Apple (AAPL)

Apple is a sound business. Its high free cash flow margin and returns on capital show it can produce cash and invest it wisely.― StockStory Analyst Team

1. News

2. Summary

Why Apple Is Interesting

Creator of the iPhone and App Store, Apple (NASDAQ:AAPL) is a legendary developer of consumer electronics and software.

- Apple's revenue base is so large because nearly everyone in the U.S. has an iPhone, but this is a double-edged sword. Growth must now come from upgrades, a harder pitch that has resulted in sluggish top-line performance recently.

- Still, Apple's devices have endured for decades, speaking to its brand, design ethos, and technological chops. Its success is rare in the world of consumer electronics, which is fraught because of commoditization, competition, and obsolescence risk.

- The company may not have the best gross margin because of its hardware orientation, but it still manages to produce elite operating and free cash flow margins. This shows it doesn’t need over-the-top marketing campaigns to convince people to buy its products.

Apple almost passes our quality test. This is a good stock to keep your eye on.

Why Should You Watch Apple

High Quality

Investable

Underperform

Why Should You Watch Apple

Apple’s stock price of $256.83 implies a valuation ratio of 30.3x forward price-to-earnings. This valuation represents a premium to consumer discretionary peers.

If Apple strings together a few solid quarters and proves it can be a high-quality company, we’d be more open to investing.

3. Apple (AAPL) Research Report: Q4 CY2025 Update

iPhone and iPad maker Apple (NASDAQ:AAPL) reported revenue ahead of Wall Streets expectations in Q4 CY2025, with sales up 15.7% year on year to $143.8 billion. Its GAAP profit of $2.84 per share was 6.4% above analysts’ consensus estimates.

Apple (AAPL) Q4 CY2025 Highlights:

- Revenue: $143.8 billion vs analyst estimates of $138.1 billion (4.1% beat)

- Operating Profit (GAAP): $50.85 billion vs analyst estimates of $47.38 billion (7.3% beat)

- EPS (GAAP): $2.84 vs analyst estimates of $2.67 (6.4% beat)

- Products Revenue: $113.7 billion vs analyst estimates of $108.1 billion (5.2% beat)

- Services Revenue: $30.01 billion vs analyst estimates of $30.06 billion (small miss)

- Gross Margin: 48.2%, up from 46.9% in the same quarter last year

- Operating Margin: 35.4%, in line with the same quarter last year

- Free Cash Flow Margin: 35.9%, up from 21.7% in the same quarter last year

- Market Capitalization: $3.77 trillion

Key Topics & Areas Of Debate

On June 9, 2025, Apple held its Worldwide Developers Conference. A major focus was Apple Intelligence, which combines GenAI with user-specific data to enhance personalization across its ecosystem. This feature is powered by a combination of internally-developed large-language models (LLMs) and OpenAI’s Chat-GPT. There are reports that Apple is spending big to build a custom model to power a major Siri upgrade.

The 17th generation of iPhones has demonstrated strong product performance, with robust demand for the new lineup, including the premium Pro models and the newly introduced Air variant. Some believe the Air product will be a precursor to a folded iPhone, which if introduced, will further diversify price points and form factors. The iPhone remains the largest revenue contributor, and the strong performance of the 17th generation is a positive catalyst for both hardware sales and higher-margin services revenue.

Before the Apple Intelligence announcement, some investors were bemoaning Apple’s seeming lack of participation in the AI wave. How did a company that introduced Siri in 2011 fail to introduce a ChatGPT-like platform before OpenAI? This is a critical juncture where previous missteps could be forgotten if the company establishes itself as an AI gatekeeper.

Samsung (KOSE:A005930) is Apple’s main competitor in the worldwide smartphone market while its mobile operating system competes with Alphabet’s (NASDAQ:GOOGL) Android. Regarding other devices and services, competitors include Microsoft (NASDAQ:MSFT) in MacBooks, Netflix (NASDAQ:NFLX) in Apple TV, and Spotify (NYSE:SPOT) in Apple Music.

4. Company Overview

Creator of the iPhone and App Store, Apple (NASDAQ:AAPL) is a legendary developer of consumer electronics and software.

Apple was founded in 1976 as a personal computer company by the visionary trio of Steve Jobs, Steve Wozniak, and Ronald Wayne. The company’s early history certainly had its ups and downs. The Macintosh–introduced in 1984–changed how consumers interact with computers, but the next year saw the departure of Steve Jobs.

He eventually returned in 1997 to lead the struggling Apple’s resurgence. First, he revolutionized music with the iPod in 2001. Then, he redefined mobile communication with the iPhone in 2007.

Although Jobs passed away in 2011, Apple is still a titan in personal technology today. Tim Cook, Jobs's successor, now leads the company and has helped transform it from a low-margin hardware maker into one that wraps its devices with high-margin software, which is included in its Services segment and encompasses app distribution (App Store), entertainment (Apple TV+, Apple Music), personal finance (Apple Pay), and advertising.

The key questions now are if Apple can continue expanding its Services products to boost margins, and if new technologies like Apple Intelligence can spur a device upgrade cycle.

5. Revenue Growth

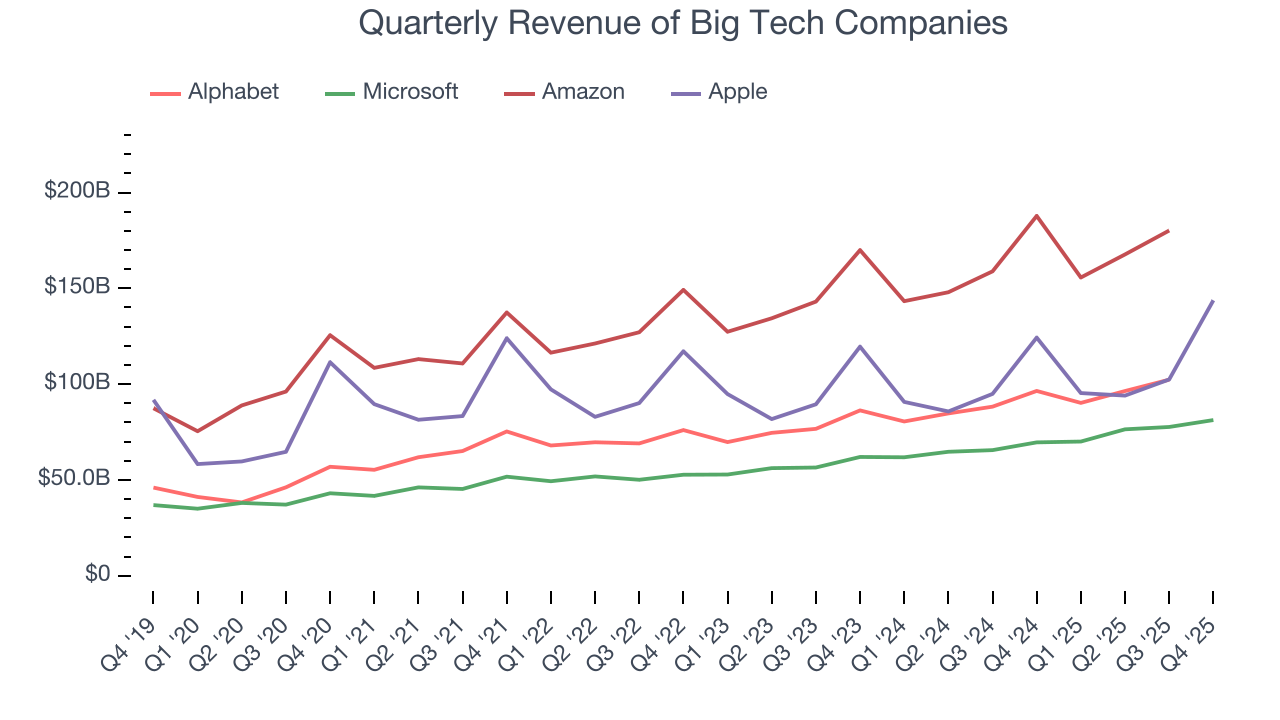

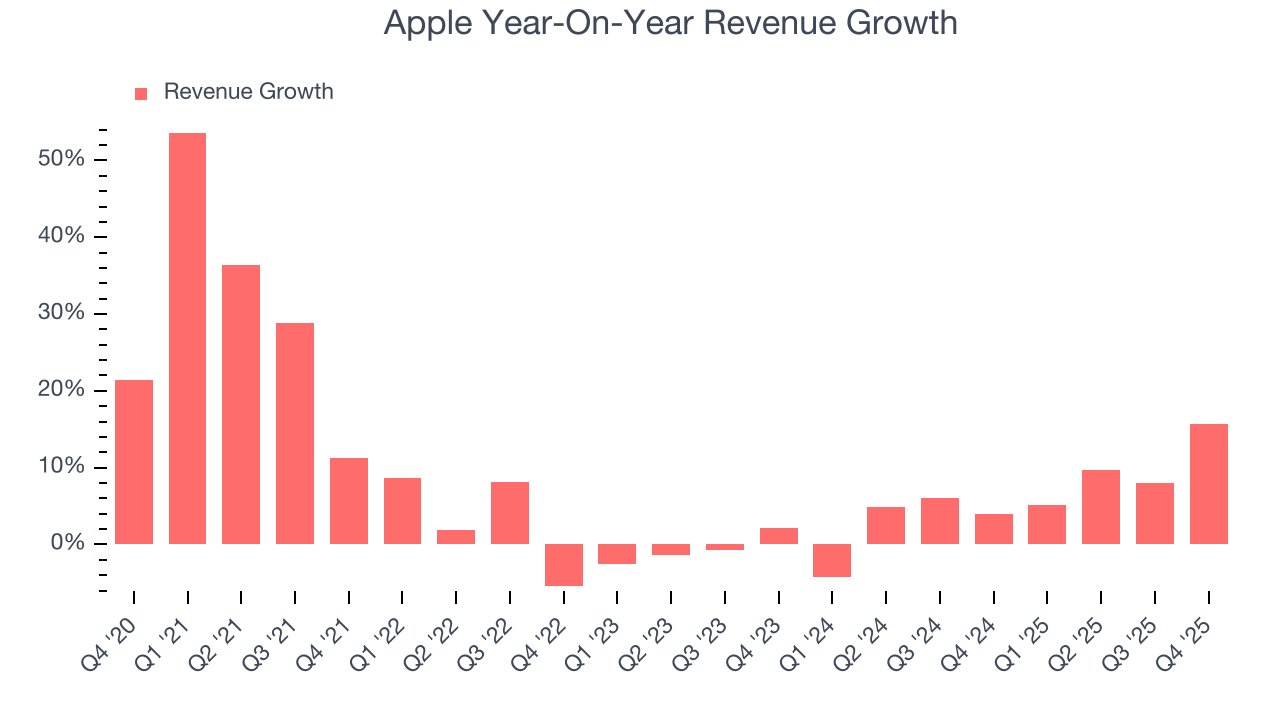

Apple (with its installed base of 2 billion+ devices) proves that huge, scaled companies can still grow. The company’s revenue base of $294.1 billion five years ago has increased to $435.6 billion in the last year, translating into a decent 8.2% annualized growth rate.

In light of its big tech peers, however, Apple’s growth trailed Amazon (14.1%), Alphabet (18.1%), and Microsoft (14.8%) over the same period. This is an important consideration because investors often use the comparisons as a starting point for their valuations. When adjusting for these benchmarks, we think Apple is a bit expensive.

Long-term growth reigns supreme in fundamentals, but for big tech companies, a half-decade historical view may miss emerging trends in AI. Apple’s recent performance shows its demand has slowed as its annualized revenue growth of 6.3% over the last two years was below its five-year trend.

This quarter, Apple reported year-on-year revenue growth of 15.7%, and its $143.8 billion of revenue exceeded Wall Street’s estimates by 4.1%. Looking ahead, sell-side This projection illustrates the market sees some success for its newer AI-enabling Apple Intelligence products. However, its anticipated growth is still a far cry from its heyday in the 2010s.

6. Products: Steve Jobs’s Legacy

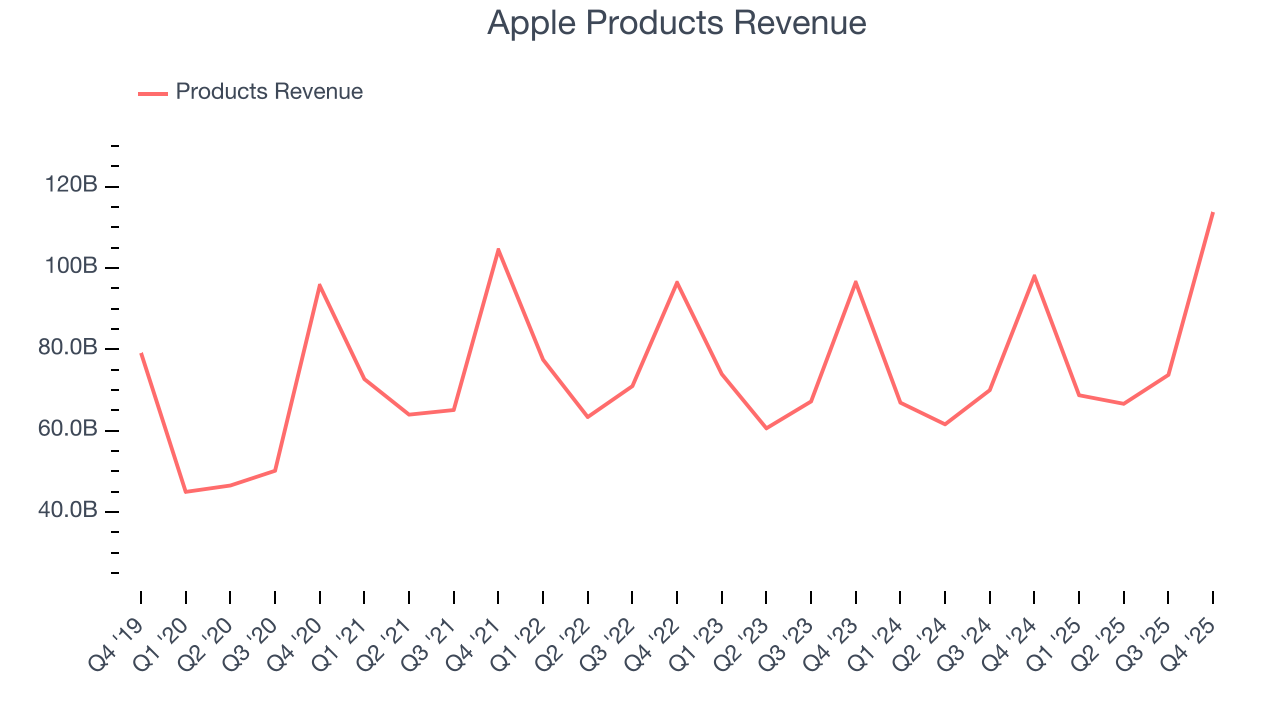

Apple’s Products segment includes everything from its flagship iPhone, iPad, and MacBook computers to AirPods and Apple Watch. We are closely monitoring whether the GenAI-powered Apple Intelligence, which was released in September 2024 but has limited interoperability with older devices, can spur an upgrade cycle for the company.

Products sales are by far the biggest chunk of Apple’s revenue at 74.1%, and they grew by 6.3% annually over the last five years, slower than total revenue. Recently, sales have also decelerated a bit, growing at an annual clip of 4% over the last two years. Apple could really use that upgrade cycle right about now.

This quarter, Products sales were up 16.1% year on year, topping Wall Street’s estimates by 5.2%. Holding aside expectations, the recently improved rate of change shows that more customers are upgrading their devices than before. We’ll be watching to see if Apple Intelligence and iOS 18 can accelerate this trend. Wall Street seems to believe it won't move the needle.

7. Services: Tim Cook’s Touch

The App Store, iCloud, and Apple Music transformed Apple from a lower-margin hardware company into a software provider. If Apple Intelligence spurs an upgrade cycle, will it also open new software revenue streams (like a paid version of Siri) that boost profit margins?

This is the key question for the Services segment, which must continue mining its existing markets or venture into new ones such as health and wellness to grow.

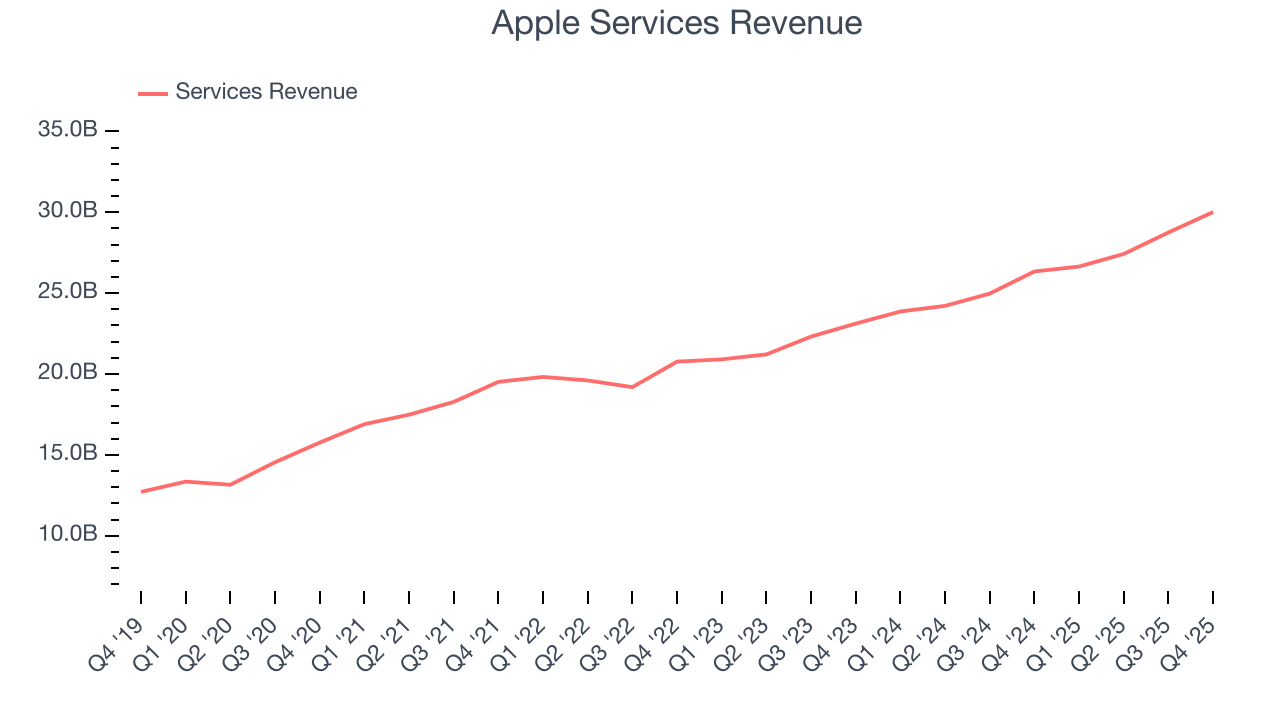

Over the last five years, Services revenue was a bright spot and grew at a solid 14.7% annualized rate, showing Apple is successfully locking customers further into its ecosystem. Services is now 25.9% of total revenue, up from 19.3% in 2020, and could become larger if its growth rate keeps exceeding Products.

Like the rest of the business, however, Services revenue slightly decelerated if we look at its 13.5% annual growth rate for the last two years. Still, this growth is a welcome figure.

The Services segment’s 13.9% revenue growth this quarter met Wall Street’s consensus estimates. This print was in line with last quarter’s 15.1%. While we’d always like to see acceleration, Services’s growth shows it’s finding monetization opportunities within Apple’s ecosystem. It also means the company can afford to wait for the potential Apple Intelligence tailwind to materialize.

8. Gross Margin

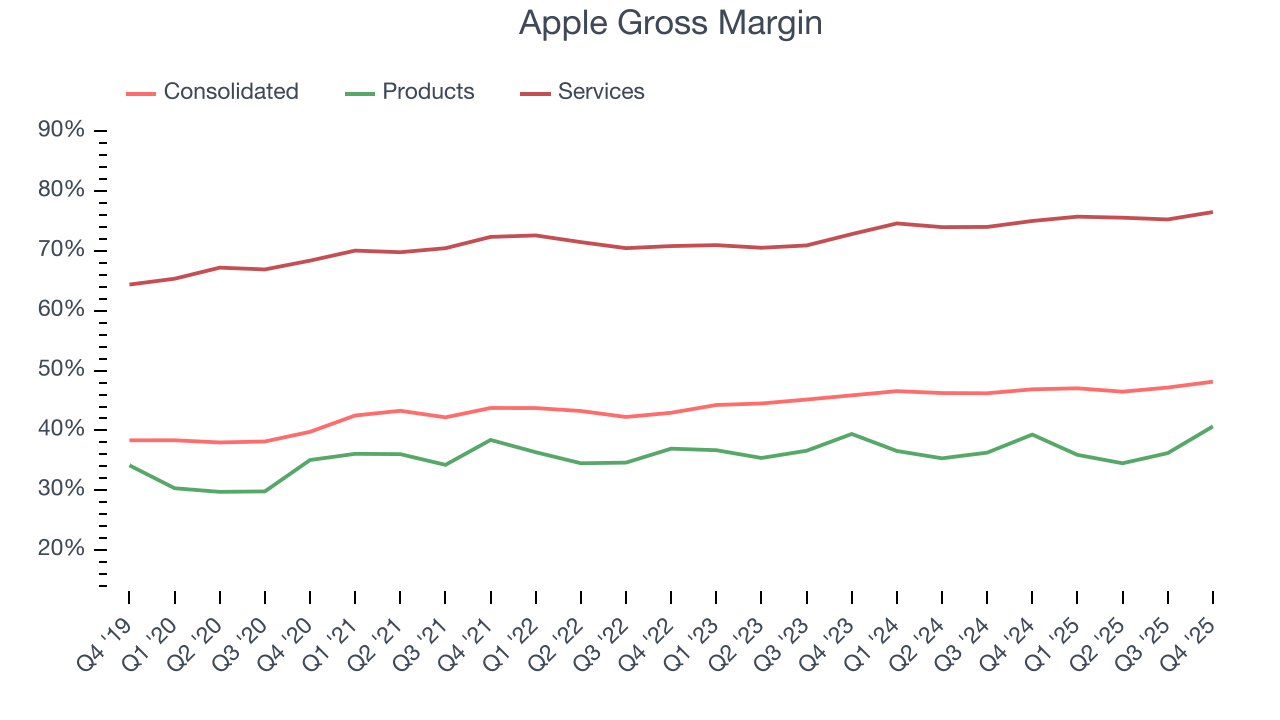

Apple’s Products and Services segments have different margin structures. Products averaged a lower gross margin of 36.8% over the last five years due to its raw materials and procurement expenses while Services, consisting of software and subscriptions with little to no physical costs, averaged 73%.

On a consolidated basis, Apple’s gross profit margin averaged 45.1%, predictably between Products and Services. Should the Services segment continue to grow its revenue faster than the Products segment as it has over the last two years, the company’s gross margin could increase even if the underlying profitability of its individual product lines doesn’t change.

Apple’s gross margin was 48.2% in Q4, up from 46.9% in the same quarter last year. That means for every $100 in revenue, $48.16 was left to invest in marketing, R&D, and general administrative overhead.

9. Operating Margin

Operating margin is an important measure of profitability for Apple. It’s the portion of revenue left after accounting for all operating expenses – everything from the cost of sales we talked about earlier to salaries, product development, and administrative expenses.

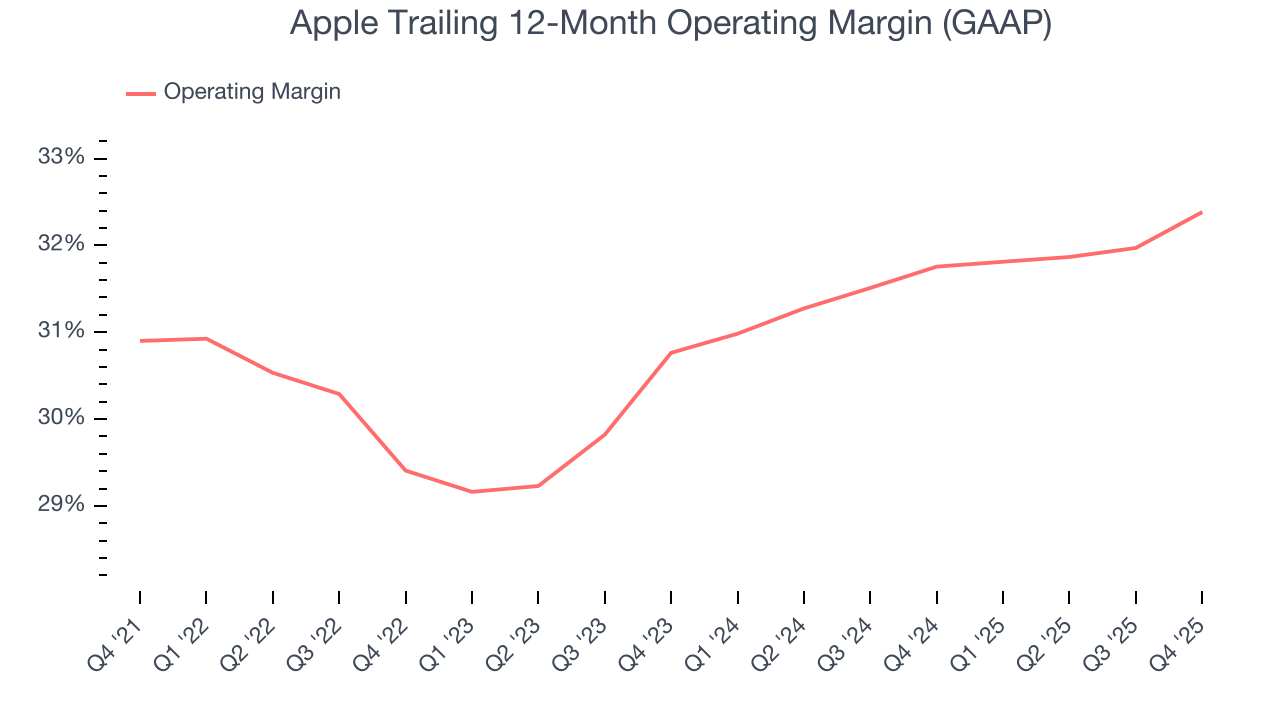

Apple has been a well-oiled machine over the last five years. It demonstrated elite profitability for a consumer discretionary business, boasting an average operating of 31.1%. This was especially robust given its large hardware revenue component.

Analyzing the trend in its profitability, Apple’s operating rose by 1.5 percentage points over the last five years, as its sales growth gave it operating leverage. This expansion was also driven by the company’s mix shift towards Services, and the rise could continue if Apple Intelligence results in more pricing power or if Products becomes an increasingly smaller part of the business.

This quarter, Apple generated an operating profit margin of 35.4%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

In the coming year, Wall Street expects Apple to maintain its trailing 12-month operating of 32.4%.

10. Earnings Per Share

We track the long-term change in earnings per share (EPS) alongside revenue and margins because it shows whether a company’s growth is profitable and what else affects shareholder returns.

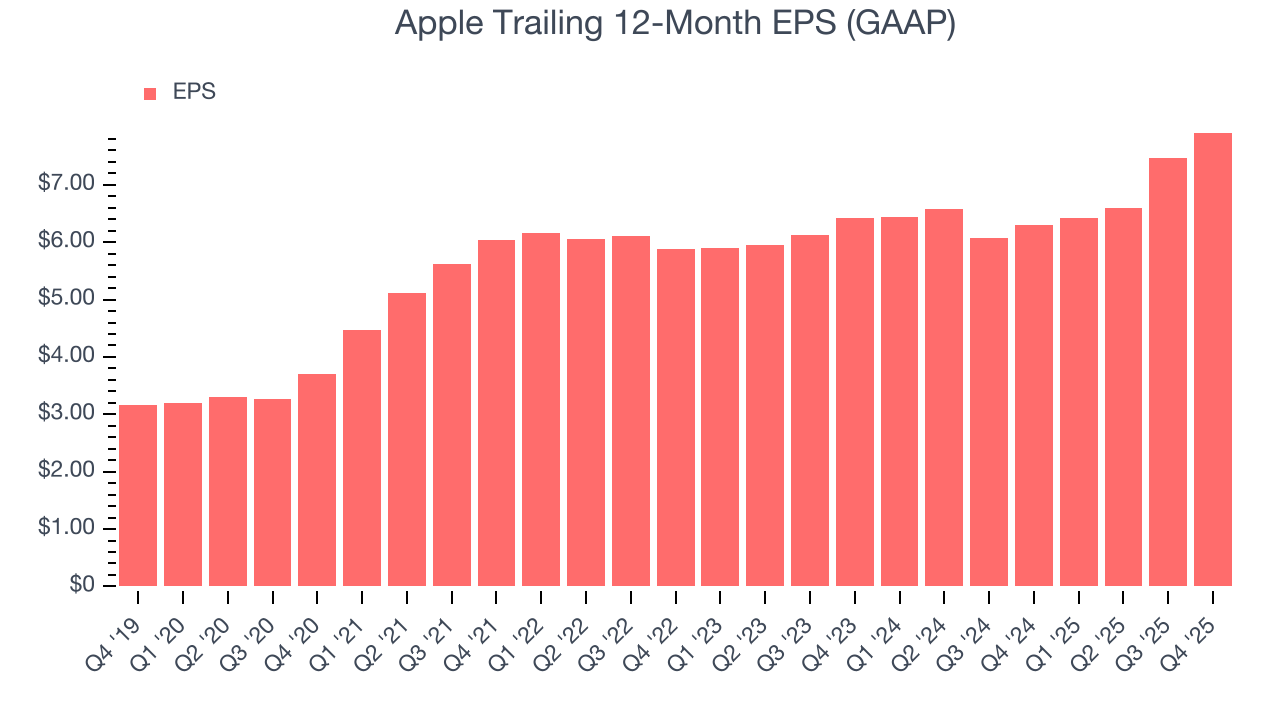

Apple’s EPS grew at a spectacular 16.4% compounded annual growth rate over the last five years, higher than its 8.2% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

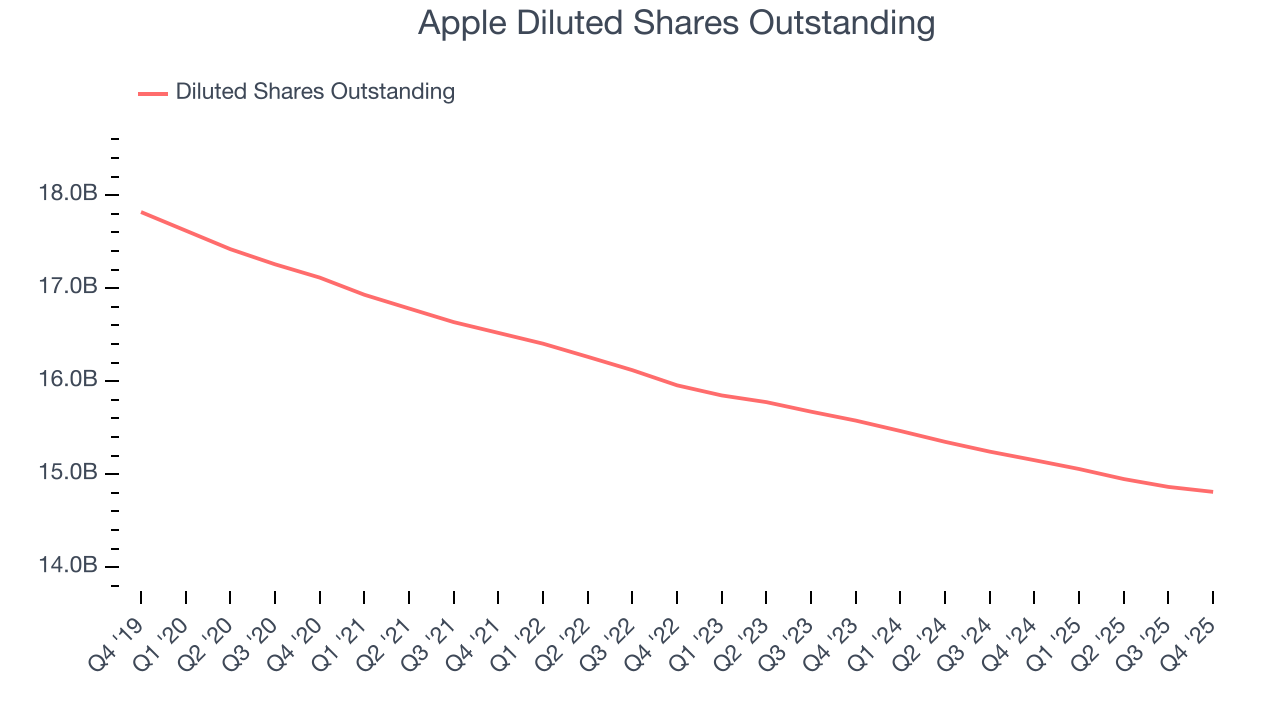

Diving into Apple’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, Apple’s operating was flat this quarter but expanded by 1.5 percentage points over the last five years. On top of that, its share count shrank by 13.5%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Apple, its two-year annual EPS growth of 10.9% was lower than its five-year trend. We still think its growth was good and could accelerate in the future if Apple Intelligence catalyzes an upgrade cycle.

In Q4, Apple reported EPS of $2.84, up from $2.40 in the same quarter last year. This print beat analysts’ estimates by 6.3%. Over the next 12 months, Wall Street expects Apple’s full-year EPS of $7.91 to grow 6.7%.

11. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills or invest for the future.

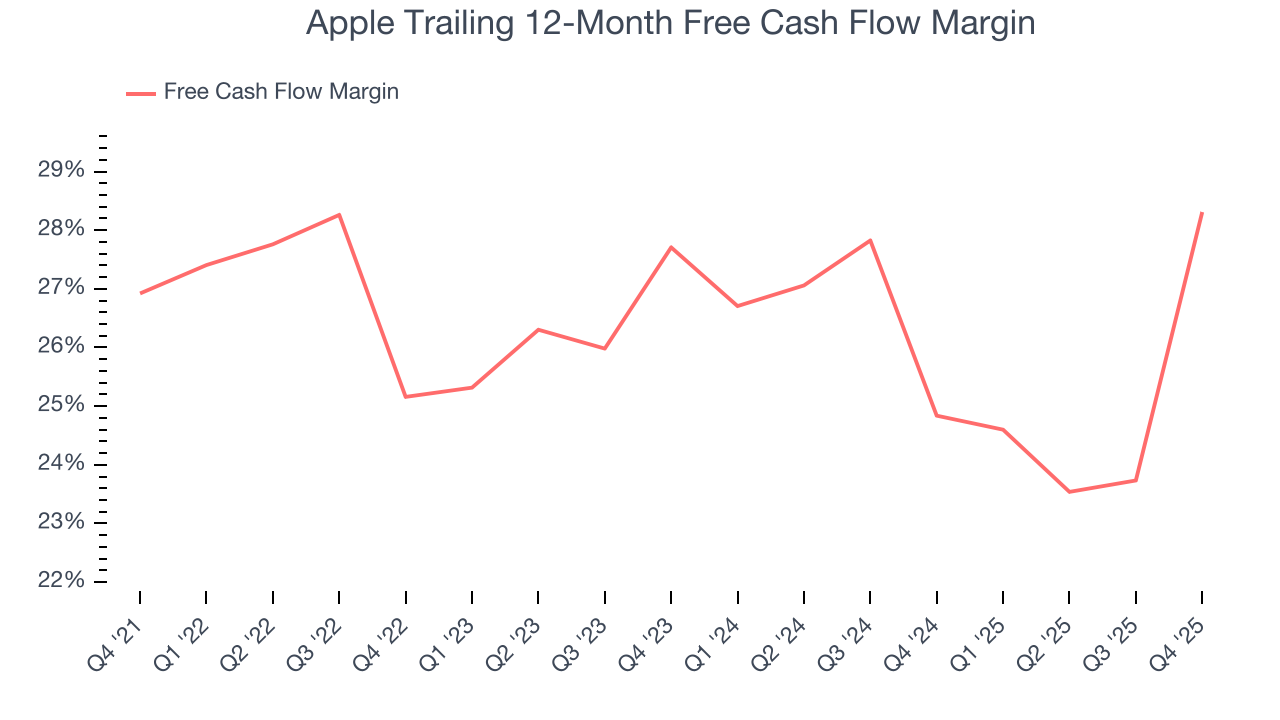

Apple has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the consumer discretionary sector, averaging 26.6% over the last five years.

Taking a step back, we can see that Apple’s margin expanded by 1.4 percentage points during that time. This is encouraging because it gives the company more optionality.

Apple’s free cash flow clocked in at $51.55 billion in Q4, equivalent to a 35.9% margin. This result was good as its margin was 14.1 percentage points higher than in the same quarter last year, building on its favorable historical trend.

Over the next year, analysts’ consensus estimates show they’re expecting Apple’s free cash flow margin of 28.3% for the last 12 months to remain the same.

12. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

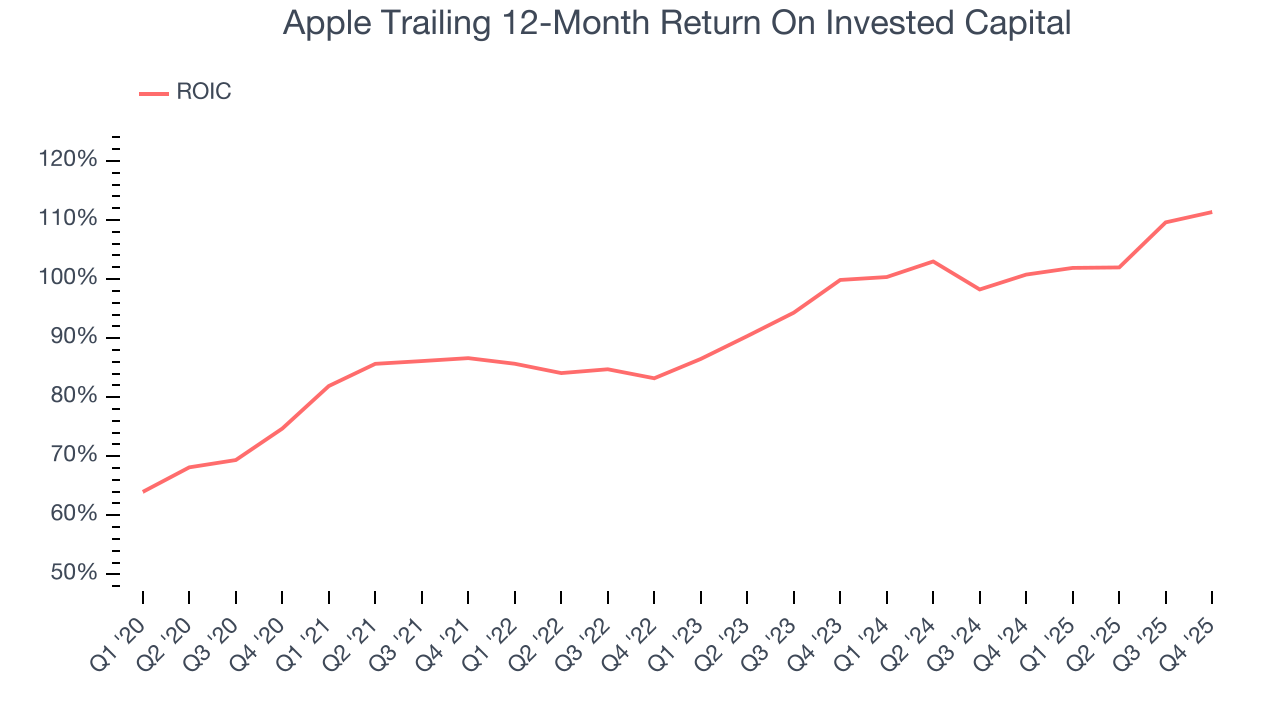

Apple’s five-year average ROIC was 96.4%, placing it among the best consumer discretionary companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Apple’s ROIC has increased significantly. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

13. Balance Sheet Assessment

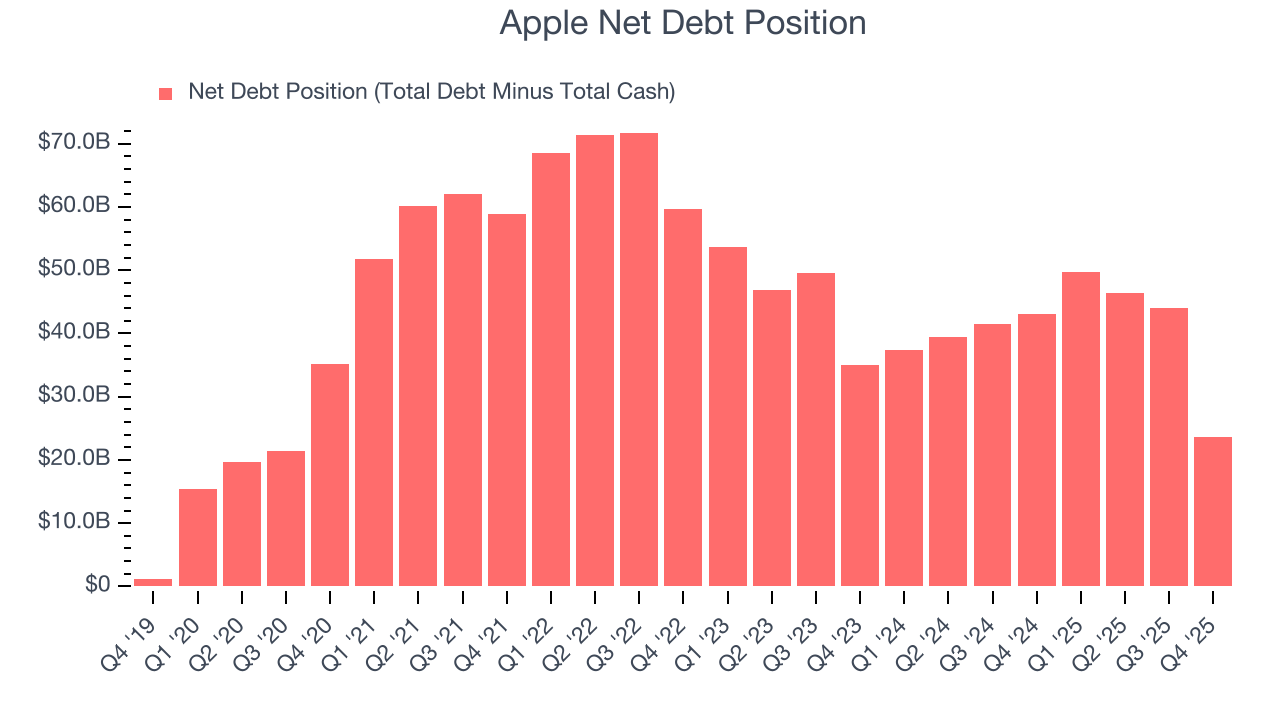

Apple reported $66.91 billion of cash and $90.51 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $156.5 billion of EBITDA over the last 12 months, we view Apple’s 0.2× net-debt-to-EBITDA ratio as safe. We also see its $2.78 billion of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

14. Key Takeaways from Apple’s Q4 Results

We were impressed by how significantly Apple blew past analysts’ revenue expectations this quarter. We were also glad its operating income outperformed Wall Street’s estimates. On the other hand, the all-important Services segment missed on revenue. Zooming out, we think this was still a good print with some key areas of upside. The stock traded up 1.1% to $261.14 immediately after reporting.

15. Is Now The Time To Buy Apple?

Updated: February 4, 2026 at 9:01 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

In our opinion, Apple is a solid company. First off, its decent long-term revenue growth driven by the Services segment implies slightly more customers are subscribing to its high-margin software offerings. And while its revenue deceleration over the last two years signals its newer products are less novel than past versions, its powerful free cash flow generation enables it to invest in growth initiatives like AI while returning capital to shareholders. On top of that, its strong operating margin suggests it has a highly efficient business model.

Apple’s price-to-earnings ratio based on the next 12 months is 31.4x. At this valuation, there’s a lot of good news priced in. Add this one to your watchlist and come back to it later.

Wall Street analysts have a consensus one-year price target of $292.46 on the company (compared to the current share price of $274.75).