate communication among workers. These devices ensure that operators can coordinate machinery operations, alerting them to start or stop processes, and warning of any potential hazards. The company also offers environmental and safety products such as air quality monitors and detectors for hazardous materials. These tools are particularly important for utility companies and transportation sectors to comply with environmental regulations and maintain safe working conditions.

Federal Signal frequently secures contracts with government agencies, municipalities, and industrial companies through bids for large-scale projects and ongoing service agreements. These contracts vary in length, ranging from short-term agreements for specific projects to longer-term arrangements spanning several years. In terms of pricing, it is determined through these bids where proposals outline costs based on factors like materials, labor, installation, and ongoing maintenance.

4. Heavy Transportation Equipment

Heavy transportation equipment companies are investing in automated vehicles that increase efficiencies and connected machinery that collects actionable data. Some are also developing electric vehicles and mobility solutions to address customers’ concerns about carbon emissions, creating new sales opportunities. Additionally, they are increasingly offering automated equipment that increases efficiencies and connected machinery that collects actionable data. On the other hand, heavy transportation equipment companies are at the whim of economic cycles. Interest rates, for example, can greatly impact the construction and transport volumes that drive demand for these companies’ offerings.

Competitors of Federal Signal Corporation include Oshkosh (NYSE:OSK), Dover NYSE:DOV), and 3M ((NYSE:MMM).

5. Revenue Growth

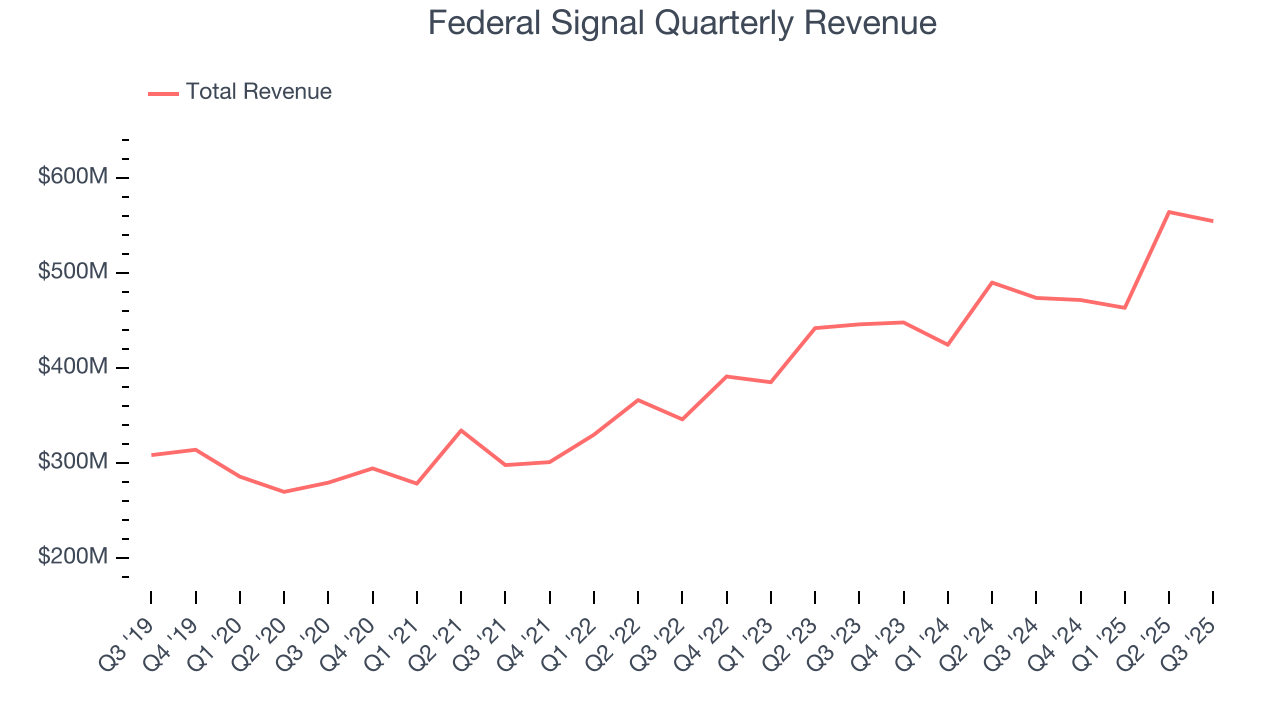

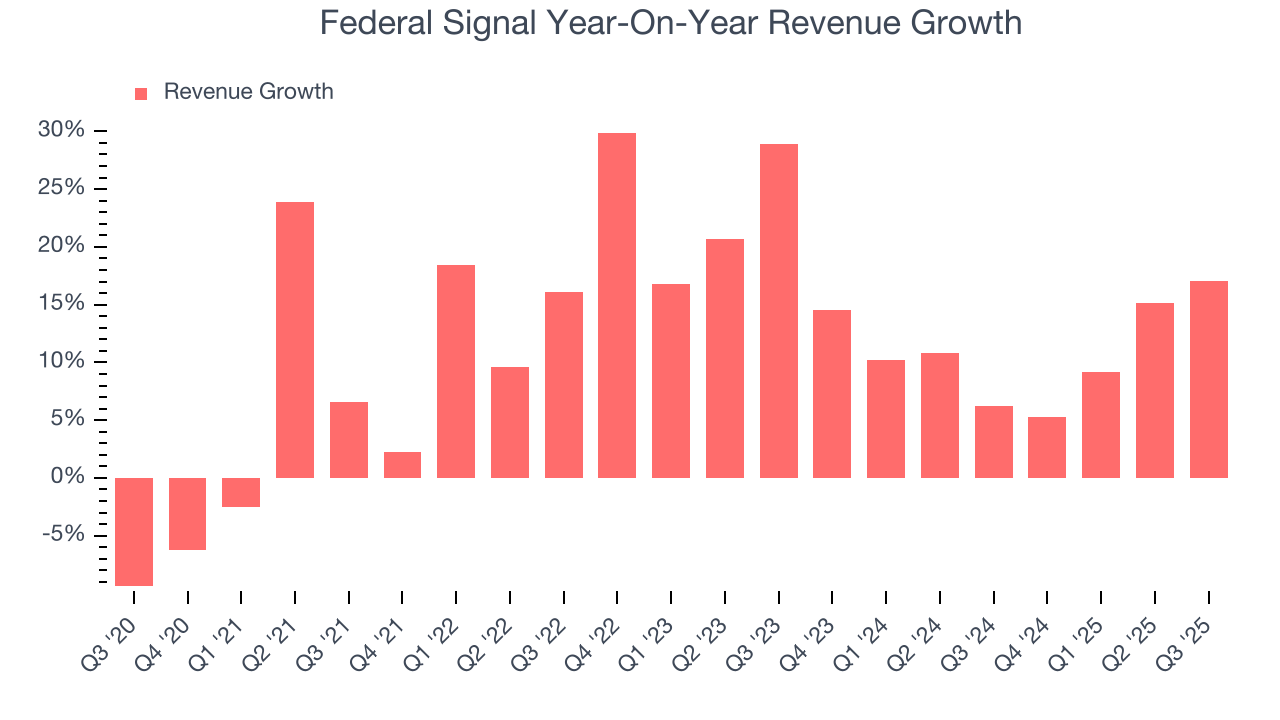

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, Federal Signal’s 12.3% annualized revenue growth over the last five years was excellent. Its growth surpassed the average industrials company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Federal Signal’s annualized revenue growth of 11.1% over the last two years is below its five-year trend, but we still think the results suggest healthy demand. Federal Signal’s recent performance shows it’s one of the better Heavy Transportation Equipment businesses as many of its peers faced declining sales because of cyclical headwinds.

We can better understand the company’s revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Federal Signal’s backlog reached $992 million in the latest quarter and averaged 4.3% year-on-year growth over the last two years. Because this number is lower than its revenue growth, we can see the company fulfilled orders at a faster rate than it added new orders to the backlog. This implies Federal Signal was operating efficiently but raises questions about the health of its sales pipeline.

This quarter, Federal Signal reported year-on-year revenue growth of 17%, and its $555 million of revenue exceeded Wall Street’s estimates by 1.9%.

Looking ahead, sell-side analysts expect revenue to grow 11.1% over the next 12 months, similar to its two-year rate. This projection is admirable and suggests the market is baking in success for its products and services.

6. Gross Margin & Pricing Power

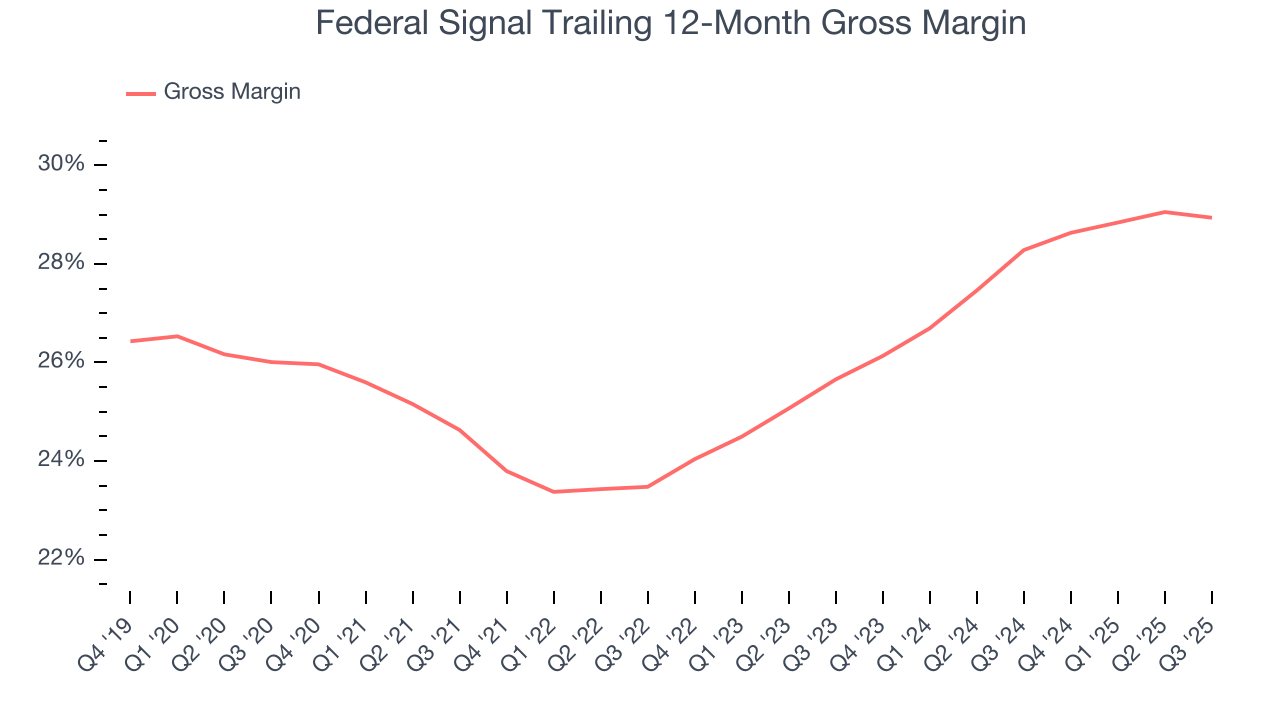

Federal Signal has bad unit economics for an industrials company, giving it less room to reinvest and develop new offerings. As you can see below, it averaged a 26.6% gross margin over the last five years. Said differently, Federal Signal had to pay a chunky $73.43 to its suppliers for every $100 in revenue.

This quarter, Federal Signal’s gross profit margin was 29.1%, in line with the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

7. Operating Margin

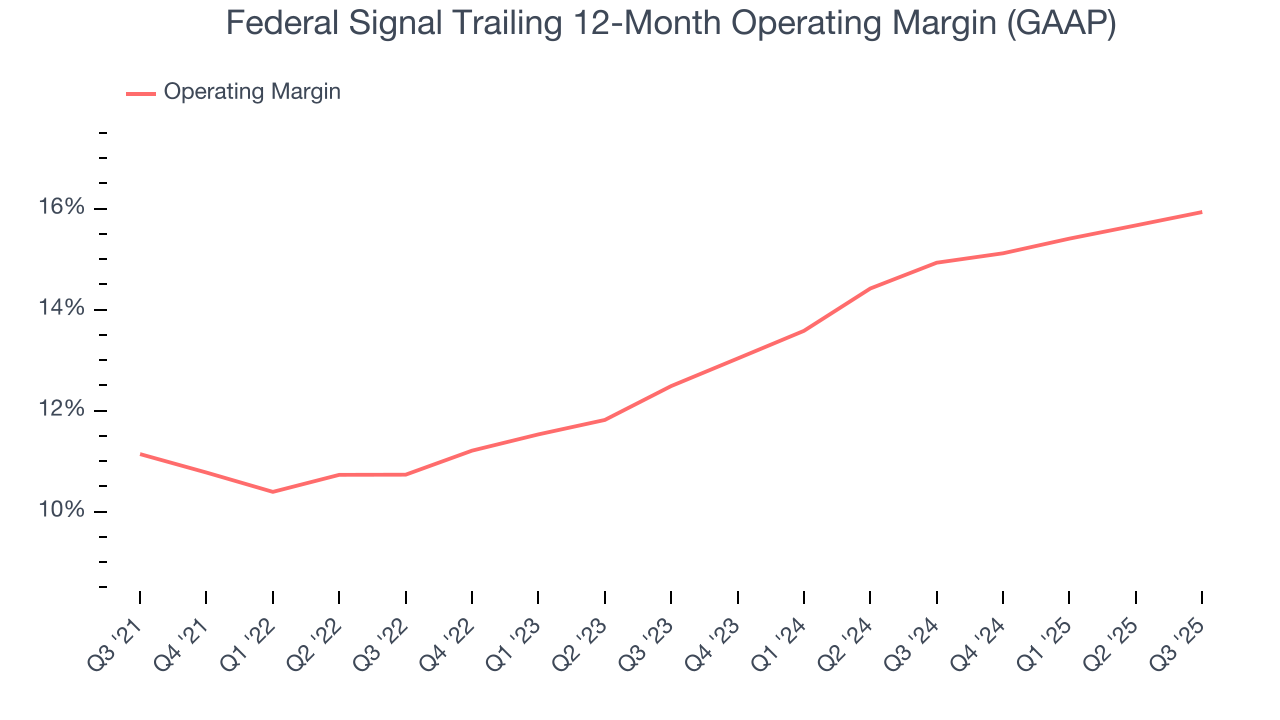

Federal Signal has been an efficient company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 13.4%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, Federal Signal’s operating margin rose by 4.8 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Federal Signal generated an operating margin profit margin of 16.9%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

8. Earnings Per Share

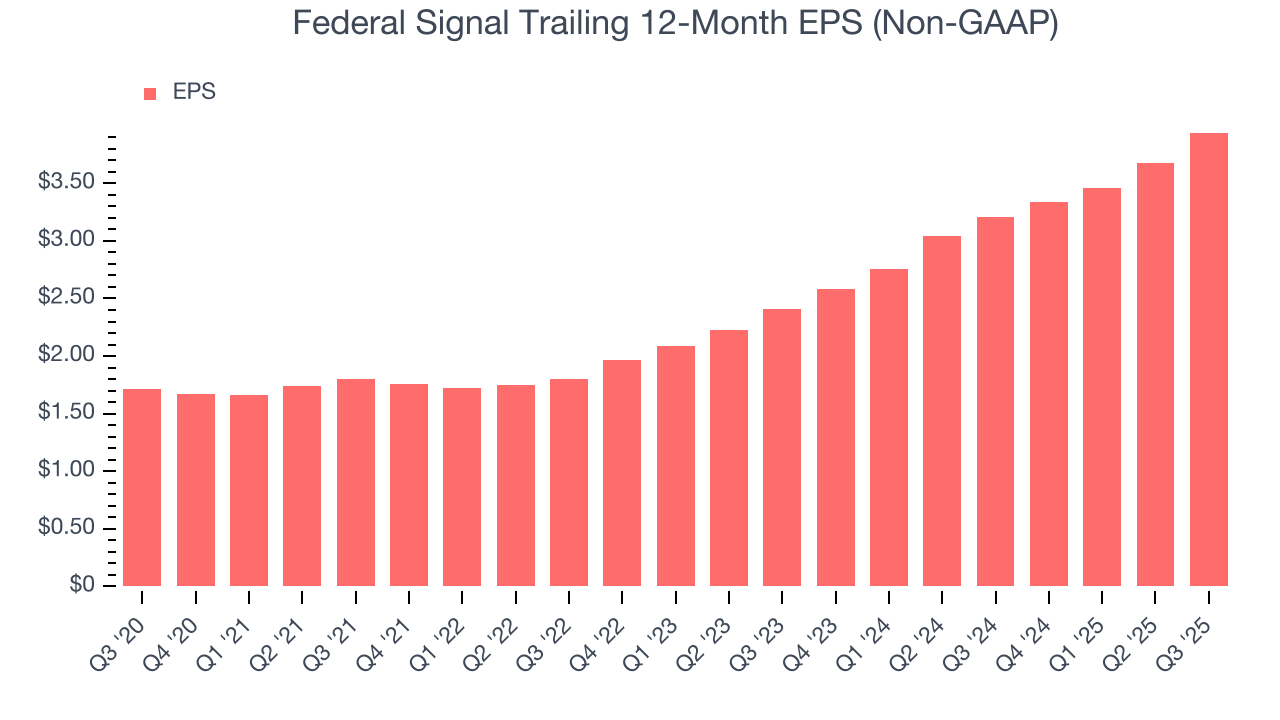

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Federal Signal’s EPS grew at an astounding 18.2% compounded annual growth rate over the last five years, higher than its 12.3% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into the nuances of Federal Signal’s earnings can give us a better understanding of its performance. As we mentioned earlier, Federal Signal’s operating margin was flat this quarter but expanded by 4.8 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Federal Signal, its two-year annual EPS growth of 27.9% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q3, Federal Signal reported adjusted EPS of $1.14, up from $0.88 in the same quarter last year. This print beat analysts’ estimates by 5.6%. Over the next 12 months, Wall Street expects Federal Signal’s full-year EPS of $3.94 to grow 12.5%.

9. Cash Is King

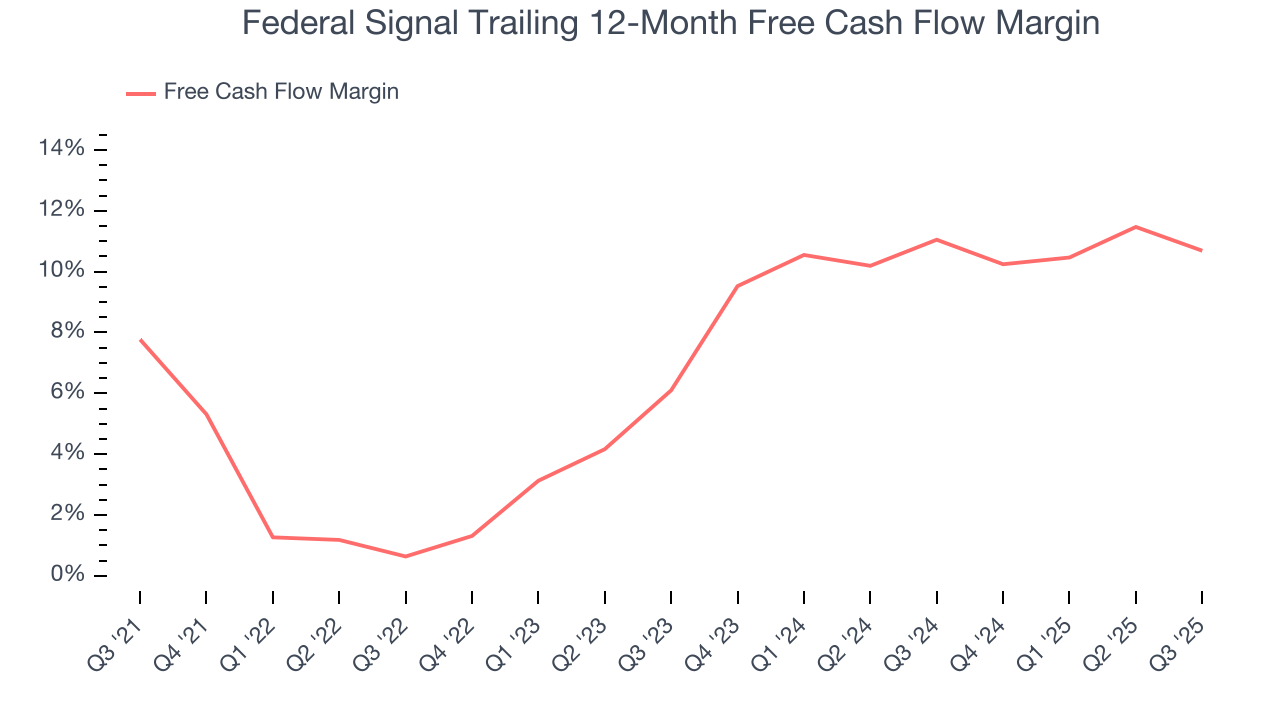

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Federal Signal has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 7.7% over the last five years, slightly better than the broader industrials sector.

Taking a step back, we can see that Federal Signal’s margin expanded by 2.9 percentage points during that time. This is encouraging because it gives the company more optionality.

Federal Signal’s free cash flow clocked in at $54.1 million in Q3, equivalent to a 9.7% margin. The company’s cash profitability regressed as it was 3.1 percentage points lower than in the same quarter last year, but it’s still above its five-year average. We wouldn’t put too much weight on this quarter’s decline because capital expenditures can be seasonal and companies often stockpile inventory in anticipation of higher demand, causing short-term swings. Long-term trends are more important.

10. Return on Invested Capital (ROIC)

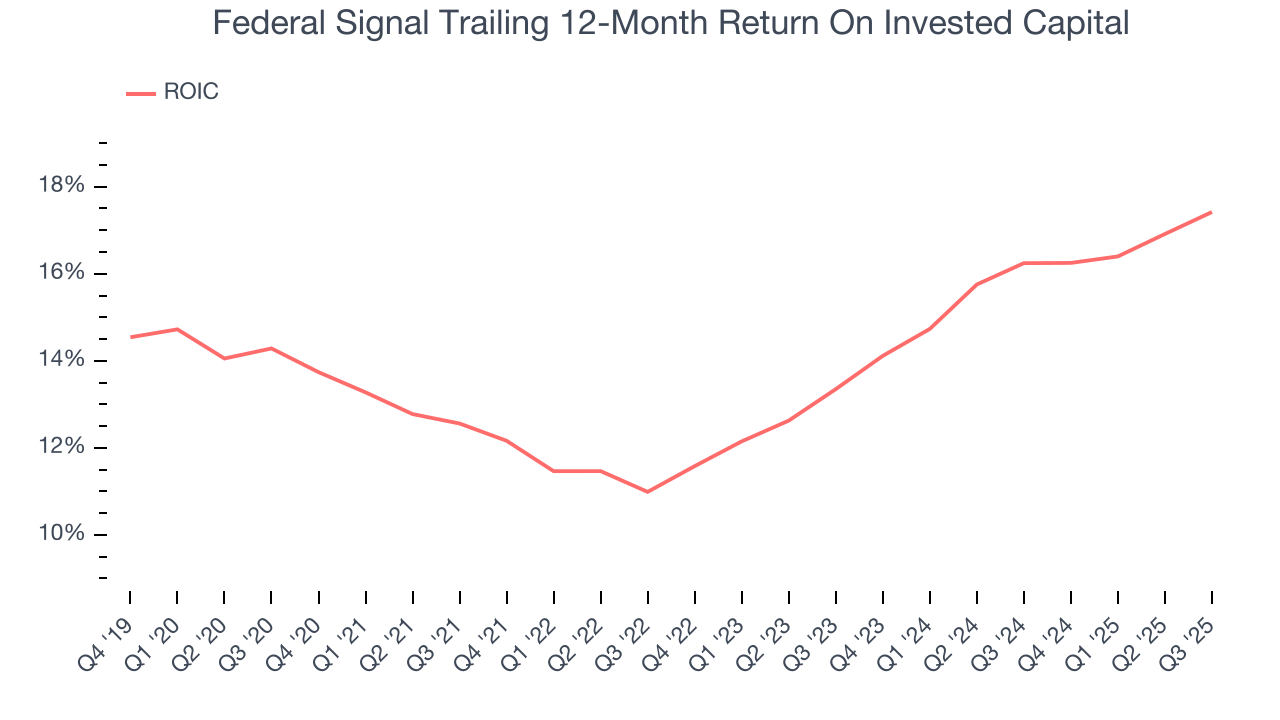

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Federal Signal’s five-year average ROIC was 14.1%, beating other industrials companies by a wide margin. This illustrates its management team’s ability to invest in attractive growth opportunities and produce tangible results for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Federal Signal’s ROIC has increased over the last few years. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

11. Balance Sheet Assessment

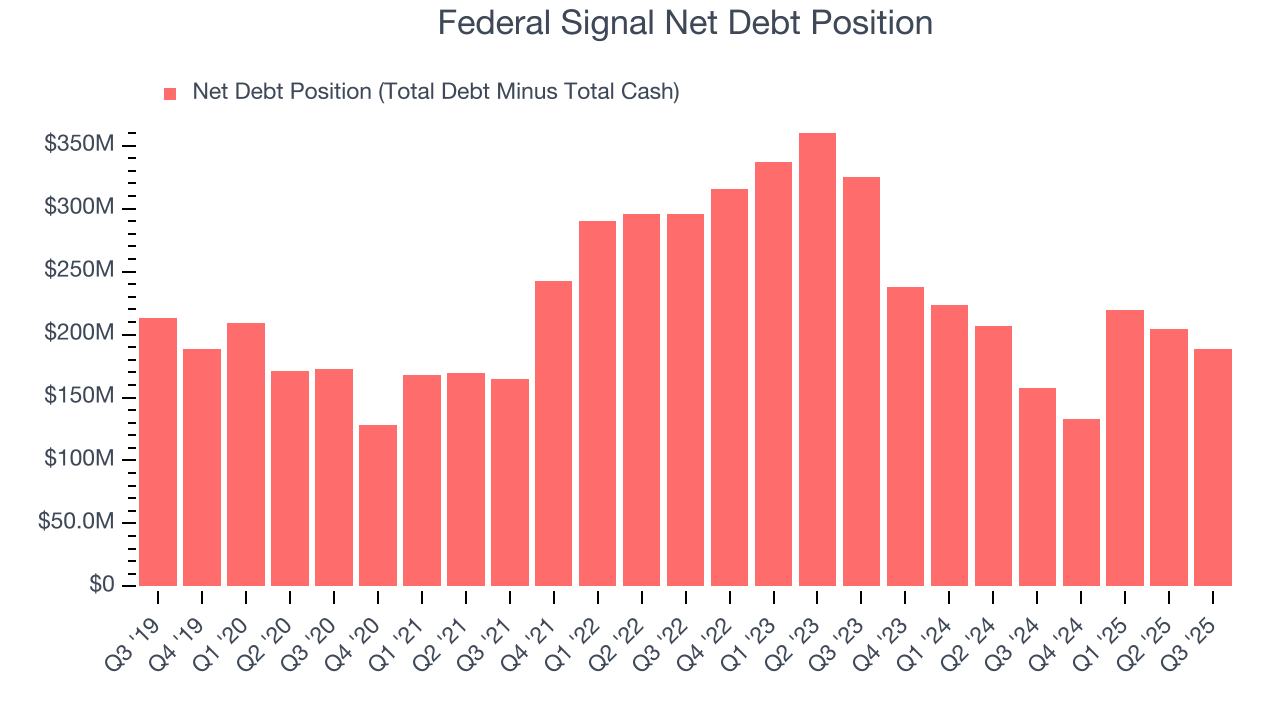

Federal Signal reported $54.4 million of cash and $243.1 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $408.8 million of EBITDA over the last 12 months, we view Federal Signal’s 0.5× net-debt-to-EBITDA ratio as safe. We also see its $6.8 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Federal Signal’s Q3 Results

Revenue, EBITDA, and EPS all beat Wall Street’s estimates in the quarter. It was also good to see Federal Signal’s backlog come in slightly better than Consensus. Additionally, full-year EPS guidance top analysts’ expectations. Overall, we think this was a solid quarter with some key areas of upside. Investors were likely hoping for more, and shares traded down 6.7% to $121.19 immediately after reporting.

13. Is Now The Time To Buy Federal Signal?

Updated: February 16, 2026 at 10:06 PM EST

Before deciding whether to buy Federal Signal or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

Federal Signal is a rock-solid business worth owning. For starters, its revenue growth was impressive over the last five years and is expected to accelerate over the next 12 months. And while its backlog declined, its astounding EPS growth over the last five years shows its profits are trickling down to shareholders. Additionally, Federal Signal’s expanding operating margin shows the business has become more efficient.

Federal Signal’s P/E ratio based on the next 12 months is 26.6x. Looking at the industrials landscape today, Federal Signal’s fundamentals really stand out, and we like it at this price.

Wall Street analysts have a consensus one-year price target of $133.83 on the company (compared to the current share price of $120.49), implying they see 11.1% upside in buying Federal Signal in the short term.