SmartRent (SMRT)

We’re skeptical of SmartRent. Its poor investment decisions are evident in its negative returns on capital, a troubling sign for investors.― StockStory Analyst Team

1. News

2. Summary

Why SmartRent Is Not Exciting

Founded by an employee at a real estate rental company, SmartRent (NYSE:SMRT) provides smart home devices and software for multifamily residential properties, single-family rental homes, and student housing communities.

- Historical operating margin losses point to an inefficient cost structure

- Cash-burning history makes us doubt the long-term viability of its business model

- On the plus side, its annual revenue growth of 23.7% over the past five years was outstanding, reflecting market share gains this cycle

SmartRent’s quality is lacking. There are more promising prospects in the market.

Why There Are Better Opportunities Than SmartRent

High Quality

Investable

Underperform

Why There Are Better Opportunities Than SmartRent

SmartRent is trading at $1.77 per share, or 2.1x forward price-to-sales. The market typically values companies like SmartRent based on their anticipated profits for the next 12 months, but there aren’t enough published estimates to arrive at a reliable number. You should avoid this stock for now - better opportunities lie elsewhere.

We’d rather pay up for companies with elite fundamentals than get a bargain on poor ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. SmartRent (SMRT) Research Report: Q4 CY2025 Update

Smart home company SmartRent (NYSE:SMRT) met Wall Street’s revenue expectations in Q4 CY2025, with sales up 3.1% year on year to $36.47 million. Its GAAP loss of $0.02 per share was in line with analysts’ consensus estimates.

SmartRent (SMRT) Q4 CY2025 Highlights:

- Revenue: $36.47 million vs analyst estimates of $36.3 million (3.1% year-on-year growth, in line)

- EPS (GAAP): -$0.02 vs analyst estimates of -$0.02 (in line)

- Adjusted EBITDA: $214,000 (0.6% margin, 103% year-on-year growth)

- Adjusted EBITDA Margin: 0.6%, up from -20.8% in the same quarter last year

- Free Cash Flow was $5.97 million, up from -$13.26 million in the same quarter last year

- Annual Recurring Revenue: $61.6 million (13.2% year-on-year growth, beat)

- Market Capitalization: $291.4 million

Company Overview

Founded by an employee at a real estate rental company, SmartRent (NYSE:SMRT) provides smart home devices and software for multifamily residential properties, single-family rental homes, and student housing communities.

SmartRent was founded in 2017 to change the property management industry through smart home automation. Its platform includes a range of smart devices (smart locks, thermostats, light switches, and leak detectors) all integrated into a central interface.

This interface allows property managers to remotely monitor and control these devices while enabling tenants to control their apartment’s environment via a smartphone app. SmartRent also provides software, such as automated maintenance requests and keyless entry for maintenance staff that helps property managers reduce costs and increase the value of their properties.

SmartRent sells its products through direct sales channels and partnerships with property management firms and real estate developers. The company engages in contracts that include installation services, technical support, and maintenance agreements. Recurring revenue comes from its subscription plans, which offer ongoing access to the SmartRent Control platform, customer support, and regular software updates.

4. Internet of Things

Industrial Internet of Things (IoT) companies are buoyed by the secular trend of a more connected world. They often specialize in nascent areas such as hardware and services for factory automation, fleet tracking, or smart home technologies. Those who play their cards right can generate recurring subscription revenues by providing cloud-based software services, boosting their margins. On the other hand, if the technologies these companies have invested in don’t pan out, they may have to make costly pivots.

Competitors offering similar products include Vivint Smart Home (NYSE:VVNT), Alarm.com (NASDAQ:ALRM), and Resideo (NYSE:REZI).

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, SmartRent grew its sales at an incredible 23.7% compounded annual growth rate. Its growth beat the average industrials company and shows its offerings resonate with customers, a helpful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. SmartRent’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 19.8% over the last two years.

We can dig further into the company’s sales dynamics by analyzing its annual recurring revenue (ARR), or the predictable, normalized yearly income from subscriptions and contracts.SmartRent’s ARR reached $61.6 million in the latest quarter and averaged 19.2% year-on-year growth over the last two years. Because this number is better than its normal revenue growth, we can see the company’s proportion of recurring revenue from long-term contracts and subscriptions has increased. This implies more stability in its business model and revenue streams.

This quarter, SmartRent grew its revenue by 3.1% year on year, and its $36.47 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 4% over the next 12 months. Although this projection indicates its newer products and services will spur better top-line performance, it is still below average for the sector. At least the company is tracking well in other measures of financial health.

6. Gross Margin & Pricing Power

SmartRent has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 17.9% gross margin over the last five years. That means SmartRent paid its suppliers a lot of money ($82.08 for every $100 in revenue) to run its business.

SmartRent produced a 38.6% gross profit margin in Q4, up 9.9 percentage points year on year. Zooming out, however, SmartRent’s full-year margin has been trending down over the past 12 months, decreasing by 1.8 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as raw materials and manufacturing expenses).

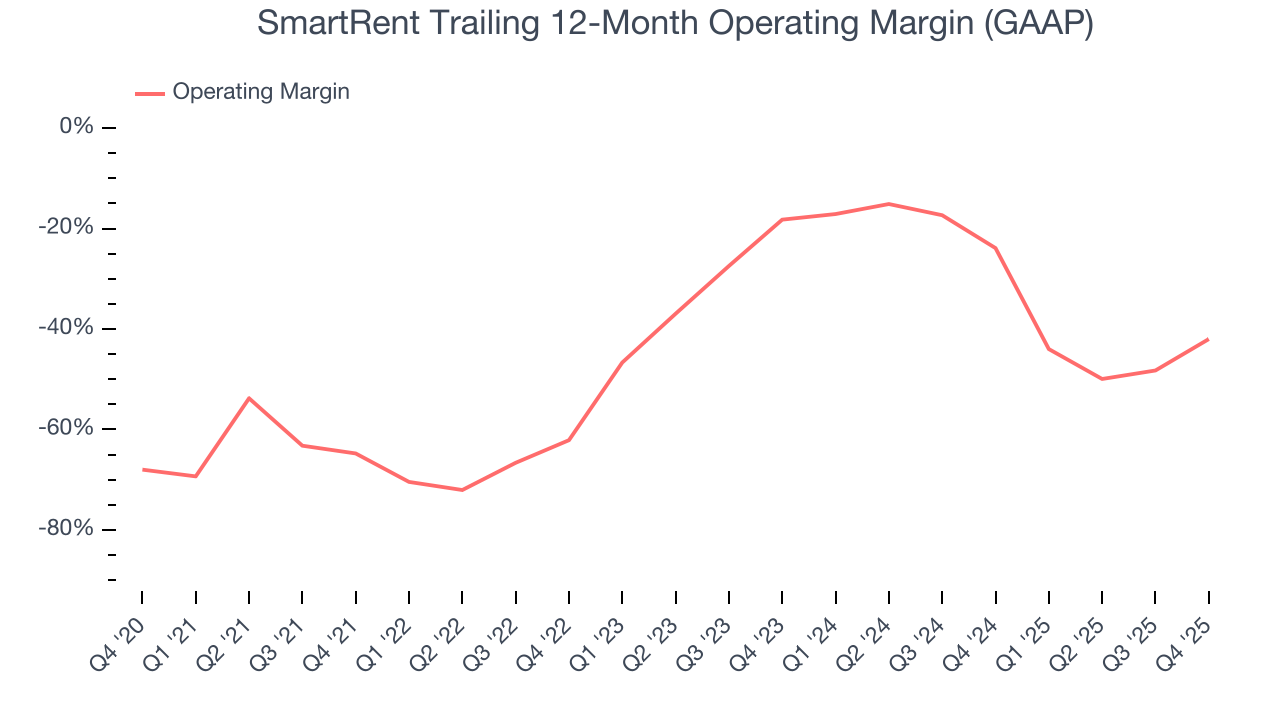

7. Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

SmartRent’s high expenses have contributed to an average operating margin of negative 38.6% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out.

On the plus side, SmartRent’s operating margin rose by 22.8 percentage points over the last five years, as its sales growth gave it operating leverage. Still, it will take much more for the company to reach long-term profitability.

In Q4, SmartRent generated a negative 10.9% operating margin.

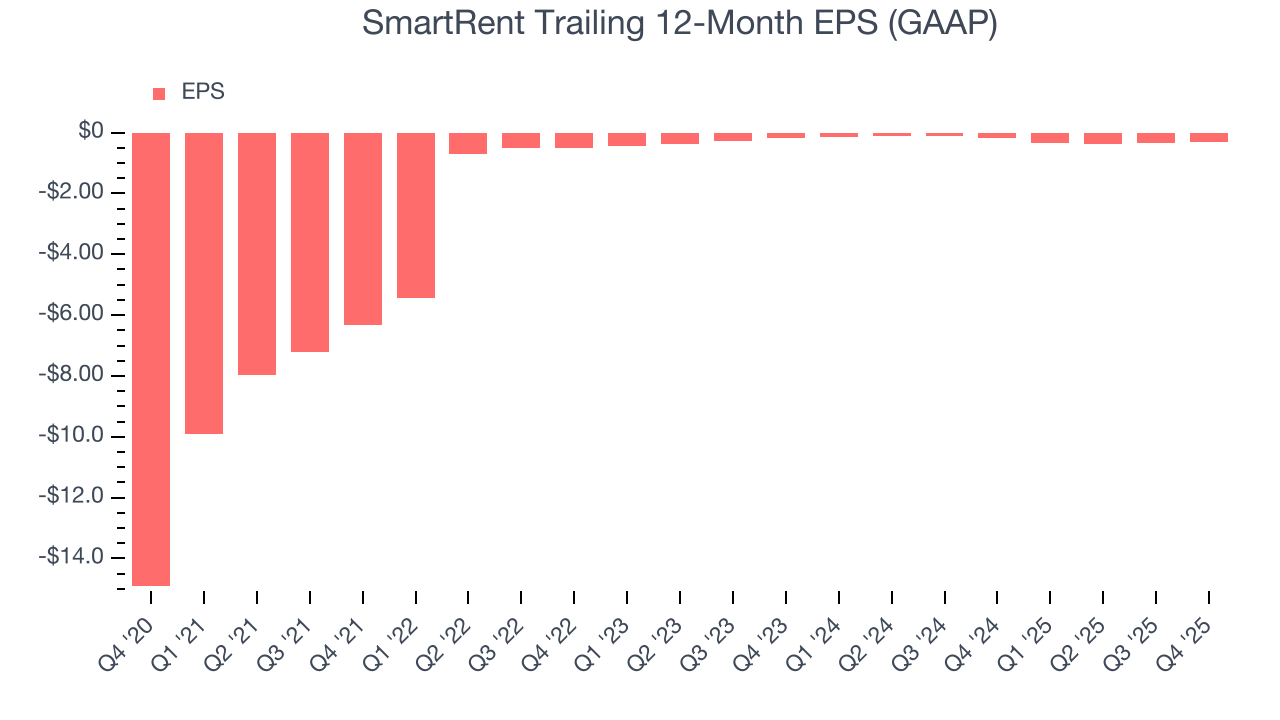

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Although SmartRent’s full-year earnings are still negative, it reduced its losses and improved its EPS by 53.6% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For SmartRent, its two-year annual EPS declines of 35.9% mark a reversal from its (seemingly) healthy five-year trend. We hope SmartRent can return to earnings growth in the future.

In Q4, SmartRent reported EPS of negative $0.02, up from negative $0.06 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects SmartRent to improve its earnings losses. Analysts forecast its full-year EPS of negative $0.32 will advance to negative $0.06.

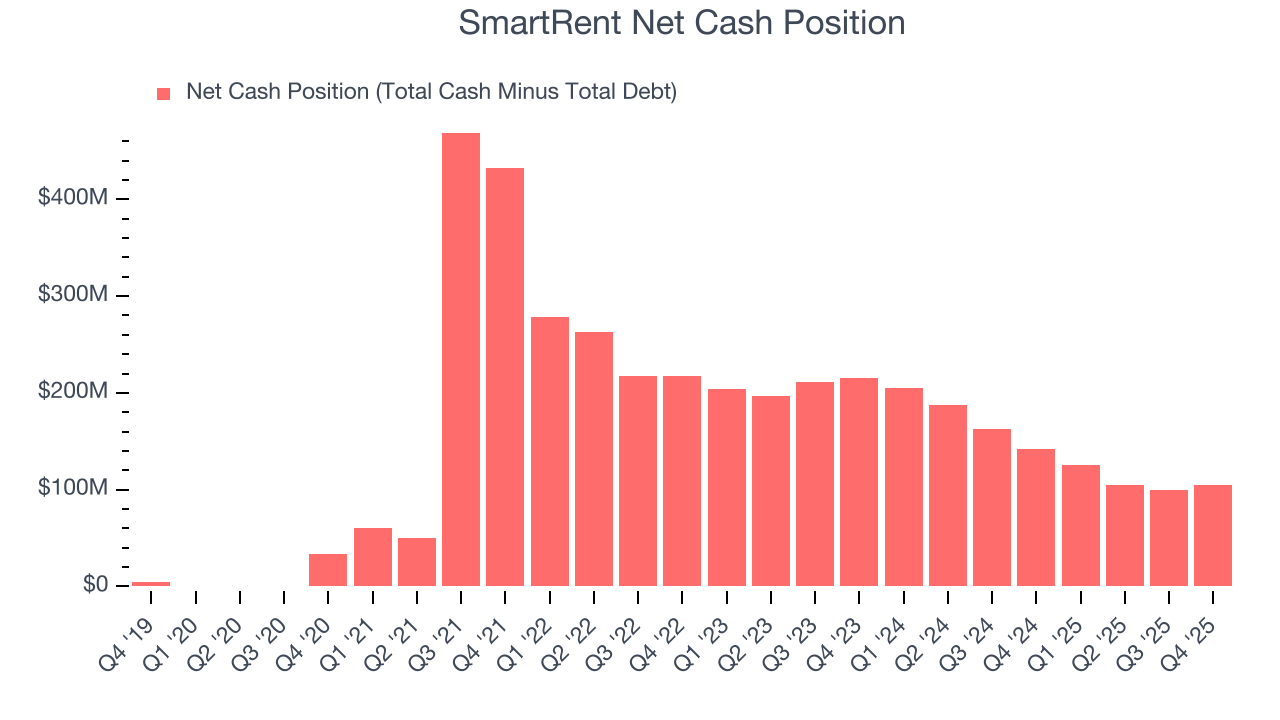

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

While SmartRent posted positive free cash flow this quarter, the broader story hasn’t been so clean. SmartRent’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 24.5%, meaning it lit $24.50 of cash on fire for every $100 in revenue.

Taking a step back, an encouraging sign is that SmartRent’s margin expanded by 47.3 percentage points during that time. In light of its glaring cash burn, however, this improvement is a bucket of hot water in a cold ocean.

SmartRent’s free cash flow clocked in at $5.97 million in Q4, equivalent to a 16.4% margin. Its cash flow turned positive after being negative in the same quarter last year, marking a potential inflection point.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although SmartRent has shown solid business quality lately, it struggled to grow profitably in the past. Its four-year average ROIC was negative 43.8%, meaning management lost money while trying to expand the business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, SmartRent’s ROIC has increased. This is a good sign, but we recognize its lack of profitable growth during the COVID era was the primary reason for the change.

11. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

SmartRent is a well-capitalized company with $104.6 million of cash and no debt. This position is 35.9% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from SmartRent’s Q4 Results

We were impressed by how significantly SmartRent blew past analysts’ EBITDA expectations this quarter. We were also glad its ARR outperformed Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 4.6% to $1.60 immediately following the results.

13. Is Now The Time To Buy SmartRent?

Updated: March 6, 2026 at 10:35 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own SmartRent, you should also grasp the company’s longer-term business quality and valuation.

SmartRent isn’t a terrible business, but it isn’t one of our picks. Although its revenue growth was exceptional over the last five years, it’s expected to deteriorate over the next 12 months and its relatively low ROIC suggests management has struggled to find compelling investment opportunities. And while the company’s ARR growth has been marvelous, the downside is its operating margins reveal poor profitability compared to other industrials companies.

SmartRent’s forward price-to-sales ratio is 2.1x. The market typically values companies like SmartRent based on their anticipated profits for the next 12 months, but there aren’t enough published estimates to arrive at a reliable number. You should avoid this stock for now - better opportunities lie elsewhere.

Wall Street analysts have a consensus one-year price target of $1.85 on the company (compared to the current share price of $1.77).