Acushnet (GOLF)

Acushnet is up against the odds. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think Acushnet Will Underperform

Producer of the acclaimed Titleist Pro V1 golf ball, Acushnet (NYSE:GOLF) is a design and manufacturing company specializing in performance-driven golf products.

- Muted 9.7% annual revenue growth over the last five years shows its demand lagged behind its consumer discretionary peers

- Earnings growth underperformed the sector average over the last five years as its EPS grew by just 13.2% annually

- Responsiveness to unforeseen market trends is restricted due to its substandard operating margin profitability

Acushnet is skating on thin ice. There’s a wealth of better opportunities.

Why There Are Better Opportunities Than Acushnet

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Acushnet

At $95.58 per share, Acushnet trades at 24.6x forward P/E. This multiple is higher than most consumer discretionary companies, and we think it’s quite expensive for the weaker revenue growth you get.

There are stocks out there similarly priced with better business quality. We prefer owning these.

3. Acushnet (GOLF) Research Report: Q4 CY2025 Update

Golf equipment and apparel company Acushnet (NYSE:GOLF) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 7.2% year on year to $477.2 million. The company’s full-year revenue guidance of $2.65 billion at the midpoint came in 1.9% above analysts’ estimates. Its GAAP loss of $0.58 per share was 90.5% below analysts’ consensus estimates.

Acushnet (GOLF) Q4 CY2025 Highlights:

- Revenue: $477.2 million vs analyst estimates of $454.2 million (7.2% year-on-year growth, 5.1% beat)

- EPS (GAAP): -$0.58 vs analyst expectations of -$0.30 (90.5% miss)

- Adjusted EBITDA: $9.79 million vs analyst estimates of $11.93 million (2.1% margin, 17.9% miss)

- EBITDA guidance for the upcoming financial year 2026 is $425 million at the midpoint, above analyst estimates of $418.9 million

- Operating Margin: -3.8%, down from -1.2% in the same quarter last year

- Free Cash Flow was -$23.33 million compared to -$33.22 million in the same quarter last year

- Market Capitalization: $5.84 billion

Company Overview

Producer of the acclaimed Titleist Pro V1 golf ball, Acushnet (NYSE:GOLF) is a design and manufacturing company specializing in performance-driven golf products.

Acushnet was founded in 1910 and has consistently focused on improving the golfing experience with high-quality equipment, influencing the standards for producing and using golf gear.

Although many people may not know Acushnet, it is recognized in the golf industry for its well-known brands such as Titleist and FootJoy. These brands offer an array of golf equipment, including balls, clubs, apparel, and accessories.

Sales of golf products are the primary source of revenue for Acushnet, and its goods are sold using a mixture of direct-to-consumer channels and collaborations with distributors. The company invests in research and development it improve its equipment, partnering with professional players to gather feedback for product development. Acushnet targets golfers who value superior equipment and has established a strong reputation, especially with its Titleist brand.

4. Consumer Discretionary - Leisure Products

The Consumer Discretionary sector, by definition, is made up of companies selling non-essential goods and services. When economic conditions deteriorate or tastes shift, consumers can easily cut back or eliminate these purchases. For long-term investors with five-year holding periods, this creates a structural challenge: the sector is inherently hit-driven, with low switching costs and fickle customers. As a result, only a handful of companies can reliably grow demand and compound earnings over long periods, which is why our bar is high and High Quality ratings are rare.

Leisure products companies manufacture recreational goods such as bicycles, marine vessels, fitness equipment, camping gear, and musical instruments. Tailwinds include heightened outdoor-activity participation, health-and-wellness awareness, and periodic innovation cycles that drive trade-up purchases. Headwinds are pronounced: demand is highly discretionary and sensitive to economic cycles—consumers readily defer big-ticket leisure purchases during downturns. Post-pandemic normalization has created excess channel inventory after demand surged then retreated. Raw-material and shipping cost inflation squeezes margins, while competition from low-cost imports and a fragmented market make pricing power elusive for most players.

Competitors in the golf equipment market include Topgolf Callaway (NYSE:MODG), Mizuno (TYO:8022), Nike (NYSE:NKE), Johnson Outdoors (NASDAQ:JOUT), and private companies TaylorMade, Ping, and Srixron.

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Regrettably, Acushnet’s sales grew at a weak 9.7% compounded annual growth rate over the last five years. This was below our standard for the consumer discretionary sector and is a poor baseline for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Acushnet’s recent performance shows its demand has slowed as its annualized revenue growth of 3.6% over the last two years was below its five-year trend. We’re wary when companies in the sector see decelerations in revenue growth, as it could signal changing consumer tastes aided by low switching costs.

Acushnet also breaks out the revenue for its three most important segments: Titleist Balls, Titleist Clubs, and FootJoy, which are 30%, 31.6%, and 21.4% of revenue. Over the last two years, Acushnet’s Titleist Balls (golf balls) and Titleist Clubs (golf clubs) revenues averaged year-on-year growth of 4.1% and 8.7% while its FootJoy revenue (apparel) was flat.

This quarter, Acushnet reported year-on-year revenue growth of 7.2%, and its $477.2 million of revenue exceeded Wall Street’s estimates by 5.1%.

Looking ahead, sell-side analysts expect revenue to grow 1.5% over the next 12 months, a slight deceleration versus the last two years. This projection doesn't excite us and suggests its products and services will see some demand headwinds.

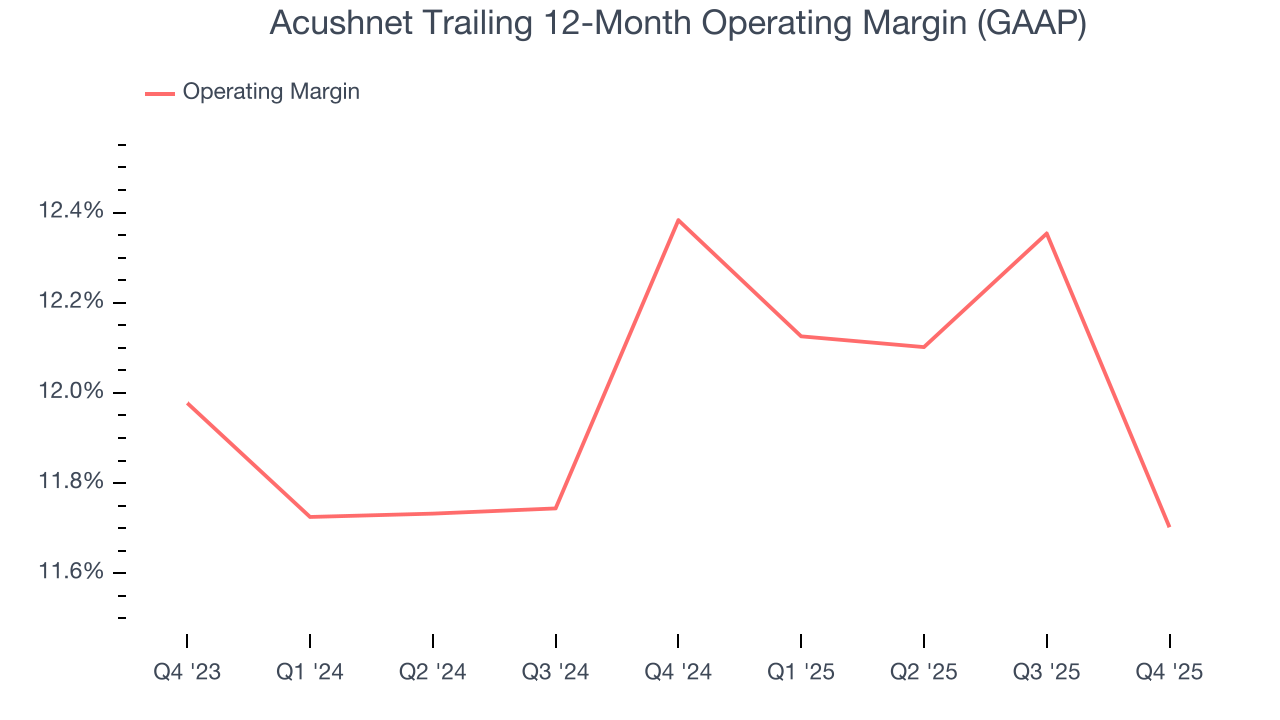

6. Operating Margin

Acushnet’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 12% over the last two years. This profitability was inadequate for a consumer discretionary business and caused by its suboptimal cost structure.

This quarter, Acushnet generated an operating margin profit margin of negative 3.8%, down 2.6 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Acushnet’s EPS grew at a weak 19.3% compounded annual growth rate over the last five years. This performance was better than its flat revenue but doesn’t tell us much about its business quality because its operating margin didn’t improve.

In Q4, Acushnet reported EPS of negative $0.58, down from negative $0.02 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Acushnet’s full-year EPS of $3.10 to grow 19.1%.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Acushnet has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 5.8%, lousy for a consumer discretionary business.

Acushnet burned through $23.33 million of cash in Q4, equivalent to a negative 4.9% margin. The company’s cash burn was similar to its $33.22 million of lost cash in the same quarter last year. These numbers deviate from its longer-term margin, indicating it is a seasonal business that must build up inventory during certain quarters.

Over the next year, analysts predict Acushnet’s cash conversion will improve. Their consensus estimates imply its free cash flow margin of 4.7% for the last 12 months will increase to 9.7%, it options for capital deployment (investments, share buybacks, etc.).

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Acushnet historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 15.6%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, Acushnet’s ROIC decreased by 1.1 percentage points annually each year over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

10. Balance Sheet Assessment

Acushnet reported $50.09 million of cash and $942.9 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $410.4 million of EBITDA over the last 12 months, we view Acushnet’s 2.2× net-debt-to-EBITDA ratio as safe. We also see its $28.77 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Acushnet’s Q4 Results

We enjoyed seeing Acushnet beat analysts’ revenue expectations this quarter. We were also glad its full-year revenue guidance exceeded Wall Street’s estimates. On the other hand, its EPS missed and its EBITDA fell short of Wall Street’s estimates. Zooming out, we think this was a mixed quarter. The stock remained flat at $99.49 immediately following the results.

12. Is Now The Time To Buy Acushnet?

Updated: March 8, 2026 at 10:59 PM EDT

Before making an investment decision, investors should account for Acushnet’s business fundamentals and valuation in addition to what happened in the latest quarter.

Acushnet falls short of our quality standards. On top of that, Acushnet’s weak EPS growth over the last five years shows it’s failed to produce meaningful profits for shareholders, and its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

Acushnet’s P/E ratio based on the next 12 months is 24.6x. This multiple tells us a lot of good news is priced in - you can find more timely opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $98 on the company (compared to the current share price of $95.58).