SPX Technologies (SPXC)

SPX Technologies is in a league of its own. Its blend of fast sales growth, robust unit economics, and superb prospects makes it a coveted asset.― StockStory Analyst Team

1. News

2. Summary

Why We Like SPX Technologies

With roots dating back to 1912 as the Piston Ring Company, SPX Technologies (NYSE:SPXC) supplies specialized infrastructure equipment for HVAC systems and detection and measurement applications across industrial, commercial, and utility markets.

- Earnings per share grew by 19.3% annually over the last five years, massively outpacing its peers

- Annual revenue growth of 14.1% over the last two years was superb and indicates its market share increased during this cycle

- Revenue outlook for the upcoming 12 months is outstanding and shows it’s on track to gain market share

SPX Technologies is a top-tier company. The valuation looks fair based on its quality, and we think now is the time to invest.

Why Is Now The Time To Buy SPX Technologies?

High Quality

Investable

Underperform

Why Is Now The Time To Buy SPX Technologies?

SPX Technologies is trading at $204.58 per share, or 27.1x forward P/E. Most companies in the industrials sector may feature a cheaper multiple, but we think SPX Technologies is priced fairly given its fundamentals.

Our analysis and backtests consistently tell us that buying high-quality companies and holding them for many years leads to market outperformance. Over the long term, entry price doesn’t matter nearly as much as business fundamentals.

3. SPX Technologies (SPXC) Research Report: Q4 CY2025 Update

Infrastructure equipment supplier SPX Technologies (NYSE:SPXC) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 19.4% year on year to $637.3 million. The company’s full-year revenue guidance of $2.57 billion at the midpoint came in 3.8% above analysts’ estimates. Its non-GAAP profit of $1.88 per share was 0.7% above analysts’ consensus estimates.

SPX Technologies (SPXC) Q4 CY2025 Highlights:

- Revenue: $637.3 million vs analyst estimates of $628 million (19.4% year-on-year growth, 1.5% beat)

- Adjusted EPS: $1.88 vs analyst estimates of $1.87 (0.7% beat)

- Adjusted EBITDA: $142 million vs analyst estimates of $141.9 million (22.3% margin, in line)

- Adjusted EPS guidance for the upcoming financial year 2026 is $7.80 at the midpoint, beating analyst estimates by 1.4%

- EBITDA guidance for the upcoming financial year 2026 is $605 million at the midpoint, above analyst estimates of $589.5 million

- Operating Margin: 15.7%, down from 16.9% in the same quarter last year

- Free Cash Flow Margin: 19.9%, down from 28.9% in the same quarter last year

- Organic Revenue rose 7.6% year on year (miss)

- Market Capitalization: $11.82 billion

Company Overview

With roots dating back to 1912 as the Piston Ring Company, SPX Technologies (NYSE:SPXC) supplies specialized infrastructure equipment for HVAC systems and detection and measurement applications across industrial, commercial, and utility markets.

The company operates through two main segments: HVAC and Detection & Measurement. In its HVAC segment, SPX provides cooling towers, air movement solutions, boilers, and heating products under brands like Marley, Recold, Cincinnati Fan, and Weil-McLain. These systems help control temperature and air quality in settings ranging from industrial facilities to residential buildings.

The Detection & Measurement segment offers tools that help maintain critical infrastructure. This includes underground pipe and cable locators that utility workers use to find buried lines before digging, inspection equipment for examining sewer pipes, and specialized navigation aids for maritime and aviation safety. The segment also provides fare collection systems for public transportation under the Genfare brand.

A utility worker might use SPX's Radiodetection equipment to precisely locate underground power lines before excavation begins, preventing accidental damage. Meanwhile, a hospital might rely on SPX's Ingenia custom air handling units to maintain the sterile environment required in operating rooms.

SPX generates revenue through direct sales to end users, third-party distributors, and independent representatives. The company has steadily expanded its portfolio through strategic acquisitions, including Ingénia Technologies (custom air handling units), TAMCO (airflow dampers), and ASPEQ Heating Group (electrical heating solutions).

4. Gas and Liquid Handling

Gas and liquid handling companies possess the technical know-how and specialized equipment to handle valuable (and sometimes dangerous) substances. Lately, water conservation and carbon capture–which requires hydrogen and other gasses as well as specialized infrastructure–have been trending up, creating new demand for products such as filters, pumps, and valves. On the other hand, gas and liquid handling companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

SPX Technologies competes with HVAC equipment manufacturers like Johnson Controls (NYSE: JCI), Carrier Global (NYSE: CARR), and Trane Technologies (NYSE: TT), while in the detection and measurement space, it faces competition from Emerson Electric (NYSE: EMR), FLIR Systems (now part of Teledyne Technologies, NYSE: TDY), and Xylem (NYSE: XYL).

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, SPX Technologies’s sales grew at an excellent 12.8% compounded annual growth rate over the last five years. Its growth surpassed the average industrials company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. SPX Technologies’s annualized revenue growth of 14.1% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

We can dig further into the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, SPX Technologies’s organic revenue averaged 4.5% year-on-year growth. Because this number is lower than its two-year revenue growth, we can see that some mixture of acquisitions and foreign exchange rates boosted its headline results.

This quarter, SPX Technologies reported year-on-year revenue growth of 19.4%, and its $637.3 million of revenue exceeded Wall Street’s estimates by 1.5%.

Looking ahead, sell-side analysts expect revenue to grow 9.6% over the next 12 months, a deceleration versus the last two years. Still, this projection is healthy and implies the market is baking in success for its products and services.

6. Gross Margin & Pricing Power

SPX Technologies’s unit economics are great compared to the broader industrials sector and signal that it enjoys product differentiation through quality or brand. As you can see below, it averaged an excellent 38.6% gross margin over the last five years. Said differently, roughly $38.64 was left to spend on selling, marketing, R&D, and general administrative overhead for every $100 in revenue.

SPX Technologies’s gross profit margin came in at 39.8% this quarter, down 1.1 percentage points year on year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

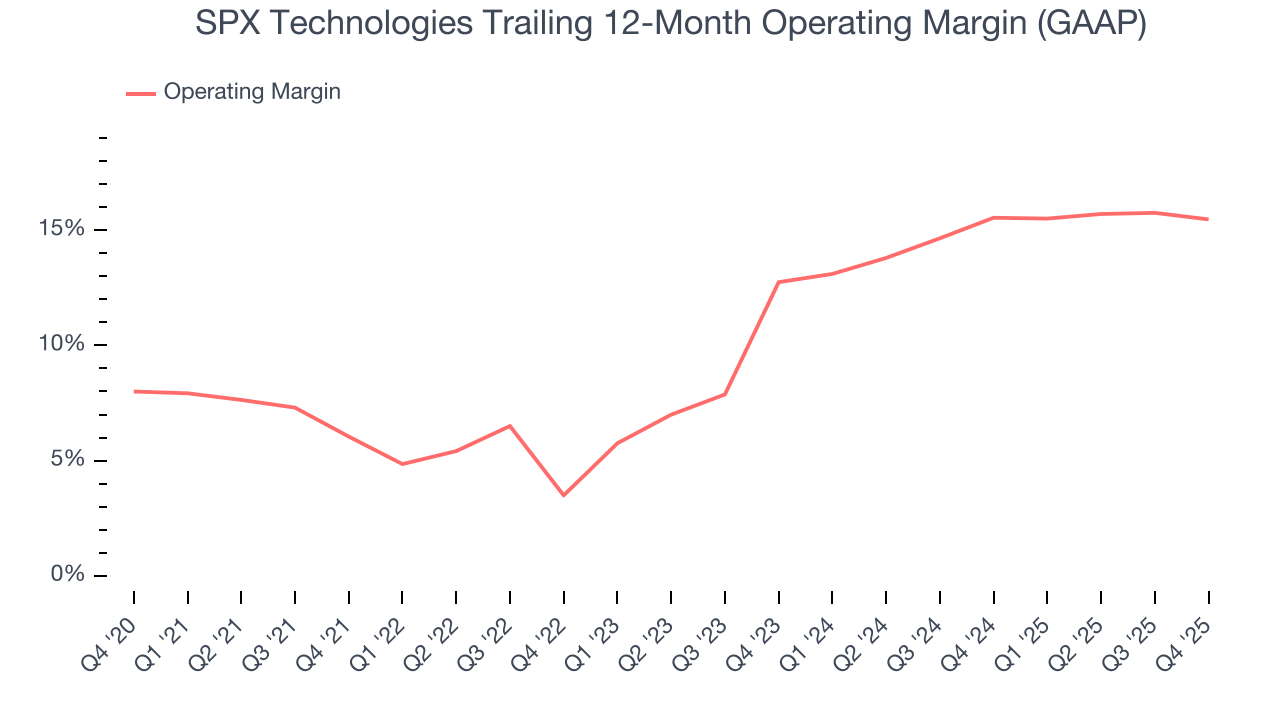

7. Operating Margin

SPX Technologies has managed its cost base well over the last five years. It demonstrated solid profitability for an industrials business, producing an average operating margin of 11.6%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, SPX Technologies’s operating margin rose by 9.4 percentage points over the last five years, as its sales growth gave it immense operating leverage.

This quarter, SPX Technologies generated an operating margin profit margin of 15.7%, down 1.2 percentage points year on year. Since SPX Technologies’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

SPX Technologies’s EPS grew at an astounding 19.3% compounded annual growth rate over the last five years, higher than its 12.8% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into SPX Technologies’s earnings to better understand the drivers of its performance. As we mentioned earlier, SPX Technologies’s operating margin declined this quarter but expanded by 9.4 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For SPX Technologies, its two-year annual EPS growth of 25.3% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, SPX Technologies reported adjusted EPS of $1.88, up from $1.51 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects SPX Technologies’s full-year EPS of $6.75 to grow 13.1%.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

SPX Technologies has shown robust cash profitability, enabling it to comfortably ride out cyclical downturns while investing in plenty of new offerings and returning capital to investors. The company’s free cash flow margin averaged 10.1% over the last five years, quite impressive for an industrials business.

SPX Technologies’s free cash flow clocked in at $126.7 million in Q4, equivalent to a 19.9% margin. The company’s cash profitability regressed as it was 9 percentage points lower than in the same quarter last year, but it’s still above its five-year average. We wouldn’t put too much weight on this quarter’s decline because capital expenditures can be seasonal and companies often stockpile inventory in anticipation of higher demand, causing short-term swings. Long-term trends are more important.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although SPX Technologies has shown solid fundamentals lately, it historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 8.3%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, SPX Technologies’s ROIC has increased. its rising ROIC is a good sign and could suggest its competitive advantage or profitable growth opportunities are expanding.

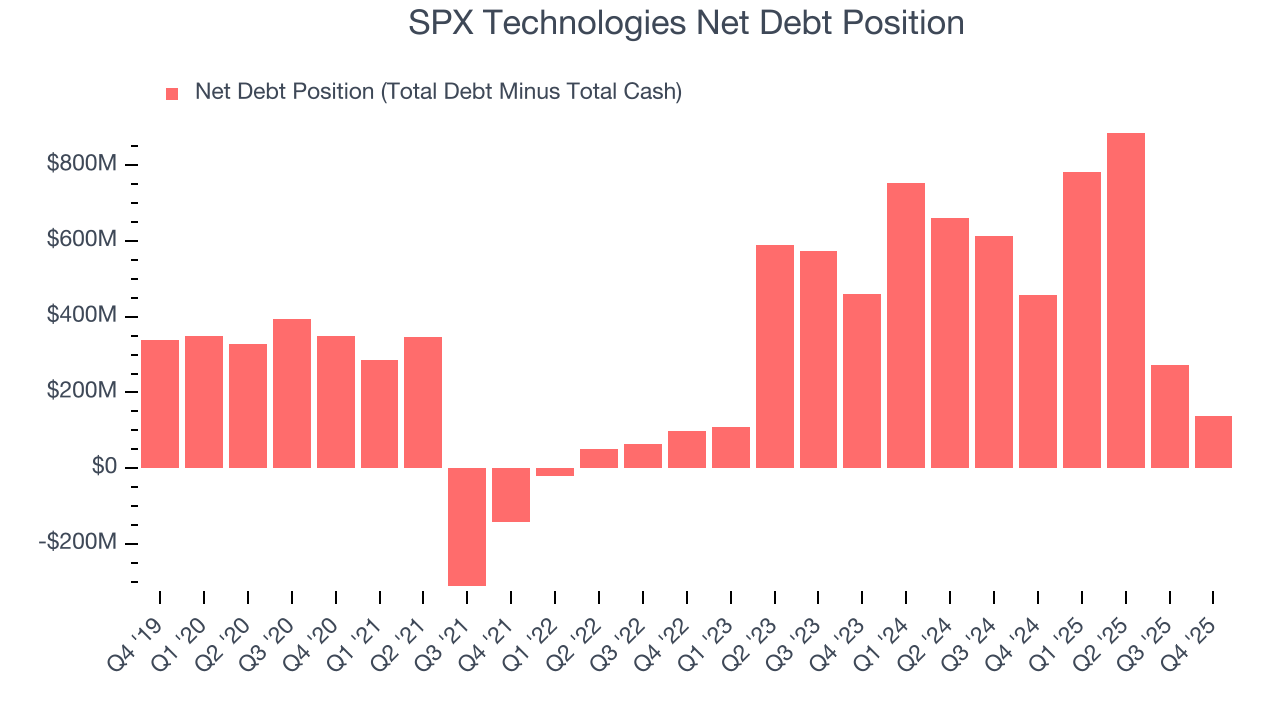

11. Balance Sheet Assessment

SPX Technologies reported $364 million of cash and $501.6 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $578.8 million of EBITDA over the last 12 months, we view SPX Technologies’s 0.2× net-debt-to-EBITDA ratio as safe. We also see its $30.1 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from SPX Technologies’s Q4 Results

We were impressed by SPX Technologies’s optimistic full-year revenue guidance, which blew past analysts’ expectations. We were also glad its full-year EBITDA guidance exceeded Wall Street’s estimates. On the other hand, its organic revenue slightly missed. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 1.2% to $245.89 immediately after reporting.

13. Is Now The Time To Buy SPX Technologies?

Updated: March 8, 2026 at 11:20 PM EDT

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own SPX Technologies, you should also grasp the company’s longer-term business quality and valuation.

SPX Technologies is one of the best industrials companies out there. To begin with, its revenue growth was impressive over the last five years, and its growth over the next 12 months is expected to accelerate. And while its relatively low ROIC suggests management has struggled to find compelling investment opportunities, its expanding operating margin shows the business has become more efficient. Additionally, SPX Technologies’s astounding EPS growth over the last five years shows its profits are trickling down to shareholders.

SPX Technologies’s P/E ratio based on the next 12 months is 27.1x. Looking across the spectrum of industrials businesses, SPX Technologies’s fundamentals clearly illustrate it’s a special business. We like the stock at this price.

Wall Street analysts have a consensus one-year price target of $266.09 on the company (compared to the current share price of $204.58), implying they see 30.1% upside in buying SPX Technologies in the short term.