Concentrix (CNXC)

We see potential in Concentrix. Its exceptional revenue growth indicates it’s winning market share.― StockStory Analyst Team

1. News

2. Summary

Why Concentrix Is Interesting

With a team of approximately 450,000 employees across 75 countries, Concentrix (NASDAQ:CNXC) designs and delivers customer experience solutions that help global brands manage their customer interactions across digital channels and contact centers.

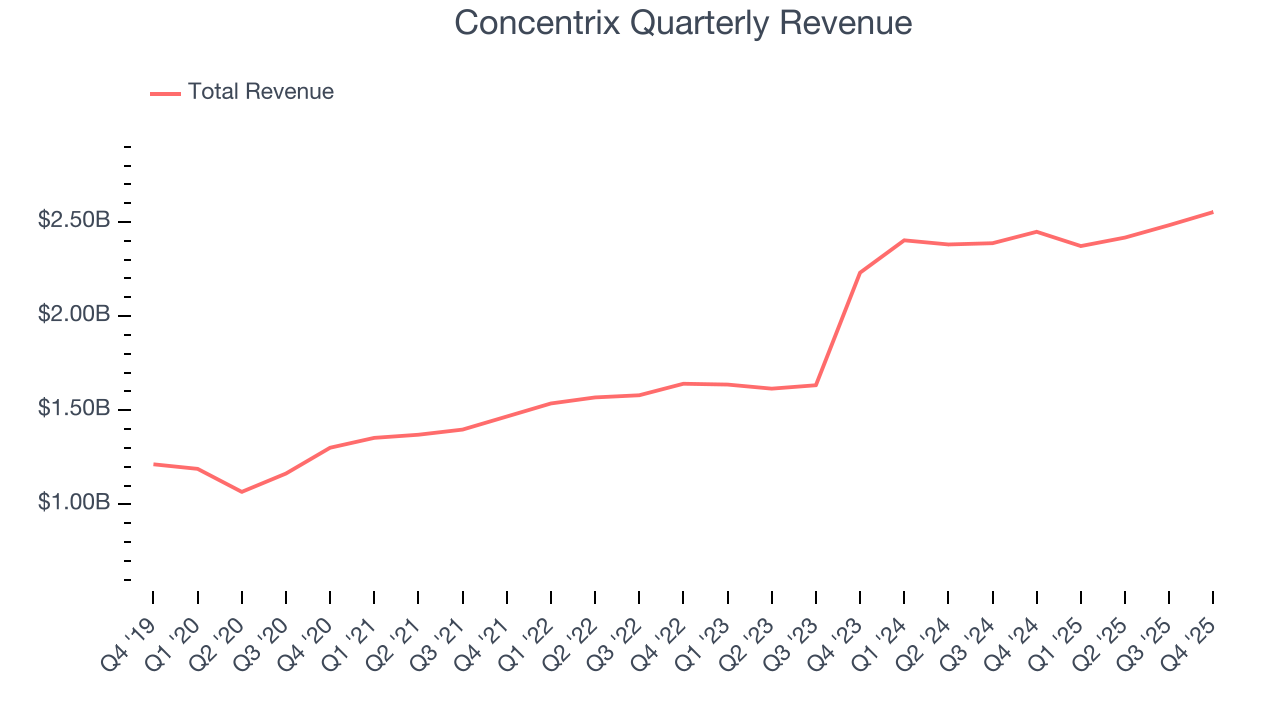

- Annual revenue growth of 15.8% over the past five years was outstanding, reflecting market share gains this cycle

- Revenue base of $9.83 billion gives it economies of scale and some distribution advantages

- One pitfall is its low returns on capital reflect management’s struggle to allocate funds effectively, and its shrinking returns suggest its past profit sources are losing steam

Concentrix is close to becoming a high-quality business. If you like the stock, the price seems reasonable.

Why Is Now The Time To Buy Concentrix?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Concentrix?

Concentrix’s stock price of $32.95 implies a valuation ratio of 2.7x forward P/E. Concentrix’s current price appears to be a good deal for the revenue growth you get.

Now could be a good time to invest if you believe in the story.

3. Concentrix (CNXC) Research Report: Q4 CY2025 Update

Customer experience solutions provider Concentrix (NASDAQ:CNXC) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 4.3% year on year to $2.55 billion. The company expects next quarter’s revenue to be around $2.49 billion, close to analysts’ estimates. Its non-GAAP profit of $2.95 per share was 1.4% above analysts’ consensus estimates.

Concentrix (CNXC) Q4 CY2025 Highlights:

- Revenue: $2.55 billion vs analyst estimates of $2.53 billion (4.3% year-on-year growth, 0.7% beat)

- Adjusted EPS: $2.95 vs analyst estimates of $2.91 (1.4% beat)

- Adjusted EBITDA: $378.6 million vs analyst estimates of $384.9 million (14.8% margin, 1.6% miss)

- Revenue Guidance for Q1 CY2026 is $2.49 billion at the midpoint, roughly in line with what analysts were expecting

- Adjusted EPS guidance for the upcoming financial year 2026 is $11.78 at the midpoint, missing analyst estimates by 3.9%

- Operating Margin: -54.1%, down from 5.9% in the same quarter last year due to non-cash goodwill impairment charge of $1,523.3 million

- Free Cash Flow Margin: 11%, up from 9.2% in the same quarter last year

- Market Capitalization: $2.52 billion

Company Overview

With a team of approximately 450,000 employees across 75 countries, Concentrix (NASDAQ:CNXC) designs and delivers customer experience solutions that help global brands manage their customer interactions across digital channels and contact centers.

Concentrix operates at the intersection of technology and human interaction, providing end-to-end customer experience (CX) services that span the entire customer lifecycle. The company's solutions include customer care, technical support, sales support, digital marketing, content moderation, and back-office services, all designed to help clients acquire, support, and retain customers.

Beyond traditional customer service, Concentrix offers strategy and design services that help businesses transform their operations through human-centered design and digital innovation. Its data and analytics capabilities enable clients to extract actionable insights from customer interactions, while its enterprise technology services assist companies in evaluating and enhancing their technology infrastructure.

For example, a global technology company might engage Concentrix to handle customer support across multiple channels, using the company's analytics to identify pain points in the customer journey and implement improvements. A financial services firm might leverage Concentrix's expertise to design and deploy AI-powered chatbots that handle routine inquiries while seamlessly escalating complex issues to human agents.

Concentrix generates revenue through long-term contracts with clients, with many relationships spanning over a decade. The company serves more than 2,000 clients globally, with particular strength in industries requiring complex customer interactions and high levels of compliance, such as technology, financial services, healthcare, and retail.

The company has expanded its capabilities and global reach through strategic acquisitions, including Webhelp in 2023, which strengthened its European presence, and PK in 2021, which enhanced its design engineering capabilities. In 2024, Concentrix launched iX Hello, an enterprise-grade generative AI product that creates customizable virtual assistants, reflecting its ongoing investment in advanced technologies.

4. Business Process Outsourcing & Consulting

The sector stands to benefit from ongoing digital transformation, increasing corporate demand for cost efficiencies, and the growing complexity of regulatory and cybersecurity landscapes. For those that invest wisely, AI and automation capabilities could emerge as competitive advantages, enhancing process efficiencies for the companies themselves as well as their clients. On the flip side, AI could be a headwind as well as the technology could lower the barrier to entry in the space and give rise to more self-service solutions. Additional challenges in the years ahead could include wage inflation for highly skilled consultants and potential regulatory scrutiny on outsourcing practices—especially in industries like finance and healthcare where who has access to certain data matters greatly.

Concentrix competes with other customer experience providers like Teleperformance, TELUS International, TaskUs, and Foundever Group, as well as with IT and business process services companies including Accenture, Cognizant, and Genpact that offer complementary services in consulting, design, and analytics.

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $9.83 billion in revenue over the past 12 months, Concentrix is one of the larger companies in the business services industry and benefits from a well-known brand that influences purchasing decisions.

As you can see below, Concentrix’s 15.8% annualized revenue growth over the last five years was incredible. This is an encouraging starting point for our analysis because it shows Concentrix’s demand was higher than many business services companies.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Concentrix’s annualized revenue growth of 17.5% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, Concentrix reported modest year-on-year revenue growth of 4.3% but beat Wall Street’s estimates by 0.7%. Company management is currently guiding for a 4.9% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 2.7% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and suggests its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

6. Operating Margin

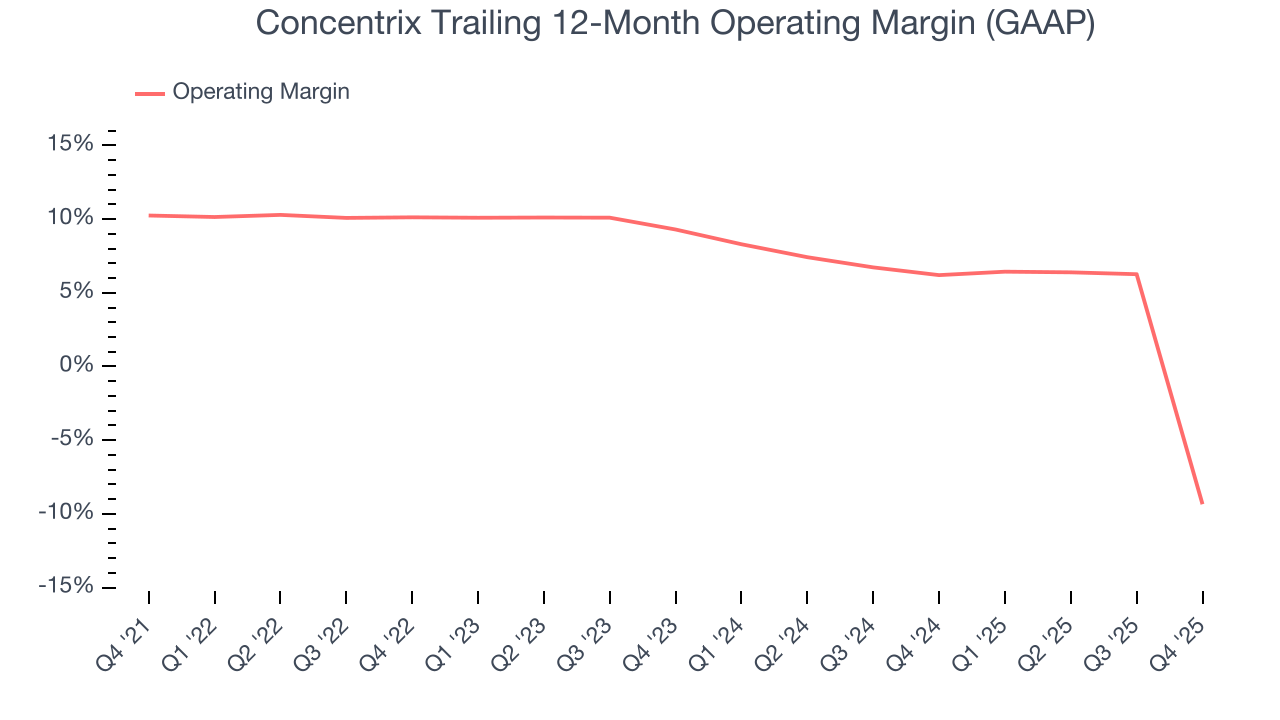

Concentrix was profitable over the last five years but held back by its large cost base. Its average operating margin of 4% was weak for a business services business.

Analyzing the trend in its profitability, Concentrix’s operating margin decreased by 19.6 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Concentrix’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, Concentrix generated an operating margin profit margin of negative 54.1%, down 60.1 percentage points year on year. This was due to a non-cash goodwill impairment charge of $1,523.3 million.

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

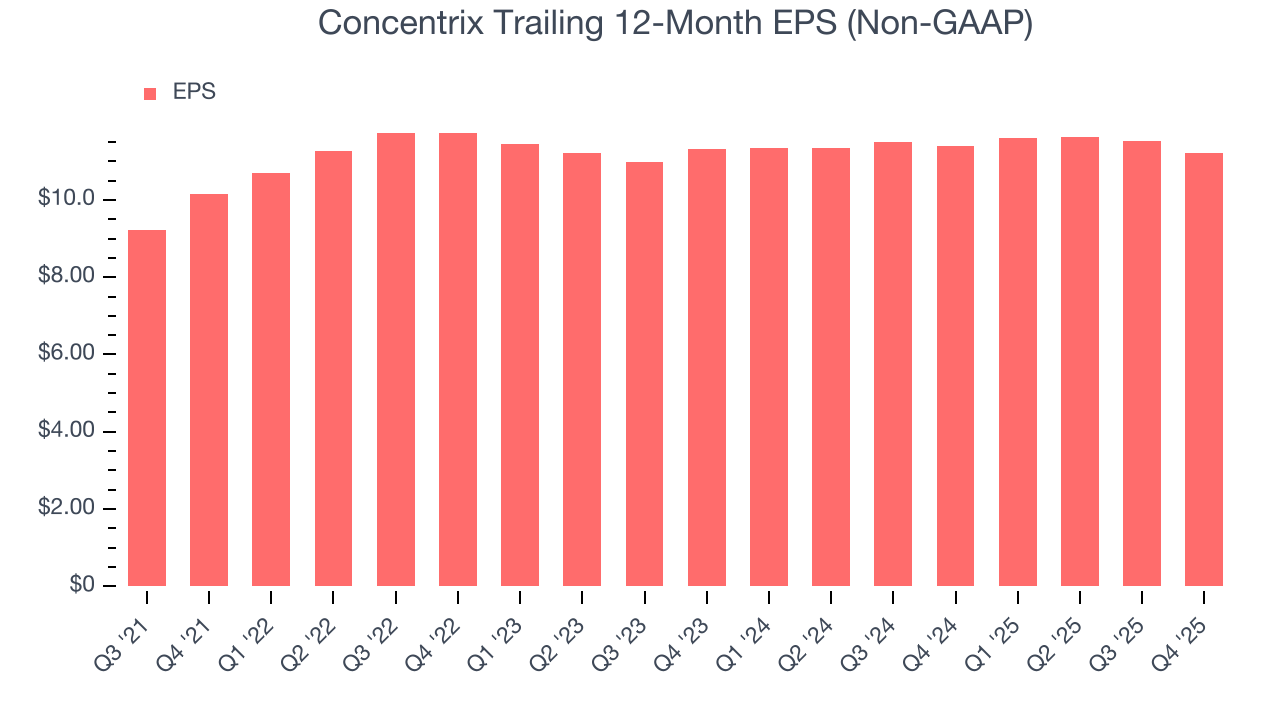

Concentrix’s full-year EPS grew at a weak 2.6% compounded annual growth rate over the last four years, worse than the broader business services sector.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Concentrix’s flat EPS over the last two years was worse than its 17.5% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

Diving into the nuances of Concentrix’s earnings can give us a better understanding of its performance. Concentrix’s operating margin has declined over the last two years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Concentrix reported adjusted EPS of $2.95, down from $3.26 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 1.4%. Over the next 12 months, Wall Street expects Concentrix’s full-year EPS of $11.22 to grow 8%.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Concentrix has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 6% over the last five years, slightly better than the broader business services sector.

Concentrix’s free cash flow clocked in at $281.2 million in Q4, equivalent to a 11% margin. This result was good as its margin was 1.8 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings. Long-term trends trump fluctuations.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although Concentrix has shown solid business quality lately, it historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 3.6%, lower than the typical cost of capital (how much it costs to raise money) for business services companies. This quarter was impacted by a non-cash goodwill impairment charge of $1,523.3 million.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Concentrix’s ROIC has unfortunately decreased significantly. If its returns keep falling, it could suggest its profitable growth opportunities are drying up. We’ll keep a close eye.

10. Balance Sheet Assessment

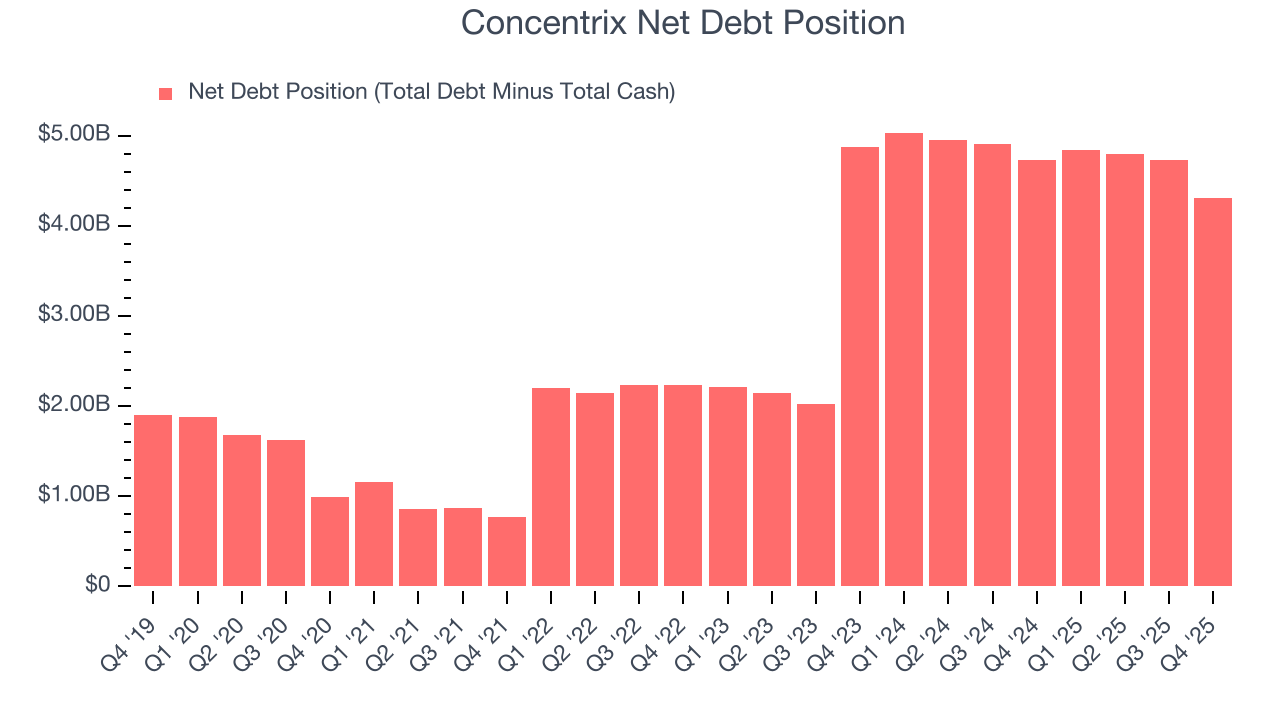

Concentrix reported $327.3 million of cash and $4.64 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.47 billion of EBITDA over the last 12 months, we view Concentrix’s 2.9× net-debt-to-EBITDA ratio as safe. We also see its $150.5 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Concentrix’s Q4 Results

It was good to see Concentrix narrowly top analysts’ revenue expectations this quarter. On the other hand, its full-year EPS guidance missed and its EPS guidance for next quarter fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 4.5% to $38.67 immediately following the results.

12. Is Now The Time To Buy Concentrix?

Updated: March 2, 2026 at 12:03 AM EST

Before deciding whether to buy Concentrix or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

We think Concentrix is a solid business. To kick things off, its revenue growth was exceptional over the last five years. And while its diminishing returns show management's recent bets still have yet to bear fruit, its scale and strong customer awareness give it negotiating power. On top of that, its sturdy operating margins show it has disciplined cost controls.

Concentrix’s P/E ratio based on the next 12 months is 2.7x. When scanning the business services space, Concentrix trades at a fair valuation. For those confident in the business and its management team, this is a good time to invest.

Wall Street analysts have a consensus one-year price target of $62.20 on the company (compared to the current share price of $32.95), implying they see 88.8% upside in buying Concentrix in the short term.