Baldwin Insurance Group (BWIN)

Not many stocks excite us like Baldwin Insurance Group. Its organic growth shows its core business is firing on all cylinders, driving top-line performance.― StockStory Analyst Team

1. News

2. Summary

Why We Like Baldwin Insurance Group

Rebranded from BRP Group in May 2024, Baldwin Insurance Group (NASDAQ:BWIN) is an independent insurance distribution company that provides tailored insurance, risk management, and employee benefits solutions to businesses and individuals.

- Annual revenue growth of 48.2% over the last five years was superb and indicates its market share increased during this cycle

- Earnings per share grew by 29.1% annually over the last five years, massively outpacing its peers

- Demand for the next 12 months is expected to accelerate above its two-year trend as Wall Street forecasts robust revenue growth of 22.4%

Baldwin Insurance Group is a market leader. The price looks fair based on its quality, and we think now is a good time to buy.

Why Is Now The Time To Buy Baldwin Insurance Group?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Baldwin Insurance Group?

Baldwin Insurance Group’s stock price of $16.49 implies a valuation ratio of 8.9x forward P/E. The valuation sure appears attractive, and we suspect the stock is trading below its intrinsic value when factoring in its business quality.

A powerful double-play is a business that can both grow earnings and achieve a loftier multiple over time. Elite companies trading at meaningful discounts are good ways to set up this play.

3. Baldwin Insurance Group (BWIN) Research Report: Q3 CY2025 Update

Insurance distribution company Baldwin Insurance Group (NASDAQ:BWIN) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 7.8% year on year to $365.4 million. Its non-GAAP profit of $0.31 per share was in line with analysts’ consensus estimates.

Baldwin Insurance Group (BWIN) Q3 CY2025 Highlights:

- Revenue: $365.4 million vs analyst estimates of $362 million (7.8% year-on-year growth, 0.9% beat)

- Adjusted EPS: $0.31 vs analyst estimates of $0.31 (in line)

- Adjusted EBITDA: $72.52 million vs analyst estimates of $71.59 million (19.8% margin, 1.3% beat)

- Operating Margin: 0.9%, down from 4.5% in the same quarter last year

- Free Cash Flow Margin: 8.8%, up from 6.6% in the same quarter last year

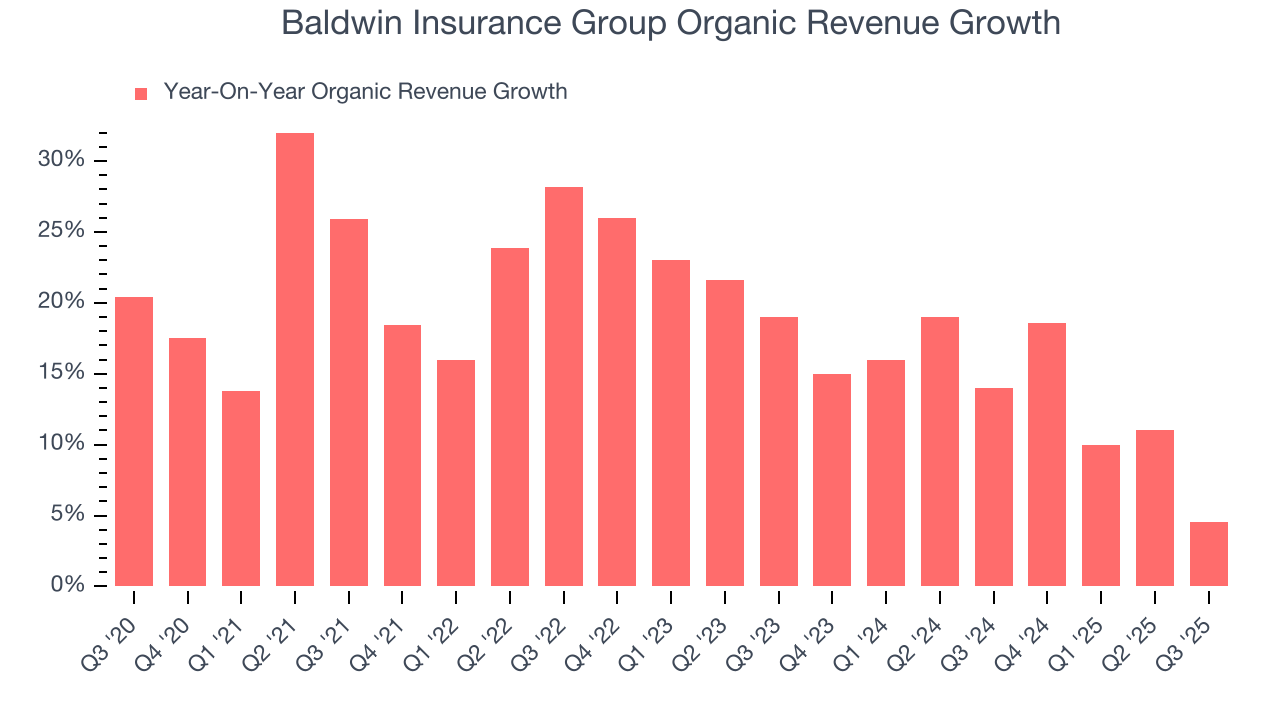

- Organic Revenue rose 4.5% year on year vs analyst estimates of 5.5% growth (92.1 basis point miss)

- Market Capitalization: $1.71 billion

Company Overview

Rebranded from BRP Group in May 2024, Baldwin Insurance Group (NASDAQ:BWIN) is an independent insurance distribution company that provides tailored insurance, risk management, and employee benefits solutions to businesses and individuals.

Baldwin operates through three distinct business segments. The Insurance Advisory Solutions group serves businesses and high-net-worth individuals with commercial risk management, employee benefits, and private risk management solutions. The Underwriting, Capacity & Technology Solutions group includes the company's "MGA of the Future" platform, which develops proprietary insurance products distributed both internally and through external partners. The Mainstreet Insurance Solutions group focuses on personal and commercial insurance for individuals and small businesses, often accessing clients through partnerships with home builders, realtors, and mortgage lenders.

The company's business model combines traditional insurance brokerage with technology-enabled insurance product development. When working with clients, Baldwin's advisors assess risks and then connect clients with appropriate insurance coverage from the company's network of insurance carriers. For certain specialty products, Baldwin creates its own insurance solutions through its MGA (Managing General Agent) platform, which allows it to capture more of the economics of each transaction while offering specialized coverage.

A typical client might be a manufacturing business seeking commercial property insurance, liability coverage, and employee benefits packages. Baldwin's advisors would evaluate the company's specific risks, recommend appropriate coverage levels, and then place that coverage with suitable insurance carriers, earning commissions on the policies sold. Beyond insurance placement, Baldwin also offers wealth management services, retirement plan consulting, and Medicare advisory services to round out its financial services offerings.

The company pursues growth through both organic expansion and acquisitions, having partnered with numerous independent insurance brokers across the United States. With approximately 4,000 employees including 700 risk advisors across 115 offices in 24 states, Baldwin serves over two million clients nationwide and internationally.

4. Insurance Brokers

The insurance brokerage industry, while influenced by insurance pricing cycles, benefits from durable secular tailwinds as rising risk complexity (climate, data privacy), regulatory scrutiny, and insurance pricing inflation. These increase demand for professional risk-management advice. Brokers operate models that rely on commissions and fees tied to premium volumes and growing contributions from recurring advisory, benefits, and compliance services. Scale is a key advantage, enabling better carrier access, stronger data and benchmarking, and efficient deployment of technology and compliance investments, which in turn supports ongoing industry consolidation. The headwinds are labor intensity and wage inflation for producers, regulatory complexity (this cuts both ways, as you can see), and execution risk when integrating new digital tools into legacy workflows.

Baldwin Insurance Group competes with large publicly traded insurance brokers including Aon, Marsh & McLennan, Willis Towers Watson, Arthur J. Gallagher, and Brown & Brown, as well as significant private competitors such as AssuredPartners, Hub International, and USI. In the personal lines segment, the company also competes with Goosehead Insurance.

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $1.49 billion in revenue over the past 12 months, Baldwin Insurance Group is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the bright side, it can still flex high growth rates because it’s working from a smaller revenue base.

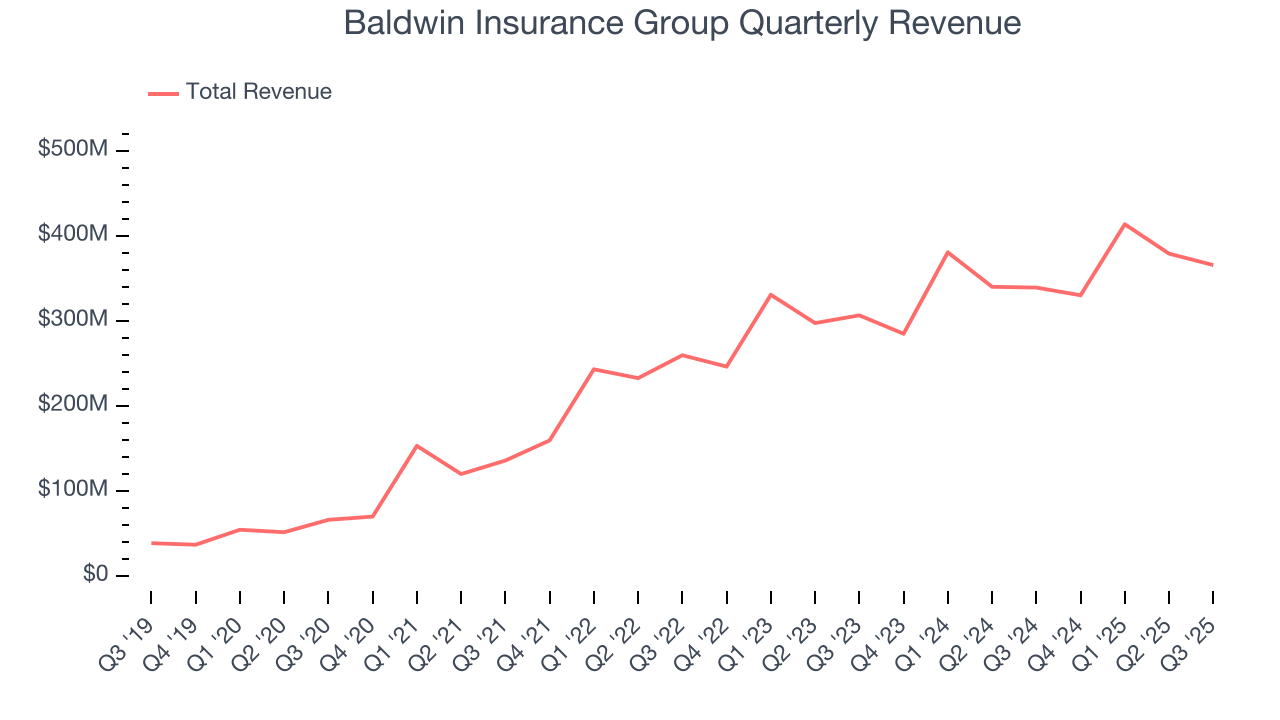

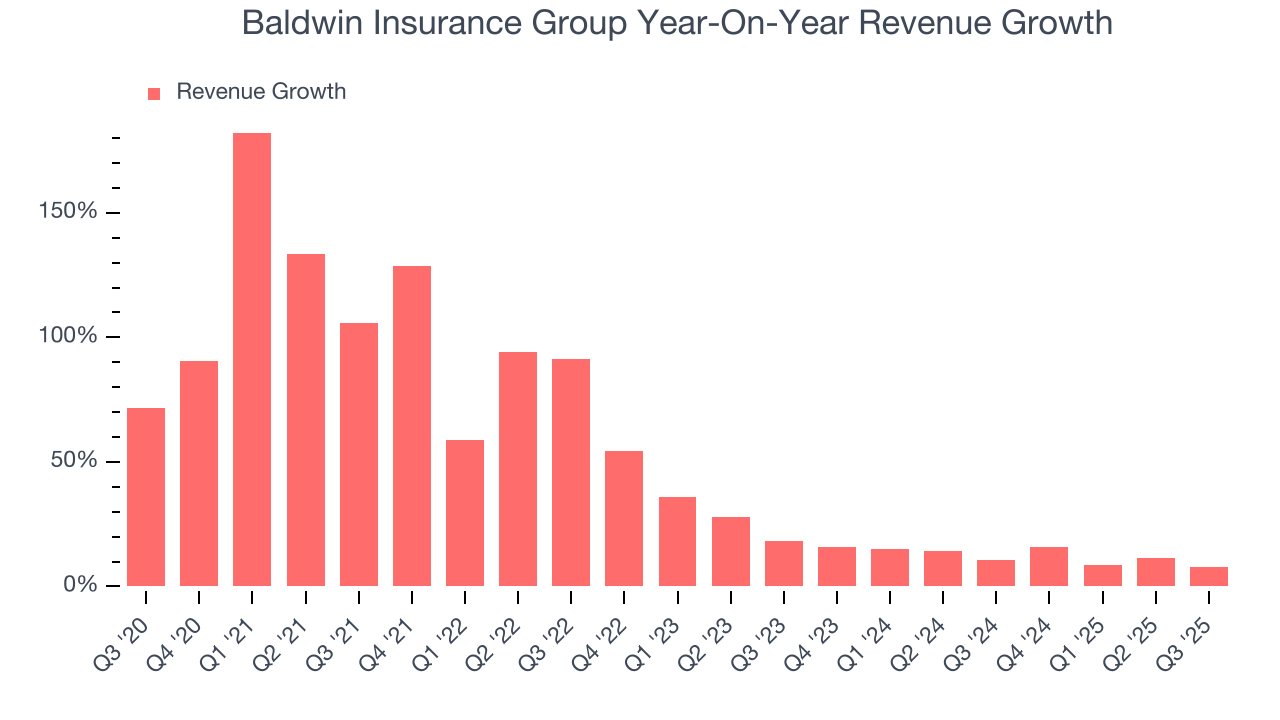

As you can see below, Baldwin Insurance Group’s sales grew at an incredible 48.2% compounded annual growth rate over the last five years. This is a great starting point for our analysis because it shows Baldwin Insurance Group’s demand was higher than many business services companies.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Baldwin Insurance Group’s annualized revenue growth of 12.3% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

Baldwin Insurance Group also reports organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Baldwin Insurance Group’s organic revenue averaged 13.5% year-on-year growth. Because this number aligns with its two-year revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, Baldwin Insurance Group reported year-on-year revenue growth of 7.8%, and its $365.4 million of revenue exceeded Wall Street’s estimates by 0.9%.

Looking ahead, sell-side analysts expect revenue to grow 17.2% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and suggests its newer products and services will catalyze better top-line performance.

6. Adjusted Operating Margin

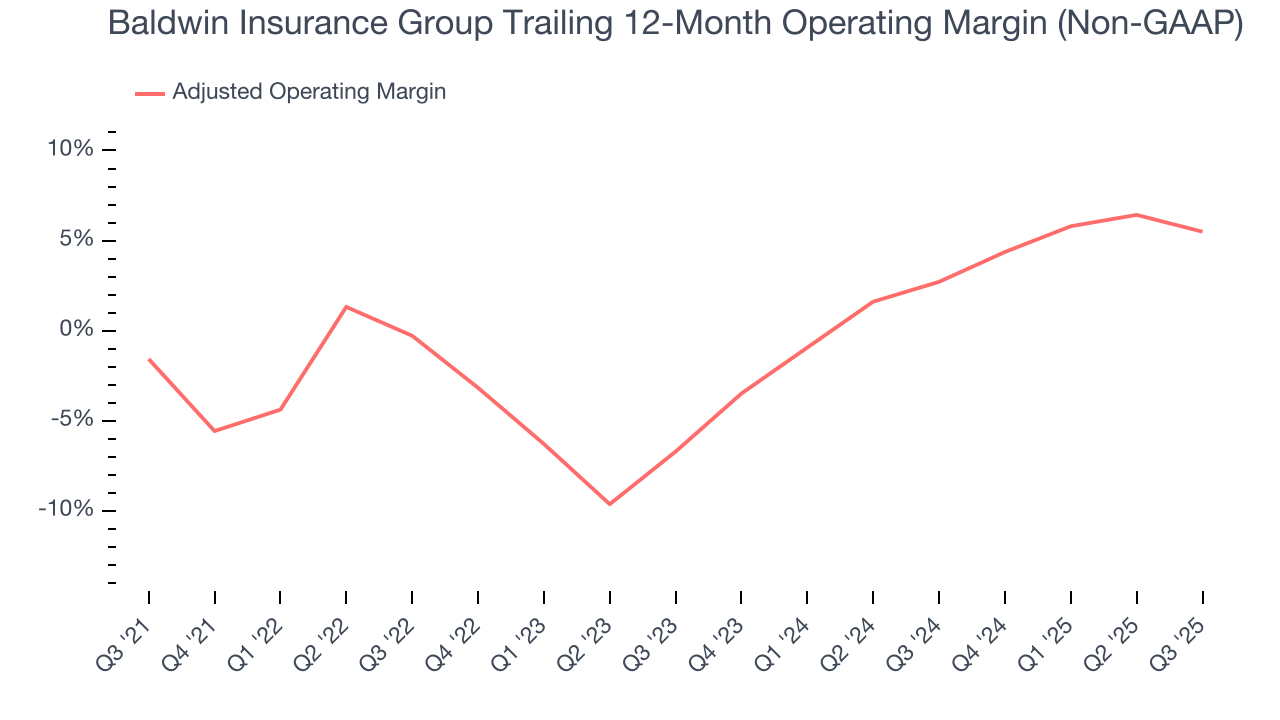

Baldwin Insurance Group was roughly breakeven when averaging the last five years of quarterly operating profits, inadequate for a business services business.

On the plus side, Baldwin Insurance Group’s adjusted operating margin rose by 7.1 percentage points over the last five years, as its sales growth gave it immense operating leverage.

In Q3, Baldwin Insurance Group’s breakeven margin was down 3.7 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

7. Earnings Per Share

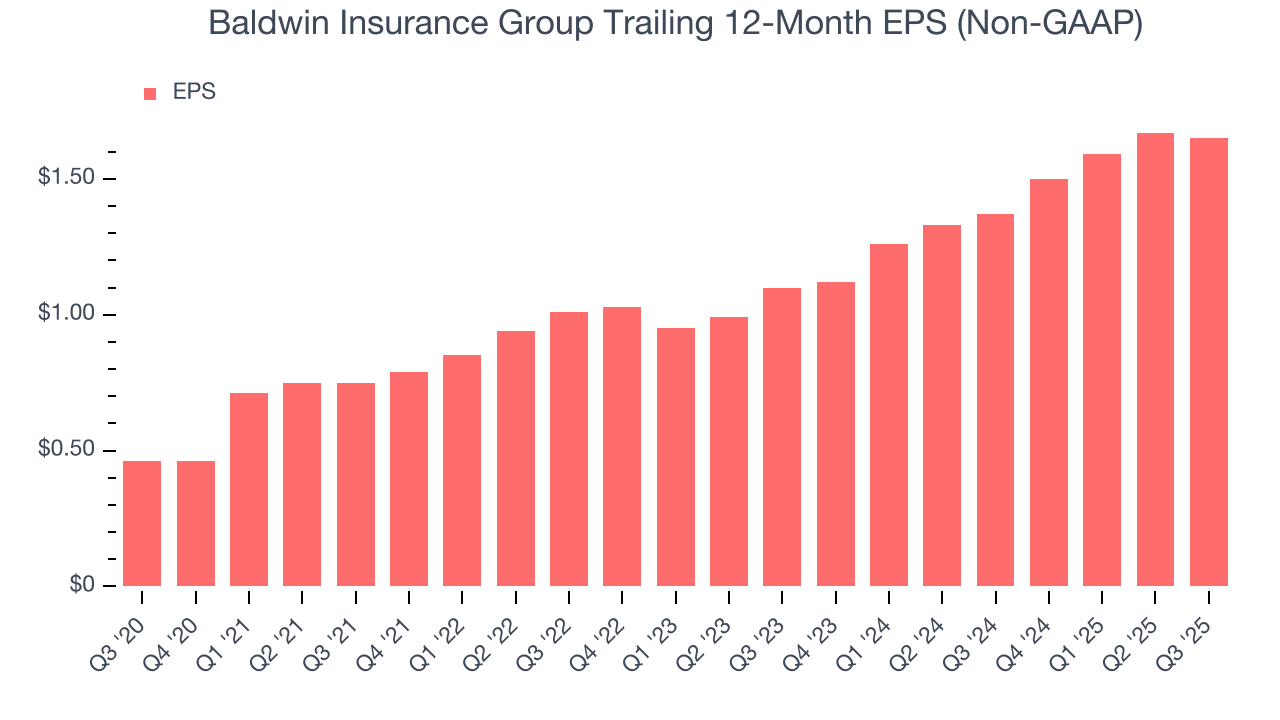

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Baldwin Insurance Group’s EPS grew at an astounding 29.1% compounded annual growth rate over the last five years. Despite its adjusted operating margin improvement during that time, this performance was lower than its 48.2% annualized revenue growth, telling us that non-fundamental factors such as interest and taxes affected its ultimate earnings.

Diving into Baldwin Insurance Group’s quality of earnings can give us a better understanding of its performance. A five-year view shows Baldwin Insurance Group has diluted its shareholders, growing its share count by 107%. This dilution overshadowed its increased operational efficiency and has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Baldwin Insurance Group, its two-year annual EPS growth of 22.5% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.

In Q3, Baldwin Insurance Group reported adjusted EPS of $0.31, down from $0.33 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Baldwin Insurance Group’s full-year EPS of $1.65 to grow 16.6%.

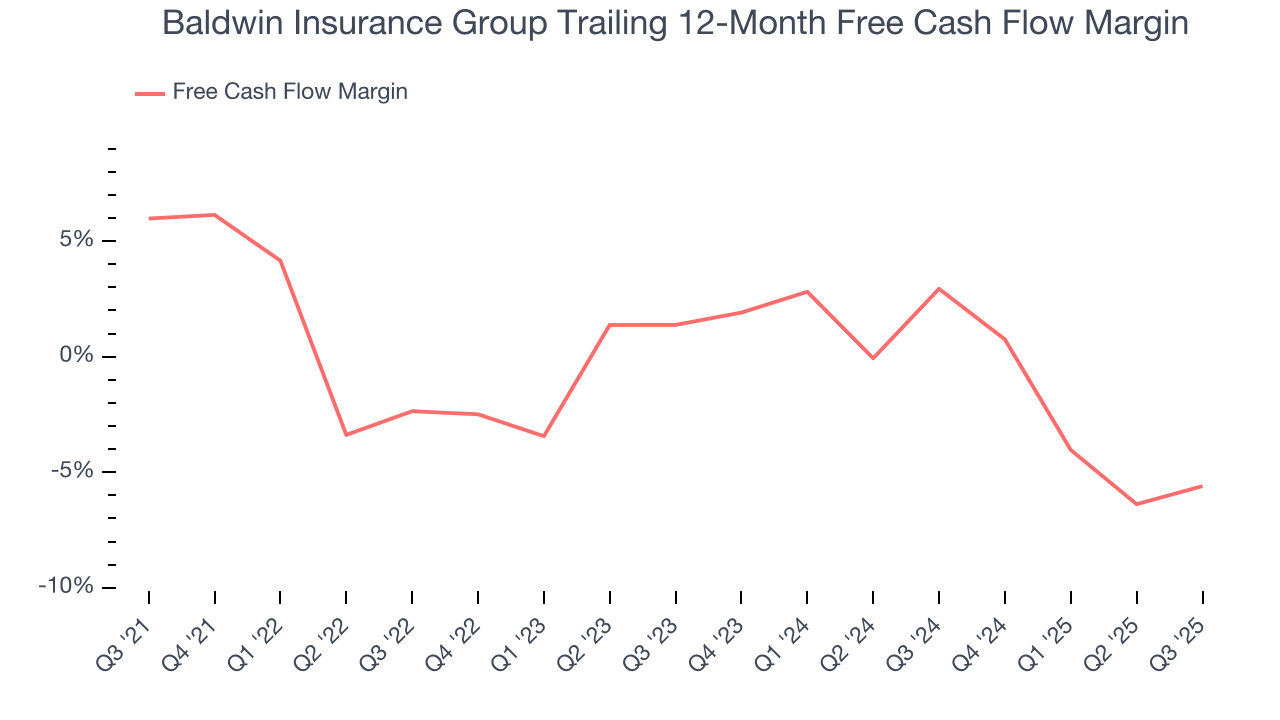

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Baldwin Insurance Group broke even from a free cash flow perspective over the last five years, giving the company limited opportunities to return capital to shareholders.

Taking a step back, we can see that Baldwin Insurance Group’s margin dropped by 11.6 percentage points during that time. If the trend continues, it could signal it’s in the middle of a big investment cycle.

Baldwin Insurance Group’s free cash flow clocked in at $32.15 million in Q3, equivalent to a 8.8% margin. This result was good as its margin was 2.2 percentage points higher than in the same quarter last year. Its cash profitability was also above its five-year level, and we hope the company can build on this trend.

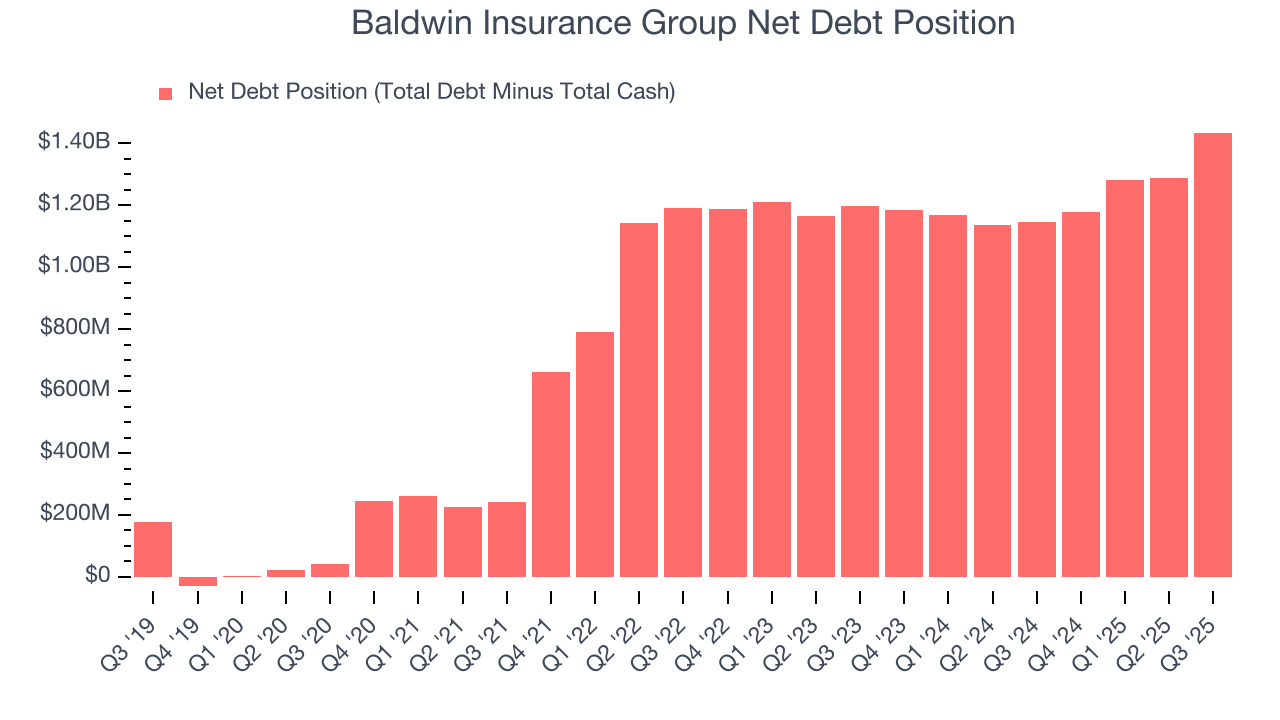

9. Balance Sheet Assessment

Baldwin Insurance Group reported $325.9 million of cash and $1.76 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $335 million of EBITDA over the last 12 months, we view Baldwin Insurance Group’s 4.3× net-debt-to-EBITDA ratio as safe. We also see its $28.29 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

10. Key Takeaways from Baldwin Insurance Group’s Q3 Results

It was good to see Baldwin Insurance Group narrowly top analysts’ revenue expectations this quarter. On the other hand, its organic revenue slightly missed and its EPS was in line with Wall Street’s estimates. Overall, this quarter could have been better. The stock remained flat at $23.78 immediately following the results.

11. Is Now The Time To Buy Baldwin Insurance Group?

Updated: February 11, 2026 at 9:08 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Baldwin Insurance Group.

There are multiple reasons why we think Baldwin Insurance Group is an elite business services company. For starters, its revenue growth was exceptional over the last five years. And while its cash profitability fell over the last five years, its expanding adjusted operating margin shows the business has become more efficient. On top of that, Baldwin Insurance Group’s astounding EPS growth over the last five years shows its profits are trickling down to shareholders.

Baldwin Insurance Group’s P/E ratio based on the next 12 months is 8.9x. Looking across the spectrum of business services businesses, Baldwin Insurance Group’s fundamentals clearly illustrate it’s a special business. We’re pounding the table at this bargain price.

Wall Street analysts have a consensus one-year price target of $33.38 on the company (compared to the current share price of $16.49), implying they see 102% upside in buying Baldwin Insurance Group in the short term.