Albertsons (ACI)

We aren’t fans of Albertsons. Its weak sales growth and declining returns on capital show its demand and profits are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why We Think Albertsons Will Underperform

With over 20 well-known grocery banners spanning 34 states, Albertsons (NYSE:ACI) operates food and drug retail stores across the US, offering groceries, pharmacy services, and own-brand products under banners like Safeway, Jewel-Osco, and Vons.

- Widely-available products (and therefore stiff competition) result in an inferior gross margin of 27.5% that must be offset through higher volumes

- Subpar operating margin constrains its ability to invest in process improvements or effectively respond to new competitive threats

- The good news is that its massive revenue base of $81.37 billion makes up for its weaker gross margin and makes it a household name that influences purchasing decisions

Albertsons’s quality isn’t up to par. We’re on the lookout for more interesting opportunities.

Why There Are Better Opportunities Than Albertsons

Why There Are Better Opportunities Than Albertsons

Albertsons’s stock price of $18.51 implies a valuation ratio of 8.5x forward P/E. This sure is a cheap multiple, but you get what you pay for.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. Albertsons (ACI) Research Report: Q3 CY2025 Update

Grocery retailer Albertsons (NYSE:ACI) met Wall Streets revenue expectations in Q3 CY2025, with sales up 2% year on year to $18.92 billion. Its non-GAAP profit of $0.44 per share was 10.6% above analysts’ consensus estimates.

Albertsons (ACI) Q3 CY2025 Highlights:

- Revenue: $18.92 billion vs analyst estimates of $18.88 billion (2% year-on-year growth, in line)

- Adjusted EPS: $0.44 vs analyst estimates of $0.40 (10.6% beat)

- Adjusted EBITDA: $848.4 million vs analyst estimates of $825 million (4.5% margin, 2.8% beat)

- Adjusted EPS guidance for the full year is $2.12 at the midpoint, missing analyst estimates by 1.2%

- EBITDA guidance for the full year is $3.85 billion at the midpoint, in line with analyst expectations

- Operating Margin: 1.6%, in line with the same quarter last year

- Free Cash Flow Margin: 0.9%, similar to the same quarter last year

- Locations: 2,257 at quarter end, down from 2,267 in the same quarter last year

- Same-Store Sales rose 2.2% year on year, in line with the same quarter last year

- Market Capitalization: $9.4 billion

Company Overview

With over 20 well-known grocery banners spanning 34 states, Albertsons (NYSE:ACI) operates food and drug retail stores across the US, offering groceries, pharmacy services, and own-brand products under banners like Safeway, Jewel-Osco, and Vons.

Albertsons functions as a multi-regional supermarket operator, creating distinct shopping experiences tailored to local preferences. The company maintains a diverse portfolio of store brands positioned at different price points and market segments, from neighborhood supermarkets to upscale specialty grocers like Balducci's Food Lovers Market.

Beyond traditional retail, Albertsons has developed an omnichannel approach that includes curbside pickup via its Drive Up & Go service and home delivery through both its proprietary platform and partnerships with third-party services like Instacart, DoorDash, Uber, and Grubhub. This digital ecosystem is enhanced by a loyalty program with tens of millions of members.

The company also maintains vertical integration through its manufacturing operations, with nearly 20 food production facilities creating thousands of private-label products. These "Own Brands" include value-oriented offerings like Value Corner, premium lines like Signature Reserve, and specialty categories such as O Organics. A typical Albertsons store might feature a pharmacy dispensing medications and vaccines, an in-store coffee shop, fresh-baked goods from company bakeries, and store-brand milk processed at company-owned dairy plants.

Revenue generation comes primarily from retail sales to consumers, with additional income from pharmacy operations, fuel centers at select locations, and digital partnerships. The company leverages both national marketing strategies and localized merchandising to address the specific demographics of its operating regions.

4. Grocery Store

Grocery stores are non-discretionary because they sell food, an essential staple for life (maybe not that ice cream?). Selling food, however, is a notoriously tough business as grocers must deal with the costs of procuring and transporting oftentimes perishable products. Plus, the costs of operating stores to sell everything from raw meat to ice cream and fresh fruit are high. Competition is also fierce because grocers and other peers such as wholesale clubs tend to sell very similar brands and products. On the bright side, grocery is one of the least penetrated categories in e-commerce because customers prefer to buy their food in person. Still, the online threat exists and will likely increase over time rather than dwindle.

Albertsons competes with other major grocery retailers like Kroger (NYSE:KR), Walmart (NYSE:WMT), Target (NYSE:TGT), Costco (NASDAQ:COST), and regional chains such as Publix and H-E-B, as well as specialty grocers like Whole Foods Market (owned by Amazon, NASDAQ:AMZN).

5. Revenue Growth

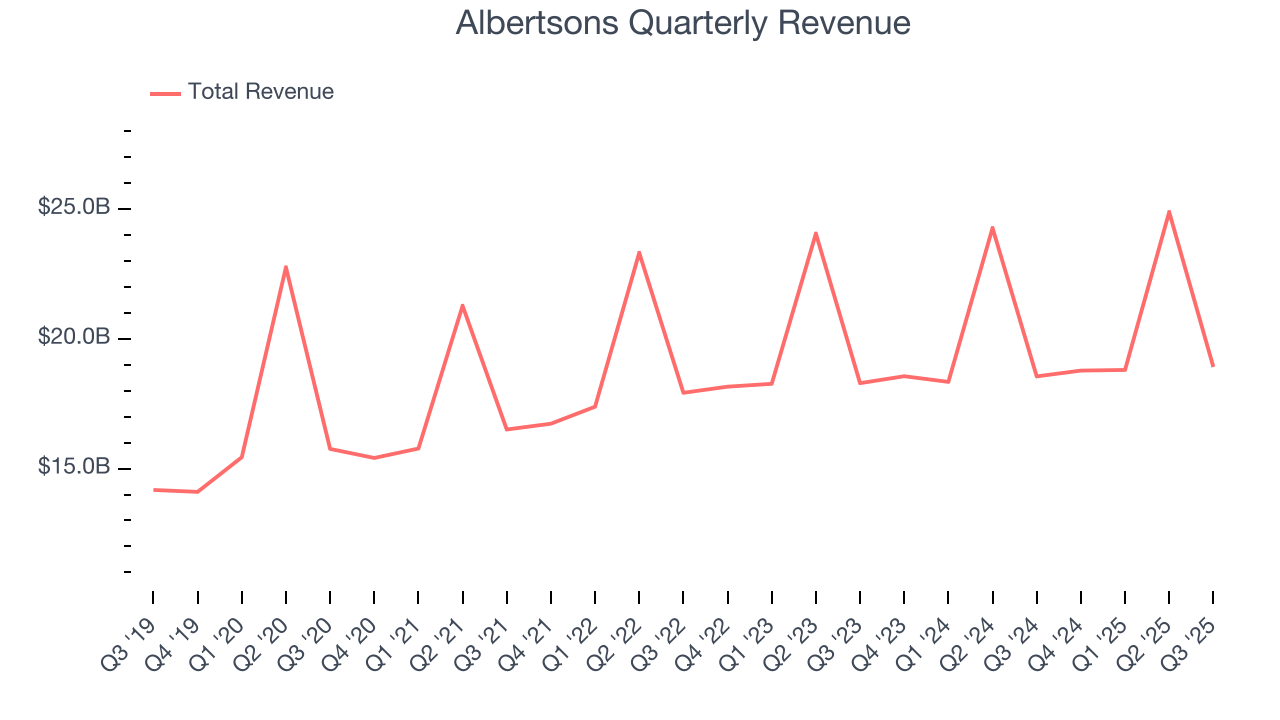

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $81.37 billion in revenue over the past 12 months, Albertsons is a behemoth in the consumer retail sector and benefits from economies of scale, giving it an edge in distribution. This also enables it to gain more leverage on its fixed costs than smaller competitors and the flexibility to offer lower prices. However, its scale is a double-edged sword because there are only a finite number of places to build new stores, making it harder to find incremental growth. To accelerate sales, Albertsons likely needs to optimize its pricing or lean into international expansion.

As you can see below, Albertsons grew its sales at a sluggish 2.6% compounded annual growth rate over the last three years as its store footprint remained unchanged.

This quarter, Albertsons grew its revenue by 2% year on year, and its $18.92 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 3.5% over the next 12 months, similar to its three-year rate. This projection is above the sector average and suggests its newer products will help support its historical top-line performance.

6. Store Performance

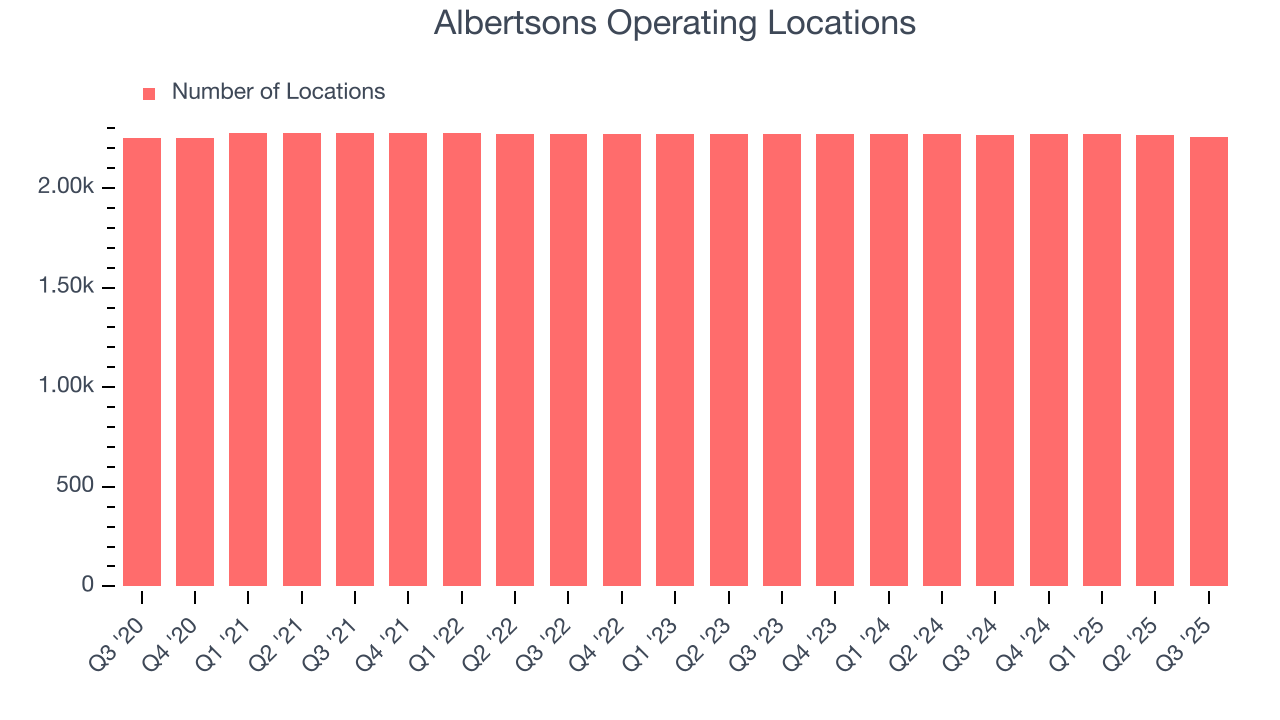

Number of Stores

A retailer’s store count influences how much it can sell and how quickly revenue can grow.

Albertsons operated 2,257 locations in the latest quarter, and over the last two years, has kept its store count flat while other consumer retail businesses have opted for growth.

When a retailer keeps its store footprint steady, it usually means demand is stable and it’s focusing on operational efficiency to increase profitability.

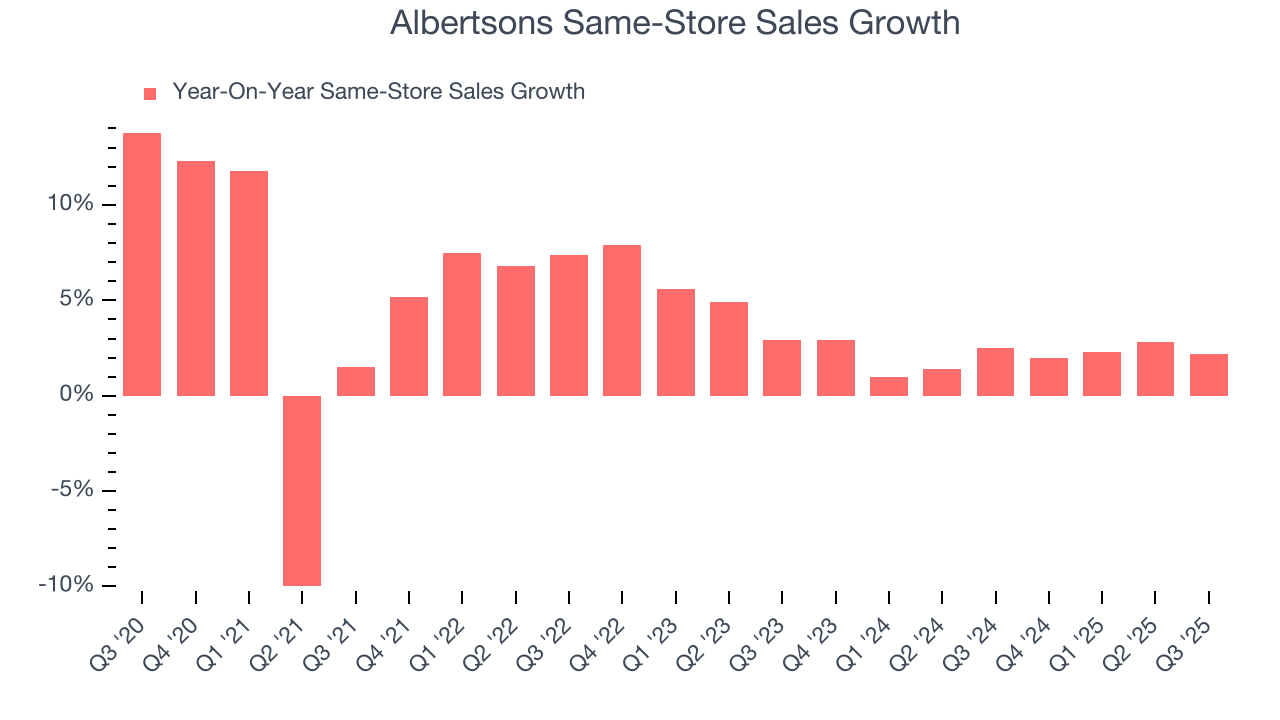

Same-Store Sales

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales gives us insight into this topic because it measures organic growth for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year.

Albertsons’s demand rose over the last two years and slightly outpaced the industry. On average, the company’s same-store sales have grown by 2.1% per year. Given its flat store base over the same period, this performance stems from not only increased foot traffic at existing locations but also higher e-commerce sales as demand shifts from in-store to online.

In the latest quarter, Albertsons’s same-store sales rose 2.2% year on year. This performance was more or less in line with its historical levels.

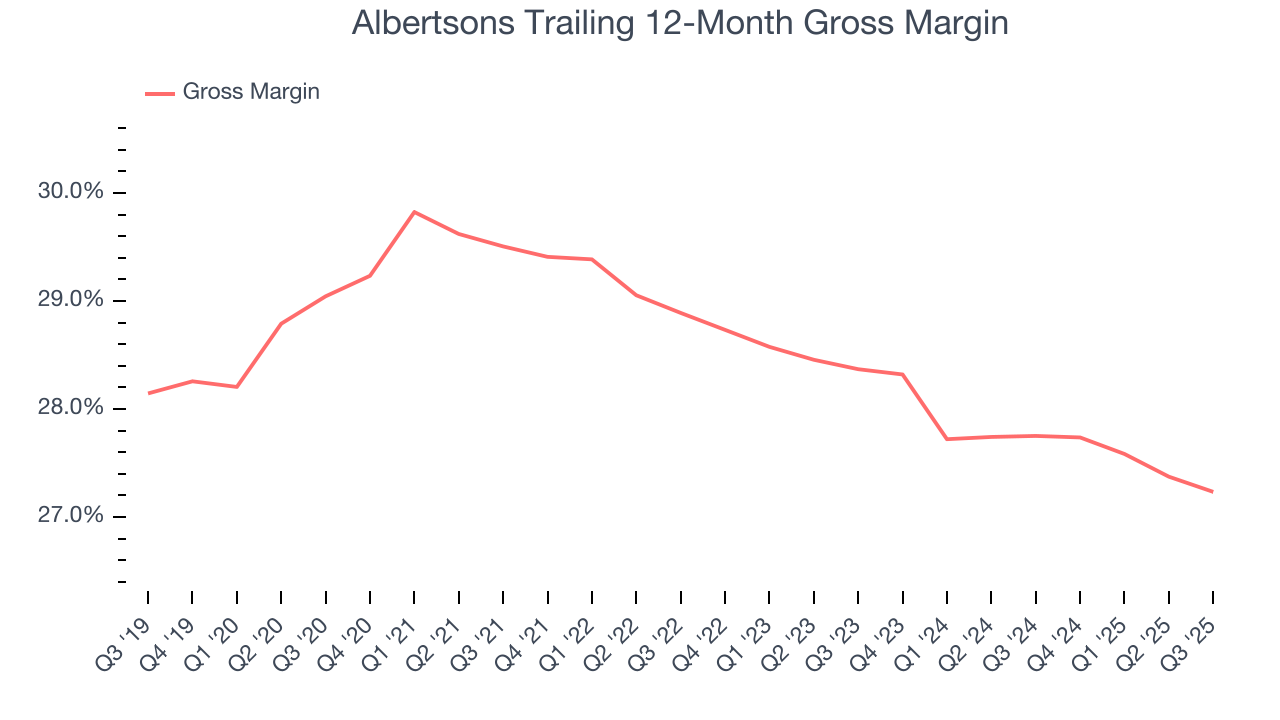

7. Gross Margin & Pricing Power

Albertsons has bad unit economics for a retailer, signaling it operates in a competitive market and lacks pricing power because its inventory is sold in many places. As you can see below, it averaged a 27.5% gross margin over the last two years.

Non-discretionary retailers, however, must be viewed through a different lens because they compete on the lowest price, sell products easily found elsewhere, and have high transportation costs to move goods. These dynamics lead to structurally lower gross margins, so the best metrics to assess them are free cash flow margin, operating leverage, and profit volatility, which account for their scale advantages and non-cyclical demand.

In Q3, Albertsons produced a 27% gross profit margin, in line with the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting it strives to keep prices low for customers and has stable input costs (such as labor and freight expenses to transport goods).

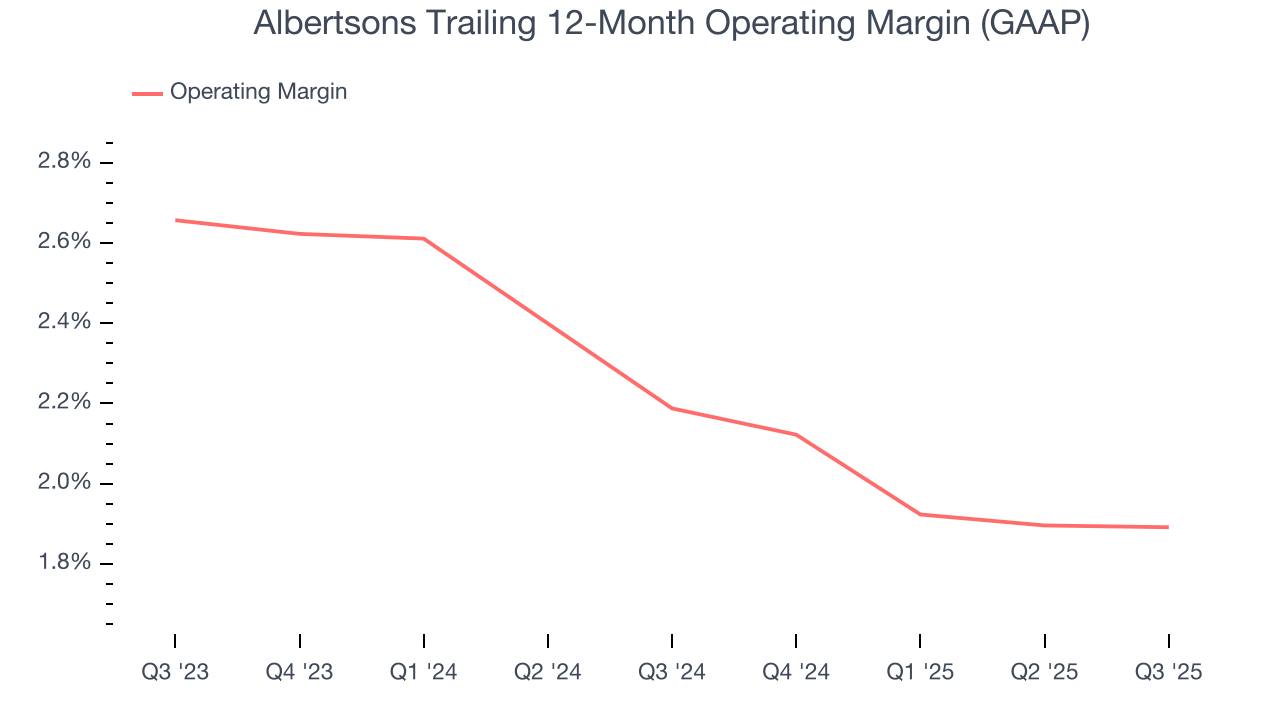

8. Operating Margin

Albertsons’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 2% over the last two years. This profitability was lousy for a consumer retail business and caused by its suboptimal cost structureand low gross margin.

Analyzing the trend in its profitability, Albertsons’s operating margin might fluctuated slightly but has generally stayed the same over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q3, Albertsons generated an operating margin profit margin of 1.6%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

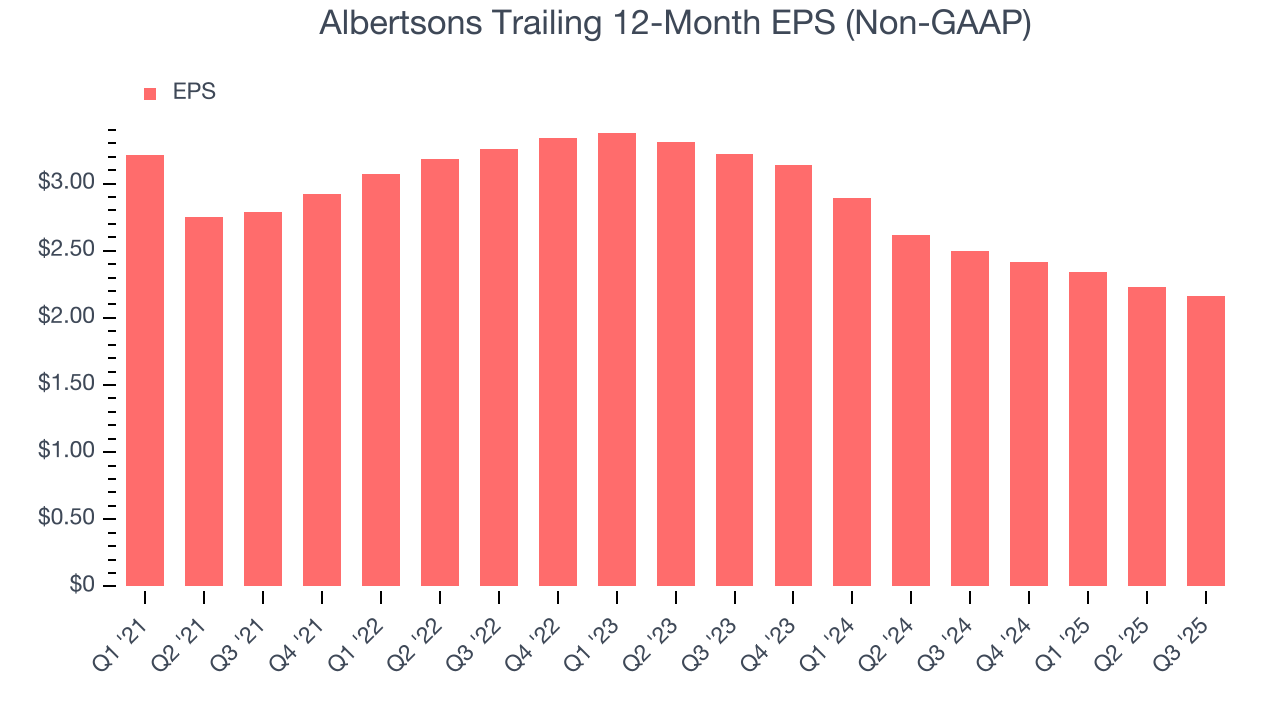

9. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Albertsons, its EPS declined by 12.8% annually over the last three years while its revenue grew by 2.6%. This tells us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

In Q3, Albertsons reported adjusted EPS of $0.44, down from $0.51 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Albertsons’s full-year EPS of $2.16 to stay about the same.

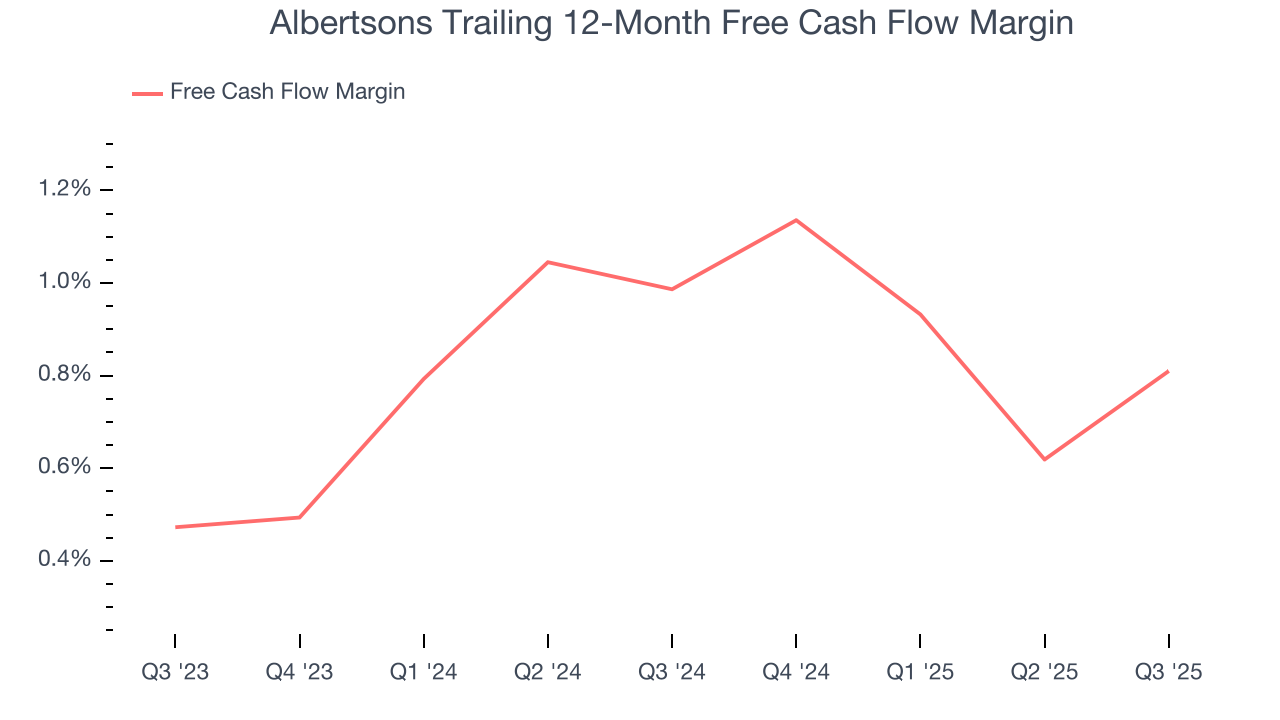

10. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Albertsons broke even from a free cash flow perspective over the last two years, giving the company limited opportunities to return capital to shareholders.

Albertsons broke even from a free cash flow perspective in Q3. This cash profitability was in line with the comparable period last year and its two-year average.

11. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Albertsons’s management team makes decent investment decisions and generates value for shareholders. Its five-year average ROIC was 15.2%, slightly better than typical consumer retail business.

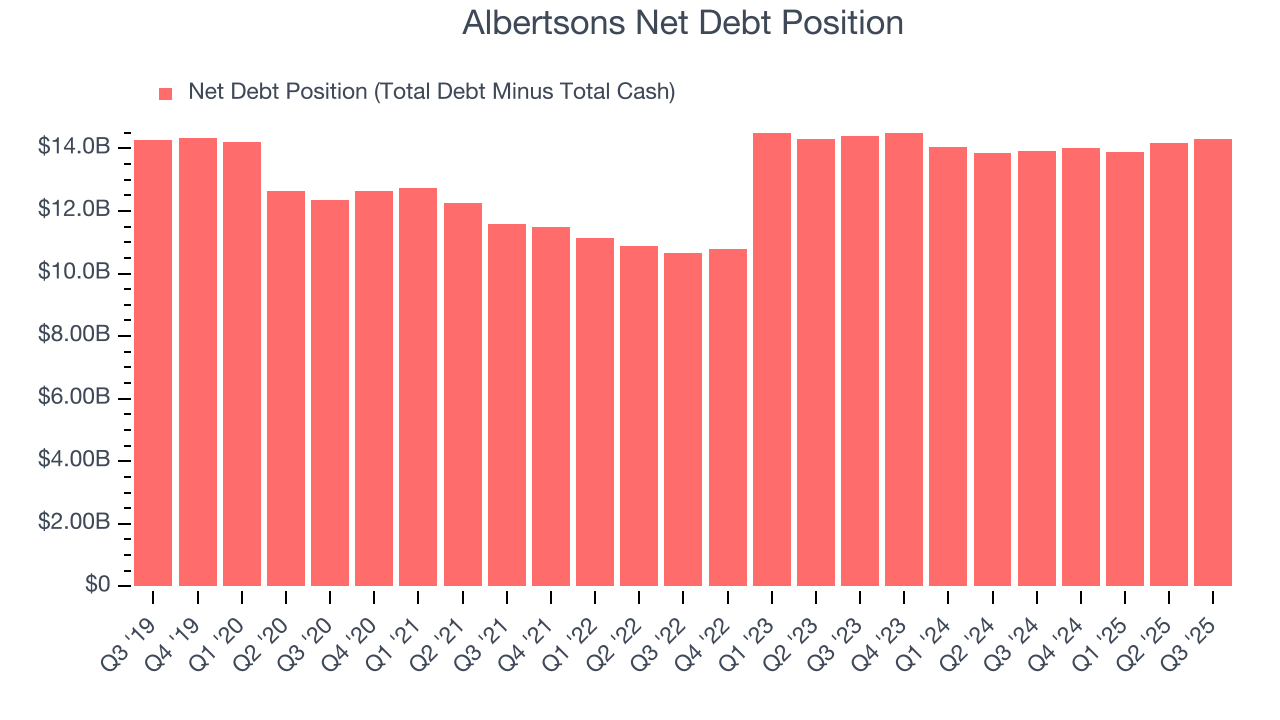

12. Balance Sheet Assessment

Albertsons reported $270.6 million of cash and $14.57 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $3.88 billion of EBITDA over the last 12 months, we view Albertsons’s 3.7× net-debt-to-EBITDA ratio as safe. We also see its $457.5 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

13. Key Takeaways from Albertsons’s Q3 Results

It was encouraging to see Albertsons beat analysts’ EBITDA expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its gross margin slightly missed. Overall, this print had some key positives. The stock remained flat at $17.15 immediately after reporting.

14. Is Now The Time To Buy Albertsons?

Updated: February 16, 2026 at 11:40 PM EST

Are you wondering whether to buy Albertsons or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

Albertsons isn’t a terrible business, but it isn’t one of our picks. First off, its revenue growth was uninspiring over the last three years, and analysts don’t see anything changing over the next 12 months. While its coveted brand awareness makes it a household name consumers consistently turn to, the downside is its gross margins make it more challenging to reach positive operating profits compared to other consumer retail businesses. On top of that, its operating margins reveal poor profitability compared to other retailers.

Albertsons’s P/E ratio based on the next 12 months is 8.5x. While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're fairly confident there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $22 on the company (compared to the current share price of $18.51).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.