Affirm (AFRM)

Affirm is intriguing, but the state of its balance sheet makes us slightly uncomfortable.― StockStory Analyst Team

1. News

2. Summary

Why Affirm Is Not Exciting

Founded by PayPal co-founder Max Levchin with a mission to create honest financial products, Affirm (NASDAQ:AFRM) provides a payment network that allows consumers to make purchases and pay for them over time with transparent, flexible installment loans.

- Negative return on equity shows that some of its growth strategies have backfired

- High net-debt-to-EBITDA ratio of 7× could force the company to raise capital at unfavorable terms if market conditions deteriorate

Affirm has some noteworthy aspects, but we’d hold off on investing until its EBITDA can comfortably service its debt.

Why There Are Better Opportunities Than Affirm

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Affirm

At $48.00 per share, Affirm trades at 13.3x forward P/E. The current valuation may be appropriate, but we’re still not buyers of the stock.

There are stocks out there similarly priced with better business quality. We prefer owning these.

3. Affirm (AFRM) Research Report: Q4 CY2025 Update

Buy now, pay later company Affirm (NASDAQ:AFRM) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 29.6% year on year to $1.12 billion. Its GAAP profit of $0.37 per share was 39.5% above analysts’ consensus estimates.

Affirm (AFRM) Q4 CY2025 Highlights:

- Revenue: $1.12 billion vs analyst estimates of $1.06 billion (29.6% year-on-year growth, 6.3% beat)

- Pre-tax Profit: $133.2 million (11.9% margin)

- EPS (GAAP): $0.37 vs analyst estimates of $0.27 (39.5% beat)

- Market Capitalization: $20.52 billion

Company Overview

Founded by PayPal co-founder Max Levchin with a mission to create honest financial products, Affirm (NASDAQ:AFRM) provides a payment network that allows consumers to make purchases and pay for them over time with transparent, flexible installment loans.

Affirm's platform offers several payment options, including its Pay-in-4 plan (four biweekly interest-free payments), 0% APR monthly installment loans, and interest-bearing installment loans with fixed rates that never compound. Unlike traditional credit cards, Affirm doesn't charge late fees, annual fees, or hidden charges, making the total cost clear to consumers upfront.

The company serves two distinct customer groups: consumers seeking flexible payment options and merchants looking to increase sales. For merchants, Affirm integrates directly into checkout systems through APIs, helping to boost conversion rates and average order values by making higher-priced items more accessible. Merchants can choose to subsidize 0% APR offers to consumers, effectively using Affirm as an alternative to discounting. The company also provides merchants with analytics tools and a dashboard to track performance.

For example, a consumer shopping for a $1,000 mattress might be hesitant to make the purchase outright but would proceed when offered the option to pay $250 now and three more payments of $250 over six weeks with no interest. The merchant gains a sale it might have otherwise lost, while Affirm earns revenue either from the merchant (who pays a fee for the 0% consumer financing) or from interest paid by the consumer on interest-bearing loans.

Affirm has expanded beyond checkout financing with the Affirm Card, which allows users to convert eligible purchases into installment plans, and a high-yield savings account. The company also operates a marketplace through its app and website where consumers can discover offers from Affirm's merchant partners.

4. Personal Loan

Personal loan providers offer unsecured credit for various consumer needs. The sector benefits from digital application processes, increasing consumer comfort with online financial services, and opportunities in underserved credit segments. Headwinds include credit risk management in unsecured lending, regulatory oversight of lending practices, and intense competition affecting margins from both traditional and fintech lenders.

Affirm competes with traditional credit card issuers like Chase, Citibank, and American Express, as well as other buy now, pay later providers such as Klarna, PayPal's Pay in 4, and Block's Afterpay. The company also faces competition from emerging fintech payment solutions and bank-offered installment payment options.

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Affirm grew its revenue at an incredible 40.9% compounded annual growth rate. Its growth beat the average financials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Affirm’s annualized revenue growth of 39.3% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Affirm reported robust year-on-year revenue growth of 29.6%, and its $1.12 billion of revenue topped Wall Street estimates by 6.3%.

6. Pre-Tax Profit Margin

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Personal Loan companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

The pre-tax profit margin includes interest because it's central to how financial institutions generate revenue and manage costs. Tax considerations are excluded since they represent government policy rather than operational performance, giving investors a clearer view of business fundamentals.

Over the last five years, Affirm’s pre-tax profit margin has fallen by 20 percentage points, going from negative 78.3% to 7.9%. It has also expanded by 47.2 percentage points on a two-year basis, showing its expenses have consistently grown at a slower rate than revenue. This typically signals prudent management.

Affirm’s pre-tax profit margin came in at 11.9% this quarter. This result was 2.3 percentage points better than the same quarter last year.

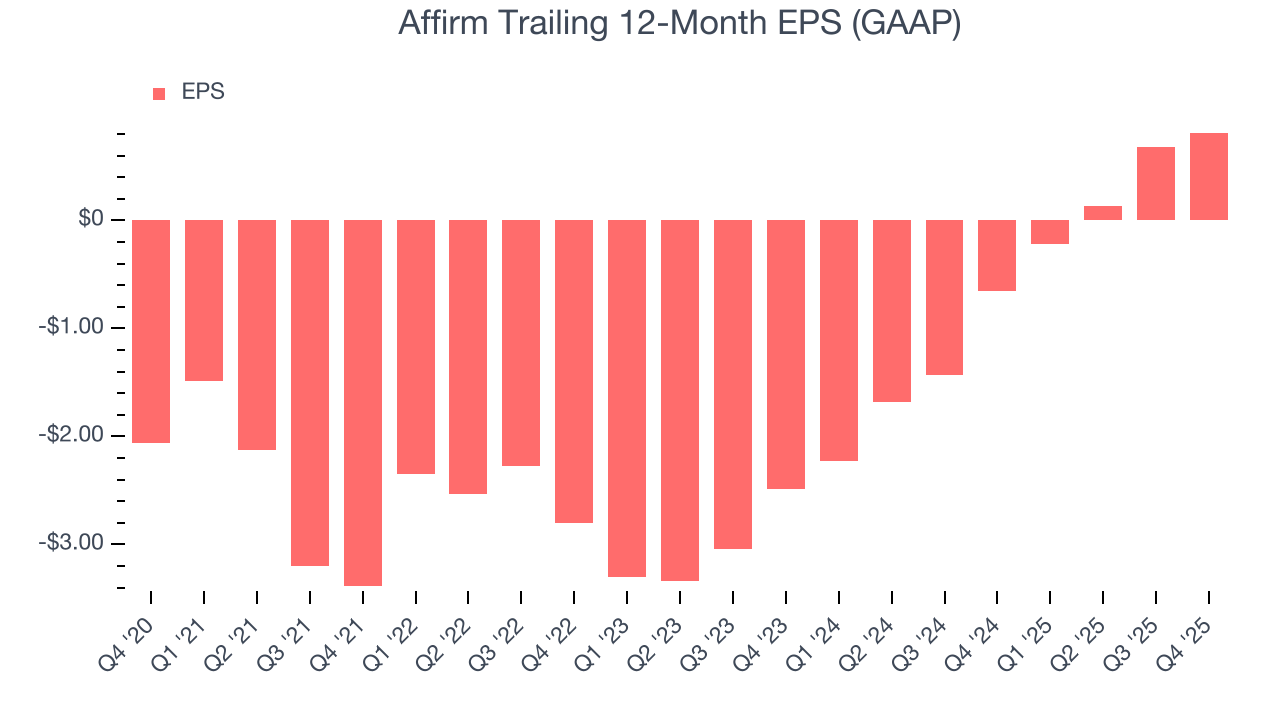

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Affirm’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Affirm, its two-year annual EPS growth of 52.5% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, Affirm reported EPS of $0.37, up from $0.23 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Affirm’s full-year EPS of $0.81 to grow 48.3%.

8. Return on Equity

Return on equity, or ROE, quantifies bank profitability relative to shareholder equity - an essential capital source for these institutions. Over extended periods, superior ROE performance drives faster shareholder wealth compounding through reinvestment, share repurchases, and dividend growth.

Over the last five years, Affirm has averaged an ROE of negative 22%, a bad result not only in absolute terms but also relative to the majority of firms putting up 25%+. It also shows that Affirm has little to no competitive moat.

9. Balance Sheet Assessment

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

Affirm currently has $9.01 billion of debt and $3.55 billion of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 2.5×. We think this is safe and raises no red flags. In general, we’re comfortable with any ratio below 3.5× for a financials business.

10. Key Takeaways from Affirm’s Q4 Results

It was good to see Affirm beat analysts’ EPS expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The market seemed to be hoping for more, and the stock traded down 3.9% to $57.29 immediately after reporting.

11. Is Now The Time To Buy Affirm?

Updated: February 25, 2026 at 12:26 AM EST

When considering an investment in Affirm, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

Aside from its balance sheet, Affirm is a pretty good company. For starters, its revenue growth was exceptional over the last five years. And while its relatively low ROE suggests management has struggled to find compelling investment opportunities, its astounding EPS growth over the last four years shows its profits are trickling down to shareholders. Additionally, Affirm’s expanding pre-tax profit margin shows the business has become more efficient.

Affirm’s P/E ratio based on the next 12 months is 13.3x. Despite its notable business characteristics, we’d hold off for now because its balance sheet concerns us. We think a potential buyer of the stock should wait until the company generates sufficient cash flows or raises money.

Wall Street analysts have a consensus one-year price target of $84.48 on the company (compared to the current share price of $48.00).