Kroger (KR)

Kroger is up against the odds. Not only are its sales cratering but also its low returns on capital suggest it struggles to generate profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Kroger Will Underperform

With a sprawling network of over 2,400 locations offering digital pickup services, Kroger (NYSE:KR) operates supermarkets, pharmacies, and fuel centers across 35 states, offering customers groceries, household items, and private-label products.

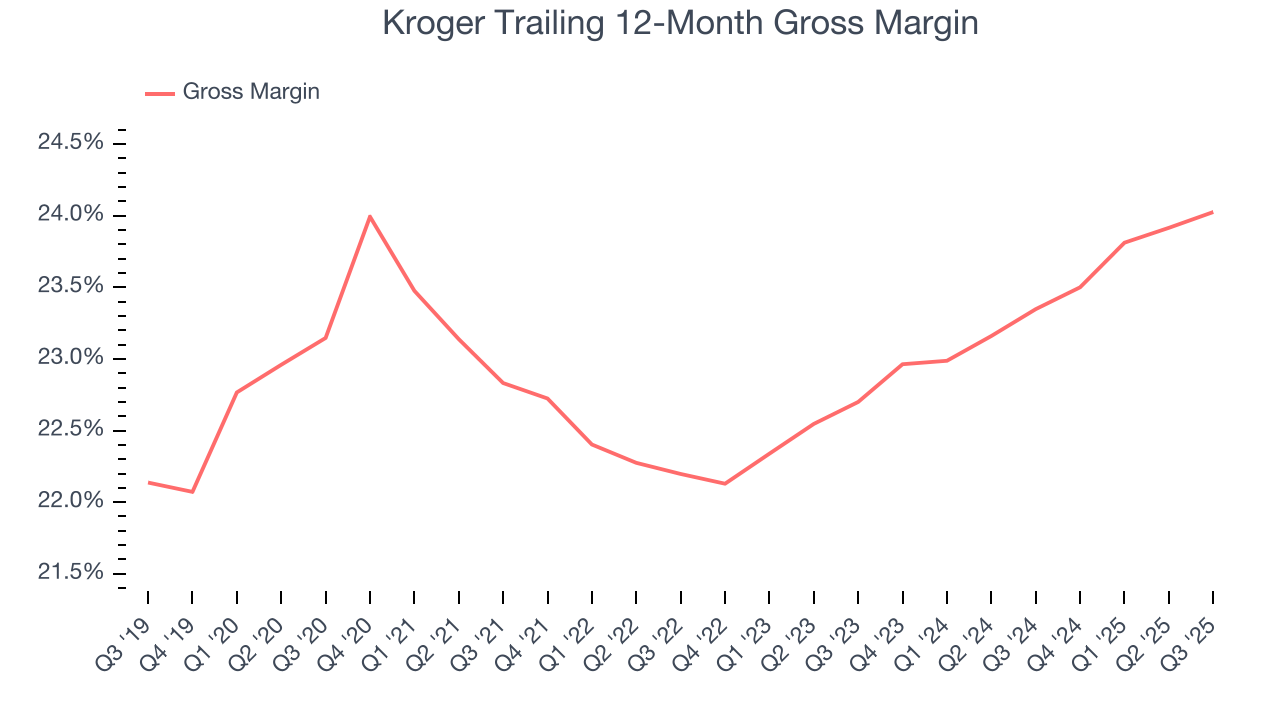

- Widely-available products (and therefore stiff competition) result in an inferior gross margin of 23.7% that must be offset through higher volumes

- Earnings per share fell by 29.8% annually over the last three years while its revenue was flat, showing each sale was less profitable

- Sales stagnated over the last three years and signal the need for new growth strategies

Kroger doesn’t check our boxes. We believe there are better opportunities elsewhere.

Why There Are Better Opportunities Than Kroger

Why There Are Better Opportunities Than Kroger

Kroger’s stock price of $71.25 implies a valuation ratio of 13.5x forward P/E. The current valuation may be fair, but we’re still passing on this stock due to better alternatives out there.

We prefer to invest in similarly-priced but higher-quality companies with superior earnings growth.

3. Kroger (KR) Research Report: Q3 CY2025 Update

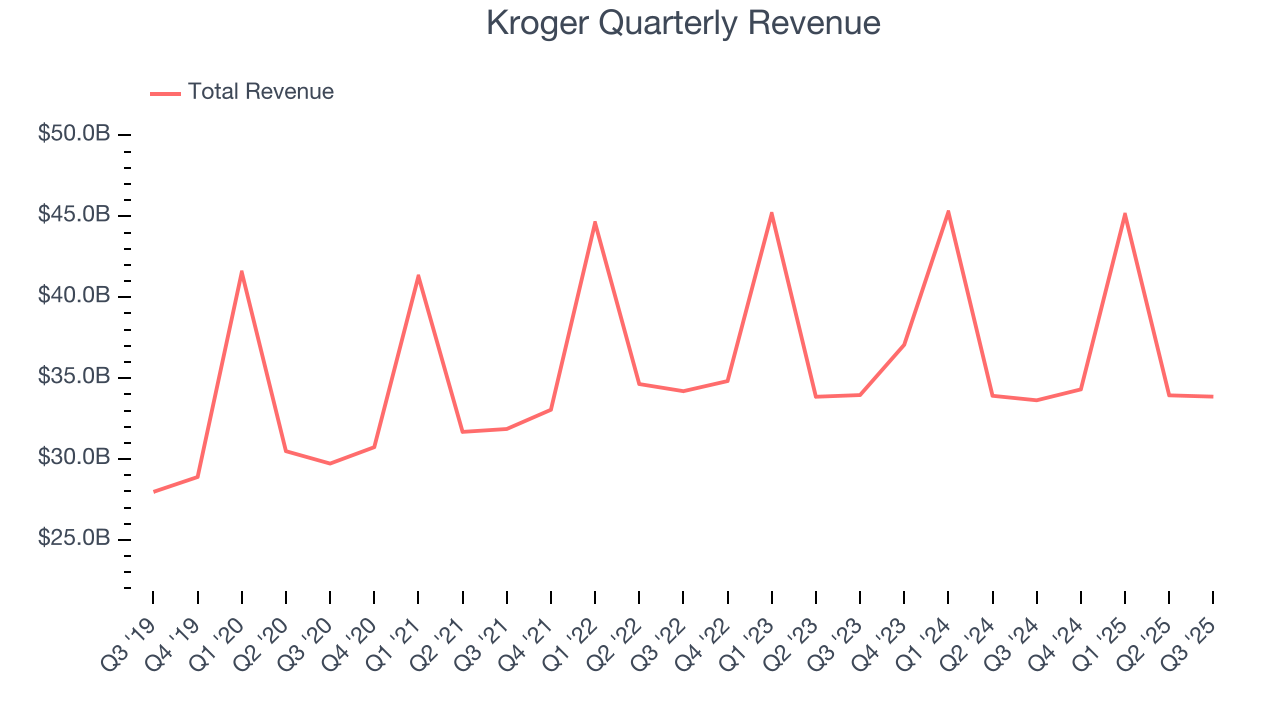

Grocery retail giant Kroger (NYSE:KR) missed Wall Street’s revenue expectations in Q3 CY2025, with sales flat year on year at $33.86 billion. Its GAAP loss of $2.02 per share was significantly below analysts’ consensus estimates.

Kroger (KR) Q3 CY2025 Highlights:

- Revenue: $33.86 billion vs analyst estimates of $34.21 billion (flat year on year, 1% miss)

- EPS (GAAP): -$2.02 vs analyst estimates of $1.05 (significant miss)

- Adjusted EBITDA: $1.83 billion vs analyst estimates of $1.83 billion (5.4% margin, in line)

- EPS (GAAP) guidance for the full year is $4.78 at the midpoint, beating analyst estimates by 4.3%

- Operating Margin: -4.6%, down from 2.5% in the same quarter last year

- Free Cash Flow was $29 million, up from -$28 million in the same quarter last year

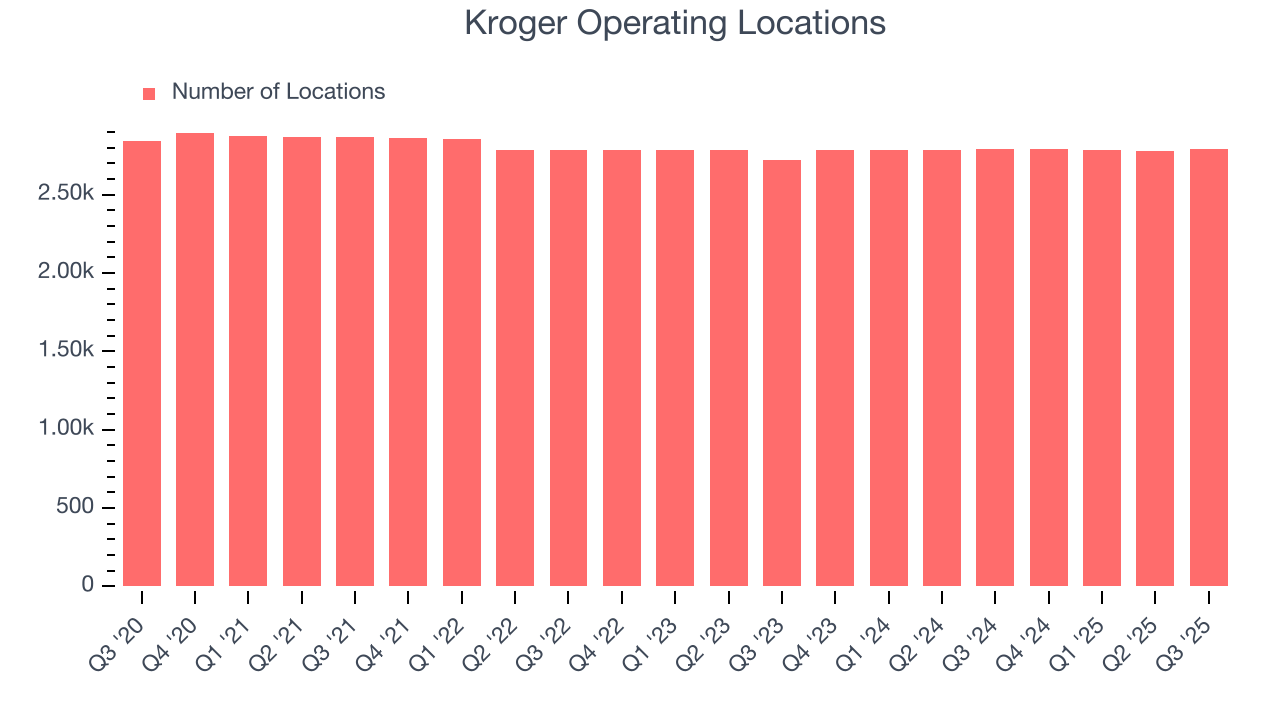

- Locations: 2,789.7 at quarter end, up from 2,788.5 in the same quarter last year

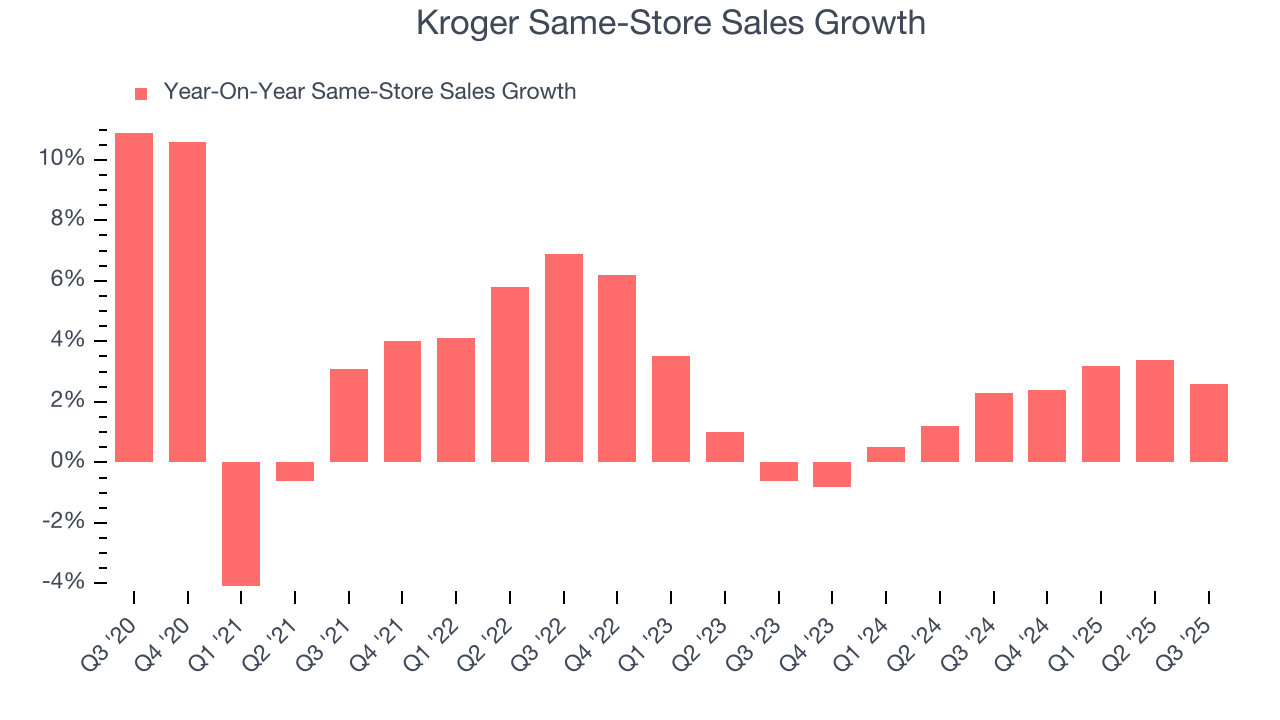

- Same-Store Sales rose 2.6% year on year, in line with the same quarter last year

- Market Capitalization: $39.84 billion

Company Overview

With a sprawling network of over 2,400 locations offering digital pickup services, Kroger (NYSE:KR) operates supermarkets, pharmacies, and fuel centers across 35 states, offering customers groceries, household items, and private-label products.

Kroger combines physical retail with an expanding digital ecosystem to create a seamless shopping experience. Customers can shop in-store or use the company's Pickup, Delivery, and Ship services to receive their orders. The company's omnichannel strategy allows it to serve customers through multiple touchpoints while maintaining consistent selection and pricing.

At the core of Kroger's merchandising approach is its three-tiered private label strategy. The premium Private Selection brand offers gourmet and specialty items; the midrange Kroger brand provides national-brand-equivalent quality at lower prices; and value brands like Big K and Smart Way deliver affordable options. Simple Truth and Simple Truth Organic round out the portfolio with natural and organic products free from artificial ingredients.

Kroger's data analytics capabilities are particularly robust. With approximately 63 million households served annually and over 95% of transactions linked to loyalty cards, the company leverages customer insights to personalize shopping experiences. This data powers Kroger Precision Marketing, the company's retail media business that provides targeted advertising capabilities for consumer packaged goods partners, creating an additional revenue stream beyond traditional retail sales.

Kroger also operates its own food manufacturing facilities, including dairies, bakeries, and meat processing plants, giving it greater control over its supply chain and enabling it to respond quickly to changing consumer preferences.

4. Grocery Store

Grocery stores are non-discretionary because they sell food, an essential staple for life (maybe not that ice cream?). Selling food, however, is a notoriously tough business as grocers must deal with the costs of procuring and transporting oftentimes perishable products. Plus, the costs of operating stores to sell everything from raw meat to ice cream and fresh fruit are high. Competition is also fierce because grocers and other peers such as wholesale clubs tend to sell very similar brands and products. On the bright side, grocery is one of the least penetrated categories in e-commerce because customers prefer to buy their food in person. Still, the online threat exists and will likely increase over time rather than dwindle.

Kroger competes primarily with Walmart (NYSE:WMT), Target (NYSE:TGT), Albertsons (NYSE:ACI), Ahold Delhaize (OTCMKTS:ADRNY), and regional grocery chains, as well as with Amazon (NASDAQ:AMZN) in the online grocery space.

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $147.2 billion in revenue over the past 12 months, Kroger is a behemoth in the consumer retail sector and benefits from economies of scale, giving it an edge in distribution. This also enables it to gain more leverage on its fixed costs than smaller competitors and the flexibility to offer lower prices. However, its scale is a double-edged sword because there is only so much real estate to build new stores, placing a ceiling on its growth. To accelerate sales, Kroger likely needs to optimize its pricing or lean into international expansion.

As you can see below, Kroger struggled to increase demand as its $147.2 billion of sales for the trailing 12 months was close to its revenue three years ago. This was mainly because it didn’t open many new stores.

This quarter, Kroger’s $33.86 billion of revenue was flat year on year, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 1.7% over the next 12 months, similar to its three-year rate. While this projection suggests its newer products will catalyze better top-line performance, it is still below average for the sector.

6. Store Performance

Number of Stores

Kroger operated 2,790 locations in the latest quarter, and over the last two years, has kept its store count flat while other consumer retail businesses have opted for growth.

When a retailer keeps its store footprint steady, it usually means demand is stable and it’s focusing on operational efficiency to increase profitability.

Same-Store Sales

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales gives us insight into this topic because it measures organic growth for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year.

Kroger’s demand within its existing locations has been relatively stable over the last two years but was below most retailers. On average, the company’s same-store sales have grown by 1.9% per year. Given its flat store base over the same period, this performance stems from a mixture of increased foot traffic at existing locations and higher e-commerce sales as demand shifts from in-store to online.

In the latest quarter, Kroger’s same-store sales rose 2.6% year on year. This performance was more or less in line with its historical levels.

7. Gross Margin & Pricing Power

Gross profit margins are an important measure of a retailer’s pricing power, product differentiation, and negotiating leverage.

Kroger has bad unit economics for a retailer, signaling it operates in a competitive market and lacks pricing power because its inventory is sold in many places. As you can see below, it averaged a 23.7% gross margin over the last two years.

Non-discretionary retailers, however, must be viewed through a different lens because they compete on the lowest price, sell products easily found elsewhere, and have high transportation costs to move goods. These dynamics lead to structurally lower gross margins, so the best metrics to assess them are free cash flow margin, operating leverage, and profit volatility, which account for their scale advantages and non-cyclical demand.

This quarter, Kroger’s gross profit margin was 23.3%, in line with the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting it strives to keep prices low for customers and has stable input costs (such as labor and freight expenses to transport goods).

8. Operating Margin

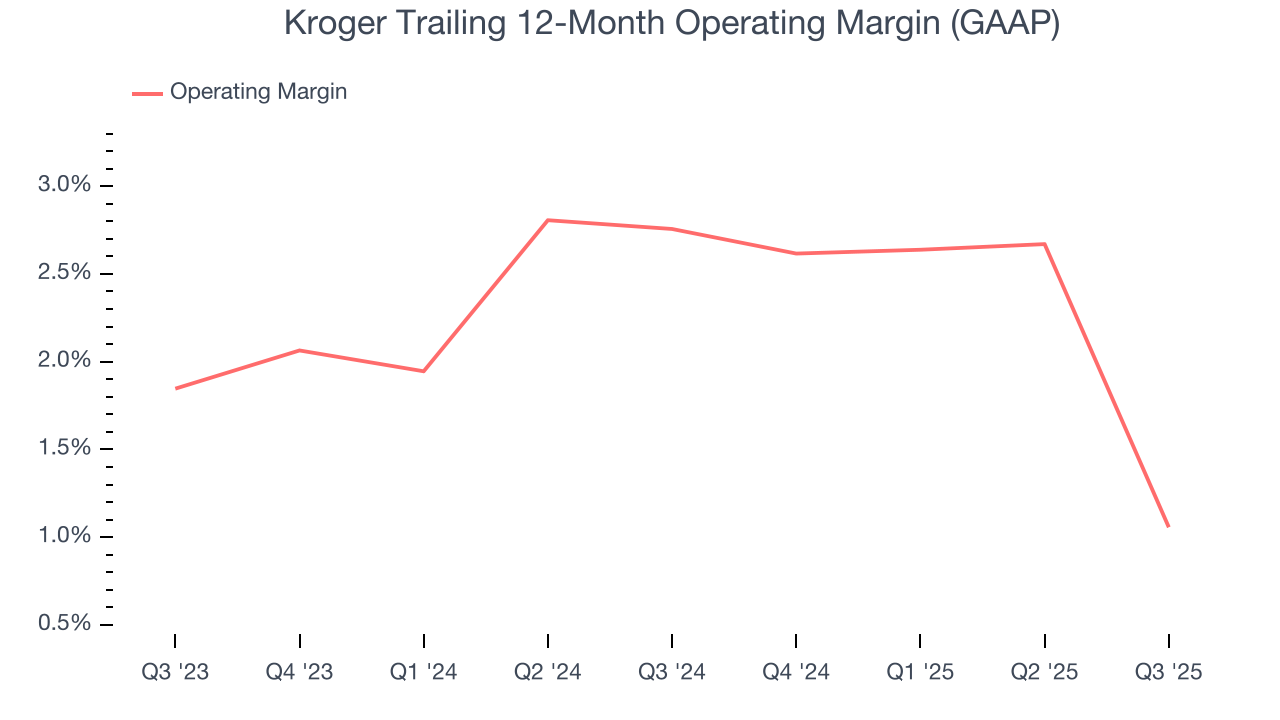

Kroger was profitable over the last two years but held back by its large cost base. Its average operating margin of 1.9% was weak for a consumer retail business. This result isn’t too surprising given its low gross margin as a starting point.

Looking at the trend in its profitability, Kroger’s operating margin decreased by 1.7 percentage points over the last year. Kroger’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, Kroger generated an operating margin profit margin of negative 4.6%, down 7 percentage points year on year. Since Kroger’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, and administrative overhead increased.

9. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

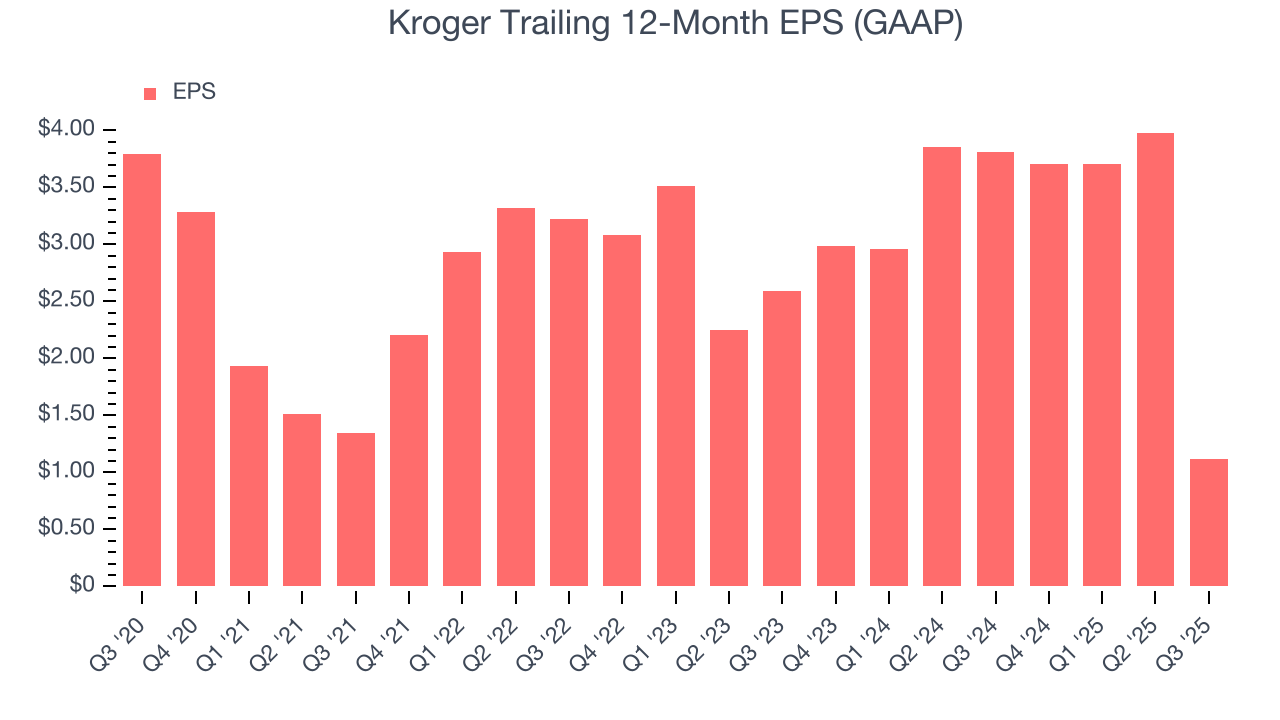

Sadly for Kroger, its EPS declined by 29.8% annually over the last three years while its revenue was flat. This tells us the company struggled because its fixed cost base made it difficult to adjust to choppy demand.

In Q3, Kroger reported EPS of negative $2.02, down from $0.85 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Kroger’s full-year EPS of $1.12 to grow 368%.

10. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

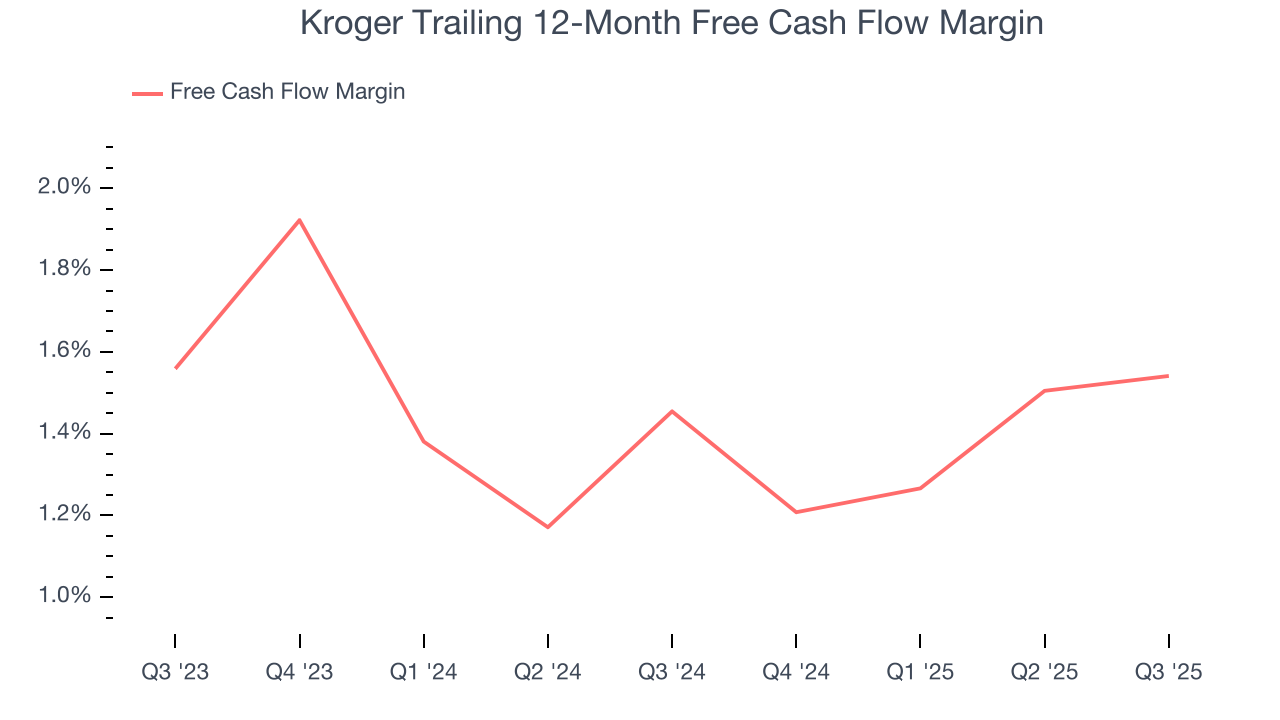

Kroger has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 1.5%, subpar for a consumer retail business.

Kroger broke even from a free cash flow perspective in Q3. This cash profitability was in line with the comparable period last year but below its two-year average. In a silo, this isn’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

11. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Kroger historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 11.1%, somewhat low compared to the best consumer retail companies that consistently pump out 25%+.

12. Balance Sheet Assessment

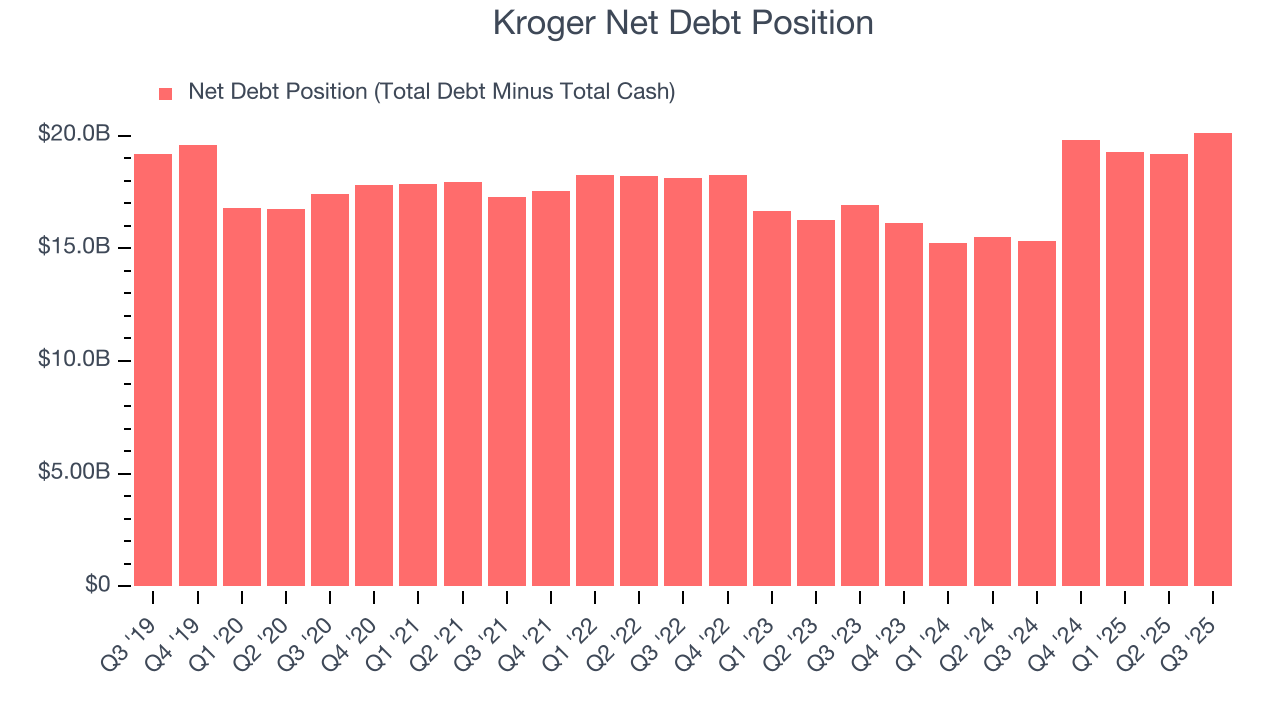

Kroger reported $5.07 billion of cash and $25.2 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $8.07 billion of EBITDA over the last 12 months, we view Kroger’s 2.5× net-debt-to-EBITDA ratio as safe. We also see its $645 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

13. Key Takeaways from Kroger’s Q3 Results

It was great to see Kroger’s full-year EPS guidance top analysts’ expectations. We were also happy its gross margin outperformed Wall Street’s estimates. On the other hand, its EPS missed and its revenue fell slightly short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 1.6% to $61.97 immediately after reporting.

14. Is Now The Time To Buy Kroger?

Updated: February 15, 2026 at 11:37 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Kroger.

We cheer for all companies serving everyday consumers, but in the case of Kroger, we’ll be cheering from the sidelines. To begin with, its revenue growth was weak over the last three years. While its projected EPS for the next year implies the company’s fundamentals will improve, the downside is its declining EPS over the last three years makes it a less attractive asset to the public markets. On top of that, its gross margins make it more challenging to reach positive operating profits compared to other consumer retail businesses.

Kroger’s P/E ratio based on the next 12 months is 13.5x. This valuation is reasonable, but the company’s shaky fundamentals present too much downside risk. There are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $73.50 on the company (compared to the current share price of $71.25).