Coupang (CPNG)

Coupang piques our interest. Its revenue is growing quickly while its profitability is rising, giving it multiple ways to win.― StockStory Analyst Team

1. News

2. Summary

Why Coupang Is Interesting

Founded in 2010 by Harvard Business School student Bom Kim, Coupang (NYSE:CPNG) is an e-commerce giant often referred to as the "Amazon of South Korea".

- Incremental sales over the last three years have been highly profitable as its earnings per share increased by 35.4% annually, topping its revenue gains

- Grip over its ecosystem is highlighted by its ability to grow engagement while increasing the average revenue per buyer by 8.5% annually

- A blemish is its high servicing costs result in an inferior gross margin of 29% that must be offset through higher volumes

Coupang shows some potential. If you like the story, the valuation looks reasonable.

Why Is Now The Time To Buy Coupang?

Why Is Now The Time To Buy Coupang?

At $20.08 per share, Coupang trades at 17.4x forward EV/EBITDA. Looking across the consumer internet landscape, we think the valuation is justified for the top-line growth characteristics.

This could be a good time to invest if you think there are underappreciated aspects of the business.

3. Coupang (CPNG) Research Report: Q3 CY2025 Update

Online platform company Coupang (NYSE:CPNG) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 17.8% year on year to $9.27 billion. Its GAAP profit of $0.05 per share was $0.01 above analysts’ consensus estimates.

Coupang (CPNG) Q3 CY2025 Highlights:

- Revenue: $9.27 billion vs analyst estimates of $9.02 billion (17.8% year-on-year growth, 2.7% beat)

- EPS (GAAP): $0.05 vs analyst estimates of $0.04 ($0.01 beat)

- Adjusted EBITDA: $413 million vs analyst estimates of $324.4 million (4.5% margin, 27.3% beat)

- Operating Margin: 1.7%, in line with the same quarter last year

- Free Cash Flow Margin: 4.7%, up from 2.9% in the previous quarter

- Active Customers: 24.7 million, up 2.02 million year on year

- Market Capitalization: $58.3 billion

Company Overview

Founded in 2010 by Harvard Business School student Bom Kim, Coupang (NYSE:CPNG) is an e-commerce giant often referred to as the "Amazon of South Korea".

Coupang revolutionized the online shopping experience in South Korea with its array of products, rapid delivery services, and customer-centric approach.

The company's extensive product range covers various categories including electronics, home goods, beauty products, fashion, groceries, and more. Coupang also operates its own private label brands to fill product assortment gaps with quality goods at competitive prices. In addition to physical goods, the company has expanded into services like video streaming and food delivery, further diversifying its offerings and increasing its appeal to a broad consumer base.

Coupang's rise can be attributed to its logistics and distribution network. The company has invested heavily in its infrastructure, establishing a vast network of warehouses and logistics centers throughout South Korea. This allows Coupang to offer "Rocket Delivery," which guarantees the delivery of millions of items within 24 hours. Unlike other countries, this is possible in South Korea because the country's high population density allows for efficient delivery routes - for example, Seoul only covers about 12% of the country's area but is home to nearly 50% of the population.

A key aspect of Coupang's strategy is its commitment to customer satisfaction. The company offers a no-questions-asked return policy, with most returns picked up directly from customers' homes. This focus on customer service has fostered strong loyalty among Korean consumers and is further amplified by its WOW membership offering, which is similar to Amazon Prime and gives customers additional perks.

4. Online Retail

Consumers ever rising demand for convenience, selection, and speed are secular engines underpinning ecommerce adoption. For years prior to Covid, ecommerce penetration as a percentage of overall retail would grow 1-2% annually, but in 2020 adoption accelerated by 5%, reaching 25%, as increased emphasis on convenience drove consumers to structurally buy more online. The surge in buying caused many online retailers to rapidly grow their logistics infrastructures, preparing them for further growth in the years ahead as consumer shopping habits continue to shift online.

Coupang's Korea-based competitors include Naver (KRX:035420), Lotte Shopping (KRX:023530), and Kakao (KRX:035720). Amazon (NASDAQ:AMZN), Pinduoduo’s Temu (NASDAQ:PDD), and Alibaba’s AliExpress (NYSE:BABA) are also big international players in the market.

5. Revenue Growth

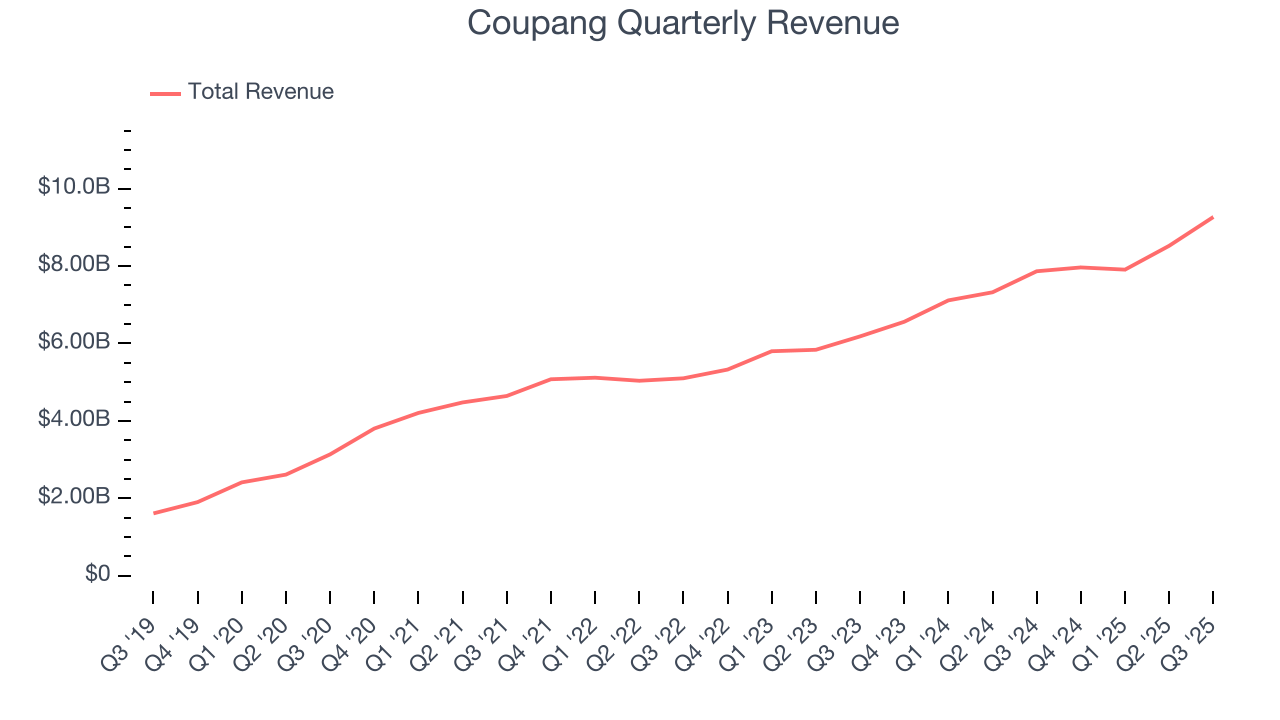

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Luckily, Coupang’s sales grew at an impressive 18.3% compounded annual growth rate over the last three years. Its growth beat the average consumer internet company and shows its offerings resonate with customers, a helpful starting point for our analysis.

This quarter, Coupang reported year-on-year revenue growth of 17.8%, and its $9.27 billion of revenue exceeded Wall Street’s estimates by 2.7%.

Looking ahead, sell-side analysts expect revenue to grow 16.6% over the next 12 months, a slight deceleration versus the last three years. We still think its growth trajectory is attractive given its scale and implies the market is baking in success for its products and services.

6. Active Customers

Buyer Growth

As an online retailer, Coupang generates revenue growth by expanding its number of users and the average order size in dollars.

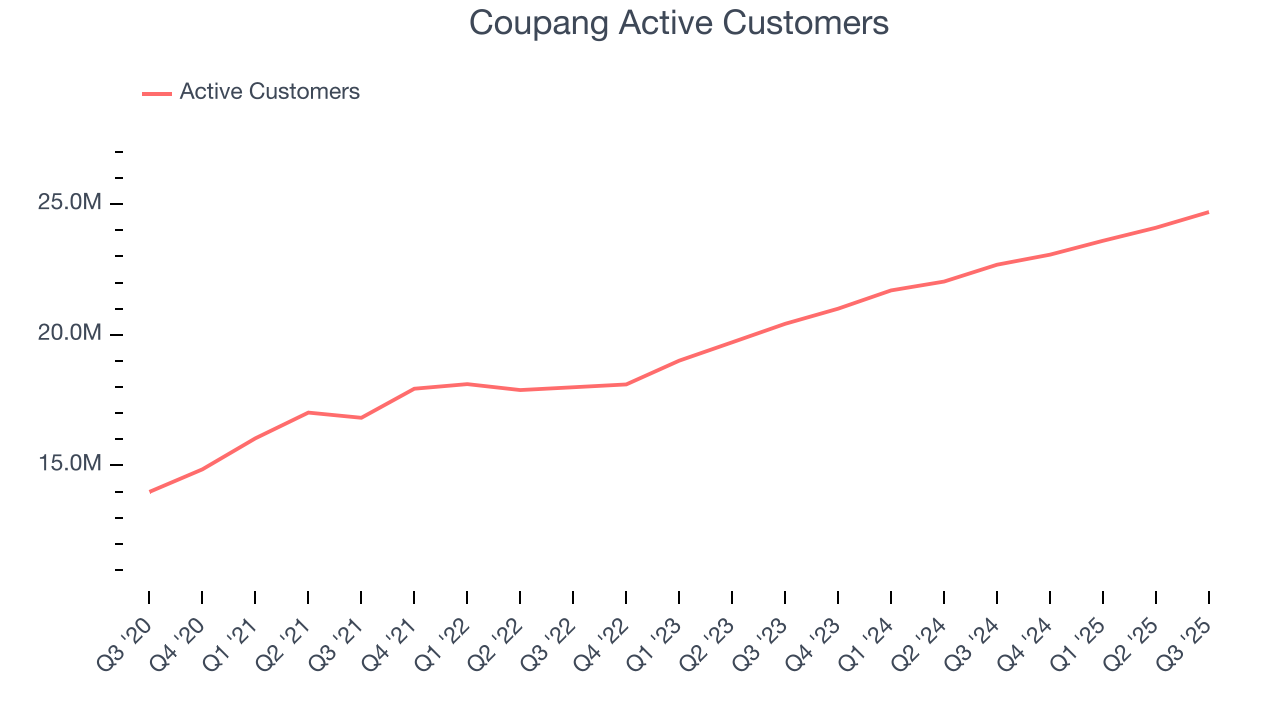

Over the last two years, Coupang’s active customers, a key performance metric for the company, increased by 11.2% annually to 24.7 million in the latest quarter. This growth rate is strong for a consumer internet business and indicates people love using its offerings.

In Q3, Coupang added 2.02 million active customers, leading to 8.9% year-on-year growth. The quarterly print was lower than its two-year result, suggesting its new initiatives aren’t accelerating buyer growth just yet.

Revenue Per Buyer

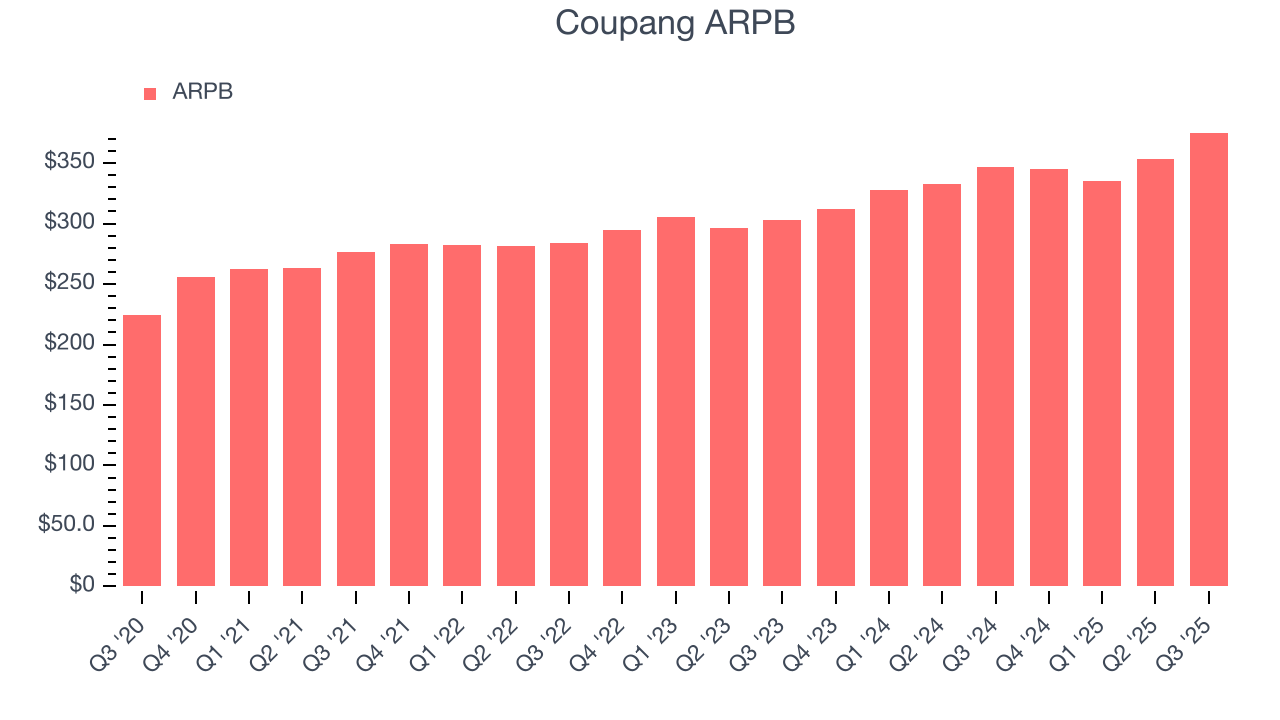

Average revenue per buyer (ARPB) is a critical metric to track because it measures how much customers spend per order.

Coupang’s ARPB growth has been impressive over the last two years, averaging 8.5%. Its ability to increase monetization while quickly growing its active customers reflects the strength of its platform, as its buyers continue to spend more each year.

This quarter, Coupang’s ARPB clocked in at $375.18. It grew by 8.2% year on year, mirroring the performance of its active customers.

7. Gross Margin & Pricing Power

For online retail (separate from online marketplaces) businesses like Coupang, gross profit tells us how much money the company gets to keep after covering the base cost of its products and services, which typically include the cost of acquiring the products sold, shipping and fulfillment, customer service, and digital infrastructure.

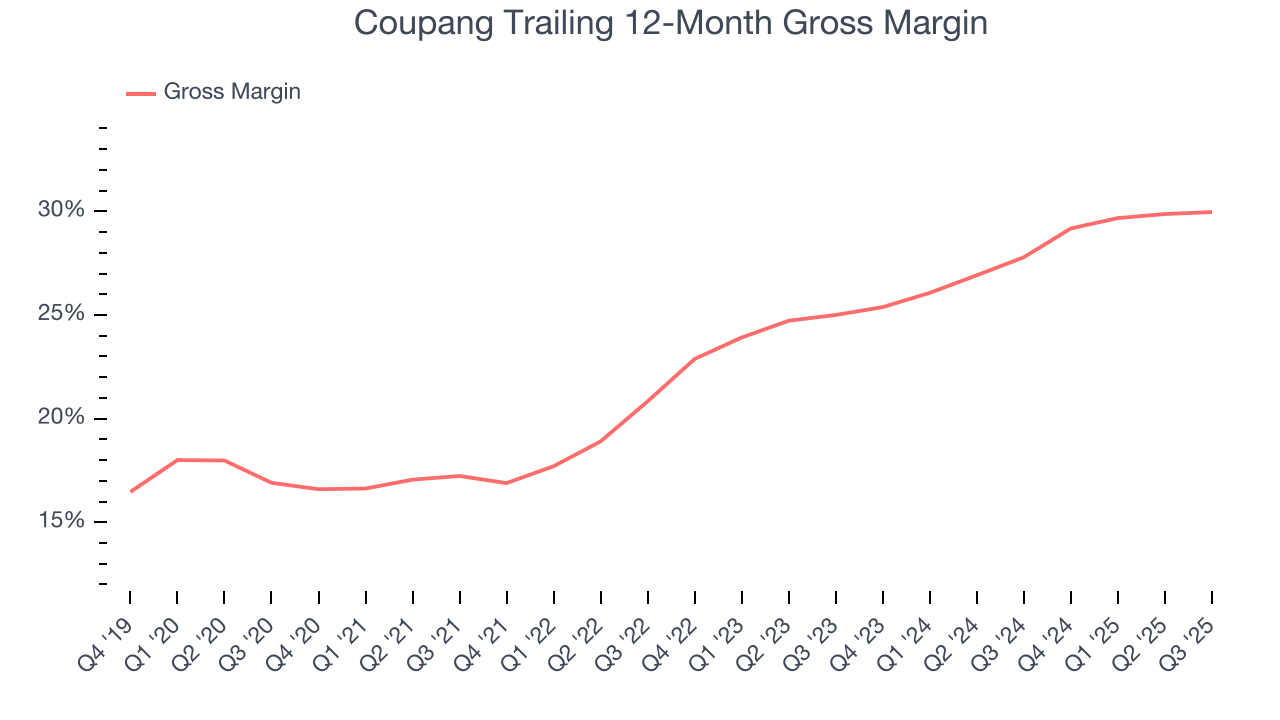

Coupang’s unit economics are far below other consumer internet companies because it must carry inventories as an online retailer. This means it has relatively higher capital intensity than a pure software business like Meta or Airbnb and signals it operates in a competitive market. As you can see below, it averaged a 29% gross margin over the last two years. That means Coupang paid its providers a lot of money ($71.04 for every $100 in revenue) to run its business.

This quarter, Coupang’s gross profit margin was 29.4%, in line with the same quarter last year. Zooming out, Coupang’s full-year margin has been trending up over the past 12 months, increasing by 2.2 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as servers).

8. EBITDA

Investors frequently analyze operating income to understand a business’s core profitability. Similar to operating income, EBITDA is a common profitability metric for consumer internet companies because it removes various one-time or non-cash expenses, offering a more normalized view of profit potential.

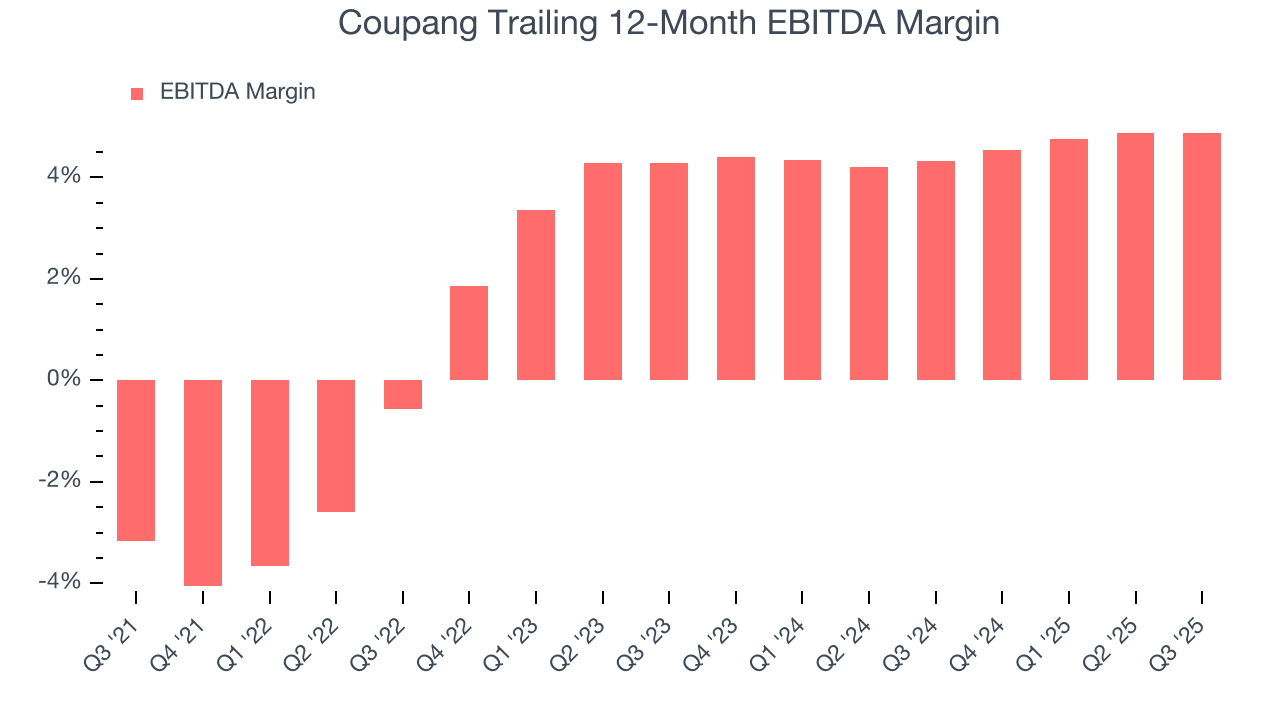

Coupang has managed its cost base well over the last two years. It demonstrated solid profitability for a consumer internet business, producing an average EBITDA margin of 4.6%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, Coupang’s EBITDA margin rose by 5.4 percentage points over the last few years, as its sales growth gave it operating leverage.

In Q3, Coupang generated an EBITDA margin profit margin of 4.5%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

9. Earnings Per Share

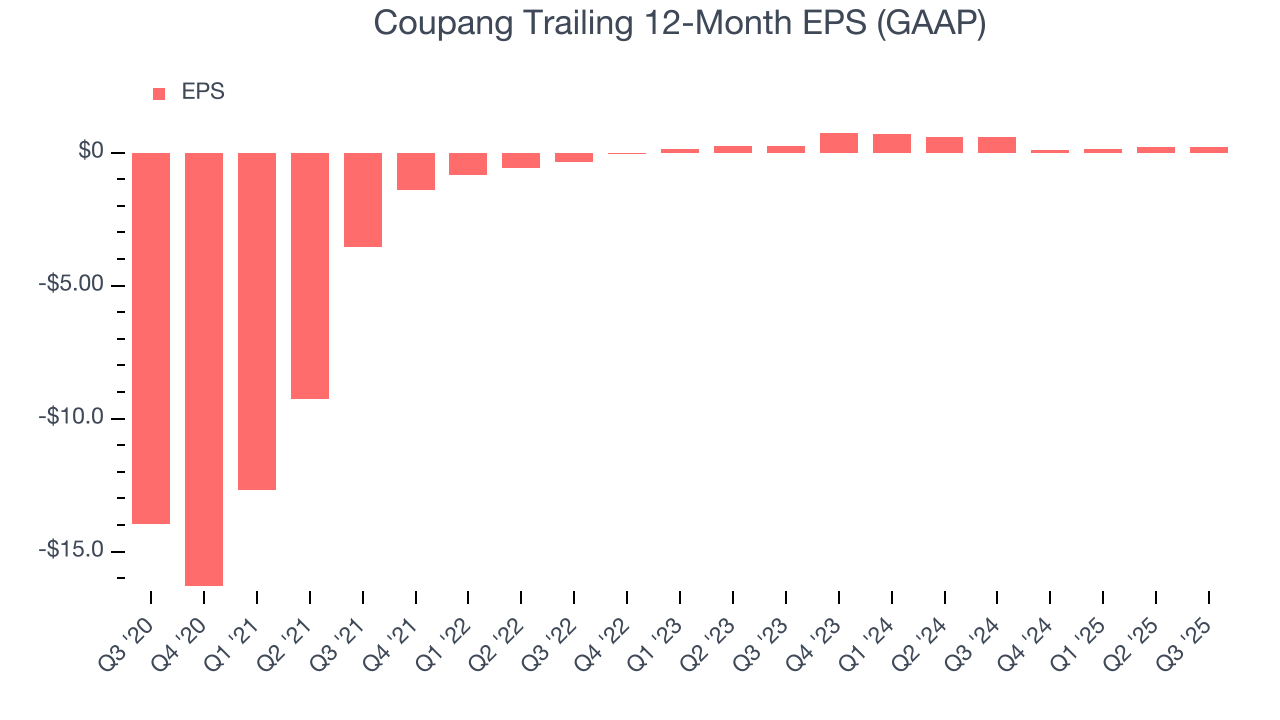

We track the change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

In Q3, Coupang reported EPS of $0.05, up from $0.04 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Coupang’s full-year EPS of $0.22 to grow 144%.

10. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

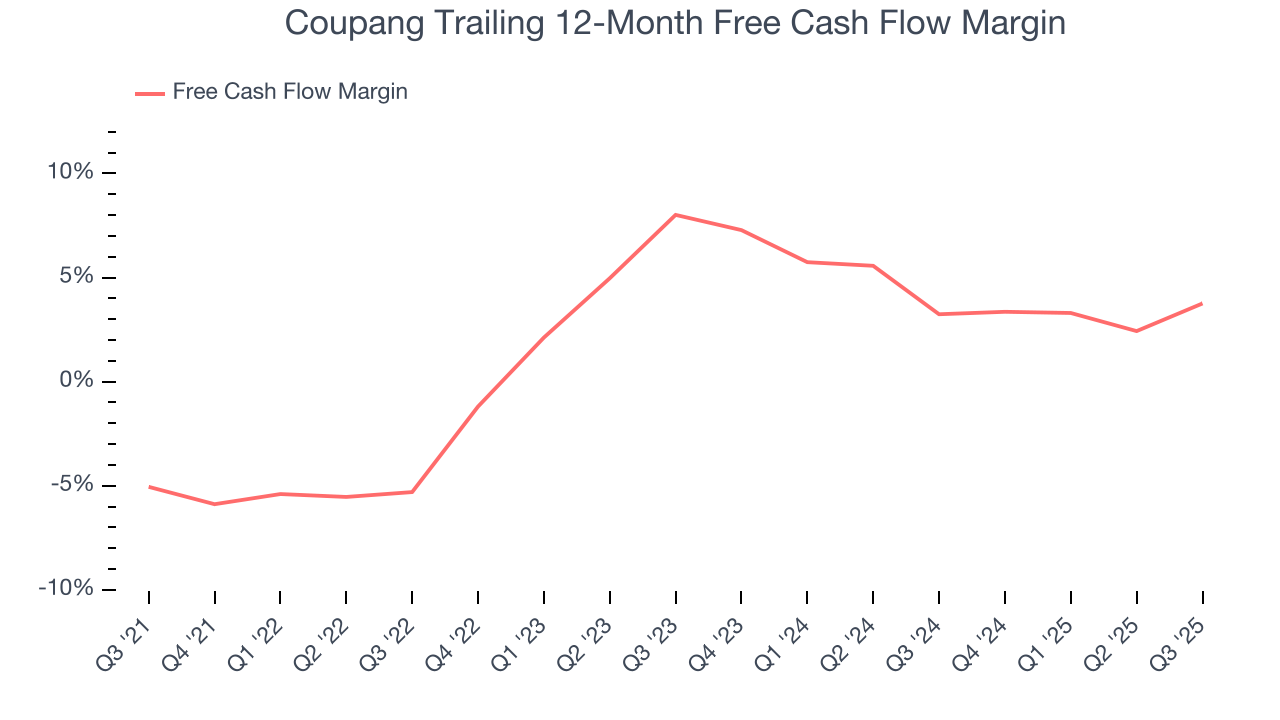

Coupang has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.5%, subpar for a consumer internet business.

Taking a step back, an encouraging sign is that Coupang’s margin expanded by 9.1 percentage points over the last few years. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

Coupang’s free cash flow clocked in at $439 million in Q3, equivalent to a 4.7% margin. This result was good as its margin was 5.3 percentage points higher than in the same quarter last year, building on its favorable historical trend.

11. Balance Sheet Assessment

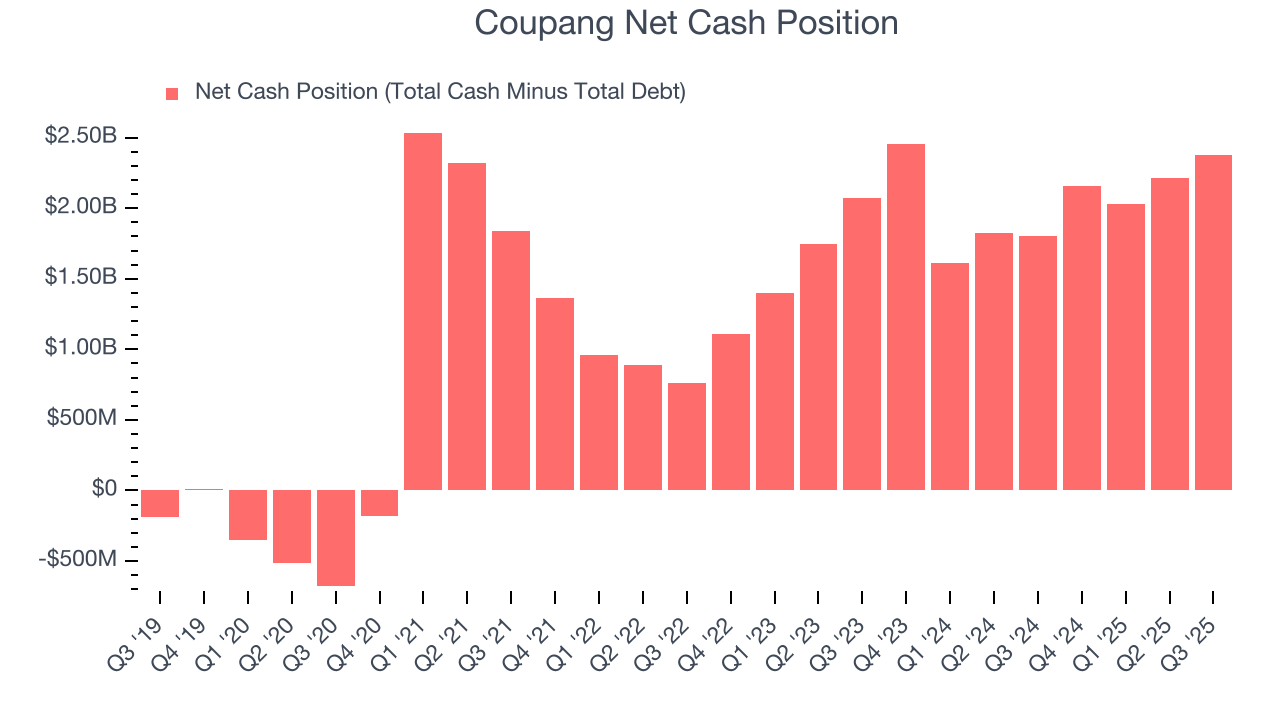

One of the best ways to mitigate bankruptcy risk is to hold more cash than debt.

Coupang is a profitable, well-capitalized company with $7.32 billion of cash and $4.95 billion of debt on its balance sheet. This $2.38 billion net cash position is 4.1% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Coupang’s Q3 Results

We were impressed by how significantly Coupang blew past analysts’ EBITDA expectations this quarter. We were also happy its revenue and EPS outperformed Wall Street’s estimates. Overall, we think this was a solid quarter with many key metrics above expectations. The stock remained flat at $32.06 immediately following the results.

13. Is Now The Time To Buy Coupang?

Updated: January 25, 2026 at 9:53 PM EST

Before making an investment decision, investors should account for Coupang’s business fundamentals and valuation in addition to what happened in the latest quarter.

Coupang possesses a number of positive attributes. To kick things off, its revenue growth was impressive over the last three years. And while its gross margins make it extremely difficult to reach positive operating profits compared to other consumer internet businesses, its EPS growth over the last three years has been fantastic. On top of that, its rising cash profitability gives it more optionality.

Coupang’s EV/EBITDA ratio based on the next 12 months is 17.4x. Looking at the consumer internet space right now, Coupang trades at a compelling valuation. For those confident in the business and its management team, this is a good time to invest.

Wall Street analysts have a consensus one-year price target of $32.91 on the company (compared to the current share price of $20.08), implying they see 63.9% upside in buying Coupang in the short term.