AAON (AAON)

We’re skeptical of AAON. Its poor sales growth and falling returns on capital suggest its growth opportunities are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why We Think AAON Will Underperform

Backed by two million square feet of lab testing space, AAON (NASDAQ:AAON) makes heating, ventilation, and air conditioning equipment for different types of buildings.

- Long-term business health is up for debate as its cash burn has increased over the last five years

- Annual earnings per share growth of 5.3% underperformed its revenue over the last five years, showing its incremental sales were less profitable

- One positive is that its market share has increased this cycle as its 20.4% annual revenue growth over the last five years was exceptional

AAON doesn’t meet our quality criteria. We see more lucrative opportunities elsewhere.

Why There Are Better Opportunities Than AAON

High Quality

Investable

Underperform

Why There Are Better Opportunities Than AAON

AAON is trading at $104.23 per share, or 52.5x forward P/E. The current multiple is quite expensive, especially for the fundamentals of the business.

There are stocks out there similarly priced with better business quality. We prefer owning these.

3. AAON (AAON) Research Report: Q3 CY2025 Update

Heating and cooling solutions company AAON (NASDAQ:AAON) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 17.4% year on year to $384.2 million. Its non-GAAP profit of $0.37 per share was 14.9% above analysts’ consensus estimates.

AAON (AAON) Q3 CY2025 Highlights:

- Revenue: $384.2 million vs analyst estimates of $337.5 million (17.4% year-on-year growth, 13.8% beat)

- Adjusted EPS: $0.37 vs analyst estimates of $0.32 (14.9% beat)

- Adjusted EBITDA: $63.55 million vs analyst estimates of $61.21 million (16.5% margin, 3.8% beat)

- Operating Margin: 11.3%, down from 20% in the same quarter last year

- Free Cash Flow was -$33.3 million, down from $29.79 million in the same quarter last year

- Backlog: $1.32 billion at quarter end, up 104% year on year

- Market Capitalization: $7.62 billion

Company Overview

Backed by two million square feet of lab testing space, AAON (NASDAQ:AAON) makes heating, ventilation, and air conditioning equipment for different types of buildings.

The company offers an extensive range of products, including rooftop HVAC units, chillers, and air handling units. It also has a specific segment that solely designs climate control systems for data centers and other niche fields like hospital surgery rooms. Its products are known for features like energy efficiency and customization, which is what allows it to serve commercial, industrial, and residential markets.

The company generates revenue primarily through the one-off sales of its equipment to American commercial, industrial, and residential builders and contractors. It breaks down its gross sales into three sub-segments: BASX, which makes climate control solutions for niche projects like data centers, and AAON Coil Products and AAON Oklahoma, which makes climate control systems more conventional needs. The BASX segment makes up a small chunk of its revenue, with Coil Products and Oklahoma segment leading the way.

4. HVAC and Water Systems

Many HVAC and water systems companies sell essential, non-discretionary infrastructure for buildings. Since the useful lives of these water heaters and vents are fairly standard, these companies have a portion of predictable replacement revenue. In the last decade, trends in energy efficiency and clean water are driving innovation that is leading to incremental demand. On the other hand, new installations for these companies are at the whim of residential and commercial construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates.

Competitors also making HVAC products include Lennox (NYSE:LII), Carrier Global (NYSE:CARR), and Trane (NYSE:TT)

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, AAON’s 20.4% annualized revenue growth over the last five years was incredible. Its growth beat the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. AAON’s annualized revenue growth of 8.6% over the last two years is below its five-year trend, but we still think the results were respectable.

We can dig further into the company’s revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. AAON’s backlog reached $1.32 billion in the latest quarter and averaged 87.9% year-on-year growth over the last two years. Because this number is better than its revenue growth, we can see the company accumulated more orders than it could fulfill and deferred revenue to the future. This could imply elevated demand for AAON’s products and services but raises concerns about capacity constraints.

This quarter, AAON reported year-on-year revenue growth of 17.4%, and its $384.2 million of revenue exceeded Wall Street’s estimates by 13.8%.

Looking ahead, sell-side analysts expect revenue to grow 13.5% over the next 12 months, an improvement versus the last two years. This projection is noteworthy and indicates its newer products and services will fuel better top-line performance.

6. Gross Margin & Pricing Power

All else equal, we prefer higher gross margins because they usually indicate that a company sells more differentiated products and commands stronger pricing power.

AAON’s unit economics are better than the typical industrials business, signaling its products are somewhat differentiated through quality or brand. As you can see below, it averaged a decent 30.1% gross margin over the last five years. That means for every $100 in revenue, roughly $30.07 was left to spend on selling, marketing, R&D, and general administrative overhead.

In Q3, AAON produced a 27.8% gross profit margin, down 7.1 percentage points year on year. AAON’s full-year margin has also been trending down over the past 12 months, decreasing by 8.8 percentage points. If this move continues, it could suggest deteriorating pricing power and higher input costs (such as raw materials and manufacturing expenses).

7. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

AAON has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 15.7%.

Looking at the trend in its profitability, AAON’s operating margin decreased by 6.1 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, AAON generated an operating margin profit margin of 11.3%, down 8.7 percentage points year on year. Since AAON’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

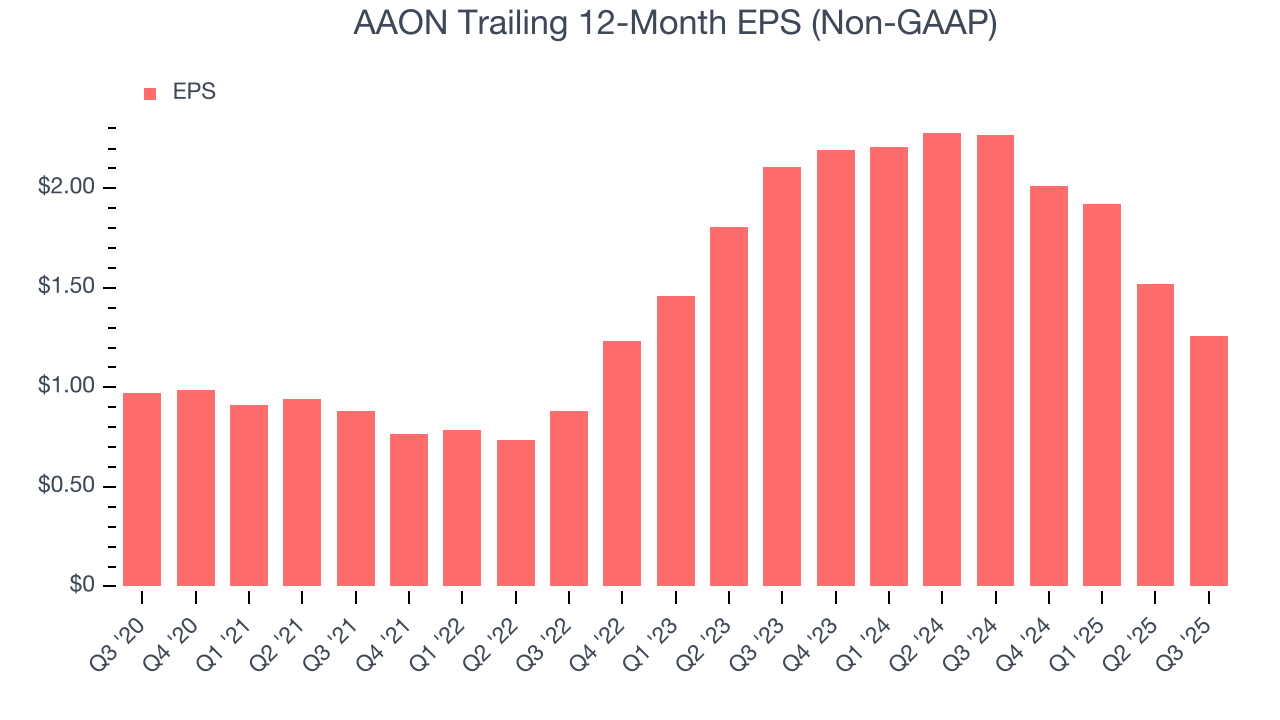

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

AAON’s EPS grew at an unimpressive 5.3% compounded annual growth rate over the last five years, lower than its 20.4% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

Diving into the nuances of AAON’s earnings can give us a better understanding of its performance. As we mentioned earlier, AAON’s operating margin declined by 6.1 percentage points over the last five years. Its share count also grew by 4%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For AAON, its two-year annual EPS declines of 22.7% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q3, AAON reported adjusted EPS of $0.37, down from $0.63 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects AAON’s full-year EPS of $1.26 to grow 45.5%.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

AAON’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 1.4%, meaning it lit $1.41 of cash on fire for every $100 in revenue. This is a stark contrast from its operating margin, and its investments in working capital/capital expenditures are the primary culprit.

Taking a step back, we can see that AAON’s margin dropped by 27.2 percentage points during that time. Almost any movement in the wrong direction is undesirable because it is already burning cash. If the trend continues, it could signal it’s becoming a more capital-intensive business.

AAON burned through $33.3 million of cash in Q3, equivalent to a negative 8.7% margin. The company’s cash flow turned negative after being positive in the same quarter last year, suggesting its historical struggles have dragged on.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although AAON hasn’t been the highest-quality company lately, it found a few growth initiatives in the past that worked out wonderfully. Its five-year average ROIC was 19.1%, splendid for an industrials business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, AAON’s ROIC decreased by 1.4 percentage points annually over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

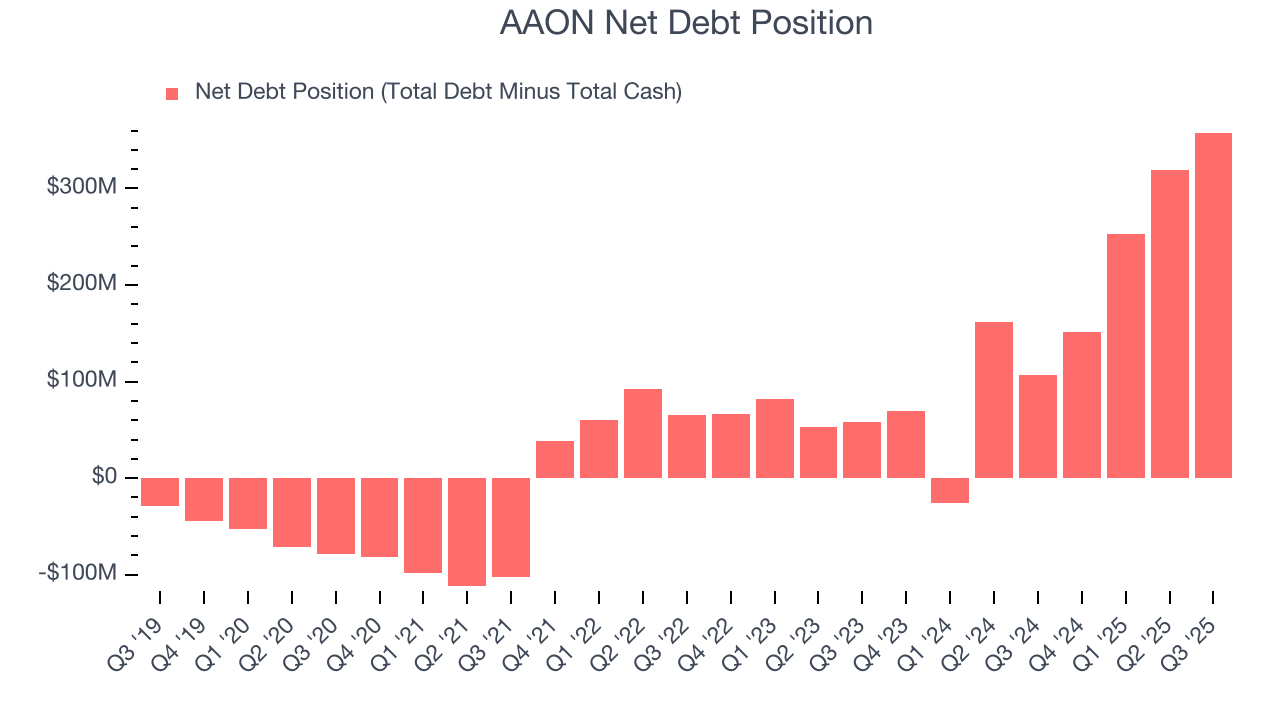

11. Balance Sheet Assessment

AAON reported $2.27 million of cash and $360.1 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $213.8 million of EBITDA over the last 12 months, we view AAON’s 1.7× net-debt-to-EBITDA ratio as safe. We also see its $13.17 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from AAON’s Q3 Results

We were impressed by how significantly AAON blew past analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock traded up 10% to $102.77 immediately after reporting.

13. Is Now The Time To Buy AAON?

Updated: February 19, 2026 at 10:17 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in AAON.

AAON’s business quality ultimately falls short of our standards. Although its revenue growth was exceptional over the last five years, it’s expected to deteriorate over the next 12 months and its declining operating margin shows the business has become less efficient. And while the company’s backlog growth has been marvelous, the downside is its cash profitability fell over the last five years.

AAON’s P/E ratio based on the next 12 months is 52.5x. This multiple tells us a lot of good news is priced in - we think there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $115.25 on the company (compared to the current share price of $104.23).