Carvana (CVNA)

Carvana piques our interest. It not only produces robust profits but also has improved its margins, showing its quality is rising.― StockStory Analyst Team

1. News

2. Summary

Why Carvana Is Interesting

Known for its glass tower car vending machines, Carvana (NYSE:CVNA) provides a convenient automotive shopping experience by offering an online platform for buying and selling used cars.

- Demand for the next 12 months is expected to accelerate above its three-year trend as Wall Street forecasts robust revenue growth of 30.5%

- Marketing spend is minimal, showing it doesn’t need advertisements to acquire new users because of its well-known brand

- On the other hand, its gross margin of 20.8% is below its competitors, leaving less money to invest in areas like marketing and R&D

Carvana shows some promise. Consider adding this company to your watchlist.

Why Should You Watch Carvana

Why Should You Watch Carvana

Carvana is trading at $317.62 per share, or 26.9x forward EV/EBITDA. This multiple is right around the sector average.

For now, this is one to add to your watchlist. We prefer owning businesses with better fundamentals that trade at similar multiples.

3. Carvana (CVNA) Research Report: Q4 CY2025 Update

Online used car dealer Carvana (NYSE: CVNA) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 58% year on year to $5.60 billion.

Carvana (CVNA) Q4 CY2025 Highlights:

- Revenue: $5.60 billion vs analyst estimates of $5.25 billion (58% year-on-year growth, 6.8% beat)

- Adjusted EBITDA: $511 million vs analyst estimates of $539.1 million (9.1% margin, 5.2% miss)

- Operating Margin: 7.6%, in line with the same quarter last year

- Market Capitalization: $49.63 billion

Company Overview

Known for its glass tower car vending machines, Carvana (NYSE:CVNA) provides a convenient automotive shopping experience by offering an online platform for buying and selling used cars.

Consumers often face two sources of friction when buying a car from traditional dealerships. First, they feel uninformed. Once they step into a dealership, they know there is information asymmetry–the dealership salespeople know a lot and they know very little. The second issue is selection. Dealership inventory is limited due to space, and consumers can waste time visiting different locations to find the right car.

Carvana's platform seeks to eliminate the traditional hassles and stresses by providing an end-to-end online platform that not only enables the buying, selling, and financing of cars but also offers detailed vehicle descriptions, 360-degree virtual tours, and a no-haggle pricing model. For instance, customers can select a vehicle online, arrange financing, and have the car delivered to their doorstep or pick it up from one of Carvana’s automated car vending machines, making the entire process convenient and efficient. Furthermore, its e-commerce orientation means it doesn't have the inventory constraints of a single-location dealer, and its data and algorithms can better match inventory with customer demand.

Carvana's business model requires it to hold inventory, and its primary revenue sources include the sale of used vehicles, financing, and trade-in transactions. The company also generates revenue from service contracts and insurance policies. Carvana appeals to tech-savvy consumers seeking a hassle-free car-buying experience.

The company's history has been marred by questions about management integrity, though. Founder and CEO Ernie Garcia III initially raised red flags for a previous conviction in a banking fraud scheme. He and his father, Ernie Garcia II, have also sold large amounts of the stock before big moves down in share price, raising concerns that they are prioritizing personal wealth over the company and its shareholders.

4. Online Retail

Consumers ever rising demand for convenience, selection, and speed are secular engines underpinning ecommerce adoption. For years prior to Covid, ecommerce penetration as a percentage of overall retail would grow 1-2% annually, but in 2020 adoption accelerated by 5%, reaching 25%, as increased emphasis on convenience drove consumers to structurally buy more online. The surge in buying caused many online retailers to rapidly grow their logistics infrastructures, preparing them for further growth in the years ahead as consumer shopping habits continue to shift online.

Competitors include traditional car dealers like AutoNation (NYSE:AN), CarMax (NYSE:KMX), Sonic Automotive (NYSE:SAH), and Lithia Motors (NYSE:LAD) as well as online rivals such as Vroom (NASDAQ:VRM).

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last three years, Carvana grew its sales at a solid 14.3% compounded annual growth rate. Its growth surpassed the average consumer internet company and shows its offerings resonate with customers, a great starting point for our analysis.

This quarter, Carvana reported magnificent year-on-year revenue growth of 58%, and its $5.60 billion of revenue beat Wall Street’s estimates by 6.8%.

Looking ahead, sell-side analysts expect revenue to grow 23.3% over the next 12 months, an acceleration versus the last three years. This projection is eye-popping for a company of its scale and implies its newer products and services will catalyze better top-line performance.

6. Gross Margin & Pricing Power

For online retail (separate from online marketplaces) businesses like Carvana, gross profit tells us how much money the company gets to keep after covering the base cost of its products and services, which typically include the cost of acquiring the products sold, shipping and fulfillment, customer service, and digital infrastructure.

Carvana’s unit economics are far below other consumer internet companies because it must carry inventories as an online retailer. This means it has relatively higher capital intensity than a pure software business like Meta or Airbnb and signals it operates in a competitive market. As you can see below, it averaged a 21.2% gross margin over the last two years. That means Carvana paid its providers a lot of money ($78.81 for every $100 in revenue) to run its business.

7. User Acquisition Efficiency

Consumer internet businesses like Carvana grow from a combination of product virality, paid advertisement, and incentives (unlike enterprise software products, which are often sold by dedicated sales teams).

Carvana is extremely efficient at acquiring new users, spending only 8.2% of its gross profit on sales and marketing expenses over the last year. This efficiency indicates that it has a highly differentiated product offering and strong brand reputation from scale, giving Carvana the freedom to invest its resources into new growth initiatives while maintaining optionality.

8. EBITDA

Carvana has been an efficient company over the last two years. It was one of the more profitable businesses in the consumer internet sector, boasting an average EBITDA margin of 10.6%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, Carvana’s EBITDA margin rose by 18.7 percentage points over the last few years, as its sales growth gave it immense operating leverage.

In Q4, Carvana generated an EBITDA margin profit margin of 9.1%, down 1 percentage points year on year. The reduction is quite minuscule and shareholders shouldn’t weigh the results too heavily.

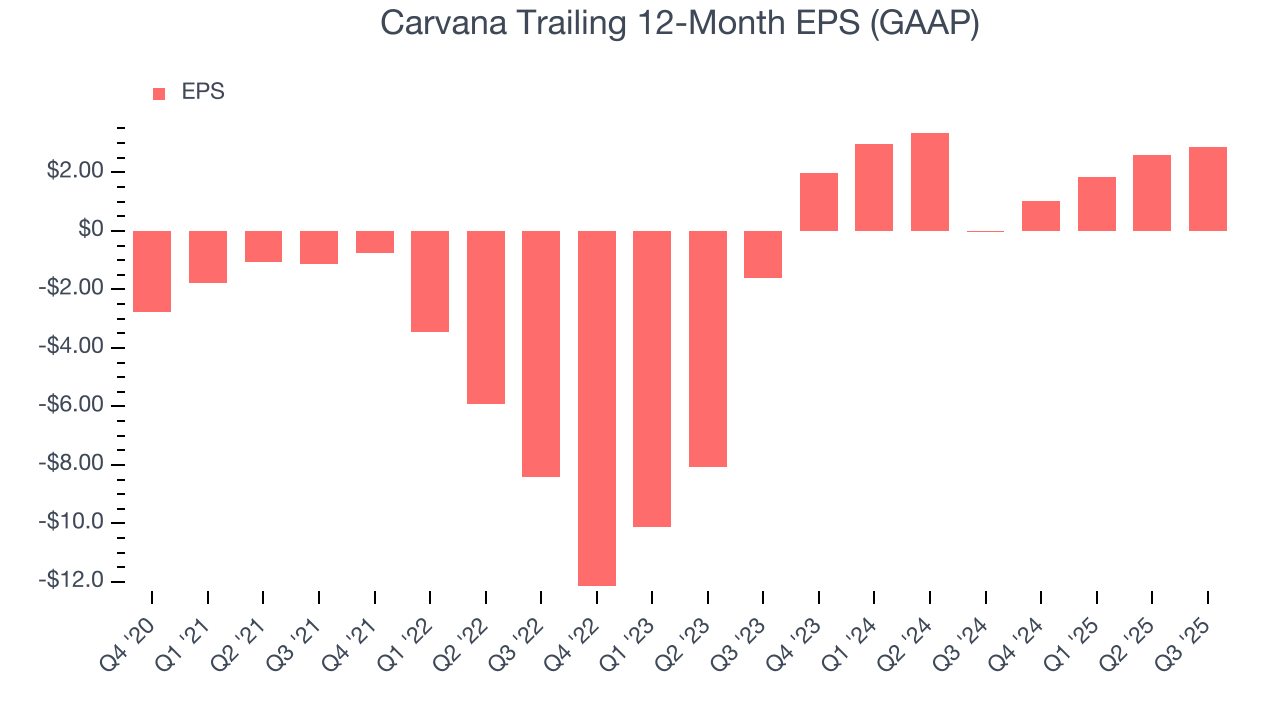

9. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Although Carvana’s full-year earnings are still negative, it reduced its losses and improved its EPS by 32.2% annually over the last three years. The next few quarters will be critical for assessing its long-term profitability. We hope to see an inflection point soon.

10. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Carvana has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.7%, subpar for a consumer internet business. The divergence from its good EBITDA margin stems from its capital-intensive business model, which requires Carvana to make large cash investments in working capital (i.e., stocking inventories) and capital expenditures (i.e., building new facilities).

Taking a step back, an encouraging sign is that Carvana’s margin expanded by 13.1 percentage points over the last few years. We have no doubt shareholders would like to continue seeing its cash conversion rise as it gives the company more optionality.

11. Balance Sheet Assessment

Carvana reported $2.33 billion of cash and $5.66 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $2.24 billion of EBITDA over the last 12 months, we view Carvana’s 1.5× net-debt-to-EBITDA ratio as safe. We also see its $309 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Carvana’s Q4 Results

We enjoyed seeing Carvana beat analysts’ revenue expectations this quarter. On the other hand, its EBITDA missed. Overall, this was a weaker quarter. The stock traded down 20.6% to $287.30 immediately after reporting.

13. Is Now The Time To Buy Carvana?

Updated: March 6, 2026 at 9:28 PM EST

Before making an investment decision, investors should account for Carvana’s business fundamentals and valuation in addition to what happened in the latest quarter.

Carvana possesses a number of positive attributes. First off, its revenue growth was solid over the last three years and is expected to accelerate over the next 12 months. And while its projected EPS for the next year is lacking, its rising cash profitability gives it more optionality. On top of that, its expanding EBITDA margin shows the business has become more efficient.

Carvana’s EV/EBITDA ratio based on the next 12 months is 26.9x. This valuation tells us it’s a bit of a market darling with a lot of good news priced in. Carvana is a good one to add to your watchlist - there are companies featuring superior fundamentals at the moment.

Wall Street analysts have a consensus one-year price target of $428.50 on the company (compared to the current share price of $317.62).