Avnet (AVT)

We’re cautious of Avnet. Its poor sales growth and falling returns on capital suggest its growth opportunities are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why We Think Avnet Will Underperform

With a century-long history of adapting to technological evolution, Avnet (NASDAQ:AVT) is a global electronic components distributor that connects manufacturers of semiconductors and other electronic parts with businesses that need these components.

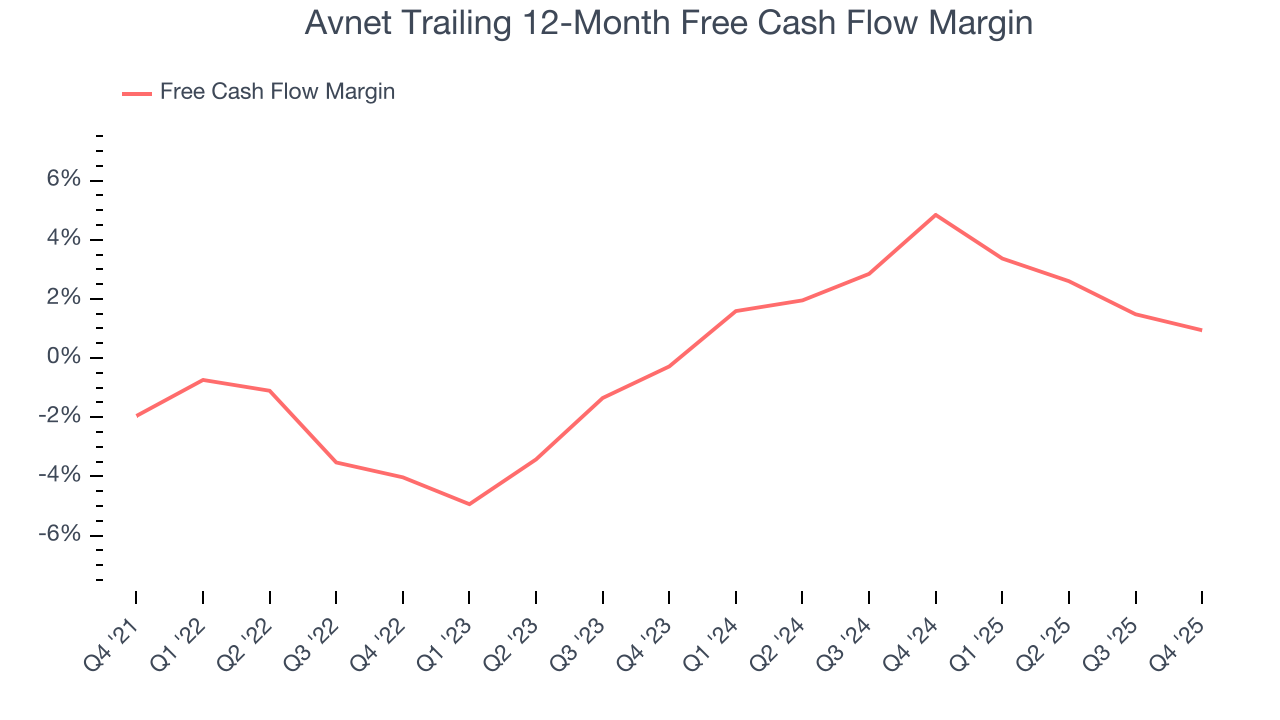

- Poor free cash flow generation means it has few chances to reinvest for growth, repurchase shares, or distribute capital

- Responsiveness to unforeseen market trends is restricted due to its substandard adjusted operating margin profitability

- A bright spot is that its unparalleled revenue scale of $22.5 billion gives it an edge in distribution

Avnet’s quality is lacking. There are more profitable opportunities elsewhere.

Why There Are Better Opportunities Than Avnet

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Avnet

Avnet is trading at $53.13 per share, or 10.4x forward P/E. This multiple is lower than most business services companies, but for good reason.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Avnet (AVT) Research Report: Q4 CY2025 Update

Electronic components distributor Avnet (NASDAQGS:AVT) reported revenue ahead of Wall Streets expectations in Q4 CY2025, with sales up 11.6% year on year to $6.32 billion. On top of that, next quarter’s revenue guidance ($6.35 billion at the midpoint) was surprisingly good and 7.9% above what analysts were expecting. Its non-GAAP profit of $1.05 per share was 10.2% above analysts’ consensus estimates.

Avnet (AVT) Q4 CY2025 Highlights:

- Revenue: $6.32 billion vs analyst estimates of $6.02 billion (11.6% year-on-year growth, 4.9% beat)

- Adjusted EPS: $1.05 vs analyst estimates of $0.95 (10.2% beat)

- Revenue Guidance for Q1 CY2026 is $6.35 billion at the midpoint, above analyst estimates of $5.89 billion

- Adjusted EPS guidance for Q1 CY2026 is $1.25 at the midpoint, above analyst estimates of $1.20

- Operating Margin: 2.3%, in line with the same quarter last year

- Free Cash Flow Margin: 3.1%, down from 5.4% in the same quarter last year

- Market Capitalization: $4.28 billion

Company Overview

With a century-long history of adapting to technological evolution, Avnet (NASDAQ:AVT) is a global electronic components distributor that connects manufacturers of semiconductors and other electronic parts with businesses that need these components.

Avnet operates through two main segments that serve different customer needs. The Electronic Components segment primarily serves medium and high-volume customers like original equipment manufacturers (OEMs) and electronic manufacturing services (EMS) providers. This segment distributes a wide range of products, with semiconductors representing about 85% of its sales, followed by interconnect, passive, and electromechanical components.

Beyond simple distribution, Avnet provides value-added services throughout the product lifecycle. Its design chain solutions help engineers select components and accelerate product development with technical support and evaluation kits. For example, a medical device manufacturer might work with Avnet's engineers to select the right microprocessors and sensors for a new patient monitoring system. The company's supply chain solutions help customers optimize procurement, warehousing, and logistics globally without investing in their own infrastructure.

The Farnell segment caters to lower-volume customers who need components quickly for development and prototyping. This segment operates primarily through e-commerce channels, serving engineers and entrepreneurs with a comprehensive portfolio of electronic components, kits, tools, and test equipment. A startup developing a smart home device might order small quantities of various components from Farnell to build and test prototypes before moving to volume production.

Avnet maintains operations in over 140 countries across the Americas, Europe, Middle East, Africa, and Asia/Pacific regions. This global footprint allows the company to serve customers wherever they operate while providing local expertise. The company generates revenue through the markup on components it distributes and through fees for its various value-added services.

4. IT Distribution & Solutions

IT Distribution & Solutions will be buoyed by the increasing complexity of IT ecosystems, rising cloud adoption, and demand for cybersecurity solutions. Enterprises are less likely than ever to embark on these complicated journeys solo, and companies in the sector boast expertise and scale in these areas. However, cloud migration also means less need for hardware, which could dent demand for large portions of the product portfolio and hurt margins. Additionally, planning for potentially supply chain disruptions is ongoing, as the COVID-19 pandemic showed how damaging a pause in global trade could be in areas like semiconductor procurement.

Avnet's main competitors include Arrow Electronics in the Electronic Components segment, while Mouser Electronics, Digi-Key Electronics, and RS Components compete with its Farnell segment. Other significant competitors include Future Electronics, World Peace Group, and WT Microelectronics.

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years.

With $23.15 billion in revenue over the past 12 months, Avnet is a behemoth in the business services sector and benefits from economies of scale, giving it an edge in distribution. This also enables it to gain more leverage on its fixed costs than smaller competitors and the flexibility to offer lower prices.

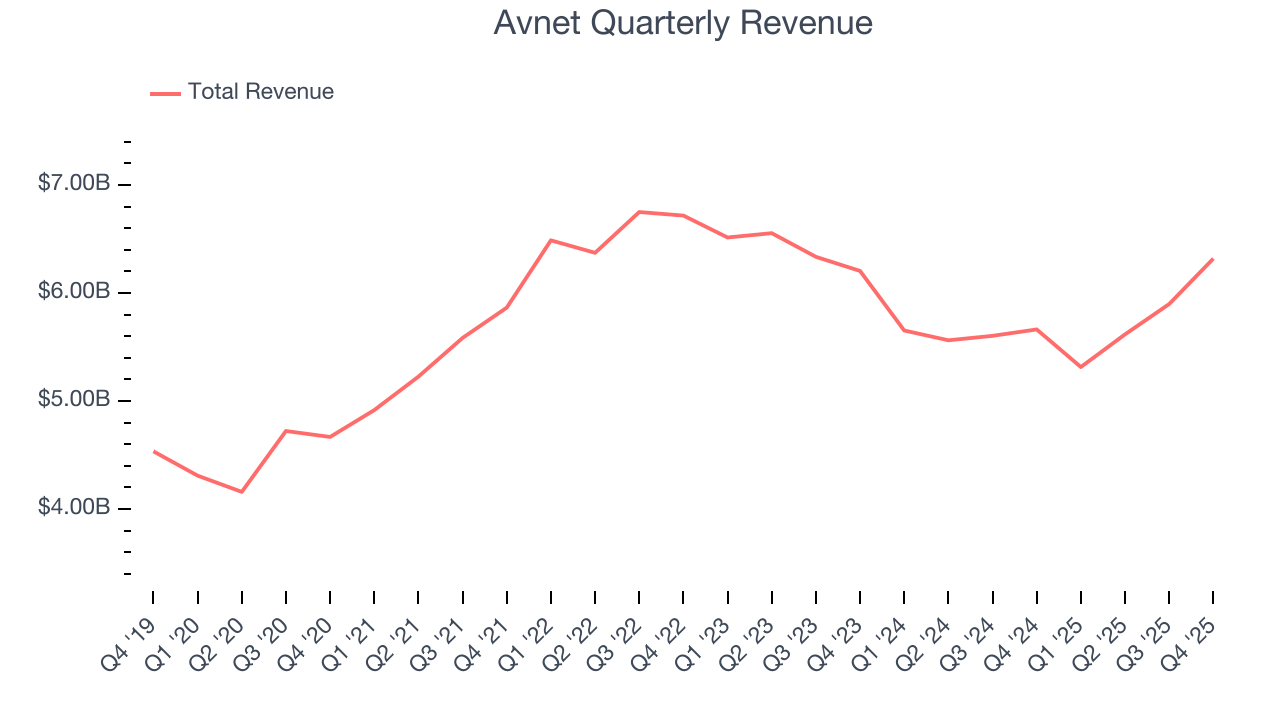

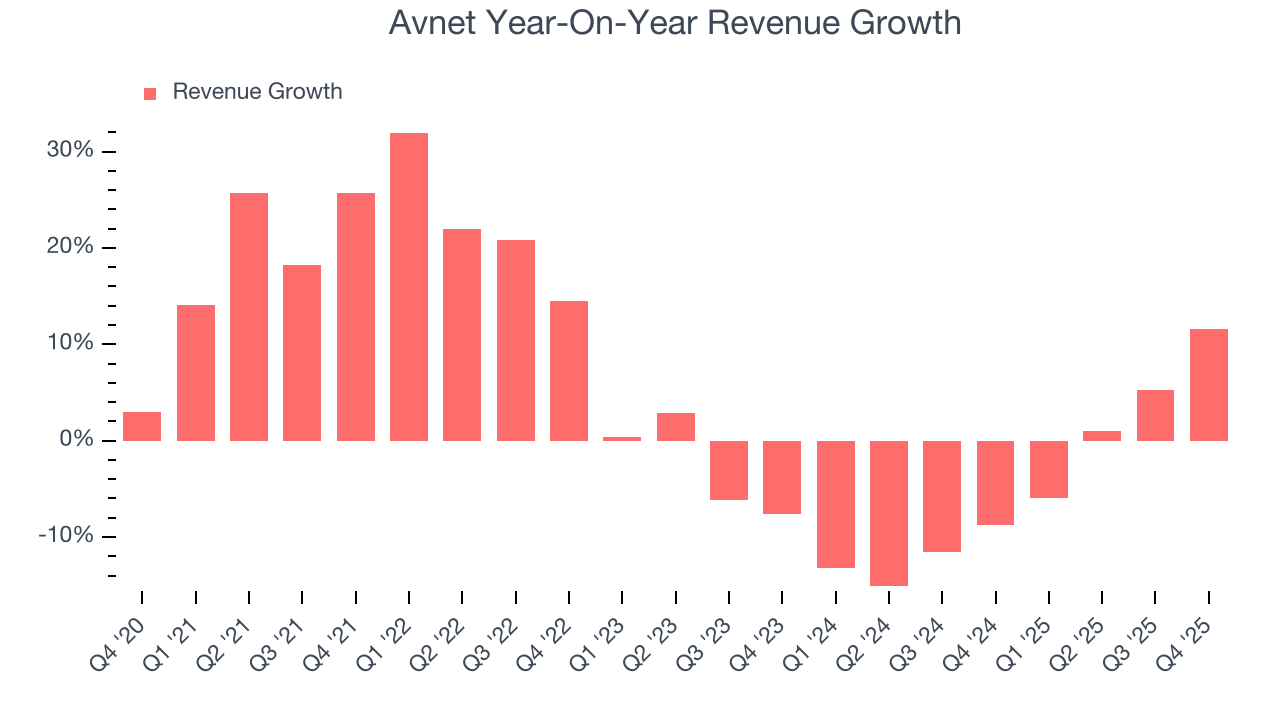

As you can see below, Avnet’s 5.3% annualized revenue growth over the last five years was decent. This shows its offerings generated slightly more demand than the average business services company, a useful starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Avnet’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 4.9% over the last two years.

This quarter, Avnet reported year-on-year revenue growth of 11.6%, and its $6.32 billion of revenue exceeded Wall Street’s estimates by 4.9%. Company management is currently guiding for a 19.5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 6.3% over the next 12 months, an improvement versus the last two years. This projection is above the sector average and implies its newer products and services will fuel better top-line performance.

6. Operating Margin

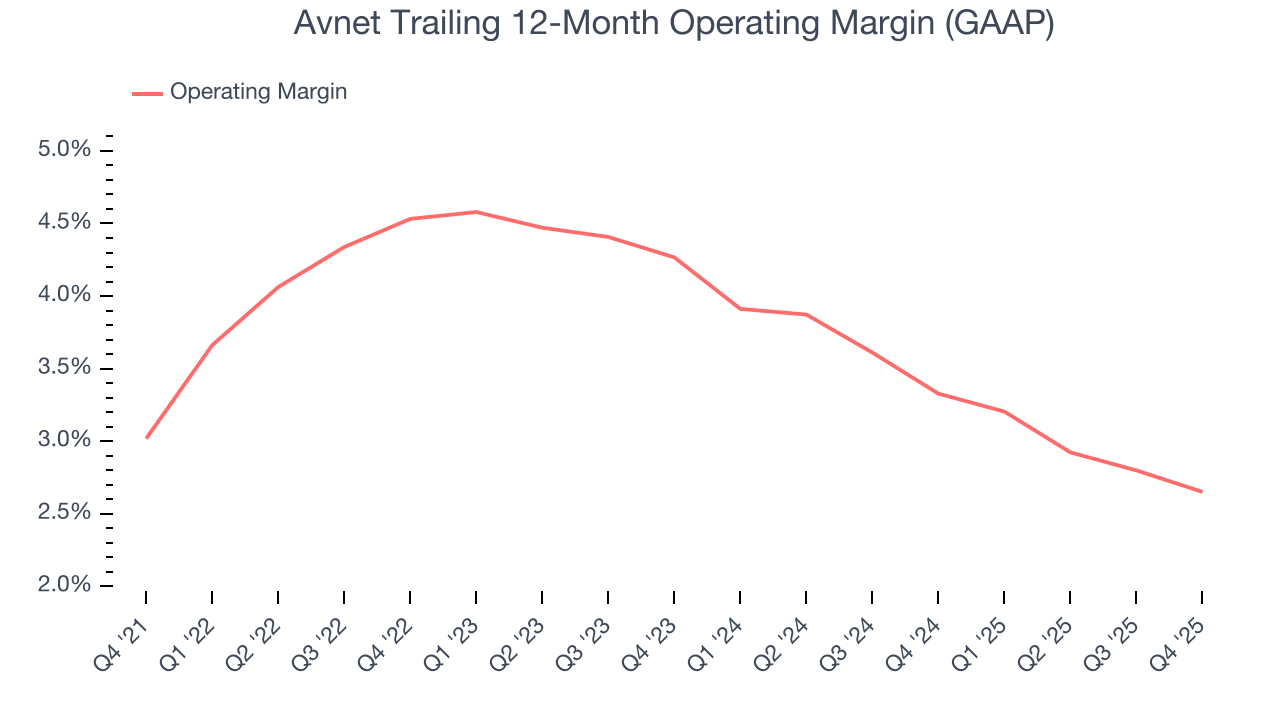

Avnet’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 3.6% over the last five years. This profitability was lousy for a business services business and caused by its suboptimal cost structure.

Looking at the trend in its profitability, Avnet’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, Avnet generated an operating margin profit margin of 2.3%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

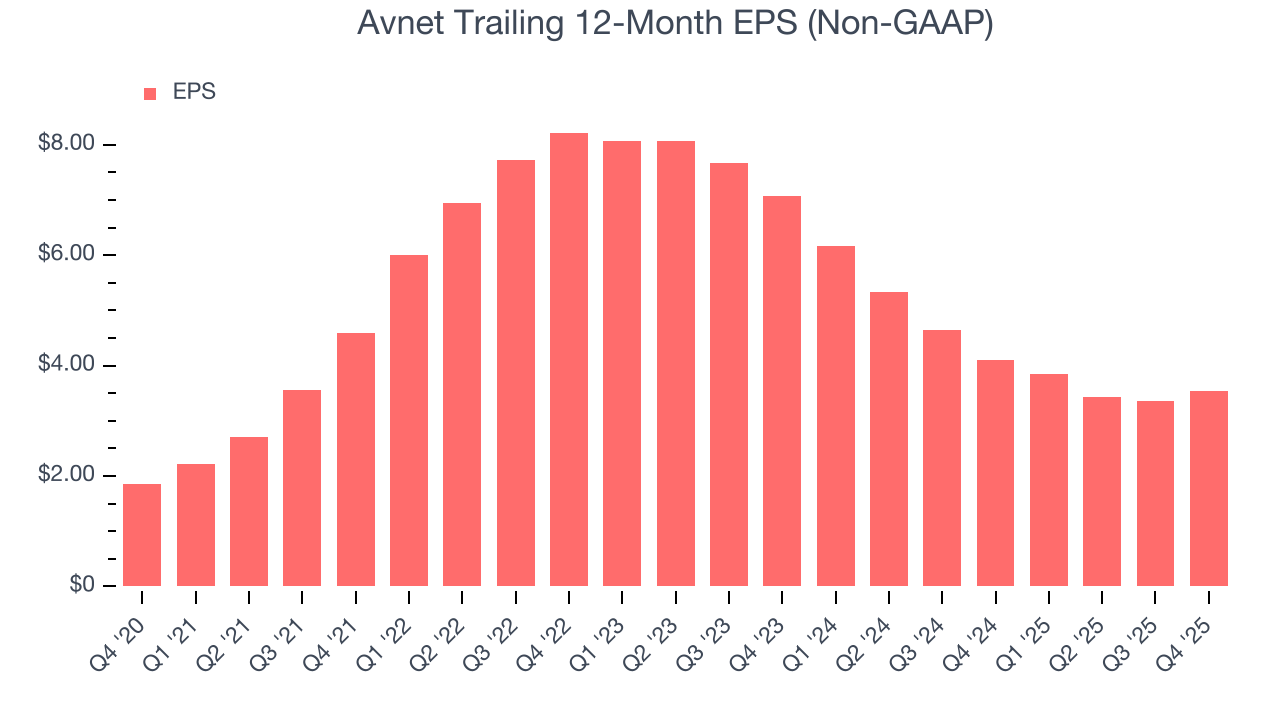

Avnet’s EPS grew at a spectacular 13.7% compounded annual growth rate over the last five years, higher than its 5.3% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t improve.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Avnet, its two-year annual EPS declines of 29.2% mark a reversal from its (seemingly) healthy five-year trend. We hope Avnet can return to earnings growth in the future.

In Q4, Avnet reported adjusted EPS of $1.05, up from $0.87 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Avnet’s full-year EPS of $3.54 to grow 56.8%.

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Avnet broke even from a free cash flow perspective over the last five years, giving the company limited opportunities to return capital to shareholders.

Taking a step back, an encouraging sign is that Avnet’s margin expanded by 2.9 percentage points during that time. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability was flat.

Avnet’s free cash flow clocked in at $192.9 million in Q4, equivalent to a 3.1% margin. The company’s cash profitability regressed as it was 2.4 percentage points lower than in the same quarter last year, but it’s still above its five-year average. We wouldn’t put too much weight on this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends are more important.

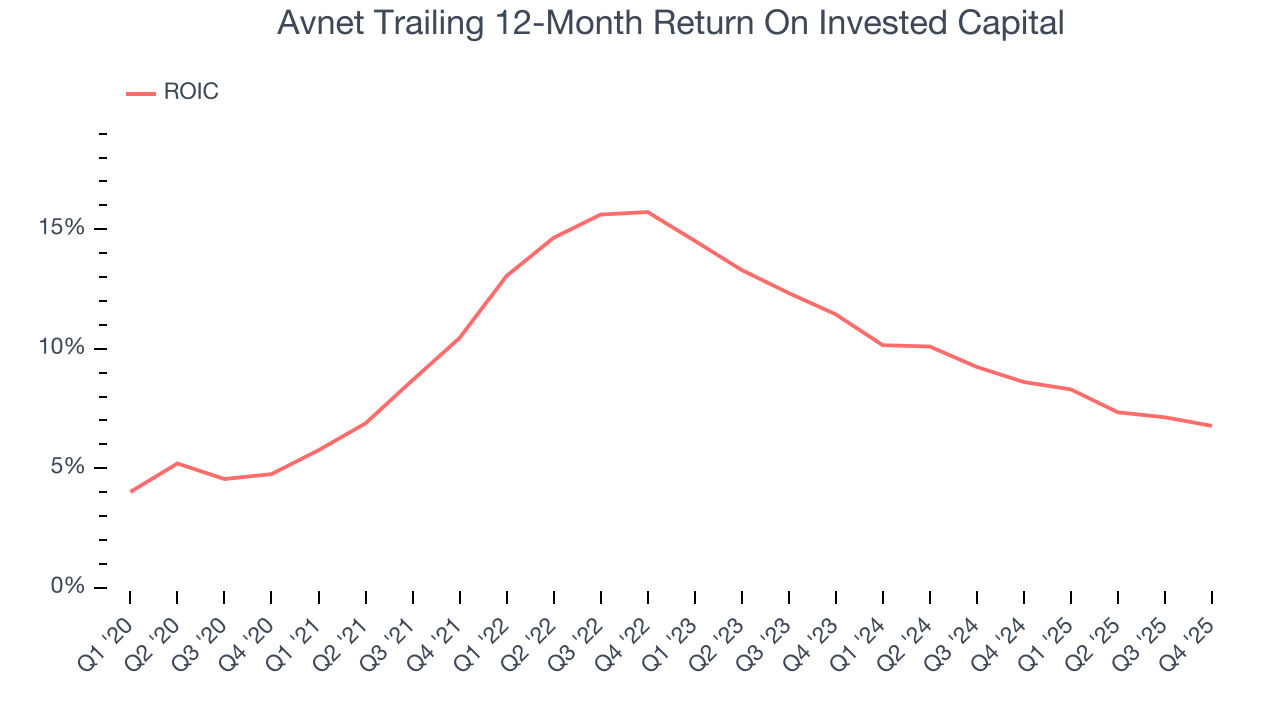

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Avnet’s management team makes decent investment decisions and generates value for shareholders. Its five-year average ROIC was 10.6%, slightly better than typical business services business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Avnet’s ROIC has unfortunately decreased. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

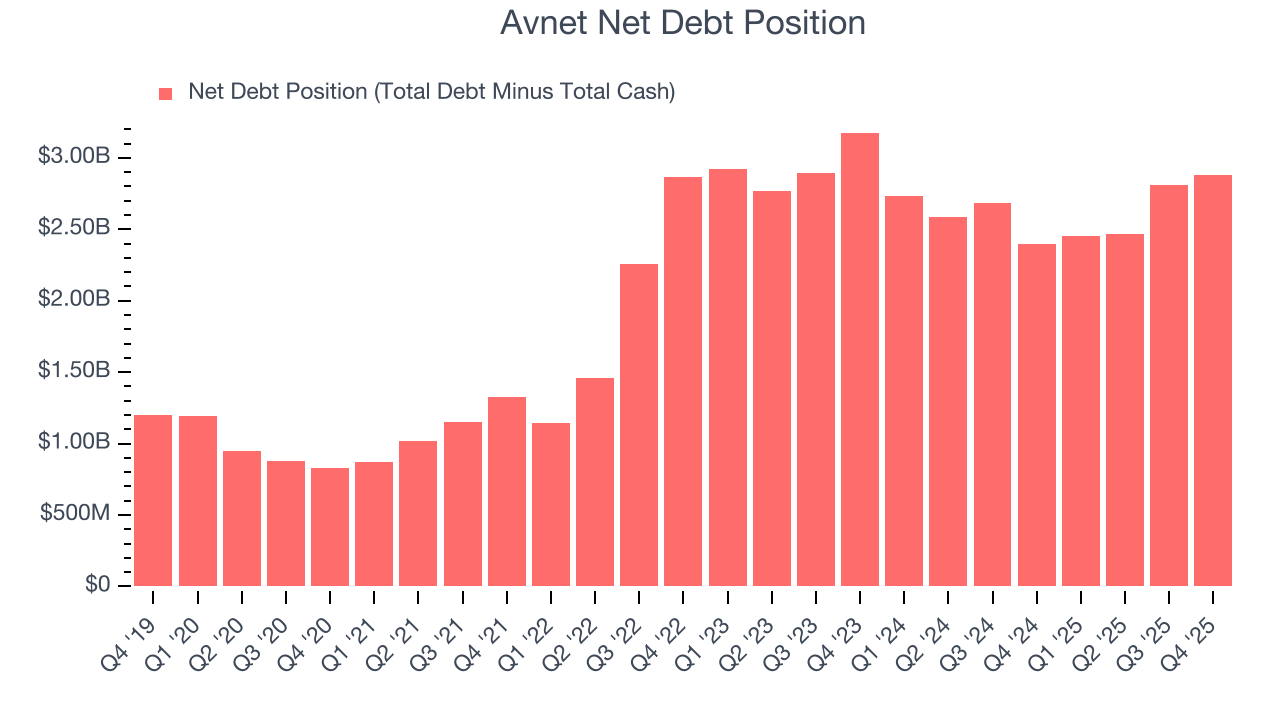

10. Balance Sheet Assessment

Avnet reported $286.5 million of cash and $3.17 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $705 million of EBITDA over the last 12 months, we view Avnet’s 4.1× net-debt-to-EBITDA ratio as safe. We also see its $239.2 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Avnet’s Q4 Results

We were impressed by Avnet’s optimistic revenue guidance for next quarter, which blew past analysts’ expectations. We were also glad its revenue outperformed Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock traded up 3.7% to $54.62 immediately following the results.

12. Is Now The Time To Buy Avnet?

Updated: January 28, 2026 at 8:13 AM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

Avnet isn’t a terrible business, but it isn’t one of our picks. Although its revenue growth was decent over the last five years and Wall Street believes it will continue to grow, its low free cash flow margins give it little breathing room. And while the company’s scale makes it a trusted partner with negotiating leverage, the downside is its operating margins reveal poor profitability compared to other business services companies.

Avnet’s P/E ratio based on the next 12 months is 9.5x. This valuation multiple is fair, but we don’t have much faith in the company. We're pretty confident there are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $53 on the company (compared to the current share price of $54.62).