Waste Management (WM)

Waste Management piques our interest. Its marriage of growth and profitability makes it a strong business with attractive upside.― StockStory Analyst Team

1. News

2. Summary

Why Waste Management Is Interesting

Headquartered in Houston, Waste Management (NYSE:WM) is a provider of comprehensive waste management services in North America.

- Healthy operating margin shows it’s a well-run company with efficient processes

- Offerings are difficult to replicate at scale and result in a top-tier gross margin of 38.8%

- One pitfall is its estimated sales growth of 5% for the next 12 months implies demand will slow from its two-year trend

Waste Management has some noteworthy aspects. If you like the story, the price looks reasonable.

Why Is Now The Time To Buy Waste Management?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Waste Management?

Waste Management’s stock price of $245.25 implies a valuation ratio of 30.1x forward P/E. While Waste Management’s valuation is higher than that of many in the industrials space, we still think the valuation is fair given the top-line growth.

This could be a good time to invest if you think there are underappreciated aspects of the business.

3. Waste Management (WM) Research Report: Q4 CY2025 Update

Waste management services provider Waste Management (NYSE:WM) missed Wall Street’s revenue expectations in Q4 CY2025, but sales rose 7.1% year on year to $6.31 billion. On the other hand, the company’s outlook for the full year was close to analysts’ estimates with revenue guided to $26.53 billion at the midpoint. Its non-GAAP profit of $1.93 per share was 0.9% below analysts’ consensus estimates.

Waste Management (WM) Q4 CY2025 Highlights:

- Revenue: $6.31 billion vs analyst estimates of $6.39 billion (7.1% year-on-year growth, 1.3% miss)

- Adjusted EPS: $1.93 vs analyst expectations of $1.95 (0.9% miss)

- Adjusted EBITDA: $1.97 billion vs analyst estimates of $1.93 billion (31.3% margin, 2.2% beat)

- EBITDA guidance for the upcoming financial year 2026 is $8.2 billion at the midpoint, above analyst estimates of $8.10 billion

- Operating Margin: 18.3%, up from 15.6% in the same quarter last year

- Free Cash Flow Margin: 16.1%, up from 6.7% in the same quarter last year

- Market Capitalization: $93.2 billion

Company Overview

Headquartered in Houston, Waste Management (NYSE:WM) is a provider of comprehensive waste management services in North America.

Waste Management began in 1968 when Wayne Huizenga and Dean Buntrock merged their waste companies to create Waste Management, becoming one of the first companies to consolidate the fragmented waste management industry. Throughout the 1970s and 1980s, the company expanded its operations across North America, becoming a leader in waste collection, recycling, and landfill management. Throughout the 1990s the company diversified into waste-to-energy and environmental services. Following a period of restructuring in the early 2000s, Waste Management refocused on its core business of waste collection

Waste Management offers waste solutions that encompass collection, disposal, recycling, and renewable energy generation. In its collection services, they provide options such as steel containers for commercial use and automated systems for residential waste. In addition to handling traditional waste, Waste Management has made significant strides in resource recovery and renewable energy. The company’s renewable energy business develops and operates landfill gas-to-energy facilities that produce renewable energy, significantly reducing greenhouse gas emissions. These facilities provide a recurring revenue stream through the production and sale of renewable energy credits and direct energy sales.

Waste Management generates revenue primarily through fees charged for its comprehensive waste management services. These services include waste collection, transfer, disposal, and recycling operations. The company leverages its vast network of facilities, including landfills, transfer stations, and recycling centers, where they charge tipping fees to third-party haulers and other customers.

The company's end markets are diverse, encompassing residential, commercial, and industrial sectors across the United States and Canada. Waste Management serves municipalities, government agencies, and private businesses, ranging from small businesses to large corporations. The company also targets specific industries such as healthcare, retail, and construction, offering tailored waste management solutions to meet the unique needs of each sector. The breadth of its services and geographical coverage allows them to maintain a broad and stable customer base, contributing to consistent revenue generation.

4. Waste Management

Waste management companies can possess licenses permitting them to handle hazardous materials. Furthermore, many services are performed through contracts and statutorily mandated, non-discretionary, or recurring, leading to more predictable revenue streams. However, regulation can be a headwind, rendering existing services obsolete or forcing companies to invest precious capital to comply with new, more environmentally-friendly rules. Lastly, waste management companies are at the whim of economic cycles. Interest rates, for example, can greatly impact industrial production or commercial projects that create waste and byproducts.

Competitors operating in the waste management sector include Republic Services (NYSE:RSG), Casella Waste Systems (NASDAQ:CWST), and Stericycle (NASDAQ:SRCL).

5. Revenue Growth

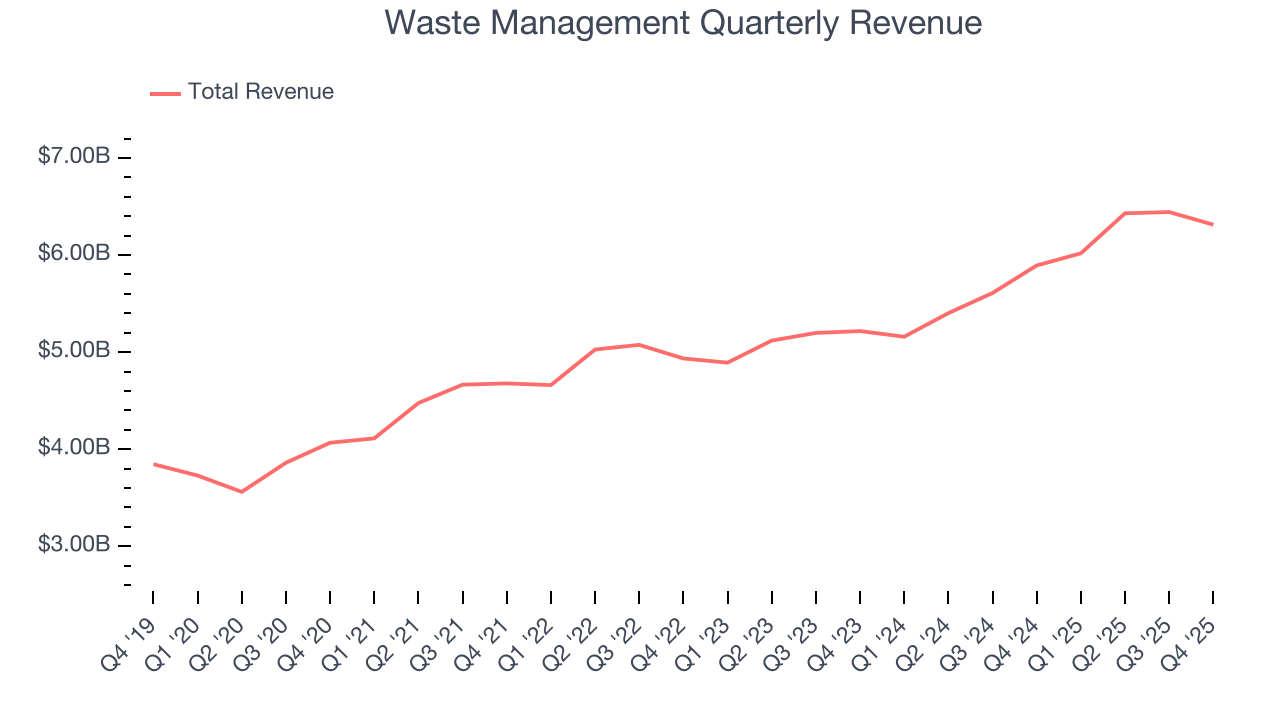

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Luckily, Waste Management’s sales grew at an impressive 10.6% compounded annual growth rate over the last five years. Its growth beat the average industrials company and shows its offerings resonate with customers, a helpful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Waste Management’s annualized revenue growth of 11.1% over the last two years aligns with its five-year trend, suggesting its demand was predictably strong.

This quarter, Waste Management’s revenue grew by 7.1% year on year to $6.31 billion, missing Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 5.5% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

6. Gross Margin & Pricing Power

All else equal, we prefer higher gross margins because they make it easier to generate more operating profits and indicate that a company commands pricing power by offering more differentiated products.

Waste Management’s unit economics are great compared to the broader industrials sector and signal that it enjoys product differentiation through quality or brand. As you can see below, it averaged an excellent 38.8% gross margin over the last five years. That means Waste Management only paid its suppliers $61.15 for every $100 in revenue.

Waste Management’s gross profit margin came in at 41.5% this quarter, marking a 1.8 percentage point increase from 39.7% in the same quarter last year. Waste Management’s full-year margin has also been trending up over the past 12 months, increasing by 1.1 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as manufacturing expenses).

7. Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

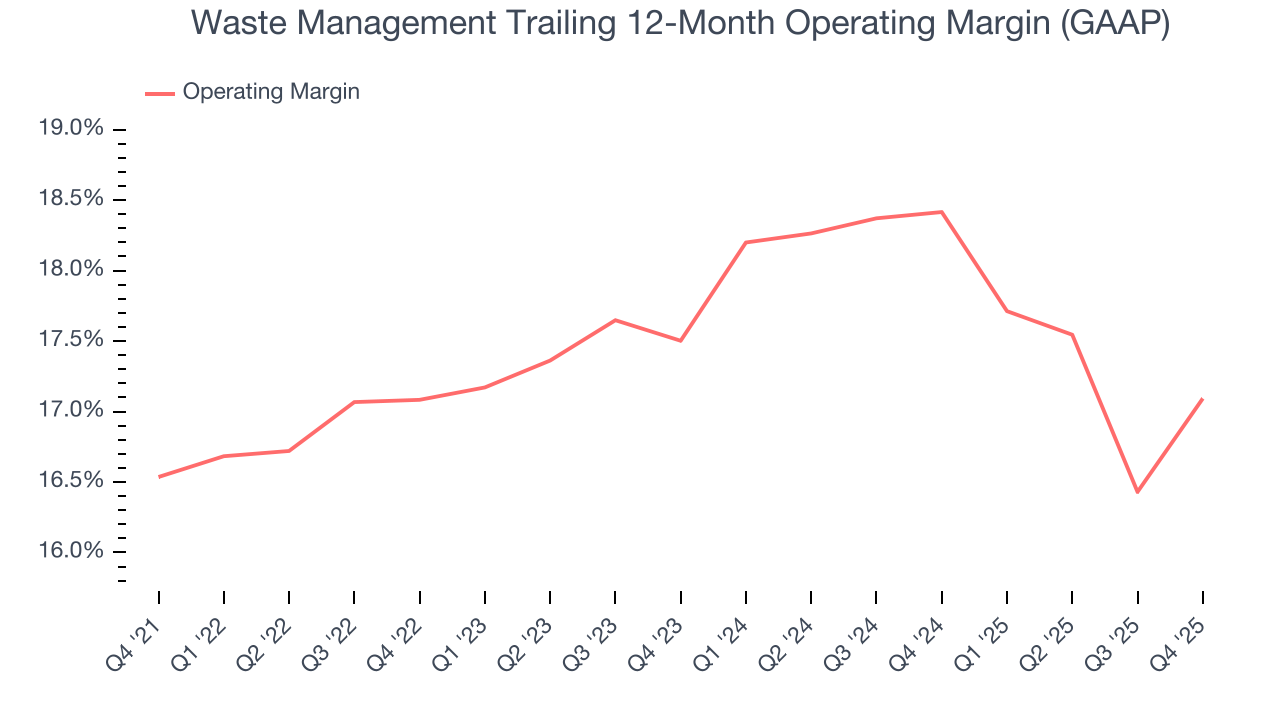

Waste Management’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 17.4% over the last five years. This profitability was elite for an industrials business thanks to its efficient cost structure and economies of scale. This is seen in its fast historical revenue growth and healthy gross margin, which is why we look at all three data points together.

Looking at the trend in its profitability, Waste Management’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. We like to see margin expansion, but Waste Management’s performance still shows it’s one of the better Waste Management companies as most peers saw their margins plummet.

This quarter, Waste Management generated an operating margin profit margin of 18.3%, up 2.7 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

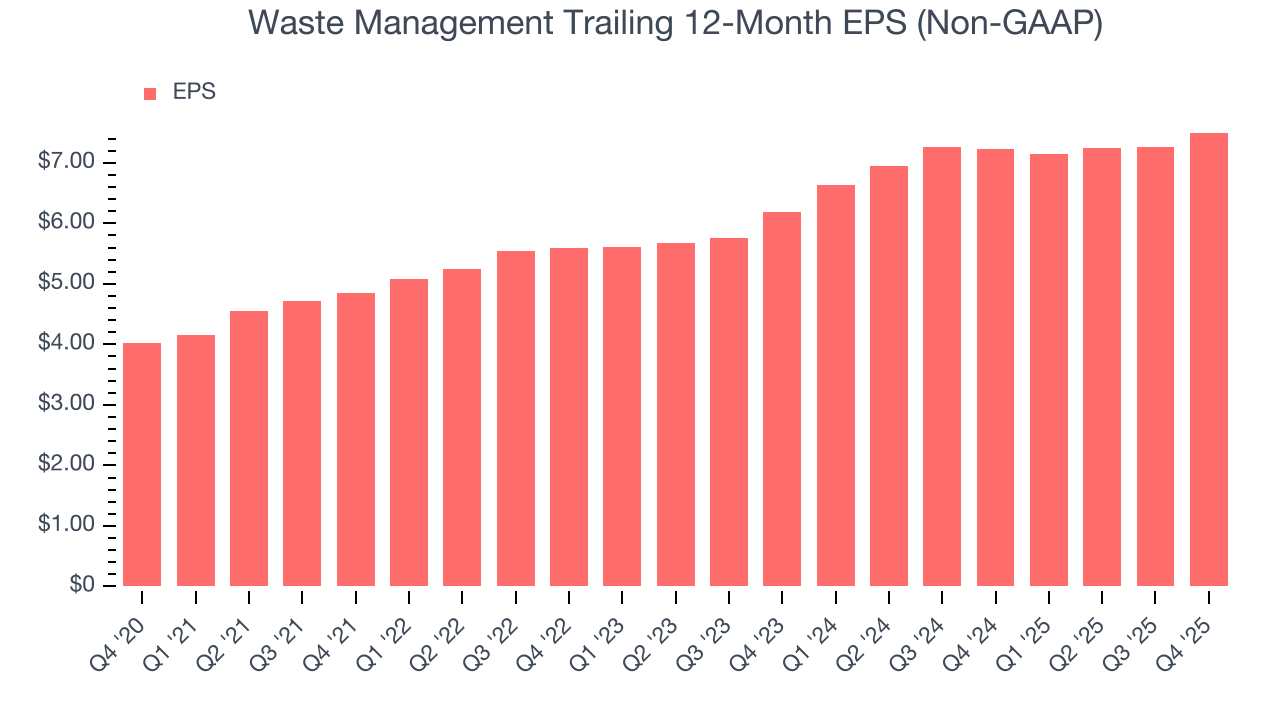

Waste Management’s EPS grew at a remarkable 13.2% compounded annual growth rate over the last five years, higher than its 10.6% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Waste Management’s earnings to better understand the drivers of its performance. A five-year view shows that Waste Management has repurchased its stock, shrinking its share count by 4.8%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Waste Management, its two-year annual EPS growth of 10.1% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.

In Q4, Waste Management reported adjusted EPS of $1.93, up from $1.70 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Waste Management’s full-year EPS of $7.50 to grow 10.7%.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

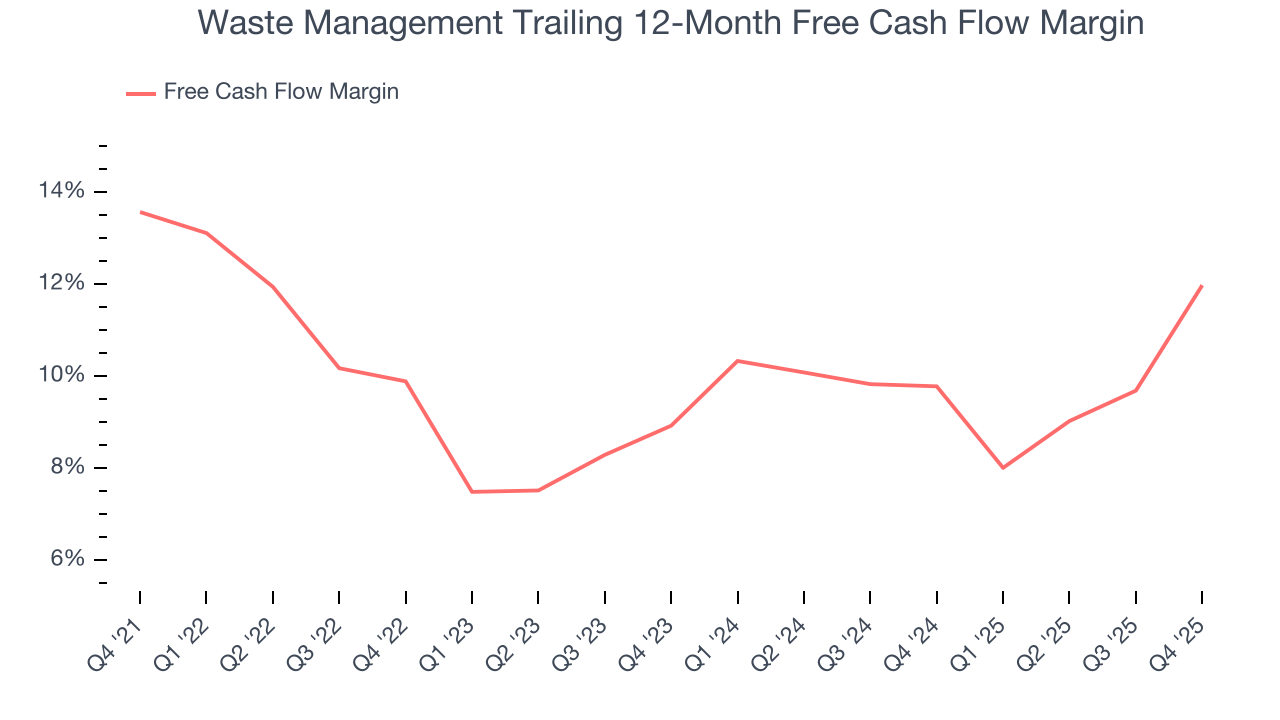

Waste Management has shown robust cash profitability, enabling it to comfortably ride out cyclical downturns while investing in plenty of new offerings and returning capital to investors. The company’s free cash flow margin averaged 10.8% over the last five years, quite impressive for an industrials business.

Taking a step back, we can see that Waste Management’s margin dropped by 1.6 percentage points during that time. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. If the longer-term trend returns, it could signal increasing investment needs and capital intensity. We’re willing to give the company some leeway give it’s one of the more cash generative and investable businesses in its space.

Waste Management’s free cash flow clocked in at $1.01 billion in Q4, equivalent to a 16.1% margin. This result was good as its margin was 9.3 percentage points higher than in the same quarter last year. Its cash profitability was also above its five-year level, and we hope the company can build on this trend.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Waste Management’s five-year average ROIC was 12.7%, higher than most industrials businesses. This illustrates its management team’s ability to invest in profitable growth opportunities and generate value for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Uneventfully, Waste Management’s ROIC has stayed the same over the last few years. Rising returns would be ideal, but this is still a noteworthy feat since they're already high.

11. Balance Sheet Assessment

Waste Management reported $201 million of cash and $22.91 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $7.58 billion of EBITDA over the last 12 months, we view Waste Management’s 3.0× net-debt-to-EBITDA ratio as safe. We also see its $912 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Waste Management’s Q4 Results

It was good to see Waste Management provide full-year EBITDA guidance that slightly beat analysts’ expectations. We were also happy its EBITDA outperformed Wall Street’s estimates. On the other hand, its revenue slightly missed and its EPS fell a bit short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 2% to $224.75 immediately after reporting.

13. Is Now The Time To Buy Waste Management?

Updated: March 6, 2026 at 11:06 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Waste Management.

In our opinion, Waste Management is a good company. First off, its revenue growth was impressive over the last five years. And while its cash profitability fell over the last five years, its impressive operating margins show it has a highly efficient business model. On top of that, its healthy gross margins indicate the value of its differentiated offerings.

Waste Management’s P/E ratio based on the next 12 months is 30.1x. Looking at the industrials space right now, Waste Management trades at a compelling valuation. If you believe in the company and its growth potential, now is an opportune time to buy shares.

Wall Street analysts have a consensus one-year price target of $253.12 on the company (compared to the current share price of $245.25), implying they see 3.2% upside in buying Waste Management in the short term.