MSA Safety (MSA)

MSA Safety doesn’t impress us. It’s recently struggled to grow its revenue, a worrying sign for investors seeking high-quality stocks.― StockStory Analyst Team

1. News

2. Summary

Why MSA Safety Is Not Exciting

Founded in 1914 as Mine Safety Appliances to protect coal miners from dangerous gases, MSA Safety (NYSE:MSA) designs and manufactures advanced safety products that protect workers and facilities across industries including fire service, energy, construction, and manufacturing.

- One positive is that its successful business model is illustrated by its impressive adjusted operating margin

MSA Safety’s quality is lacking. There are more profitable opportunities elsewhere.

Why There Are Better Opportunities Than MSA Safety

High Quality

Investable

Underperform

Why There Are Better Opportunities Than MSA Safety

At $196.40 per share, MSA Safety trades at 22.2x forward P/E. This multiple is higher than that of business services peers; it’s also rich for the business quality. Not a great combination.

We’d rather invest in similarly-priced but higher-quality companies with more reliable earnings growth.

3. MSA Safety (MSA) Research Report: Q4 CY2025 Update

Safety equipment manufacturer MSA Safety (NYSE:MSA) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 2.2% year on year to $510.9 million. Its non-GAAP profit of $2.38 per share was 5.3% above analysts’ consensus estimates.

MSA Safety (MSA) Q4 CY2025 Highlights:

- Revenue: $510.9 million vs analyst estimates of $507.5 million (2.2% year-on-year growth, 0.7% beat)

- Adjusted EPS: $2.38 vs analyst estimates of $2.26 (5.3% beat)

- Adjusted EBITDA: $136 million vs analyst estimates of $131.3 million (26.6% margin, 3.6% beat)

- Operating Margin: 22.3%, down from 24.5% in the same quarter last year

- Free Cash Flow Margin: 20.8%, up from 18.7% in the same quarter last year

- Market Capitalization: $7.62 billion

Company Overview

Founded in 1914 as Mine Safety Appliances to protect coal miners from dangerous gases, MSA Safety (NYSE:MSA) designs and manufactures advanced safety products that protect workers and facilities across industries including fire service, energy, construction, and manufacturing.

MSA Safety's product portfolio is organized into three main categories: Firefighter Safety, Detection, and Industrial Personal Protective Equipment (PPE). The company's firefighter safety line includes self-contained breathing apparatus (SCBA), protective apparel, and helmets under brands like Cairns and Gallet. Its detection products encompass fixed gas and flame detection systems and portable gas detection instruments that monitor for hazardous gases in various environments. The industrial PPE category features the iconic V-Gard hard hats and comprehensive fall protection equipment.

The company serves two primary customer types: distributors and end-users. In the Americas, MSA primarily sells through distribution networks, while its International segment utilizes both direct and indirect sales channels. MSA maintains relationships with over 2,100 authorized distributor locations worldwide to reach diverse markets and segments.

A firefighter entering a burning building might rely on MSA's G1 SCBA for breathable air, while wearing the company's helmet and protective clothing. Similarly, an oil refinery worker might use MSA's portable gas detector to check for dangerous gas leaks before performing maintenance.

MSA generates revenue through both initial equipment sales and recurring business from replacement components and services, particularly in its fixed gas and flame detection systems. The company has enhanced its recurring revenue through MSA+, a platform launched in 2022 that integrates hardware with cloud software solutions and subscription-based safety services.

The company invests significantly in research and development, with dedicated teams working alongside industry standards groups to develop innovative safety solutions. This commitment to innovation has resulted in numerous patents and proprietary technologies like XCell sensors for faster gas detection and ReflectIR thermal barrier technology in hard hats.

4. Safety & Security Services

Rising concerns over physical security, cybersecurity threats, and workplace safety regulations will present opportunities for companies in this sector. AI and digitization will enhance surveillance, access control, and threat detection, which could benefit key players in Safety & Security Services. These trends could also introduce ethical and regulatory concerns over data privacy and automated decision-making in security operations, giving rise to headline risks. Finally, increasing scrutiny on private security practices and evolving criminal justice policies again mean that companies in the space need to operate with the utmost care or risk being the poster child of abuse of power.

MSA Safety's competitors include 3M (NYSE:MMM) in respiratory and head protection, Honeywell (NASDAQ:HON) in gas detection and protective equipment, and Dräger (ETR:DRW3) in breathing apparatus and gas detection systems. In the fire service market, they compete with Globe Manufacturing (owned by MSA) and Lion Group.

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $1.87 billion in revenue over the past 12 months, MSA Safety is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the bright side, it can still flex high growth rates because it’s working from a smaller revenue base.

As you can see below, MSA Safety’s sales grew at a decent 6.8% compounded annual growth rate over the last five years. This shows its offerings generated slightly more demand than the average business services company, a useful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. MSA Safety’s recent performance shows its demand has slowed as its annualized revenue growth of 2.4% over the last two years was below its five-year trend. We’re wary when companies in the sector see decelerations in revenue growth, as it could signal changing consumer tastes aided by low switching costs.

This quarter, MSA Safety reported modest year-on-year revenue growth of 2.2% but beat Wall Street’s estimates by 0.7%.

Looking ahead, sell-side analysts expect revenue to grow 5.5% over the next 12 months, an improvement versus the last two years. This projection is above the sector average and implies its newer products and services will catalyze better top-line performance.

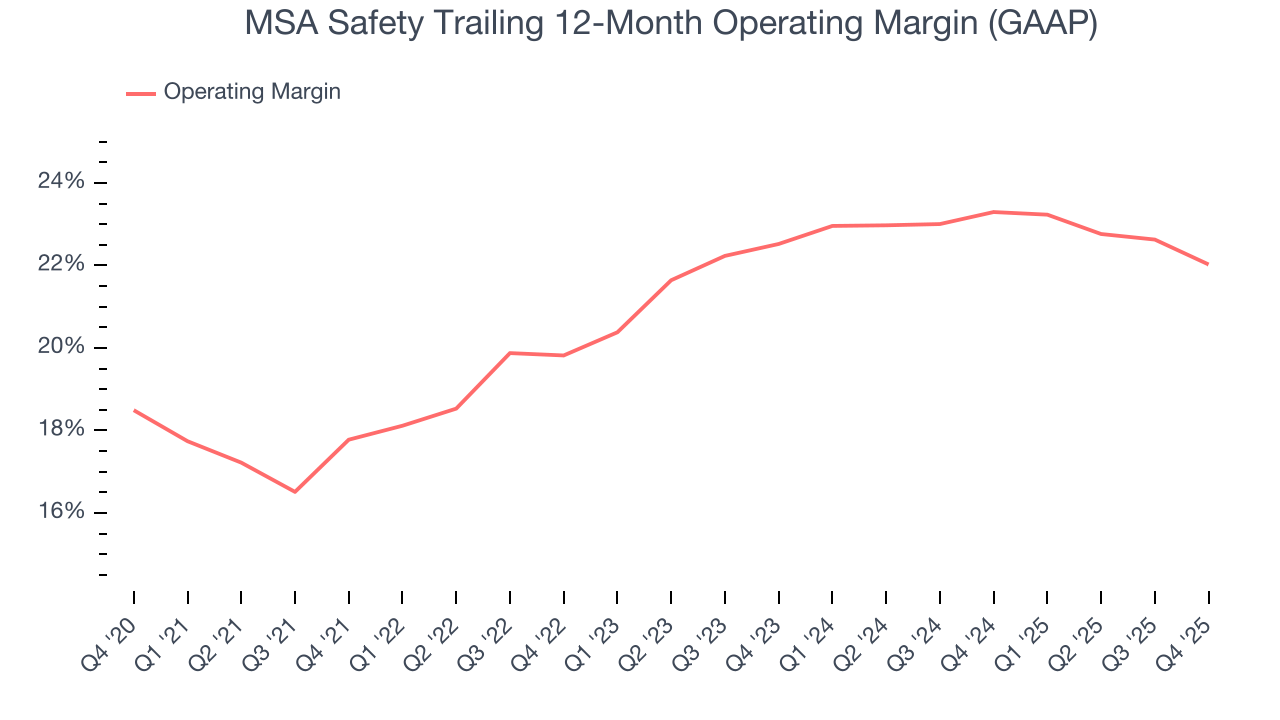

6. Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

MSA Safety has been a well-oiled machine over the last five years. It demonstrated elite profitability for a business services business, boasting an average operating margin of 21.3%.

Looking at the trend in its profitability, MSA Safety’s operating margin rose by 4.2 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q4, MSA Safety generated an operating margin profit margin of 22.3%, down 2.3 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

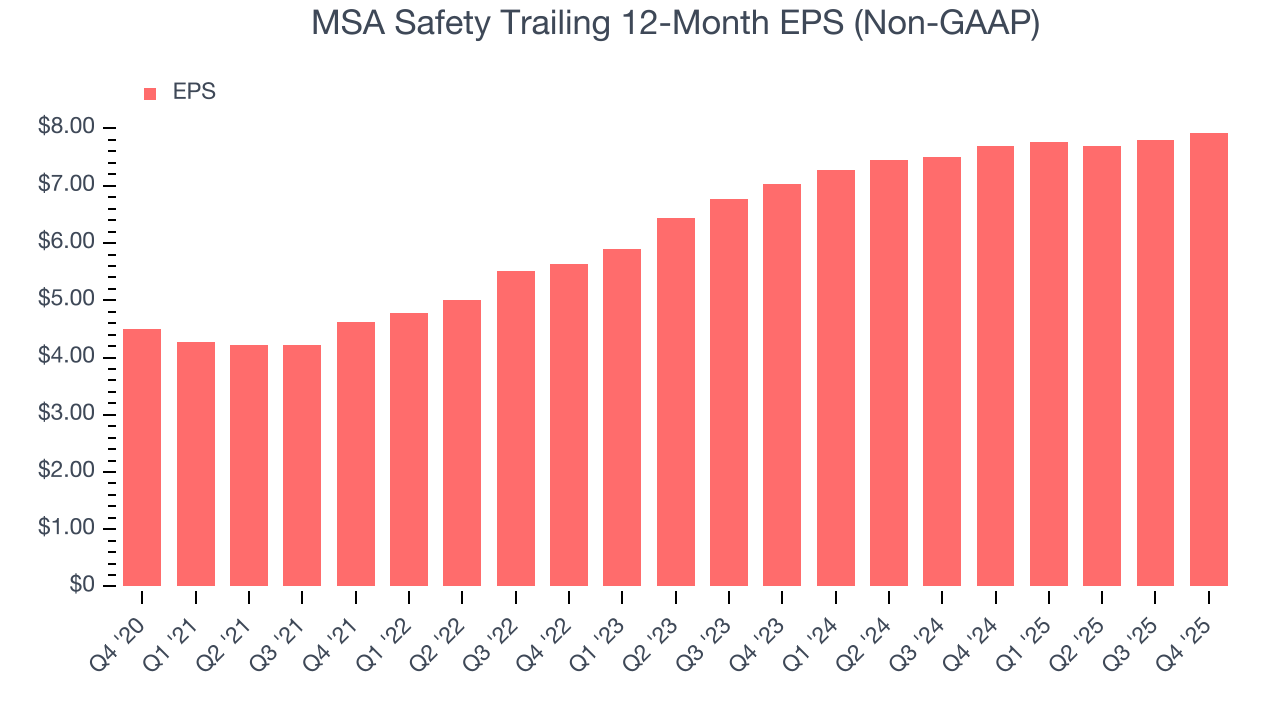

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

MSA Safety’s EPS grew at a remarkable 12% compounded annual growth rate over the last five years, higher than its 6.8% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into MSA Safety’s earnings to better understand the drivers of its performance. As we mentioned earlier, MSA Safety’s operating margin declined this quarter but expanded by 4.2 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For MSA Safety, its two-year annual EPS growth of 6.2% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q4, MSA Safety reported adjusted EPS of $2.38, up from $2.25 in the same quarter last year. This print beat analysts’ estimates by 5.3%. Over the next 12 months, Wall Street expects MSA Safety’s full-year EPS of $7.93 to grow 9%.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

MSA Safety has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the business services sector, averaging 14.3% over the last five years.

Taking a step back, we can see that MSA Safety’s margin expanded by 4.7 percentage points during that time. This is encouraging because it gives the company more optionality.

MSA Safety’s free cash flow clocked in at $106 million in Q4, equivalent to a 20.8% margin. This result was good as its margin was 2 percentage points higher than in the same quarter last year, building on its favorable historical trend.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although MSA Safety hasn’t been the highest-quality company lately, it historically found a few growth initiatives that worked out well. Its five-year average ROIC was 20.5%, impressive for a business services business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Uneventfully, MSA Safety’s ROIC has stayed the same over the last few years. Given the company’s underwhelming financial performance in other areas, we’d like to see its returns improve before recommending the stock.

10. Balance Sheet Assessment

MSA Safety reported $165.1 million of cash and $580.9 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $472.9 million of EBITDA over the last 12 months, we view MSA Safety’s 0.9× net-debt-to-EBITDA ratio as safe. We also see its $14.94 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from MSA Safety’s Q4 Results

It was good to see MSA Safety beat analysts’ EPS expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. Overall, this print had some key positives. The stock remained flat at $196.72 immediately following the results.

12. Is Now The Time To Buy MSA Safety?

Updated: February 23, 2026 at 10:29 PM EST

When considering an investment in MSA Safety, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

There are some bright spots in MSA Safety’s fundamentals, but its business quality ultimately falls short. First off, its revenue growth was good over the last five years, and analysts believe it can continue growing at these levels. Plus, MSA Safety’s impressive operating margins show it has a highly efficient business model, and its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits.

MSA Safety’s P/E ratio based on the next 12 months is 22.5x. Investors with a higher risk tolerance might like the company, but we don’t really see a big opportunity at the moment. We're pretty confident there are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $212.43 on the company (compared to the current share price of $193.58).