Byrna (BYRN)

We see potential in Byrna, but its cash burn shows it only has 20 months of runway left.― StockStory Analyst Team

1. News

2. Summary

Why Byrna Is Not Exciting

Providing civilians with tools to disable, disarm, and deter would-be assailants, Byrna (NASDAQ:BYRN) is a provider of non-lethal weapons.

- Poor expense management has led to an operating margin that is below the industry average

- Negative free cash flow raises questions about the return timeline for its investments

- Limited cash reserves may force the company to seek unfavorable financing terms that could dilute shareholders

Byrna has some noteworthy aspects, but we’d hold off on buying the stock until its EBITDA can comfortably support its debt.

Why There Are Better Opportunities Than Byrna

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Byrna

Byrna is trading at $12.82 per share, or 23.4x forward P/E. This multiple is lower than most industrials companies, but for good reason.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. Byrna (BYRN) Research Report: Q4 CY2025 Update

Non-lethal weapons company Byrna (NASDAQ:BYRN) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 26% year on year to $35.25 million. Its GAAP profit of $0.14 per share was in line with analysts’ consensus estimates.

Byrna (BYRN) Q4 CY2025 Highlights:

- Revenue: $35.25 million vs analyst estimates of $34.92 million (26% year-on-year growth, 0.9% beat)

- EPS (GAAP): $0.14 vs analyst estimates of $0.13 (in line)

- Adjusted EBITDA: $6.02 million vs analyst estimates of $6.08 million (17.1% margin, 1.1% miss)

- Operating Margin: 11.2%, down from 14.6% in the same quarter last year

- Market Capitalization: $277.7 million

Company Overview

Providing civilians with tools to disable, disarm, and deter would-be assailants, Byrna (NASDAQ:BYRN) is a provider of non-lethal weapons.

At the forefront of Byrna’s product offerings is the Byrna HD, a compact and powerful CO2-powered launcher designed for self-defense. This device is equipped to fire Byrna's proprietary projectiles, providing a safe yet impactful means for individuals to protect themselves in a variety of situations. The company is widely known for its similar non-lethal projectile weapons referred to as self-defense launchers.

Byrna predominantly serves individual consumers, private security firms, and law enforcement agencies seeking less-lethal alternatives for crowd control and personal protection. The versatility of Byrna's products caters to a wide range of security needs, contributing to its widespread adoption in various sectors.

Byrna distributes its products through a combination of online sales platforms, authorized dealers, and strategic partnerships. Byrna prioritizes direct-to-consumer sales through its website, providing customers with convenient access to their innovative self-defense solutions. Additionally, the company collaborates with distributors like Amazon and sporting goods stores to sell its products.

4. Law Enforcement Suppliers

Many law enforcement suppliers companies require licensing and clearance to manufacture products such as firearms. These companies can enjoy long-term contracts with law enforcement and corrections bodies, leading to more predictable revenue. It is still unclear how the recent focus on excessive force and police accountability will impact longer-term demand. On the one hand, lethal force products could become less popular. On the other hand, products such as body cams that aid in the transparency of policing could become standard. Generally, the sector’s fate will also ebb and flow with state or local budgets, and there is high reputational risk, as one mishap or bad headline can change a company’s fortunes.

Byrna’s peers and competitors include Axon (NASDAQ:AXON) and Microvast Holdings (NASDAQ:MVST).

5. Revenue Growth

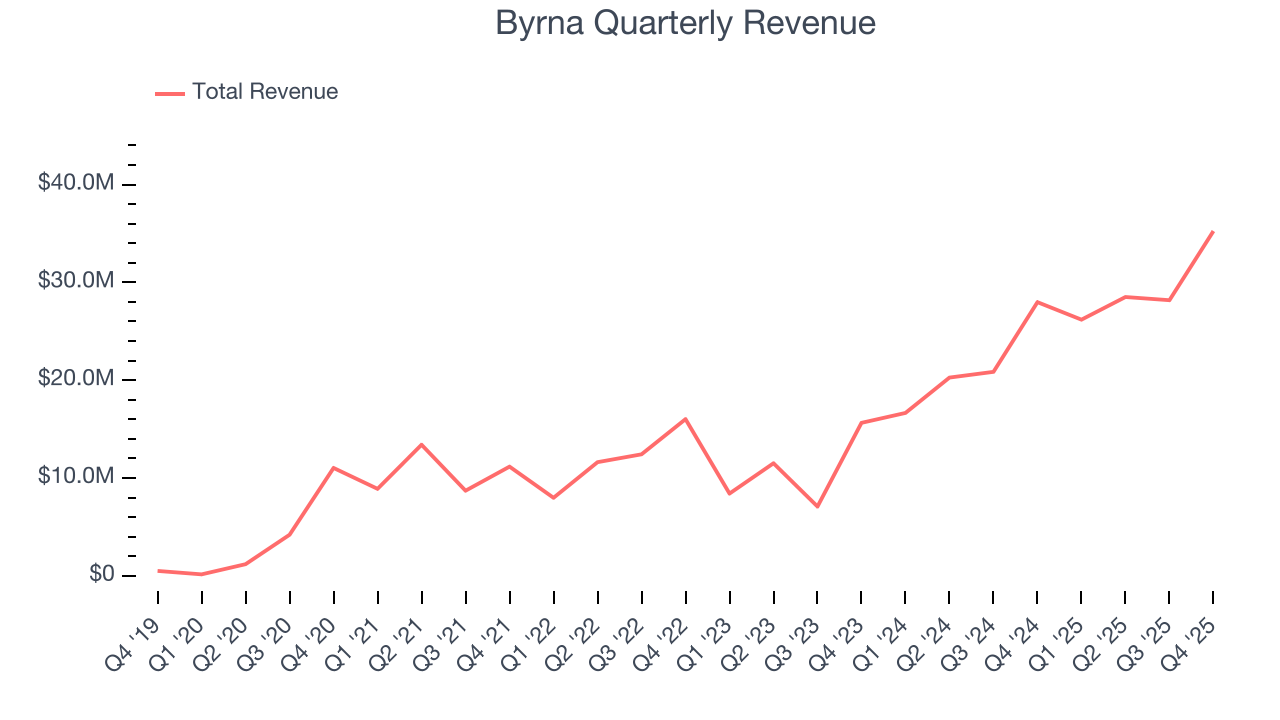

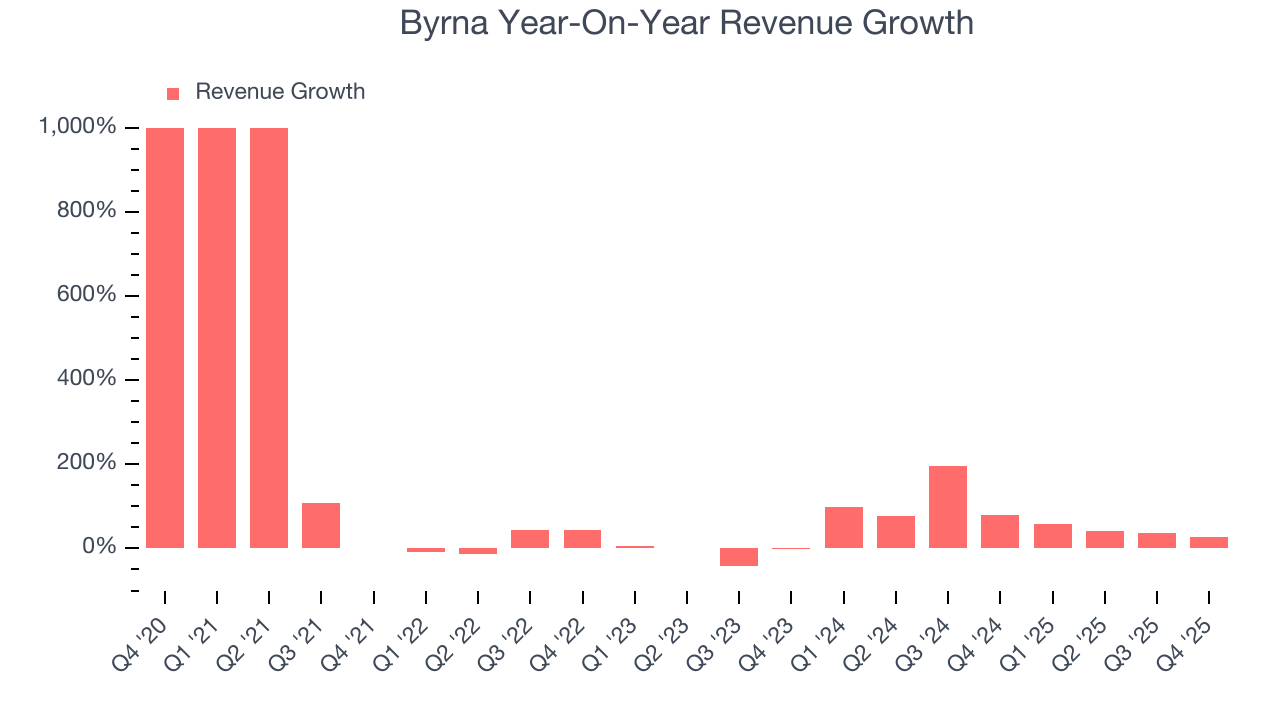

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Luckily, Byrna’s sales grew at an incredible 48.1% compounded annual growth rate over the last five years. Its growth beat the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Byrna’s annualized revenue growth of 66.4% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, Byrna reported robust year-on-year revenue growth of 26%, and its $35.25 million of revenue topped Wall Street estimates by 0.9%.

Looking ahead, sell-side analysts expect revenue to grow 18.8% over the next 12 months, a deceleration versus the last two years. Still, this projection is noteworthy and implies the market is forecasting success for its products and services.

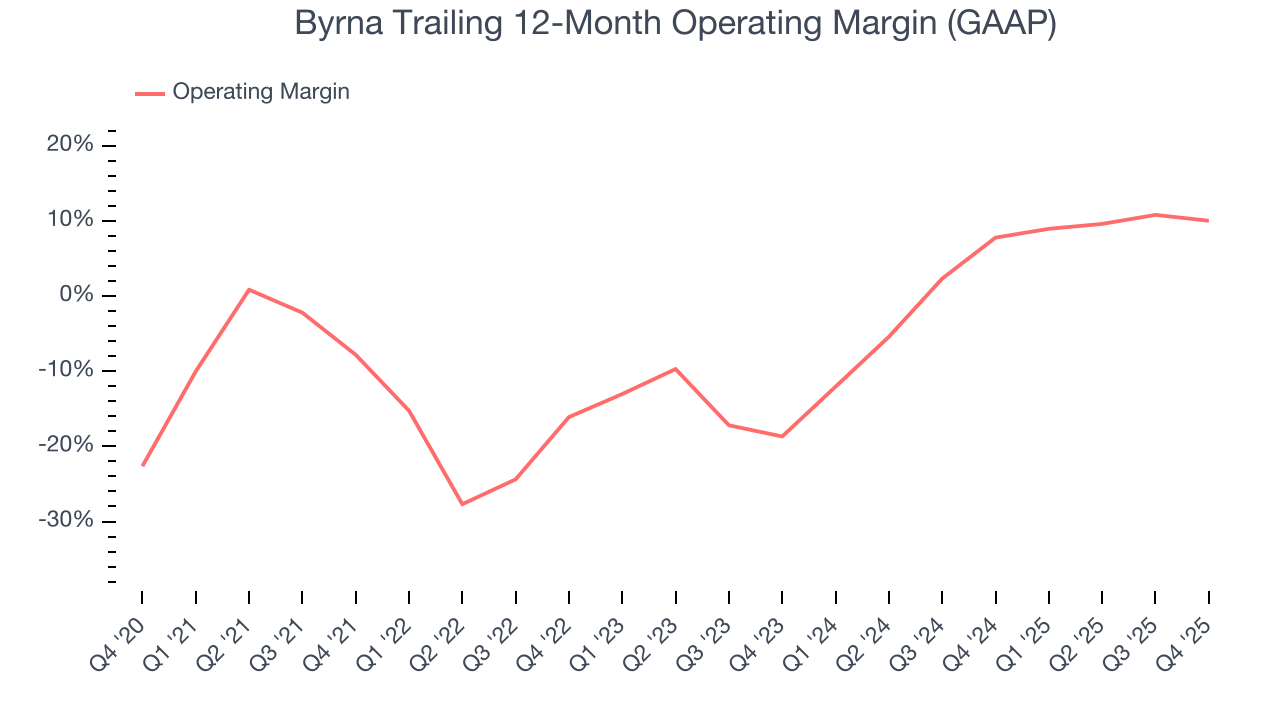

6. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Byrna was roughly breakeven when averaging the last five years of quarterly operating profits, one of the worst outcomes in the industrials sector.

On the plus side, Byrna’s operating margin rose by 17.8 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Byrna generated an operating margin profit margin of 11.2%, down 3.4 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

7. Earnings Per Share

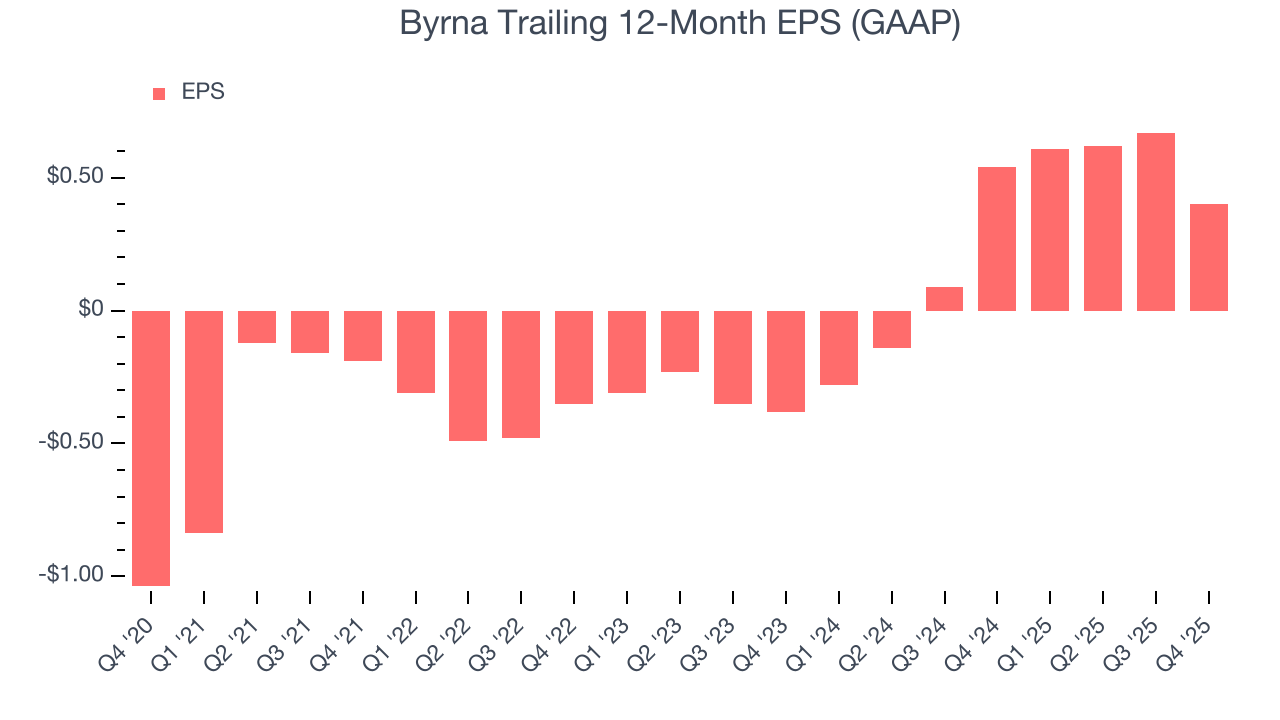

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Byrna’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Byrna, its two-year annual EPS growth of 74.7% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, Byrna reported EPS of $0.14, down from $0.41 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 5.7%. Over the next 12 months, Wall Street expects Byrna’s full-year EPS of $0.40 to grow 52.1%.

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

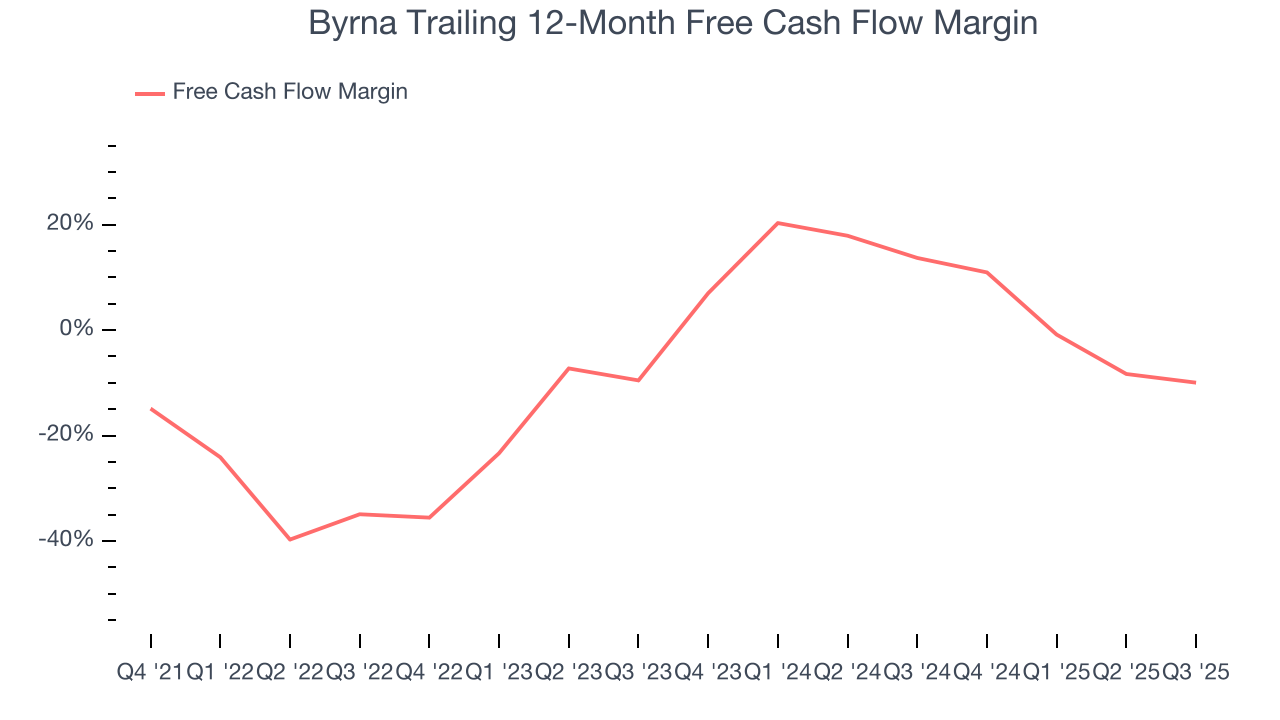

Byrna’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 9.4%, meaning it lit $9.39 of cash on fire for every $100 in revenue.

Taking a step back, an encouraging sign is that Byrna’s margin expanded by 5.4 percentage points during that time. The company’s improvement shows it’s heading in the right direction, and continued increases could help it achieve long-term cash profitability.

9. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

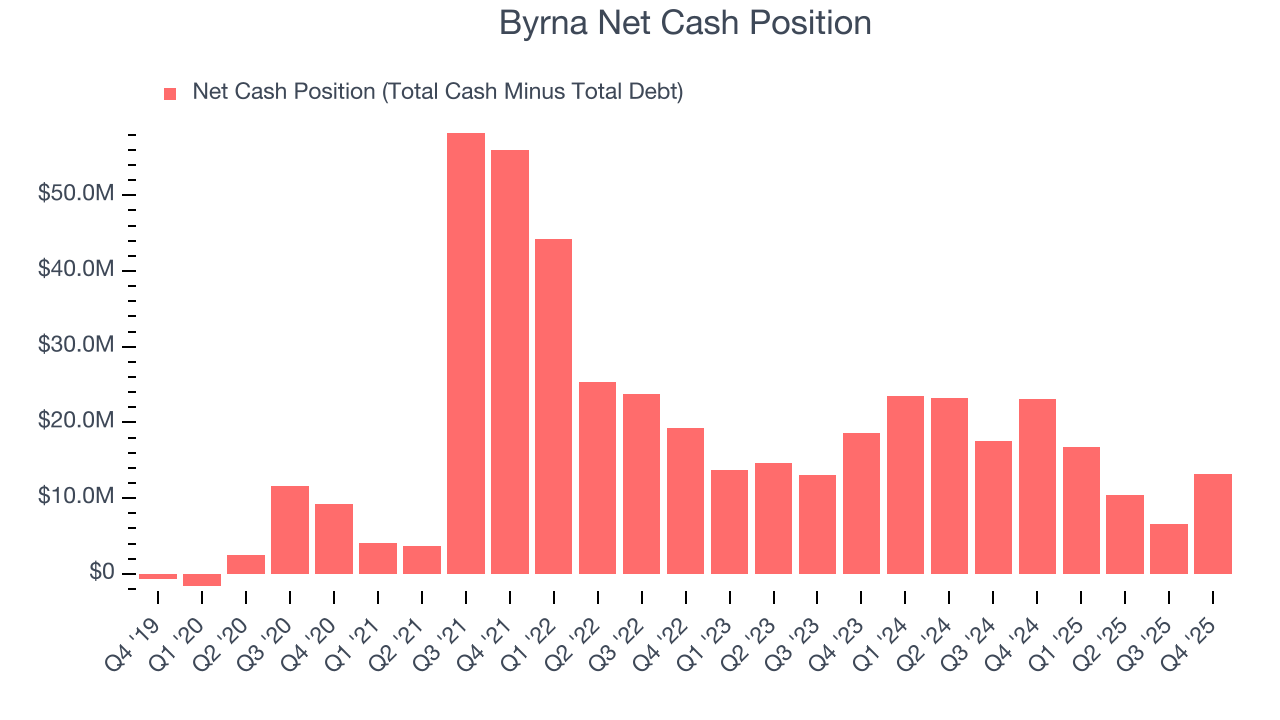

Byrna burned through $9.20 million of cash over the last year. With $15.48 million of cash on its balance sheet, the company has around 20 months of runway left (assuming its $2.35 million of debt isn’t due right away).

Unless the Byrna’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.

We remain cautious of Byrna until it generates consistent free cash flow or any of its announced financing plans materialize on its balance sheet.

10. Key Takeaways from Byrna’s Q4 Results

It was good to see Byrna narrowly top analysts’ revenue expectations this quarter. We were also glad its EPS was in line with Wall Street’s estimates. On the other hand, its EBITDA slightly missed. Zooming out, we think this was a mixed quarter. The stock traded up 5% to $12.83 immediately after reporting.

11. Is Now The Time To Buy Byrna?

Updated: February 12, 2026 at 10:47 PM EST

Before investing in or passing on Byrna, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

Byrna is a pretty good company if you ignore its balance sheet. First of all, the company’s revenue growth was exceptional over the last five years. And while its operating margins reveal poor profitability compared to other industrials companies, its rising cash profitability gives it more optionality. Additionally, Byrna’s expanding operating margin shows the business has become more efficient.

Byrna’s P/E ratio based on the next 12 months is 23.4x. Certain aspects of its fundamentals are attractive, but we aren’t investing at the moment because its balance sheet makes us uneasy. If you’re interested in buying the stock, wait until its debt falls or its profits increase.

Wall Street analysts have a consensus one-year price target of $34.80 on the company (compared to the current share price of $12.82).