Target (TGT)

Target faces an uphill battle. Its plummeting sales and returns on capital show its profits are shrinking as demand fizzles out.― StockStory Analyst Team

1. News

2. Summary

Why We Think Target Will Underperform

With a higher focus on style and aesthetics compared to other large general merchandise retailers, Target (NYSE:TGT) serves the suburban consumer who is looking for a wide range of products under one roof.

- Commoditized inventory, bad unit economics, and high competition are reflected in its low gross margin of 28%

- Sales tumbled by 1.3% annually over the last three years, showing consumer trends are working against its favor

- Subpar operating margin constrains its ability to invest in process improvements or effectively respond to new competitive threats

Target’s quality doesn’t meet our expectations. We’d search for superior opportunities elsewhere.

Why There Are Better Opportunities Than Target

Why There Are Better Opportunities Than Target

Target is trading at $120.61 per share, or 15x forward P/E. While valuation is appropriate for the quality you get, we’re still not buyers.

There are stocks out there similarly priced with better business quality. We prefer owning these.

3. Target (TGT) Research Report: Q4 CY2025 Update

General merchandise retailer Target (NYSE:TGT) met Wall Street’s revenue expectations in Q4 CY2025, but sales fell by 1.5% year on year to $30.45 billion. Its non-GAAP profit of $2.44 per share was 13% above analysts’ consensus estimates.

Target (TGT) Q4 CY2025 Highlights:

- Revenue: $30.45 billion vs analyst estimates of $30.46 billion (1.5% year-on-year decline, in line)

- Adjusted EPS: $2.44 vs analyst estimates of $2.16 (13% beat)

- Adjusted EBITDA: $2.15 billion vs analyst estimates of $2.13 billion (7% margin, 0.7% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $8 at the midpoint, beating analyst estimates by 4.7%

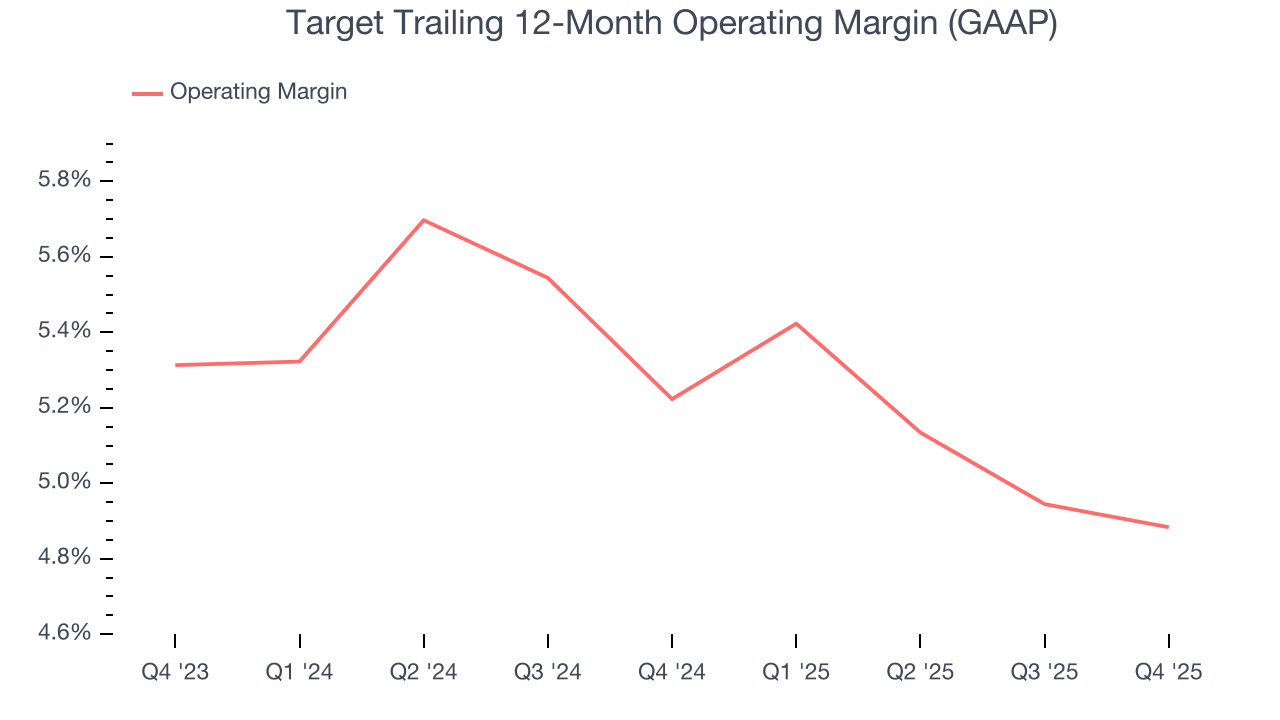

- Operating Margin: 4.5%, in line with the same quarter last year

- Free Cash Flow Margin: 7.2%, similar to the same quarter last year

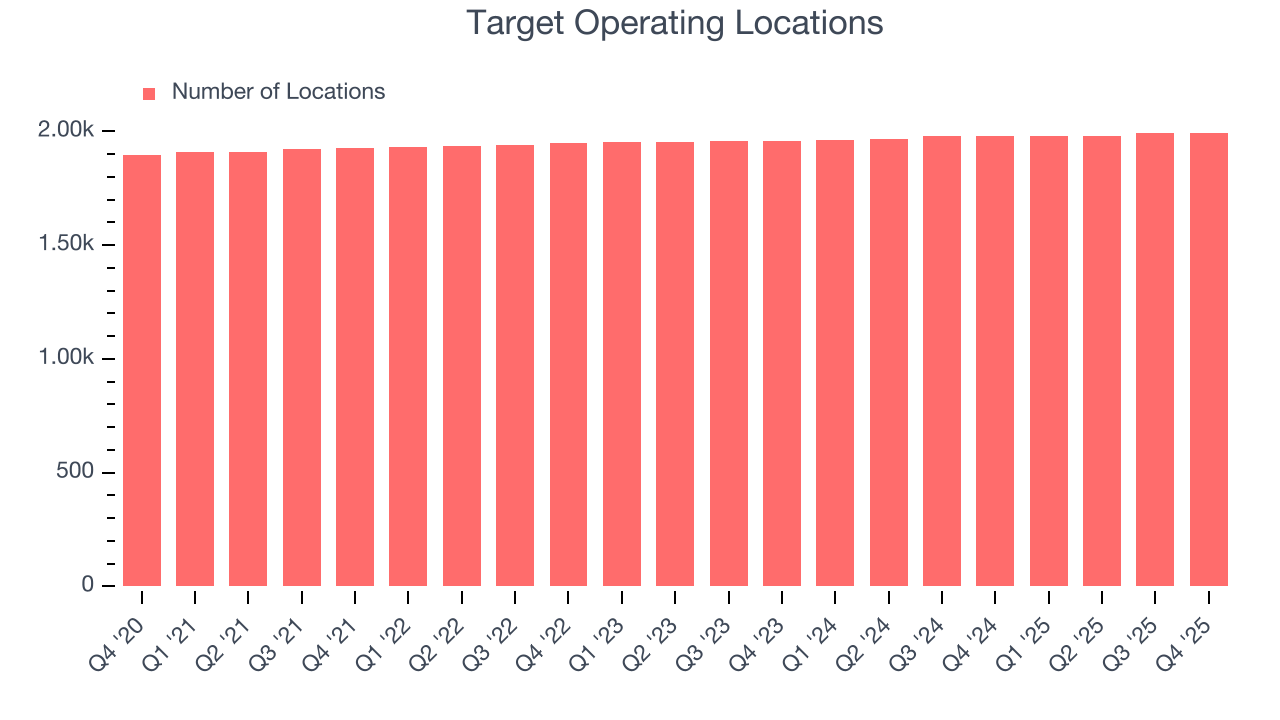

- Locations: 1,995 at quarter end, up from 1,978 in the same quarter last year

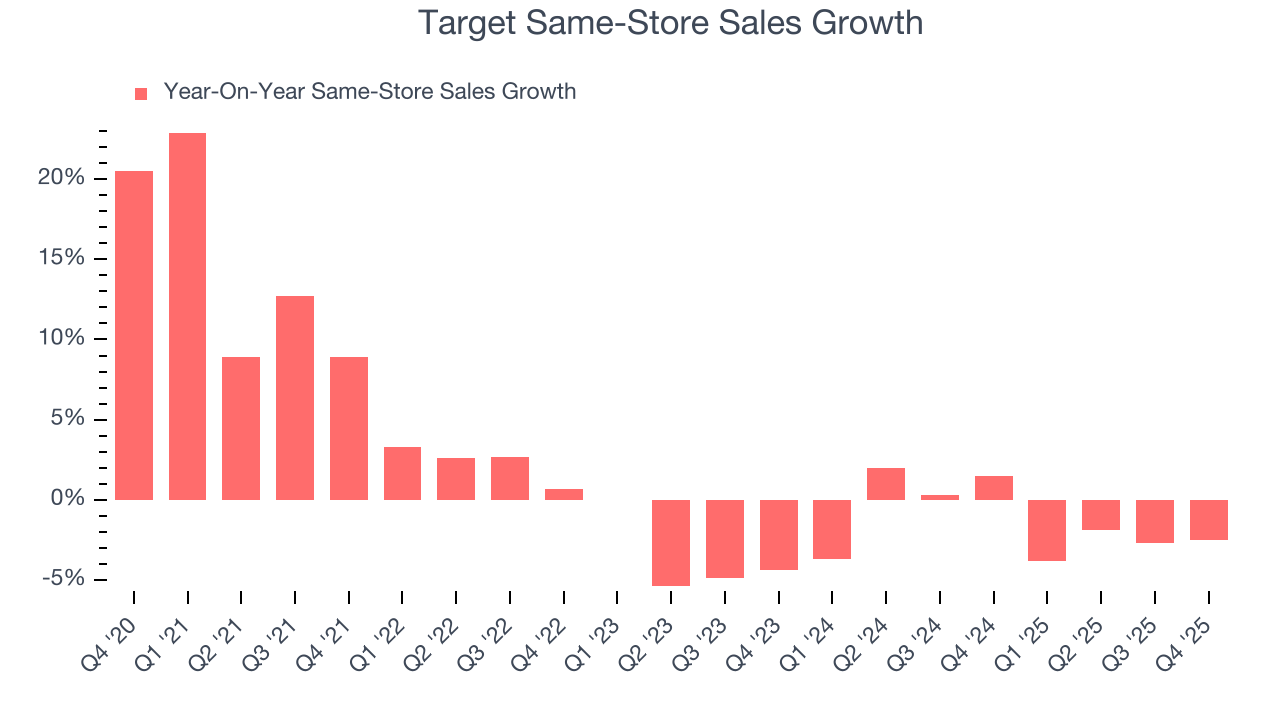

- Same-Store Sales fell 2.5% year on year (1.5% in the same quarter last year)

- Market Capitalization: $51.24 billion

Company Overview

With a higher focus on style and aesthetics compared to other large general merchandise retailers, Target (NYSE:TGT) serves the suburban consumer who is looking for a wide range of products under one roof.

Founded in 1902 as the Dayton Dry Goods Company, Target now positions itself as both a one-stop shop but also a trendier alternative to competitors. The company serves the customer who is both value and trend-focused, and this customer is usually a middle-aged female shopping for herself and her family. While that shopper can find everything from clothing to home decor to toys to groceries at Target, the company differentiates itself through collaborations with designers to create exclusive clothing lines or partnerships with popular brands. The aim is to bring affordable luxury within reach of its customers.

A traditional Target store is large and averages over 100,000 square feet. These stores are located mostly in suburban areas, often as an anchor tenant in a shopping center and in close proximity to residential neighborhoods. The store layout is straightforward and organized, with sections for grocery, apparel, electronics, and home goods. Target has also introduced smaller, more localized store formats to serve urban and densely populated areas such as college campuses. In addition to physical stores, Target has an e-commerce presence that was launched in 2000. Customers can shop online and choose home delivery or store pickup, even with grocery offerings.

4. Large-format Grocery & General Merchandise Retailer

Big-box retailers operate large stores that sell groceries and general merchandise at highly competitive prices. Because of their scale and resulting purchasing power, these big-box retailers–with annual sales in the tens to hundreds of billions of dollars–are able to get attractive volume discounts and sell at often the lowest prices. While e-commerce is a threat, these retailers have been able to weather the storm by either providing a unique in-store shopping experience or by reinvesting their hefty profits into omnichannel investments.

Scaled competitors that sell general merchandise and/or groceries to US consumers include Walmart (NYSE:WMT), Amazon.com (NASDAQ:AMZN)–which as a reminder owns Whole Foods market, and Costco (NYSE:COST).

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $104.8 billion in revenue over the past 12 months, Target is a behemoth in the consumer retail sector and benefits from economies of scale, giving it an edge in distribution. This also enables it to gain more leverage on its fixed costs than smaller competitors and the flexibility to offer lower prices. However, its scale is a double-edged sword because there are only a finite number of places to build new stores, making it harder to find incremental growth. To expand meaningfully, Target likely needs to tweak its prices or enter new markets.

As you can see below, Target’s demand was weak over the last three years. Its sales fell by 1.3% annually as it didn’t open many new stores and observed lower sales at existing, established locations.

This quarter, Target reported a rather uninspiring 1.5% year-on-year revenue decline to $30.45 billion of revenue, in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 2% over the next 12 months. Although this projection suggests its newer products will catalyze better top-line performance, it is still below the sector average.

6. Store Performance

Number of Stores

A retailer’s store count often determines how much revenue it can generate.

Target operated 1,995 locations in the latest quarter, and over the last two years, has kept its store count flat while other consumer retail businesses have opted for growth.

When a retailer keeps its store footprint steady, it usually means demand is stable and it’s focusing on operational efficiency to increase profitability.

Same-Store Sales

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales is an industry measure of whether revenue is growing at those existing stores and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Target’s demand has been shrinking over the last two years as its same-store sales have averaged 1.4% annual declines. This performance isn’t ideal, and we’d be concerned if Target starts opening new stores to artificially boost revenue growth.

In the latest quarter, Target’s same-store sales fell by 2.5% year on year. This decrease represents a further deceleration from its historical levels. We hope the business can get back on track.

7. Gross Margin & Pricing Power

Target has bad unit economics for a retailer, signaling it operates in a competitive market and lacks pricing power because its inventory is sold in many places. As you can see below, it averaged a 28% gross margin over the last two years.

Non-discretionary retailers, however, must be viewed through a different lens because they compete on the lowest price, sell products easily found elsewhere, and have high transportation costs to move goods. These dynamics lead to structurally lower gross margins, so the best metrics to assess them are free cash flow margin, operating leverage, and profit volatility, which account for their scale advantages and non-cyclical demand.

In Q4, Target produced a 26.6% gross profit margin, in line with the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting it strives to keep prices low for customers and has stable input costs (such as labor and freight expenses to transport goods).

8. Operating Margin

Target’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 5.1% over the last two years. This profitability was paltry for a consumer retail business and caused by its suboptimal cost structureand low gross margin.

Looking at the trend in its profitability, Target’s operating margin might fluctuated slightly but has generally stayed the same over the last year, which doesn’t help its cause.

This quarter, Target generated an operating margin profit margin of 4.5%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

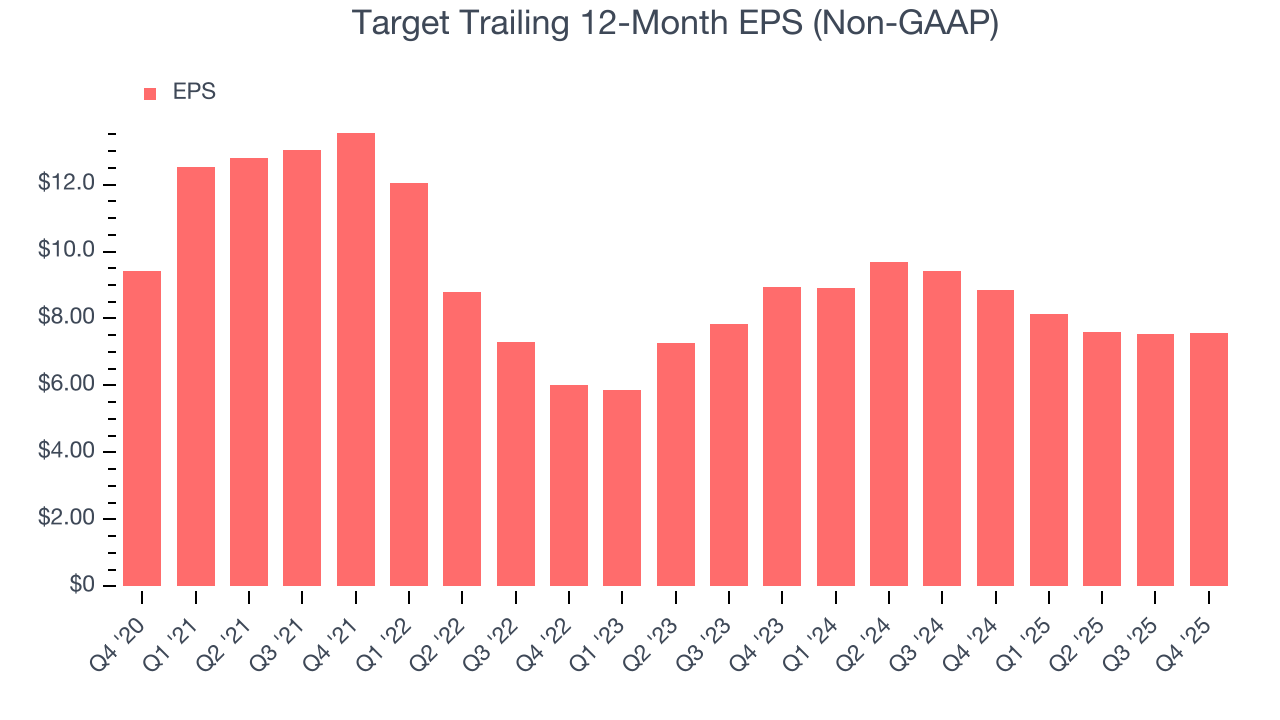

9. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Target’s EPS grew at an unimpressive 8% compounded annual growth rate over the last three years. This performance was better than its 1.3% annualized revenue declines but doesn’t tell us much about its business quality because its operating margin didn’t improve.

In Q4, Target reported adjusted EPS of $2.44, up from $2.41 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Target’s full-year EPS of $7.57 to grow 1.7%.

10. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Target has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 3.5% over the last two years, slightly better than the broader consumer retail sector.

Taking a step back, we can see that Target’s margin dropped by 1.5 percentage points over the last year. This decrease warrants extra caution because Target failed to grow its same-store sales. Its cash profitability could decay further if it tries to reignite growth by opening new stores.

Target’s free cash flow clocked in at $2.19 billion in Q4, equivalent to a 7.2% margin. This cash profitability was in line with the comparable period last year and above its two-year average.

11. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Target’s management team makes decent investment decisions and generates value for shareholders. Its five-year average ROIC was 17.3%, slightly better than typical consumer retail business.

12. Balance Sheet Assessment

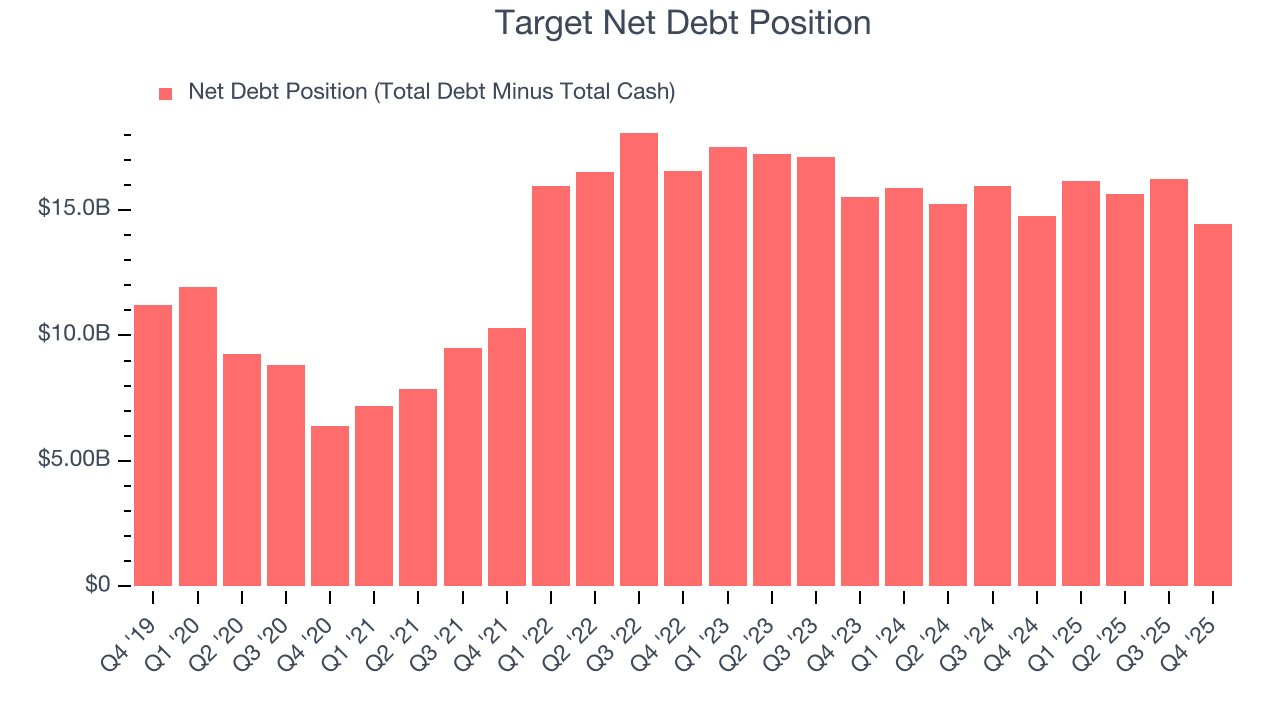

Target reported $5.49 billion of cash and $19.92 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $7.39 billion of EBITDA over the last 12 months, we view Target’s 2.0× net-debt-to-EBITDA ratio as safe. We also see its $248 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

13. Key Takeaways from Target’s Q4 Results

It was great to see Target’s full-year EPS guidance top analysts’ expectations. We were also glad its EPS outperformed Wall Street’s estimates. Overall, we think this was still a solid quarter with some key areas of upside. The stock traded up 3.9% to $117.60 immediately following the results.

14. Is Now The Time To Buy Target?

Updated: March 6, 2026 at 9:47 PM EST

Before deciding whether to buy Target or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

Target doesn’t pass our quality test. For starters, its revenue has declined over the last three years. While its coveted brand awareness makes it a household name consumers consistently turn to, the downside is its gross margins make it more challenging to reach positive operating profits compared to other consumer retail businesses. On top of that, its shrinking same-store sales tell us it will need to change its strategy to succeed.

Target’s P/E ratio based on the next 12 months is 15x. This valuation is reasonable, but the company’s shaky fundamentals present too much downside risk. There are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $123.13 on the company (compared to the current share price of $120.61).