Haemonetics (HAE)

We aren’t fans of Haemonetics. Its underwhelming returns on capital show it struggled to generate meaningful profits for shareholders.― StockStory Analyst Team

1. News

2. Summary

Why We Think Haemonetics Will Underperform

With roots dating back to 1971 and a mission to improve blood-related healthcare, Haemonetics (NYSE:HAE) provides specialized medical devices and software for blood collection, processing, and management across plasma centers, blood banks, and hospitals.

- Smaller revenue base of $1.32 billion means it hasn’t achieved the economies of scale that some industry juggernauts enjoy

- Absence of organic revenue growth over the past two years suggests it may have to lean into acquisitions to drive its expansion

- A silver lining is that its incremental sales over the last five years have been highly profitable as its earnings per share increased by 13.8% annually, topping its revenue gains

Haemonetics doesn’t measure up to our expectations. There are more promising prospects in the market.

Why There Are Better Opportunities Than Haemonetics

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Haemonetics

At $64.10 per share, Haemonetics trades at 12.4x forward P/E. This multiple is lower than most healthcare companies, but for good reason.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Haemonetics (HAE) Research Report: Q4 CY2025 Update

Blood products company Haemonetics (NYSE:HAE). reported Q4 CY2025 results topping the market’s revenue expectations, but sales fell by 2.7% year on year to $339 million. Its non-GAAP profit of $1.31 per share was 4.8% above analysts’ consensus estimates.

Haemonetics (HAE) Q4 CY2025 Highlights:

- Revenue: $339 million vs analyst estimates of $331.1 million (2.7% year-on-year decline, 2.4% beat)

- Adjusted EPS: $1.31 vs analyst estimates of $1.25 (4.8% beat)

- Management raised its full-year Adjusted EPS guidance to $4.95 at the midpoint, a 1% increase

- Operating Margin: 19.9%, up from 16.9% in the same quarter last year

- Free Cash Flow Margin: 25.7%, up from 10.1% in the same quarter last year

- Organic Revenue rose 1.2% year on year (beat)

- Market Capitalization: $3.09 billion

Company Overview

With roots dating back to 1971 and a mission to improve blood-related healthcare, Haemonetics (NYSE:HAE) provides specialized medical devices and software for blood collection, processing, and management across plasma centers, blood banks, and hospitals.

Haemonetics operates through three main business segments: Plasma, Blood Center, and Hospital. Each segment addresses distinct needs in the blood management ecosystem with specialized technologies.

In its Plasma business, Haemonetics offers automated collection systems like the NexSys PCS platform that enable plasma collection centers to efficiently collect source plasma used in manufacturing life-saving pharmaceuticals. These systems incorporate technologies like Persona Technology, which customizes collection based on individual donor characteristics to maximize plasma yield. The company also provides comprehensive software solutions such as NexLynk DMS that manage donor information, streamline workflows, and optimize the entire plasma supply chain.

The Blood Center segment supplies equipment and disposables for blood component collection and processing. Products include the MCS brand apheresis equipment for collecting specific blood components like platelets, along with whole blood collection sets that offer flexibility in collecting and storing various blood components.

The Hospital segment consists of two franchises. The Interventional Technologies franchise includes vascular closure devices like VASCADE, which seal access sites after catheter-based procedures, and sensor-guided technologies like OptoWire and SavvyWire that assist in cardiac procedures. The Blood Management Technologies franchise offers hemostasis diagnostic systems (TEG analyzers) that assess a patient's coagulation status, Cell Saver systems that recover and process a patient's own blood during surgery for reinfusion, and transfusion management software that ensures safety and traceability of blood products within hospitals.

Haemonetics' customers include major biopharmaceutical companies that collect plasma, blood collection centers, hospitals, and healthcare providers worldwide. The company's technologies help these organizations improve efficiency, enhance patient outcomes, and optimize blood resource management while maintaining high standards of safety and quality.

4. Medical Devices & Supplies - Specialty

The medical devices industry operates a business model that balances steady demand with significant investments in innovation and regulatory compliance. The industry benefits from recurring revenue streams tied to consumables, maintenance services, and incremental upgrades to the latest technologies, although specialty devices are more niche. The capital-intensive nature of product development, coupled with lengthy regulatory pathways and the need for clinical validation, can weigh on profitability and timelines. In addition, there are constant pricing pressures from healthcare systems and insurers maximizing cost efficiency. Over the next several years, one tailwind is demographic–aging populations means rising chronic disease rates that drive greater demand for medical interventions and monitoring solutions. Advances in digital health, such as remote patient monitoring and smart devices, are also expected to unlock new demand by shortening upgrade cycles. On the other hand, the industry faces headwinds from pricing and reimbursement pressures as healthcare providers increasingly adopt value-based care models. Additionally, the integration of cybersecurity for connected devices adds further risk and complexity for device manufacturers.

Haemonetics faces competition from several medical technology companies across its business segments. In the Plasma market, it primarily competes with Fresenius and Terumo Blood and Cell Technologies (Terumo BCT). In the Hospital segment, competitors include Abbott Laboratories, Cardinal Health, and LivaNova for various product lines.

5. Revenue Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With just $1.32 billion in revenue over the past 12 months, Haemonetics is a small company in an industry where scale matters. This makes it difficult to build trust with customers because healthcare is heavily regulated, complex, and resource-intensive.

6. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Luckily, Haemonetics’s sales grew at a decent 8.3% compounded annual growth rate over the last five years. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Haemonetics’s recent performance shows its demand has slowed as its annualized revenue growth of 1.9% over the last two years was below its five-year trend.

We can dig further into the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Haemonetics’s organic revenue averaged 2% year-on-year growth. Because this number aligns with its two-year revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, Haemonetics’s revenue fell by 2.7% year on year to $339 million but beat Wall Street’s estimates by 2.4%.

Looking ahead, sell-side analysts expect revenue to grow 3.6% over the next 12 months. While this projection suggests its newer products and services will catalyze better top-line performance, it is still below the sector average.

7. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

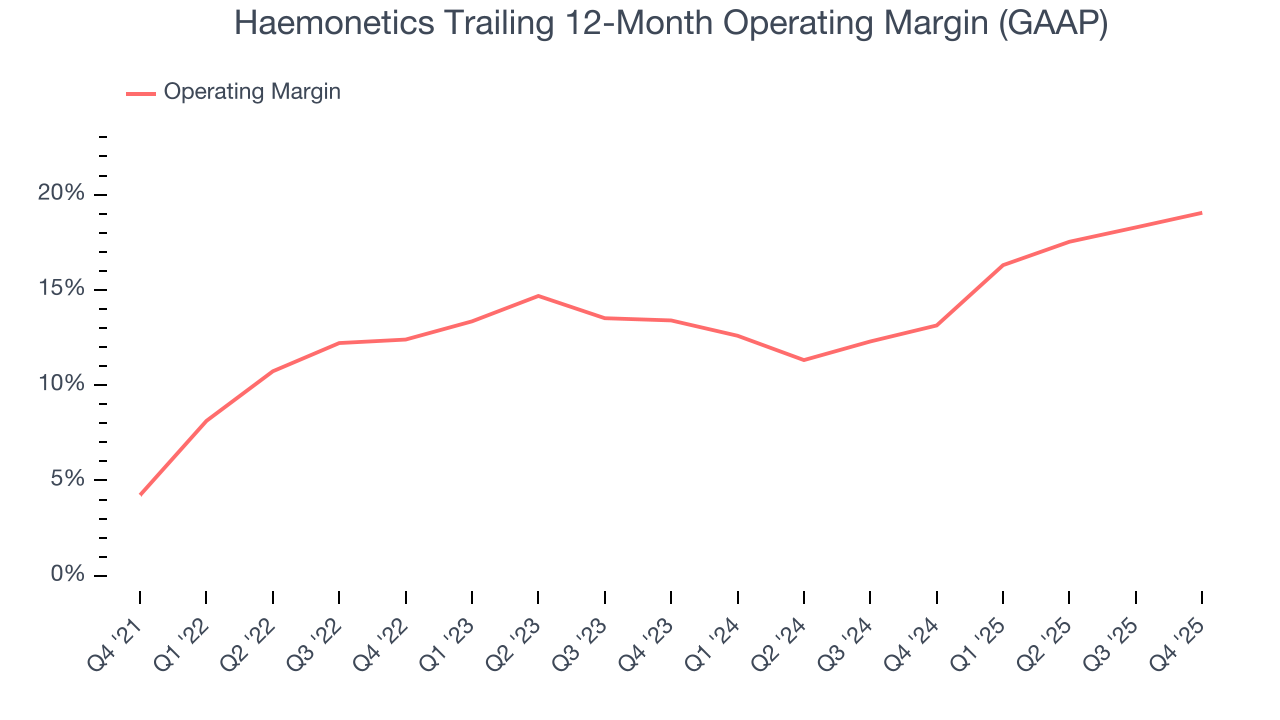

Haemonetics has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 12.9%, higher than the broader healthcare sector.

Analyzing the trend in its profitability, Haemonetics’s operating margin rose by 14.8 percentage points over the last five years, as its sales growth gave it operating leverage. Zooming in on its more recent performance, we can see the company’s trajectory is intact as its margin has also increased by 5.6 percentage points on a two-year basis.

In Q4, Haemonetics generated an operating margin profit margin of 19.9%, up 2.9 percentage points year on year. This increase was a welcome development, especially since its revenue fell, showing it was more efficient because it scaled down its expenses.

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

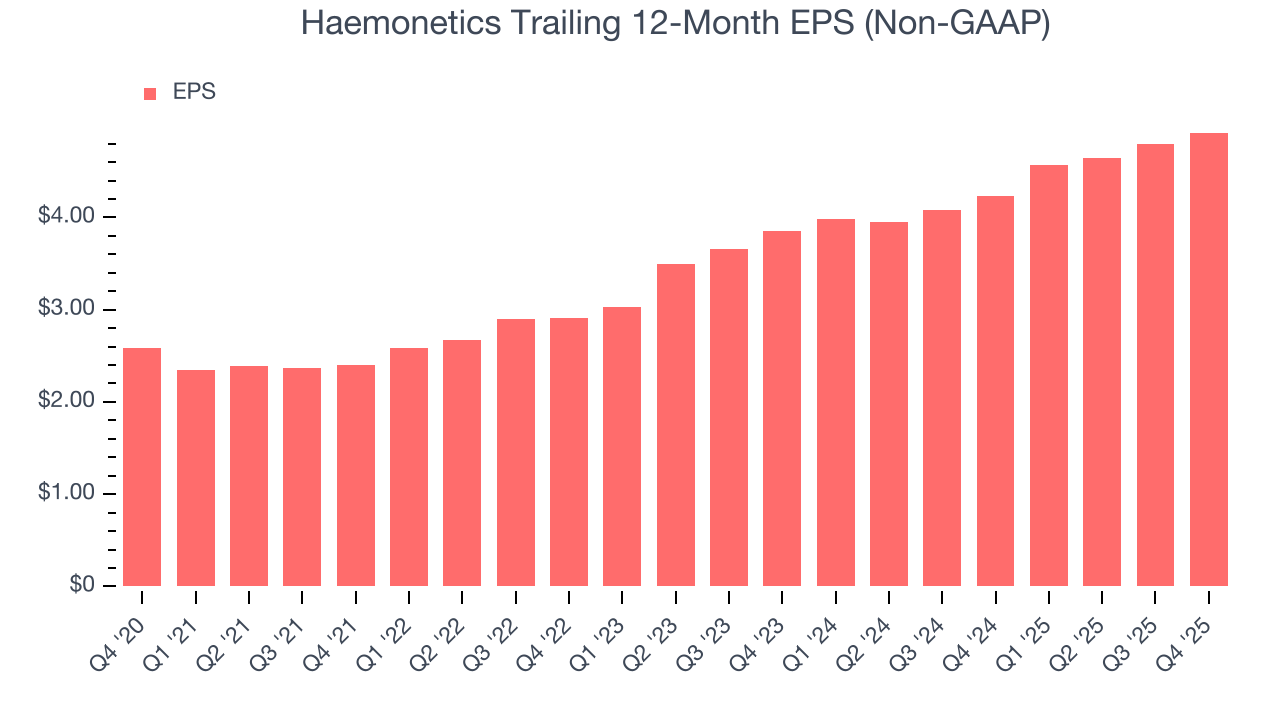

Haemonetics’s EPS grew at a spectacular 13.8% compounded annual growth rate over the last five years, higher than its 8.3% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into Haemonetics’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, Haemonetics’s operating margin expanded by 14.8 percentage points over the last five years. On top of that, its share count shrank by 8.5%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

In Q4, Haemonetics reported adjusted EPS of $1.31, up from $1.19 in the same quarter last year. This print beat analysts’ estimates by 4.8%. Over the next 12 months, Wall Street expects Haemonetics’s full-year EPS of $4.92 to grow 6.9%.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Haemonetics has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 10.4% over the last five years, better than the broader healthcare sector.

Taking a step back, we can see that Haemonetics’s margin expanded by 19.1 percentage points during that time. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

Haemonetics’s free cash flow clocked in at $87.22 million in Q4, equivalent to a 25.7% margin. This result was good as its margin was 15.6 percentage points higher than in the same quarter last year, building on its favorable historical trend.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Haemonetics historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 6.6%, somewhat low compared to the best healthcare companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, Haemonetics’s ROIC increased by 4.2 percentage points annually each year over the last few years. This is a good sign, and if its returns keep rising, there’s a chance it could evolve into an investable business.

11. Balance Sheet Assessment

Haemonetics reported $363.4 million of cash and $1.22 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $398.7 million of EBITDA over the last 12 months, we view Haemonetics’s 2.2× net-debt-to-EBITDA ratio as safe. We also see its $42.4 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Haemonetics’s Q4 Results

We enjoyed seeing Haemonetics beat analysts’ organic revenue expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. Additionally, EPS beat, and the company raised its full-year EPS guidance. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 8.7% to $71.66 immediately following the results.

13. Is Now The Time To Buy Haemonetics?

Updated: March 9, 2026 at 12:35 AM EDT

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Haemonetics.

Haemonetics’s business quality ultimately falls short of our standards. Although its revenue growth was decent over the last five years, it’s expected to deteriorate over the next 12 months and its subscale operations give it fewer distribution channels than its larger rivals.

Haemonetics’s P/E ratio based on the next 12 months is 12.4x. While this valuation is fair, the upside isn’t great compared to the potential downside. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $88 on the company (compared to the current share price of $64.10).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.