Chart (GTLS)

Not many stocks excite us like Chart. Its robust backlog growth shows it has a long tail of demand that will fuel sales for many quarters.― StockStory Analyst Team

1. News

2. Summary

Why We Like Chart

Installing the first bulk Co2 tank for McDonalds’s sodas, Chart (NYSE:GTLS) provides equipment to store and transport gasses.

- Annual revenue growth of 29.3% over the past five years was outstanding, reflecting market share gains this cycle

- Earnings growth has trumped its peers over the last five years as its EPS has compounded at 29.5% annually

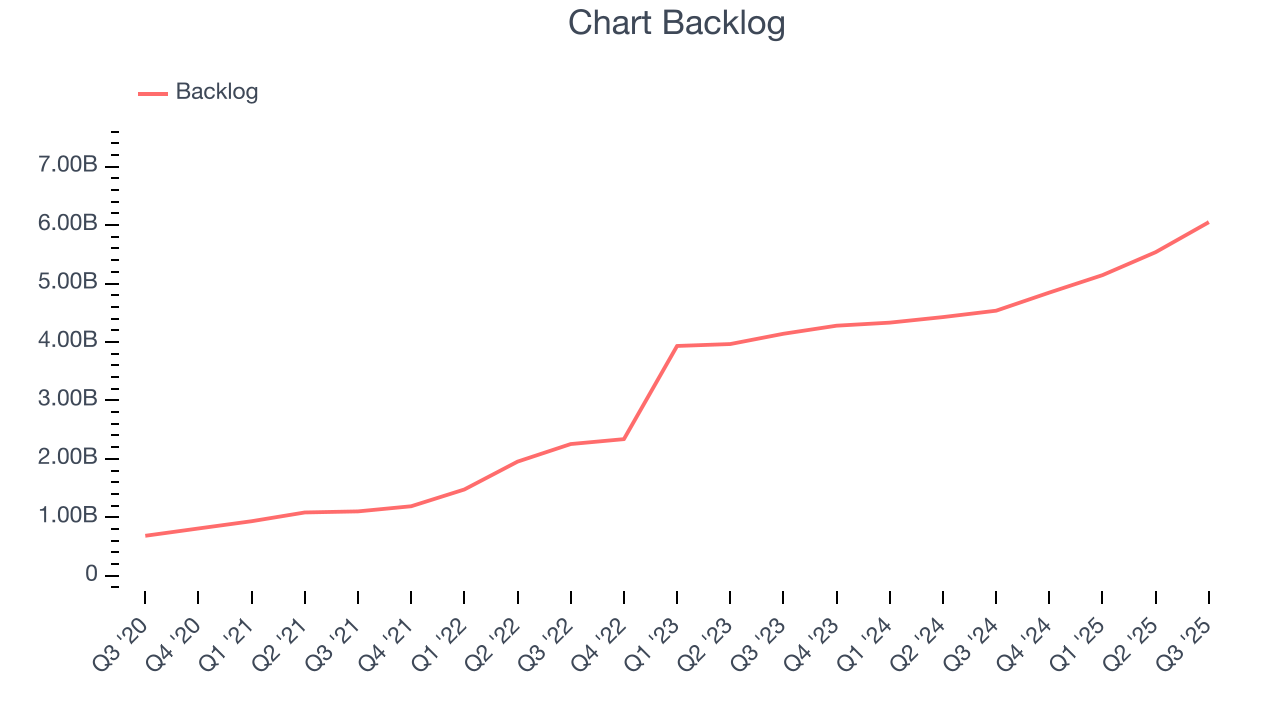

- Backlog has averaged 22.8% growth over the past two years, showing it has a pipeline of unfulfilled orders that will support revenue in the future

We’re optimistic about Chart. The price seems fair relative to its quality, and we think now is an opportune time to invest in the stock.

Why Is Now The Time To Buy Chart?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Chart?

Chart is trading at $207.40 per share, or 16.8x forward P/E. Most industrials companies are more expensive, so we think Chart is a good deal when considering its quality characteristics.

Entry price matters much less than business quality when investing for the long term, but hey, it certainly doesn’t hurt to get in at an attractive price.

3. Chart (GTLS) Research Report: Q3 CY2025 Update

Gas handling company Chart (NYSE:GTLS) fell short of the markets revenue expectations in Q3 CY2025 as sales rose 3.6% year on year to $1.10 billion. Its non-GAAP profit of $2.78 per share was 11.2% below analysts’ consensus estimates.

Chart (GTLS) Q3 CY2025 Highlights:

- On July 28, 2025 Baker Hughes (NASDAQ: BKR) and Chart entered into a definitive agreement for Baker Hughes to acquire all outstanding shares of Chart’s common stock for $210 per share in cash. The deal is expected to close in mid-2026

- Revenue: $1.10 billion vs analyst estimates of $1.17 billion (3.6% year-on-year growth, 6.3% miss)

- Adjusted EPS: $2.78 vs analyst expectations of $3.13 (11.2% miss)

- Adjusted EBITDA: $277.1 million vs analyst estimates of $308.8 million (25.2% margin, 10.3% miss)

- Operating Margin: -8%, down from 16.8% in the same quarter last year

- Free Cash Flow Margin: 8.6%, down from 16.4% in the same quarter last year

- Backlog: $6.05 billion at quarter end, up 33.4% year on year

- Market Capitalization: $8.97 billion

Company Overview

Installing the first bulk Co2 tank for McDonalds’s sodas, Chart (NYSE:GTLS) provides equipment to store and transport gasses.

Chart, originally known as John Marston, was established as a manufacturer of bicycles and eventually made a transition to become a gas handling company. The company invested in research and development and later acquired various small- to mid-sized companies to facilitate its transition. Today, the company offers stationary and rotating equipment used to store and transport gasses.

Chart’s stationary equipment is designed to store gas at the right temperatures and pressures. For instance, these tanks store gas used in manufacturing processes such as steel production or semiconductor manufacturing. It also offers rotating equipment, such as pumps and compressors, which transport gasses from storage tanks to where they are needed. Its pumps move gasses through pipes or hoses by creating pressure while its compressors increase the pressure of gasses to make them easier to store or transport over long distances. It also offers maintenance and repair services which establishes a stream of recurring revenue.

The company sells its products through one-time purchases and long-term supply agreements, though the latter is more common. These supply agreements vary in duration and are typically up to 5 years. It incentivizes its customers to purchase larger quantities by offering volume discounts thereby reducing the per-unit cost of the equipment. Additionally, Chart offers leasing options ranging from short-term rentals responding to seasonal demand to long-term rentals lasting up to 10 years.

Chart continues to focus on improving its existing products and strengthening its international presence. Specifically, its $4.4 billion acquisition of Howden in 2023 did just that.

4. Gas and Liquid Handling

Gas and liquid handling companies possess the technical know-how and specialized equipment to handle valuable (and sometimes dangerous) substances. Lately, water conservation and carbon capture–which requires hydrogen and other gasses as well as specialized infrastructure–have been trending up, creating new demand for products such as filters, pumps, and valves. On the other hand, gas and liquid handling companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

Competitors offering similar products include Snap-On (NYSE:SNA), IDEX (NYSE:IEX), and Graco (NYSE:GGG).

5. Revenue Growth

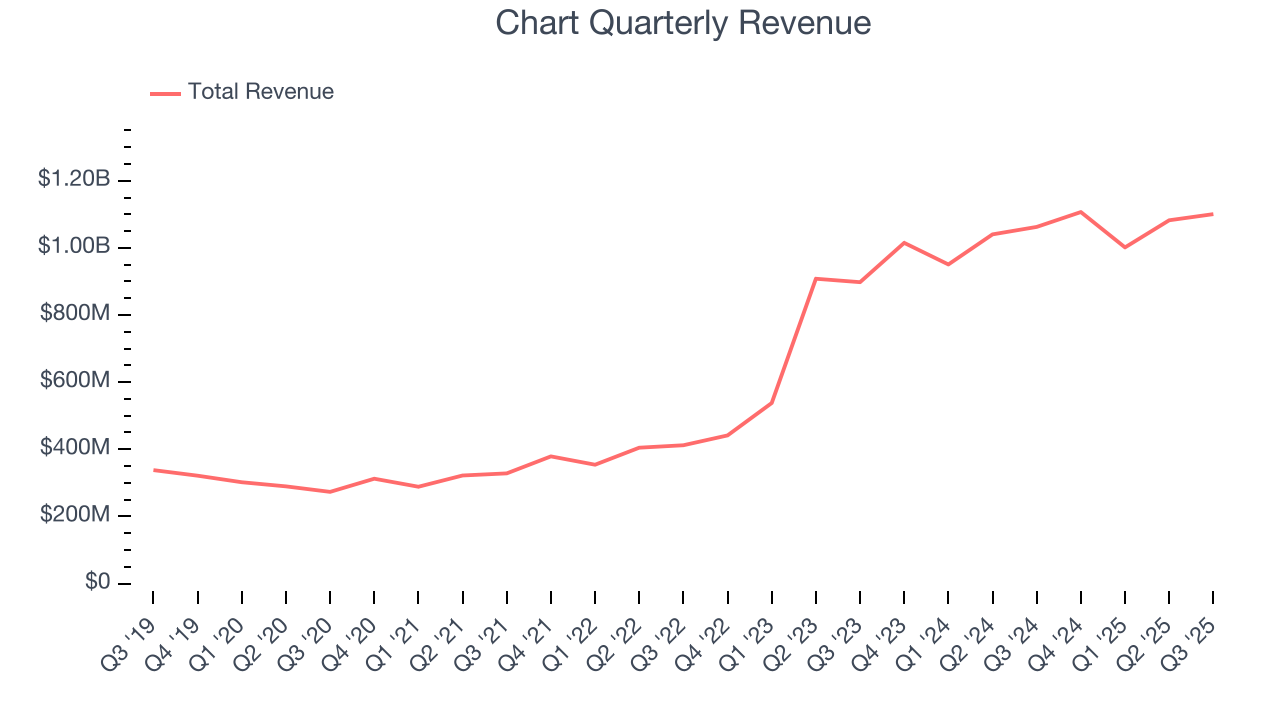

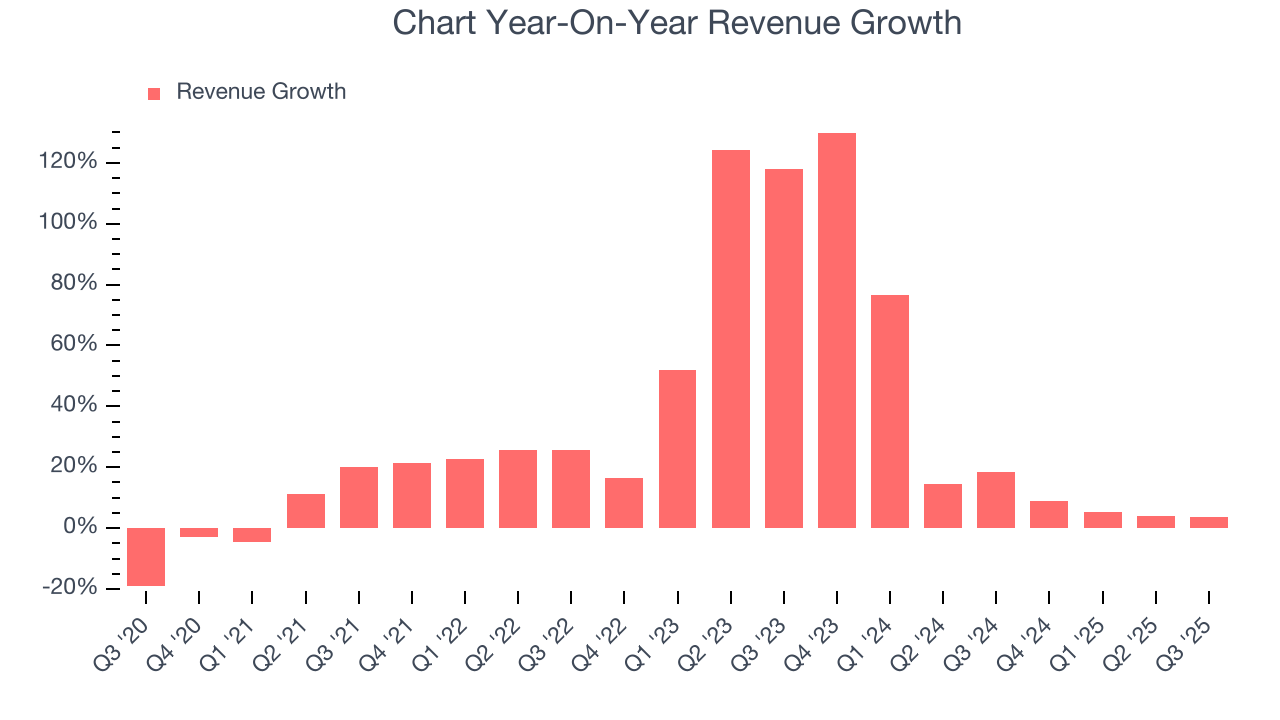

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, Chart’s 29.3% annualized revenue growth over the last five years was incredible. Its growth surpassed the average industrials company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Chart’s annualized revenue growth of 24.1% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

We can dig further into the company’s revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Chart’s backlog reached $6.05 billion in the latest quarter and averaged 25.6% year-on-year growth over the last two years. Because this number is in line with its revenue growth, we can see the company effectively balanced its new order intake and fulfillment processes.

This quarter, Chart’s revenue grew by 3.6% year on year to $1.10 billion, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 14.3% over the next 12 months, a deceleration versus the last two years. Still, this projection is admirable and indicates the market is baking in success for its products and services.

6. Gross Margin & Pricing Power

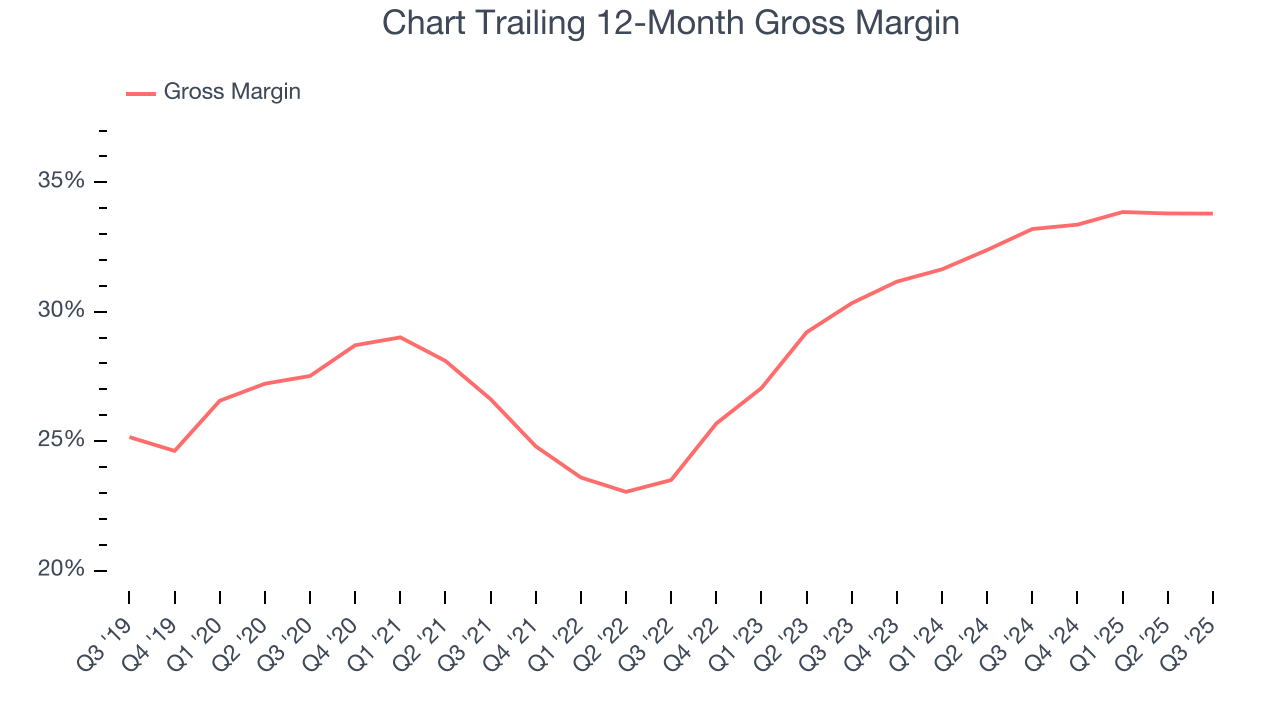

Chart’s unit economics are better than the typical industrials business, signaling its products are somewhat differentiated through quality or brand. As you can see below, it averaged a decent 31.1% gross margin over the last five years. That means for every $100 in revenue, roughly $31.14 was left to spend on selling, marketing, R&D, and general administrative overhead.

Chart’s gross profit margin came in at 34.1% this quarter, in line with the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

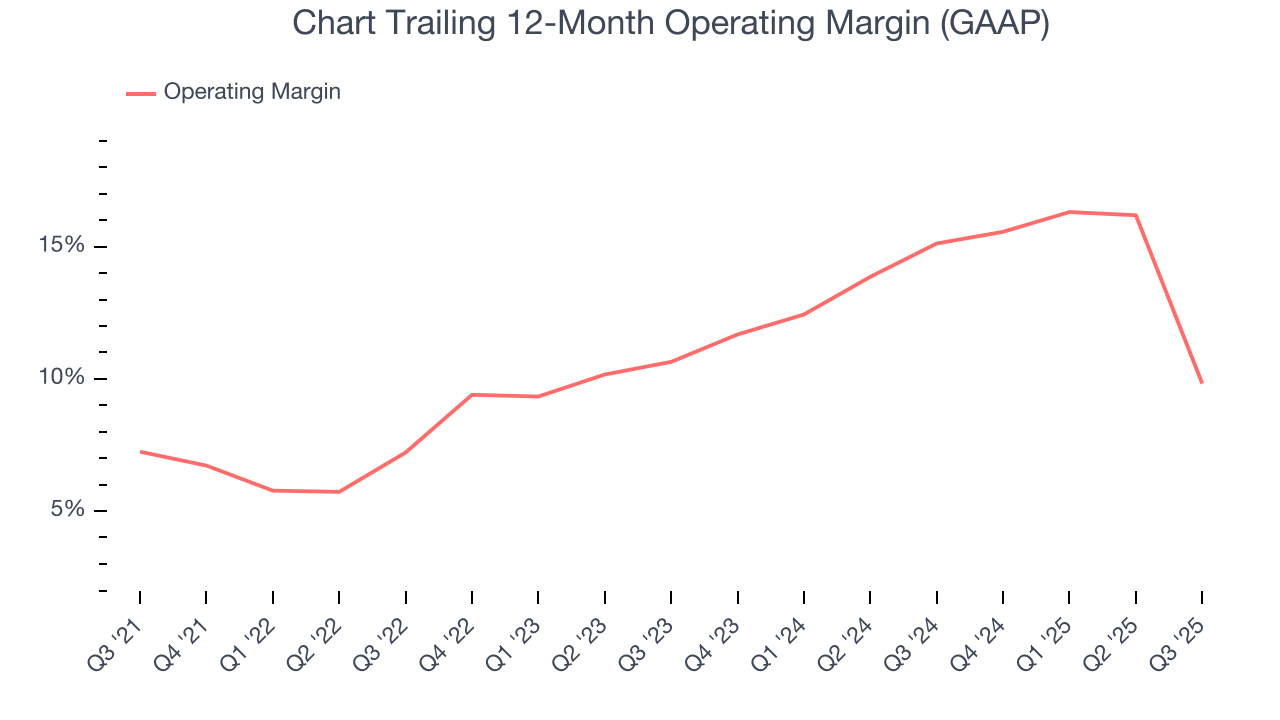

7. Operating Margin

Chart has managed its cost base well over the last five years. It demonstrated solid profitability for an industrials business, producing an average operating margin of 11%.

Looking at the trend in its profitability, Chart’s operating margin rose by 2.6 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q3, Chart generated an operating margin profit margin of negative 8%, down 24.8 percentage points year on year. Since Chart’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

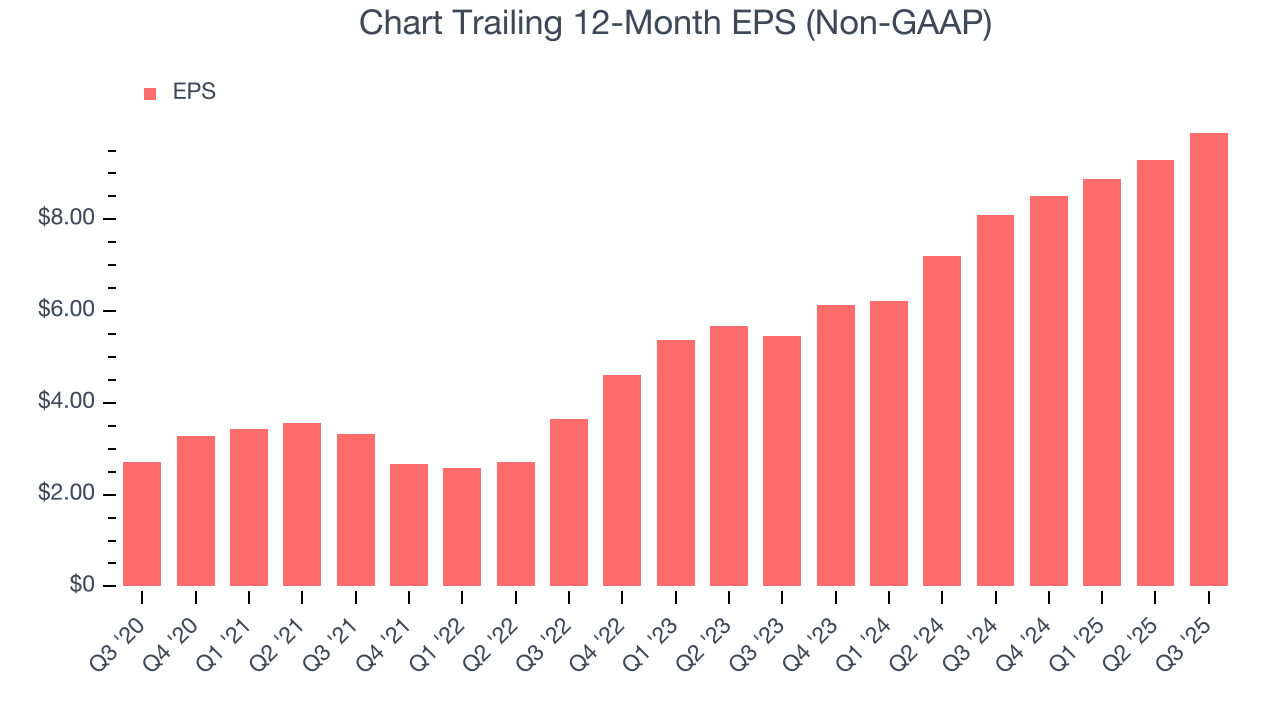

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Chart’s astounding 29.5% annual EPS growth over the last five years aligns with its revenue performance. This tells us its incremental sales were profitable.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Chart’s two-year annual EPS growth of 34.6% was fantastic and topped its 24.1% two-year revenue growth.

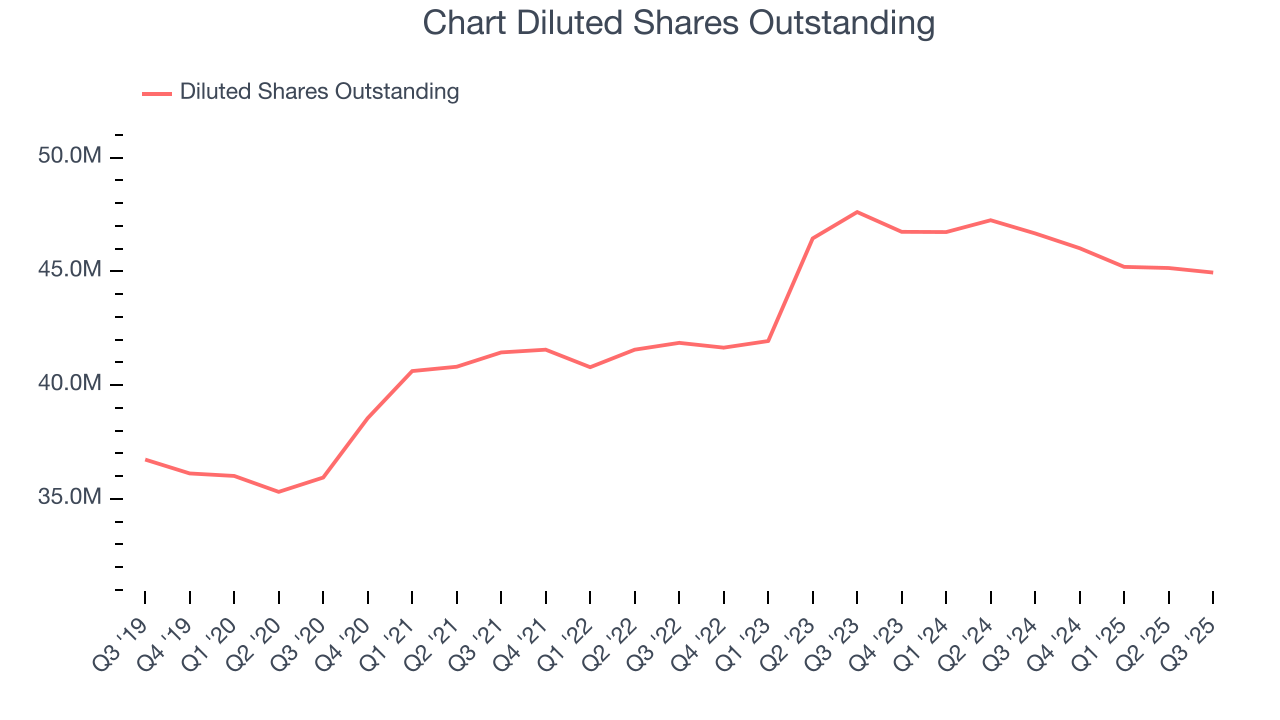

Diving into the nuances of Chart’s earnings can give us a better understanding of its performance. A two-year view shows that Chart has repurchased its stock, shrinking its share count by 5.6%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

In Q3, Chart reported adjusted EPS of $2.78, up from $2.18 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates, but we care more about long-term adjusted EPS growth than short-term movements. Over the next 12 months, Wall Street expects Chart’s full-year EPS of $9.89 to grow 40.9%.

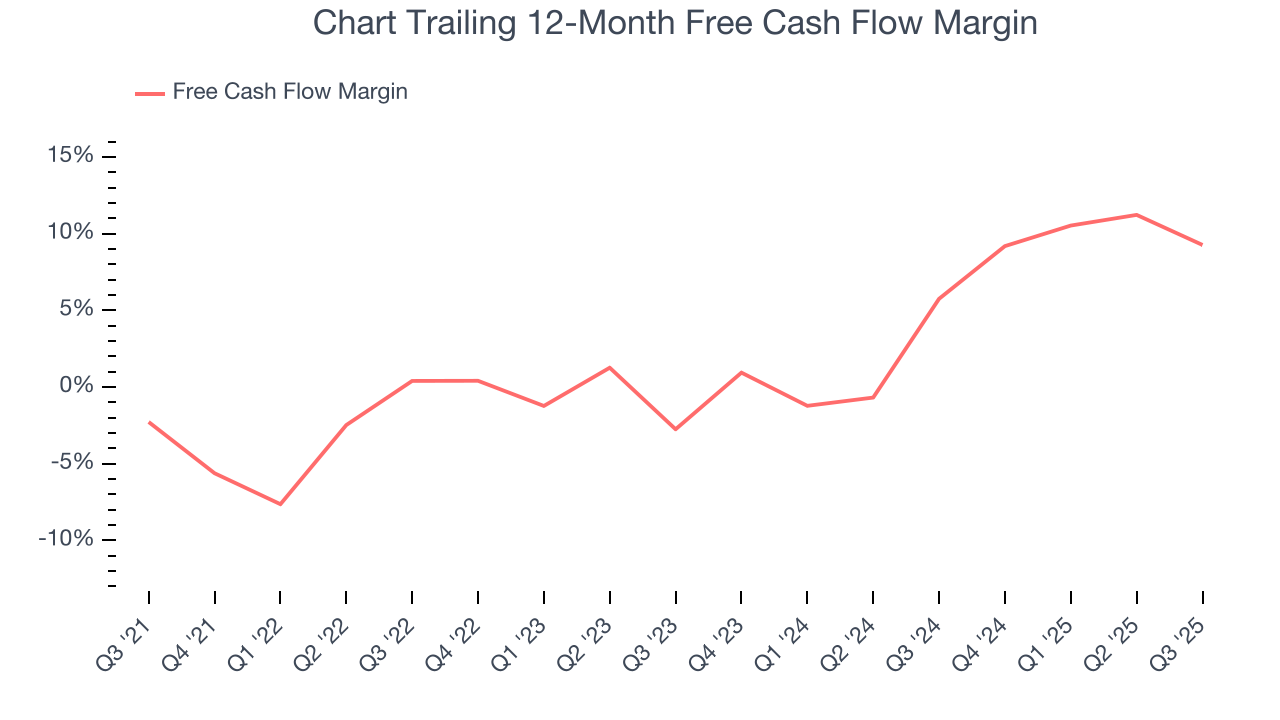

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Chart has shown weak cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.8%, subpar for an industrials business. The divergence from its good operating margin stems from its capital-intensive business model, which requires Chart to make large cash investments in working capital and capital expenditures.

Taking a step back, an encouraging sign is that Chart’s margin expanded by 11.5 percentage points during that time. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

Chart’s free cash flow clocked in at $94.7 million in Q3, equivalent to a 8.6% margin. The company’s cash profitability regressed as it was 7.8 percentage points lower than in the same quarter last year, but it’s still above its five-year average. We wouldn’t read too much into this quarter’s decline because capital expenditures can be seasonal and companies often stockpile inventory in anticipation of higher demand, causing short-term swings. Long-term trends trump temporary fluctuations.

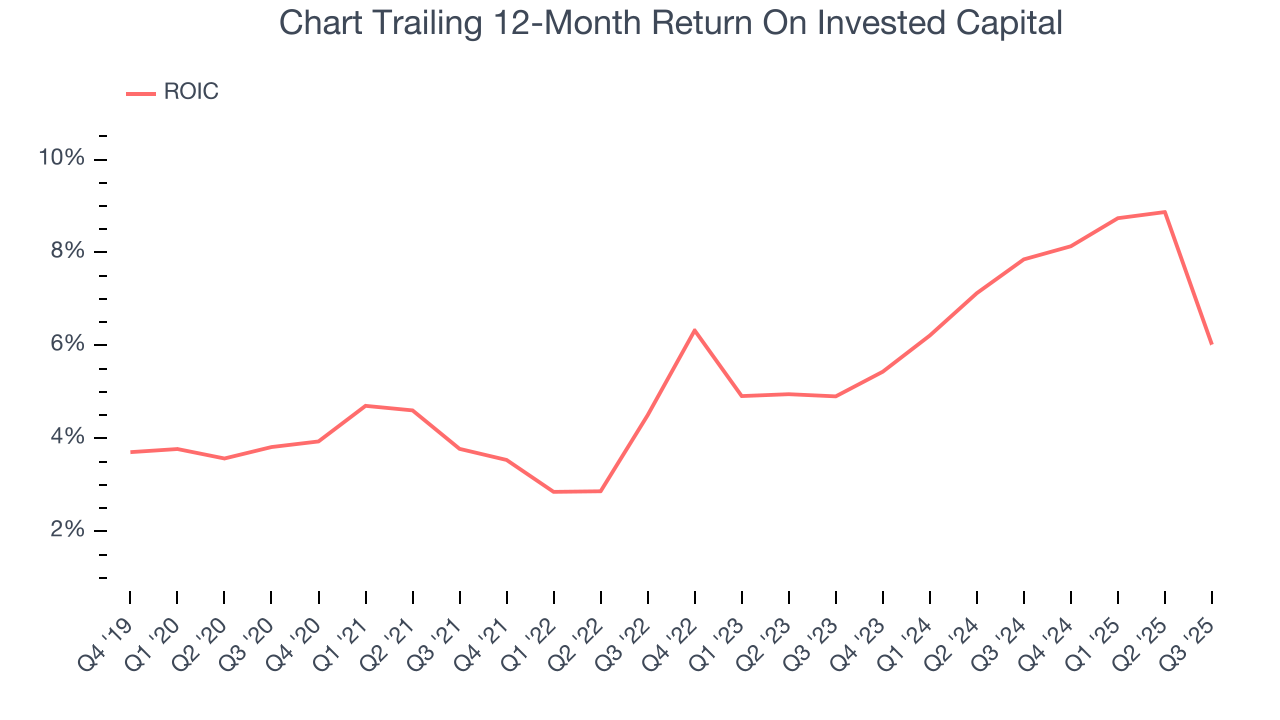

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although Chart has shown solid business quality lately, it historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 5.4%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, Chart’s ROIC increased by 2.8 percentage points annually over the last few years. its rising ROIC is a good sign and could suggest its competitive advantage or profitable growth opportunities are expanding.

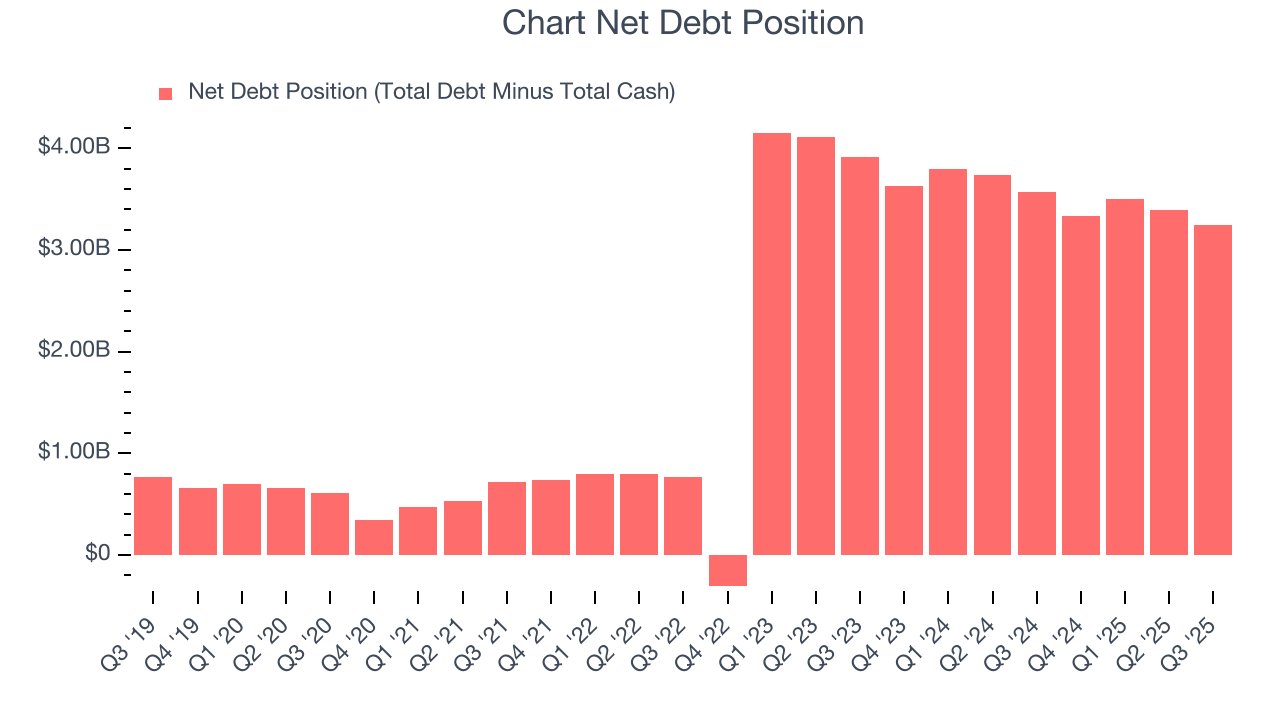

11. Balance Sheet Assessment

Chart reported $399.2 million of cash and $3.65 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.06 billion of EBITDA over the last 12 months, we view Chart’s 3.1× net-debt-to-EBITDA ratio as safe. We also see its $154.2 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Chart’s Q3 Results

We liked that Chart beat analysts’ backlog expectations this quarter. On the other hand, its revenue missed and its EBITDA fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock remained flat at $200.50 immediately following the results.

On July 28, 2025 Baker Hughes (NASDAQ: BKR) and Chart entered into a definitive agreement for Baker Hughes to acquire all outstanding shares of Chart’s common stock for $210 per share in cash. The deal is expected to close in mid-2026.

13. Is Now The Time To Buy Chart?

Updated: February 18, 2026 at 10:26 PM EST

Are you wondering whether to buy Chart or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

Chart is a cream-of-the-crop industrials company. First of all, the company’s revenue growth was exceptional over the last five years. And while its relatively low ROIC suggests management has struggled to find compelling investment opportunities, its backlog growth has been marvelous. Additionally, Chart’s rising cash profitability gives it more optionality.

Chart’s P/E ratio based on the next 12 months is 16.8x. Looking at the industrials space today, Chart’s qualities as one of the best businesses really stand out, and we like it at this price.

Wall Street analysts have a consensus one-year price target of $206.45 on the company (compared to the current share price of $207.40).