Illinois Tool Works (ITW)

We’re cautious of Illinois Tool Works. Its sluggish sales growth shows demand is soft, a worrisome sign for investors in high-quality stocks.― StockStory Analyst Team

1. News

2. Summary

Why We Think Illinois Tool Works Will Underperform

Founded by Byron Smith, an investor who held over 100 patents, Illinois Tool Works (NYSE:ITW) manufactures engineered components and specialized equipment for numerous industries.

- Organic sales performance over the past two years indicates the company may need to make strategic adjustments or rely on M&A to catalyze faster growth

- Anticipated sales growth of 3.2% for the next year implies demand will be shaky

- A consolation is that its excellent operating margin highlights the strength of its business model, and its operating leverage amplified its profits over the last five years

Illinois Tool Works’s quality isn’t great. Our attention is focused on better businesses.

Why There Are Better Opportunities Than Illinois Tool Works

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Illinois Tool Works

At $282.76 per share, Illinois Tool Works trades at 25.6x forward P/E. This multiple is high given its weaker fundamentals.

Paying up for elite businesses with strong earnings potential is better than investing in lower-quality companies with shaky fundamentals. That’s how you avoid big downside over the long term.

3. Illinois Tool Works (ITW) Research Report: Q4 CY2025 Update

Manufacturing company Illinois Tool Works (NYSE:ITW) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 4.1% year on year to $4.09 billion. Its GAAP profit of $2.72 per share was 1.2% above analysts’ consensus estimates.

Illinois Tool Works (ITW) Q4 CY2025 Highlights:

- Revenue: $4.09 billion vs analyst estimates of $4.06 billion (4.1% year-on-year growth, 0.7% beat)

- EPS (GAAP): $2.72 vs analyst estimates of $2.69 (1.2% beat)

- EPS (GAAP) guidance for the upcoming financial year 2026 is $11.20 at the midpoint, missing analyst estimates by 0.6%

- Operating Margin: 26.5%, in line with the same quarter last year

- Free Cash Flow Margin: 21%, down from 25.3% in the same quarter last year

- Organic Revenue rose 1.3% year on year (miss)

- Market Capitalization: $76.65 billion

Company Overview

Founded by Byron Smith, an investor who held over 100 patents, Illinois Tool Works (NYSE:ITW) manufactures engineered components and specialized equipment for numerous industries.

The company began as a small operation in Chicago producing tools such as cutters, hobs, and jigs from a leased lot. By the 1920s, Illinois Tool Works had become a significant producer of metal fasteners for the automotive industry through its acquisition of Shakeproof Screw and Nut Lock Company, marking a pivot towards specialized and patented products.

Since then, it has grown its product portfolio by consolidating its competitors and acquiring approximately 100 companies throughout the 1990s. Over the past decade, it has transitioned to a strategy of selective high-quality acquisitions to further its reach, such as the acquisition of the Test & Simulation division of MTS Systems in 2021.

Today, Illinois Tool Works produces a variety of goods across the entire industrials industry. Its products range from metal components and fasteners for automotive original equipment manufacturers (OEM) to cooking and refrigeration equipment, such as ovens, slicers, and mixers for the food industry. The company generates revenue from the sale of these products as well as from contracts for related software and maintenance services.

Central to ITW’s business model is the 80/20 Front-to-Back process given the number of companies it has acquired. This strategy involves focusing on the most profitable opportunities (the 80%) while divesting less profitable areas (the 20%) and reallocating resources. Hence, its management team’s capital allocation prowess is pivotal to its success.

4. General Industrial Machinery

Automation that increases efficiency and connected equipment that collects analyzable data have been trending, creating new demand for general industrial machinery companies. Those who innovate and create digitized solutions can spur sales and speed up replacement cycles, but all general industrial machinery companies are still at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

Competitors offering similar products include 3M (NYSE:MMM), Emerson Electric (NYSE:EMR), Stanley Black & Decker (NYSE:SWK), Parker-Hannifin (NYSE:PH), and Eaton Corporation (NYSE:ETN).

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, Illinois Tool Works’s sales grew at a tepid 5% compounded annual growth rate over the last five years. This was below our standard for the industrials sector and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Illinois Tool Works’s recent performance shows its demand has slowed as its revenue was flat over the last two years.

We can dig further into the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Illinois Tool Works’s organic revenue was flat. Because this number aligns with its two-year revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, Illinois Tool Works reported modest year-on-year revenue growth of 4.1% but beat Wall Street’s estimates by 0.7%.

Looking ahead, sell-side analysts expect revenue to grow 3% over the next 12 months. Although this projection implies its newer products and services will catalyze better top-line performance, it is still below the sector average.

6. Gross Margin & Pricing Power

Gross profit margin is a critical metric to track because it sheds light on its pricing power, complexity of products, and ability to procure raw materials, equipment, and labor.

Illinois Tool Works has best-in-class unit economics for an industrials company, enabling it to invest in areas such as research and development. Its margin also signals it sells differentiated products, not commodities. As you can see below, it averaged an elite 42.6% gross margin over the last five years. Said differently, roughly $42.55 was left to spend on selling, marketing, R&D, and general administrative overhead for every $100 in revenue.

Illinois Tool Works’s gross profit margin came in at 44.2% this quarter, in line with the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

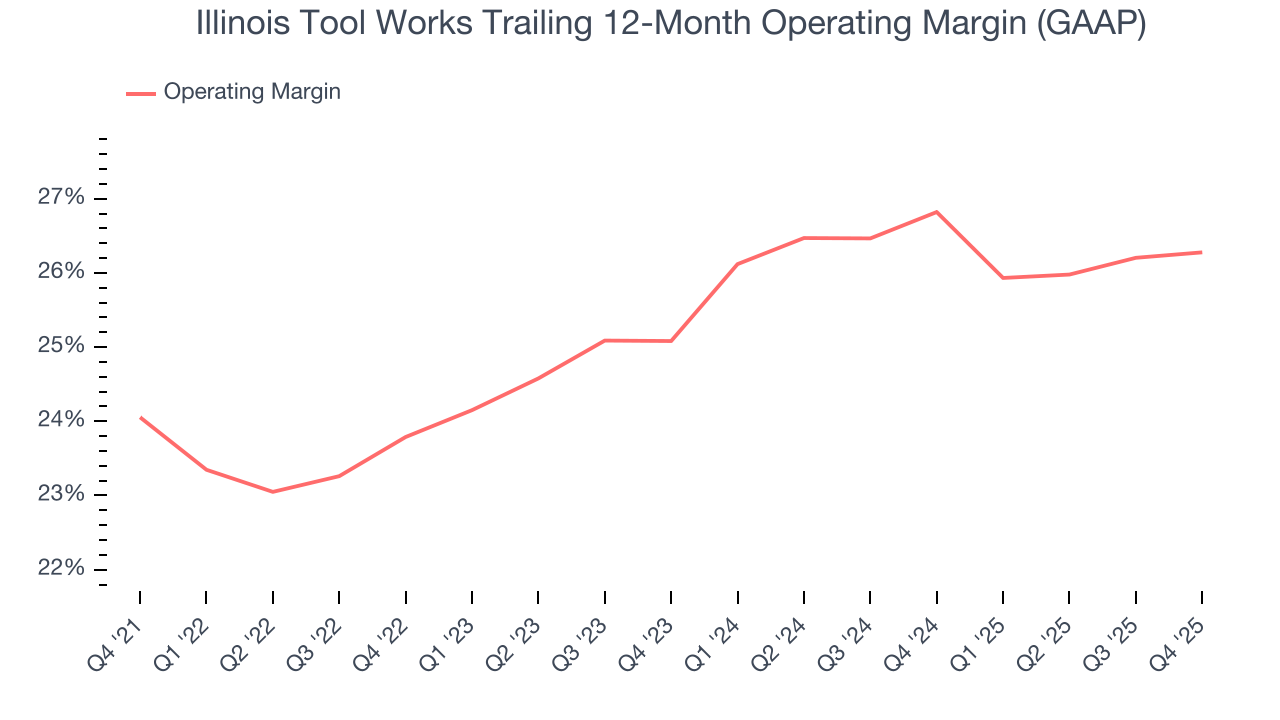

7. Operating Margin

Illinois Tool Works has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 25.2%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Illinois Tool Works’s operating margin rose by 2.2 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Illinois Tool Works generated an operating margin profit margin of 26.5%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

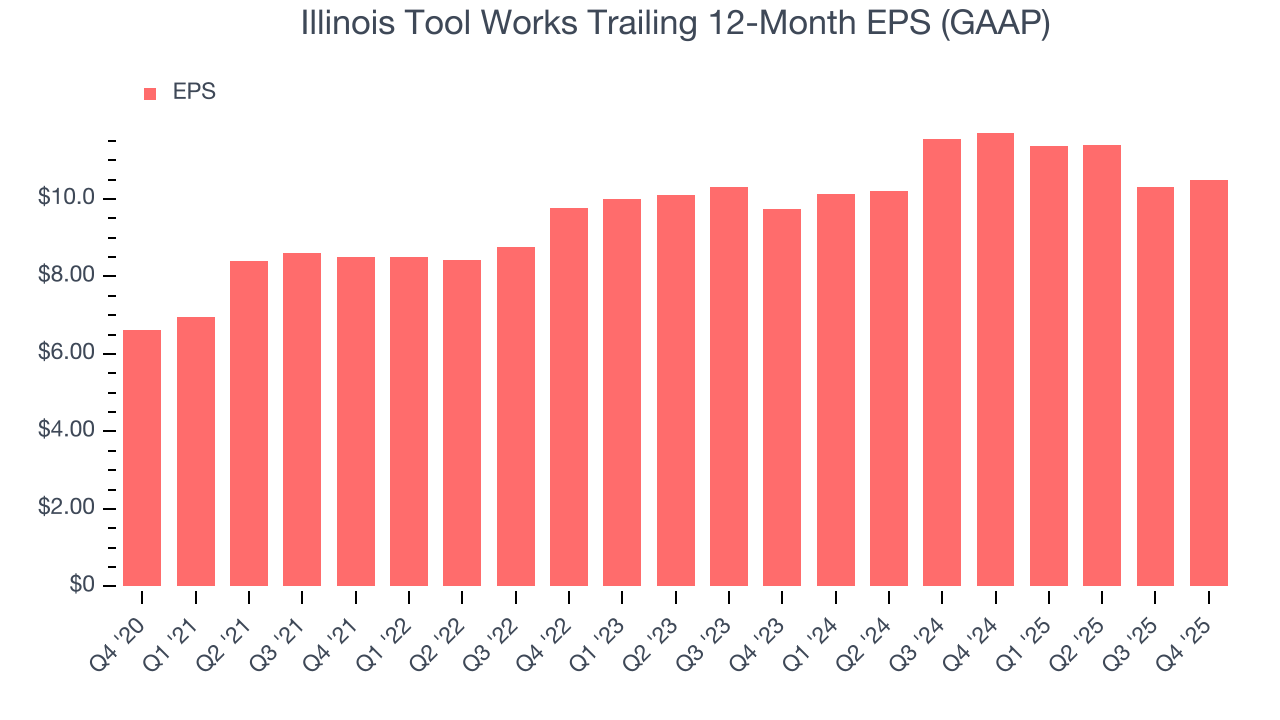

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Illinois Tool Works’s EPS grew at a decent 9.6% compounded annual growth rate over the last five years, higher than its 5% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Illinois Tool Works’s earnings to better understand the drivers of its performance. As we mentioned earlier, Illinois Tool Works’s operating margin was flat this quarter but expanded by 2.2 percentage points over the last five years. On top of that, its share count shrank by 8.8%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Illinois Tool Works, its two-year annual EPS growth of 3.8% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q4, Illinois Tool Works reported EPS of $2.72, up from $2.54 in the same quarter last year. This print beat analysts’ estimates by 1.2%. Over the next 12 months, Wall Street expects Illinois Tool Works’s full-year EPS of $10.49 to grow 6.5%.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Illinois Tool Works has shown terrific cash profitability, putting it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the industrials sector, averaging 16.4% over the last five years.

Taking a step back, we can see that Illinois Tool Works’s margin expanded by 1.2 percentage points during that time. This is encouraging because it gives the company more optionality.

Illinois Tool Works’s free cash flow clocked in at $858 million in Q4, equivalent to a 21% margin. The company’s cash profitability regressed as it was 4.4 percentage points lower than in the same quarter last year, but it’s still above its five-year average. We wouldn’t put too much weight on this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends trump temporary fluctuations.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although Illinois Tool Works hasn’t been the highest-quality company lately, it found a few growth initiatives in the past that worked out wonderfully. Its five-year average ROIC was 31.9%, splendid for an industrials business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, Illinois Tool Works’s ROIC averaged 1.9 percentage point increases over the last few years. This is a good sign, and we hope the company can keep improving.

11. Balance Sheet Assessment

Illinois Tool Works reported $851 million of cash and $8.97 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $4.3 billion of EBITDA over the last 12 months, we view Illinois Tool Works’s 1.9× net-debt-to-EBITDA ratio as safe. We also see its $142 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Illinois Tool Works’s Q4 Results

It was good to see Illinois Tool Works narrowly top analysts’ revenue expectations this quarter. On the other hand, its full-year EPS guidance slightly missed. Zooming out, we think this was a mixed quarter. The stock remained flat at $263.94 immediately following the results.

13. Is Now The Time To Buy Illinois Tool Works?

Updated: March 5, 2026 at 10:27 PM EST

Before deciding whether to buy Illinois Tool Works or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

Illinois Tool Works isn’t a terrible business, but it isn’t one of our picks. To kick things off, its revenue growth was uninspiring over the last five years, and analysts expect its demand to deteriorate over the next 12 months. While its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits, the downside is its flat organic revenue disappointed. On top of that, its projected EPS for the next year is lacking.

Illinois Tool Works’s P/E ratio based on the next 12 months is 25.6x. Beauty is in the eye of the beholder, but our analysis shows the upside isn’t great compared to the potential downside. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $280.88 on the company (compared to the current share price of $282.76).