American Superconductor (AMSC)

We like American Superconductor. It’s one of the fastest-growing companies we cover, and there’s a solid chance its momentum will continue.― StockStory Analyst Team

1. News

2. Summary

Why We Like American Superconductor

Founded in 1987, American Superconductor (NASDAQ:AMSC) has shifted from superconductor research to developing power systems, adapting to changing energy grid needs and naval technology requirements.

- Market share has increased this cycle as its 27.7% annual revenue growth over the last five years was exceptional

- Earnings per share grew by 24.3% annually over the last five years and trumped its peers

- Notable projected revenue growth of 21.8% for the next 12 months hints at market share gains

We’re optimistic about American Superconductor. No surprise this ranks among our best industrials stocks.

Is Now The Time To Buy American Superconductor?

High Quality

Investable

Underperform

Is Now The Time To Buy American Superconductor?

American Superconductor’s stock price of $33.32 implies a valuation ratio of 38.7x forward P/E. There’s no denying that the lofty valuation means there’s much good news priced into the stock.

If you like the company and believe the bull case, we suggest making it a smaller position as our analysis shows high-quality companies outperform the market over a multi-year period regardless of valuation.

3. American Superconductor (AMSC) Research Report: Q3 CY2025 Update

Power resiliency solutions provider American Superconductor (NASDAQ:AMSC) fell short of the markets revenue expectations in Q3 CY2025, but sales rose 20.9% year on year to $65.86 million. Next quarter’s revenue guidance of $67.5 million underwhelmed, coming in 0.6% below analysts’ estimates. Its non-GAAP profit of $0.20 per share was 30.4% above analysts’ consensus estimates.

American Superconductor (AMSC) Q3 CY2025 Highlights:

- Revenue: $65.86 million vs analyst estimates of $67.23 million (20.9% year-on-year growth, 2% miss)

- Adjusted EPS: $0.20 vs analyst estimates of $0.15 (30.4% beat)

- Adjusted EBITDA: $972,000 vs analyst estimates of $2.7 million (1.5% margin, 64% miss)

- Revenue Guidance for Q4 CY2025 is $67.5 million at the midpoint, below analyst estimates of $67.93 million

- Adjusted EPS guidance for Q4 CY2025 is $0.14 at the midpoint, below analyst estimates of $0.14

- Operating Margin: 4.5%, down from 5.8% in the same quarter last year

- Free Cash Flow Margin: 7.7%, down from 22.3% in the same quarter last year

- Market Capitalization: $2.54 billion

Company Overview

Founded in 1987, American Superconductor (NASDAQ:AMSC) has shifted from superconductor research to developing power systems, adapting to changing energy grid needs and naval technology requirements.

Founded in 1987, AMSC has been developing and implementing advanced technologies that enhance the reliability, efficiency, and security of power systems. The company's core focus is on creating solutions of power on the grid while also protecting and expanding the capabilities of the U.S. Navy's fleet.

AMSC's business is built around two primary segments: Grid and Wind. The Grid segment offers solutions designed to improve the reliability, security, and capacity of electrical power infrastructure. These include D-VAR systems for voltage control, REG (Resilient Electric Grid) systems for urban power grids, and VVO (Volt VAR Optimization) systems for distribution networks. The company's solutions address challenges faced by power grid operators, such as integrating renewable energy sources, managing power quality, and enhancing grid resilience against natural disasters and cyber threats.

In the marine sector, AMSC provides advanced ship protection systems to the U.S. Navy. The company's degaussing systems, which reduce a naval ship's magnetic signature, offer advantages over traditional copper-based systems in terms of weight reduction and energy efficiency.

The Wind segment of AMSC focuses on providing electrical control systems and engineering services to wind turbine manufacturers. The company designs and licenses wind turbine systems, offering a comprehensive approach that includes turbine design, customer support, and the supply of critical components such as electrical control systems.

4. Renewable Energy

Renewable energy companies are buoyed by the secular trend of green energy that is upending traditional power generation. Those who innovate and evolve with this dynamic market can win share while those who continue to rely on legacy technologies can see diminishing demand, which includes headwinds from increasing regulation against “dirty” energy. Additionally, these companies are at the whim of economic cycles, as interest rates can impact the willingness to invest in renewable energy projects.

Competitors of American Superconductor Corporation (NASDAQ: AMSC) include ABB Ltd. (NYSE: ABB), Siemens AG (OTC: SIEGY), and General Electric Company (NYSE: GE).

5. Revenue Growth

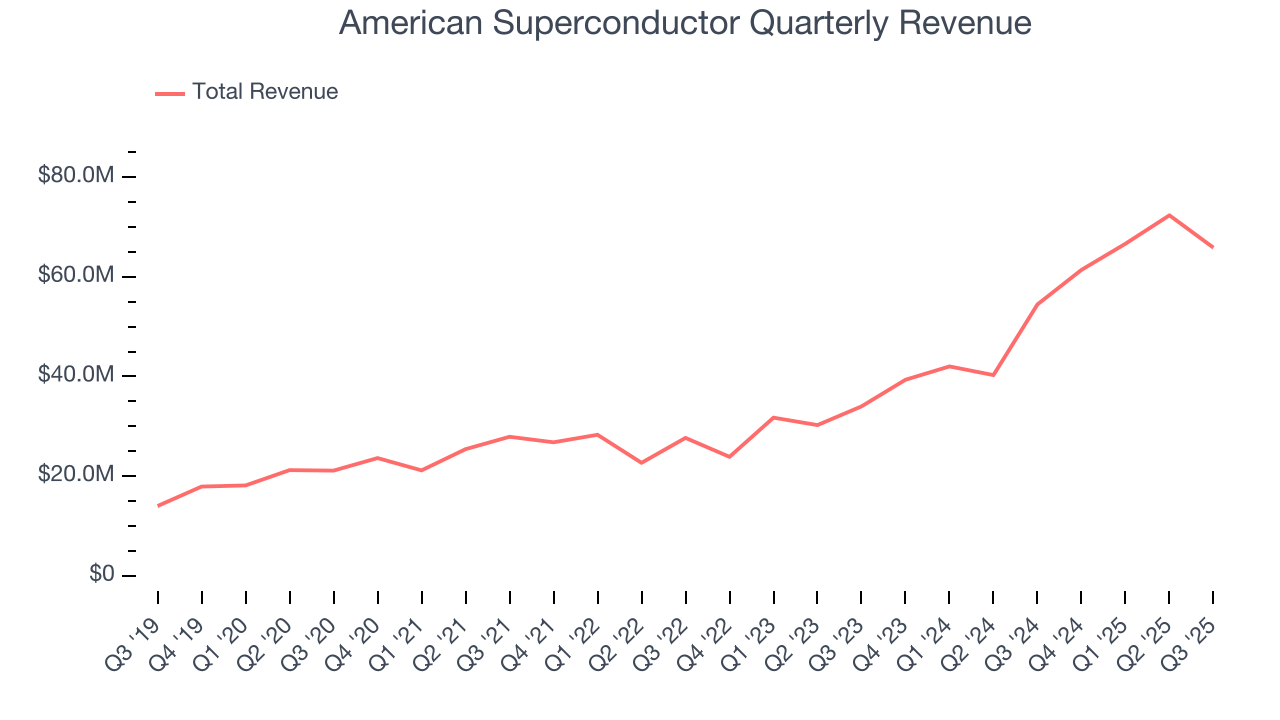

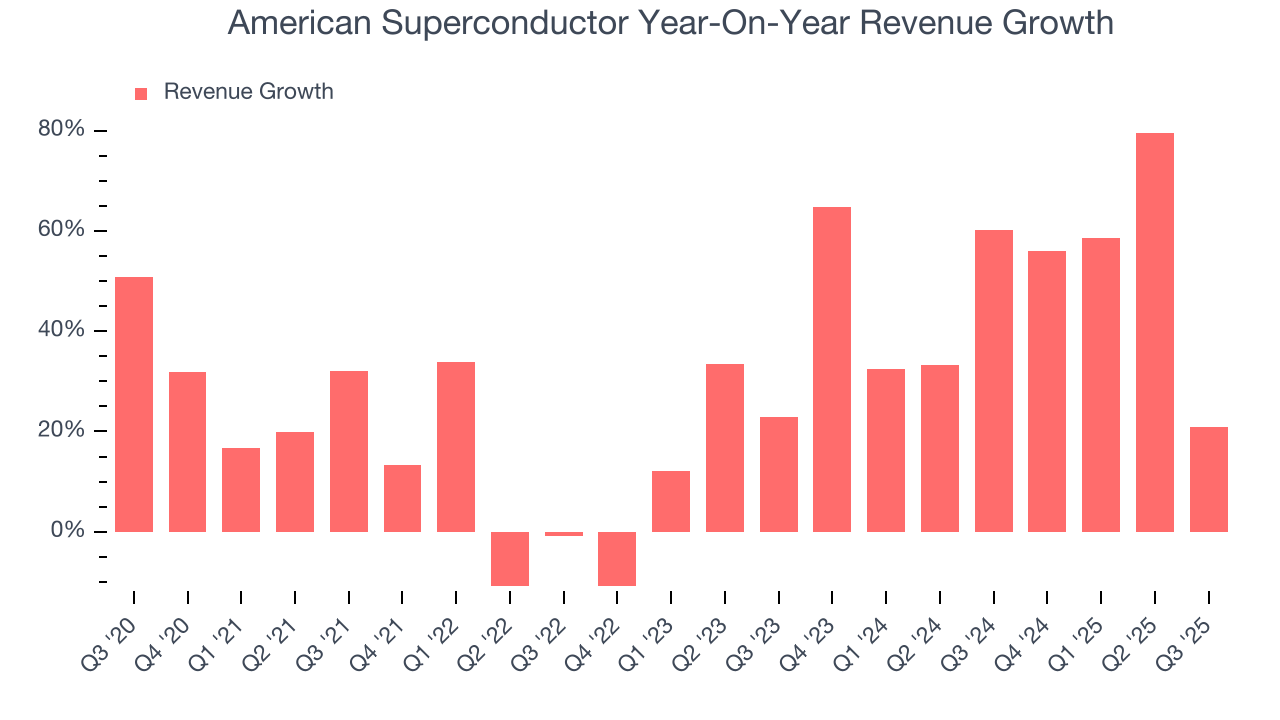

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Thankfully, American Superconductor’s 27.7% annualized revenue growth over the last five years was incredible. Its growth surpassed the average industrials company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. American Superconductor’s annualized revenue growth of 49% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, American Superconductor generated an excellent 20.9% year-on-year revenue growth rate, but its $65.86 million of revenue fell short of Wall Street’s high expectations. Company management is currently guiding for a 9.9% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 8% over the next 12 months, a deceleration versus the last two years. Still, this projection is above average for the sector and implies the market is forecasting some success for its newer products and services.

6. Gross Margin & Pricing Power

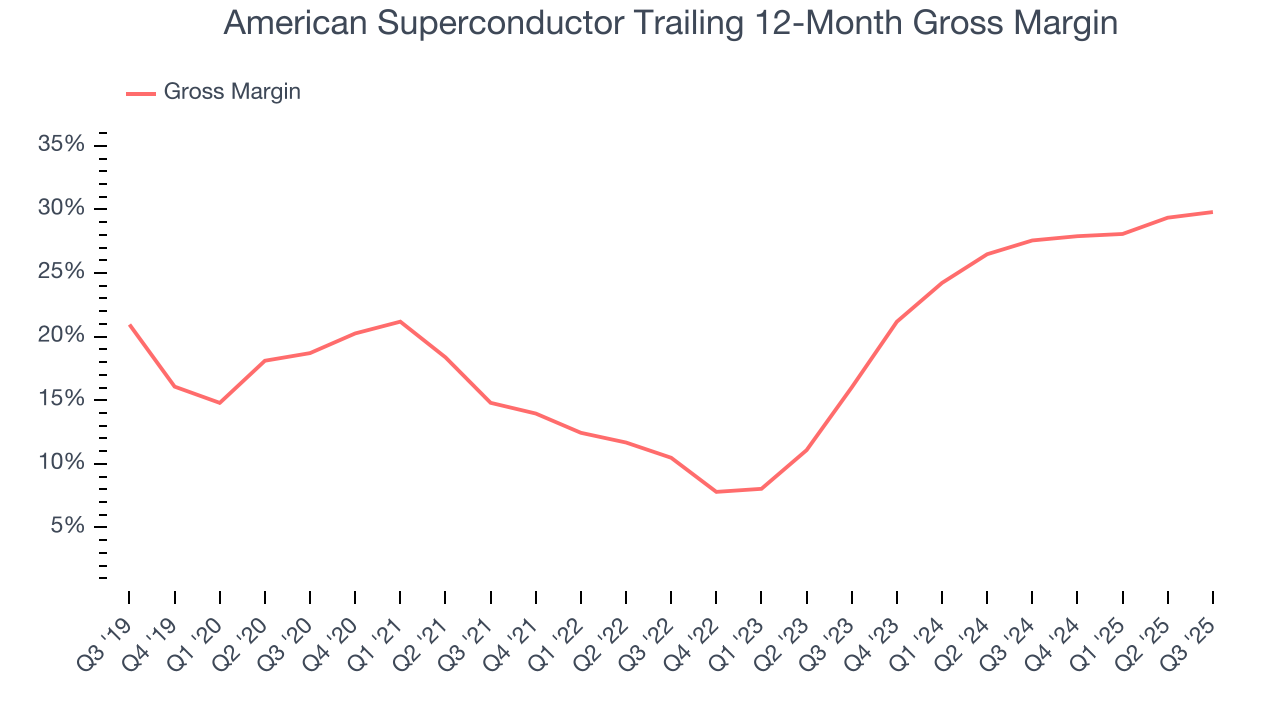

American Superconductor has bad unit economics for an industrials company, giving it less room to reinvest and develop new offerings. As you can see below, it averaged a 22.5% gross margin over the last five years. That means American Superconductor paid its suppliers a lot of money ($77.45 for every $100 in revenue) to run its business.

In Q3, American Superconductor produced a 31% gross profit margin, marking a 1.8 percentage point increase from 29.2% in the same quarter last year. American Superconductor’s full-year margin has also been trending up over the past 12 months, increasing by 2.2 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as manufacturing expenses).

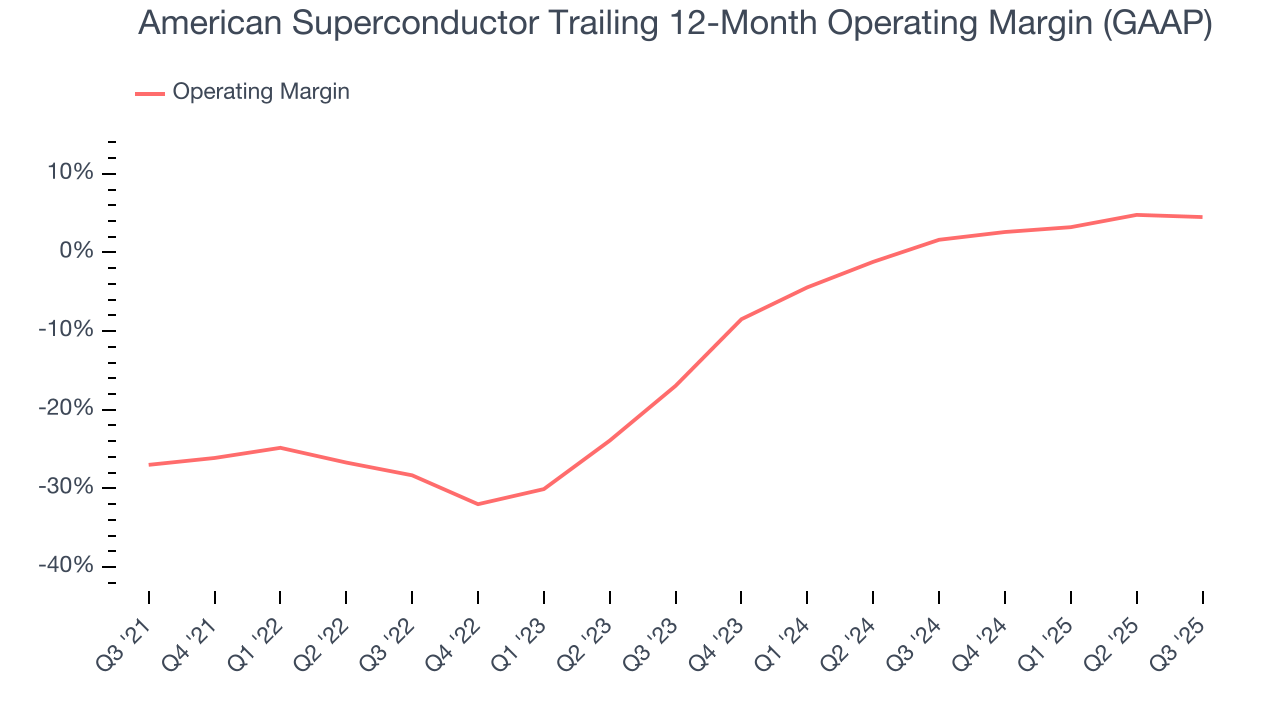

7. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Although American Superconductor was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 8.1% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out.

On the plus side, American Superconductor’s operating margin rose by 31.5 percentage points over the last five years, as its sales growth gave it operating leverage. Still, it will take much more for the company to show consistent profitability.

In Q3, American Superconductor generated an operating margin profit margin of 4.5%, down 1.3 percentage points year on year. Conversely, its revenue and gross margin actually rose, so we can assume it was less efficient because its operating expenses like marketing, R&D, and administrative overhead grew faster than its revenue.

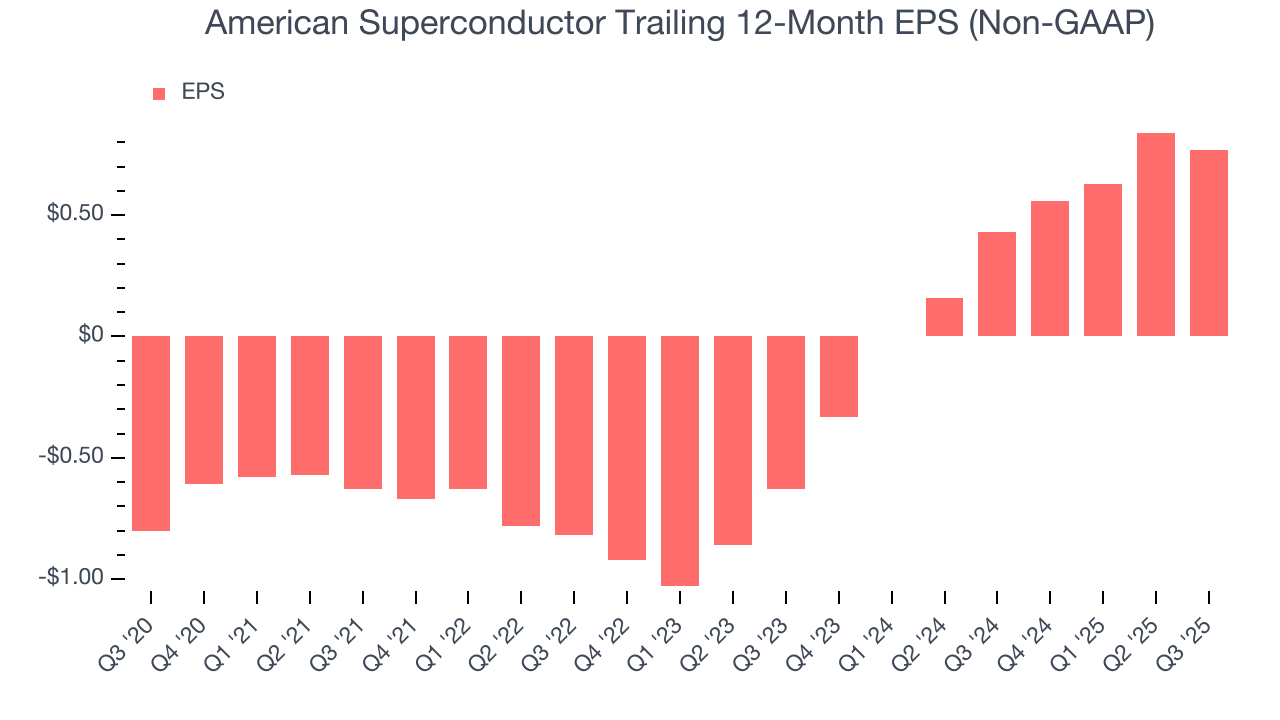

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

American Superconductor’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For American Superconductor, its two-year annual EPS growth of 79.5% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q3, American Superconductor reported adjusted EPS of $0.20, down from $0.27 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects American Superconductor’s full-year EPS of $0.77 to shrink by 8.2%.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

While American Superconductor posted positive free cash flow this quarter, the broader story hasn’t been so clean. American Superconductor’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 1.4%, meaning it lit $1.40 of cash on fire for every $100 in revenue.

Taking a step back, an encouraging sign is that American Superconductor’s margin expanded by 22.2 percentage points during that time. The company’s improvement and free cash flow generation this quarter show it’s heading in the right direction, and continued increases could help it achieve long-term cash profitability.

American Superconductor’s free cash flow clocked in at $5.10 million in Q3, equivalent to a 7.7% margin. The company’s cash profitability regressed as it was 14.5 percentage points lower than in the same quarter last year, but it’s still above its five-year average. We wouldn’t read too much into this quarter’s decline because capital expenditures can be seasonal and companies often stockpile inventory in anticipation of higher demand, leading to short-term swings. Long-term trends carry greater meaning.

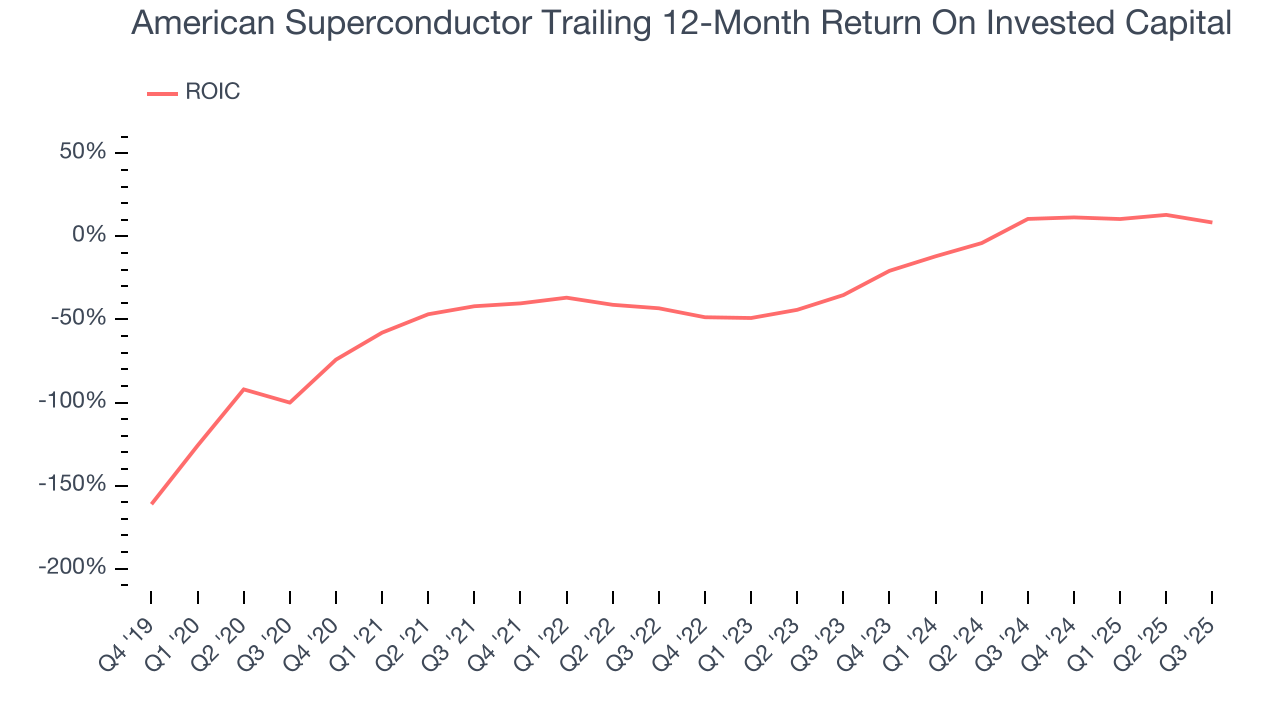

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although American Superconductor has shown solid business quality lately, it struggled to grow profitably in the past. Its five-year average ROIC was negative 20.3%, meaning management lost money while trying to expand the business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, American Superconductor’s ROIC has increased. This is a good sign, but we recognize its lack of profitable growth during the COVID era was the primary reason for the change.

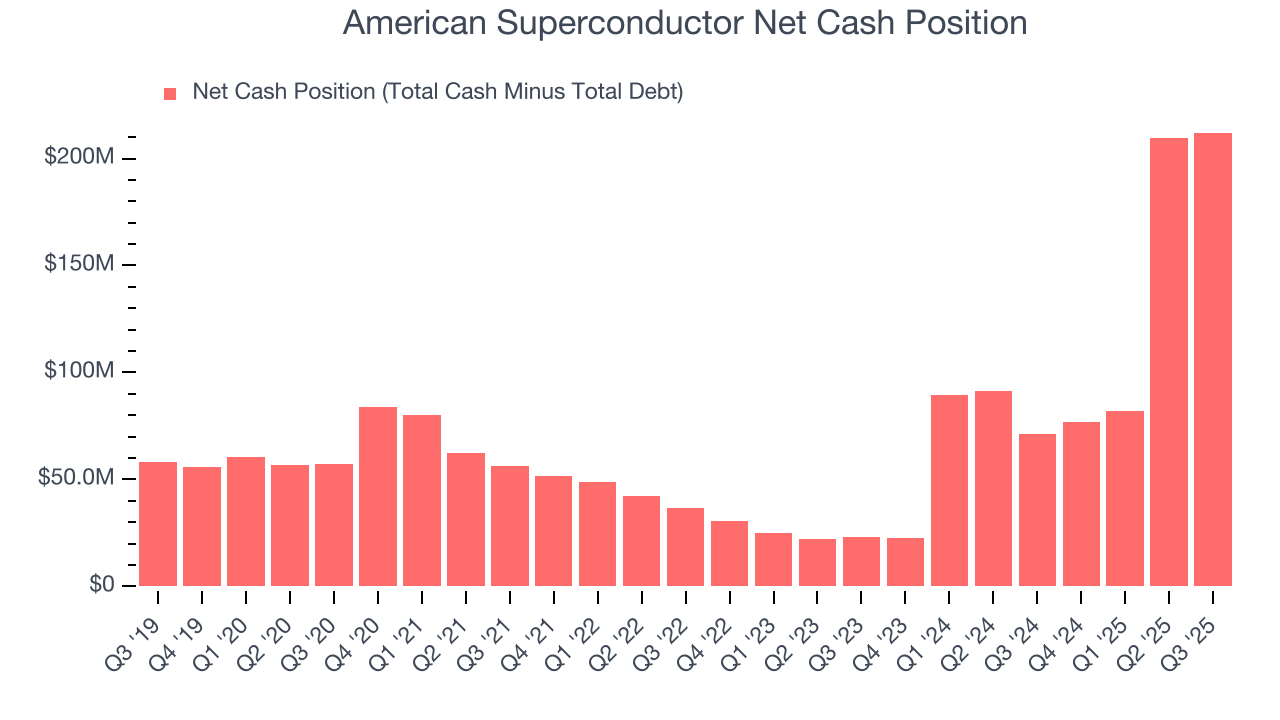

11. Balance Sheet Assessment

One of the best ways to mitigate bankruptcy risk is to hold more cash than debt.

American Superconductor is a profitable, well-capitalized company with $215.8 million of cash and $3.65 million of debt on its balance sheet. This $212.1 million net cash position is 8.3% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from American Superconductor’s Q3 Results

It was good to see American Superconductor beat analysts’ EPS expectations this quarter. On the other hand, its revenue missed and its EBITDA fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 16.9% to $49.20 immediately after reporting.

13. Is Now The Time To Buy American Superconductor?

Updated: January 24, 2026 at 10:06 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in American Superconductor.

There are several reasons why we think American Superconductor is a great business. For starters, its revenue growth was exceptional over the last five years. And while its relatively low ROIC suggests management has struggled to find compelling investment opportunities, its rising cash profitability gives it more optionality. On top of that, American Superconductor’s expanding operating margin shows the business has become more efficient.

American Superconductor’s P/E ratio based on the next 12 months is 38.7x. Some good news is baked into the stock given its multiple, but we’ll happily own American Superconductor as its fundamentals really stand out. It’s often wise to hold investments like this for at least three to five years, as the power of long-term compounding negates short-term price swings that can accompany relatively high valuations.

Wall Street analysts have a consensus one-year price target of $61 on the company (compared to the current share price of $33.32).