Kirby (KEX)

Kirby doesn’t excite us. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why Kirby Is Not Exciting

Transporting goods along all U.S. coasts, Kirby (NYSE:KEX) provides inland and coastal marine transportation services.

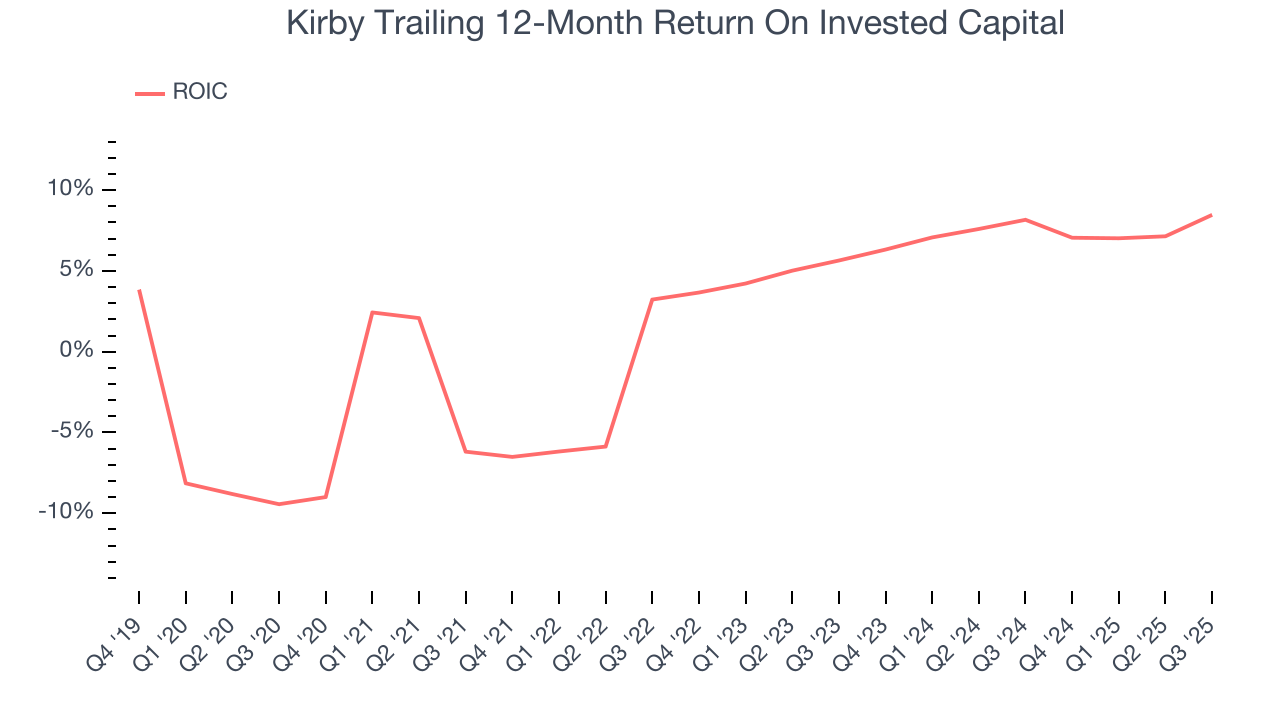

- ROIC of 3.6% reflects management’s challenges in identifying attractive investment opportunities

- Projected sales growth of 6.1% for the next 12 months suggests sluggish demand

- A consolation is that its earnings growth has outpaced its peers over the last five years as its EPS has compounded at 23.7% annually

Kirby lacks the business quality we seek. We’ve identified better opportunities elsewhere.

Why There Are Better Opportunities Than Kirby

Why There Are Better Opportunities Than Kirby

At $128.70 per share, Kirby trades at 19.2x forward P/E. Kirby’s multiple may seem like a great deal among industrials peers, but we think there are valid reasons why it’s this cheap.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Kirby (KEX) Research Report: Q3 CY2025 Update

Marine transportation service company Kirby (NYSE:KEX) reported revenue ahead of Wall Streets expectations in Q3 CY2025, with sales up 4.8% year on year to $871.2 million. Its GAAP profit of $1.65 per share was 2.2% above analysts’ consensus estimates.

Kirby (KEX) Q3 CY2025 Highlights:

- Revenue: $871.2 million vs analyst estimates of $851.2 million (4.8% year-on-year growth, 2.3% beat)

- EPS (GAAP): $1.65 vs analyst estimates of $1.62 (2.2% beat)

- Adjusted EBITDA: $201.4 million vs analyst estimates of $193.5 million (23.1% margin, 4.1% beat)

- Operating Margin: 14.8%, in line with the same quarter last year

- Free Cash Flow Margin: 18.4%, up from 15.7% in the same quarter last year

- Market Capitalization: $4.95 billion

Company Overview

Transporting goods along all U.S. coasts, Kirby (NYSE:KEX) provides inland and coastal marine transportation services.

Kirby was established in 1921 and initially focused on marine transportation services. Over the years, the company was able to expand its operations and fleet by targeting small to medium sized companies in the marine transportation industry. Specifically, acquisitions have focused on acquiring fleets of tank barges, towboats, and related assets.

Kirby specializes in transporting large amounts of liquid products, like chemicals and petroleum, using its fleet of tank barges and towboats which are owned and operated by the company. It serves big oil companies that need to move oil and refined fuels by rivers and along coasts, chemical manufacturers that need chemicals for making products delivered, and agricultural businesses that need fertilizers.

The process of making deliveries typically involves loading the liquid products onto the tank barges at production facilities or refineries located near waterways. Once loaded, the towboats navigate through inland waterways or along coastal routes with the barges to reach the destinations.

Kirby engages in long-term contracts with customers, typically spanning five to ten years. Pricing on these contracts are based on the volume of liquid cargo being transported, the distance and route of delivery, the type of vessel and equipment required, and any additional services or specialized requirements.

4. Marine Transportation

The growth of e-commerce and global trade continues to drive demand for shipping services, presenting opportunities for marine transportation companies. While ocean freight is more fuel efficient and therefore cheaper than its air and ground counterparts, it results in slower delivery times, presenting a trade off. To improve transit speeds, the industry continues to invest in digitization to optimize fleets and routes. However, marine transportation companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins. Geopolitical tensions can also affect access to trade routes, and if certain countries are banned from using passageways like the Panama Canal, costs can spiral out of control.

Competitors offering similar products include SEACOR (NYSE:CKH), Marine Products (NYSE:MPX), and Gulf Island (NASDAQ:GIFI).

5. Revenue Growth

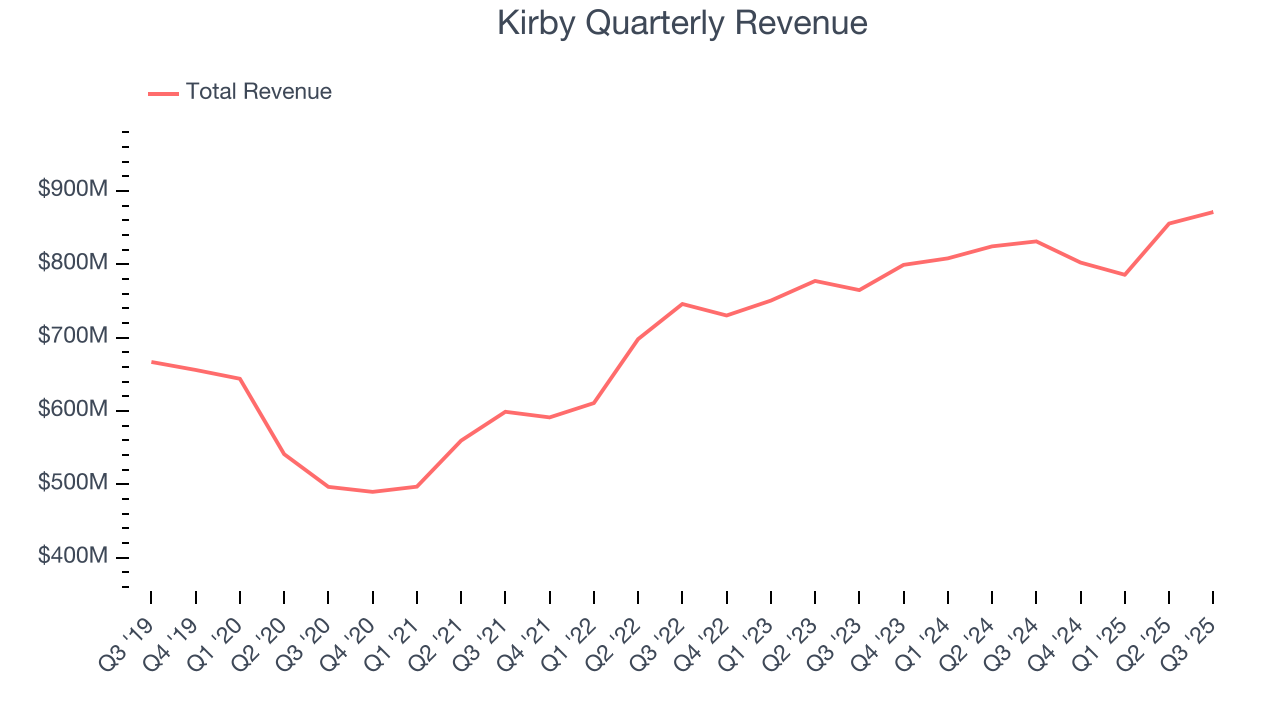

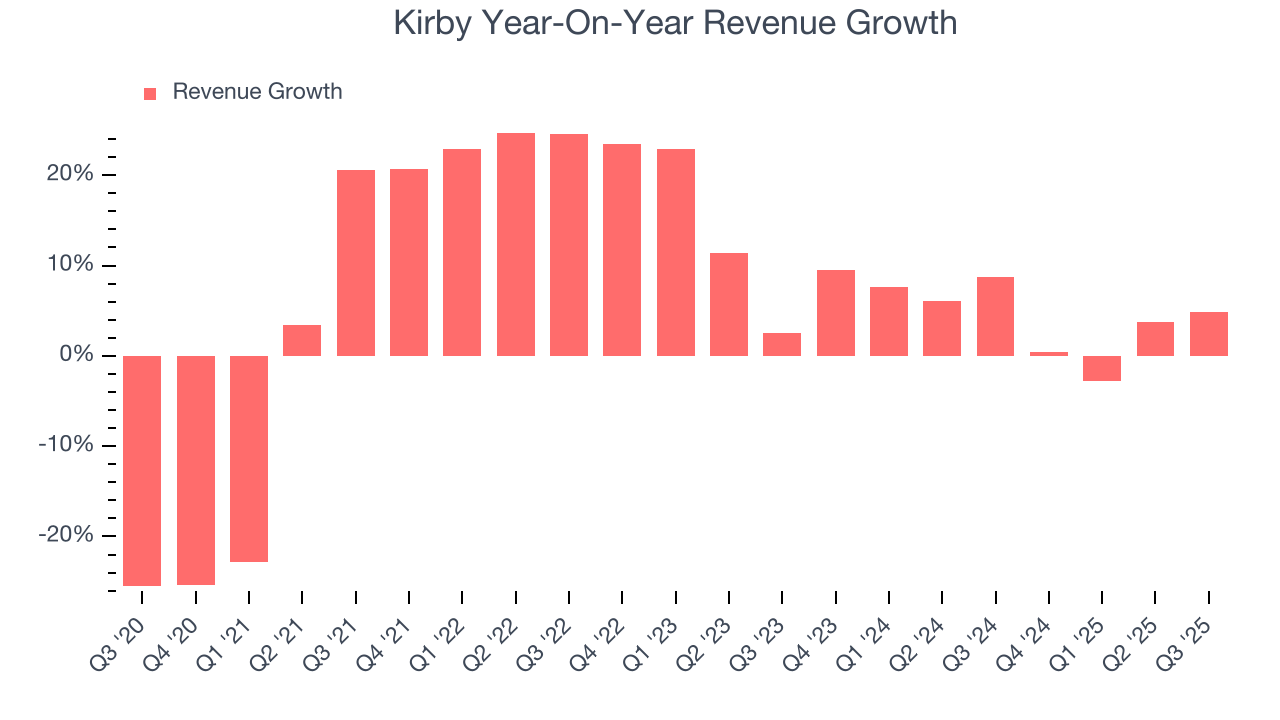

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Kirby grew its sales at a mediocre 7.2% compounded annual growth rate. This was below our standard for the industrials sector and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Kirby’s recent performance shows its demand has slowed as its annualized revenue growth of 4.7% over the last two years was below its five-year trend. We also note many other Marine Transportation businesses have faced declining sales because of cyclical headwinds. While Kirby grew slower than we’d like, it did do better than its peers.

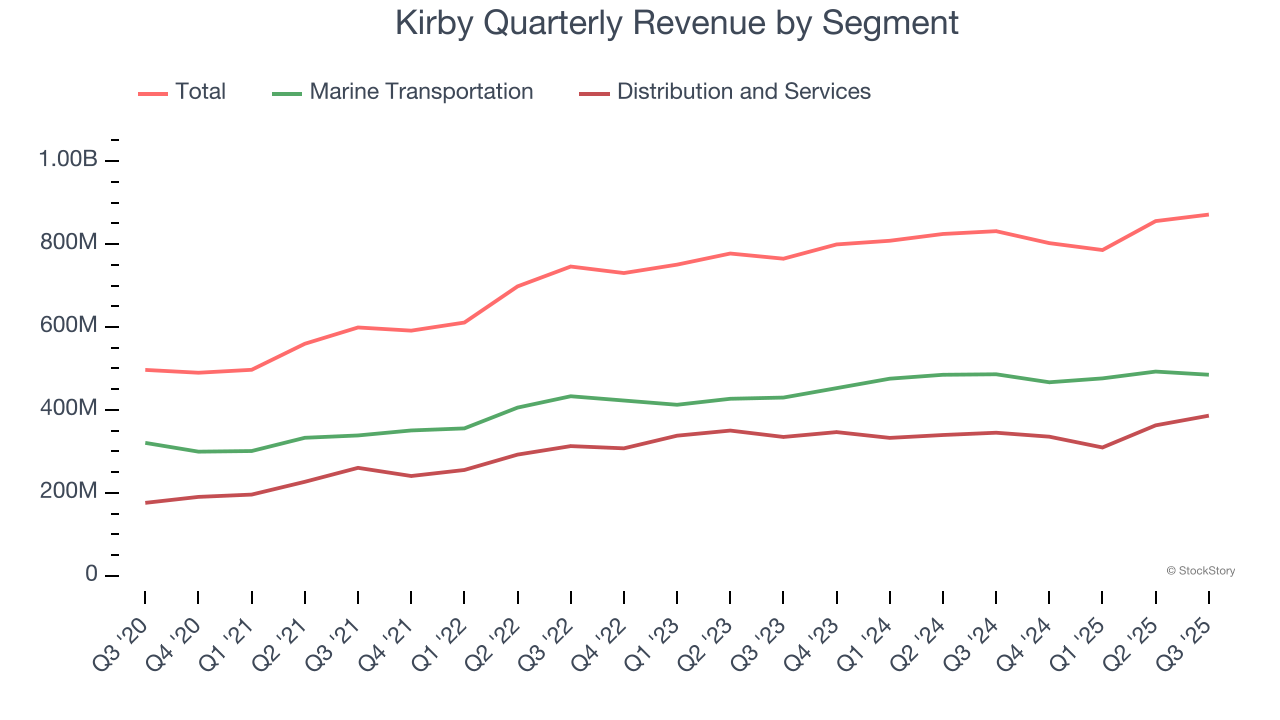

We can better understand the company’s revenue dynamics by analyzing its most important segments, Marine Transportation and Distribution and Services, which are 55.7% and 44.3% of revenue. Over the last two years, Kirby’s Marine Transportation revenue (petroleum products and chemicals) averaged 6.7% year-on-year growth while its Distribution and Services revenue (aftermarket parts and equipment) averaged 2.5% growth.

This quarter, Kirby reported modest year-on-year revenue growth of 4.8% but beat Wall Street’s estimates by 2.3%.

Looking ahead, sell-side analysts expect revenue to grow 4.1% over the next 12 months, similar to its two-year rate. This projection is underwhelming and implies its newer products and services will not accelerate its top-line performance yet.

6. Gross Margin & Pricing Power

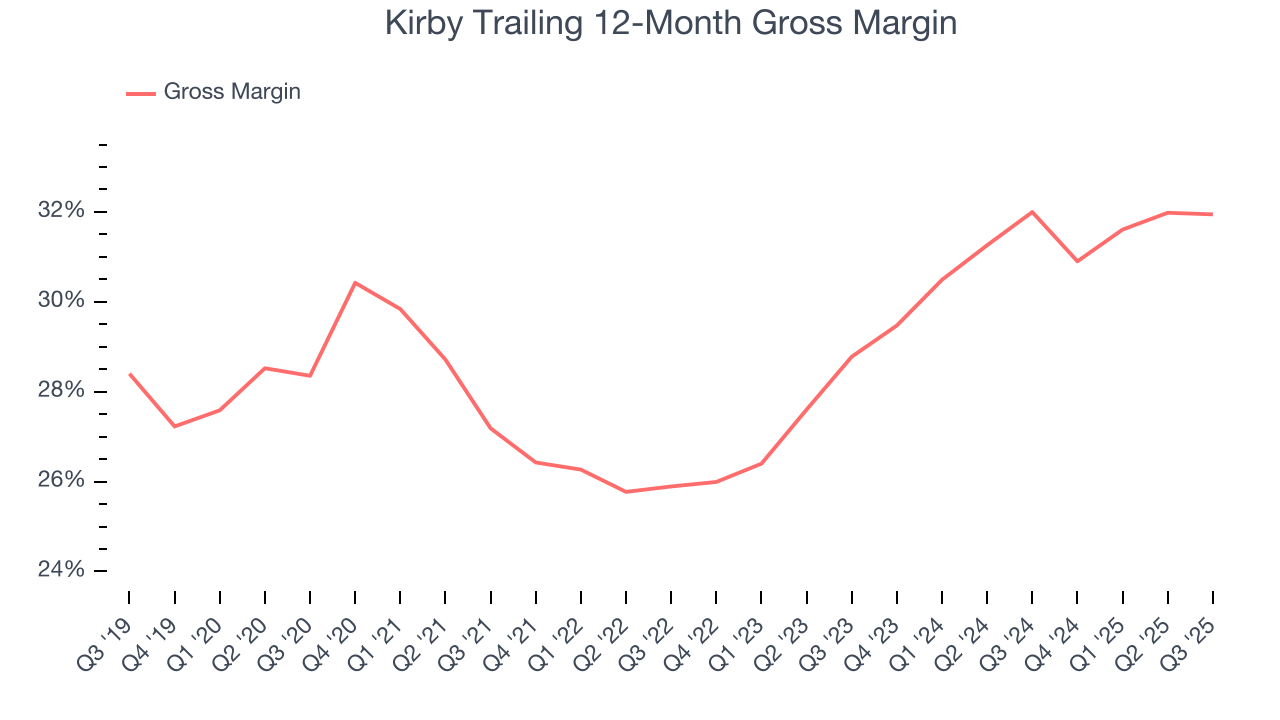

Kirby’s gross margin is slightly below the average industrials company, giving it less room to invest in areas such as research and development. As you can see below, it averaged a 29.5% gross margin over the last five years. Said differently, Kirby had to pay a chunky $70.53 to its suppliers for every $100 in revenue.

Kirby’s gross profit margin came in at 33.4% this quarter, in line with the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

7. Operating Margin

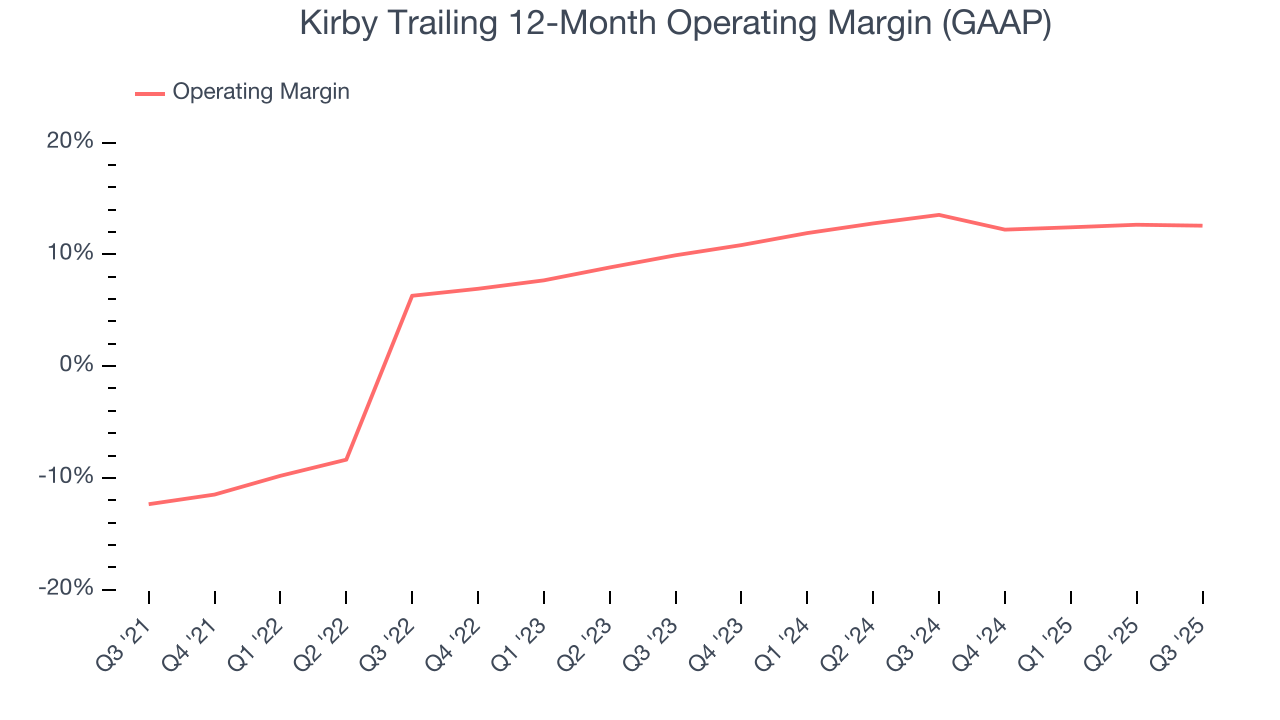

Kirby was profitable over the last five years but held back by its large cost base. Its average operating margin of 7.4% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

On the plus side, Kirby’s operating margin rose by 24.9 percentage points over the last five years, as its sales growth gave it operating leverage. We’ll take Kirby’s improvement as many Marine Transportation companies saw their margins fall (along with revenue, as mentioned above) because the cycle turned in the wrong direction.

In Q3, Kirby generated an operating margin profit margin of 14.8%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

8. Earnings Per Share

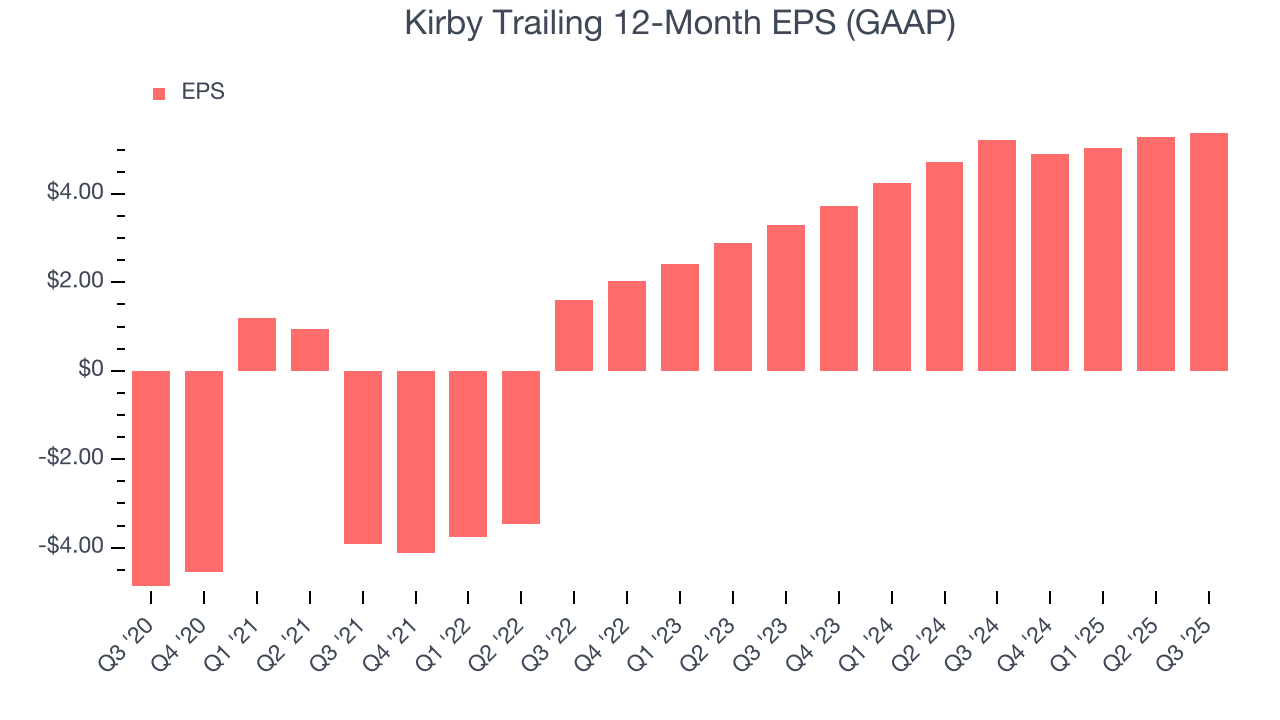

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Kirby’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Kirby’s EPS grew at an astounding 27.7% compounded annual growth rate over the last two years, higher than its 4.7% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

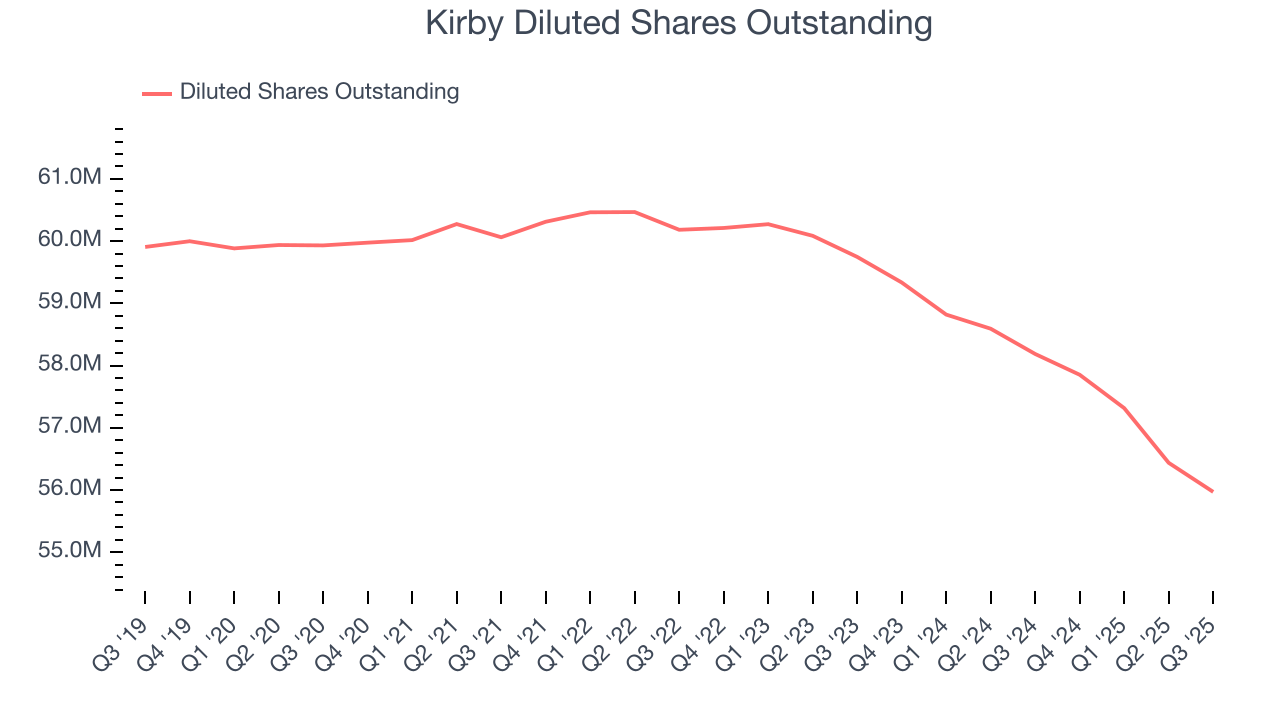

We can take a deeper look into Kirby’s earnings to better understand the drivers of its performance. While we mentioned earlier that Kirby’s operating margin was flat this quarter, a two-year view shows its margin has expandedwhile its share count has shrunk 6.3%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

In Q3, Kirby reported EPS of $1.65, up from $1.55 in the same quarter last year. This print beat analysts’ estimates by 2.2%. Over the next 12 months, Wall Street expects Kirby’s full-year EPS of $5.39 to grow 24.7%.

9. Cash Is King

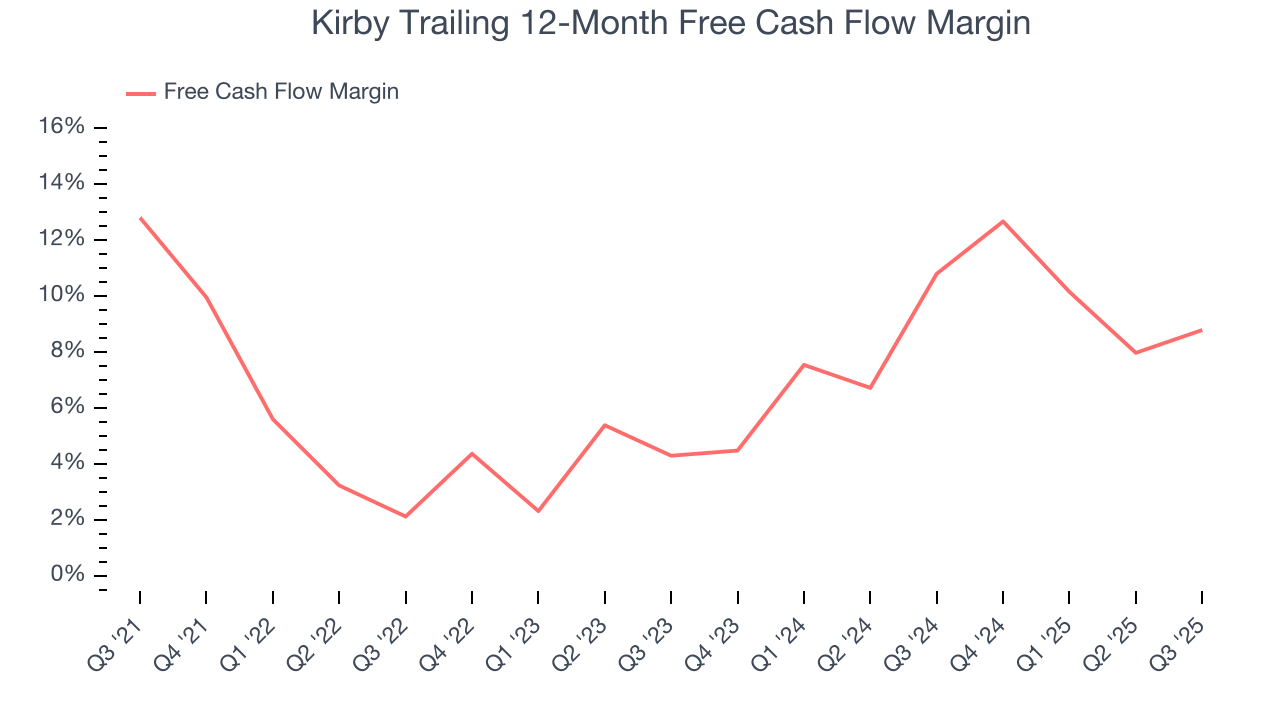

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Kirby has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 7.7% over the last five years, slightly better than the broader industrials sector.

Taking a step back, we can see that Kirby’s margin dropped by 4 percentage points during that time. If its declines continue, it could signal increasing investment needs and capital intensity.

Kirby’s free cash flow clocked in at $160.3 million in Q3, equivalent to a 18.4% margin. This result was good as its margin was 2.7 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings. Long-term trends are more important.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Kirby historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 3.9%, lower than the typical cost of capital (how much it costs to raise money) for industrials companies.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Kirby’s ROIC has increased. This is a good sign, but we recognize its lack of profitable growth during the COVID era was the primary reason for the change.

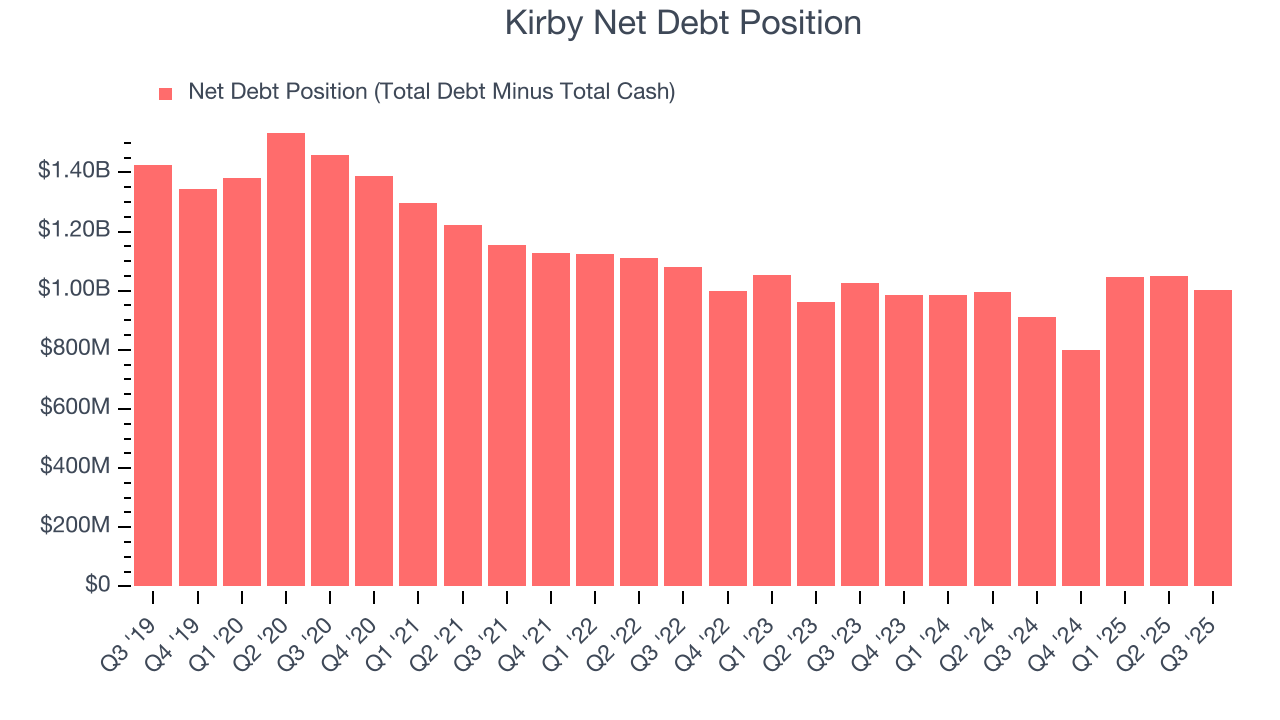

11. Balance Sheet Assessment

Kirby reported $47.03 million of cash and $1.05 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $741 million of EBITDA over the last 12 months, we view Kirby’s 1.4× net-debt-to-EBITDA ratio as safe. We also see its $22.09 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Kirby’s Q3 Results

We were glad Kirby's revenue and EPS both outperformed Wall Street’s estimates. Overall, we think this was still a solid quarter with some key areas of upside. The stock traded up 1.4% to $90 immediately after reporting.

13. Is Now The Time To Buy Kirby?

Updated: January 24, 2026 at 10:17 PM EST

When considering an investment in Kirby, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

There are some bright spots in Kirby’s fundamentals, but its business quality ultimately falls short. Although its revenue growth was mediocre over the last five years and analysts expect growth to slow over the next 12 months, its expanding operating margin shows the business has become more efficient. Investors should tread carefully with this one, however, as Kirby’s relatively low ROIC suggests management has struggled to find compelling investment opportunities.

Kirby’s P/E ratio based on the next 12 months is 19.2x. This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're fairly confident there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $138.50 on the company (compared to the current share price of $128.70).