Huron (HURN)

Not many stocks excite us like Huron. Its revenue is growing quickly while its profitability is rising, giving it multiple ways to win.― StockStory Analyst Team

1. News

2. Summary

Why We Like Huron

Founded in 2002 during a time of significant regulatory change in corporate America, Huron Consulting Group (NASDAQ:HURN) is a professional services company that helps organizations develop growth strategies, optimize operations, and implement digital transformation solutions.

- Incremental sales over the last five years have been highly profitable as its earnings per share increased by 29.4% annually, topping its revenue gains

- Market share has increased this cycle as its 14.3% annual revenue growth over the last five years was exceptional

- Forecasted revenue growth of 10.2% for the next 12 months indicates its momentum over the last two years is sustainable

We have an affinity for Huron. The price seems reasonable relative to its quality, and we think now is a good time to buy.

Why Is Now The Time To Buy Huron?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Huron?

Huron’s stock price of $123.61 implies a valuation ratio of 14.5x forward P/E. The valuation multiple is below many companies in the business services sector. We therefore think the stock is a good deal for the fundamentals.

Entry price matters far less than business fundamentals if you’re investing for a multi-year period. But if you can get a bargain price it’s certainly icing on the cake.

3. Huron (HURN) Research Report: Q4 CY2025 Update

Professional services firm Huron Consulting Group (NASDAQ:HURN) fell short of the market’s revenue expectations in Q4 CY2025, but sales rose 10.7% year on year to $442 million. On the other hand, the company’s outlook for the full year was close to analysts’ estimates with revenue guided to $1.82 billion at the midpoint. Its non-GAAP profit of $2.17 per share was 11.3% above analysts’ consensus estimates.

Huron (HURN) Q4 CY2025 Highlights:

- Revenue: $442 million vs analyst estimates of $446 million (10.7% year-on-year growth, 0.9% miss)

- Adjusted EPS: $2.17 vs analyst estimates of $1.95 (11.3% beat)

- Adjusted EBITDA: $68.01 million vs analyst estimates of $67.27 million (15.4% margin, 1.1% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $8.75 at the midpoint, in line with analyst estimates

- Operating Margin: 11.4%, in line with the same quarter last year

- Free Cash Flow Margin: 28%, down from 33.2% in the same quarter last year

- Market Capitalization: $2.03 billion

Company Overview

Founded in 2002 during a time of significant regulatory change in corporate America, Huron Consulting Group (NASDAQ:HURN) is a professional services company that helps organizations develop growth strategies, optimize operations, and implement digital transformation solutions.

Huron operates across three main industry segments: Healthcare (49% of revenue), Education (32%), and Commercial (19%). In healthcare, Huron serves hospitals, health systems, physician groups, and long-term care providers with services ranging from financial performance improvement to digital technology implementation. Their education segment works with colleges, universities, and research institutes to optimize operations, implement technology solutions, and improve research administration.

The company delivers its services through two principal capabilities: Consulting and Managed Services, and Digital. The Consulting arm addresses strategic, operational, and organizational challenges, while the Digital capability provides technology implementation, data analytics, and software solutions. Huron has partnerships with over 25 technology companies including Oracle, Salesforce, Workday, and Amazon Web Services.

A healthcare system might engage Huron to optimize its revenue cycle operations, implement a new electronic health record system, and develop strategies for care delivery transformation. Similarly, a university could work with Huron to implement student information systems, improve research administration processes, or develop a financial sustainability plan.

Huron generates revenue through project-based consulting fees, managed services contracts, and software licensing. The company has expanded its proprietary software portfolio to include products like Huron Research Suite for research administration and Huron Intelligence Analytic Suite for healthcare predictive analytics, creating recurring revenue streams to complement its consulting business.

4. Business Process Outsourcing & Consulting

The sector stands to benefit from ongoing digital transformation, increasing corporate demand for cost efficiencies, and the growing complexity of regulatory and cybersecurity landscapes. For those that invest wisely, AI and automation capabilities could emerge as competitive advantages, enhancing process efficiencies for the companies themselves as well as their clients. On the flip side, AI could be a headwind as well as the technology could lower the barrier to entry in the space and give rise to more self-service solutions. Additional challenges in the years ahead could include wage inflation for highly skilled consultants and potential regulatory scrutiny on outsourcing practices—especially in industries like finance and healthcare where who has access to certain data matters greatly.

Huron's competitors include global consulting firms such as Accenture (NYSE: ACN), Deloitte, and McKinsey & Company, as well as specialized healthcare and education consultancies like Advisory Board (formerly NASDAQ: ABCO, now part of UnitedHealth Group) and EAB (formerly part of NASDAQ: APOL).

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $1.70 billion in revenue over the past 12 months, Huron is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the bright side, it can still flex high growth rates because it’s working from a smaller revenue base.

As you can see below, Huron grew its sales at an exceptional 14.3% compounded annual growth rate over the last five years. This is a great starting point for our analysis because it shows Huron’s demand was higher than many business services companies.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Huron’s annualized revenue growth of 10.2% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Huron’s revenue grew by 10.7% year on year to $442 million but fell short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 10.2% over the next 12 months, similar to its two-year rate. This projection is admirable and indicates the market is baking in success for its products and services.

6. Operating Margin

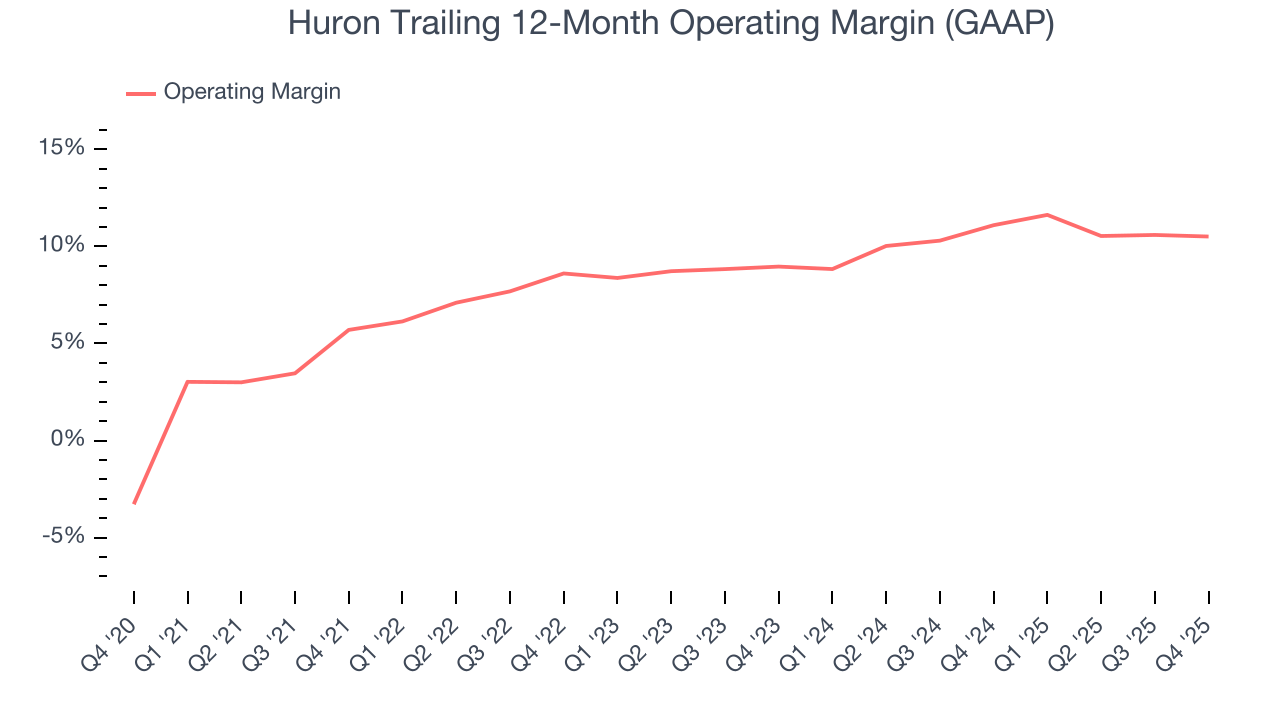

Huron was profitable over the last five years but held back by its large cost base. Its average operating margin of 9.3% was weak for a business services business.

On the plus side, Huron’s operating margin rose by 4.8 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Huron generated an operating margin profit margin of 11.4%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

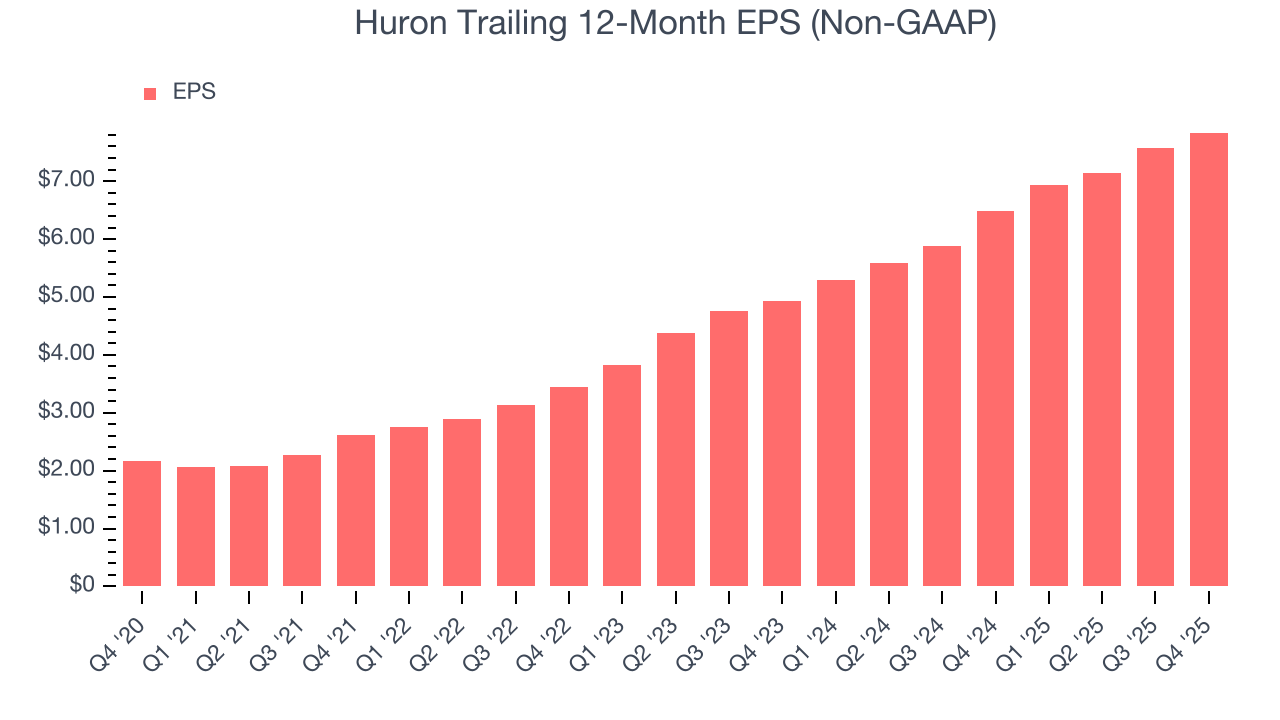

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Huron’s EPS grew at an astounding 29.4% compounded annual growth rate over the last five years, higher than its 14.3% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Huron’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, Huron’s operating margin was flat this quarter but expanded by 4.8 percentage points over the last five years. On top of that, its share count shrank by 18.5%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Huron, its two-year annual EPS growth of 26.1% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.

In Q4, Huron reported adjusted EPS of $2.17, up from $1.90 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Huron’s full-year EPS of $7.84 to grow 12.2%.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Huron has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 7.5% over the last five years, better than the broader business services sector. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Taking a step back, we can see that Huron’s margin expanded by 9.6 percentage points during that time. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

Huron’s free cash flow clocked in at $123.8 million in Q4, equivalent to a 28% margin. The company’s cash profitability regressed as it was 5.1 percentage points lower than in the same quarter last year, but it’s still above its five-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, leading to short-term swings. Long-term trends are more important.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although Huron has shown solid fundamentals lately, it historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 9.9%, somewhat low compared to the best business services companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Huron’s ROIC has increased over the last few years. its rising ROIC is a good sign and could suggest its competitive advantage or profitable growth opportunities are expanding.

10. Balance Sheet Assessment

Huron reported $24.51 million of cash and $548.3 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $237.5 million of EBITDA over the last 12 months, we view Huron’s 2.2× net-debt-to-EBITDA ratio as safe. We also see its $34.2 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Huron’s Q4 Results

It was good to see Huron beat analysts’ EPS expectations this quarter. On the other hand, its revenue slightly missed. Overall, this print had some key positives. Investors were likely hoping for more, and shares traded down 2% to $123.61 immediately after reporting.

12. Is Now The Time To Buy Huron?

Updated: February 25, 2026 at 12:04 AM EST

When considering an investment in Huron, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

There is a lot to like about Huron. First of all, the company’s revenue growth was exceptional over the last five years. On top of that, its rising cash profitability gives it more optionality, and its astounding EPS growth over the last five years shows its profits are trickling down to shareholders.

Huron’s P/E ratio based on the next 12 months is 14.5x. Scanning the business services landscape today, Huron’s fundamentals clearly illustrate that it’s an elite business, and we like it at this price.

Wall Street analysts have a consensus one-year price target of $215.50 on the company (compared to the current share price of $123.61), implying they see 74.3% upside in buying Huron in the short term.