CBIZ (CBZ)

We see solid potential in CBIZ. Its exceptional revenue growth indicates it’s winning market share.― StockStory Analyst Team

1. News

2. Summary

Why We Like CBIZ

With over 120 offices across 33 states and a team of more than 6,700 professionals, CBIZ (NYSE:CBZ) provides accounting, tax, benefits, insurance brokerage, and advisory services to help small and mid-sized businesses manage their finances and operations.

- Market share has increased this cycle as its 23.4% annual revenue growth over the last five years was exceptional

- Earnings per share grew by 20.3% annually over the last five years, massively outpacing its peers

- Free cash flow generation is better than most peers and allows it to explore new investment opportunities

We’re optimistic about CBIZ. The price seems reasonable relative to its quality, so this could be a favorable time to invest in some shares.

Why Is Now The Time To Buy CBIZ?

High Quality

Investable

Underperform

Why Is Now The Time To Buy CBIZ?

CBIZ’s stock price of $28.66 implies a valuation ratio of 8.4x forward P/E. The valuation sure appears attractive, and we suspect the stock is trading below its intrinsic value when factoring in its business quality.

Our eyes light up when companies with elite fundamentals trade at bargain prices because shareholders can benefit from both earnings growth and a positive re-rating - a powerful one-two punch.

3. CBIZ (CBZ) Research Report: Q4 CY2025 Update

Financial services provider CBIZ (NYSE:CBZ) missed Wall Street’s revenue expectations in Q4 CY2025, but sales rose 17.9% year on year to $542.7 million. The company’s full-year revenue guidance of $2.85 billion at the midpoint came in 1.8% below analysts’ estimates. Its non-GAAP loss of $0.70 per share was 6.2% below analysts’ consensus estimates.

CBIZ (CBZ) Q4 CY2025 Highlights:

- Revenue: $542.7 million vs analyst estimates of $578 million (17.9% year-on-year growth, 6.1% miss)

- Adjusted EPS: -$0.70 vs analyst expectations of -$0.66 (6.2% miss)

- Adjusted EBITDA: -$28.7 million (-5.3% margin, 61.9% year-on-year growth)

- Adjusted EPS guidance for the upcoming financial year 2026 is $3.80 at the midpoint, missing analyst estimates by 1.2%

- EBITDA guidance for the upcoming financial year 2026 is $455 million at the midpoint, below analyst estimates of $457.9 million

- Operating Margin: -15.7%, down from -11.6% in the same quarter last year

- Market Capitalization: $1.49 billion

Company Overview

With over 120 offices across 33 states and a team of more than 6,700 professionals, CBIZ (NYSE:CBZ) provides accounting, tax, benefits, insurance brokerage, and advisory services to help small and mid-sized businesses manage their finances and operations.

CBIZ operates through three main practice groups: Financial Services, Benefits and Insurance Services, and National Practices. The Financial Services group delivers core accounting, tax compliance, and specialty advisory services like transaction support, risk management, and valuation. Since regulatory restrictions prevent CBIZ from providing audit and attest services directly, the company maintains partnerships with independent CPA firms that can offer these services to CBIZ clients.

The Benefits and Insurance Services group functions as a broker and consultant for businesses seeking employee benefits packages, property and casualty insurance, retirement plans, and human capital management solutions. This division maintains relationships with numerous insurance carriers to provide clients with competitive options tailored to their needs.

The National Practices group focuses on information technology services and healthcare consulting. The IT business provides managed networking and hardware services, while the healthcare consulting team helps hospitals and healthcare providers with revenue management and reimbursement optimization.

A typical CBIZ client might be a growing manufacturing company with 200 employees that uses CBIZ for payroll processing, employee benefits administration, and tax planning. The business owner might also engage CBIZ's valuation experts when considering acquiring a competitor or its risk advisory team when facing regulatory changes.

CBIZ generates revenue through professional service fees and insurance commissions. The company's business is somewhat seasonal, with higher operating margins typically occurring in the first half of the year. CBIZ serves approximately 100,000 clients across more than 25 industries, including about 60,000 businesses ranging from small local companies to large organizations with thousands of employees.

4. Business Process Outsourcing & Consulting

The sector stands to benefit from ongoing digital transformation, increasing corporate demand for cost efficiencies, and the growing complexity of regulatory and cybersecurity landscapes. For those that invest wisely, AI and automation capabilities could emerge as competitive advantages, enhancing process efficiencies for the companies themselves as well as their clients. On the flip side, AI could be a headwind as well as the technology could lower the barrier to entry in the space and give rise to more self-service solutions. Additional challenges in the years ahead could include wage inflation for highly skilled consultants and potential regulatory scrutiny on outsourcing practices—especially in industries like finance and healthcare where who has access to certain data matters greatly.

CBIZ competes with other professional services firms including Paychex (NASDAQ:PAYX), ADP (NASDAQ:ADP), Willis Towers Watson (NASDAQ:WTW), and Marsh & McLennan (NYSE:MMC), as well as regional accounting and consulting firms across the country.

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years.

With $2.76 billion in revenue over the past 12 months, CBIZ is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the bright side, it can still flex high growth rates because it’s working from a smaller revenue base.

As you can see below, CBIZ grew its sales at an incredible 23.4% compounded annual growth rate over the last five years. This is a great starting point for our analysis because it shows CBIZ’s demand was higher than many business services companies.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. CBIZ’s annualized revenue growth of 31.7% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, CBIZ’s revenue grew by 17.9% year on year to $542.7 million but fell short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 4.7% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and suggests its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

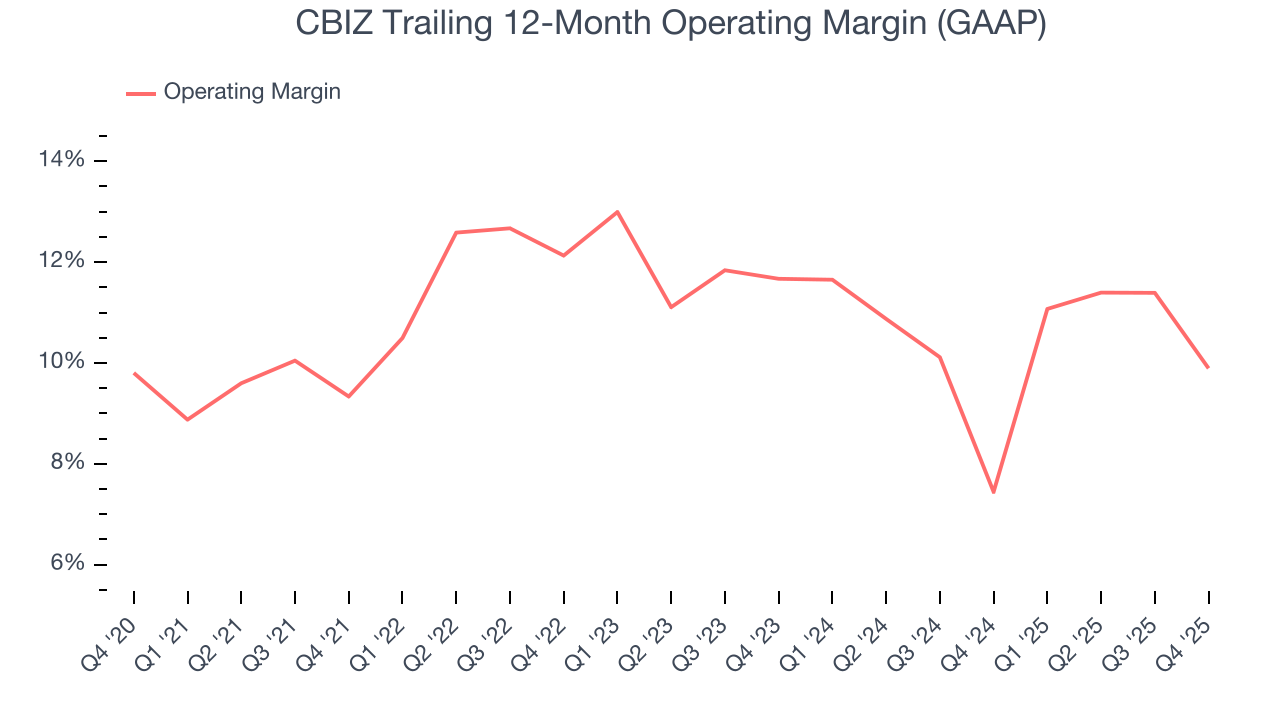

6. Operating Margin

CBIZ’s operating margin has been trending up over the last 12 months and averaged 10% over the last five years. Although its profitability is still mediocre, we can see its elite revenue growth is giving it operating leverage as it scales. This gives it a shot at higher long-term profits if it can keep expanding.

Looking at the trend in its profitability, CBIZ’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, CBIZ generated an operating margin profit margin of negative 15.7%, down 4.1 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

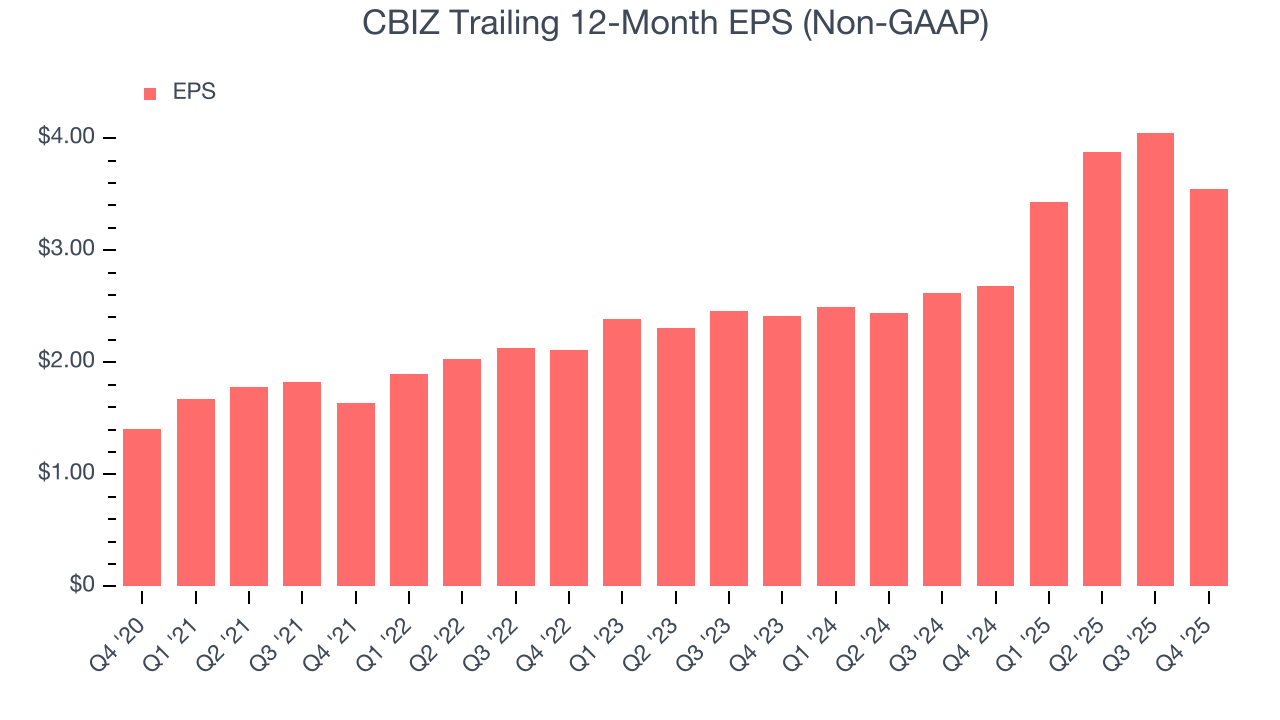

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

CBIZ’s EPS grew at an astounding 20.3% compounded annual growth rate over the last five years. However, this performance was lower than its 23.4% annualized revenue growth, telling us the company became less profitable on a per-share basis as it expanded.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For CBIZ, its two-year annual EPS growth of 21.4% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, CBIZ reported adjusted EPS of negative $0.70, down from negative $0.20 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term adjusted EPS growth than short-term movements. Over the next 12 months, Wall Street expects CBIZ’s full-year EPS of $3.55 to grow 7.8%.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

CBIZ has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 6.3% over the last five years, slightly better than the broader business services sector.

Taking a step back, we can see that CBIZ’s margin dropped by 7.1 percentage points during that time. If its declines continue, it could signal increasing investment needs and capital intensity.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although CBIZ has shown solid fundamentals lately, it historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 9.3%, somewhat low compared to the best business services companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, CBIZ’s ROIC averaged 4.2 percentage point decreases each year over the last few years. If its returns keep falling, it could suggest its profitable growth opportunities are drying up. We’ll keep a close eye.

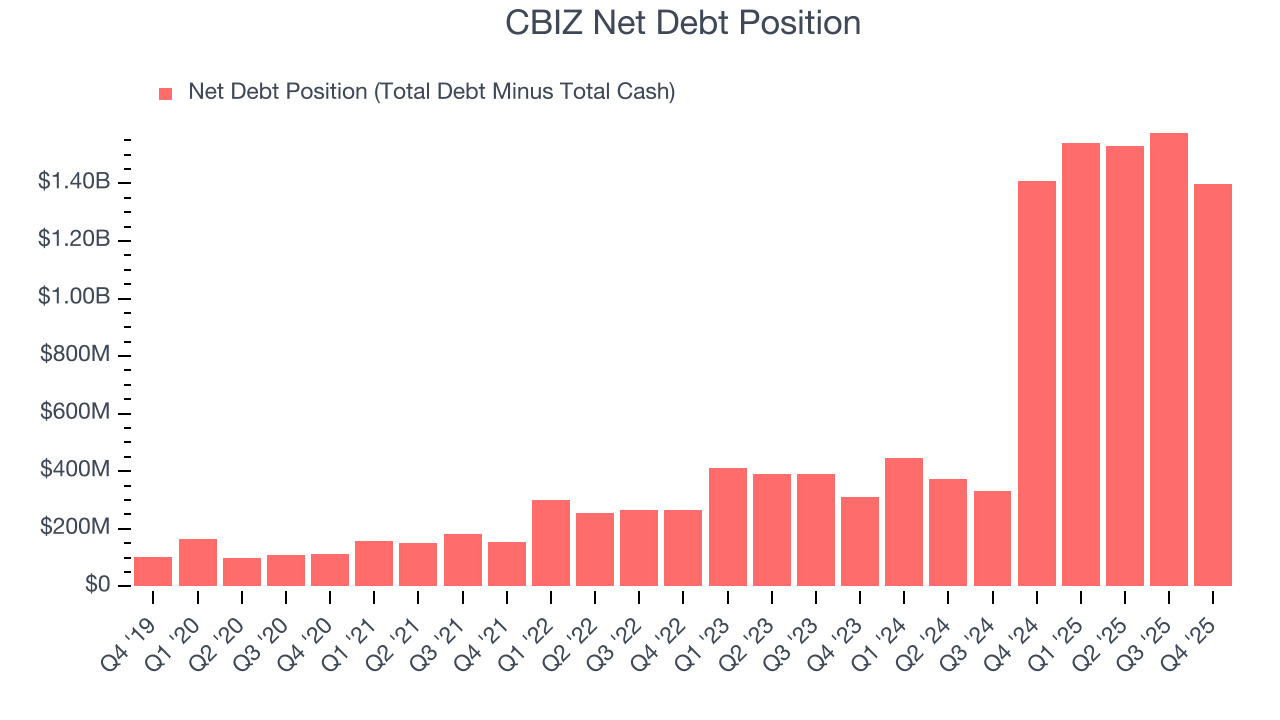

10. Balance Sheet Assessment

CBIZ reported $56.52 million of cash and $1.46 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $446.1 million of EBITDA over the last 12 months, we view CBIZ’s 3.1× net-debt-to-EBITDA ratio as safe. We also see its $54.75 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from CBIZ’s Q4 Results

We struggled to find many positives in these results. Its revenue missed and its EPS fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded up 3.6% to $28.32 immediately following the results.

12. Is Now The Time To Buy CBIZ?

Updated: February 28, 2026 at 11:41 PM EST

Before making an investment decision, investors should account for CBIZ’s business fundamentals and valuation in addition to what happened in the latest quarter.

CBIZ is a rock-solid business worth owning. For starters, its revenue growth was exceptional over the last five years. And while its cash profitability fell over the last five years, its astounding EPS growth over the last five years shows its profits are trickling down to shareholders. On top of that, CBIZ’s strong free cash flow generation allows it to invest in growth initiatives while maintaining an ample cushion.

CBIZ’s P/E ratio based on the next 12 months is 8.4x. Scanning the business services landscape today, CBIZ’s fundamentals really stand out, and we like it at this bargain price.

Wall Street analysts have a consensus one-year price target of $50 on the company (compared to the current share price of $28.66), implying they see 74.5% upside in buying CBIZ in the short term.