Amplitude (AMPL)

Amplitude is up against the odds. Its growth has decelerated and its failure to generate meaningful free cash flow makes us question its prospects.― StockStory Analyst Team

1. News

2. Summary

Why We Think Amplitude Will Underperform

Born from the realization that companies were flying blind when it came to understanding user behavior in their digital products, Amplitude (NASDAQ:AMPL) provides a digital analytics platform that helps businesses understand how people use their digital products to improve user experiences and drive revenue growth.

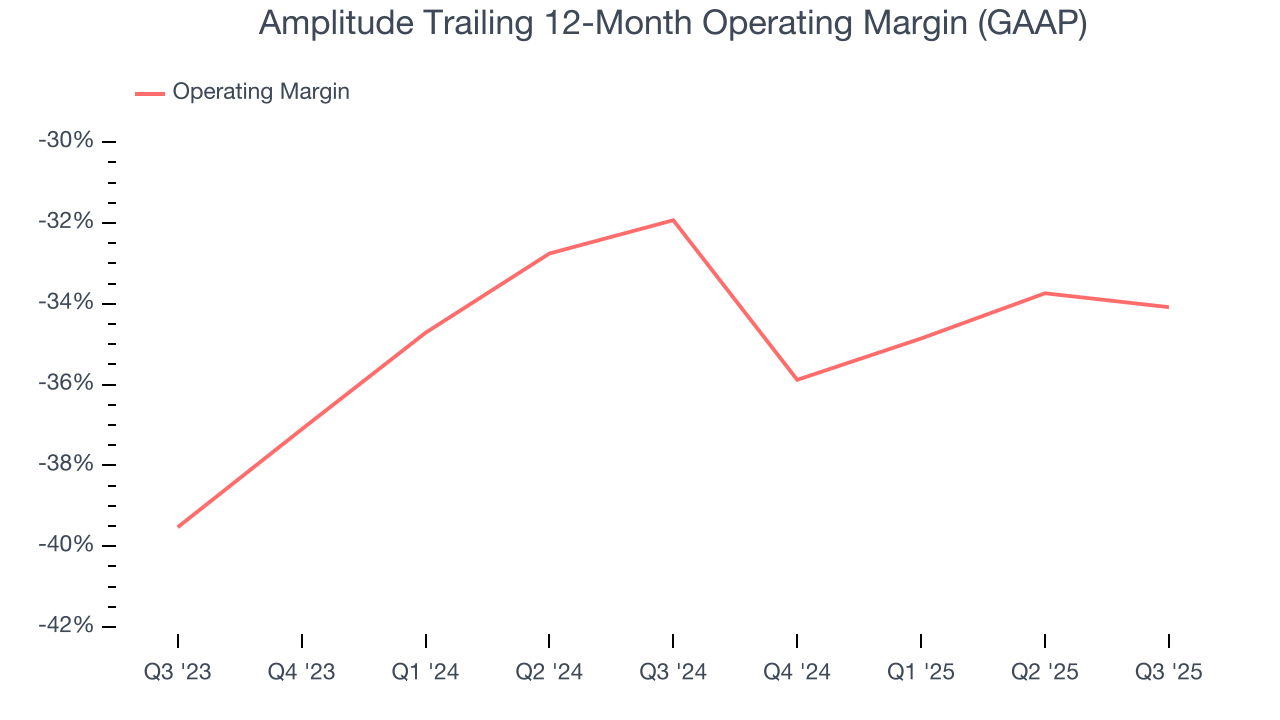

- Historical operating margin losses point to an inefficient cost structure

- Efficiency has decreased over the last year as its operating margin fell by 2.2 percentage points

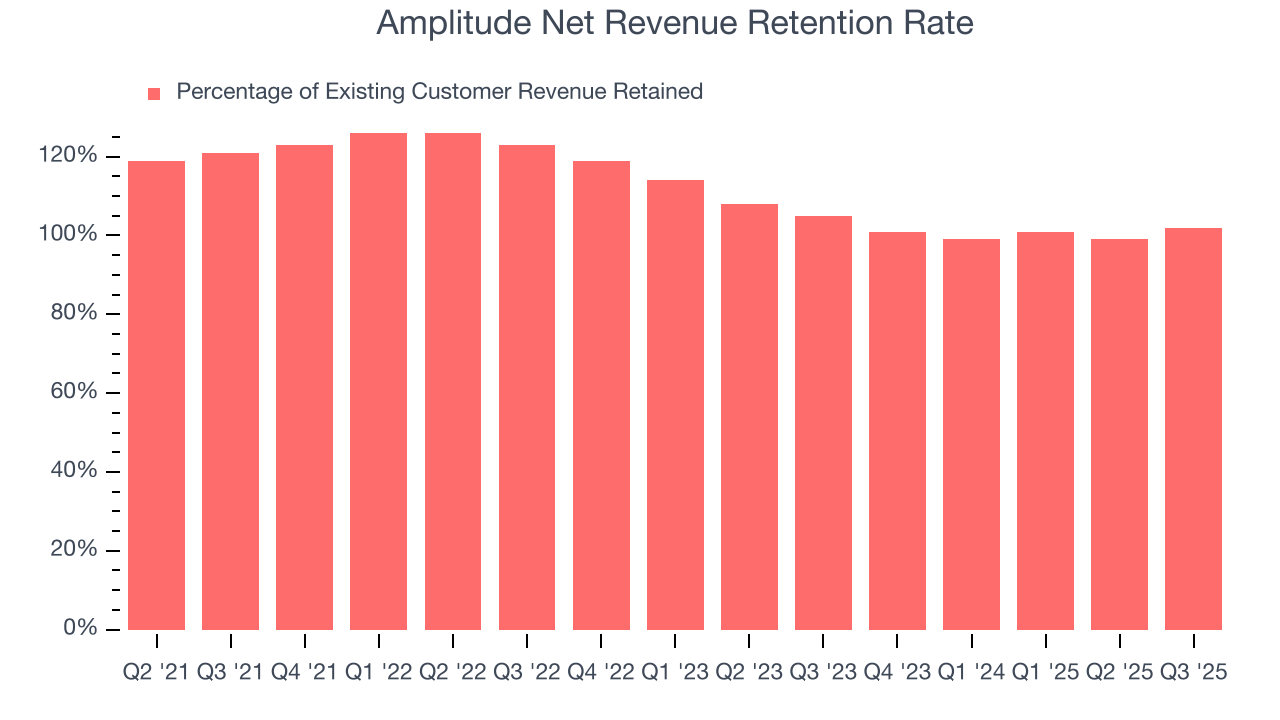

- Below-average net revenue retention rate of 101% suggests it has some trouble expanding within existing accounts

Amplitude’s quality isn’t great. We’re on the lookout for more interesting opportunities.

Why There Are Better Opportunities Than Amplitude

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Amplitude

Amplitude’s stock price of $10.07 implies a valuation ratio of 3.6x forward price-to-sales. Amplitude’s valuation may seem like a bargain, but we think there are valid reasons why it’s so cheap.

Our advice is to pay up for elite businesses whose advantages are tailwinds to earnings growth. Don’t get sucked into lower-quality businesses just because they seem like bargains. These mediocre businesses often never achieve a higher multiple as hoped, a phenomenon known as a “value trap”.

3. Amplitude (AMPL) Research Report: Q3 CY2025 Update

Digital analytics platform Amplitude (NASDAQ:AMPL) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 17.7% year on year to $88.56 million. Guidance for next quarter’s revenue was optimistic at $90 million at the midpoint, 2.3% above analysts’ estimates. Its non-GAAP profit of $0.02 per share was in line with analysts’ consensus estimates.

Amplitude (AMPL) Q3 CY2025 Highlights:

- Revenue: $88.56 million vs analyst estimates of $86.34 million (17.7% year-on-year growth, 2.6% beat)

- Adjusted EPS: $0.02 vs analyst estimates of $0.01 (in line)

- Adjusted Operating Income: $568,000 vs analyst estimates of $26,820 (0.6% margin, relatively in line)

- Revenue Guidance for Q4 CY2025 is $90 million at the midpoint, above analyst estimates of $87.95 million

- Operating Margin: -29%, down from -26.6% in the same quarter last year

- Free Cash Flow Margin: 3.8%, down from 21.8% in the previous quarter

- Customers: 4,500, up from 4,271 in the previous quarter

- Net Revenue Retention Rate: 102%, up from 99% in the previous quarter

- Annual Recurring Revenue: $347 million vs analyst estimates of $344.6 million (16.4% year-on-year growth, 0.7% beat)

- Market Capitalization: $1.26 billion

Company Overview

Born from the realization that companies were flying blind when it came to understanding user behavior in their digital products, Amplitude (NASDAQ:AMPL) provides a digital analytics platform that helps businesses understand how people use their digital products to improve user experiences and drive revenue growth.

The Amplitude Digital Analytics Platform enables companies to collect, analyze, and act on customer behavioral data across websites, mobile apps, and other digital touchpoints. At the core of its technology is the Amplitude Behavioral Graph, a proprietary database specifically designed to process complex user interactions and identify patterns that lead to desired outcomes like conversions or retention.

The platform consists of several integrated components: Amplitude Analytics for understanding user behavior through quantitative and qualitative insights; Amplitude Experiment for testing new features; Amplitude CDP for managing customer data; and Session Replay for visualizing exactly how users interact with digital interfaces. Through these tools, teams can identify which user actions predict purchasing behavior, why customers abandon processes, and which pathways lead to successful outcomes.

A typical customer might use Amplitude to discover that users who complete a specific sequence of actions (like watching a tutorial video followed by creating a project) are significantly more likely to convert to paid subscribers. The product team could then redesign the onboarding flow to encourage this behavior pattern.

Amplitude operates on a subscription-based software-as-a-service (SaaS) model, serving over 2,700 customers across industries ranging from finance and retail to healthcare and telecommunications. Its platform is designed for cross-functional use, enabling product managers, marketers, engineers, analysts, and executives to work from a shared understanding of user behavior.

4. Data Analytics

Organizations generate a lot of data that is stored in silos, often in incompatible formats, making it slow and costly to extract actionable insights, which in turn drives demand for modern cloud-based data analysis platforms that can efficiently analyze the siloed data.

Amplitude competes with product analytics solutions like Pendo, Mixpanel, and Heap, as well as larger players including Adobe Experience Cloud and Google Analytics. In the experimentation space, it faces competition from Optimizely and LaunchDarkly, while in the customer data platform category, it competes with mParticle and Twilio Segment.

5. Revenue Growth

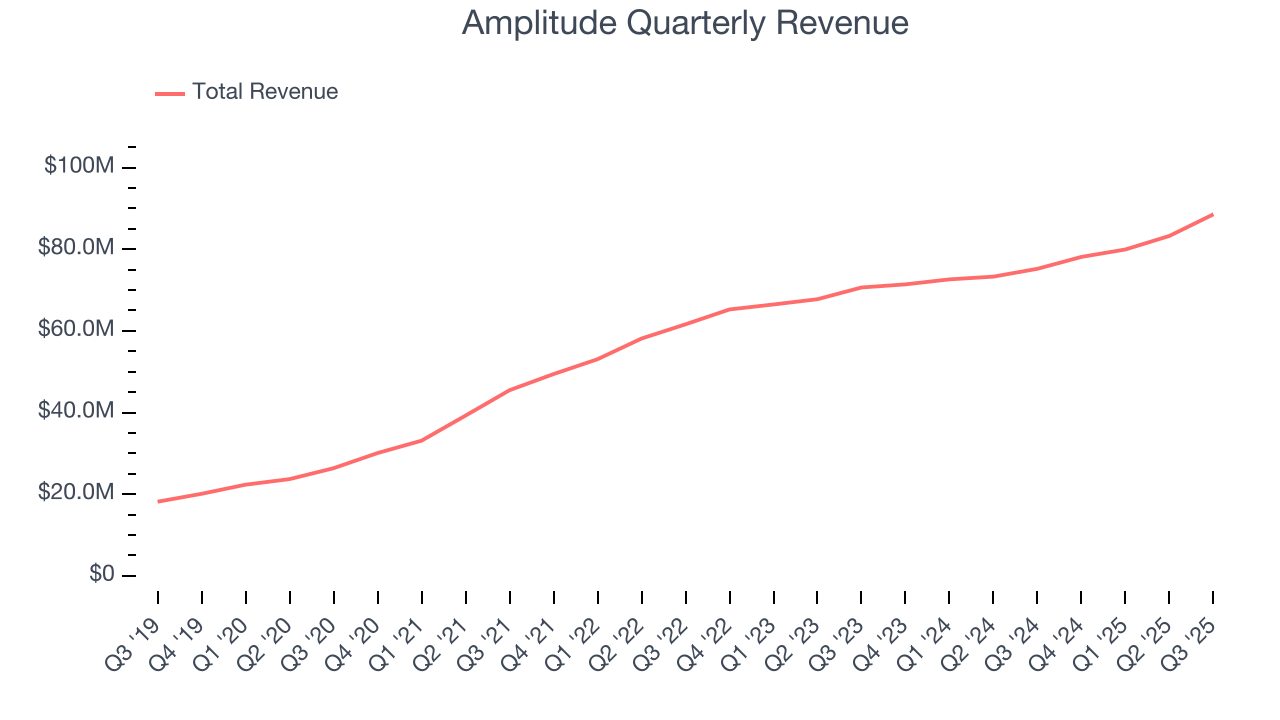

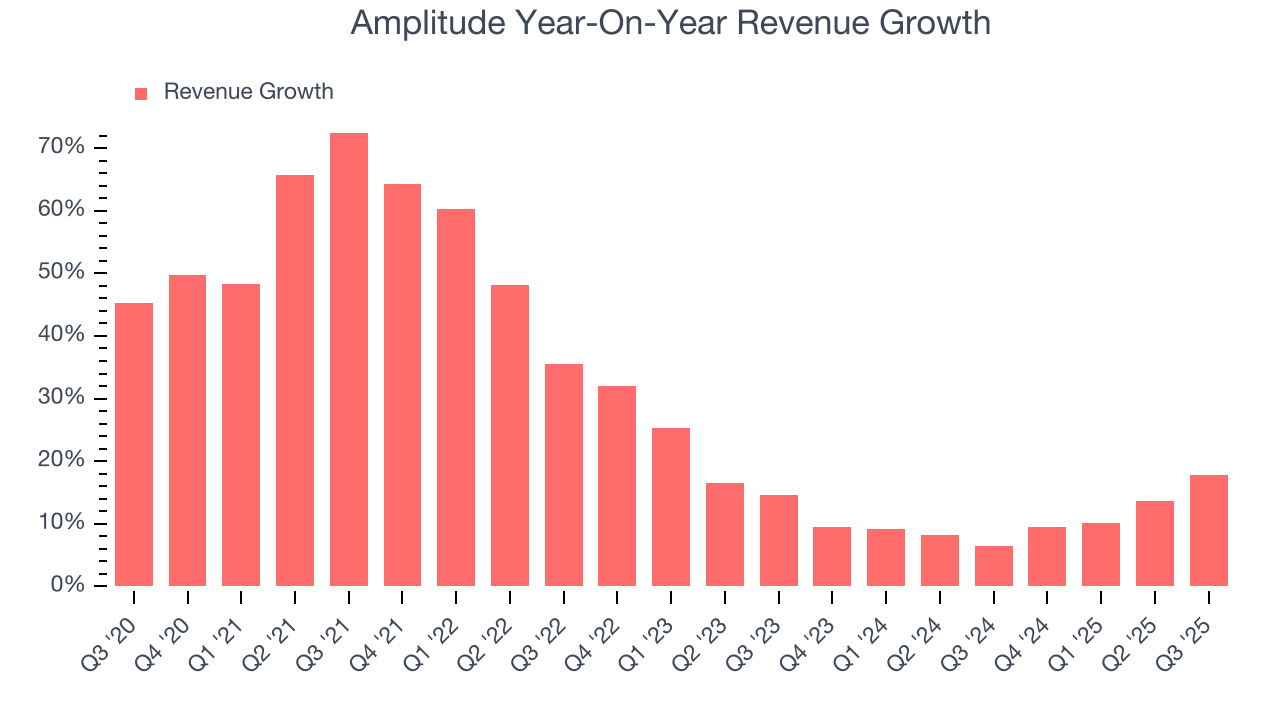

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Thankfully, Amplitude’s 29% annualized revenue growth over the last five years was impressive. Its growth beat the average software company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. Amplitude’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 10.5% over the last two years was well below its five-year trend.

This quarter, Amplitude reported year-on-year revenue growth of 17.7%, and its $88.56 million of revenue exceeded Wall Street’s estimates by 2.6%. Company management is currently guiding for a 15.2% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 11.8% over the next 12 months, similar to its two-year rate. Although this projection implies its newer products and services will catalyze better top-line performance, it is still below the sector average.

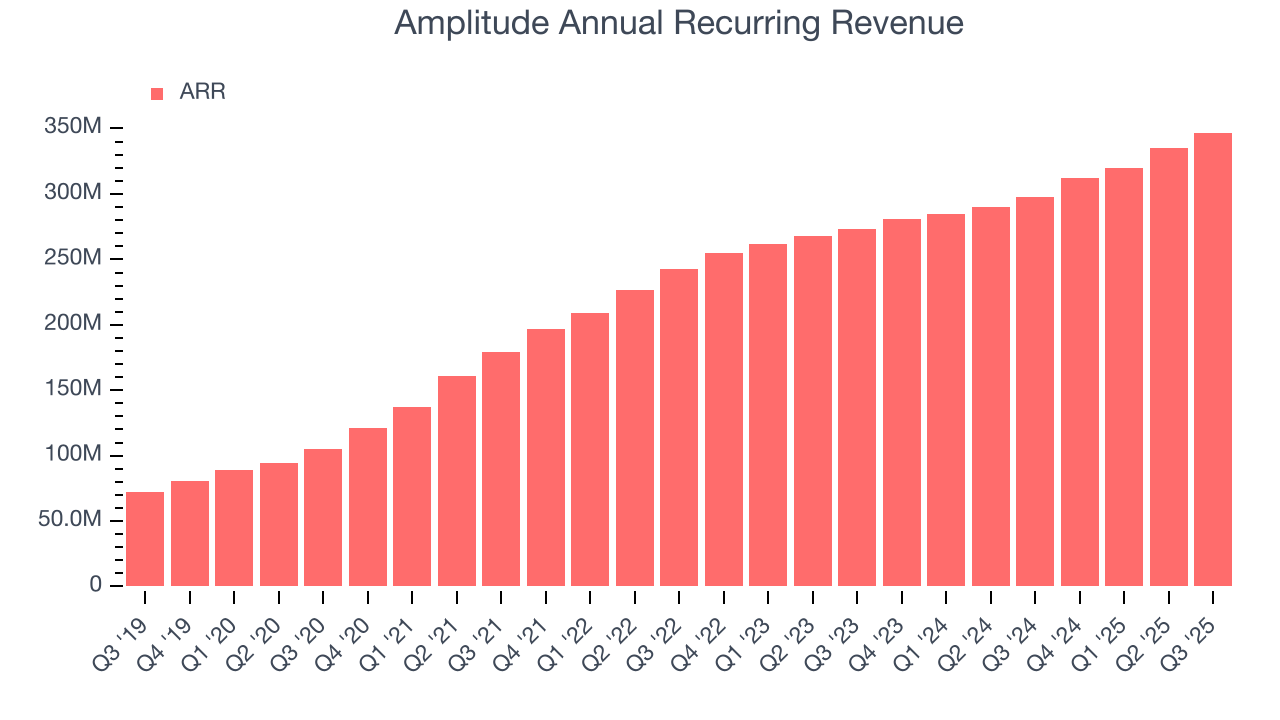

6. Annual Recurring Revenue

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

Amplitude’s ARR came in at $347 million in Q3, and over the last four quarters, its growth slightly lagged the sector as it averaged 13.8% year-on-year increases. This performance mirrored its total sales and suggests that increasing competition is causing challenges in securing longer-term commitments.

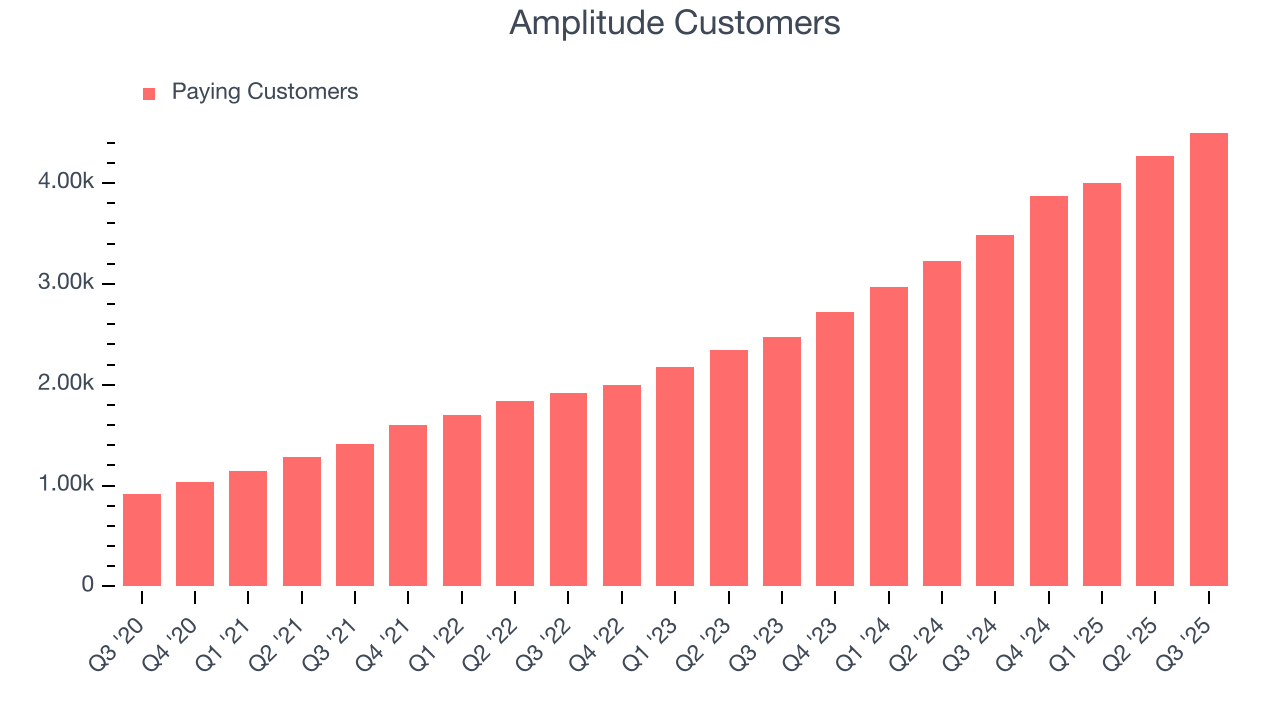

7. Customer Base

Amplitude reported 4,500 customers at the end of the quarter, a sequential increase of 229.2. That’s worse than what we’ve observed previously, and we’ve no doubt shareholders would like to see the company accelerate its sales momentum.

8. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

It’s relatively expensive for Amplitude to acquire new customers as its CAC payback period checked in at 60.2 months this quarter. The company’s drawn-out sales cycles partly stem from its focus on enterprise clients who require some degree of customization, resulting in long onboarding periods that delay delay returns and limit customer growth.

9. Customer Retention

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

Amplitude’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 101% in Q3. This means Amplitude would’ve grown its revenue by 0.7% even if it didn’t win any new customers over the last 12 months.

Amplitude has an adequate net retention rate, showing us that it generally keeps customers but lags behind the best SaaS businesses, which routinely post net retention rates of 120%+.

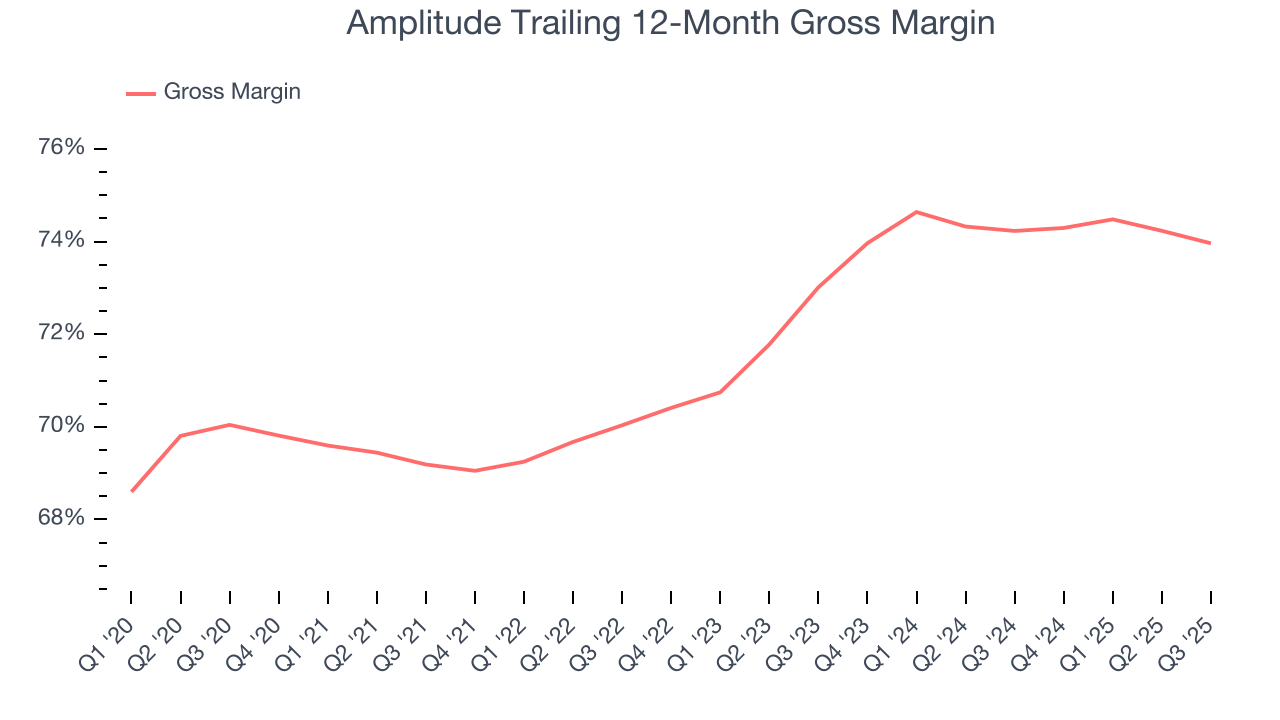

10. Gross Margin & Pricing Power

For software companies like Amplitude, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

Amplitude’s gross margin is better than the broader software industry and signals it has solid unit economics and competitive products. As you can see below, it averaged a decent 74% gross margin over the last year. That means for every $100 in revenue, roughly $73.96 was left to spend on selling, marketing, and R&D.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Amplitude has seen gross margins improve by 1 percentage points over the last 2 year, which is slightly better than average for software.

This quarter, Amplitude’s gross profit margin was 73.9%, marking a 1.1 percentage point decrease from 75.1% in the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs have been stable and it isn’t under pressure to lower prices.

11. Operating Margin

Amplitude’s expensive cost structure has contributed to an average operating margin of negative 34.1% over the last year. Unprofitable, high-growth software companies require extra attention because they spend heaps of money to capture market share. As seen in its fast historical revenue growth, this strategy seems to have worked so far, but it’s unclear what would happen if Amplitude reeled back its investments. Wall Street seems to think it will face some obstacles, and we tend to agree.

Analyzing the trend in its profitability, Amplitude’s operating margin decreased by 2.2 percentage points over the last two years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Amplitude’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q3, Amplitude generated a negative 29% operating margin.

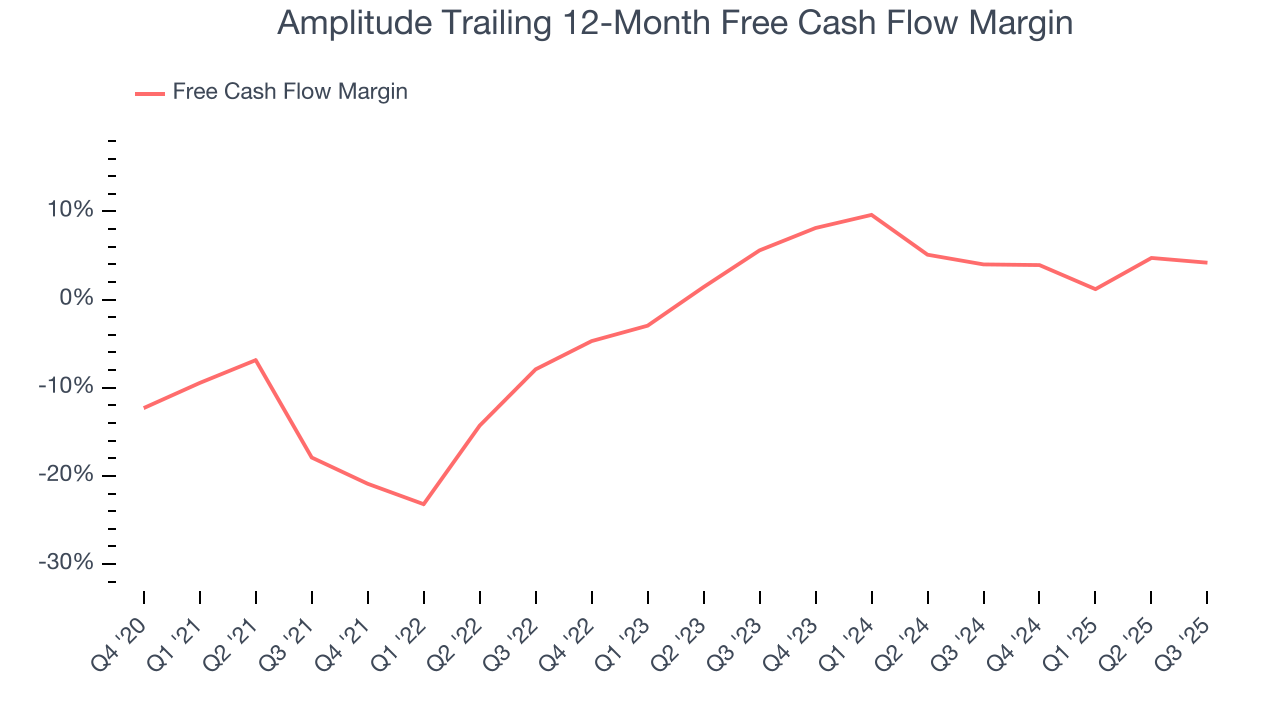

12. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Amplitude has shown poor cash profitability over the last year, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.2%, lousy for a software business.

Amplitude’s free cash flow clocked in at $3.35 million in Q3, equivalent to a 3.8% margin. The company’s cash profitability regressed as it was 2.2 percentage points lower than in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

Over the next year, analysts predict Amplitude’s cash conversion will improve. Their consensus estimates imply its free cash flow margin of 4.2% for the last 12 months will increase to 6.1%, giving it more flexibility for investments, share buybacks, and dividends.

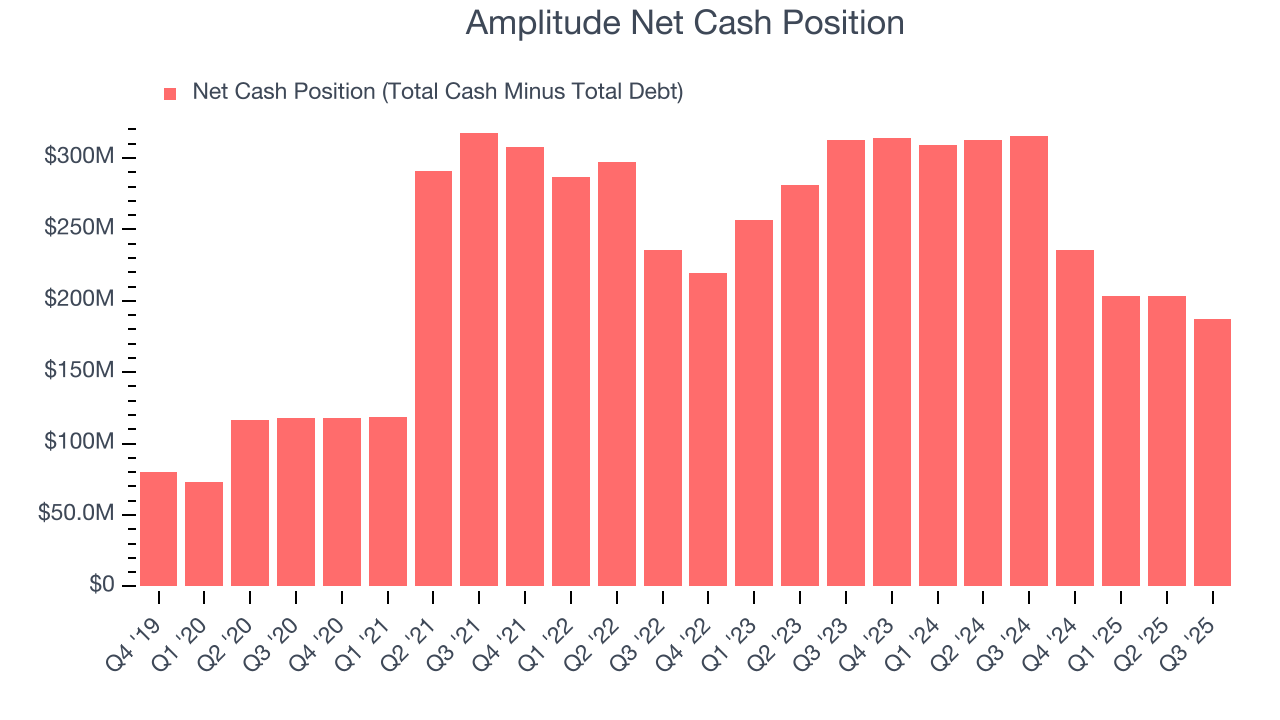

13. Balance Sheet Assessment

One of the best ways to mitigate bankruptcy risk is to hold more cash than debt.

Amplitude is a well-capitalized company with $189.2 million of cash and $1.77 million of debt on its balance sheet. This $187.4 million net cash position is 14.3% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

14. Key Takeaways from Amplitude’s Q3 Results

We enjoyed seeing Amplitude materially improve its net revenue retention this quarter. We were also glad its revenue guidance for next quarter exceeded Wall Street’s estimates. On the other hand, its customer growth stalled. Overall, this print had some key positives. The stock traded up 2.7% to $9.90 immediately following the results.

15. Is Now The Time To Buy Amplitude?

Updated: January 18, 2026 at 9:21 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Amplitude, you should also grasp the company’s longer-term business quality and valuation.

Amplitude falls short of our quality standards. Although its revenue growth was strong over the last five years, it’s expected to deteriorate over the next 12 months and its declining operating margin shows it’s becoming less efficient at building and selling its software. And while the company’s gross margin suggests it can generate sustainable profits, the downside is its operating margins reveal poor profitability compared to other software companies.

Amplitude’s price-to-sales ratio based on the next 12 months is 3.6x. This valuation is reasonable, but the company’s shaky fundamentals present too much downside risk. There are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $15.50 on the company (compared to the current share price of $10.07).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.