Hexcel (HXL)

Hexcel doesn’t excite us. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think Hexcel Will Underperform

Founded shortly after World War II by a group of engineers from UC Berkley, Hexcel (NYSE:HXL) manufactures lightweight composite materials primarily for the aerospace and defense sectors.

- ROIC of 6.4% reflects management’s challenges in identifying attractive investment opportunities

- 4.7% annual revenue growth over the last five years was slower than its industrials peers

- On the bright side, its earnings growth has outpaced its peers over the last five years as its EPS has compounded at 47.7% annually

Hexcel falls short of our quality standards. Better stocks can be found in the market.

Why There Are Better Opportunities Than Hexcel

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Hexcel

Hexcel’s stock price of $87.16 implies a valuation ratio of 39.3x forward P/E. This multiple is higher than most industrials companies, and we think it’s quite expensive for the weaker revenue growth you get.

We prefer to invest in similarly-priced but higher-quality companies with superior earnings growth.

3. Hexcel (HXL) Research Report: Q4 CY2025 Update

Aerospace and defense company Hexcel (NYSE:HXL) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 3.7% year on year to $491.3 million. On the other hand, the company’s full-year revenue guidance of $2.05 billion at the midpoint came in 0.7% below analysts’ estimates. Its non-GAAP profit of $0.52 per share was 5.2% above analysts’ consensus estimates.

Hexcel (HXL) Q4 CY2025 Highlights:

- Revenue: $491.3 million vs analyst estimates of $480.5 million (3.7% year-on-year growth, 2.2% beat)

- Adjusted EPS: $0.52 vs analyst estimates of $0.49 (5.2% beat)

- Adjusted EBITDA: $93.2 million vs analyst estimates of $94.32 million (19% margin, 1.2% miss)

- Adjusted EPS guidance for the upcoming financial year 2026 is $2.20 at the midpoint, missing analyst estimates by 3.1%

- Operating Margin: 12.5%, up from 1.9% in the same quarter last year

- Free Cash Flow Margin: 21.8%, down from 30.4% in the same quarter last year

- Market Capitalization: $6.49 billion

Company Overview

Founded shortly after World War II by a group of engineers from UC Berkley, Hexcel (NYSE:HXL) manufactures lightweight composite materials primarily for the aerospace and defense sectors.

Hexcel Corporation started in 1948 initially developing honeycomb materials for aerospace applications. This innovation led to early collaborations with the aerospace sector, especially as the company expanded into composites involving fiberglass and resins during the 1950s and 1960s, supporting significant aerospace projects like the Apollo moon missions. Over the decades, Hexcel strategically broadened its technological base and market reach through numerous acquisitions, venturing into sports equipment and industrial applications. However, its focus remains on its composite technology for the aerospace, defense, and industrial sectors.

Hexcel’s product line spans advanced lightweight composites technology, encompassing everything from essential structural materials used in aerospace applications to specialized components for defense and industrial sectors. Its offerings range from carbon fiber and specialty reinforcements to complex engineered products like honeycomb structures and composite assemblies. For example, Hexcel's carbon fiber prepregs are crucial in manufacturing critical airframe components for commercial aircraft, significantly enhancing performance through weight reduction and improved fuel efficiency. Additionally, under the HexWeb® brand, Hexcel provides products such as Acousti-Cap® technology, which offers significant noise reduction in aircraft engines. The company primarily serves aerospace and defense end markets, but is also complemented by some sales from the general industrial market such as the automotive and wind turbine industries.

The use of the company’s composite materials is closely tied to the production rates of new commercial aircraft and military equipment, reflecting broader economic conditions and technological advancements in these industries. Beyond the initial sale of materials, Hexcel benefits from limited aftermarket revenues due to the long-lasting nature of its products, although ongoing development and the introduction of new technologies continually open new avenues for revenue.

4. Aerospace

Aerospace companies often possess technical expertise and have made significant capital investments to produce complex products. It is an industry where innovation is important, and lately, emissions and automation are in focus, so companies that boast advances in these areas can take market share. On the other hand, demand for aerospace products can ebb and flow with economic cycles and geopolitical tensions, which can be particularly painful for companies with high fixed costs.

Hexcel’s peers and competitors include Spirit Aerosystems (NYSE:SPR) and TPI Composites (NASDAQ:TPIC).

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Hexcel grew its sales at a tepid 4.7% compounded annual growth rate. This fell short of our benchmark for the industrials sector and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Hexcel’s recent performance shows its demand has slowed as its annualized revenue growth of 2.9% over the last two years was below its five-year trend.

Hexcel also breaks out the revenue for its most important segments, Commercial aerospace and Space & defense, which are 61% and 39% of revenue. Over the last two years, Hexcel’s Commercial aerospace revenue (customers like Airbus, Boeing) averaged 4.2% year-on-year growth while its Space & defense revenue (government customers) averaged 13% growth.

This quarter, Hexcel reported modest year-on-year revenue growth of 3.7% but beat Wall Street’s estimates by 2.2%.

Looking ahead, sell-side analysts expect revenue to grow 9.5% over the next 12 months, an improvement versus the last two years. This projection is healthy and suggests its newer products and services will catalyze better top-line performance.

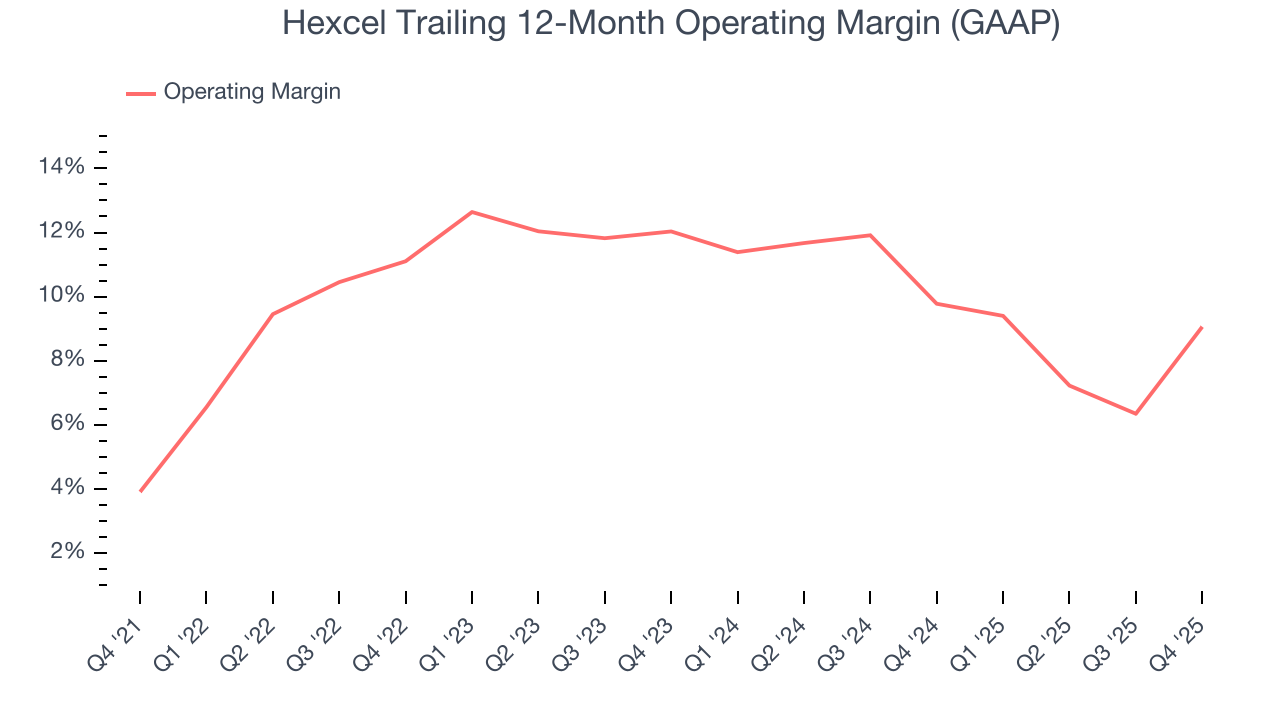

6. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Hexcel has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 9.4%, higher than the broader industrials sector.

Looking at the trend in its profitability, Hexcel’s operating margin rose by 5.2 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Hexcel generated an operating margin profit margin of 12.5%, up 10.6 percentage points year on year. This increase was a welcome development and shows it was more efficient.

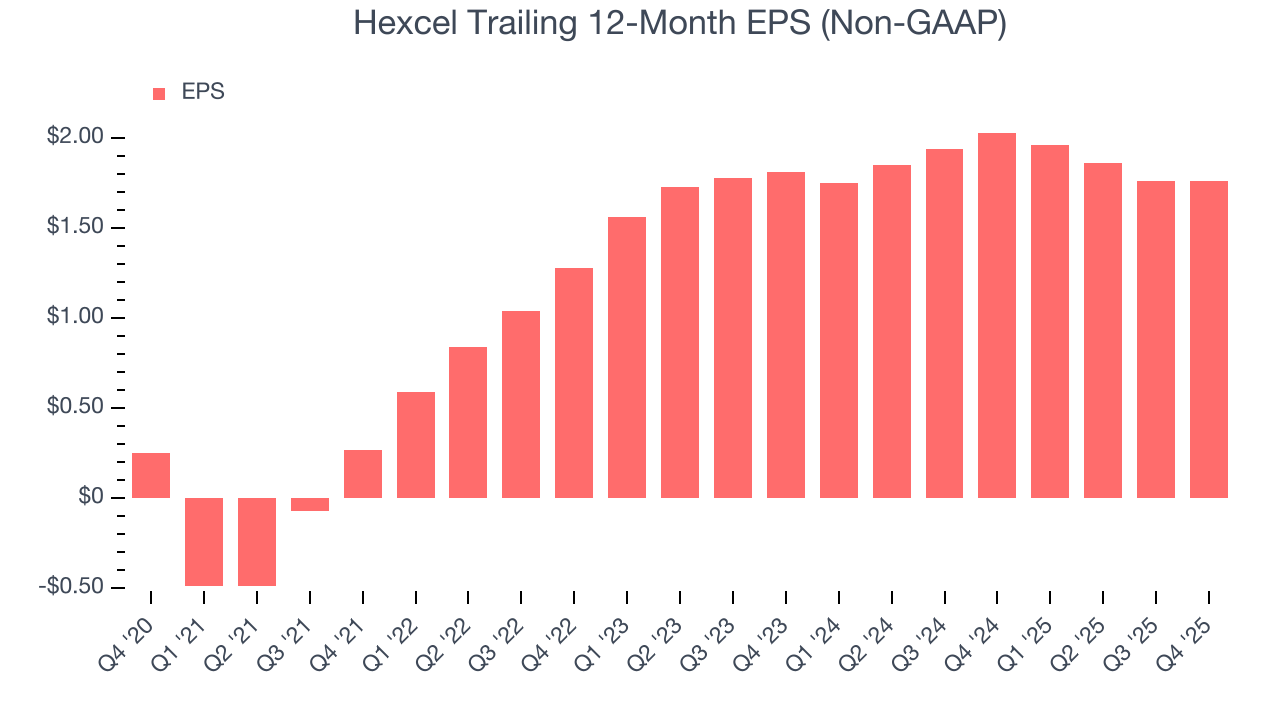

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Hexcel’s EPS grew at an astounding 47.7% compounded annual growth rate over the last five years, higher than its 4.7% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Hexcel’s earnings to better understand the drivers of its performance. As we mentioned earlier, Hexcel’s operating margin expanded by 5.2 percentage points over the last five years. On top of that, its share count shrank by 7.4%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Hexcel, its two-year annual EPS declines of 1.4% mark a reversal from its (seemingly) healthy five-year trend. We hope Hexcel can return to earnings growth in the future.

In Q4, Hexcel reported adjusted EPS of $0.52, in line with the same quarter last year. This print beat analysts’ estimates by 5.2%. Over the next 12 months, Wall Street expects Hexcel’s full-year EPS of $1.76 to grow 30.8%.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Hexcel has shown impressive cash profitability, enabling it to ride out cyclical downturns more easily while maintaining its investments in new and existing offerings. The company’s free cash flow margin averaged 8.6% over the last five years, better than the broader industrials sector.

Taking a step back, we can see that Hexcel’s margin dropped by 1 percentage points during that time. If its declines continue, it could signal increasing investment needs and capital intensity.

Hexcel’s free cash flow clocked in at $107.3 million in Q4, equivalent to a 21.8% margin. The company’s cash profitability regressed as it was 8.6 percentage points lower than in the same quarter last year, but it’s still above its five-year average. We wouldn’t read too much into this quarter’s decline because capital expenditures can be seasonal and companies often stockpile inventory in anticipation of higher demand, leading to short-term swings. Long-term trends are more important.

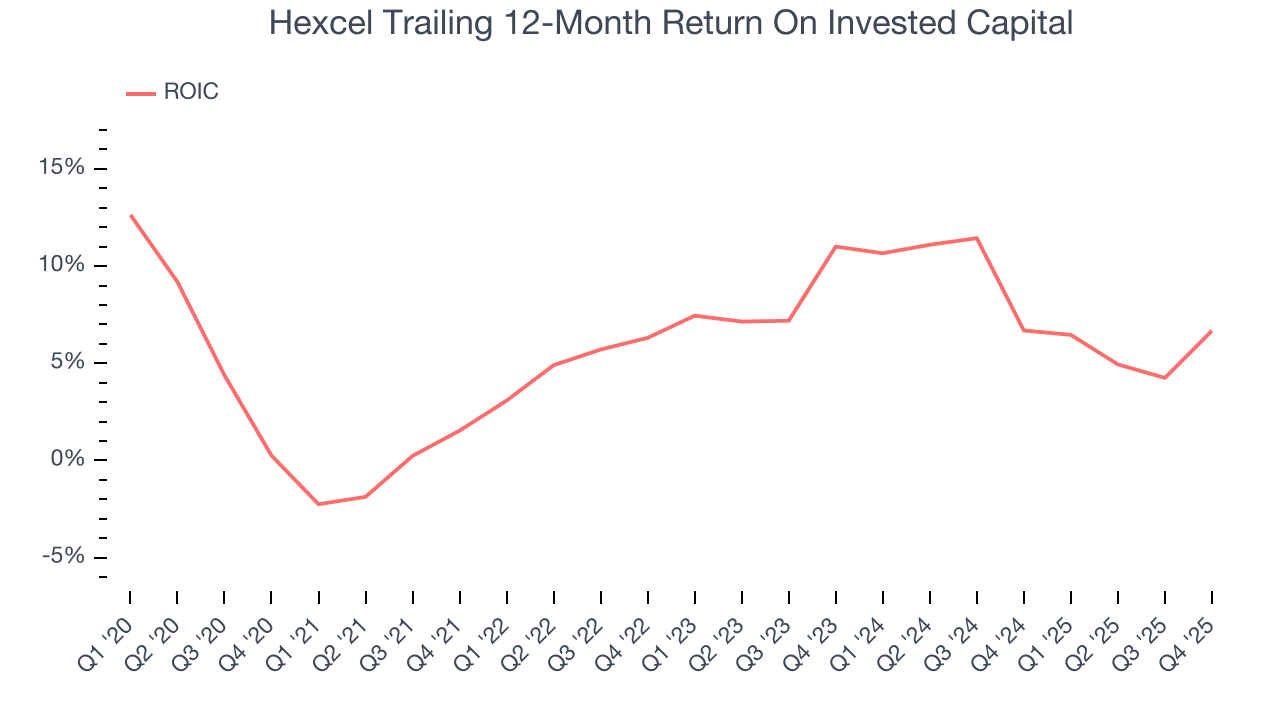

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Hexcel historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 6.4%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, Hexcel’s ROIC averaged 2.8 percentage point increases over the last few years. This is a good sign, and we hope the company can continue improving.

10. Balance Sheet Assessment

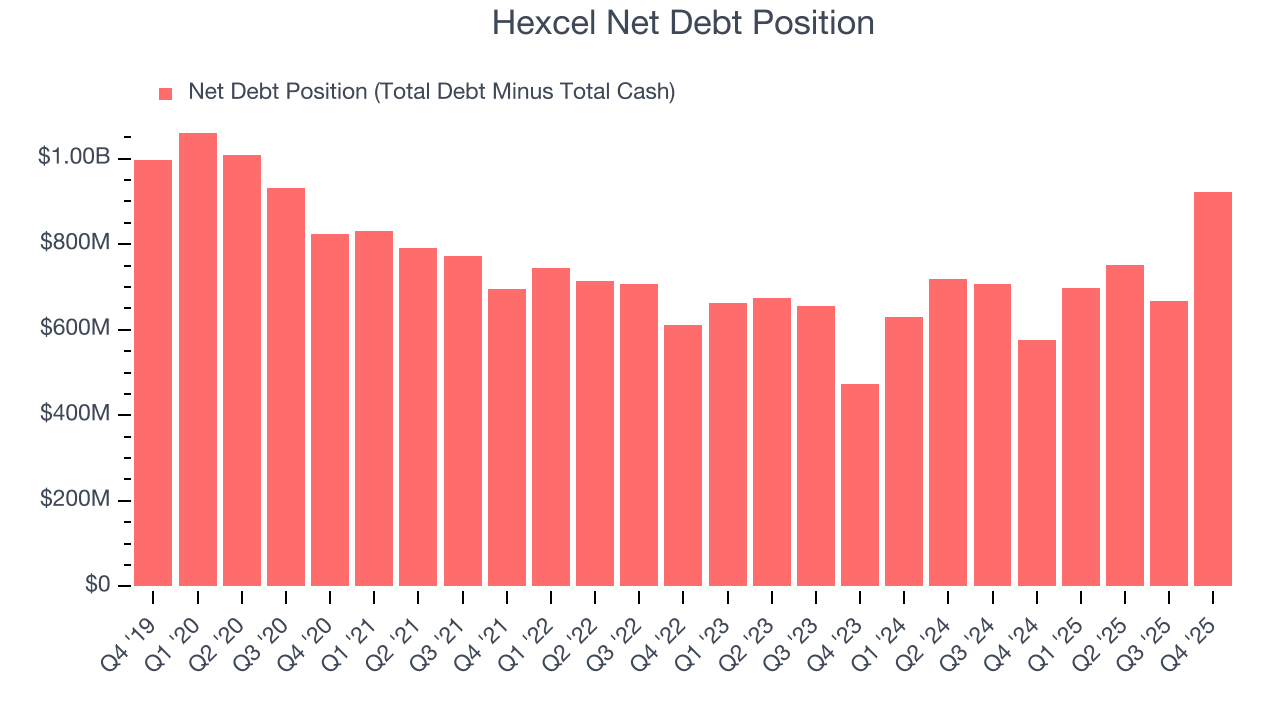

Hexcel reported $71 million of cash and $993 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $329 million of EBITDA over the last 12 months, we view Hexcel’s 2.8× net-debt-to-EBITDA ratio as safe. We also see its $14.5 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Hexcel’s Q4 Results

We were impressed by how significantly Hexcel blew past analysts’ Commercial aerospace revenue expectations this quarter. We were also glad its Space & defense revenue topped Wall Street’s estimates. On the other hand, its full-year EPS guidance missed and its full-year revenue guidance fell slightly short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded up 8.9% to $87.31 immediately following the results.

12. Is Now The Time To Buy Hexcel?

Updated: February 19, 2026 at 9:06 PM EST

When considering an investment in Hexcel, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

Hexcel isn’t a terrible business, but it doesn’t pass our quality test. To begin with, its revenue growth was uninspiring over the last five years. And while Hexcel’s expanding operating margin shows the business has become more efficient, its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

Hexcel’s P/E ratio based on the next 12 months is 39.3x. This multiple tells us a lot of good news is priced in - we think other companies feature superior fundamentals at the moment.

Wall Street analysts have a consensus one-year price target of $88.57 on the company (compared to the current share price of $87.16).