CRA (CRAI)

CRA catches our eye. Its eye-popping 20.9% annualized EPS growth over the last five years has significantly outpaced its peers.― StockStory Analyst Team

1. News

2. Summary

Why CRA Is Interesting

Often retained for high-stakes matters with multibillion-dollar implications, CRA International (NASDAQ:CRAI) provides economic, financial, and management consulting services to corporations, law firms, and government agencies for litigation, regulatory proceedings, and business strategy.

- Earnings growth has massively outpaced its peers over the last five years as its EPS has compounded at 20.9% annually

- Market-beating returns on capital illustrate that management has a knack for investing in profitable ventures

- A blemish is its smaller revenue base of $731.1 million means it hasn’t achieved the economies of scale that some industry juggernauts enjoy (but also enables it to grow faster if it executes properly)

CRA has the potential to be a high-quality business. If you believe in the company, the price looks reasonable.

Why Is Now The Time To Buy CRA?

High Quality

Investable

Underperform

Why Is Now The Time To Buy CRA?

CRA’s stock price of $156.77 implies a valuation ratio of 18.2x forward P/E. Looking at the business services space, we think the multiple is fair for the revenue growth characteristics.

If you think the market is not giving the company enough credit for its fundamentals, now could be a good time to invest.

3. CRA (CRAI) Research Report: Q4 CY2025 Update

Economic consulting firm CRA International (NASDAQ:CRAI) announced better-than-expected revenue in Q4 CY2025, with sales up 11.6% year on year to $197 million. The company’s full-year revenue guidance of $795 million at the midpoint came in 2.9% above analysts’ estimates. Its non-GAAP profit of $2.06 per share was in line with analysts’ consensus estimates.

CRA (CRAI) Q4 CY2025 Highlights:

- Revenue: $197 million vs analyst estimates of $190.5 million (11.6% year-on-year growth, 3.4% beat)

- Adjusted EPS: $2.06 vs analyst estimates of $2.07 (in line)

- Adjusted EBITDA: $24.35 million vs analyst estimates of $23.41 million (12.4% margin, 4% beat)

- Operating Margin: 10.5%, down from 12.1% in the same quarter last year

- Free Cash Flow Margin: 29.9%, down from 39% in the same quarter last year

- Market Capitalization: $1.05 billion

Company Overview

Often retained for high-stakes matters with multibillion-dollar implications, CRA International (NASDAQ:CRAI) provides economic, financial, and management consulting services to corporations, law firms, and government agencies for litigation, regulatory proceedings, and business strategy.

CRA International operates through two main service areas: litigation/regulatory consulting and management consulting. In litigation and regulatory matters, CRA's consultants work with law firms and corporate counsel to develop economic arguments, analyze damages, provide expert testimony, and support clients in antitrust cases, intellectual property disputes, securities litigation, and merger approvals. Their experts combine analytical rigor with industry knowledge to help clients navigate complex legal challenges.

For example, when a major merger faces regulatory scrutiny, CRA might analyze market competition data and provide economic models demonstrating whether the transaction would harm consumers. In another scenario, CRA might calculate potential damages in a patent infringement case by modeling lost profits and reasonable royalties.

The company's management consulting practice helps businesses address strategic and operational challenges. Services include corporate strategy development, performance improvement, auction design, environmental strategy, and transaction advisory. CRA consultants might help an energy company develop a sustainability strategy or assist a technology firm in valuing intellectual property for acquisition purposes.

CRA generates revenue through billable hours from its highly credentialed consultants, who have backgrounds in economics, finance, accounting, and various scientific disciplines. The company maintains relationships with academic and industry experts to enhance its expertise. This network allows CRA to assemble specialized teams tailored to each client's needs.

The company serves a diverse client base across numerous industries, including financial services, healthcare, energy, technology, and telecommunications. With offices throughout the Americas, Europe, and Australia, CRA provides services globally while maintaining deep expertise in specific regional markets and regulatory environments.

4. Business Process Outsourcing & Consulting

The sector stands to benefit from ongoing digital transformation, increasing corporate demand for cost efficiencies, and the growing complexity of regulatory and cybersecurity landscapes. For those that invest wisely, AI and automation capabilities could emerge as competitive advantages, enhancing process efficiencies for the companies themselves as well as their clients. On the flip side, AI could be a headwind as well as the technology could lower the barrier to entry in the space and give rise to more self-service solutions. Additional challenges in the years ahead could include wage inflation for highly skilled consultants and potential regulatory scrutiny on outsourcing practices—especially in industries like finance and healthcare where who has access to certain data matters greatly.

CRA International's competitors include other economic and management consulting firms such as Compass Lexecon (part of FTI Consulting, NYSE:FCN), Analysis Group, Cornerstone Research, and larger professional services firms like Deloitte, PwC, and McKinsey & Company.

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $751.6 million in revenue over the past 12 months, CRA is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels. On the bright side, it can grow faster because it has more room to expand.

As you can see below, CRA’s 8.1% annualized revenue growth over the last five years was solid. This is an encouraging starting point for our analysis because it shows CRA’s demand was higher than many business services companies.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. CRA’s annualized revenue growth of 9.8% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, CRA reported year-on-year revenue growth of 11.6%, and its $197 million of revenue exceeded Wall Street’s estimates by 3.4%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

6. Operating Margin

CRA has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 10.1%, higher than the broader business services sector.

Looking at the trend in its profitability, CRA’s operating margin rose by 1.2 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q4, CRA generated an operating margin profit margin of 10.5%, down 1.6 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

CRA’s EPS grew at an astounding 19.7% compounded annual growth rate over the last five years, higher than its 8.1% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into CRA’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, CRA’s operating margin declined this quarter but expanded by 1.2 percentage points over the last five years. Its share count also shrank by 16.2%, and these factors together are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For CRA, its two-year annual EPS growth of 22.6% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, CRA reported adjusted EPS of $2.06, up from $2.03 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects CRA’s full-year EPS of $8.22 to grow 8.4%.

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

CRA has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 6.3% over the last five years, slightly better than the broader business services sector.

Taking a step back, we can see that CRA’s margin dropped by 10.4 percentage points during that time. If its declines continue, it could signal increasing investment needs and capital intensity.

CRA’s free cash flow clocked in at $58.96 million in Q4, equivalent to a 29.9% margin. The company’s cash profitability regressed as it was 9.1 percentage points lower than in the same quarter last year, but it’s still above its five-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends carry greater meaning.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

CRA’s five-year average ROIC was 18%, beating other business services companies by a wide margin. This illustrates its management team’s ability to invest in attractive growth opportunities and produce tangible results for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, CRA’s ROIC averaged 3.4 percentage point decreases each year. Only time will tell if its new bets can bear fruit and potentially reverse the trend.

10. Balance Sheet Assessment

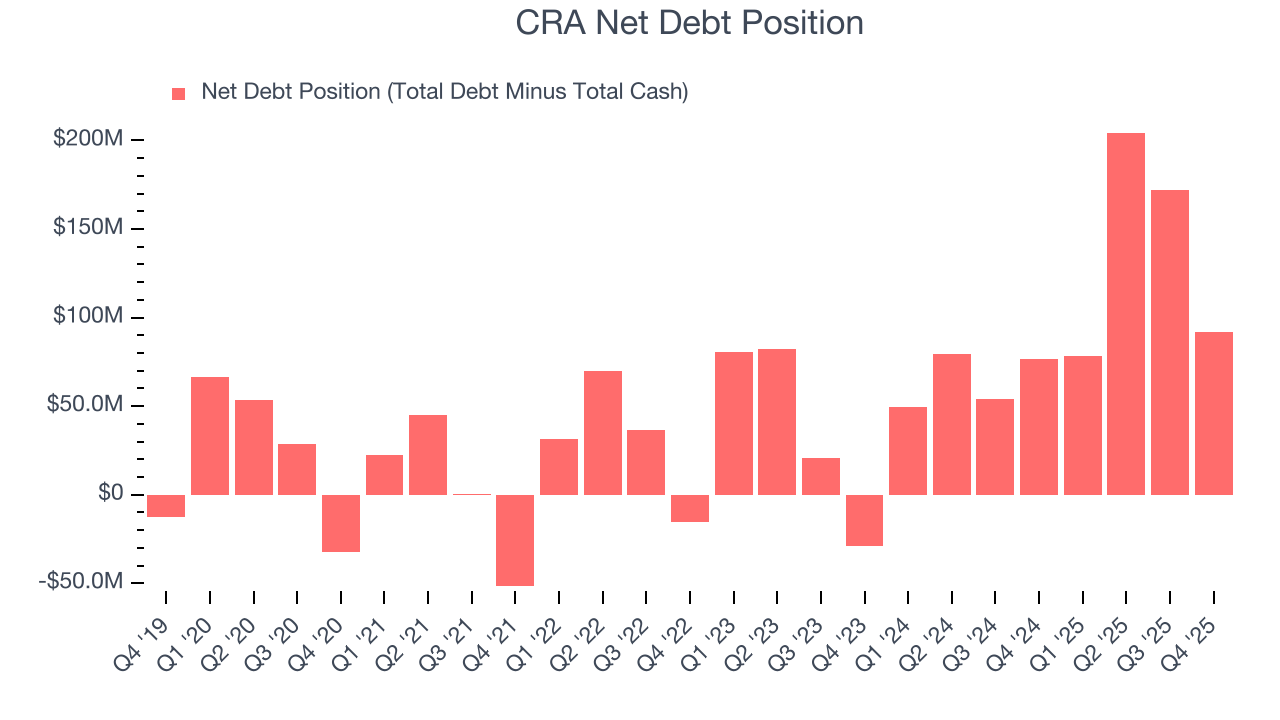

CRA reported $18.21 million of cash and $110 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $96.8 million of EBITDA over the last 12 months, we view CRA’s 0.9× net-debt-to-EBITDA ratio as safe. We also see its $2.59 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from CRA’s Q4 Results

We enjoyed seeing CRA beat analysts’ revenue expectations this quarter. We were also glad its full-year revenue guidance exceeded Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The stock remained flat at $160.26 immediately following the results.

12. Is Now The Time To Buy CRA?

Updated: February 26, 2026 at 8:10 AM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

There are some positives when it comes to CRA’s fundamentals. To kick things off, its revenue growth was solid over the last five years. And while its cash profitability fell over the last five years, its astounding EPS growth over the last five years shows its profits are trickling down to shareholders. On top of that, its market-beating ROIC suggests it has been a well-managed company historically.

CRA’s P/E ratio based on the next 12 months is 18x. Looking at the business services space right now, CRA trades at a compelling valuation. If you’re a fan of the business and management team, now is a good time to scoop up some shares.

Wall Street analysts have a consensus one-year price target of $252.50 on the company (compared to the current share price of $160.26), implying they see 57.6% upside in buying CRA in the short term.