Biogen (BIIB)

We’re skeptical of Biogen. Not only is its demand weak but also its falling returns on capital suggest it’s becoming less profitable.― StockStory Analyst Team

1. News

2. Summary

Why We Think Biogen Will Underperform

Founded in 1978 and pioneering treatments for some of medicine's most complex challenges, Biogen (NASDAQ:BIIB) develops and markets therapies for neurological conditions, including multiple sclerosis, Alzheimer's disease, spinal muscular atrophy, and rare diseases.

- Falling earnings per share over the last five years has some investors worried as stock prices ultimately follow EPS over the long term

- Projected sales decline of 8.9% for the next 12 months points to an even tougher demand environment ahead

- A positive is that its successful business model is illustrated by its impressive adjusted operating margin

Biogen’s quality isn’t up to par. We’re hunting for superior stocks elsewhere.

Why There Are Better Opportunities Than Biogen

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Biogen

At $184.85 per share, Biogen trades at 14.5x forward P/E. Biogen’s multiple may seem like a great deal among healthcare peers, but we think there are valid reasons why it’s this cheap.

Our advice is to pay up for elite businesses whose advantages are tailwinds to earnings growth. Don’t get sucked into lower-quality businesses just because they seem like bargains. These mediocre businesses often never achieve a higher multiple as hoped, a phenomenon known as a “value trap”.

3. Biogen (BIIB) Research Report: Q4 CY2025 Update

Biotech company Biogen (NASDAQ:BIIB) reported Q4 CY2025 results exceeding the market’s revenue expectations, but sales fell by 7.1% year on year to $2.28 billion. Its non-GAAP profit of $1.99 per share was 22.1% above analysts’ consensus estimates.

Biogen (BIIB) Q4 CY2025 Highlights:

- Revenue: $2.28 billion vs analyst estimates of $2.2 billion (7.1% year-on-year decline, 3.6% beat)

- Adjusted EPS: $1.99 vs analyst estimates of $1.63 (22.1% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $15.75 at the midpoint, beating analyst estimates by 5.3%

- Operating Margin: -2.5%, down from 18% in the same quarter last year

- Free Cash Flow Margin: 24.4%, down from 29.4% in the same quarter last year

- Market Capitalization: $27.19 billion

Company Overview

Founded in 1978 and pioneering treatments for some of medicine's most complex challenges, Biogen (NASDAQ:BIIB) develops and markets therapies for neurological conditions, including multiple sclerosis, Alzheimer's disease, spinal muscular atrophy, and rare diseases.

Biogen's portfolio includes several flagship products that address serious neurological disorders. For multiple sclerosis, the company markets TECFIDERA, VUMERITY, AVONEX, PLEGRIDY, and TYSABRI. Its rare disease treatments include SPINRAZA for spinal muscular atrophy, QALSODY for amyotrophic lateral sclerosis (ALS) with SOD1 mutations, and SKYCLARYS for Friedreich's Ataxia.

The company has expanded into Alzheimer's disease treatment through its collaboration with Eisai on LEQEMBI, which targets amyloid plaques in the brain. Biogen also partners with Sage Therapeutics on ZURZUVAE for postpartum depression.

Beyond neurology, Biogen has diversified into biosimilars, marketing products like BENEPALI (etanercept), IMRALDI (adalimumab), and FLIXABI (infliximab) in international markets. These biosimilars provide more affordable alternatives to established biologic medications for conditions like rheumatoid arthritis and inflammatory bowel disease.

Biogen's business model combines internal research and development with strategic collaborations. For example, a patient with spinal muscular atrophy might receive SPINRAZA, administered by spinal injection several times yearly, to increase production of a protein essential for motor neuron survival. Similarly, a person with early Alzheimer's disease might receive LEQEMBI infusions to slow cognitive decline by removing amyloid plaques.

The company maintains manufacturing facilities in North Carolina and Switzerland, while also utilizing contract manufacturing organizations. Biogen generates revenue through direct sales to healthcare providers, specialty pharmacies, and distributors, with pricing often negotiated with insurance companies and government payers.

4. Therapeutics

Over the next few years, therapeutic companies, which develop a wide variety of treatments for diseases and disorders, face strong tailwinds from advancements in precision medicine (including the use of AI to improve hit rates) and growing demand for treatments targeting rare diseases. However, headwinds such as rising scrutiny over drug pricing, regulatory unknowns, and competition from larger, more resourced pharmaceutical companies could weigh on growth.

Biogen competes with pharmaceutical companies like Novartis (NYSE:NVS) and Roche (OTCQX:RHHBY) in multiple sclerosis treatments, Eli Lilly (NYSE:LLY) in Alzheimer's disease with its KISUNLA therapy, and Novartis and Roche again in the spinal muscular atrophy market with their respective ZOLGENSMA and EVRYSDI treatments.

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $9.89 billion in revenue over the past 12 months, Biogen has decent scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

6. Revenue Growth

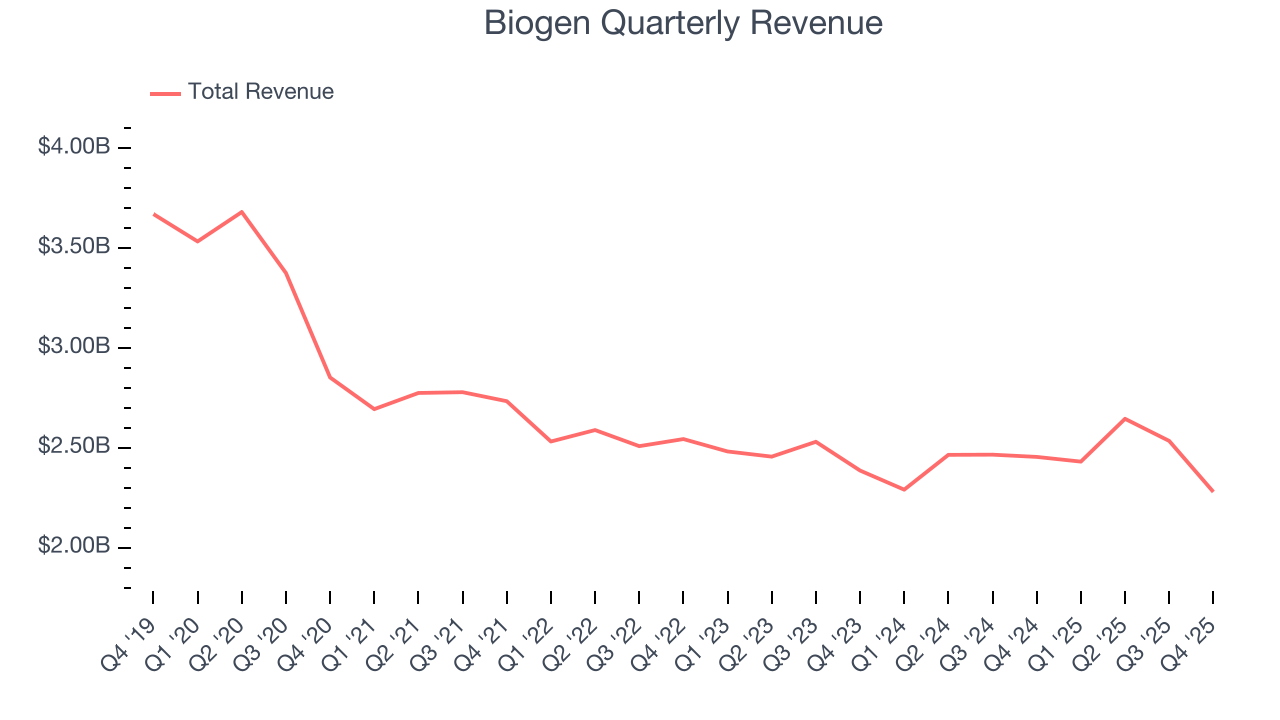

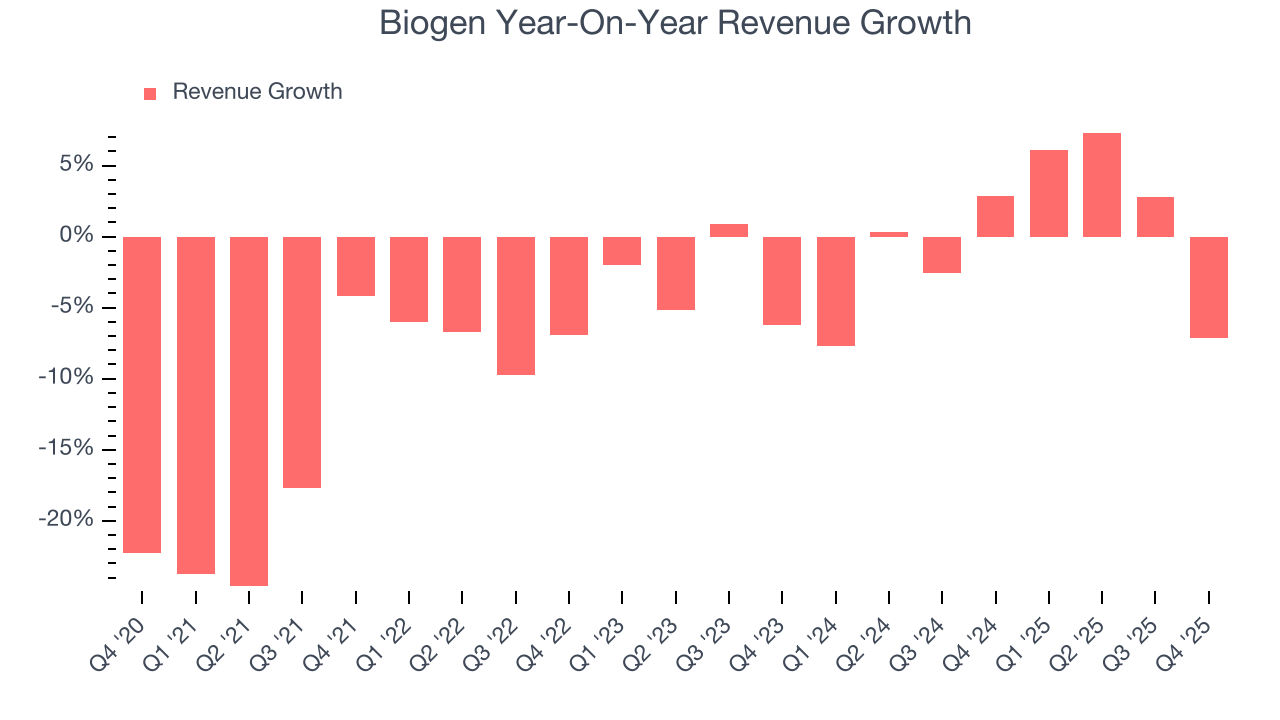

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Biogen’s demand was weak over the last five years as its sales fell at a 6% annual rate. This was below our standards and suggests it’s a low quality business.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Biogen’s revenue over the last two years was flat, sugggesting its demand was weak but stabilized after its initial drop.

This quarter, Biogen’s revenue fell by 7.1% year on year to $2.28 billion but beat Wall Street’s estimates by 3.6%.

Looking ahead, sell-side analysts expect revenue to decline by 6.6% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will face some demand challenges.

7. Operating Margin

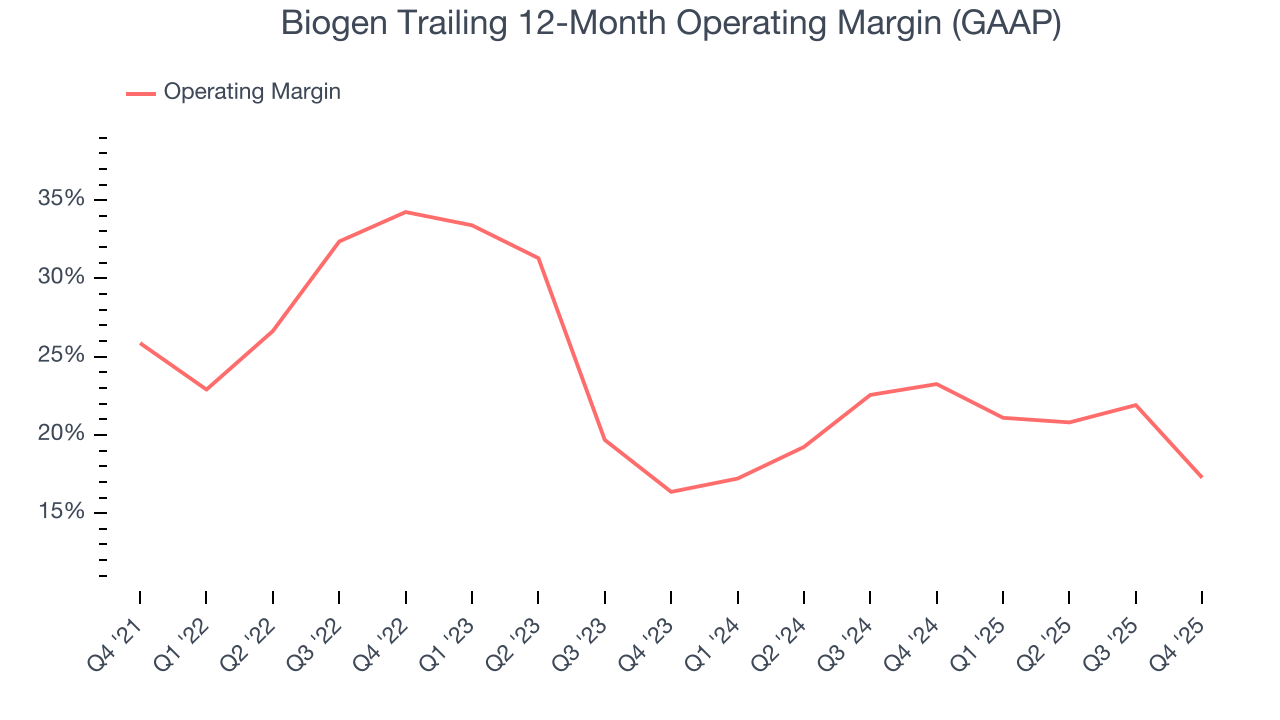

Biogen has been an efficient company over the last five years. It was one of the more profitable businesses in the healthcare sector, boasting an average operating margin of 23.5%.

Looking at the trend in its profitability, Biogen’s operating margin decreased by 8.6 percentage points over the last five years. Even though its historical margin was healthy, shareholders will want to see Biogen become more profitable in the future.

This quarter, Biogen generated an operating margin profit margin of negative 2.5%, down 20.4 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

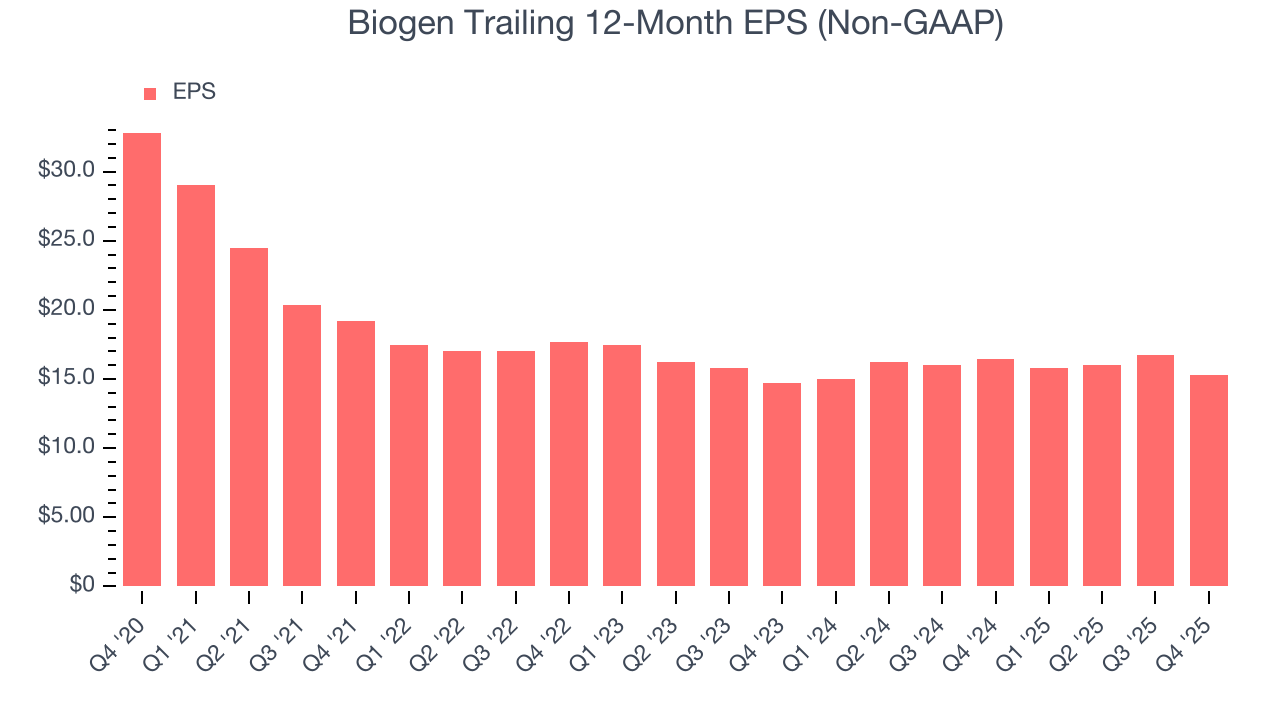

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Biogen, its EPS declined by 14.2% annually over the last five years, more than its revenue. We can see the difference stemmed from higher interest expenses or taxes as the company actually improved its operating margin and repurchased its shares during this time.

Diving into the nuances of Biogen’s earnings can give us a better understanding of its performance. As we mentioned earlier, Biogen’s operating margin declined by 8.6 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Biogen reported adjusted EPS of $1.99, down from $3.44 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Biogen’s full-year EPS of $15.29 to shrink by 5.6%.

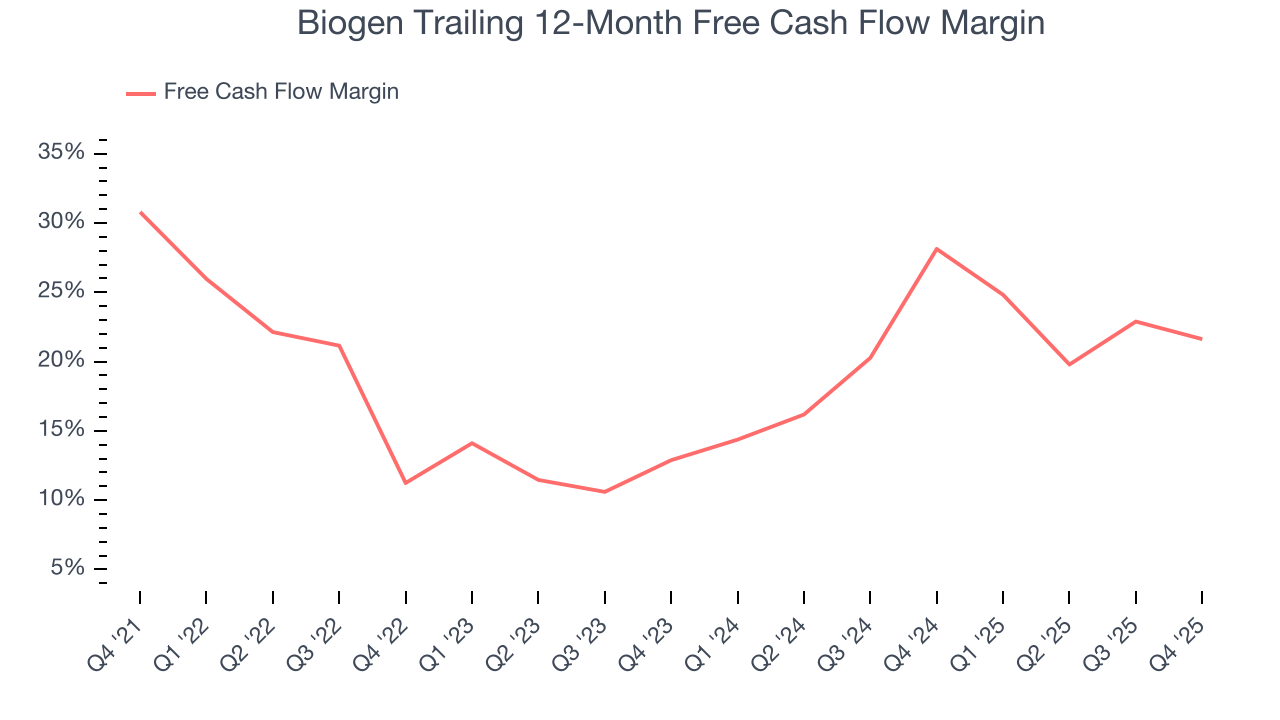

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Biogen has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 21.1% over the last five years, quite impressive for a healthcare business.

Taking a step back, we can see that Biogen’s margin dropped by 9.2 percentage points during that time. Continued declines could signal it is in the middle of an investment cycle.

Biogen’s free cash flow clocked in at $555.9 million in Q4, equivalent to a 24.4% margin. The company’s cash profitability regressed as it was 5 percentage points lower than in the same quarter last year, but it’s still above its five-year average. We wouldn’t put too much weight on this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends trump temporary fluctuations.

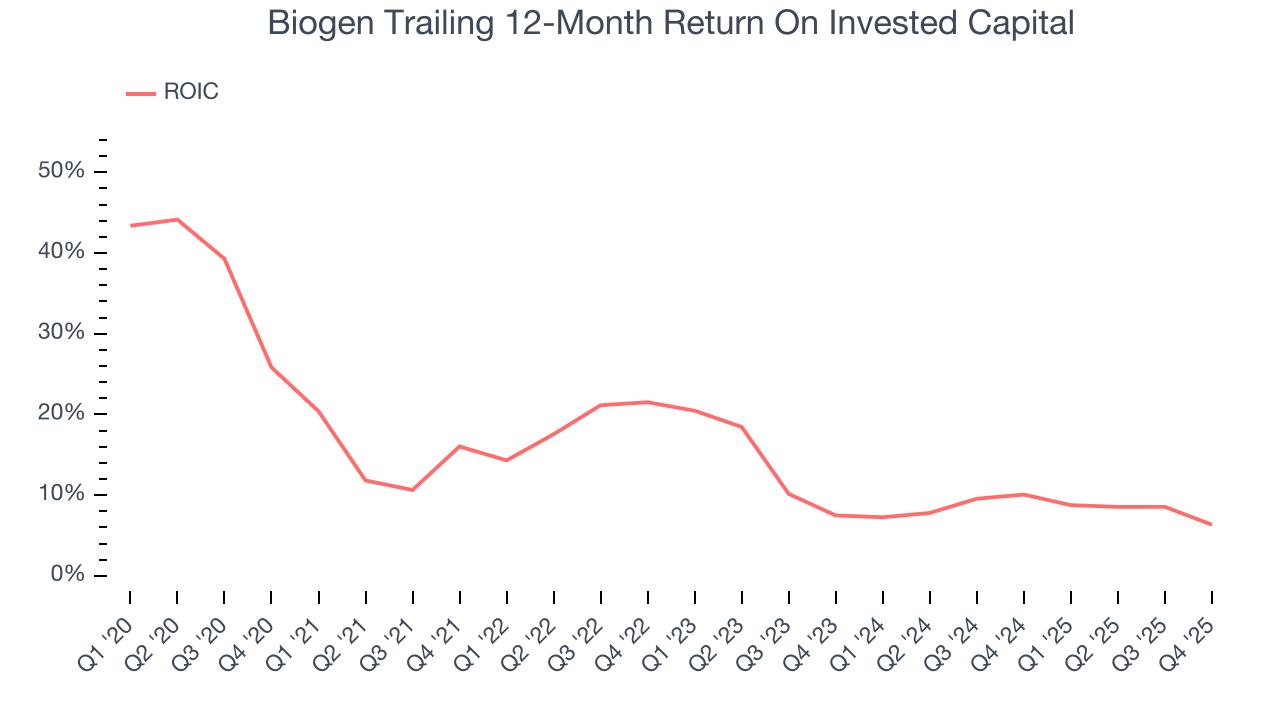

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although Biogen hasn’t been the highest-quality company lately because of its poor revenue and EPS performance, it historically found a few growth initiatives that worked. Its five-year average ROIC was 12.3%, higher than most healthcare businesses.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Biogen’s ROIC has decreased significantly over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

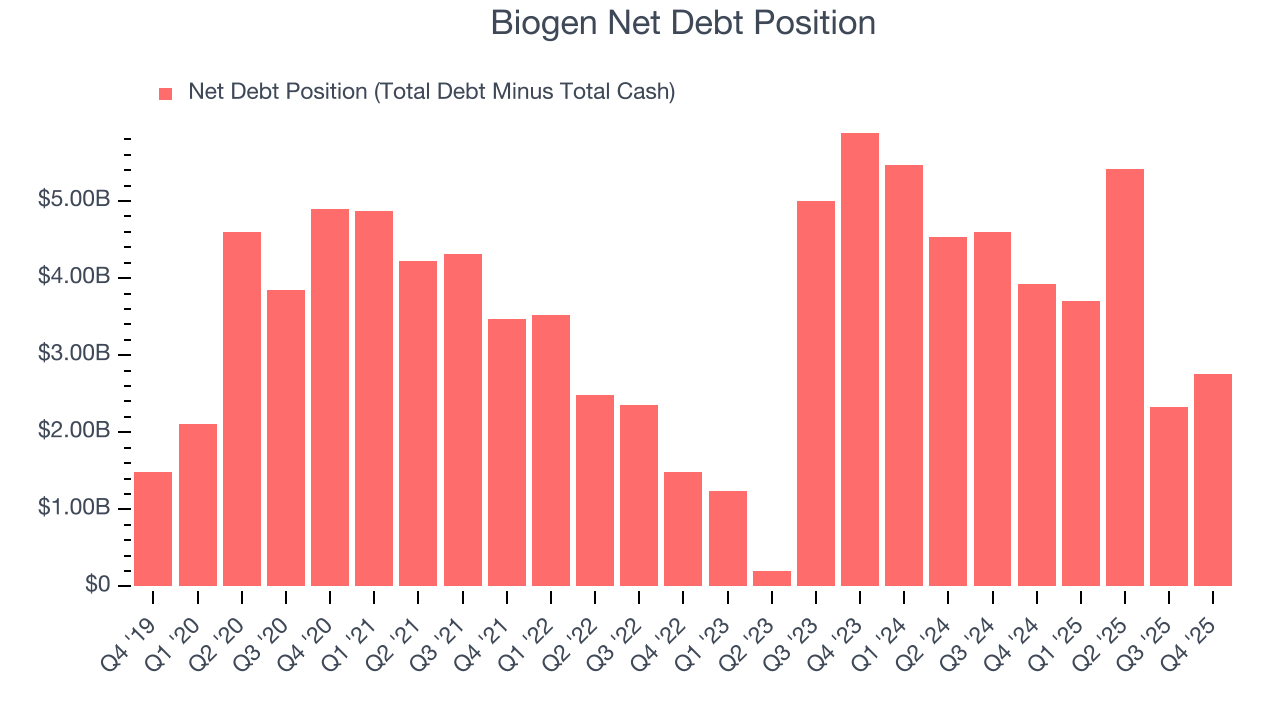

11. Balance Sheet Assessment

Biogen reported $3.82 billion of cash and $6.58 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $3.13 billion of EBITDA over the last 12 months, we view Biogen’s 0.9× net-debt-to-EBITDA ratio as safe. We also see its $112.2 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Biogen’s Q4 Results

We were impressed by how significantly Biogen blew past analysts’ full-year EPS guidance expectations this quarter. We were also glad its revenue and EPS in the reported quarter outperformed Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock remained flat at $185.89 immediately following the results.

13. Is Now The Time To Buy Biogen?

When considering an investment in Biogen, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

We see the value of companies making people healthier, but in the case of Biogen, we’re out. For starters, its revenue has declined over the last five years, and analysts don’t see anything changing over the next 12 months. And while its strong free cash flow generation allows it to invest in growth initiatives while maintaining an ample cushion, the downside is its declining EPS over the last five years makes it a less attractive asset to the public markets. On top of that, its diminishing returns show management's prior bets haven't worked out.

Biogen’s P/E ratio based on the next 12 months is 12.8x. At this valuation, there’s a lot of good news priced in - we think other companies feature superior fundamentals at the moment.

Wall Street analysts have a consensus one-year price target of $192.72 on the company (compared to the current share price of $185.89).