AGNC Investment (AGNC)

AGNC Investment is in for a bumpy ride. Its low returns on capital and plummeting sales suggest it struggles to generate demand and profits, a red flag.― StockStory Analyst Team

1. News

2. Summary

Why We Think AGNC Investment Will Underperform

Born during the 2008 financial crisis when mortgage markets were in turmoil, AGNC Investment (NASDAQ:AGNC) is a real estate investment trust that primarily invests in mortgage-backed securities guaranteed by U.S. government agencies or enterprises.

- Sales tumbled by 51.9% annually over the last five years, showing market trends are working against its favor during this cycle

- Earnings per share have contracted by 9.5% annually over the last five years, a headwind for returns as stock prices often echo long-term EPS performance

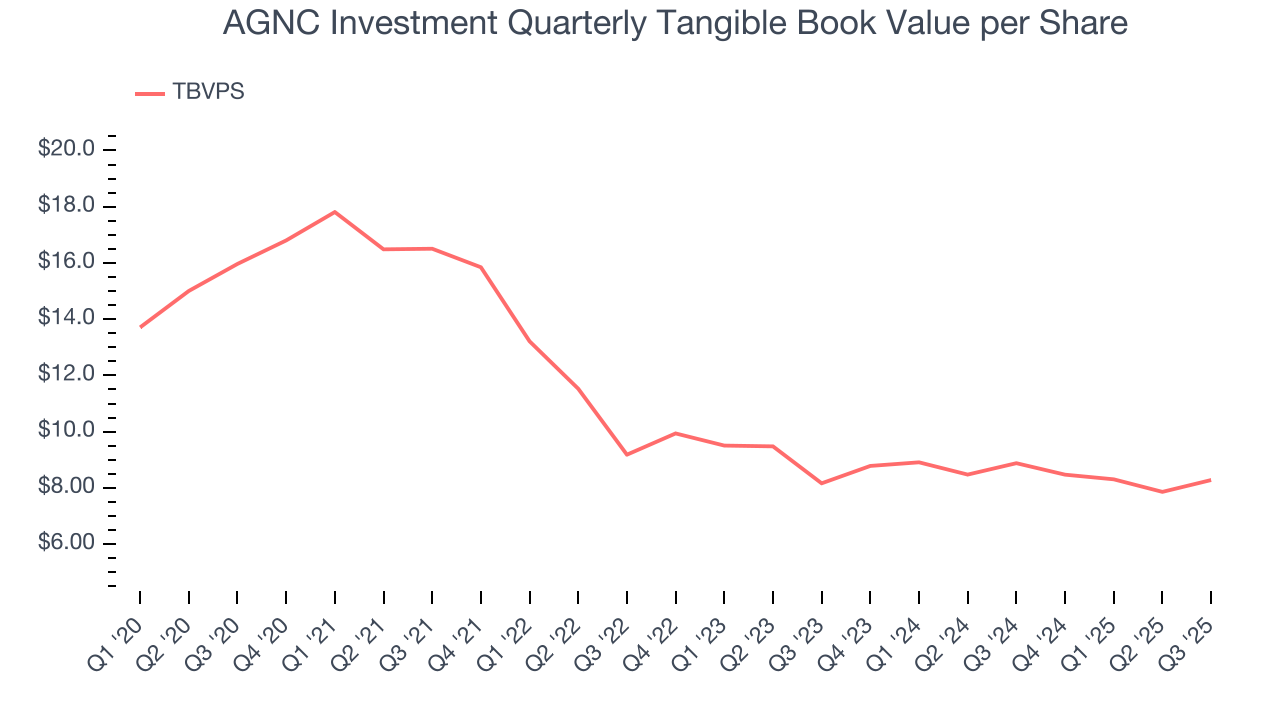

- Loan losses and capital returns have eroded its tangible book value per share this cycle as its tangible book value per share declined by 12.2% annually over the last five years

AGNC Investment doesn’t pass our quality test. We’re redirecting our focus to better businesses.

Why There Are Better Opportunities Than AGNC Investment

High Quality

Investable

Underperform

Why There Are Better Opportunities Than AGNC Investment

At $11.87 per share, AGNC Investment trades at 1.3x forward P/B. This multiple is high given its weaker fundamentals.

Paying a premium for high-quality companies with strong long-term earnings potential is preferable to owning challenged businesses with questionable prospects. That helps the prudent investor sleep well at night.

3. AGNC Investment (AGNC) Research Report: Q3 CY2025 Update

Mortgage REIT AGNC Investment (NASDAQ:AGNC) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 122% year on year to $836 million. Its GAAP profit of $0.72 per share was 31.5% above analysts’ consensus estimates.

AGNC Investment (AGNC) Q3 CY2025 Highlights:

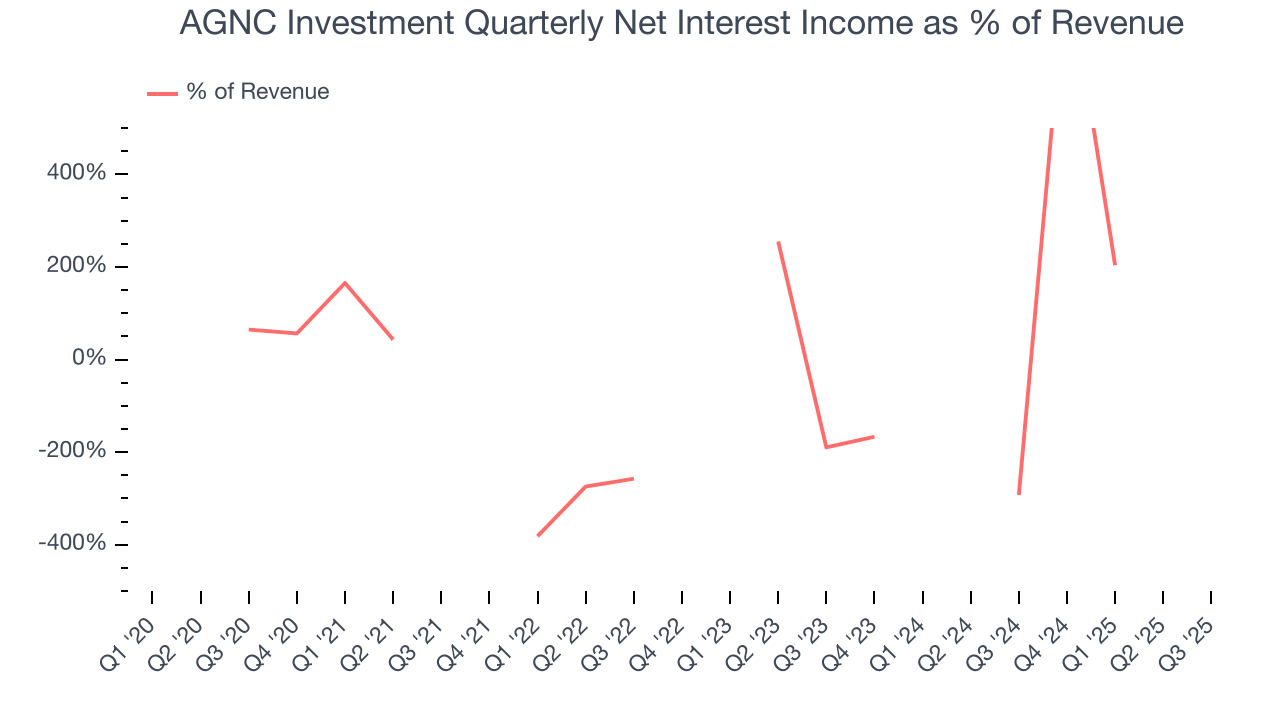

- Net Interest Income: $148 million vs analyst estimates of $468.5 million (68.4% miss)

- Revenue: $836 million vs analyst estimates of $587.6 million (122% year-on-year growth, 42.3% beat)

- Efficiency Ratio: 3.6% (439 basis point year-on-year increase)

- EPS (GAAP): $0.72 vs analyst estimates of $0.55 (31.5% beat)

- Tangible Book Value per Share: $8.28 vs analyst estimates of $8.04 (6.8% year-on-year decline, 3% beat)

- Market Capitalization: $10.41 billion

Company Overview

Born during the 2008 financial crisis when mortgage markets were in turmoil, AGNC Investment (NASDAQ:AGNC) is a real estate investment trust that primarily invests in mortgage-backed securities guaranteed by U.S. government agencies or enterprises.

AGNC focuses on Agency residential mortgage-backed securities (RMBS), which are securities backed by pools of home loans where the principal and interest payments are guaranteed by government-sponsored enterprises like Fannie Mae and Freddie Mac, or by government agencies like Ginnie Mae. This government backing significantly reduces default risk compared to non-guaranteed mortgage investments.

The company uses sophisticated modeling techniques to analyze and select assets with favorable risk-return profiles, considering factors like prepayment risk and interest rate sensitivity. AGNC typically employs leverage (borrowing money) to amplify returns on its investments, a common strategy among mortgage REITs.

Beyond Agency RMBS, AGNC may invest in other real estate-related assets including Credit Risk Transfer securities, which transfer some mortgage default risk from government entities to private investors, and non-Agency residential and commercial mortgage-backed securities that lack government guarantees.

A homeowner might benefit from AGNC's operations when they obtain a mortgage that gets packaged into a security purchased by AGNC. This investment provides liquidity to mortgage lenders, enabling them to make more loans to other homebuyers.

AGNC generates income primarily through the interest spread between the yield on its mortgage investments and its borrowing costs, as well as from changes in the value of its securities. As a REIT, AGNC must distribute at least 90% of its taxable income to shareholders annually, making it a potential income-generating investment for stockholders seeking dividend yields.

4. Thrifts & Mortgage Finance

Thrifts & Mortgage Finance institutions operate by accepting deposits and extending loans primarily for residential mortgages, earning revenue through interest rate spreads (difference between lending rates and borrowing costs) and origination fees. The industry benefits from demographic tailwinds as millennials enter prime homebuying age, technological advancements streamlining the loan approval process, and potential interest rate stabilization improving affordability. However, significant headwinds include net interest margin compression during rate volatility, increased competition from fintech disruptors offering digital-first experiences, mounting regulatory compliance costs, and potential housing market corrections that could impact loan portfolios and default rates.

AGNC Investment's main competitors include other mortgage REITs such as Annaly Capital Management (NYSE:NLY), Two Harbors Investment Corp. (NYSE:TWO), and ARMOUR Residential REIT (NYSE:ARR), all of which similarly focus on investing in mortgage-backed securities.

5. Sales Growth

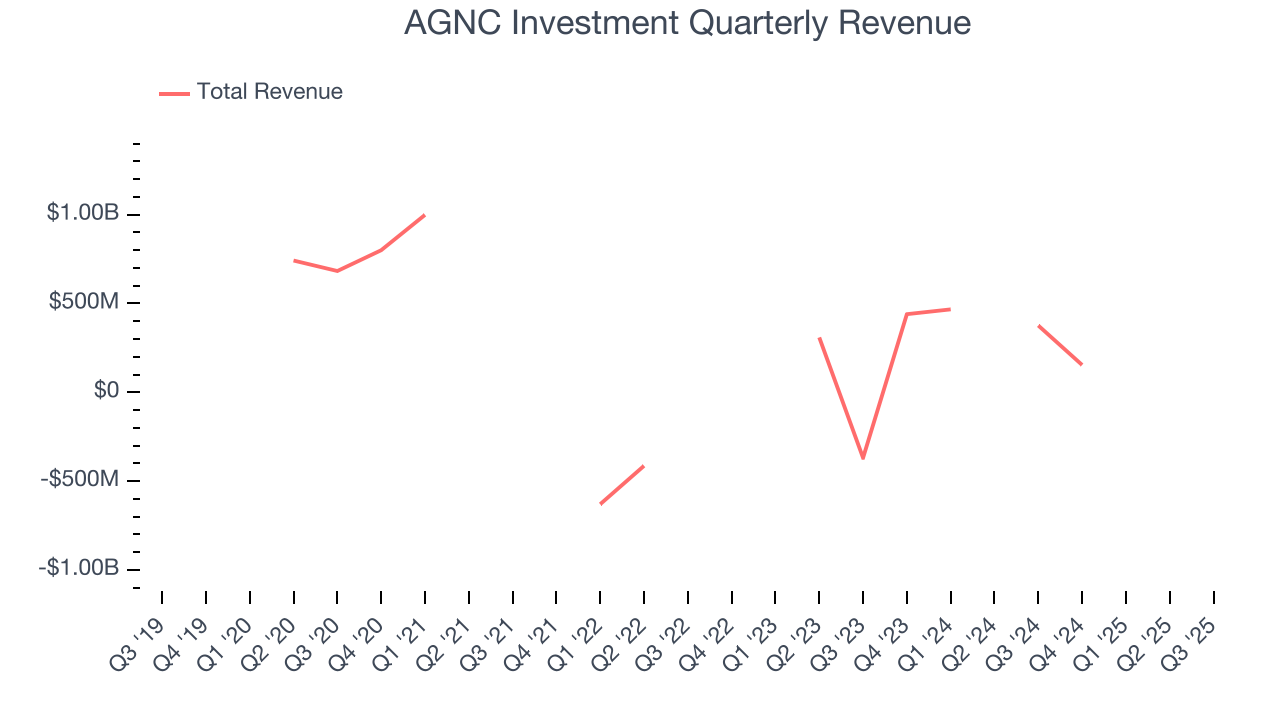

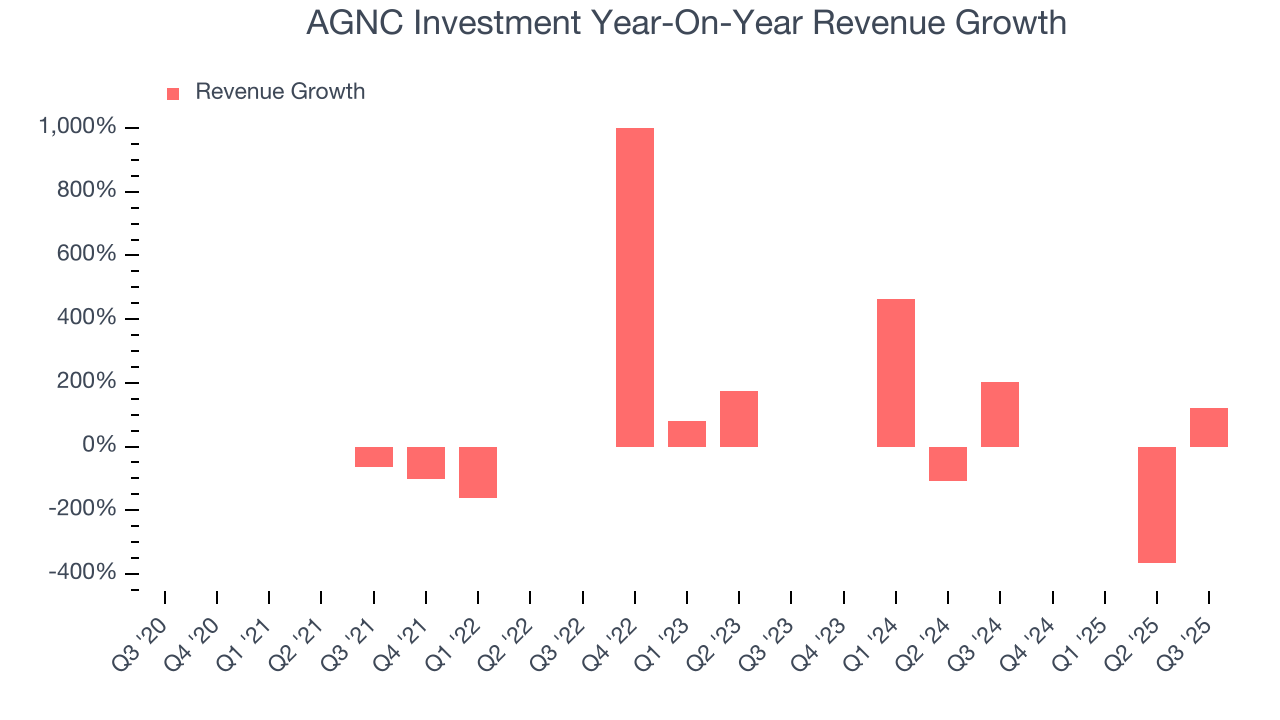

From lending activities to service fees, most banks build their revenue model around two income sources. Interest rate spreads between loans and deposits create the first stream, with the second coming from charges on everything from basic bank accounts to complex investment banking transactions. AGNC Investment’s demand was weak over the last five years as its revenue fell at a 51.9% annual rate. This wasn’t a great result and suggests it’s a lower quality business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. AGNC Investment’s recent performance shows its demand remained suppressed as its revenue has declined by 78.2% annually over the last two years.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, AGNC Investment reported magnificent year-on-year revenue growth of 122%, and its $836 million of revenue beat Wall Street’s estimates by 42.3%.

Net interest income made up -429% of the company’s total revenue during the last five years, meaning AGNC Investment is well diversified and has a variety of income streams driving its overall growth. Nevertheless, net interest income is critical to analyze for banks because they’re considered a higher-quality, more recurring revenue source by investors.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.6. Earnings Per Share

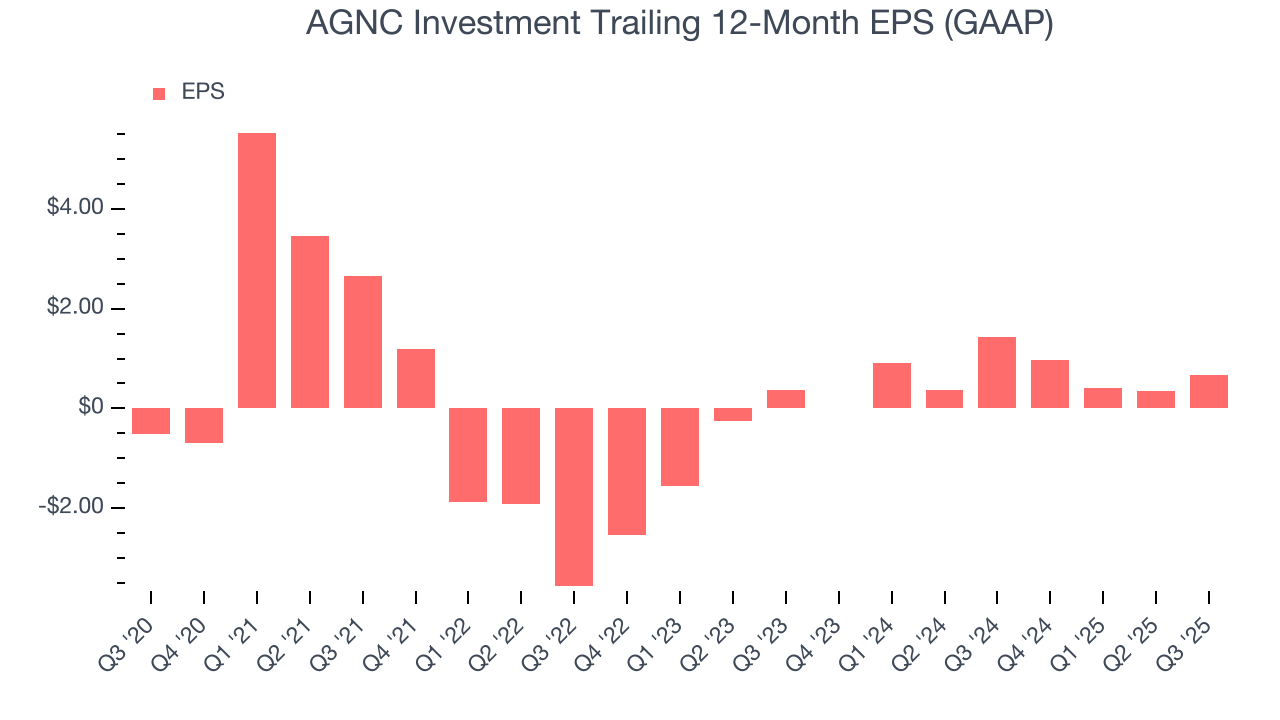

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

AGNC Investment’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

AGNC Investment’s EPS grew at an astounding 34.6% compounded annual growth rate over the last two years, higher than its 78.2% annualized revenue declines. This tells us management adapted its cost structure in response to a challenging demand environment.

In Q3, AGNC Investment reported EPS of $0.72, up from $0.39 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects AGNC Investment’s full-year EPS of $0.67 to grow 129%.

7. Tangible Book Value Per Share (TBVPS)

Banks are balance sheet-driven businesses because they generate earnings primarily through borrowing and lending. They’re also valued based on their balance sheet strength and ability to compound book value (another name for shareholders’ equity) over time.

This explains why tangible book value per share (TBVPS) stands as the premier banking metric. TBVPS strips away questionable intangible assets, revealing concrete per-share net worth that investors can trust. EPS can become murky due to acquisition impacts or accounting flexibility around loan provisions, and TBVPS resists financial engineering manipulation.

AGNC Investment’s TBVPS declined at a 12.3% annual clip over the last five years. TBVPS has stabilized recently as it was flat over the last two years at about $8.28 per share.

Over the next 12 months, Consensus estimates call for AGNC Investment’s TBVPS to shrink by 2.9% to $8.04, a sour projection.

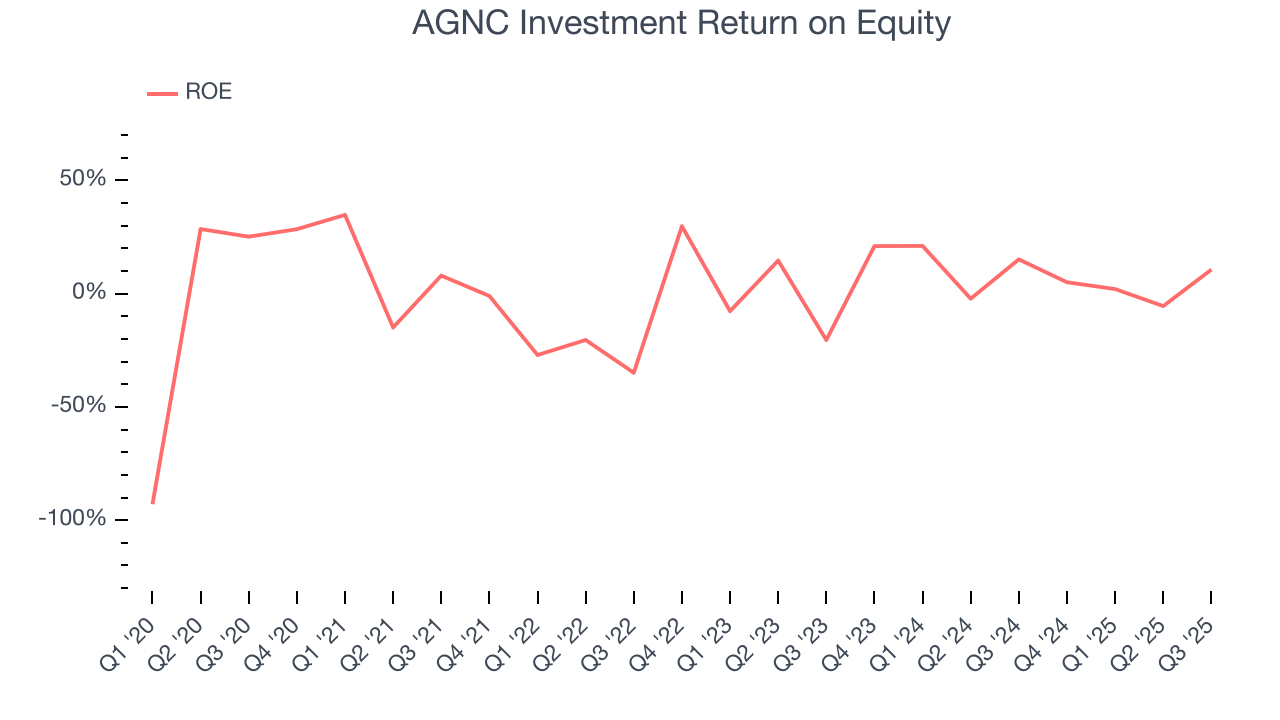

8. Return on Equity

Return on equity, or ROE, tells us how much profit a company generates for each dollar of shareholder equity, a key funding source for banks. Over a long period, banks with high ROE tend to compound shareholder wealth faster through retained earnings, buybacks, and dividends.

Over the last five years, AGNC Investment has averaged an ROE of 2.8%, uninspiring for a company operating in a sector where the average shakes out around 7.5%.

9. Key Takeaways from AGNC Investment’s Q3 Results

It was good to see AGNC Investment beat analysts’ EPS expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. On the other hand, its net interest income missed. Overall, we think this was a mixed quarter. The stock remained flat at $10.07 immediately after reporting.

10. Is Now The Time To Buy AGNC Investment?

Updated: January 23, 2026 at 11:45 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own AGNC Investment, you should also grasp the company’s longer-term business quality and valuation.

AGNC Investment doesn’t pass our quality test. To kick things off, its revenue has declined over the last five years. And while its net interest income growth was exceptional over the last five years, the downside is its TBVPS has declined over the last five years. On top of that, its declining EPS over the last five years makes it a less attractive asset to the public markets.

AGNC Investment’s P/B ratio based on the next 12 months is 1.3x. This multiple tells us a lot of good news is priced in - we think there are better opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $10.78 on the company (compared to the current share price of $11.87), implying they don’t see much short-term potential in AGNC Investment.