Bel Fuse (BELFA)

Bel Fuse is a sound business. It consistently invests in attractive growth opportunities, generating substantial profits and returns.― StockStory Analyst Team

1. News

2. Summary

Why Bel Fuse Is Interesting

Founded by 26-year-old Elliot Bernstein during the electronics boom after WW2, Bel Fuse (NASDAQ:BELF.A) provides electronic systems and devices to the telecommunications, networking, transportation, and industrial sectors.

- Performance over the past five years shows its incremental sales were extremely profitable, as its annual earnings per share growth of 47.7% outpaced its revenue gains

- Market-beating returns on capital illustrate that management has a knack for investing in profitable ventures

- The stock is trading at a reasonable price if you like its story and growth prospects

Bel Fuse has some noteworthy aspects. If you like the story, the valuation seems fair.

Why Is Now The Time To Buy Bel Fuse?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Bel Fuse?

Bel Fuse’s stock price of $172.88 implies a valuation ratio of 27.1x forward P/E. While Bel Fuse features a higher multiple higher than that of industrials peers, we think the valuation is justified given its business quality.

If you think the market is not giving the company enough credit for its fundamentals, now could be a good time to invest.

3. Bel Fuse (BELFA) Research Report: Q4 CY2025 Update

Electronic system and device provider Bel Fuse (NASDAQ:BELFA) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 17.4% year on year to $175.9 million. On top of that, next quarter’s revenue guidance ($172.5 million at the midpoint) was surprisingly good and 6.3% above what analysts were expecting. Its non-GAAP profit of $1.98 per share was 80.8% above analysts’ consensus estimates.

Bel Fuse (BELFA) Q4 CY2025 Highlights:

- Revenue: $175.9 million vs analyst estimates of $173.4 million (17.4% year-on-year growth, 1.5% beat)

- Adjusted EPS: $1.98 vs analyst estimates of $1.10 (80.8% beat)

- Adjusted EBITDA: $37.59 million vs analyst estimates of $34.13 million (21.4% margin, 10.1% beat)

- Revenue Guidance for Q1 CY2026 is $172.5 million at the midpoint, above analyst estimates of $162.3 million

- Operating Margin: 14.7%, down from 18.1% in the same quarter last year

- Free Cash Flow Margin: 14.9%, up from 1.4% in the same quarter last year

- Market Capitalization: $2.91 billion

Company Overview

Founded by 26-year-old Elliot Bernstein during the electronics boom after WW2, Bel Fuse (NASDAQ:BELF.A) provides electronic systems and devices to the telecommunications, networking, transportation, and industrial sectors.

Bel Fuse was founded in 1949 and was originally established as a manufacturer of small transformers and fuse kits. The company has primarily acquired smaller to mid-sized companies that offer new technologies, complementary product lines, or access to new markets. Today, the company offers magnetics, power management devices, circuit protection components, and interconnect products.

Bel Fuse's electronic systems and components power, protect, and connect electronic circuits. Some specific offerings include DC-DC converters, AC-DC power supplies, transformers, fuse holders, and cable assemblies. For example, its DC-DC converters regulate and convert DC voltage levels to ensure a stable and efficient power supply. These products are utilized in telecommunications networks, data centers, automotive systems, industrial equipment, and consumer electronics.

Bel Fuse generates recurring revenue through its established partnerships with major original equipment manufacturers (OEMs), distributors, and contract manufacturers. It engages in long-term contracts which often involve commitments for the purchase of a certain volume of products over an extended period. In addition, Bel Fuse offers volume discounts to incentivize customers to purchase larger quantities of its products.

4. Electronic Components

Like many equipment and component manufacturers, electronic components companies are buoyed by secular trends such as connectivity and industrial automation. More specific pockets of strong demand include data centers and telecommunications, which can benefit companies whose optical and transceiver offerings fit those markets. But like the broader industrials sector, these companies are also at the whim of economic cycles. Consumer spending, for example, can greatly impact these companies’ volumes.

Competitors offering similar products include TE Connectivity (NYSE:TEL), Amphenol (NYSE:APH), and Vishay (NYSE:VSH).

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, Bel Fuse’s 7.7% annualized revenue growth over the last five years was decent. Its growth was slightly above the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Bel Fuse’s recent performance shows its demand has slowed as its annualized revenue growth of 2.7% over the last two years was below its five-year trend. We’re wary when companies in the sector see decelerations in revenue growth, as it could signal changing consumer tastes aided by low switching costs.

This quarter, Bel Fuse reported year-on-year revenue growth of 17.4%, and its $175.9 million of revenue exceeded Wall Street’s estimates by 1.5%. Company management is currently guiding for a 13.3% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 5.9% over the next 12 months. Although this projection implies its newer products and services will spur better top-line performance, it is still below the sector average.

6. Gross Margin & Pricing Power

Bel Fuse’s unit economics are better than the typical industrials business, signaling its products are somewhat differentiated through quality or brand.As you can see below, it averaged a decent 32.8% gross margin over the last five years. Said differently, Bel Fuse paid its suppliers $67.19 for every $100 in revenue.

This quarter, Bel Fuse’s gross profit margin was 39.4% , marking a 1.9 percentage point increase from 37.5% in the same quarter last year. Bel Fuse’s full-year margin has also been trending up over the past 12 months, increasing by 1.3 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as manufacturing expenses).

7. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Bel Fuse has been an efficient company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 12.2%.

Looking at the trend in its profitability, Bel Fuse’s operating margin rose by 10.8 percentage points over the last five years, as its sales growth gave it immense operating leverage.

This quarter, Bel Fuse generated an operating margin profit margin of 14.7%, down 3.4 percentage points year on year. Conversely, its revenue and gross margin actually rose, so we can assume it was less efficient because its operating expenses like marketing, R&D, and administrative overhead grew faster than its revenue.

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Bel Fuse’s EPS grew at an astounding 48.1% compounded annual growth rate over the last five years, higher than its 7.7% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into the nuances of Bel Fuse’s earnings can give us a better understanding of its performance. As we mentioned earlier, Bel Fuse’s operating margin declined this quarter but expanded by 10.8 percentage points over the last five years. Its share count also shrank by 14.4%, and these factors together are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Bel Fuse, its one-year annual EPS growth of 7.9% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q4, Bel Fuse reported adjusted EPS of $1.98, up from $1.45 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Bel Fuse’s full-year EPS of $6.49 to grow 3.9%.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Bel Fuse has shown impressive cash profitability, enabling it to ride out cyclical downturns more easily while maintaining its investments in new and existing offerings. The company’s free cash flow margin averaged 8.3% over the last five years, better than the broader industrials sector.

Taking a step back, we can see that Bel Fuse’s margin expanded by 11 percentage points during that time. This is encouraging because it gives the company more optionality.

Bel Fuse’s free cash flow clocked in at $26.14 million in Q4, equivalent to a 14.9% margin. This result was good as its margin was 13.4 percentage points higher than in the same quarter last year, building on its favorable historical trend.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although Bel Fuse hasn’t been the highest-quality company lately, it historically found a few growth initiatives that worked out well. Its five-year average ROIC was 17.7%, impressive for an industrials business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Uneventfully, Bel Fuse’s ROIC has stayed the same over the last few years. Given the company’s underwhelming financial performance in other areas, we’d like to see its returns improve before recommending the stock.

11. Balance Sheet Assessment

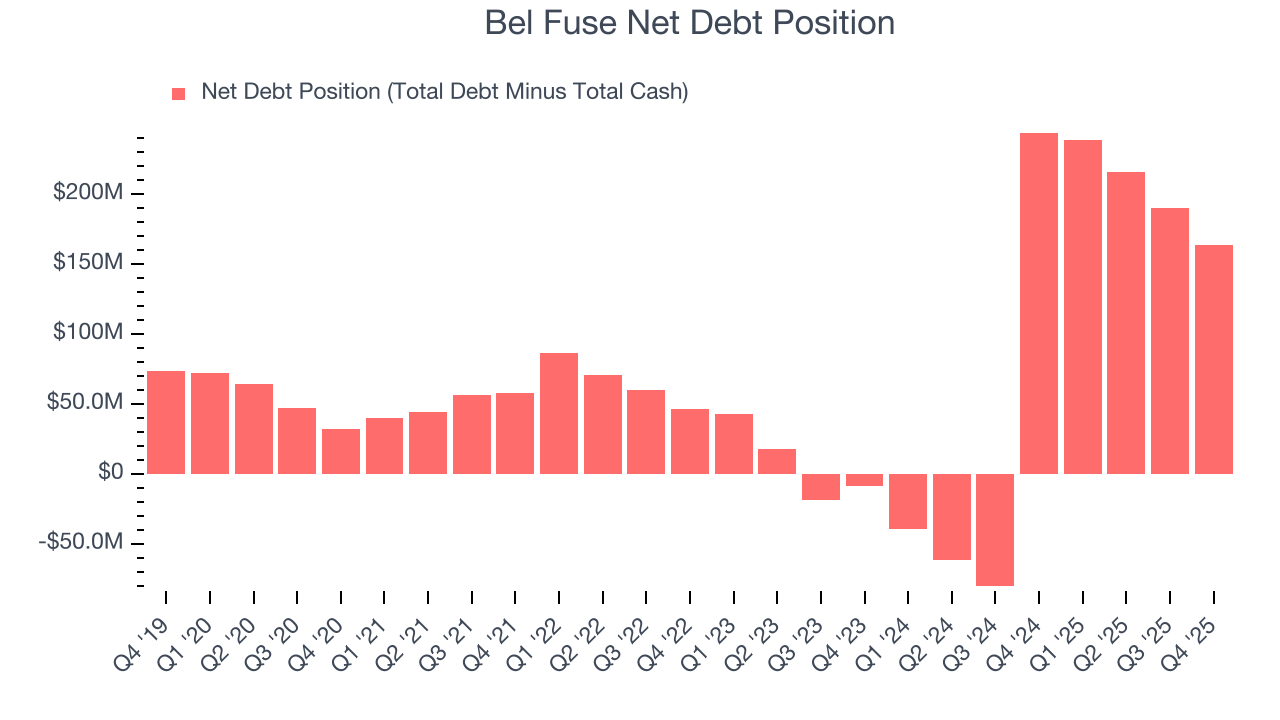

Bel Fuse reported $57.8 million of cash and $221.4 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $142.9 million of EBITDA over the last 12 months, we view Bel Fuse’s 1.1× net-debt-to-EBITDA ratio as safe. We also see its $8.28 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Bel Fuse’s Q4 Results

It was good to see Bel Fuse beat analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a solid print. The stock remained flat at $214.21 immediately after reporting.

13. Is Now The Time To Buy Bel Fuse?

Updated: March 7, 2026 at 10:10 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Bel Fuse, you should also grasp the company’s longer-term business quality and valuation.

Bel Fuse possesses a number of positive attributes. To begin with, the its revenue growth was decent over the last five years, and analysts believe it can continue growing at these levels. And while its projected EPS for the next year is lacking, its rising cash profitability gives it more optionality. On top of that, its expanding operating margin shows the business has become more efficient.

Bel Fuse’s P/E ratio based on the next 12 months is 27.1x. When scanning the industrials space, Bel Fuse trades at a fair valuation. If you believe in the company and its growth potential, now is an opportune time to buy shares.