Bentley Systems (BSY)

We’re skeptical of Bentley Systems. Its growth has been lacking and its cash conversion is projected to decline, a situation we’d avoid.― StockStory Analyst Team

1. News

2. Summary

Why Bentley Systems Is Not Exciting

Pioneering the concept of "digital twins" for infrastructure projects long before it became an industry buzzword, Bentley Systems (NASDAQ:BSY) provides software solutions that help engineers design, build, and operate infrastructure projects across sectors including roads, bridges, utilities, mining, and industrial facilities.

- Operating margin expanded by 1.8 percentage points over the last year as it scaled and became more efficient

- Annual revenue growth of 13.4% over the last five years was below our standards for the software sector

- On the bright side, its excellent operating margin highlights the strength of its business model, and its operating leverage amplified its profits over the last year

Bentley Systems’s quality is insufficient. We’re on the lookout for more interesting opportunities.

Why There Are Better Opportunities Than Bentley Systems

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Bentley Systems

Bentley Systems is trading at $38.13 per share, or 7.2x forward price-to-sales. This multiple is higher than most software companies, and we think it’s quite expensive for the weaker revenue growth you get.

There are stocks out there similarly priced with better business quality. We prefer owning these.

3. Bentley Systems (BSY) Research Report: Q4 CY2025 Update

Infrastructure engineering software company Bentley Systems (NASDAQ:BSY) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 11.9% year on year to $391.6 million. The company’s full-year revenue guidance of $1.7 billion at the midpoint came in 3.2% above analysts’ estimates. Its non-GAAP profit of $0.27 per share was in line with analysts’ consensus estimates.

Bentley Systems (BSY) Q4 CY2025 Highlights:

- Revenue: $391.6 million vs analyst estimates of $381.3 million (11.9% year-on-year growth, 2.7% beat)

- Adjusted EPS: $0.27 vs analyst estimates of $0.26 (in line)

- Adjusted Operating Income: $111.9 million vs analyst estimates of $114 million (28.6% margin, 1.8% miss)

- Operating Margin: 20%, up from 17.6% in the same quarter last year

- Free Cash Flow Margin: 34.8%, up from 29.5% in the previous quarter

- Net Revenue Retention Rate: 109%, in line with the previous quarter

- Annual Recurring Revenue: $1.46 billion (13.9% year-on-year growth, beat)

- Billings: $435 million at quarter end, up 17.2% year on year

- Market Capitalization: $10.21 billion

Company Overview

Pioneering the concept of "digital twins" for infrastructure projects long before it became an industry buzzword, Bentley Systems (NASDAQ:BSY) provides software solutions that help engineers design, build, and operate infrastructure projects across sectors including roads, bridges, utilities, mining, and industrial facilities.

Bentley's comprehensive software portfolio serves the entire infrastructure lifecycle, with specialized applications for engineering disciplines ranging from structural analysis to water system design. The company's flagship products include MicroStation for 3D design, ProjectWise for project delivery collaboration, AssetWise for operations management, and the iTwin Platform that powers their digital twin capabilities.

Infrastructure owners and operators use Bentley's software to manage complex projects like bridges, tunnels, power plants, and water networks throughout their operational life, while engineering firms use these tools to create detailed designs and simulations. For example, an engineering team might use OpenRail to design a transit system, LEGION to simulate pedestrian traffic, and SYNCHRO to visualize construction sequencing.

Bentley generates revenue primarily through subscription-based licensing models, with Enterprise 365 (E365) being their consumption-based subscription for larger organizations. The company also offers traditional perpetual licenses with annual maintenance subscriptions and 12-month named-user subscriptions for small and medium-sized businesses through their e-store, Virtuosity. Additionally, Bentley provides "Success Plans" that include proactive engagement with specialists who have domain expertise in infrastructure engineering to help customers achieve better outcomes with their software.

4. Vertical Software

Software is eating the world, and while a large number of solutions such as project management or video conferencing software can be useful to a wide array of industries, some have very specific needs. As a result, vertical software, which addresses industry-specific workflows, is growing and fueled by the pressures to improve productivity, whether it be for a life sciences, education, or banking company.

Bentley Systems competes with Autodesk (NASDAQ:ADSK) and Trimble (NASDAQ:TRMB) in public infrastructure applications, Hexagon AB (STO:HEXA-B) and Schneider Electric's AVEVA unit in industrial and resources applications, and Nemetschek SE (ETR:NEM) in building design software.

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Bentley Systems grew its sales at a 13.4% annual rate. Though this growth is acceptable on an absolute basis, we need to see more than just topline growth for the software sector, which can display significant earnings volatility. This means our bar for the sector is particularly high, reflecting the non-essential and hit-driven nature of the products and services offered. Additionally, five-year CAGR starts around Covid, when revenue was depressed then rebounded.

Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. Bentley Systems’s recent performance shows its demand has slowed as its annualized revenue growth of 10.6% over the last two years was below its five-year trend. We’re wary when companies in the sector see decelerations in revenue growth, as it could signal changing consumer tastes aided by low switching costs.

This quarter, Bentley Systems reported year-on-year revenue growth of 11.9%, and its $391.6 million of revenue exceeded Wall Street’s estimates by 2.7%.

Looking ahead, sell-side analysts expect revenue to grow 9.6% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and suggests its products and services will see some demand headwinds.

6. Annual Recurring Revenue

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

Bentley Systems’s ARR came in at $1.46 billion in Q4, and over the last four quarters, its growth was underwhelming as it averaged 12.3% year-on-year increases. This performance mirrored its total sales and suggests that increasing competition is causing challenges in securing longer-term commitments.

7. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Bentley Systems is extremely efficient at acquiring new customers, and its CAC payback period checked in at 4.2 months this quarter. The company’s rapid recovery of its customer acquisition costs means it can attempt to spur growth by increasing its sales and marketing investments.

8. Customer Retention

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

Bentley Systems’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 109% in Q4. This means Bentley Systems would’ve grown its revenue by 9.3% even if it didn’t win any new customers over the last 12 months.

Bentley Systems has a decent net retention rate, showing us that its customers not only tend to stick around but also get increasing value from its software over time.

9. Gross Margin & Pricing Power

For software companies like Bentley Systems, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

Bentley Systems’s robust unit economics are better than the broader software industry, an output of its asset-lite business model and pricing power. They also enable the company to fund large investments in new products and sales during periods of rapid growth to achieve higher profits in the future. As you can see below, it averaged an excellent 81.5% gross margin over the last year. That means Bentley Systems only paid its providers $18.48 for every $100 in revenue.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Bentley Systems has seen gross margins improve by 2.9 percentage points over the last 2 year, which is very good in the software space.

In Q4, Bentley Systems produced a 81.9% gross profit margin , marking a 1.3 percentage point increase from 80.6% in the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs have been stable and it isn’t under pressure to lower prices.

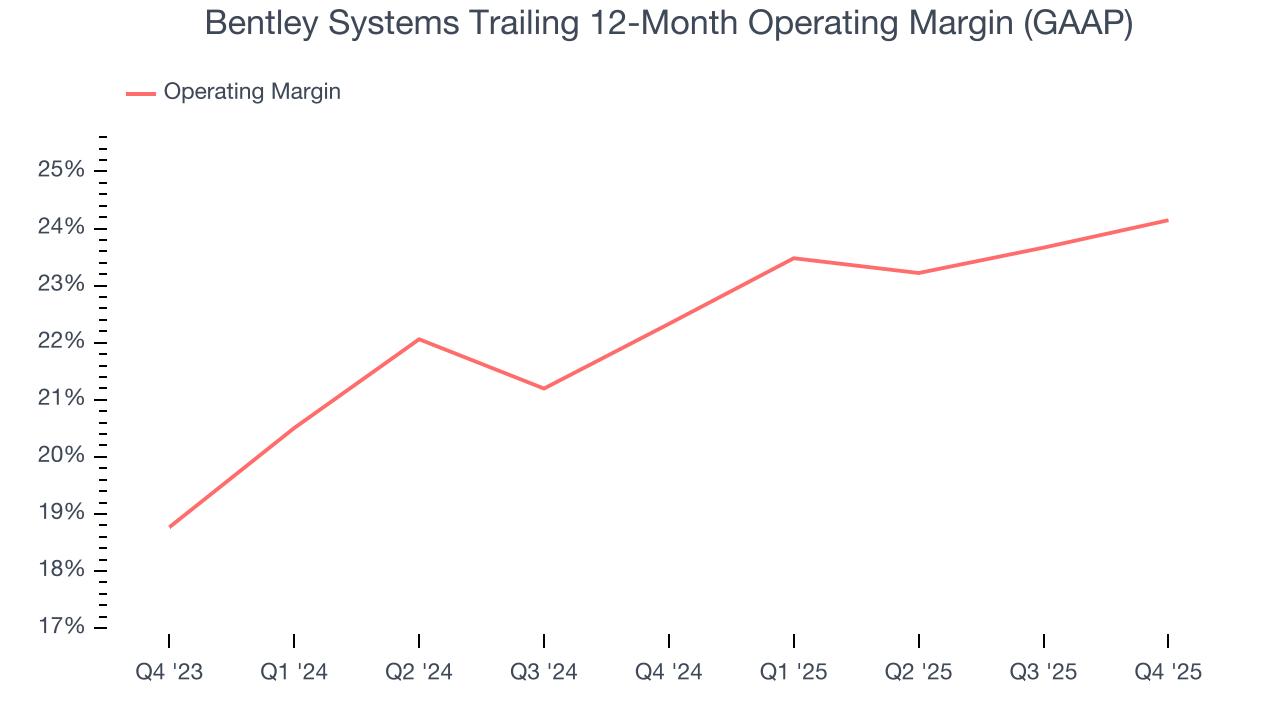

10. Operating Margin

Bentley Systems has been a well-oiled machine over the last year. It demonstrated elite profitability for a software business, boasting an average operating margin of 24.1%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Bentley Systems’s operating margin rose by 1.8 percentage points over the last two years, as its sales growth gave it operating leverage.

This quarter, Bentley Systems generated an operating margin profit margin of 20%, up 2.5 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

11. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Bentley Systems has shown terrific cash profitability, driven by its lucrative business model and cost-effective customer acquisition strategy that enable it to stay ahead of the competition through investments in new products rather than sales and marketing. The company’s free cash flow margin was among the best in the software sector, averaging an eye-popping 34.6% over the last year.

Bentley Systems’s free cash flow clocked in at $136.2 million in Q4, equivalent to a 34.8% margin. This result was good as its margin was 13 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends are more important.

Over the next year, analysts predict Bentley Systems’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 34.6% for the last 12 months will decrease to 32.5%.

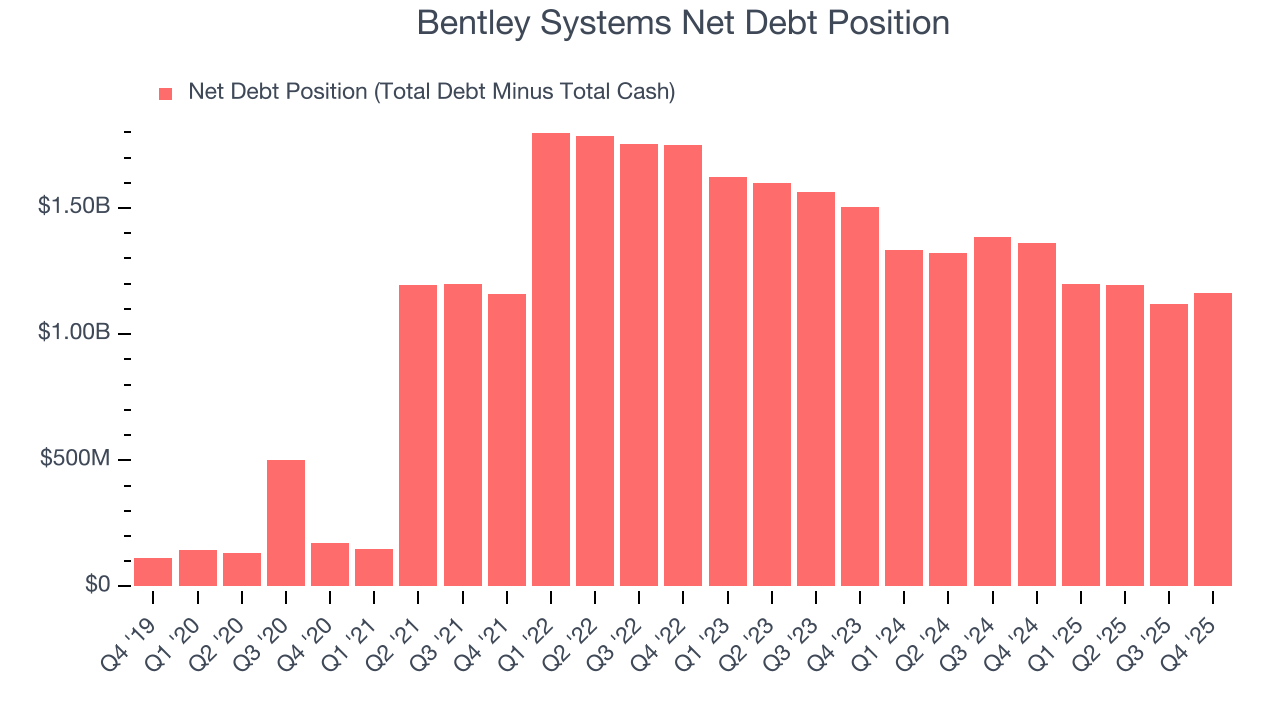

12. Balance Sheet Assessment

Bentley Systems reported $123.3 million of cash and $1.28 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $525.8 million of EBITDA over the last 12 months, we view Bentley Systems’s 2.2× net-debt-to-EBITDA ratio as safe. We also see its $8.27 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

13. Key Takeaways from Bentley Systems’s Q4 Results

We were impressed by how significantly Bentley Systems blew past analysts’ billings expectations this quarter. We were also glad next year’s revenue guidance was robust. On the other hand, its adjusted operating income missed. Overall, we think this was still a decent quarter with some key metrics above expectations. The stock traded up 5.7% to $34.34 immediately following the results.

14. Is Now The Time To Buy Bentley Systems?

Updated: March 2, 2026 at 9:33 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Bentley Systems.

Bentley Systems isn’t a terrible business, but it doesn’t pass our bar. To begin with, its revenue growth was uninspiring over the last five years, and analysts don’t see anything changing over the next 12 months. While its efficient sales strategy allows it to target and onboard new users at scale, the downside is its expanding operating margin shows it’s becoming more efficient at building and selling its software. On top of that, its ARR has disappointed and shows the company is having difficulty retaining customers and their spending.

Bentley Systems’s price-to-sales ratio based on the next 12 months is 7.2x. This valuation multiple is fair, but we don’t have much faith in the company. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $48 on the company (compared to the current share price of $38.13).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.