Astronics (ATRO)

Astronics is an exciting business. Its sales and EPS are anticipated to grow nicely over the next 12 months, a welcome sign for investors.― StockStory Analyst Team

1. News

2. Summary

Why We Like Astronics

Integrating power outlets into many Boeing aircraft, Astronics (NASDAQ:ATRO) is a provider of technologies and services to the global aerospace, defense, and electronics industries.

- Performance over the past five years shows its incremental sales were extremely profitable, as its annual earnings per share growth of 83.9% outpaced its revenue gains

- Market share will likely rise over the next 12 months as its expected revenue growth of 14.2% is robust

- Annual revenue growth of 12.9% over the past two years was outstanding, reflecting market share gains this cycle

We have an affinity for Astronics. The price looks fair based on its quality, so this could be a good time to invest in some shares.

Why Is Now The Time To Buy Astronics?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Astronics?

Astronics’s stock price of $76.50 implies a valuation ratio of 31.4x forward P/E. Valuation is above that of many industrials companies, but we think the price is justified given its business fundamentals.

Our analysis and backtests show it’s often prudent to pay up for high-quality businesses because they routinely outperform the market over a multi-year period almost regardless of the entry price.

3. Astronics (ATRO) Research Report: Q3 CY2025 Update

Aerospace and defense technology solutions provider Astronics Corporation (NASDAQ:ATRO) met Wall Streets revenue expectations in Q3 CY2025, with sales up 3.8% year on year to $211.4 million. The company expects next quarter’s revenue to be around $230 million, close to analysts’ estimates. Its non-GAAP profit of $0.49 per share was 17.6% above analysts’ consensus estimates.

Astronics (ATRO) Q3 CY2025 Highlights:

- Revenue: $211.4 million vs analyst estimates of $212.1 million (3.8% year-on-year growth, in line)

- Adjusted EPS: $0.49 vs analyst estimates of $0.42 (17.6% beat)

- Adjusted EBITDA: $32.72 million vs analyst estimates of $30.62 million (15.5% margin, 6.8% beat)

- Revenue Guidance for Q4 CY2025 is $230 million at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: 10.9%, up from 3.8% in the same quarter last year

- Free Cash Flow Margin: 9.9%, up from 3.2% in the same quarter last year

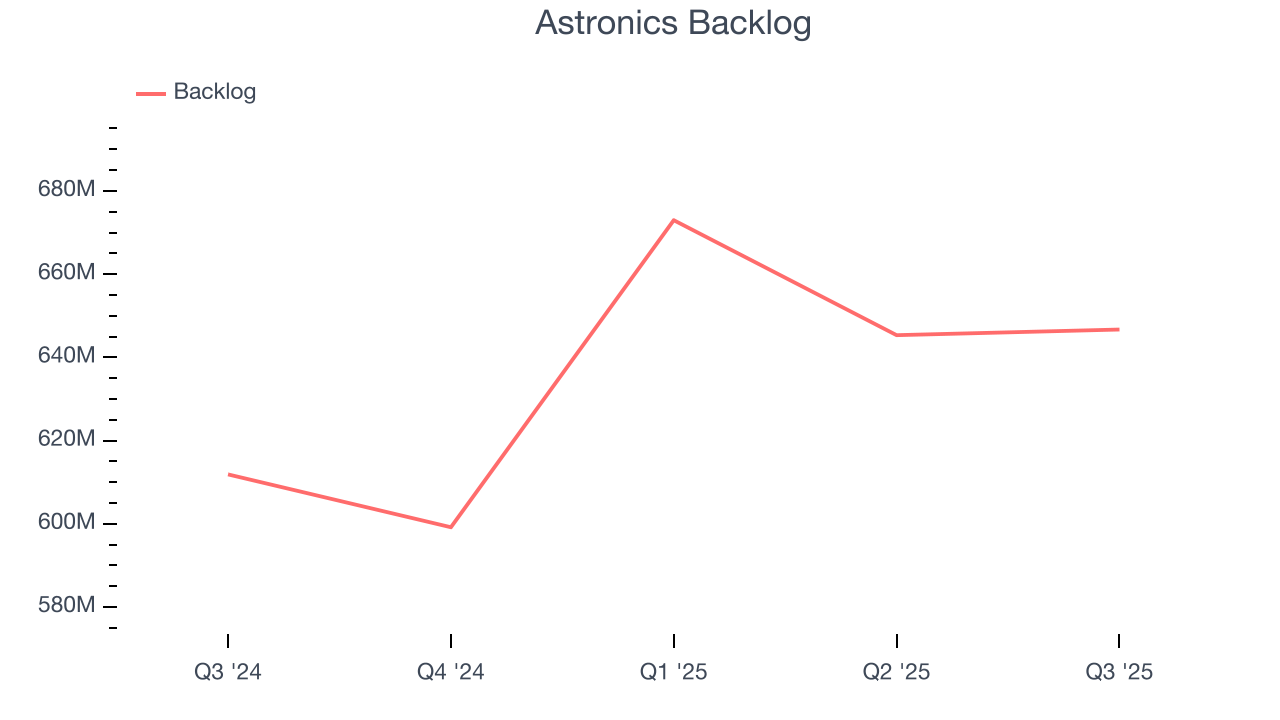

- Backlog: $646.7 million at quarter end, up 5.7% year on year

- Market Capitalization: $1.74 billion

Company Overview

Integrating power outlets into many Boeing aircraft, Astronics (NASDAQ:ATRO) is a provider of technologies and services to the global aerospace, defense, and electronics industries.

Founded in 1968 and headquartered in East Aurora, New York, Astronics has established itself in the development and manufacture of electrical power generation, distribution and motion systems, lighting and safety systems, avionics products, aircraft structures, and automated test systems. Astronics has its operations in the United States, Canada, France, and England, as well as engineering offices in Ukraine and India.

The company operates through two primary business segments: Aerospace and Test Systems. The Aerospace segment, which accounts for the majority of Astronics' sales, designs and manufactures products for the global aerospace industry. This segment's offerings include lighting and safety systems, electrical power generation and distribution systems, aircraft structures, avionics products, and systems certification services. Astronics' Aerospace customers span a wide range, including airframe manufacturers, suppliers, aircraft operators, and branches of the U.S. Department of Defense.

The Test Systems segment focuses on the design, development, manufacture, and maintenance of automated test systems that support the aerospace and defense, communications, and mass transit industries. This segment also produces training and simulation devices for both commercial and military applications. Astronics' Test Systems products are sold to a global customer base, including original equipment manufacturers and prime government contractors for both electronics and military products.

4. Aerospace

Aerospace companies often possess technical expertise and have made significant capital investments to produce complex products. It is an industry where innovation is important, and lately, emissions and automation are in focus, so companies that boast advances in these areas can take market share. On the other hand, demand for aerospace products can ebb and flow with economic cycles and geopolitical tensions, which can be particularly painful for companies with high fixed costs.

Astronics’ peers and competitors include AerSale (NASDAQ:ATRO) and Virgin Galactic (NASDAQ:SPCE)

5. Revenue Growth

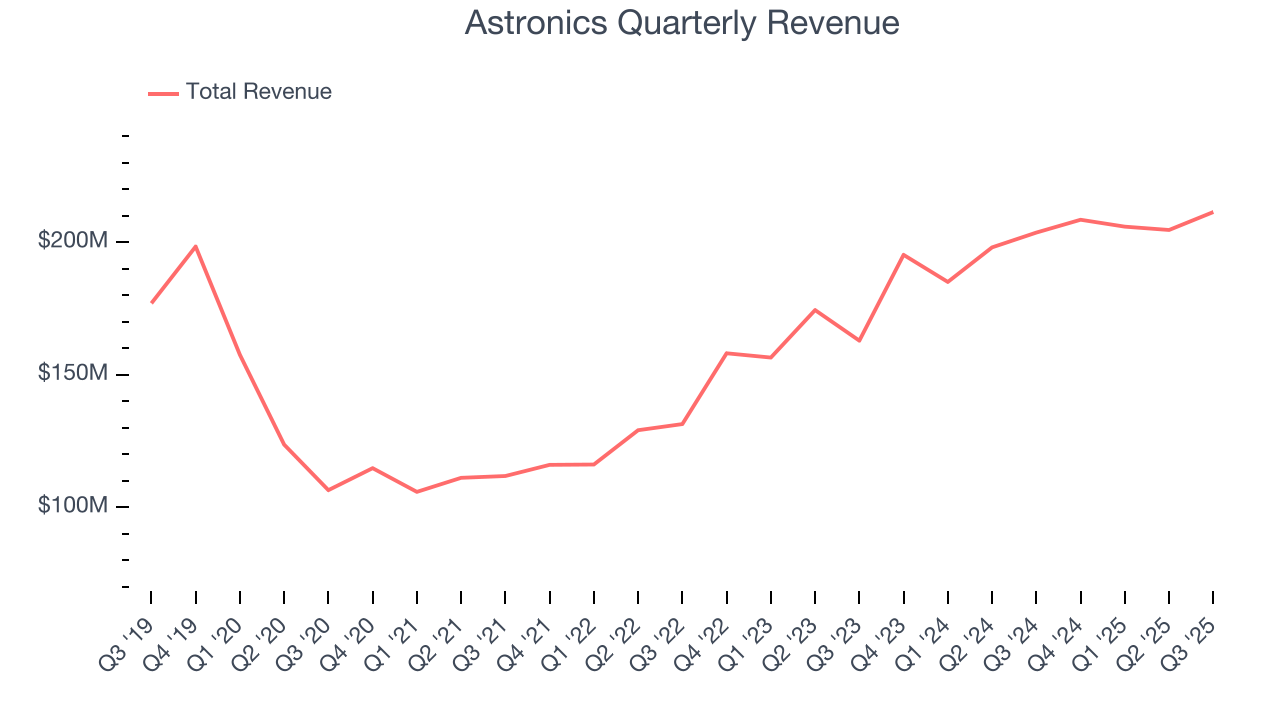

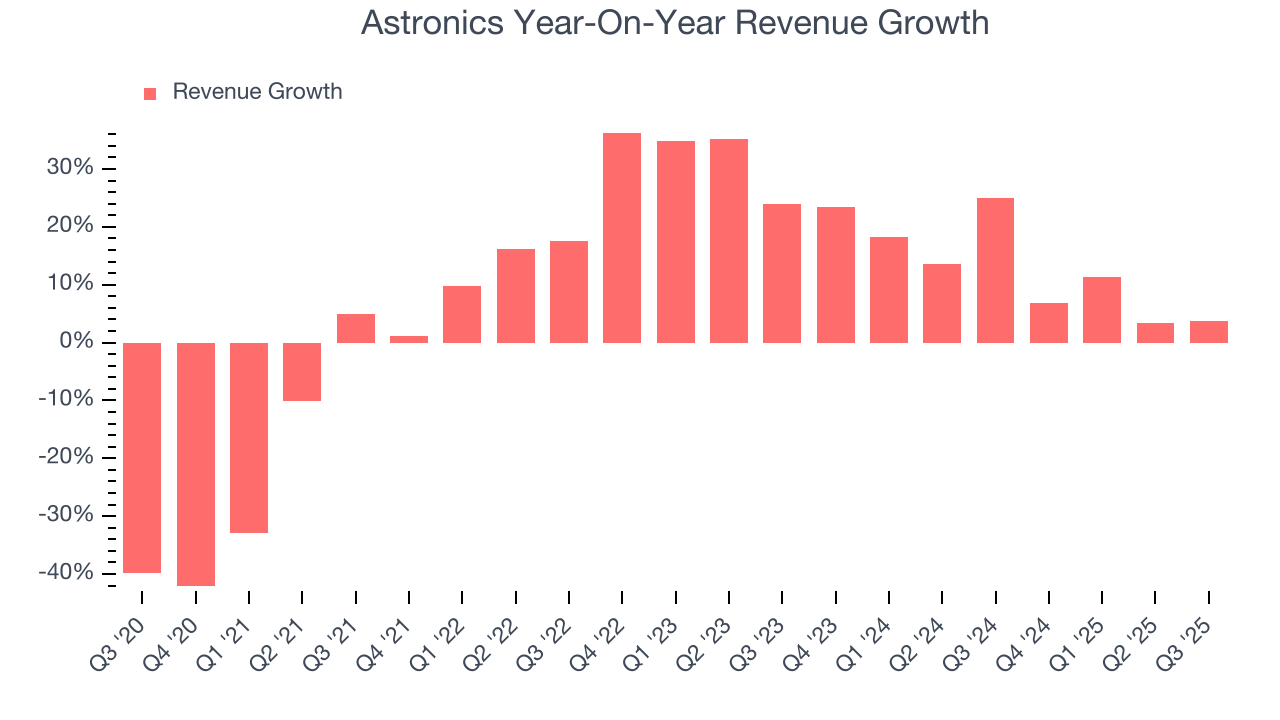

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Regrettably, Astronics’s sales grew at a mediocre 7.2% compounded annual growth rate over the last five years. This wasn’t a great result compared to the rest of the industrials sector, but there are still things to like about Astronics.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Astronics’s annualized revenue growth of 12.9% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

We can dig further into the company’s revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Astronics’s backlog reached $646.7 million in the latest quarter and averaged 5.7% year-on-year growth over the last two years. Because this number is lower than its revenue growth, we can see the company fulfilled orders at a faster rate than it added new orders to the backlog. This implies Astronics was operating efficiently but raises questions about the health of its sales pipeline.

This quarter, Astronics grew its revenue by 3.8% year on year, and its $211.4 million of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 10.3% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 7.8% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is above average for the sector and indicates the market is baking in some success for its newer products and services.

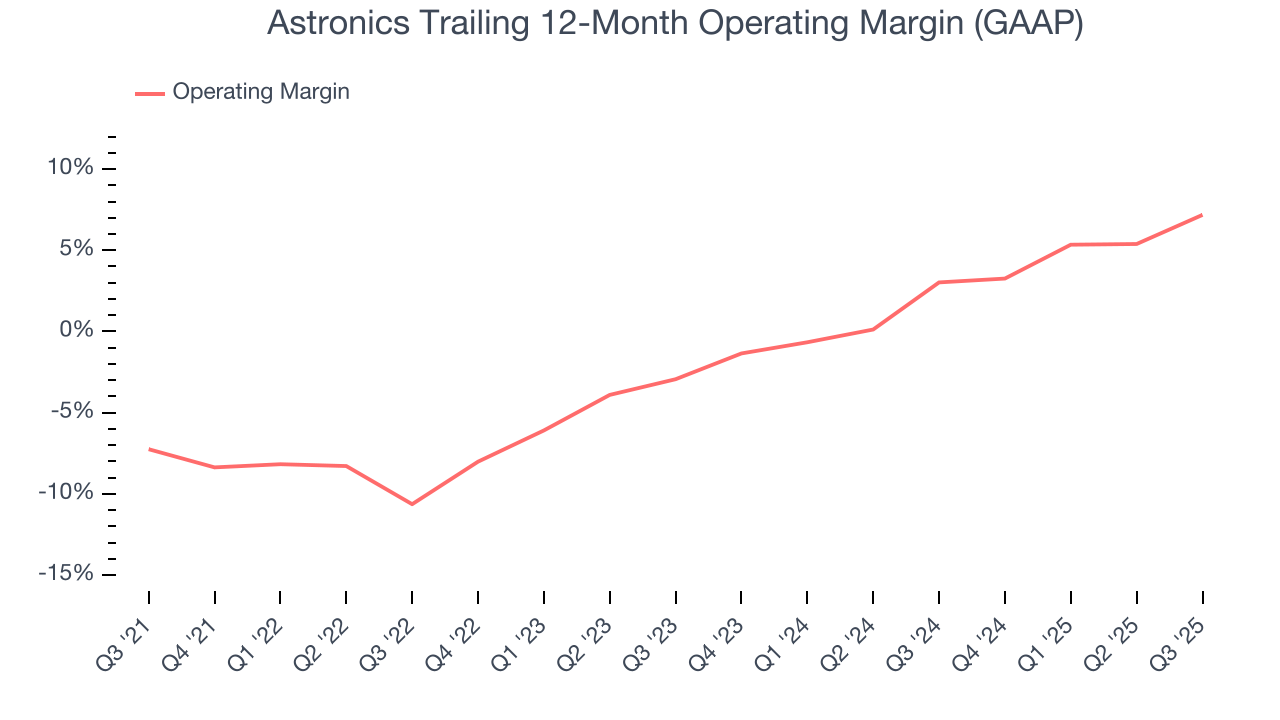

6. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Astronics was roughly breakeven when averaging the last five years of quarterly operating profits, one of the worst outcomes in the industrials sector.

On the plus side, Astronics’s operating margin rose by 14.4 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Astronics generated an operating margin profit margin of 10.9%, up 7.1 percentage points year on year. This increase was a welcome development and shows it was more efficient.

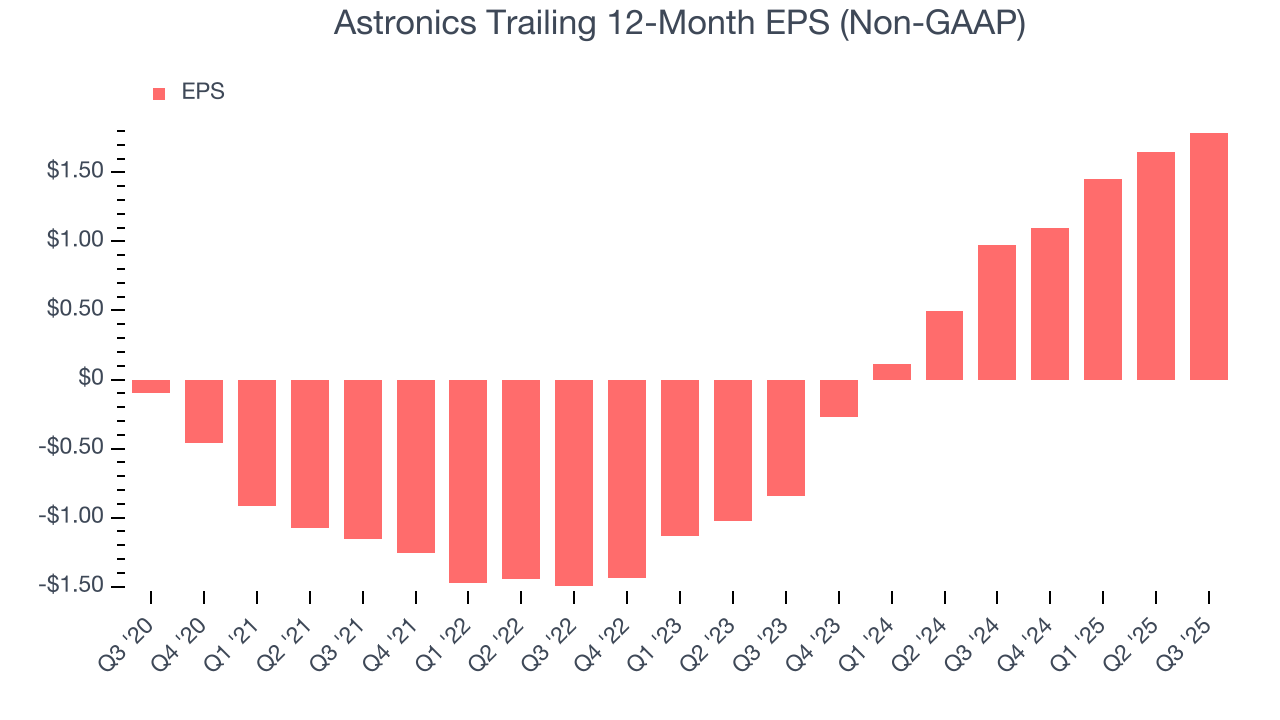

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Astronics’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Astronics, its two-year annual EPS growth of 103% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q3, Astronics reported adjusted EPS of $0.49, up from $0.35 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Astronics’s full-year EPS of $1.79 to grow 11.1%.

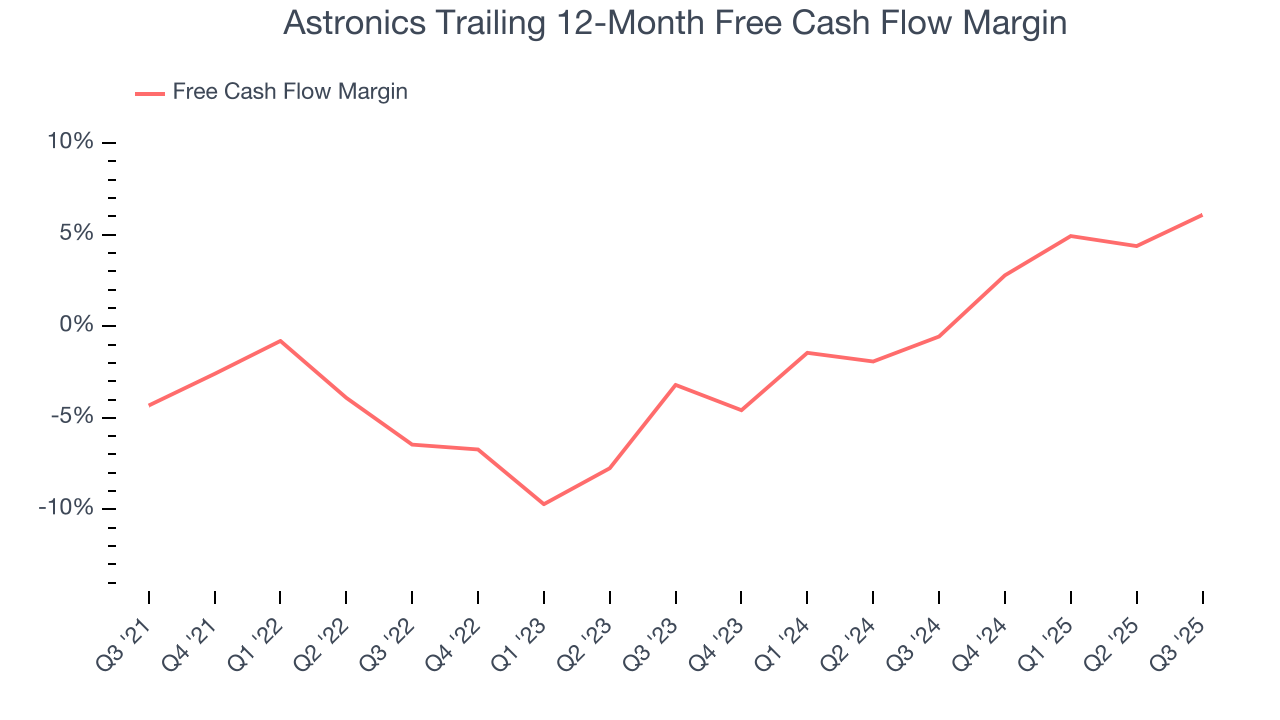

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Astronics broke even from a free cash flow perspective over the last five years, giving the company limited opportunities to return capital to shareholders.

Taking a step back, an encouraging sign is that Astronics’s margin expanded by 10.4 percentage points during that time. We have no doubt shareholders would like to continue seeing its cash conversion rise as it gives the company more optionality.

Astronics’s free cash flow clocked in at $21.01 million in Q3, equivalent to a 9.9% margin. This result was good as its margin was 6.7 percentage points higher than in the same quarter last year, building on its favorable historical trend.

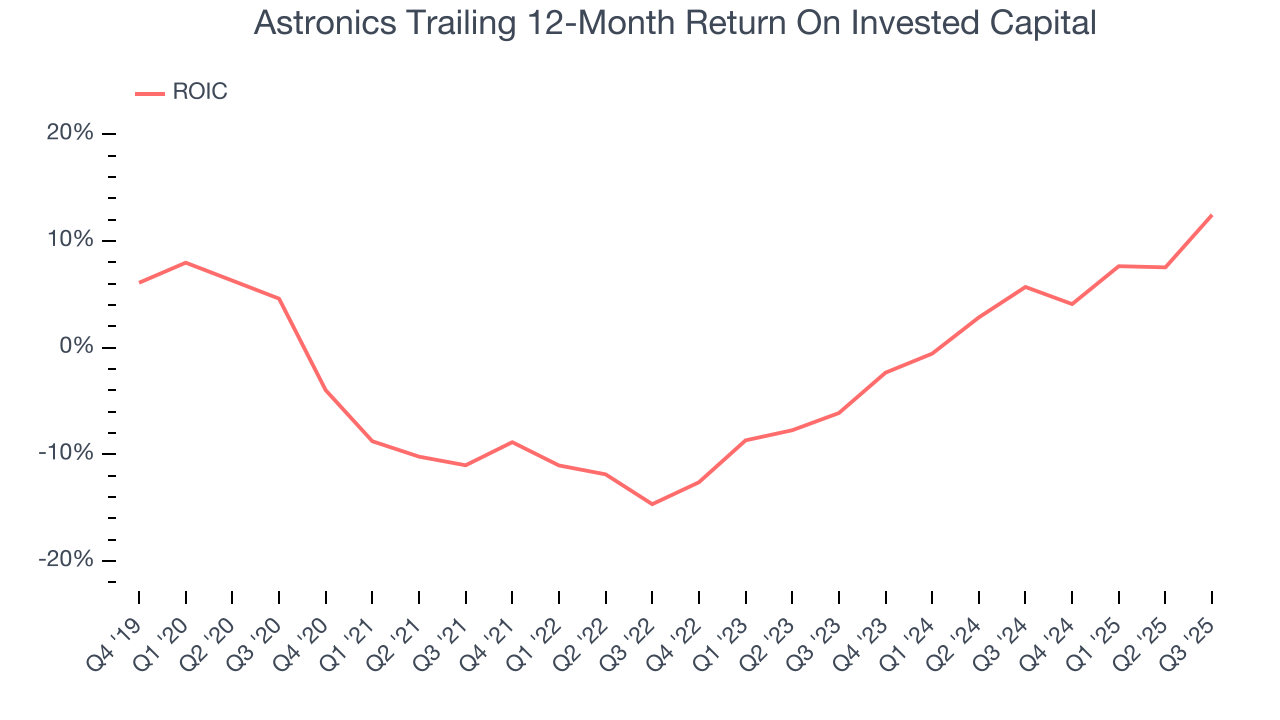

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although Astronics has shown solid business quality lately, it struggled to grow profitably in the past. Its five-year average ROIC was negative 2.7%, meaning management lost money while trying to expand the business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Astronics’s ROIC has increased. This is a good sign, but we recognize its lack of profitable growth during the COVID era was the primary reason for the change.

10. Balance Sheet Assessment

Astronics reported $19.58 million of cash and $379.4 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $120.4 million of EBITDA over the last 12 months, we view Astronics’s 3.0× net-debt-to-EBITDA ratio as safe. We also see its $7.49 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Astronics’s Q3 Results

We enjoyed seeing Astronics beat analysts’ EBITDA expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its revenue was in line. Overall, this print had some key positives. The stock traded up 3.9% to $49.80 immediately after reporting.

12. Is Now The Time To Buy Astronics?

Updated: January 23, 2026 at 10:15 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

There are multiple reasons why we think Astronics is an amazing business. Although its revenue growth was mediocre over the last five years, its growth over the next 12 months is expected to be higher. And while its relatively low ROIC suggests management has struggled to find compelling investment opportunities, its rising cash profitability gives it more optionality. In addition, Astronics’s expanding operating margin shows the business has become more efficient.

Astronics’s P/E ratio based on the next 12 months is 31.4x. Looking across the spectrum of industrials companies today, Astronics’s fundamentals shine bright. We like the stock at this price.

Wall Street analysts have a consensus one-year price target of $76.98 on the company (compared to the current share price of $76.50).