Atlanticus Holdings (ATLC)

We see potential in Atlanticus Holdings, but the state of its balance sheet makes us slightly uncomfortable.― StockStory Analyst Team

1. News

2. Summary

Why Atlanticus Holdings Is Not Exciting

Using data analytics to serve the millions of Americans with less-than-perfect credit scores, Atlanticus Holdings (NASDAQ:ATLC) provides technology and services that help lenders offer credit products to consumers often overlooked by traditional financing providers.

- Earnings per share have dipped by 6.2% annually over the past four years, which is concerning because stock prices follow EPS over the long term

- 34× net-debt-to-EBITDA ratio shows it’s overleveraged and increases the probability of shareholder dilution if things turn unexpectedly

Atlanticus Holdings has some respectable qualities, but we’d hold off on investing until its EBITDA can comfortably service its debt.

Why There Are Better Opportunities Than Atlanticus Holdings

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Atlanticus Holdings

At $51.84 per share, Atlanticus Holdings trades at 7.2x forward P/E. Atlanticus Holdings’s valuation may seem like a bargain, but we think there are valid reasons why it’s so cheap.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Atlanticus Holdings (ATLC) Research Report: Q3 CY2025 Update

Financial technology company Atlanticus Holdings (NASDAQ:ATLC) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 36.1% year on year to $419.8 million. Its non-GAAP profit of $1.21 per share was 24.1% below analysts’ consensus estimates.

Atlanticus Holdings (ATLC) Q3 CY2025 Highlights:

- Volume: $4.93 billion vs analyst estimates of $4.39 billion (86.2% year-on-year growth, 12.5% beat)

- Revenue: $419.8 million vs analyst estimates of $417.6 million (36.1% year-on-year growth, 0.5% beat)

- Pre-tax Profit: $32.48 million (7.7% margin)

- Adjusted EPS: $1.21 vs analyst expectations of $1.60 (24.1% miss)

- Tangible Book Value per Share: $36.85 (18.7% year-on-year growth)

- Market Capitalization: $1.06 billion

Company Overview

Using data analytics to serve the millions of Americans with less-than-perfect credit scores, Atlanticus Holdings (NASDAQ:ATLC) provides technology and services that help lenders offer credit products to consumers often overlooked by traditional financing providers.

Atlanticus operates through two main segments: Credit as a Service (CaaS) and Auto Finance. The CaaS segment serves as a program manager for bank partners like Bank of Missouri and WebBank, offering a technology platform that enables instant credit decisions at retail points of sale, through digital marketing channels, and via partnerships. Private label credit cards are issued under the Fortiva and Curae brands (the latter focused on healthcare financing), while general purpose credit cards use the Aspire, Imagine, and Fortiva brands.

The company's proprietary decisioning platform leverages machine learning and hundreds of data points to evaluate applications, allowing its bank partners to approve consumers with lower FICO scores who might be rejected by traditional lenders. When receivables are generated, Atlanticus typically acquires them from its bank partners, earning returns through interest, fees, and merchant payments.

In the Auto Finance segment, through its CAR subsidiary, Atlanticus purchases and services auto loans from independent dealerships in the buy-here, pay-here used car market. It generates revenue by purchasing loans at a discount and through servicing fees. The company also provides floor-plan financing and other services to its network of dealers across numerous states.

Atlanticus processes these transactions through paperless platforms that integrate with retailers, healthcare providers, and auto dealers, creating a seamless experience for both merchants and consumers seeking financing options.

4. Personal Loan

Personal loan providers offer unsecured credit for various consumer needs. The sector benefits from digital application processes, increasing consumer comfort with online financial services, and opportunities in underserved credit segments. Headwinds include credit risk management in unsecured lending, regulatory oversight of lending practices, and intense competition affecting margins from both traditional and fintech lenders.

Atlanticus Holdings competes with traditional credit card issuers, payment technology providers like Block (NYSE:SQ) and PayPal (NASDAQ:PYPL), buy-now-pay-later companies such as Affirm (NASDAQ:AFRM) and Klarna, and other financial technology firms focused on non-prime consumers like Upstart (NASDAQ:UPST) and Enova International (NYSE:ENVA).

5. Revenue Growth

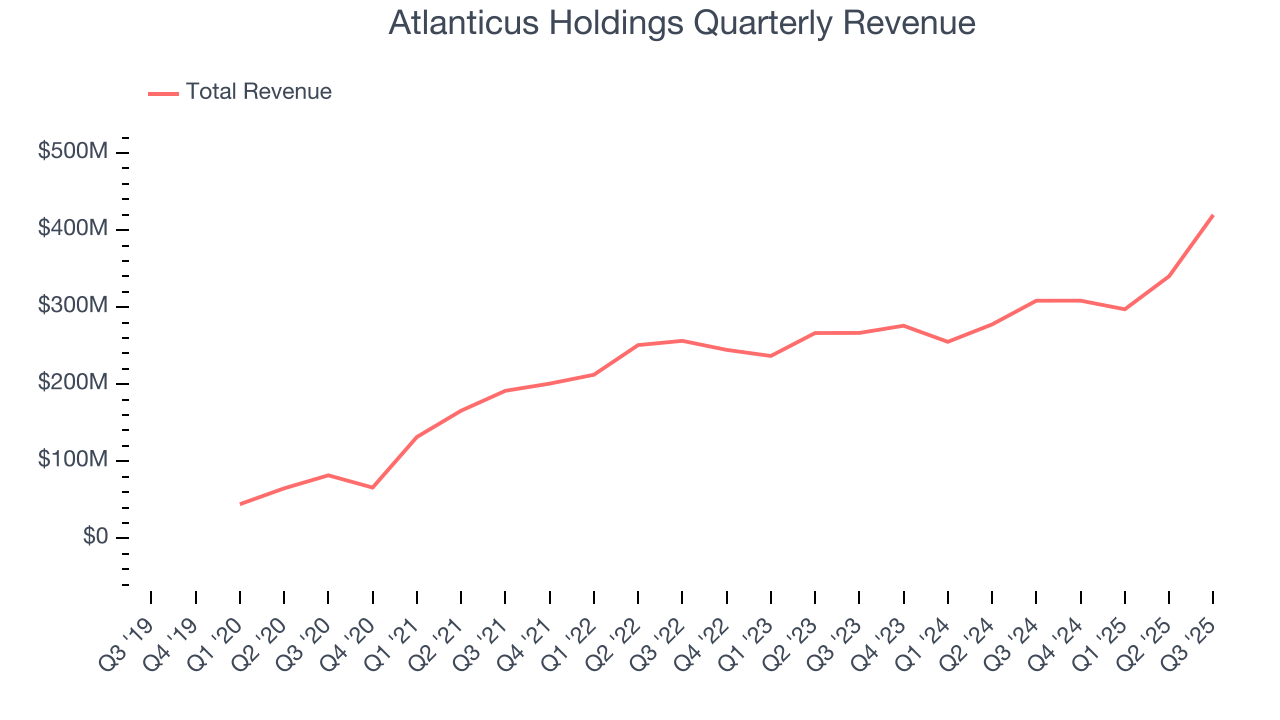

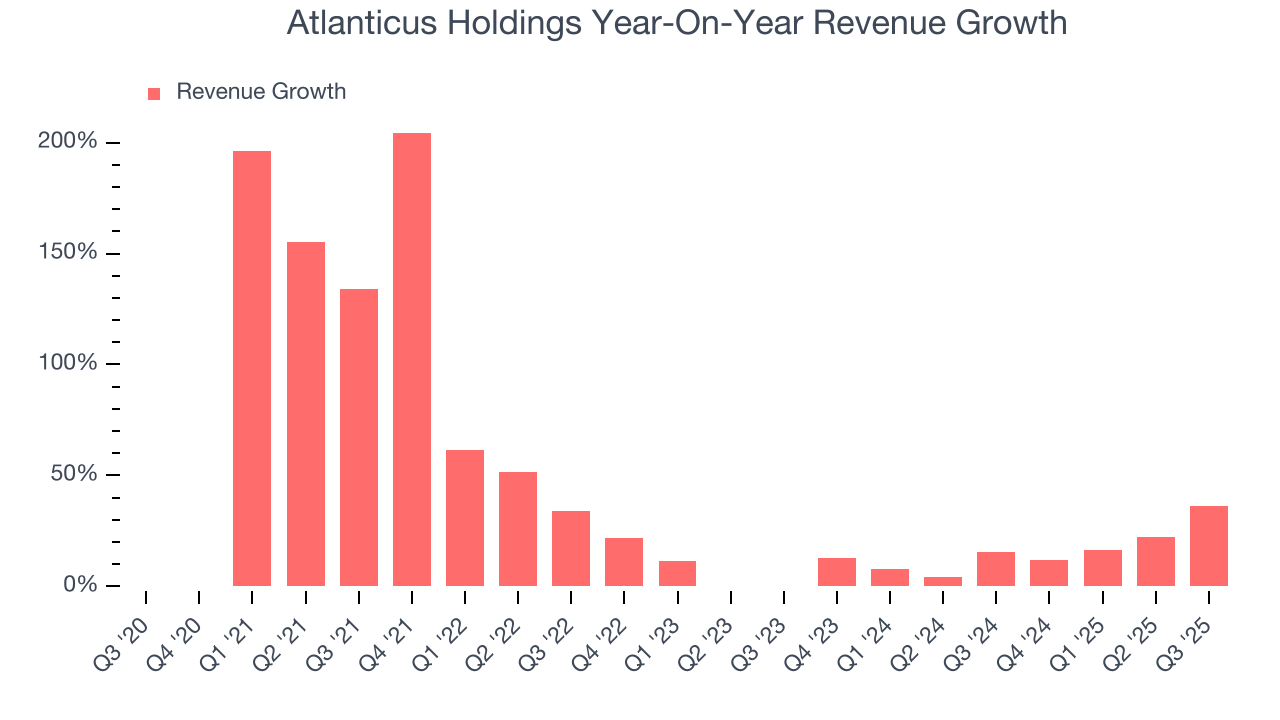

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Atlanticus Holdings grew its revenue at an incredible 40.8% compounded annual growth rate. Its growth beat the average financials company and shows its offerings resonate with customers.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Atlanticus Holdings’s annualized revenue growth of 16% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Atlanticus Holdings reported wonderful year-on-year revenue growth of 36.1%, and its $419.8 million of revenue exceeded Wall Street’s estimates by 0.5%.

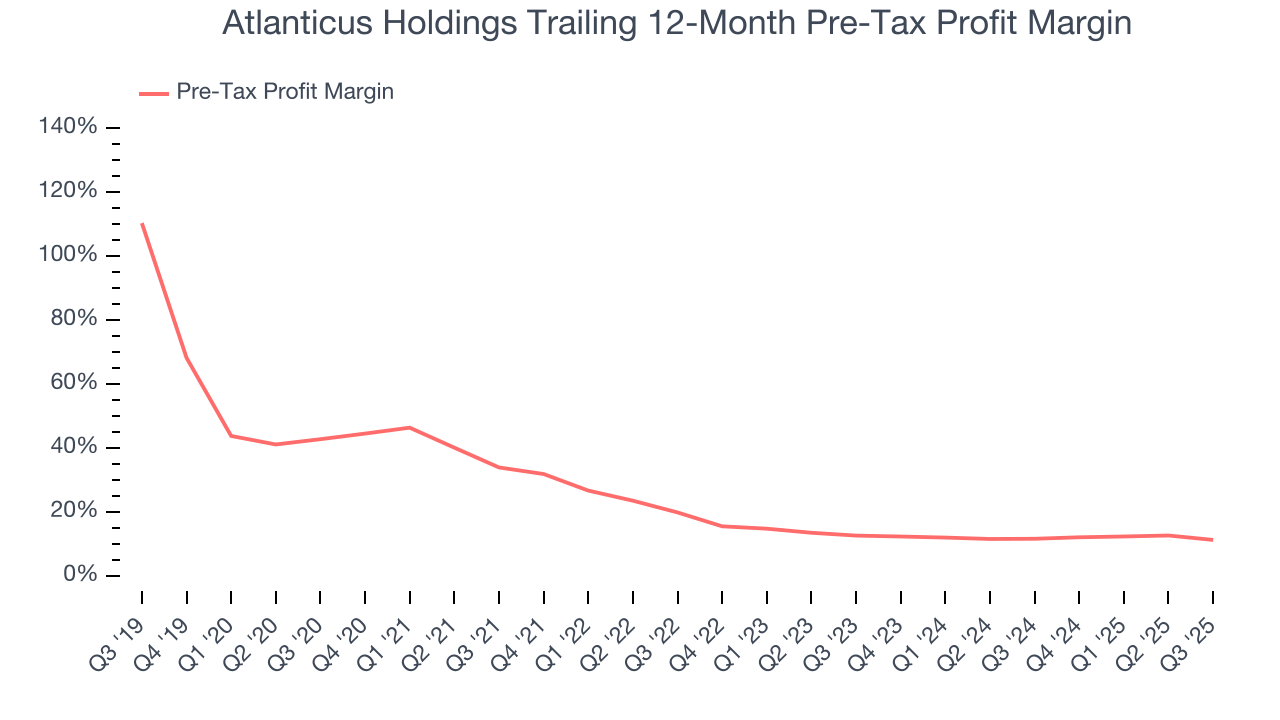

6. Pre-Tax Profit Margin

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Personal Loan companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

The pre-tax profit margin includes interest because it's central to how financial institutions generate revenue and manage costs. Tax considerations are excluded since they represent government policy rather than operational performance, giving investors a clearer view of business fundamentals.

Over the last five years, Atlanticus Holdings’s pre-tax profit margin has risen by 31.5 percentage points, going from 33.9% to 11.2%. It has also declined by 1.4 percentage points on a two-year basis, showing its expenses have consistently increased at a faster rate than revenue. This usually raises questions unless the company is in high-growth mode and reinvesting its profits into attractive ventures.

In Q3, Atlanticus Holdings’s pre-tax profit margin was 7.7%. This result was 4.4 percentage points worse than the same quarter last year.

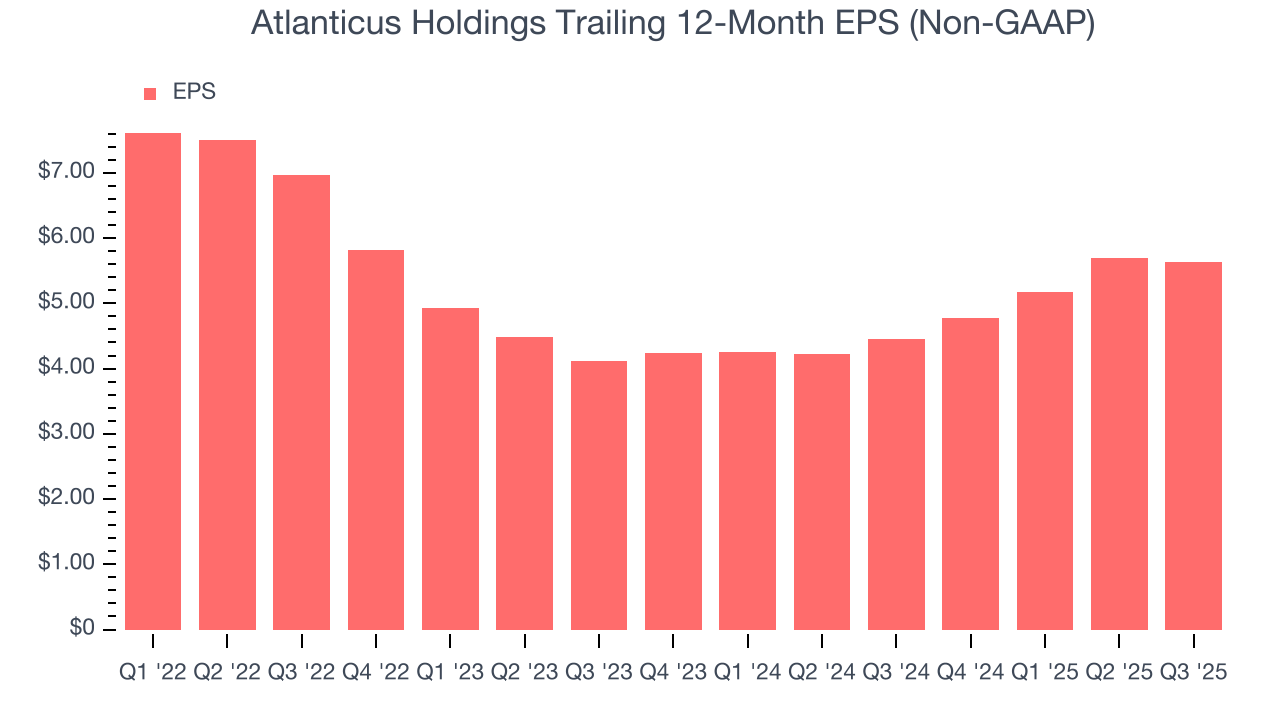

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Atlanticus Holdings’s full-year EPS dropped 27.4%, or 6.2% annually, over the last four years. We’ll keep a close eye on the company as diminishing earnings could imply changing secular trends and preferences.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Atlanticus Holdings’s remarkable 17% annual EPS growth over the last two years aligns with its revenue trend. This tells us it maintained its per-share profitability as it expanded.

In Q3, Atlanticus Holdings reported adjusted EPS of $1.21, down from $1.27 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Atlanticus Holdings’s full-year EPS of $5.63 to grow 38%.

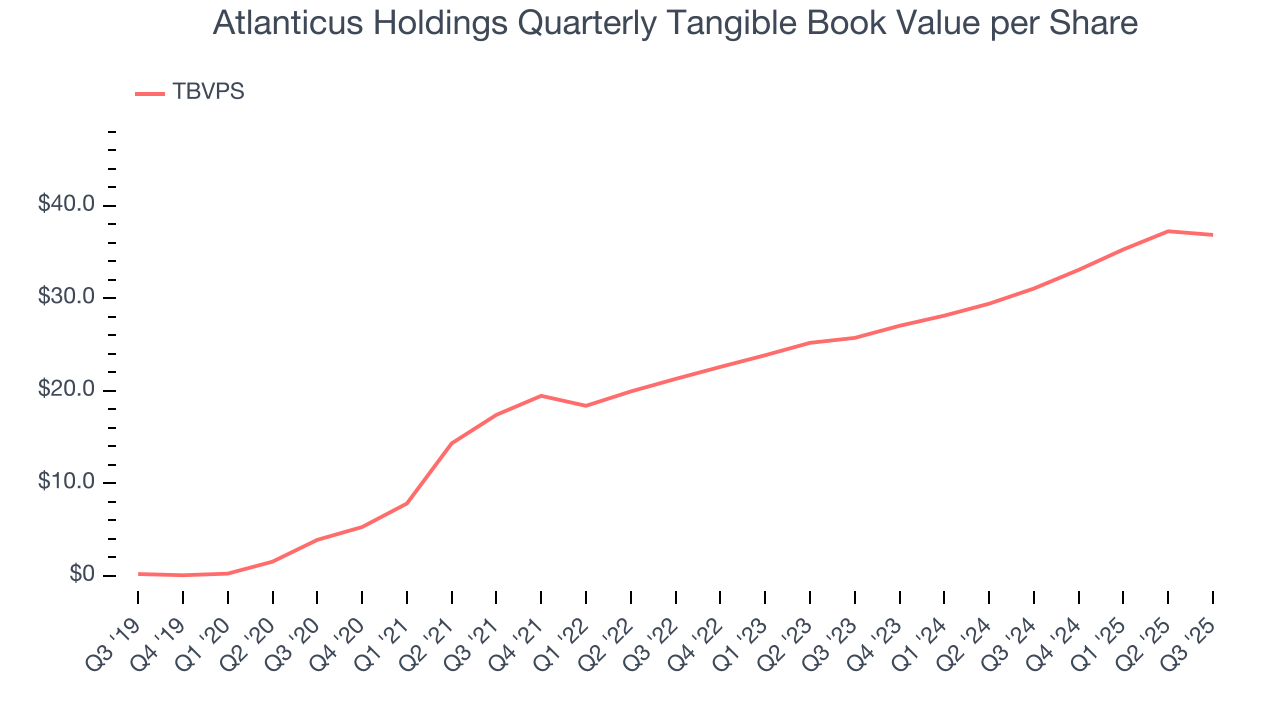

8. Tangible Book Value Per Share (TBVPS)

Financial firms are valued based on their balance sheet strength and ability to compound book value across diverse business lines.

This is why we consider tangible book value per share (TBVPS) an important metric for the sector. TBVPS represents the real net worth per share across all business segments, providing a clear measure of shareholder equity regardless of the complexity of operations. Other (and more commonly known) per-share metrics like EPS can sometimes be murky due to the complexity of multiple business lines, M&A activity, or accounting rules that vary across different financial services segments.

Atlanticus Holdings’s TBVPS grew at an incredible 56.8% annual clip over the last five years. TBVPS growth has recently decelerated to 19.7% annual growth over the last two years (from $25.72 to $36.85 per share).

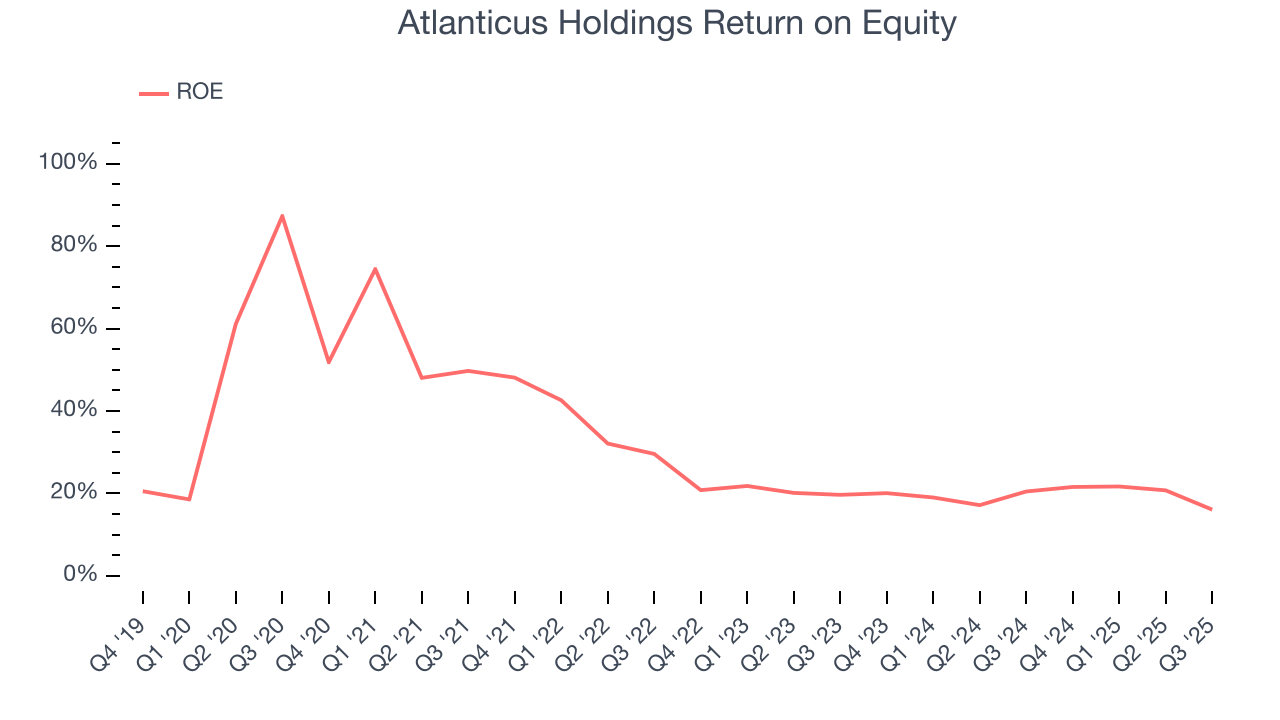

9. Return on Equity

Return on equity (ROE) reveals the profit generated per dollar of shareholder equity, which represents a key source of bank funding. Banks maintaining elevated ROE levels tend to accelerate wealth creation for shareholders via earnings retention, buybacks, and distributions.

Over the last five years, Atlanticus Holdings has averaged an ROE of 30.8%, exceptional for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This is a bright spot for Atlanticus Holdings.

10. Balance Sheet Risk

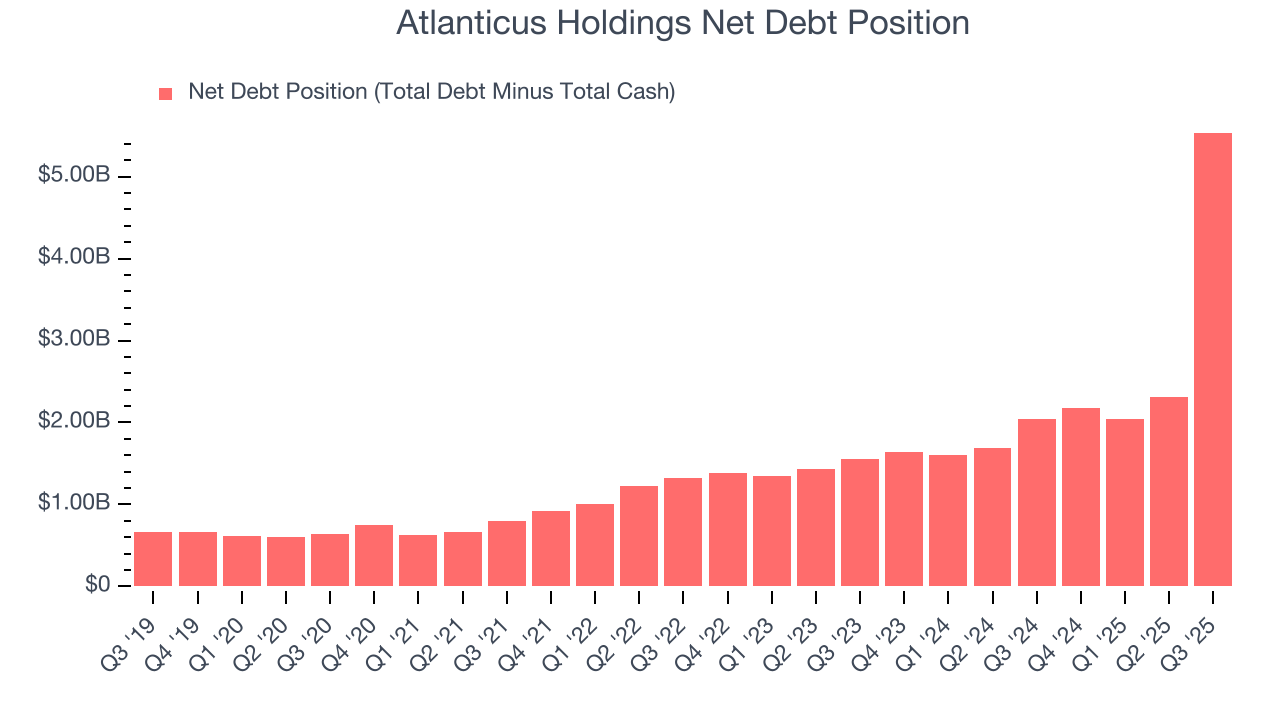

Atlanticus Holdings reported $525.9 million of cash and $6.06 billion of debt on its balance sheet in the most recent quarter.

As investors in high-quality companies, we primarily focus on whether a company’s profits can support its debt.

With $163.8 million of EBITDA over the last 12 months, we view Atlanticus Holdings’s 33.8× net-debt-to-EBITDA ratio as inadequate. The company’s lacking profits relative to its borrowings give it little breathing room, raising red flags.

11. Key Takeaways from Atlanticus Holdings’s Q3 Results

We were impressed by how significantly Atlanticus Holdings blew past analysts’ transaction volumes expectations this quarter. On the other hand, its EPS missed. Overall, this was a softer quarter. The stock remained flat at $69.94 immediately after reporting.

12. Is Now The Time To Buy Atlanticus Holdings?

Updated: February 13, 2026 at 11:30 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Atlanticus Holdings.

Atlanticus Holdings is a pretty good company if you ignore its balance sheet. For starters, its revenue growth was exceptional over the last five years and is expected to accelerate over the next 12 months. And while its declining pre-tax profit margin shows the business has become less efficient, its stellar ROE suggests it has been a well-run company historically. On top of that, Atlanticus Holdings’s TBVPS growth was exceptional over the last five years.

Atlanticus Holdings’s P/E ratio based on the next 12 months is 7.2x. Despite its notable business characteristics, we’d hold off for now because its balance sheet concerns us. Interested in this company and its prospects? We recommend you wait until its debt load falls or its profits increase.

Wall Street analysts have a consensus one-year price target of $91.60 on the company (compared to the current share price of $51.84).