Ruger (RGR)

We wouldn’t buy Ruger. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Ruger Will Underperform

Founded in 1949, Ruger (NYSE:RGR) is an American manufacturer of firearms for the commercial sporting market.

- Sales trends were unexciting over the last five years as its 1.4% annual growth was below the typical consumer discretionary company

- Performance over the past five years shows its incremental sales were much less profitable, as its earnings per share fell by 21.6% annually

- Sales are expected to decline once again over the next 12 months as it continues working through a challenging demand environment

Ruger falls short of our quality standards. We believe there are better businesses elsewhere.

Why There Are Better Opportunities Than Ruger

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Ruger

At $37.25 per share, Ruger trades at 24.2x forward P/E. This multiple is higher than most consumer discretionary companies, and we think it’s quite expensive for the weaker revenue growth you get.

We’d rather invest in similarly-priced but higher-quality companies with more reliable earnings growth.

3. Ruger (RGR) Research Report: Q3 CY2025 Update

American firearm manufacturing company Ruger (NYSE:RGR) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 3.7% year on year to $126.8 million. Its non-GAAP profit of $0.11 per share was 69% below analysts’ consensus estimates.

Ruger (RGR) Q3 CY2025 Highlights:

- Revenue: $126.8 million vs analyst estimates of $124.2 million (3.7% year-on-year growth, 2.1% beat)

- Adjusted EPS: $0.11 vs analyst expectations of $0.36 (69% miss)

- Adjusted EBITDA: $2.85 million vs analyst estimates of $11.97 million (2.2% margin, 76.2% miss)

- Operating Margin: -2.7%, down from 3.1% in the same quarter last year

- Free Cash Flow Margin: 5.5%, up from 2.1% in the same quarter last year

- Market Capitalization: $674 million

Company Overview

Founded in 1949, Ruger (NYSE:RGR) is an American manufacturer of firearms for the commercial sporting market.

Ruger was founded by William B. Ruger and Alexander McCormick Sturm in a small rented machine shop, with their first product, the Ruger Standard .22 caliber pistol, setting a high standard for reliable, well-made guns. The founders' vision was to offer shooters quality firearms that were both functional and affordable, filling a gap in the market for well-crafted weapons that could be enjoyed by shooting enthusiasts of all levels.

Today, Ruger provides an array of firearms, including rifles, pistols, and revolvers, catering to the needs of hunters, competitive shooters, and those seeking personal defense options. Specifically, the company's customers include law enforcement and military organizations as well as recreational shooters.

4. Leisure Products

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

Competitors in the firearm sector include Smith & Wesson Brands (NASDAQ:SWBI), Vista Outdoor (NYSE:VSTO), and American Outdoor Brands (NASDAQ:AOUT).

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Ruger grew its sales at a weak 1.4% compounded annual growth rate. This fell short of our benchmarks and is a poor baseline for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Ruger’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 1.9% annually.

This quarter, Ruger reported modest year-on-year revenue growth of 3.7% but beat Wall Street’s estimates by 2.1%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. While this projection implies its newer products and services will catalyze better top-line performance, it is still below the sector average.

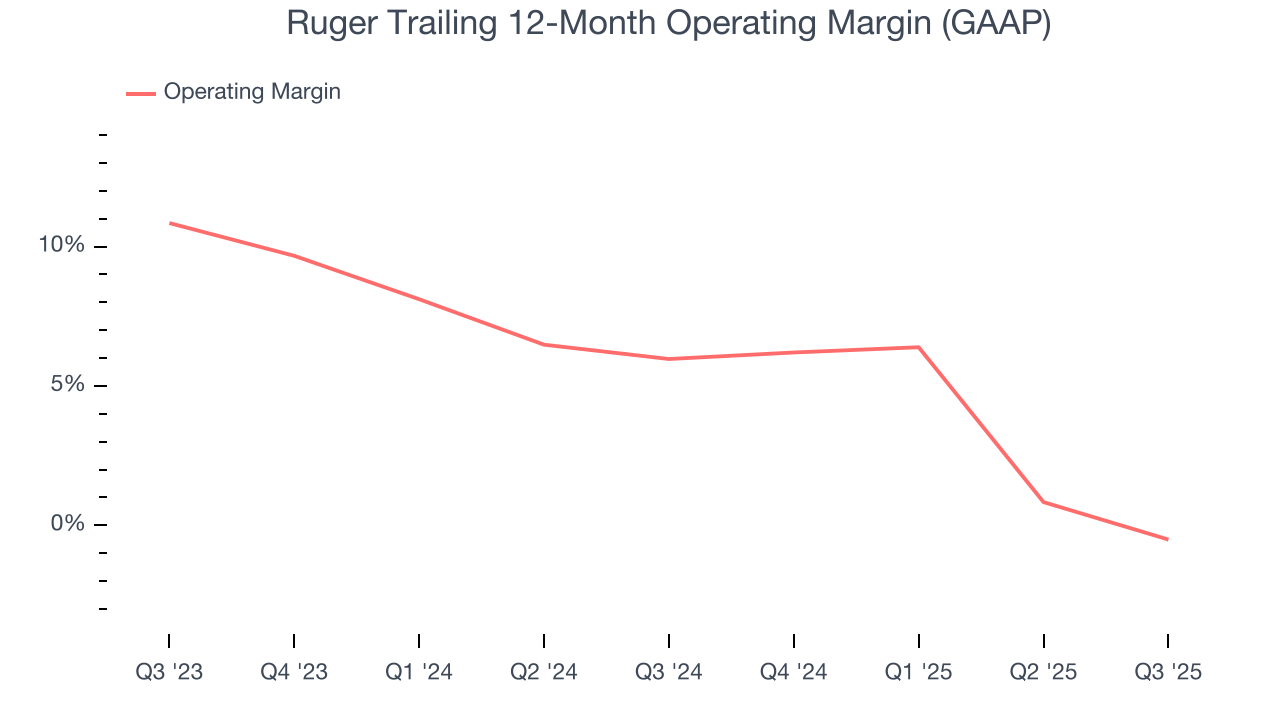

6. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Ruger’s operating margin has been trending down over the last 12 months and averaged 2.7% over the last two years. The company’s profitability was mediocre for a consumer discretionary business and shows it couldn’t pass its higher operating expenses onto its customers.

This quarter, Ruger generated an operating margin profit margin of negative 2.7%, down 5.8 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Ruger, its EPS declined by 21.6% annually over the last five years while its revenue grew by 1.4%. This tells us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

In Q3, Ruger reported adjusted EPS of $0.11, down from $0.28 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Ruger’s full-year EPS of $1.60 to grow 26.2%.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Ruger has shown weak cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 6.9%, subpar for a consumer discretionary business.

Ruger’s free cash flow clocked in at $7.00 million in Q3, equivalent to a 5.5% margin. This result was good as its margin was 3.4 percentage points higher than in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends are more important.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although Ruger hasn’t been the highest-quality company lately because of its poor revenue and EPS performance, it found a few growth initiatives in the past that worked out wonderfully. Its five-year average ROIC was 25.1%, splendid for a consumer discretionary business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Ruger’s ROIC has unfortunately decreased significantly. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

10. Balance Sheet Assessment

Companies with more cash than debt have lower bankruptcy risk.

Ruger is a well-capitalized company with $80.84 million of cash and no debt. This position is 12% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from Ruger’s Q3 Results

It was encouraging to see Ruger beat analysts’ revenue expectations this quarter. On the other hand, its EBITDA missed and its EPS fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 5.1% to $41.70 immediately after reporting.

12. Is Now The Time To Buy Ruger?

Updated: March 1, 2026 at 10:22 PM EST

Before making an investment decision, investors should account for Ruger’s business fundamentals and valuation in addition to what happened in the latest quarter.

Ruger doesn’t pass our quality test. On top of that, Ruger’s declining EPS over the last five years makes it a less attractive asset to the public markets, and its projected EPS for the next year is lacking.

Ruger’s P/E ratio based on the next 12 months is 24.2x. This valuation tells us it’s a bit of a market darling with a lot of good news priced in - you can find more timely opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $44.50 on the company (compared to the current share price of $37.25).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.