Wyndham (WH)

Wyndham is in for a bumpy ride. Its low returns on capital and plummeting sales suggest it struggles to generate demand and profits, a red flag.― StockStory Analyst Team

1. News

2. Summary

Why We Think Wyndham Will Underperform

Established in 1981, Wyndham (NYSE:WH) is a global hotel franchising company with over 9,000 hotels across nearly 95 countries on six continents.

- Sales were flat over the last five years, indicating it’s failed to expand its business

- Low returns on capital reflect management’s struggle to allocate funds effectively, and its falling returns suggest its earlier profit pools are drying up

- Weak revenue per room over the past two years indicates challenges in maintaining pricing power and occupancy rates

Wyndham doesn’t meet our quality criteria. Better businesses are for sale in the market.

Why There Are Better Opportunities Than Wyndham

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Wyndham

Wyndham is trading at $72.79 per share, or 15.3x forward P/E. Wyndham’s multiple may seem like a great deal among consumer discretionary peers, but we think there are valid reasons why it’s this cheap.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. Wyndham (WH) Research Report: Q3 CY2025 Update

Hotel franchising company Wyndham (NYSE:WH) missed Wall Street’s revenue expectations in Q3 CY2025, with sales falling 3.5% year on year to $382 million. Its non-GAAP profit of $1.46 per share was 2% above analysts’ consensus estimates.

Wyndham (WH) Q3 CY2025 Highlights:

- Revenue: $382 million vs analyst estimates of $401 million (3.5% year-on-year decline, 4.7% miss)

- Adjusted EPS: $1.46 vs analyst estimates of $1.43 (2% beat)

- Adjusted EBITDA: $208 million vs analyst estimates of $210.6 million (54.5% margin, 1.2% miss)

- Management lowered its full-year Adjusted EPS guidance to $4.55 at the midpoint, a 3% decrease

- EBITDA guidance for the full year is $720 million at the midpoint, below analyst estimates of $734.9 million

- Operating Margin: 46.6%, up from 43.2% in the same quarter last year

- Free Cash Flow Margin: 25.4%, up from 17.9% in the same quarter last year

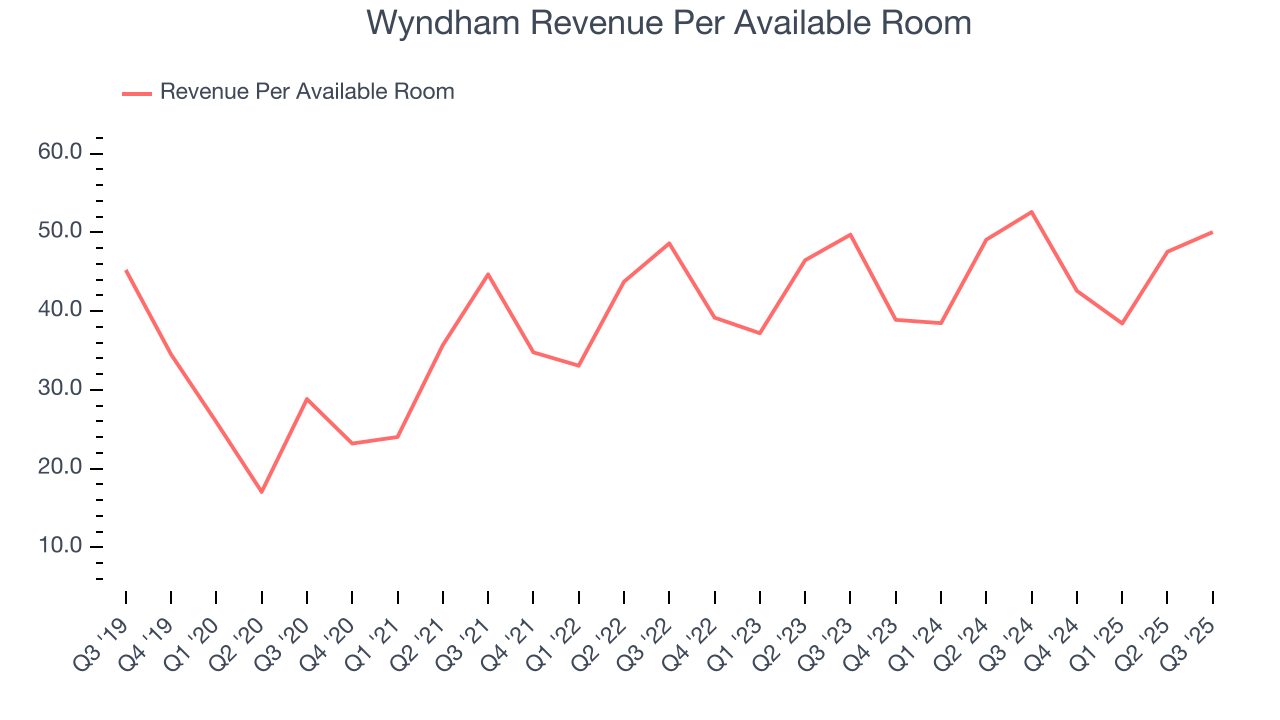

- RevPAR: $50.05 at quarter end, down 4.8% year on year

- Market Capitalization: $6.19 billion

Company Overview

Established in 1981, Wyndham (NYSE:WH) is a global hotel franchising company with over 9,000 hotels across nearly 95 countries on six continents.

The company's portfolio is diverse, encompassing over 20 hotel brands that cater to a broad spectrum of travelers and budgets.

At the luxury and upscale end, Wyndham offers brands like Wyndham Grand and Dolce Hotels and Resorts, known for their refined experiences and exceptional service. The company's mid-scale offerings, such as Ramada and Wingate, provide comfortable and value-driven accommodations for business and leisure travelers. Lastly, Wyndham's economy brands, including Days Inn and Super 8, offer affordable and reliable lodging options.

Wyndham primarily focuses on hotel franchising, with a vast majority of its properties operated by independent owners under franchise agreements. This model has allowed Wyndham to maintain a wide geographic spread without the substantial capital investment typically associated with owning properties. The company also manages a smaller number of hotels through management contracts.

Customer loyalty is key to Wyndham's operations. Wyndham Rewards, its loyalty program, is a notable example, offering members a simple and generous points system that can be redeemed for free nights, discounts, and other rewards.

4. Travel and Vacation Providers

Airlines, hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional airlines, hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

Wyndham’s primary competitors include Marriott International (NYSE:MAR), Hilton Worldwide Holdings (NYSE:HLT), InterContinental Hotels Group (NYSE:IHG), Choice Hotels International (NYSE:CHH), and Hyatt Hotels (NYSE:H).

5. Revenue Growth

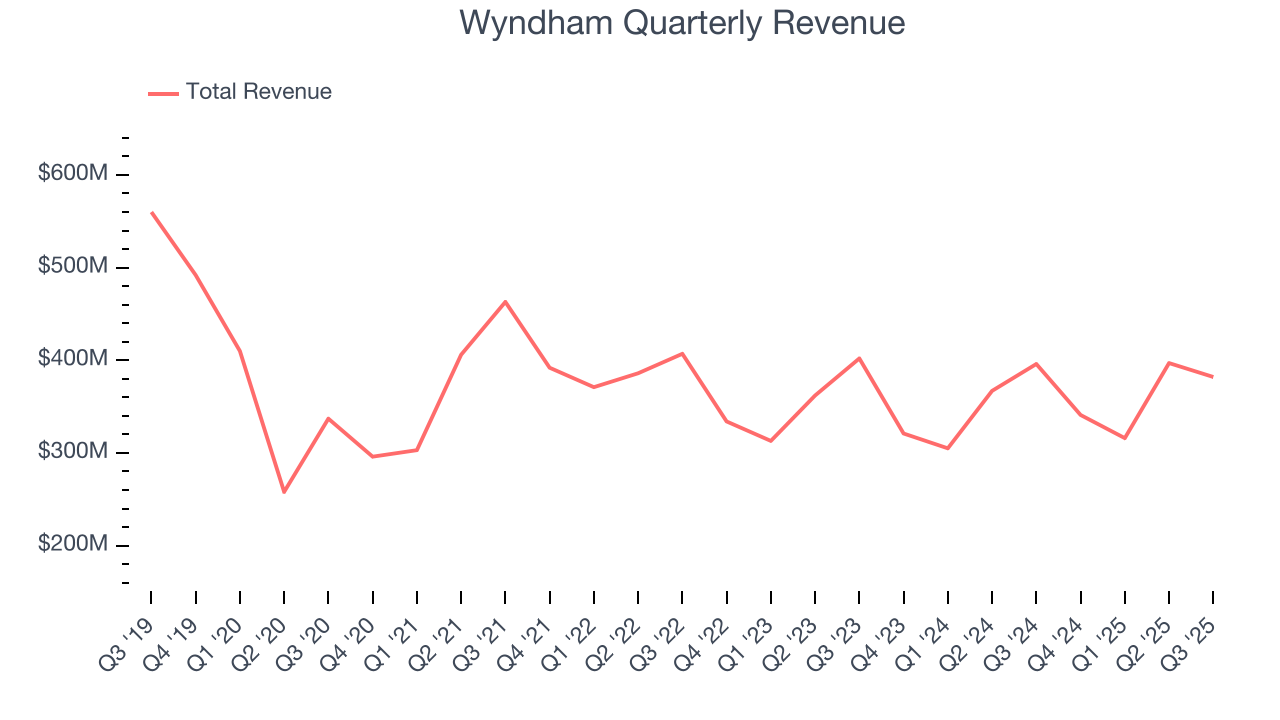

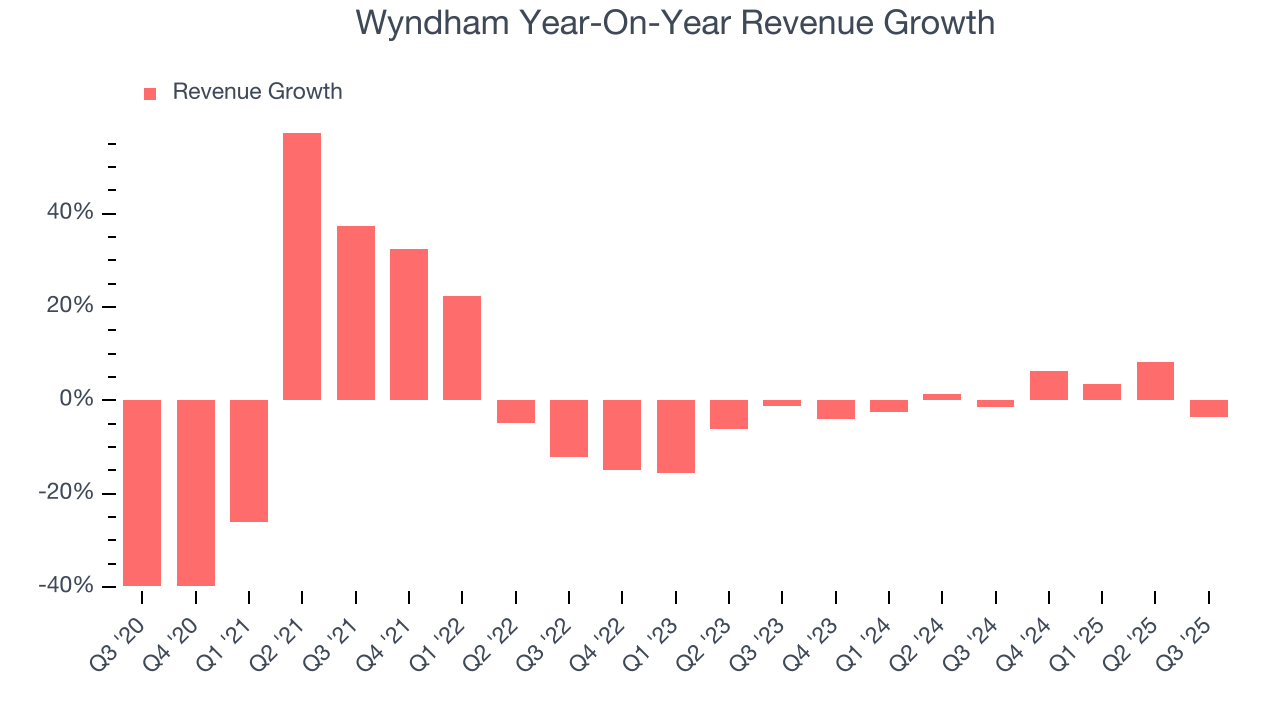

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Wyndham struggled to consistently increase demand as its $1.44 billion of sales for the trailing 12 months was close to its revenue five years ago. This wasn’t a great result and is a sign of lacking business quality.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new property or trend. Just like its five-year trend, Wyndham’s revenue over the last two years was flat, suggesting it is in a slump.

We can better understand the company’s revenue dynamics by analyzing its revenue per available room, which clocked in at $50.05 this quarter and is a key metric accounting for daily rates and occupancy levels. Over the last two years, Wyndham’s revenue per room averaged 1.9% year-on-year growth. This number doesn’t surprise us as it’s in line with its revenue growth.

This quarter, Wyndham missed Wall Street’s estimates and reported a rather uninspiring 3.5% year-on-year revenue decline, generating $382 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 5.9% over the next 12 months. While this projection suggests its newer products and services will spur better top-line performance, it is still below the sector average.

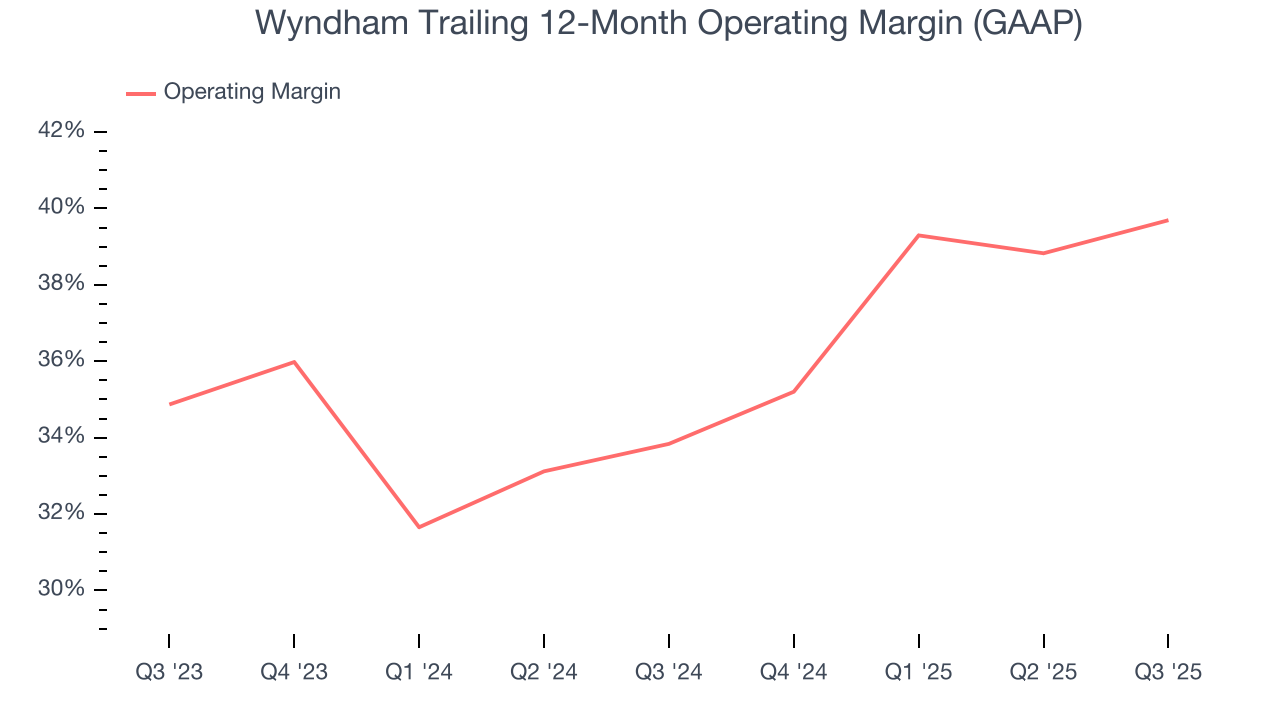

6. Operating Margin

Wyndham’s operating margin has been trending up over the last 12 months and averaged 36.8% over the last two years. On top of that, its profitability was elite for a consumer discretionary business thanks to its efficient cost structure and economies of scale.

In Q3, Wyndham generated an operating margin profit margin of 46.6%, up 3.4 percentage points year on year. This increase was a welcome development, especially since its revenue fell, showing it was more efficient because it scaled down its expenses.

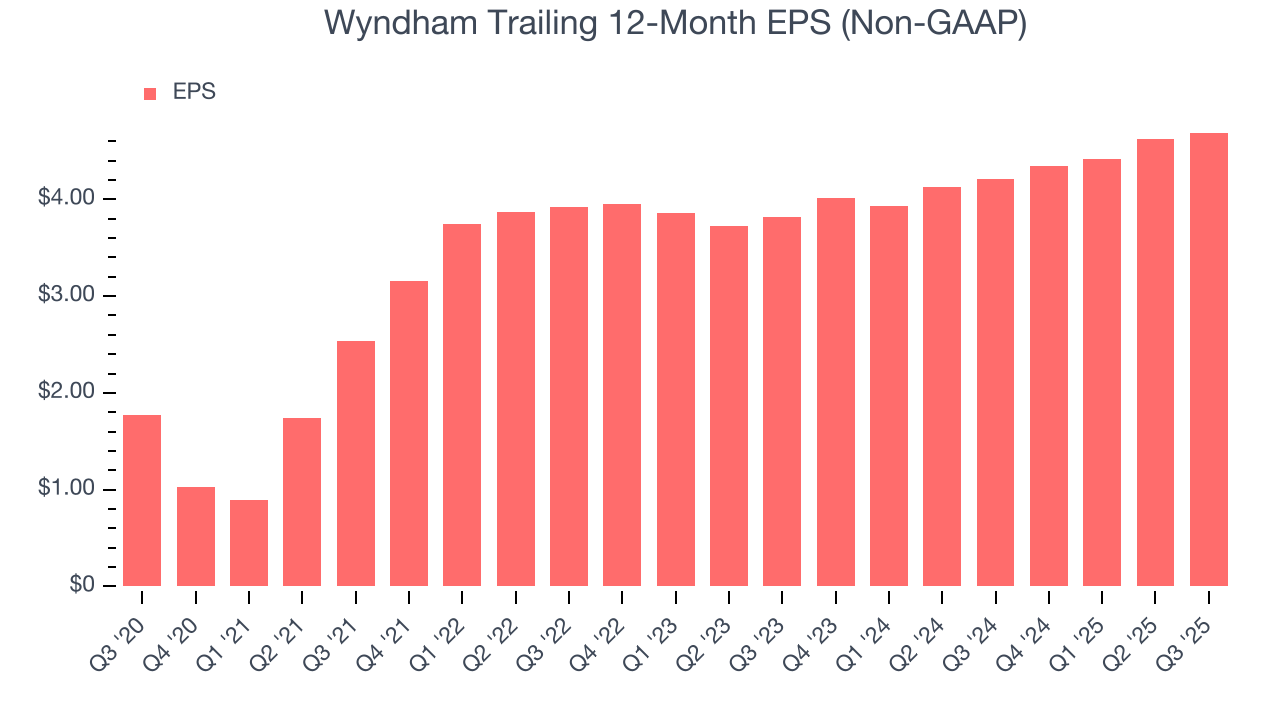

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Wyndham’s EPS grew at a spectacular 21.5% compounded annual growth rate over the last five years, higher than its flat revenue. This tells us management responded to softer demand by adapting its cost structure.

In Q3, Wyndham reported adjusted EPS of $1.46, up from $1.39 in the same quarter last year. This print beat analysts’ estimates by 2%. Over the next 12 months, Wall Street expects Wyndham’s full-year EPS of $4.69 to grow 9.3%.

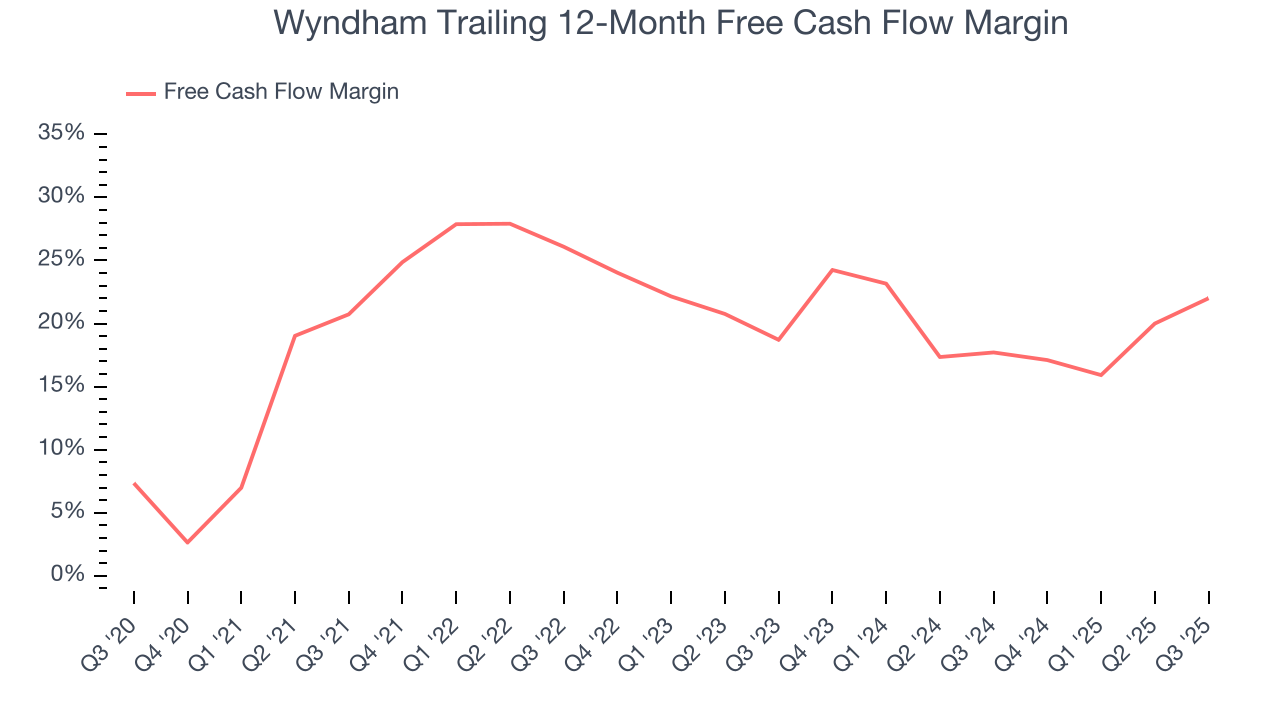

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Wyndham has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 19.9% over the last two years, quite impressive for a consumer discretionary business.

Wyndham’s free cash flow clocked in at $97 million in Q3, equivalent to a 25.4% margin. This result was good as its margin was 7.5 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends carry greater meaning.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Wyndham historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 12%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Wyndham’s ROIC averaged 1.9 percentage point decreases over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

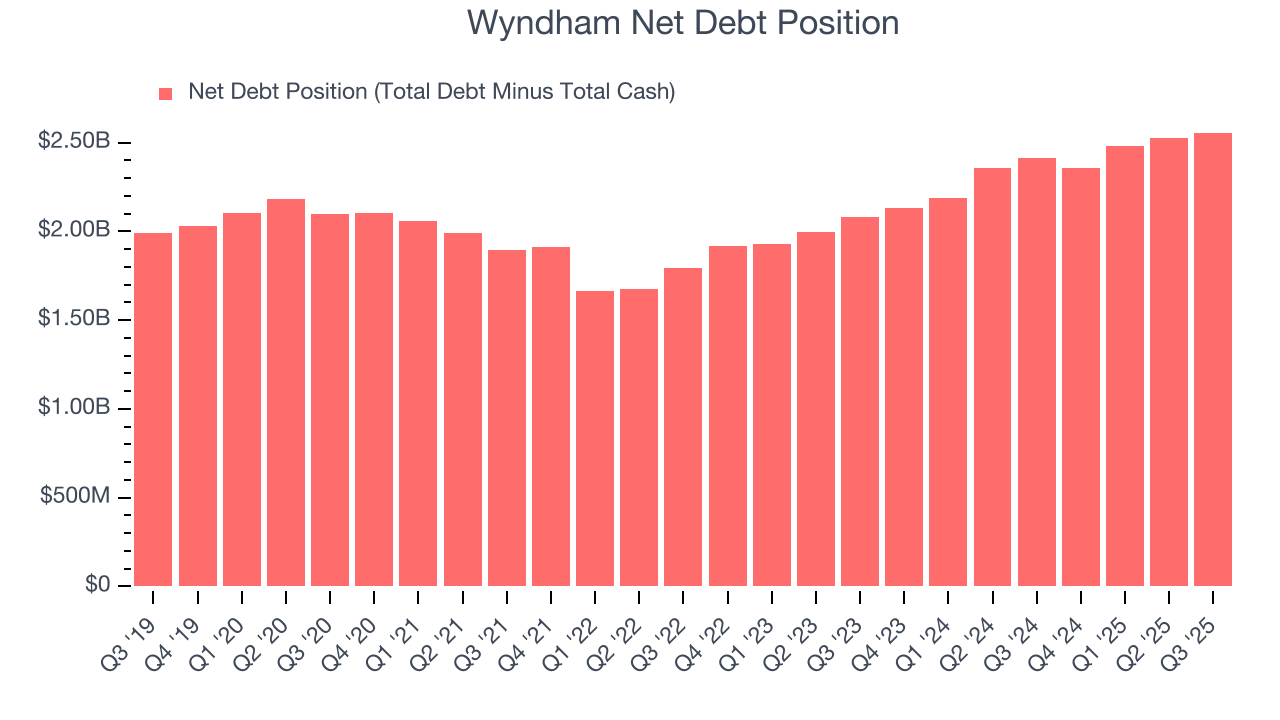

10. Balance Sheet Assessment

Wyndham reported $70 million of cash and $2.63 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $716 million of EBITDA over the last 12 months, we view Wyndham’s 3.6× net-debt-to-EBITDA ratio as safe. We also see its $62 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Wyndham’s Q3 Results

We struggled to find many positives in these results. Its revenue missed and its full-year EBITDA guidance fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 4.8% to $76.50 immediately following the results.

12. Is Now The Time To Buy Wyndham?

Updated: January 30, 2026 at 10:07 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Wyndham.

We cheer for all companies serving everyday consumers, but in the case of Wyndham, we’ll be cheering from the sidelines. To kick things off, its revenue growth was weak over the last five years. On top of that, Wyndham’s revenue per room has disappointed, and its projected EPS for the next year is lacking.

Wyndham’s P/E ratio based on the next 12 months is 15.3x. While this valuation is reasonable, we don’t see a big opportunity at the moment. There are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $94.29 on the company (compared to the current share price of $72.79).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.