Genpact (G)

Genpact catches our eye. It repeatedly invests in lucrative growth initiatives, generating robust cash flows and returns on capital.― StockStory Analyst Team

1. News

2. Summary

Why Genpact Is Interesting

Originally spun off from General Electric in 2005 to provide business process services, Genpact (NYSE:G) is a global professional services firm that helps businesses transform their operations through digital technology, AI, and data analytics solutions.

- Robust free cash flow profile gives it the flexibility to invest in growth initiatives or return capital to shareholders

- Successful business model is illustrated by its impressive adjusted operating margin

- The stock is trading at a reasonable price if you like its story and growth prospects

Genpact is close to becoming a high-quality business. If you believe in the company, the valuation looks fair.

Why Is Now The Time To Buy Genpact?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Genpact?

Genpact’s stock price of $39.66 implies a valuation ratio of 9.8x forward P/E. The current valuation sure seems like a good deal considering Genpact’s business fundamentals.

If you think the market is not giving the company enough credit for its fundamentals, now could be a good time to invest.

3. Genpact (G) Research Report: Q4 CY2025 Update

Business transformation services company Genpact (NYSE:G) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 5.6% year on year to $1.32 billion. On the other hand, next quarter’s revenue guidance of $1.29 billion was less impressive, coming in 0.5% below analysts’ estimates. Its non-GAAP profit of $0.97 per share was 3.8% above analysts’ consensus estimates.

Genpact (G) Q4 CY2025 Highlights:

- Revenue: $1.32 billion vs analyst estimates of $1.31 billion (5.6% year-on-year growth, 0.8% beat)

- Adjusted EPS: $0.97 vs analyst estimates of $0.93 (3.8% beat)

- Revenue Guidance for Q1 CY2026 is $1.29 billion at the midpoint, below analyst estimates of $1.30 billion

- Adjusted EPS guidance for Q1 CY2026 is $0.93 at the midpoint, above analyst estimates of $0.92

- Operating Margin: 14.8%, in line with the same quarter last year

- Free Cash Flow Margin: 20.4%, up from 14.6% in the same quarter last year

- Market Capitalization: $6.61 billion

Company Overview

Originally spun off from General Electric in 2005 to provide business process services, Genpact (NYSE:G) is a global professional services firm that helps businesses transform their operations through digital technology, AI, and data analytics solutions.

Genpact operates at the intersection of business process expertise and digital innovation, serving clients across financial services, consumer goods, healthcare, high tech, and manufacturing sectors. The company's services are organized into two main categories: Digital Operations Services and Data-Tech-AI Services.

In Digital Operations, Genpact embeds digital technologies, analytics, and AI into traditional business process outsourcing. This allows clients to transform functions like finance, procurement, and customer service while achieving greater flexibility and efficiency. The company's proprietary Enterprise360 intelligence platform helps clients leverage data from their operations to identify improvement opportunities.

The Data-Tech-AI Services division focuses on designing and implementing solutions that harness digital technologies, data analytics, AI, and cloud-based software. Using human-centered design principles, Genpact helps clients develop new products, create digital workspaces, and enhance engagement with customers and partners.

A manufacturing company might engage Genpact to transform its supply chain operations, using AI-powered analytics to predict demand fluctuations, optimize inventory levels, and identify potential disruptions before they occur. Similarly, a bank might work with Genpact to streamline its loan processing operations, reducing approval times while maintaining compliance with regulatory requirements.

Genpact's approach is built on its Digital Smart Enterprise Processes (Digital SEPs), a patented methodology that combines Lean Six Sigma principles with domain-specific digital technologies. The company has developed benchmarks by analyzing millions of client transactions across thousands of business processes, allowing it to identify improvement opportunities and measure effectiveness.

With delivery centers in more than 25 countries, Genpact offers clients a global delivery model with multilingual capabilities and the flexibility to work across different time zones. The company employs a "Virtual Captive" service delivery model, creating dedicated teams that function as extensions of their clients' organizations.

4. Business Process Outsourcing & Consulting

The sector stands to benefit from ongoing digital transformation, increasing corporate demand for cost efficiencies, and the growing complexity of regulatory and cybersecurity landscapes. For those that invest wisely, AI and automation capabilities could emerge as competitive advantages, enhancing process efficiencies for the companies themselves as well as their clients. On the flip side, AI could be a headwind as well as the technology could lower the barrier to entry in the space and give rise to more self-service solutions. Additional challenges in the years ahead could include wage inflation for highly skilled consultants and potential regulatory scrutiny on outsourcing practices—especially in industries like finance and healthcare where who has access to certain data matters greatly.

Genpact competes with other professional services and business process outsourcing firms including Accenture (NYSE: ACN), Cognizant (NASDAQ: CTSH), Infosys (NYSE: INFY), and Tata Consultancy Services (NSE: TCS), as well as with the consulting arms of major accounting firms like Deloitte and EY.

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $5.08 billion in revenue over the past 12 months, Genpact is one of the larger companies in the business services industry and benefits from a well-known brand that influences purchasing decisions.

As you can see below, Genpact grew its sales at a decent 6.5% compounded annual growth rate over the last five years. This shows its offerings generated slightly more demand than the average business services company, a helpful starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Genpact’s annualized revenue growth of 6.5% over the last two years aligns with its five-year trend, suggesting its demand was stable.

This quarter, Genpact reported year-on-year revenue growth of 5.6%, and its $1.32 billion of revenue exceeded Wall Street’s estimates by 0.8%. Company management is currently guiding for a 6% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 7% over the next 12 months, similar to its two-year rate. This projection is above the sector average and implies its newer products and services will help support its recent top-line performance.

6. Adjusted Operating Margin

Adjusted operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies because it excludes non-recurring expenses, interest on debt, and taxes.

Genpact’s adjusted operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 16.9% over the last five years. This profitability was top-notch for a business services business, showing it’s an well-run company with an efficient cost structure.

Analyzing the trend in its profitability, Genpact’s adjusted operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, Genpact generated an adjusted operating margin profit margin of 17.6%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

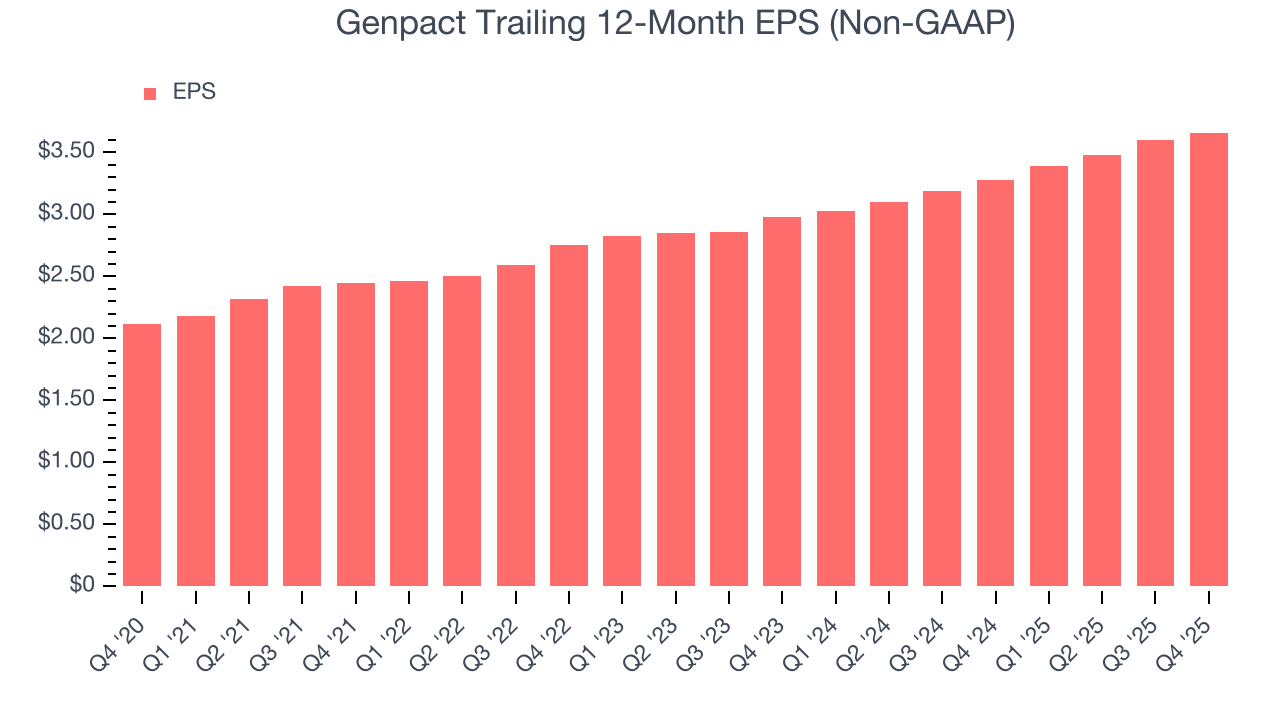

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Genpact’s EPS grew at a remarkable 11.5% compounded annual growth rate over the last five years, higher than its 6.5% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Genpact, its two-year annual EPS growth of 10.8% is similar to its five-year trend, implying stable earnings power.

In Q4, Genpact reported adjusted EPS of $0.97, up from $0.91 in the same quarter last year. This print beat analysts’ estimates by 3.8%. Over the next 12 months, Wall Street expects Genpact’s full-year EPS of $3.66 to grow 7.9%.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Genpact has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 12% over the last five years, quite impressive for a business services business.

Taking a step back, we can see that Genpact’s margin dropped by 1.5 percentage points during that time. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. If the longer-term trend returns, it could signal increasing investment needs and capital intensity. We’re willing to give the company some leeway give it’s one of the more cash generative and investable businesses in its space.

Genpact’s free cash flow clocked in at $269 million in Q4, equivalent to a 20.4% margin. This result was good as its margin was 5.8 percentage points higher than in the same quarter last year. Its cash profitability was also above its five-year level, and we hope the company can build on this trend.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Genpact’s five-year average ROIC was 17.6%, beating other business services companies by a wide margin. This illustrates its management team’s ability to invest in attractive growth opportunities and produce tangible results for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, Genpact’s ROIC increased by 1 percentage points annually each year over the last few years. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

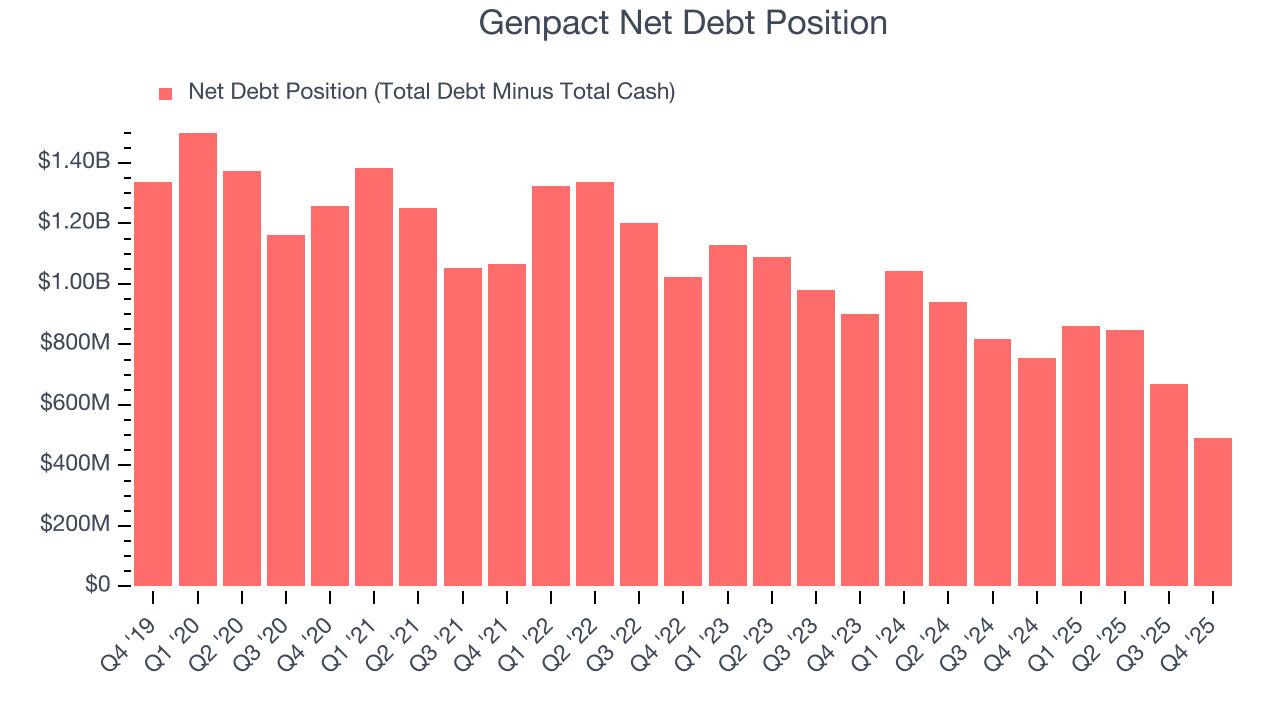

10. Balance Sheet Assessment

Genpact reported $1.20 billion of cash and $1.69 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $964.5 million of EBITDA over the last 12 months, we view Genpact’s 0.5× net-debt-to-EBITDA ratio as safe. We also see its $49.6 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Genpact’s Q4 Results

It was good to see Genpact beat analysts’ EPS expectations this quarter. We were also happy its EPS guidance for next quarter narrowly outperformed Wall Street’s estimates. On the other hand, its revenue guidance for next quarter slightly missed. Zooming out, we think this was a mixed quarter. The stock remained flat at $38.00 immediately following the results.

12. Is Now The Time To Buy Genpact?

Updated: March 1, 2026 at 11:52 PM EST

Before making an investment decision, investors should account for Genpact’s business fundamentals and valuation in addition to what happened in the latest quarter.

There are things to like about Genpact. First off, its revenue growth was good over the last five years, and analysts believe it can continue growing at these levels. And while its cash profitability fell over the last five years, its strong free cash flow generation allows it to invest in growth initiatives while maintaining an ample cushion. On top of that, its strong operating margins show it’s a well-run business.

Genpact’s P/E ratio based on the next 12 months is 9.8x. Looking at the business services landscape right now, Genpact trades at a pretty interesting price. For those confident in the business and its management team, this is a good time to invest.

Wall Street analysts have a consensus one-year price target of $48.64 on the company (compared to the current share price of $39.66), implying they see 22.6% upside in buying Genpact in the short term.