Array (ARRY)

Array is up against the odds. Its poor sales growth shows demand is soft and its negative returns on capital suggest it destroyed value.― StockStory Analyst Team

1. News

2. Summary

Why We Think Array Will Underperform

Going public in October 2020, Array (NASDAQ:ARRY) is a global manufacturer of ground-mounting tracking systems for utility and distributed generation solar energy projects.

- Annual sales declines of 9.8% for the past two years show its products and services struggled to connect with the market during this cycle

- Earnings per share have dipped by 9.7% annually over the past two years, which is concerning because stock prices follow EPS over the long term

- Push for growth has led to negative returns on capital, signaling value destruction, and its shrinking returns suggest its past profit sources are losing steam

Array doesn’t satisfy our quality benchmarks. We see more favorable opportunities in the market.

Why There Are Better Opportunities Than Array

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Array

At $10.45 per share, Array trades at 14.3x forward P/E. Array’s multiple may seem like a great deal among industrials peers, but we think there are valid reasons why it’s this cheap.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Array (ARRY) Research Report: Q3 CY2025 Update

Solar tracking systems manufacturer Array (NASDAQ:ARRY) announced better-than-expected revenue in Q3 CY2025, with sales up 70% year on year to $393.5 million. The company’s full-year revenue guidance of $1.27 billion at the midpoint came in 4.5% above analysts’ estimates. Its non-GAAP profit of $0.30 per share was 48.9% above analysts’ consensus estimates.

Array (ARRY) Q3 CY2025 Highlights:

- Revenue: $393.5 million vs analyst estimates of $311.5 million (70% year-on-year growth, 26.3% beat)

- Adjusted EPS: $0.30 vs analyst estimates of $0.20 (48.9% beat)

- Adjusted EBITDA: $72.19 million vs analyst estimates of $56.76 million (18.3% margin, 27.2% beat)

- The company lifted its revenue guidance for the full year to $1.27 billion at the midpoint from $1.20 billion, a 5.6% increase

- Management slightly raised its full-year Adjusted EPS guidance to $0.67 at the midpoint

- EBITDA guidance for the full year is $190 million at the midpoint, below analyst estimates of $196 million

- Operating Margin: 11.6%, up from -57.3% in the same quarter last year

- Free Cash Flow Margin: 5.6%, down from 24.1% in the same quarter last year

- Market Capitalization: $1.18 billion

Company Overview

Going public in October 2020, Array (NASDAQ:ARRY) is a global manufacturer of ground-mounting tracking systems for utility and distributed generation solar energy projects.

The company specializes in single-axis solar trackers, which move solar panels throughout the day to maintain optimal orientation to the sun, increasing energy production compared to fixed-tilt mounting systems. Array has established itself as a significant player in the solar energy infrastructure market, with a reported shipment of more than 73 gigawatts of trackers to customers worldwide as of December 31, 2023.

Its product portfolio includes three main tracker systems: DuraTrack, Array STI, and Array OmniTrack. The DuraTrack is Array's flagship product and features a patented single-bolt per module mounting system and a passive wind load mitigation system. The Array STI, added through the acquisition of Soluciones Técnicas Integrales Norland ("STI") in January 2022, is a dual-row tracker system designed for sites with irregular boundaries or fragmented project areas. The Array OmniTrack, introduced in September 2022, is designed to accommodate uneven terrain and requires less grading and civil work.

Array also offers SmarTrack software, which uses historical weather and energy production data along with machine learning algorithms to optimize solar array positioning in real time. The company provides additional services including field services and customer training programs to support installation and operation efficiency. It operates manufacturing facilities in Albuquerque, New Mexico, as well as in Spain and Brazil (632,000 square feet) acquired through the STI acquisition.

4. Renewable Energy

Renewable energy companies are buoyed by the secular trend of green energy that is upending traditional power generation. Those who innovate and evolve with this dynamic market can win share while those who continue to rely on legacy technologies can see diminishing demand, which includes headwinds from increasing regulation against “dirty” energy. Additionally, these companies are at the whim of economic cycles, as interest rates can impact the willingness to invest in renewable energy projects.

Competitors in the solar industry include First Solar (NASDAQ:FSLR), SunPower Corporation (NASDAQ:SPWR), and SolarEdge Technologies (NASDAQ:SEDG).

5. Revenue Growth

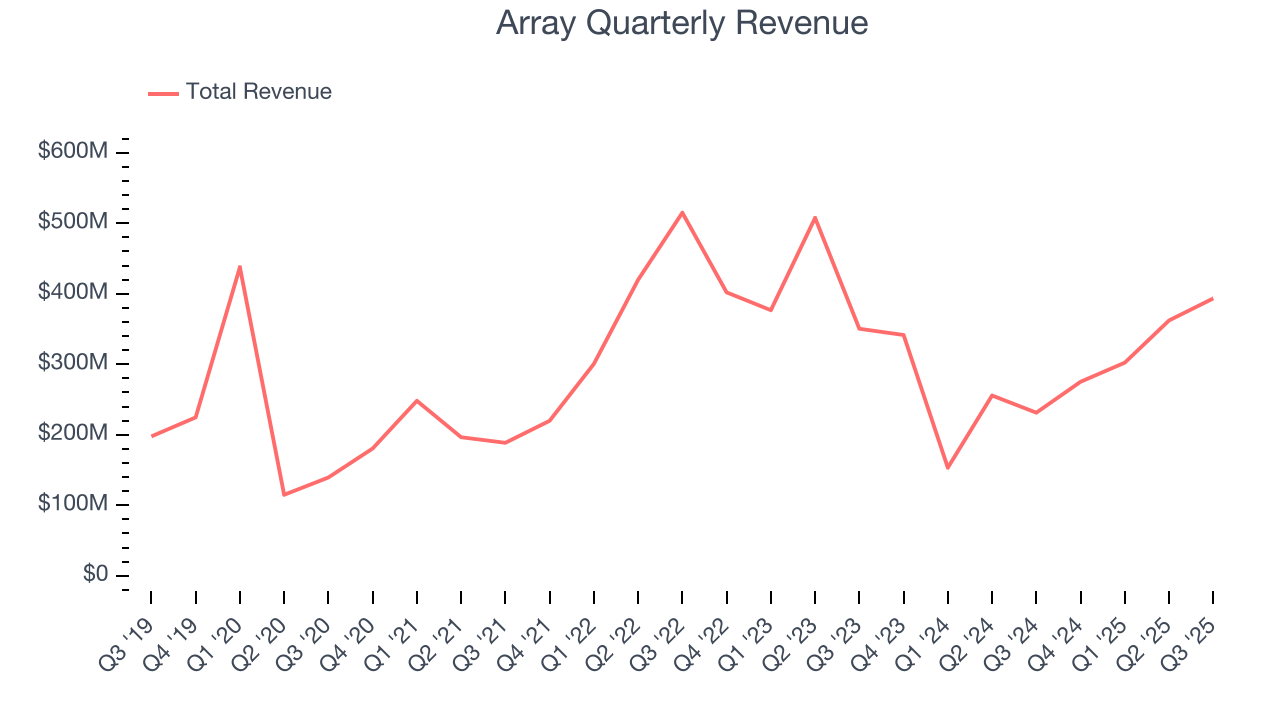

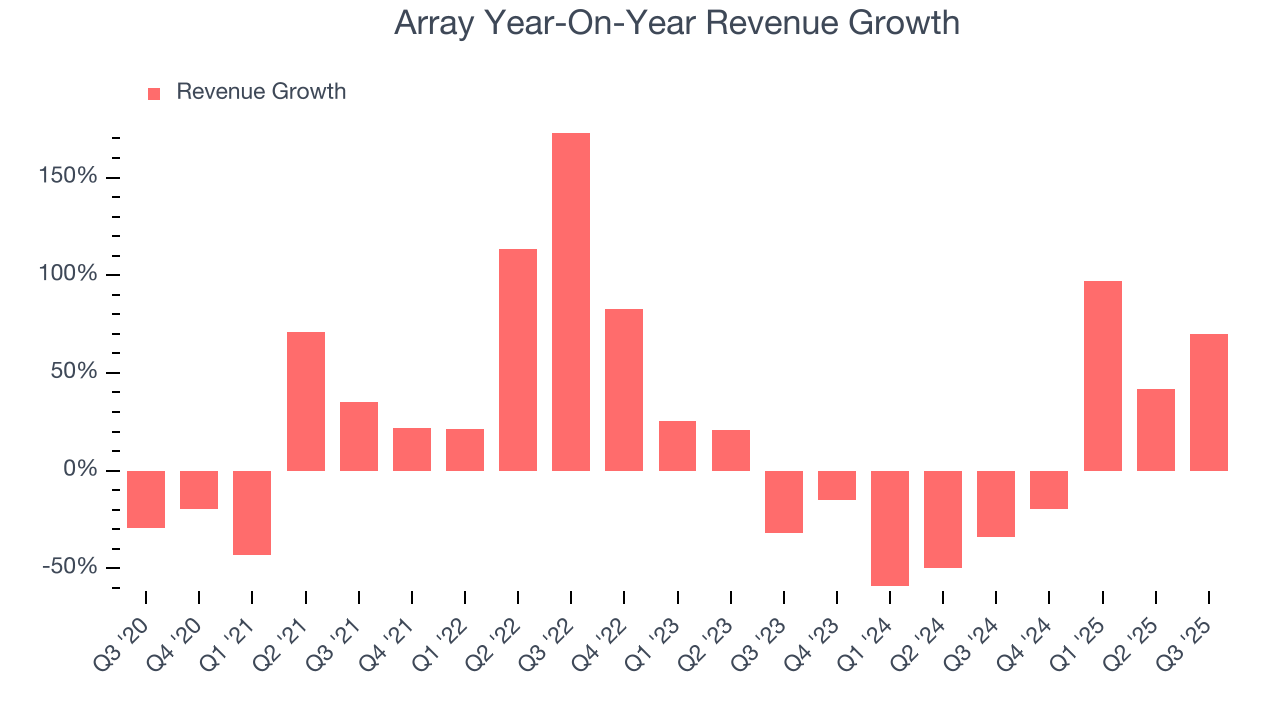

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Array grew its sales at a decent 7.8% compounded annual growth rate. Its growth was slightly above the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Array’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 9.8% over the last two years.

This quarter, Array reported magnificent year-on-year revenue growth of 70%, and its $393.5 million of revenue beat Wall Street’s estimates by 26.3%.

Looking ahead, sell-side analysts expect revenue to decline by 1.4% over the next 12 months. Although this projection is better than its two-year trend, it’s hard to get excited about a company that is struggling with demand.

6. Gross Margin & Pricing Power

For industrials businesses, cost of sales is usually comprised of the direct labor, raw materials, and supplies needed to offer a product or service. These costs can be impacted by inflation and supply chain dynamics in the short term and a company’s purchasing power and scale over the long term.

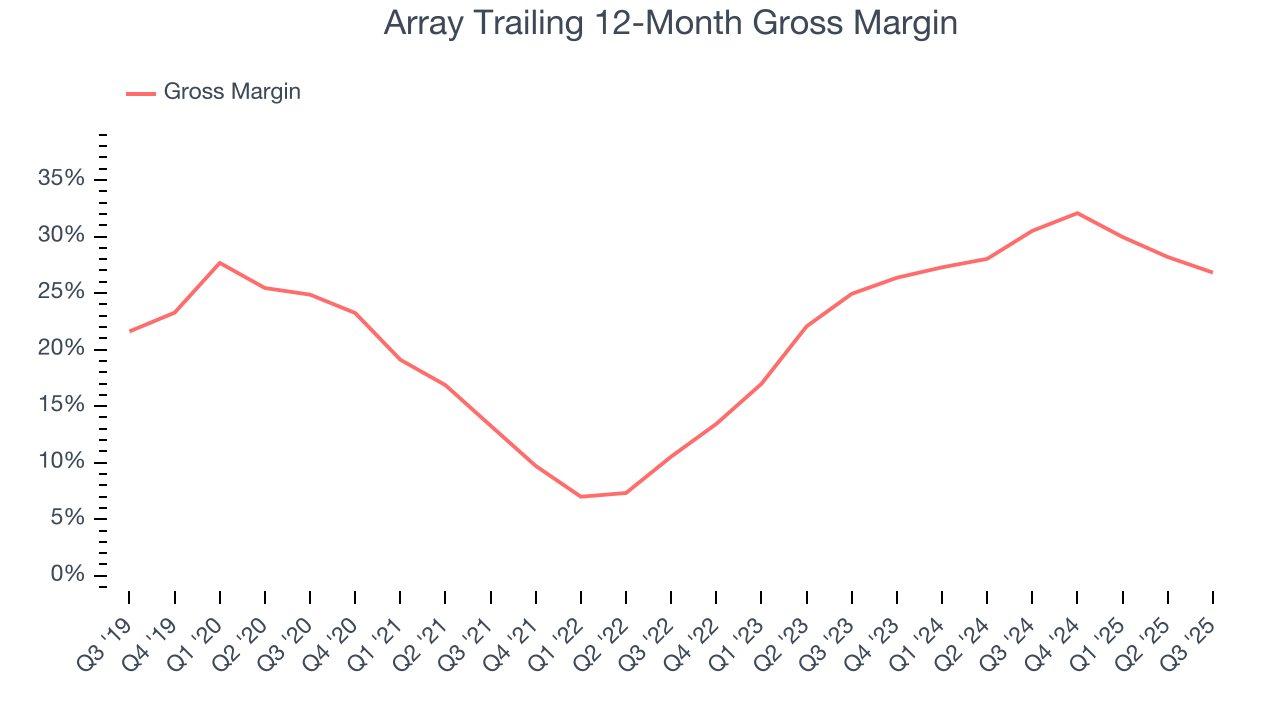

Array has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 21.3% gross margin over the last five years. That means Array paid its suppliers a lot of money ($78.68 for every $100 in revenue) to run its business.

Array produced a 26.9% gross profit margin in Q3, marking a 7 percentage point decrease from 33.8% in the same quarter last year. Array’s full-year margin has also been trending down over the past 12 months, decreasing by 3.7 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as raw materials and manufacturing expenses).

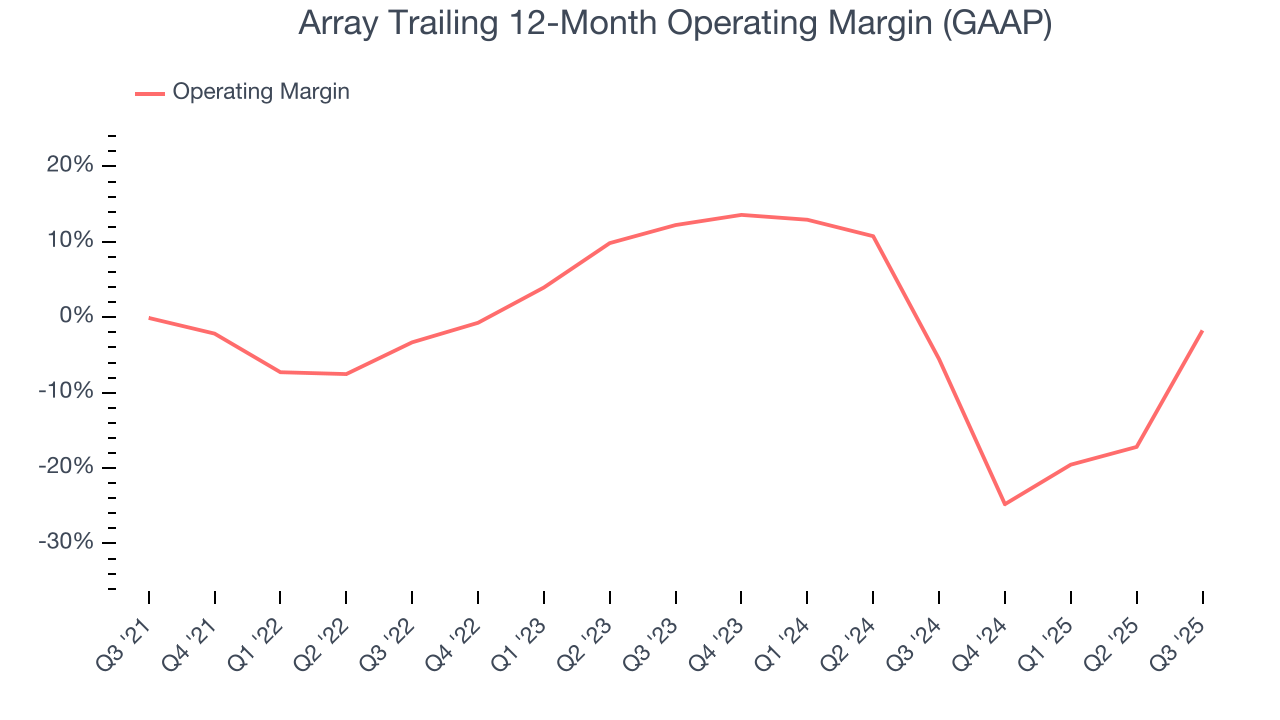

7. Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

Array was profitable over the last five years but held back by its large cost base. Its average operating margin of 1.2% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

Looking at the trend in its profitability, Array’s operating margin decreased by 1.7 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Array’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q3, Array generated an operating margin profit margin of 11.6%, up 68.9 percentage points year on year. The increase was solid, and because its gross margin actually decreased, we can assume it was more efficient because its operating expenses like marketing, R&D, and administrative overhead grew slower than its revenue.

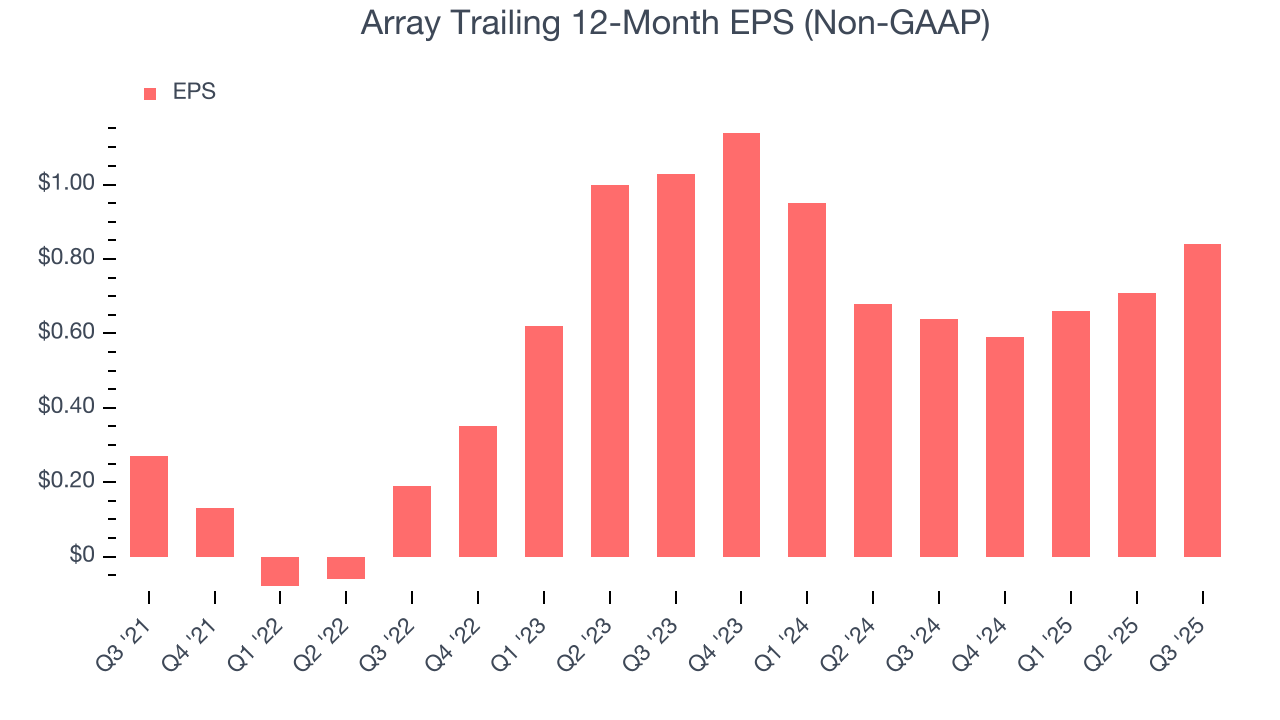

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Array’s full-year EPS grew at an astounding 32.8% compounded annual growth rate over the last four years, better than the broader industrials sector.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Sadly for Array, its EPS and revenue declined by 9.7% and 9.8% annually over the last two years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Array’s low margin of safety could leave its stock price susceptible to large downswings.

In Q3, Array reported adjusted EPS of $0.30, up from $0.17 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Array’s full-year EPS of $0.84 to shrink by 5.5%.

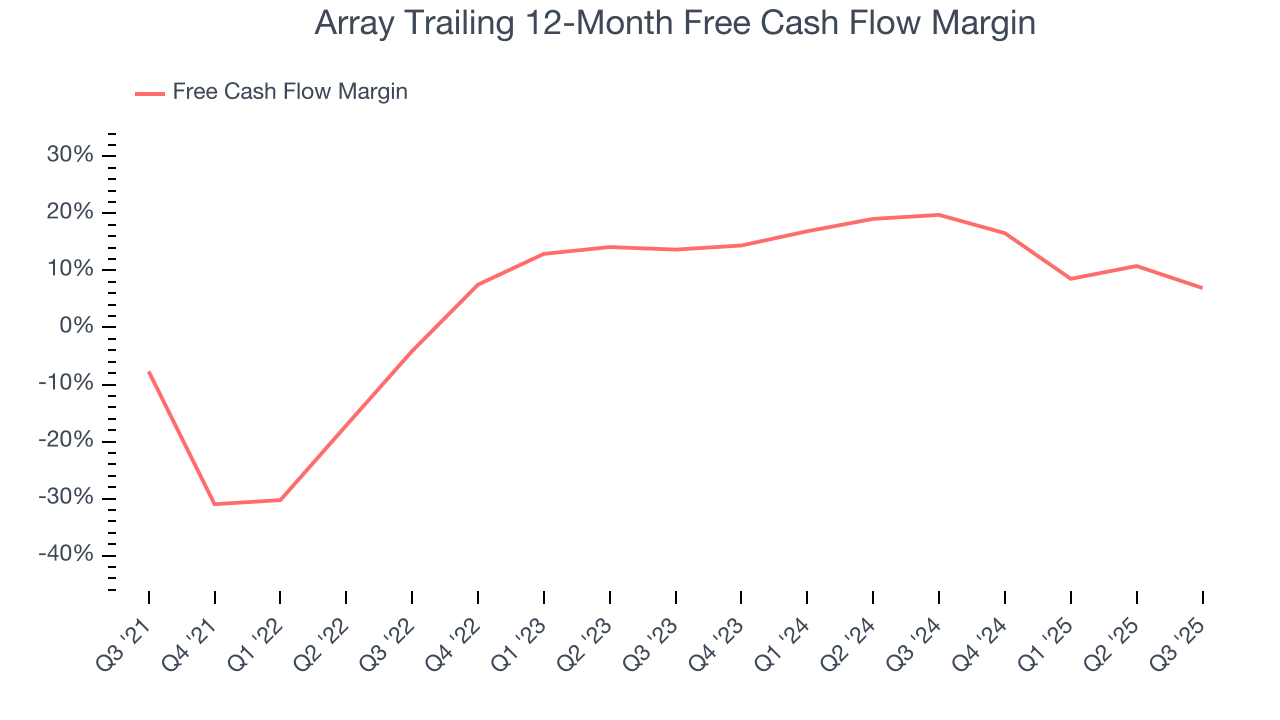

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Array has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 6.2% over the last five years, slightly better than the broader industrials sector.

Taking a step back, we can see that Array’s margin expanded by 14.6 percentage points during that time. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability fell.

Array’s free cash flow clocked in at $21.85 million in Q3, equivalent to a 5.6% margin. The company’s cash profitability regressed as it was 18.6 percentage points lower than in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

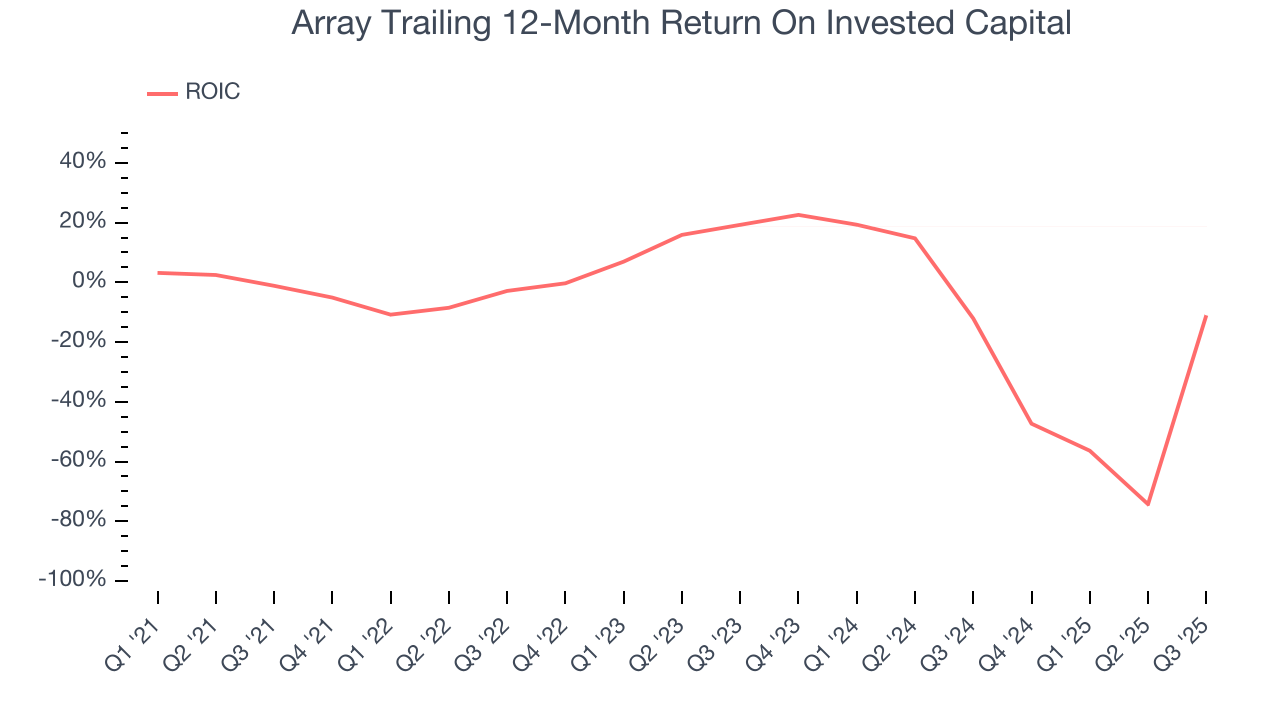

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Array’s five-year average ROIC was negative 1.6%, meaning management lost money while trying to expand the business. Its returns were among the worst in the industrials sector.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Array’s ROIC has decreased over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

11. Balance Sheet Assessment

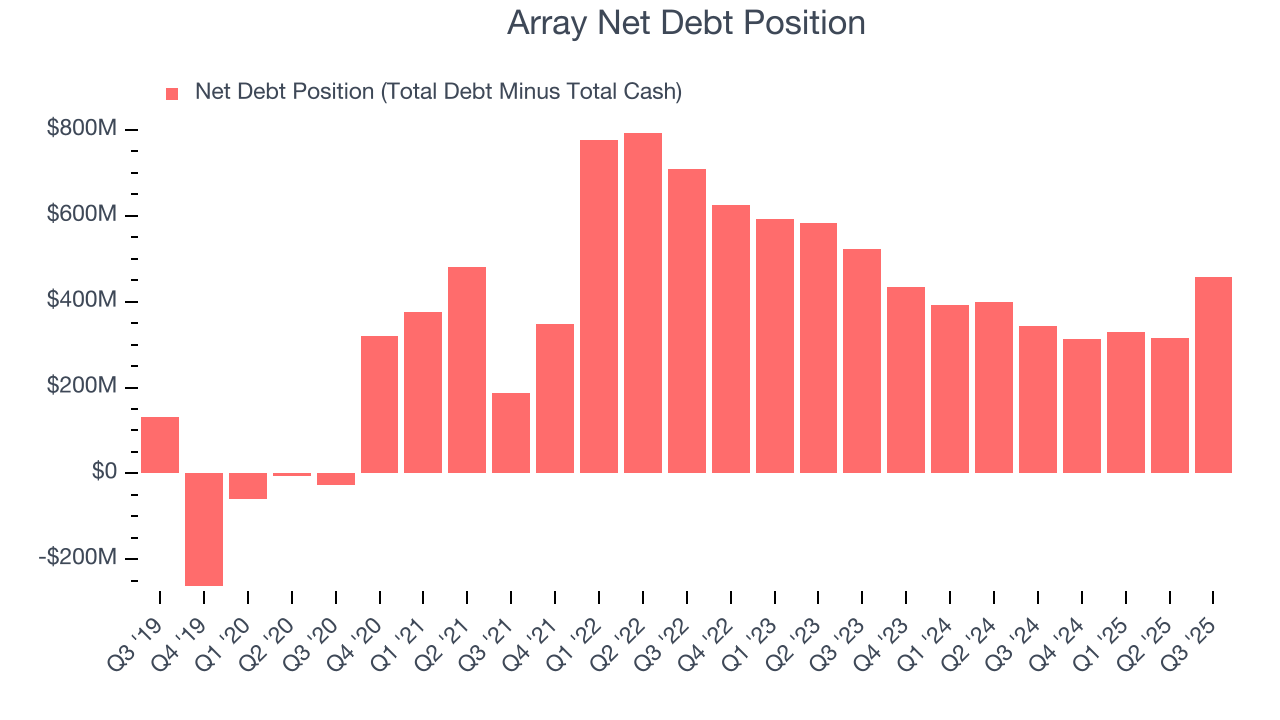

Array reported $223.1 million of cash and $681 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $139.7 million of EBITDA over the last 12 months, we view Array’s 3.3× net-debt-to-EBITDA ratio as safe. We also see its $12.53 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Array’s Q3 Results

It was good to see Array beat analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. On the other hand, its full-year EBITDA guidance missed. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 3.1% to $8.61 immediately after reporting.

13. Is Now The Time To Buy Array?

Updated: January 24, 2026 at 9:09 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Array.

We cheer for all companies making their customers lives easier, but in the case of Array, we’ll be cheering from the sidelines. Although its revenue growth was decent over the last five years, it’s expected to deteriorate over the next 12 months and its diminishing returns show management's prior bets haven't worked out. And while the company’s growth in unit sales was surging, the downside is its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

Array’s P/E ratio based on the next 12 months is 14.3x. While this valuation is reasonable, we don’t see a big opportunity at the moment. There are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $11.09 on the company (compared to the current share price of $10.45).