ServiceNow (NOW)

We like ServiceNow. It’s not only a customer acquisition machine but also sports robust unit economics, a deadly combo.― StockStory Analyst Team

1. News

2. Summary

Why We Like ServiceNow

Built on a single code base that processes over 4 billion workflow transactions daily, ServiceNow (NYSE:NOW) provides a cloud-based platform that helps organizations automate and digitize workflows across departments, from IT and HR to customer service and security.

- Robust free cash flow profile gives it the flexibility to invest in growth initiatives or return capital to shareholders

- Annual revenue growth of 22.3% over the last two years was superb and indicates its market share is rising

- Healthy operating margin shows it’s a well-run company with efficient processes, and its operating leverage amplified its profits over the last year

ServiceNow is a standout company. The price seems reasonable when considering its quality, so this could be a favorable time to buy some shares.

Why Is Now The Time To Buy ServiceNow?

High Quality

Investable

Underperform

Why Is Now The Time To Buy ServiceNow?

ServiceNow’s stock price of $133.58 implies a valuation ratio of 9x forward price-to-sales. Valuation is above that of many software companies, but we think the price is justified given its business fundamentals.

By definition, where you buy a stock impacts returns. Still, our extensive analysis shows that investors should worry much more about business quality than entry price if the ultimate goal is long-term returns.

3. ServiceNow (NOW) Research Report: Q3 CY2025 Update

Enterprise workflow automation company ServiceNow (NYSE:NOW) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 21.8% year on year to $3.41 billion. Its non-GAAP profit of $4.82 per share was 13% above analysts’ consensus estimates.

ServiceNow (NOW) Q3 CY2025 Highlights:

- Revenue: $3.41 billion vs analyst estimates of $3.36 billion (21.8% year-on-year growth, 1.4% beat)

- Adjusted EPS: $4.82 vs analyst estimates of $4.27 (13% beat)

- Adjusted Operating Income: $1.14 billion vs analyst estimates of $1.03 billion (33.5% margin, 11.1% beat)

- Raised full-year subscription revenue guidance slightly (20% CC growth vs. 19.5-20% previously) and full-year operating margin as well (31% vs. 30.5% previously)

- Operating Margin: 16.8%, up from 14.9% in the same quarter last year

- Free Cash Flow Margin: 17.4%, up from 16.4% in the previous quarter

- Market Capitalization: $194.6 billion

Company Overview

Built on a single code base that processes over 4 billion workflow transactions daily, ServiceNow (NYSE:NOW) provides a cloud-based platform that helps organizations automate and digitize workflows across departments, from IT and HR to customer service and security.

The company's flagship product, the Now Platform, serves as a central digital command center for enterprises, connecting disparate systems and breaking down departmental silos. Rather than requiring organizations to juggle multiple applications for different functions, ServiceNow's platform integrates these capabilities through a unified interface. For example, when an employee needs a new laptop, the platform can automatically route the request, track the approval process, update inventory systems, and schedule delivery—all without manual intervention.

ServiceNow's offerings are organized into four main categories: Technology Workflows for IT departments, Customer and Industry Workflows for service delivery, Employee Workflows for HR and workplace services, and Creator Workflows that allow businesses to build custom applications. The company has heavily invested in AI capabilities through its "Now Assist" solutions, which can summarize incidents, generate knowledge articles, and even create code with minimal human input.

The company generates revenue primarily through subscription-based licensing of its cloud software. It targets large enterprises across industries ranging from healthcare and manufacturing to financial services and government agencies. ServiceNow enhances its platform with biannual releases that introduce new features and capabilities, maintaining technological relevance in the rapidly evolving enterprise software market.

4. Automation Software

The whole purpose of software is to automate tasks to increase productivity. Today, innovative new software techniques, often involving AI and machine learning, are finally allowing automation that has graduated from simple one- or two-step workflows to more complex processes integral to enterprises. The result is surging demand for modern automation software.

ServiceNow competes with large enterprise software vendors like Salesforce (NYSE:CRM), Microsoft (NASDAQ:MSFT), and Oracle (NYSE:ORCL) in various segments of its business. In IT service management, it faces competition from Atlassian's Jira Service Management (NASDAQ:TEAM) and BMC Software, while in customer service it competes with Zendesk (private) and Freshworks (NASDAQ:FRSH).

5. Revenue Growth

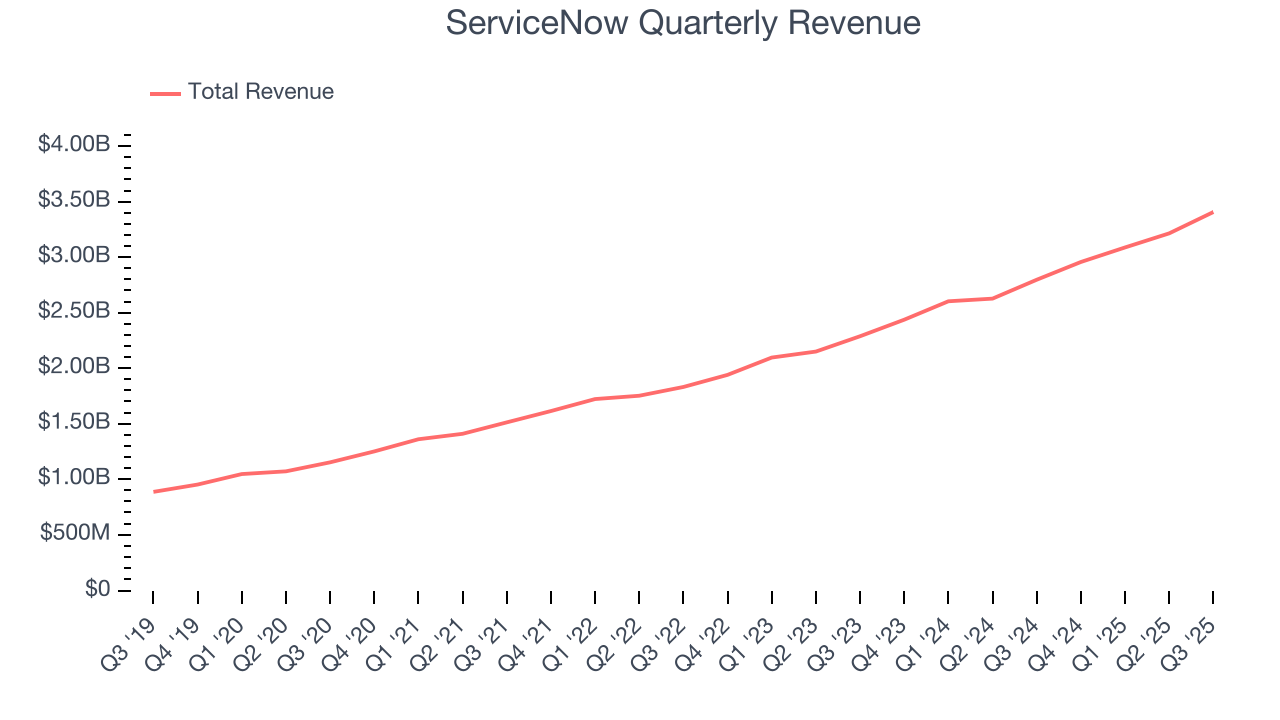

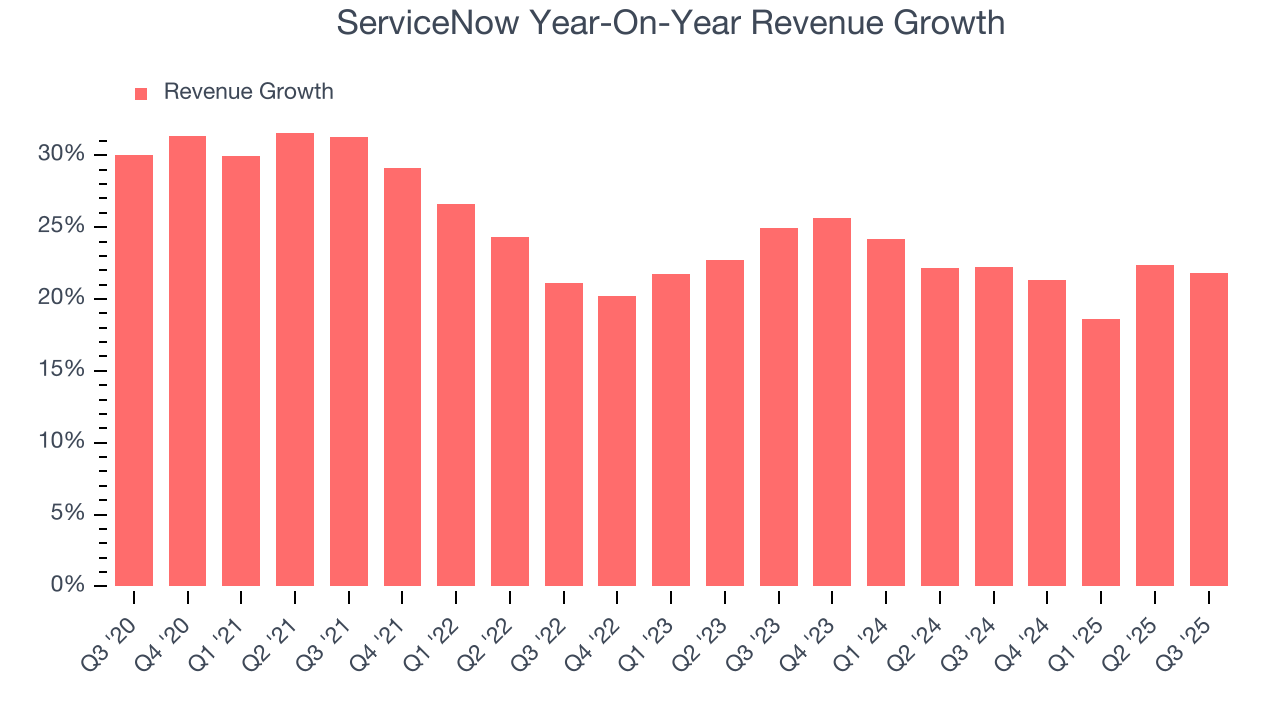

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, ServiceNow’s sales grew at a solid 24.6% compounded annual growth rate over the last five years. Its growth surpassed the average software company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. ServiceNow’s annualized revenue growth of 22.3% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, ServiceNow reported robust year-on-year revenue growth of 21.8%, and its $3.41 billion of revenue topped Wall Street estimates by 1.4%.

Looking ahead, sell-side analysts expect revenue to grow 18% over the next 12 months, a deceleration versus the last two years. We still think its growth trajectory is attractive given its scale and suggests the market sees success for its products and services.

6. Annual Recurring Revenue

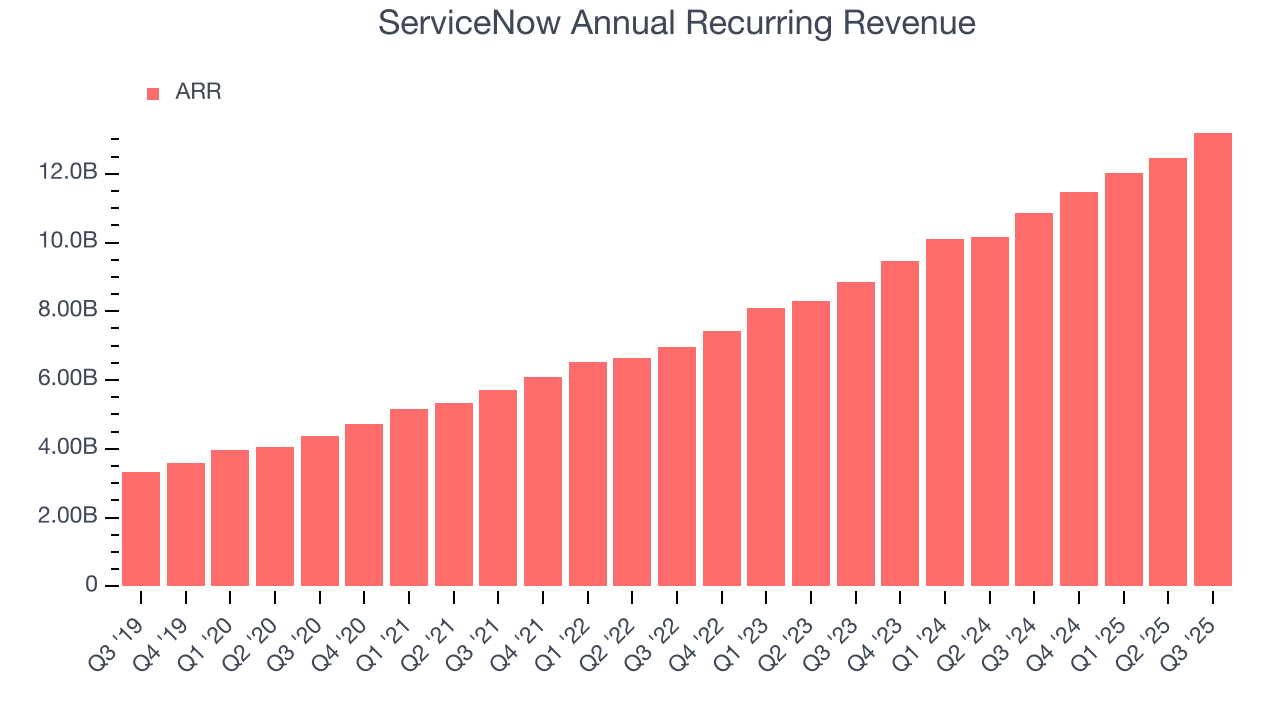

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

ServiceNow’s ARR punched in at $13.2 billion in Q3, and over the last four quarters, its growth was impressive as it averaged 21.1% year-on-year increases. This performance aligned with its total sales growth and shows that customers are willing to take multi-year bets on the company’s technology. Its growth also makes ServiceNow a more predictable business, a tailwind for its valuation as investors typically prefer businesses with recurring revenue.

7. Customer Acquisition Efficiency

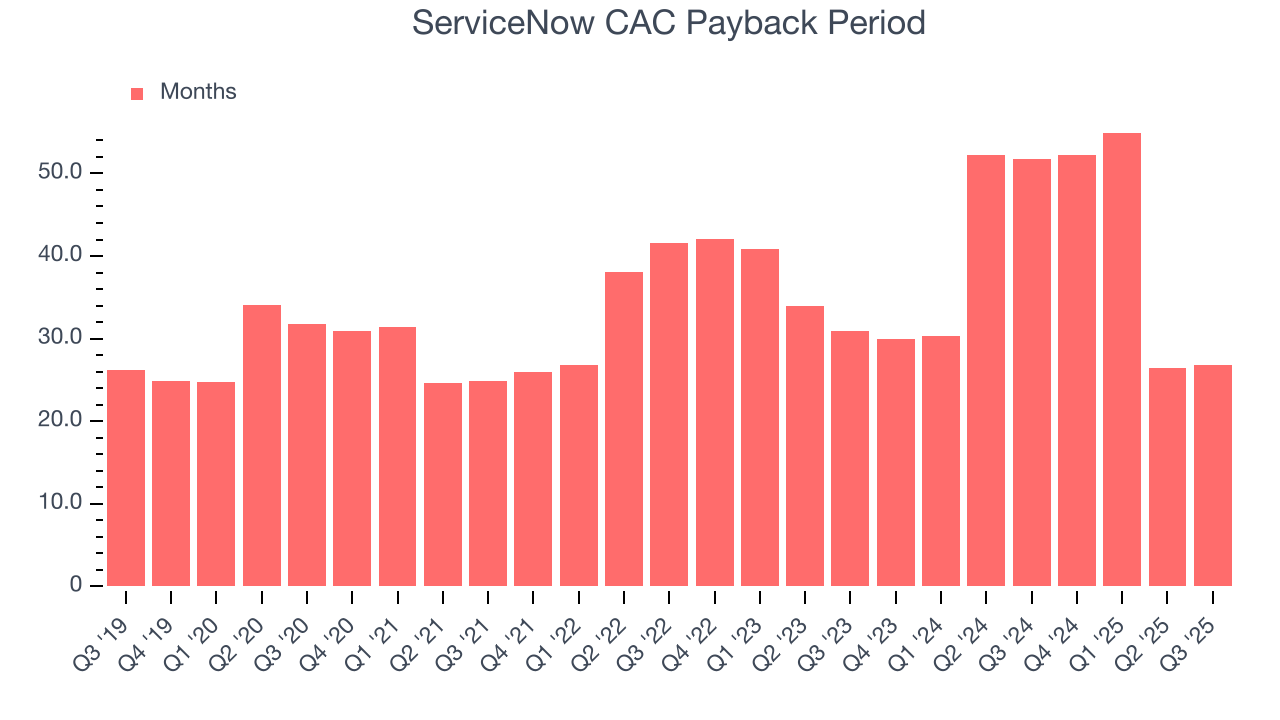

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

ServiceNow is very efficient at acquiring new customers, and its CAC payback period checked in at 26.8 months this quarter. The company’s rapid recovery of its customer acquisition costs indicates it has a highly differentiated product offering and a strong brand reputation due to its scale. These dynamics give ServiceNow more resources to pursue new product initiatives while maintaining the flexibility to increase its sales and marketing investments.

8. Gross Margin & Pricing Power

Software is eating the world. It’s one of our favorite business models because once you develop the product, it usually doesn’t cost much to provide it as an ongoing service. These minimal costs can include servers, licenses, and certain personnel.

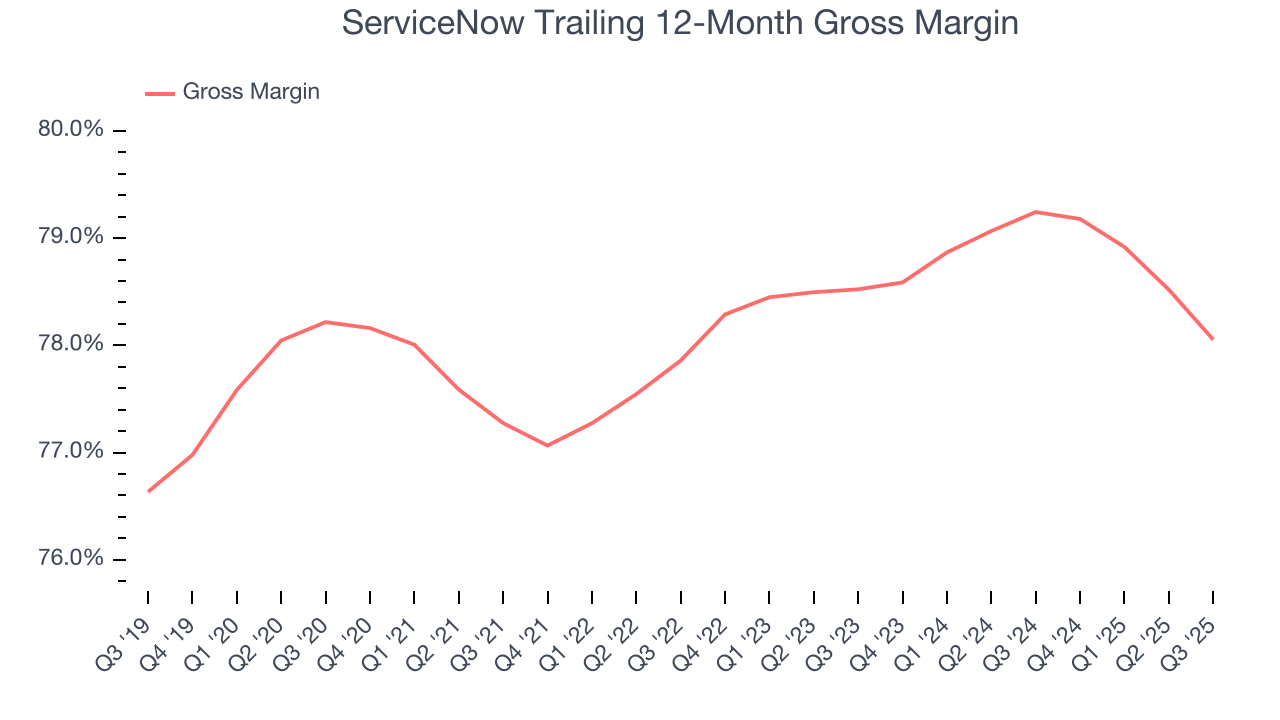

ServiceNow’s robust unit economics are better than the broader software industry, an output of its asset-lite business model and pricing power. They also enable the company to fund large investments in new products and sales during periods of rapid growth to achieve higher profits in the future. As you can see below, it averaged an excellent 78.1% gross margin over the last year. Said differently, roughly $78.05 was left to spend on selling, marketing, and R&D for every $100 in revenue.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. ServiceNow has seen gross margins decline by 0.5 percentage points over the last 2 year, which is slightly worse than average for software.

This quarter, ServiceNow’s gross profit margin was 77.3%, down 1.8 percentage points year on year. ServiceNow’s full-year margin has also been trending down over the past 12 months, decreasing by 1.2 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs.

9. Operating Margin

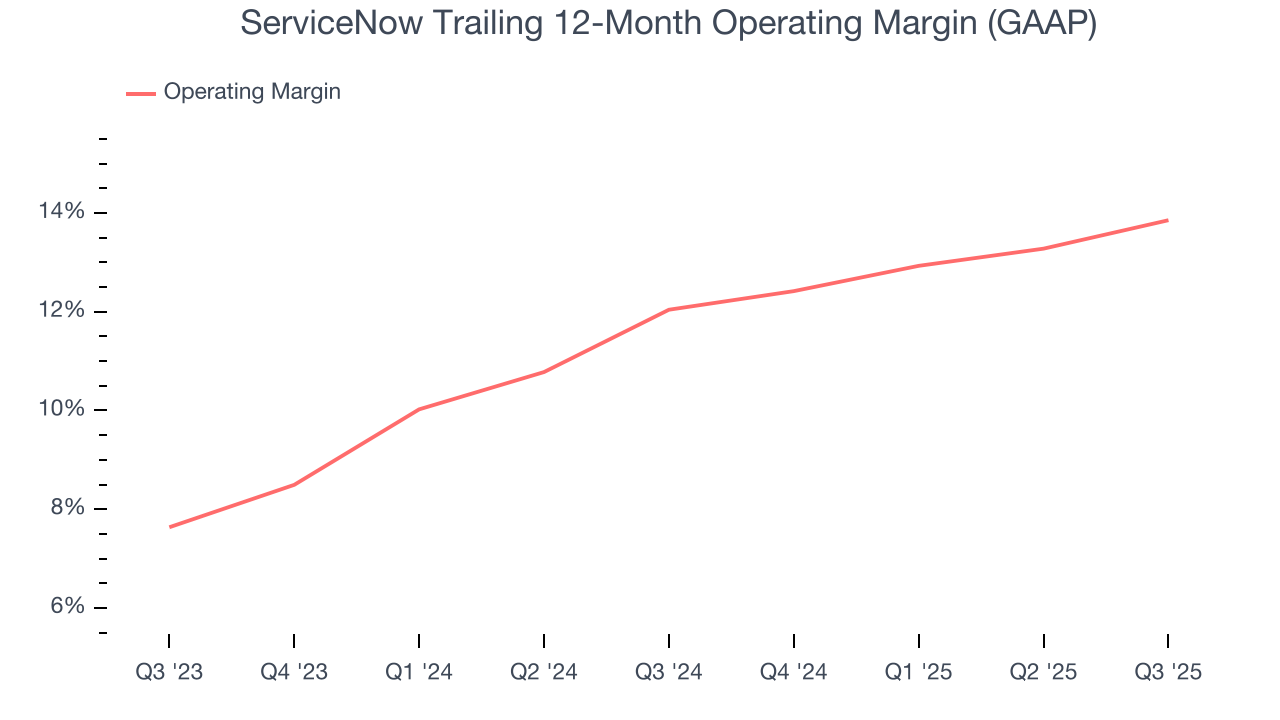

ServiceNow has been an efficient company over the last year. It was one of the more profitable businesses in the software sector, boasting an average operating margin of 13.9%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, ServiceNow’s operating margin rose by 1.8 percentage points over the last two years, as its sales growth gave it operating leverage.

In Q3, ServiceNow generated an operating margin profit margin of 16.8%, up 1.8 percentage points year on year. The increase was encouraging, and because its gross margin actually decreased, we can assume it was more efficient because its operating expenses like marketing, R&D, and administrative overhead grew slower than its revenue.

10. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

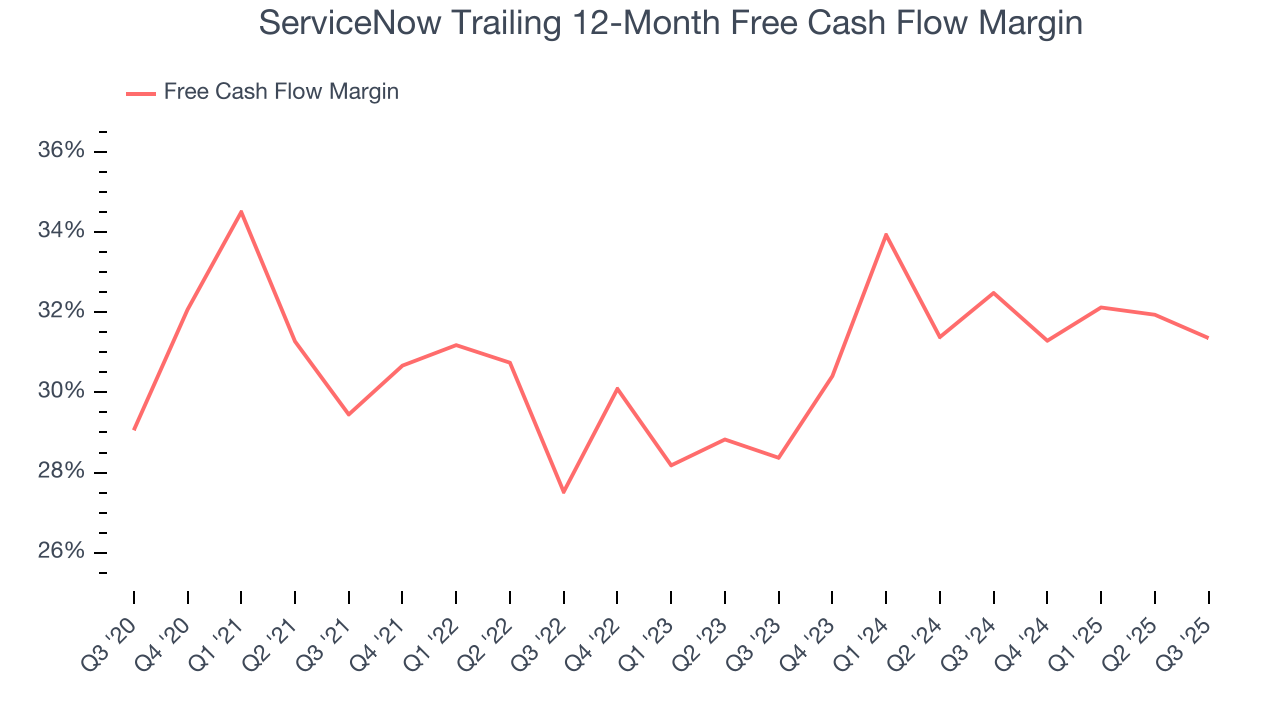

ServiceNow has shown terrific cash profitability, driven by its lucrative business model and cost-effective customer acquisition strategy that enable it to stay ahead of the competition through investments in new products rather than sales and marketing. The company’s free cash flow margin was among the best in the software sector, averaging an eye-popping 31.4% over the last year.

ServiceNow’s free cash flow clocked in at $592 million in Q3, equivalent to a 17.4% margin. This cash profitability was in line with the comparable period last year but below its one-year average. We wouldn’t read too much into it because investment needs can be seasonal, causing short-term swings. Long-term trends are more important.

Over the next year, analysts’ consensus estimates show they’re expecting ServiceNow’s free cash flow margin of 31.4% for the last 12 months to remain the same.

11. Balance Sheet Assessment

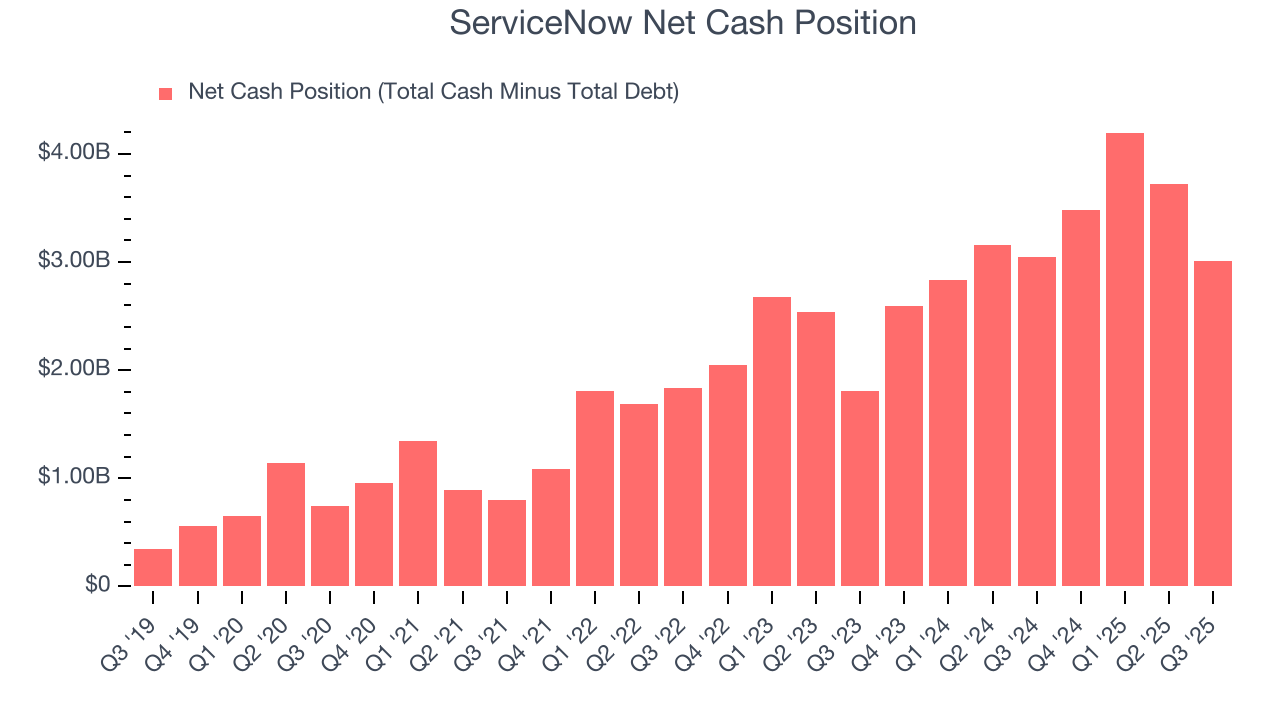

Businesses that maintain a cash surplus face reduced bankruptcy risk.

ServiceNow is a profitable, well-capitalized company with $5.41 billion of cash and $2.40 billion of debt on its balance sheet. This $3.01 billion net cash position gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from ServiceNow’s Q3 Results

This was a beat and raise quarter. Specifically, it was good to see ServiceNow top analysts’ revenue and adjusted operating profit expectations this quarter. Furthermore, it was good to see full-year guidance slightly raised for subscription revenue and operating margin. Overall, this print had plenty of positives. The stock traded up 4.6% to $955 immediately following the results.

13. Is Now The Time To Buy ServiceNow?

Updated: January 20, 2026 at 9:13 PM EST

Are you wondering whether to buy ServiceNow or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

There are multiple reasons why we think ServiceNow is an amazing business. For starters, its revenue growth was strong over the last five years. And while its expanding operating margin shows it’s becoming more efficient at building and selling its software, its bountiful generation of free cash flow empowers it to invest in growth initiatives. Additionally, ServiceNow’s strong operating margins show it’s a well-run business.

ServiceNow’s price-to-sales ratio based on the next 12 months is 8.7x. Scanning the software space today, ServiceNow’s fundamentals really stand out, and we like it at this price.

Wall Street analysts have a consensus one-year price target of $216.58 on the company (compared to the current share price of $125.45), implying they see 72.6% upside in buying ServiceNow in the short term.