Avis Budget Group (CAR)

We’re cautious of Avis Budget Group. Its poor sales growth and falling returns on capital suggest its growth opportunities are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why We Think Avis Budget Group Will Underperform

The parent company of brands such as Zipcar and Budget Truck Rental, Avis (NASDAQ:CAR) is a provider of car rental and mobility solutions.

- Projected sales growth of 1.3% for the next 12 months suggests sluggish demand

- Limited cash reserves may force the company to seek unfavorable financing terms that could dilute shareholders

Avis Budget Group falls below our quality standards. We’ve identified better opportunities elsewhere.

Why There Are Better Opportunities Than Avis Budget Group

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Avis Budget Group

Avis Budget Group is trading at $122.12 per share, or 14.5x forward P/E. This multiple is lower than most industrials companies, but for good reason.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Avis Budget Group (CAR) Research Report: Q4 CY2025 Update

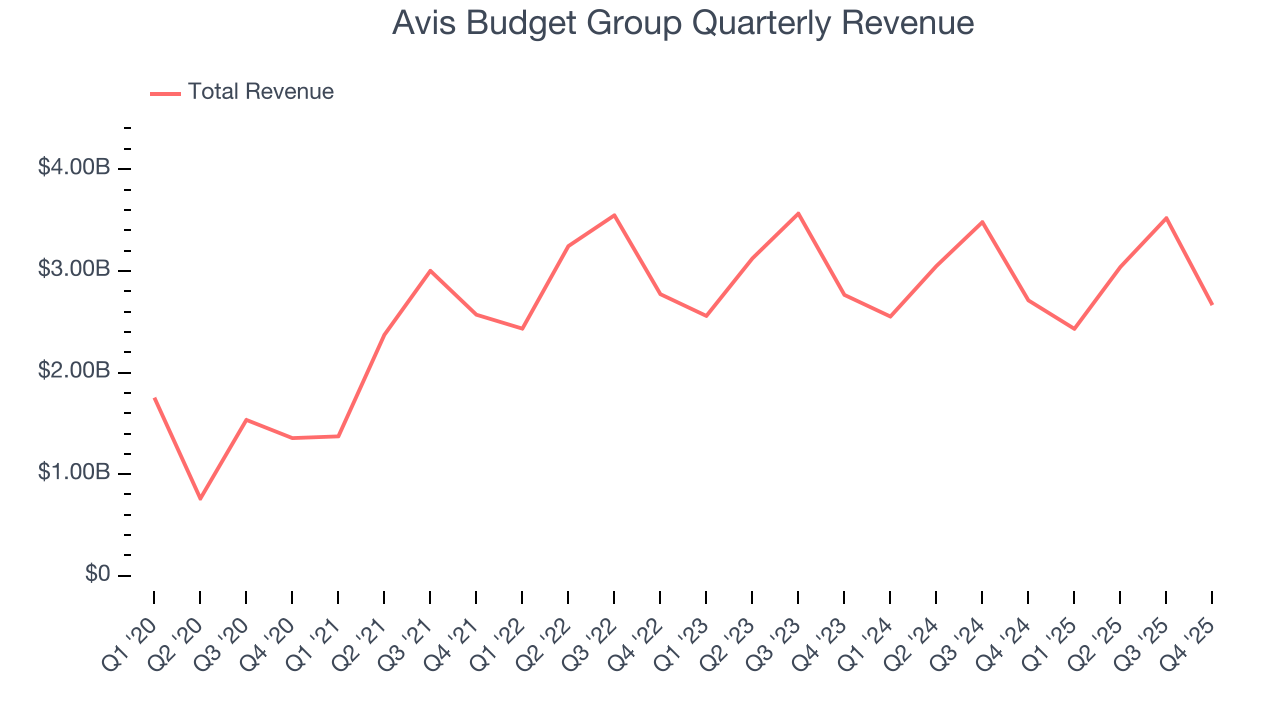

Car rental services provider Avis (NASDAQ:CAR) missed Wall Street’s revenue expectations in Q4 CY2025, with sales falling 1.7% year on year to $2.66 billion. Its GAAP loss of $21.25 per share was significantly below analysts’ consensus estimates.

Avis Budget Group (CAR) Q4 CY2025 Highlights:

- Revenue: $2.66 billion vs analyst estimates of $2.74 billion (1.7% year-on-year decline, 2.9% miss)

- EPS (GAAP): -$21.25 vs analyst estimates of -$0.19 (significant miss)

- Adjusted EBITDA: $5 million vs analyst estimates of $145.8 million (0.2% margin, 96.6% miss)

- Operating Margin: 33%, up from -9% in the same quarter last year

- Free Cash Flow was -$181 million compared to -$579.3 million in the same quarter last year

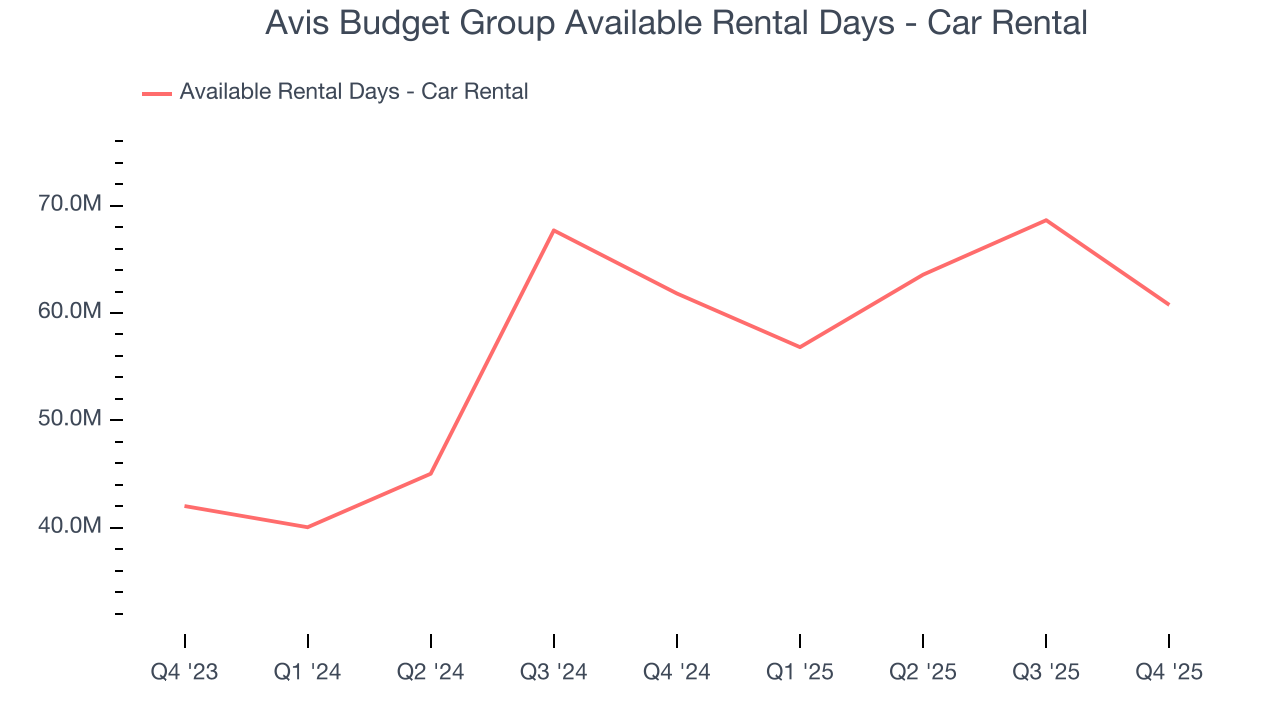

- Available rental days - Car rental: 60.76 million, down 1.06 million year on year

- Market Capitalization: $4.30 billion

Company Overview

The parent company of brands such as Zipcar and Budget Truck Rental, Avis (NASDAQ:CAR) is a provider of car rental and mobility solutions.

Originally established in 1946 by Warren Avis, Avis emerged as one of the first companies in the car rental industry. Over the years, Avis has grown from a single location to a global brand, catering to diverse customer needs in mobility services.

Avis offers car rental options, including sedans, SUVs, trucks, and luxury vehicles, catering to leisure and business travelers. The company also provides mobility solutions through its subsidiary brands like Zipcar, offering convenient car-sharing services in urban areas, and Budget Truck Rental, facilitating affordable moving solutions. Avis' offerings solve the problem of transportation accessibility for individuals and businesses, whether for short-term rentals, long-term leases, or specialized mobility needs.

Revenue is primarily derived from car rental fees, insurance sales, and additional services like GPS navigation and child safety seats. Its business model focuses on providing customers with flexibility, convenience, and affordability, appealing to a broad spectrum of consumers, from budget-conscious travelers to corporate clients.

4. Ground Transportation

The growth of e-commerce and global trade continues to drive demand for shipping services, especially last-mile delivery, presenting opportunities for ground transportation companies. The industry continues to invest in data, analytics, and autonomous fleets to optimize efficiency and find the most cost-effective routes. Despite the essential services this industry provides, ground transportation companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins.

Public competitors in the car rental industry include Hertz (NASDAQ:HTZ), U-Haul (NYSE:UHAL) while a prominent private competitor is Enterprise.

5. Revenue Growth

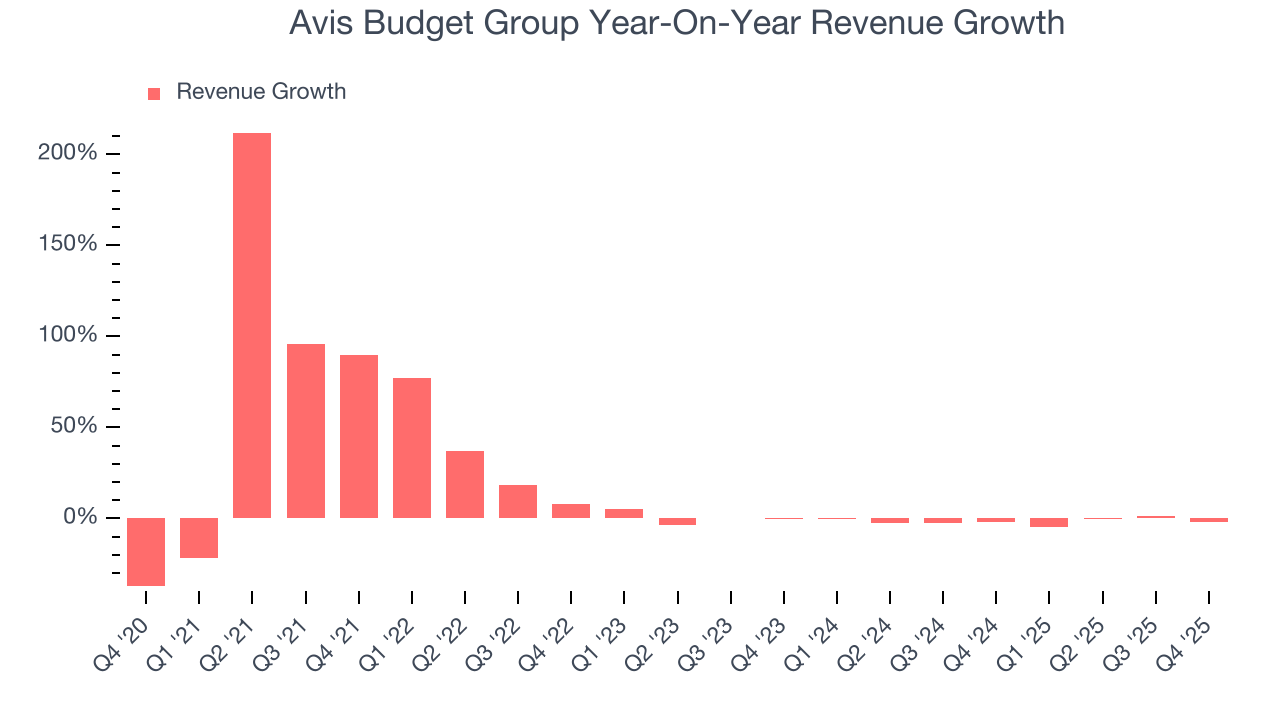

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Luckily, Avis Budget Group’s sales grew at an incredible 16.6% compounded annual growth rate over the last five years. Its growth beat the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Avis Budget Group’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 1.5% over the last two years.

We can dig further into the company’s revenue dynamics by analyzing its number of available rental days - car rental, which reached 60.76 million in the latest quarter. Over the last two years, Avis Budget Group’s available rental days - car rental averaged 26% year-on-year growth. Because this number is higher than its revenue growth during the same period, we can see the company’s monetization has fallen.

This quarter, Avis Budget Group missed Wall Street’s estimates and reported a rather uninspiring 1.7% year-on-year revenue decline, generating $2.66 billion of revenue.

Looking ahead, sell-side analysts expect revenue to grow 1.9% over the next 12 months. While this projection indicates its newer products and services will fuel better top-line performance, it is still below average for the sector.

6. Gross Margin & Pricing Power

All else equal, we prefer higher gross margins because they usually indicate that a company sells more differentiated products and commands stronger pricing power.

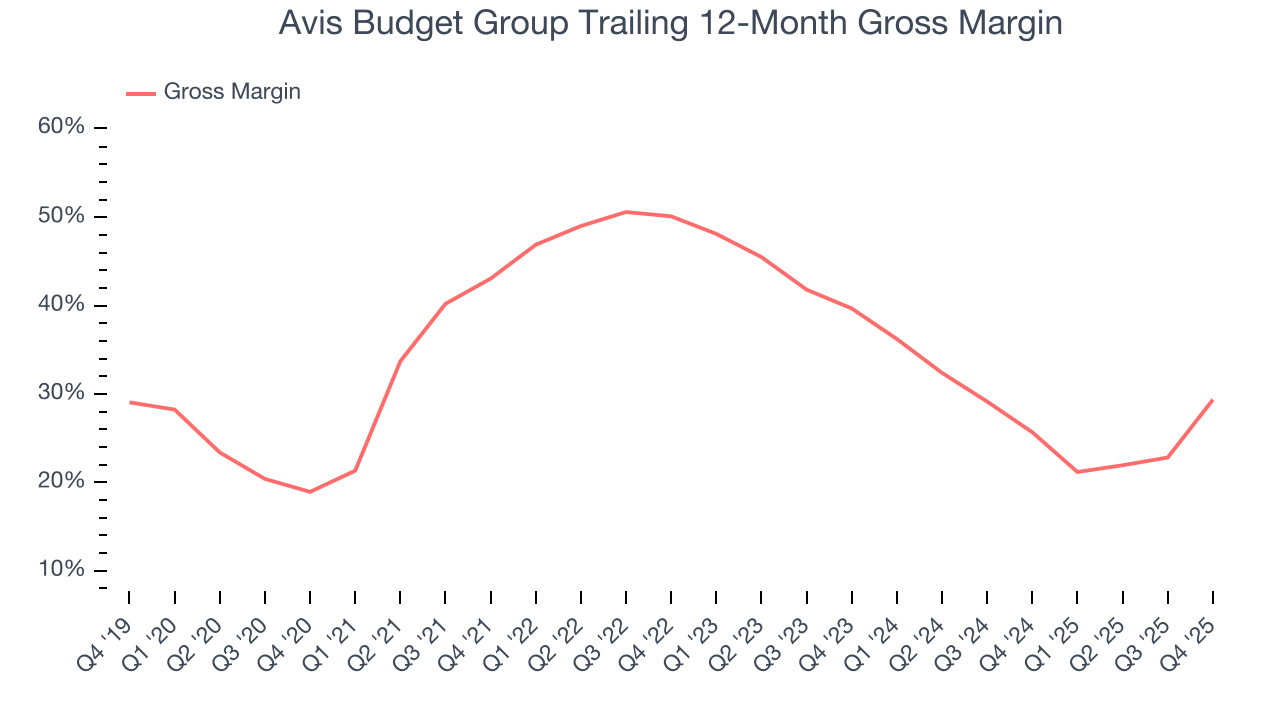

Avis Budget Group’s unit economics are great compared to the broader industrials sector and signal that it enjoys product differentiation through quality or brand. As you can see below, it averaged an excellent 37.4% gross margin over the last five years. That means Avis Budget Group only paid its suppliers $62.58 for every $100 in revenue.

Avis Budget Group’s gross profit margin came in at 45% this quarter, up 28.5 percentage points year on year. Avis Budget Group’s full-year margin has also been trending up over the past 12 months, increasing by 3.7 percentage points. If this move continues, it could suggest better unit economics due to some combination of stable to improving pricing power and input costs (such as raw materials).

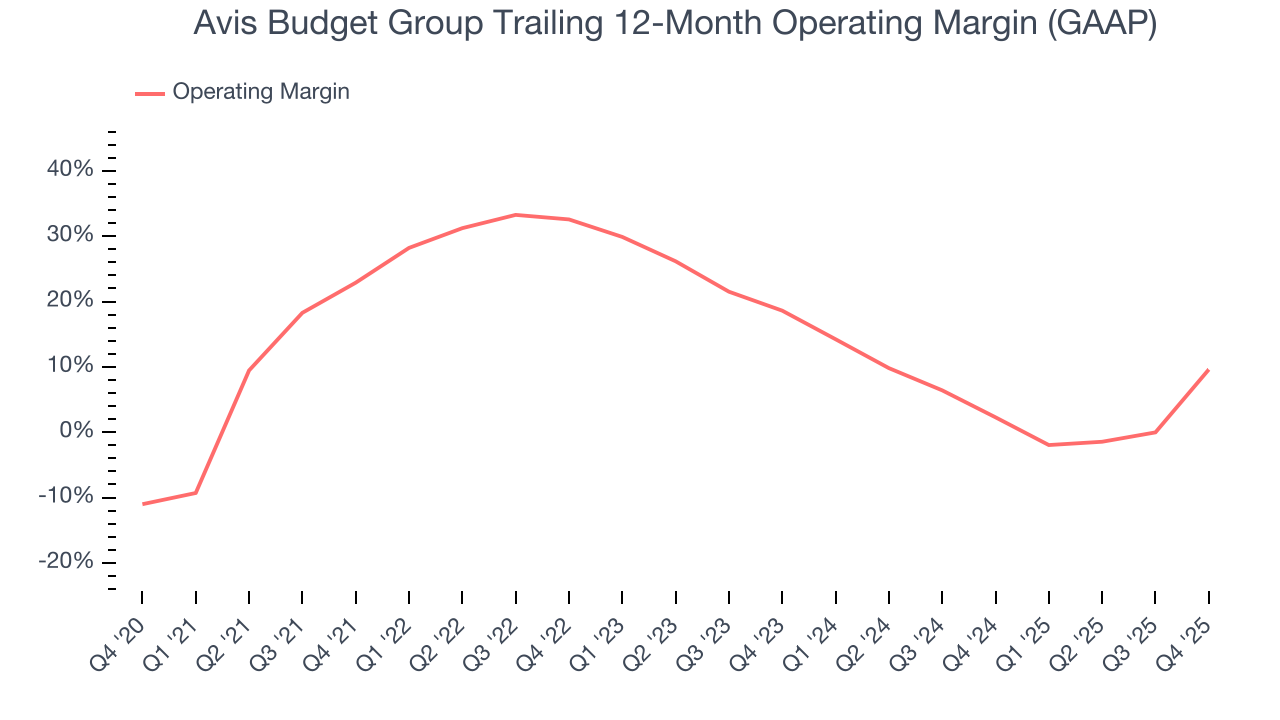

7. Operating Margin

Avis Budget Group has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 17%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Avis Budget Group’s operating margin decreased by 13.3 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, Avis Budget Group generated an operating margin profit margin of 33%, up 41.9 percentage points year on year. The increase was solid, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

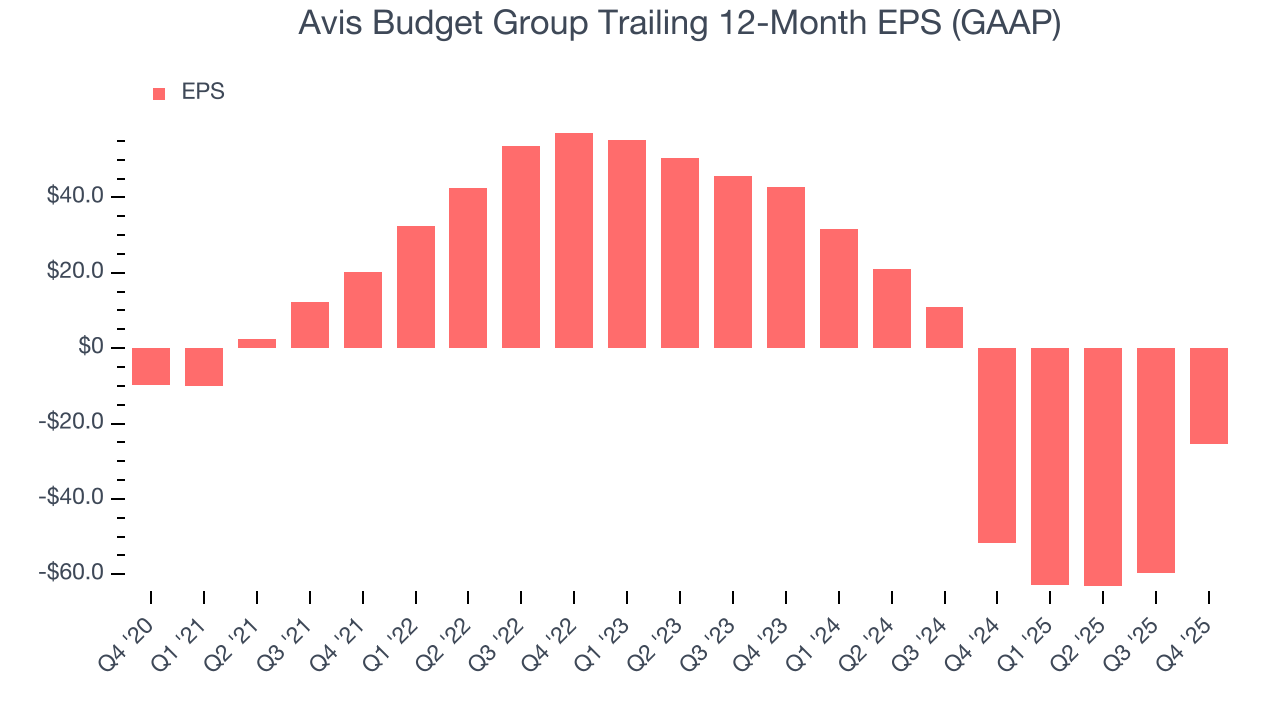

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Avis Budget Group’s earnings losses deepened over the last five years as its EPS dropped 21.2% annually. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Avis Budget Group’s low margin of safety could leave its stock price susceptible to large downswings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Sadly for Avis Budget Group, its EPS declined by more than its revenue over the last two years, dropping 61.1%. This tells us the company struggled to adjust to shrinking demand.

In Q4, Avis Budget Group reported EPS of negative $21.25, up from negative $55.63 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Avis Budget Group’s full-year EPS of negative $25.37 will flip to positive $8.80.

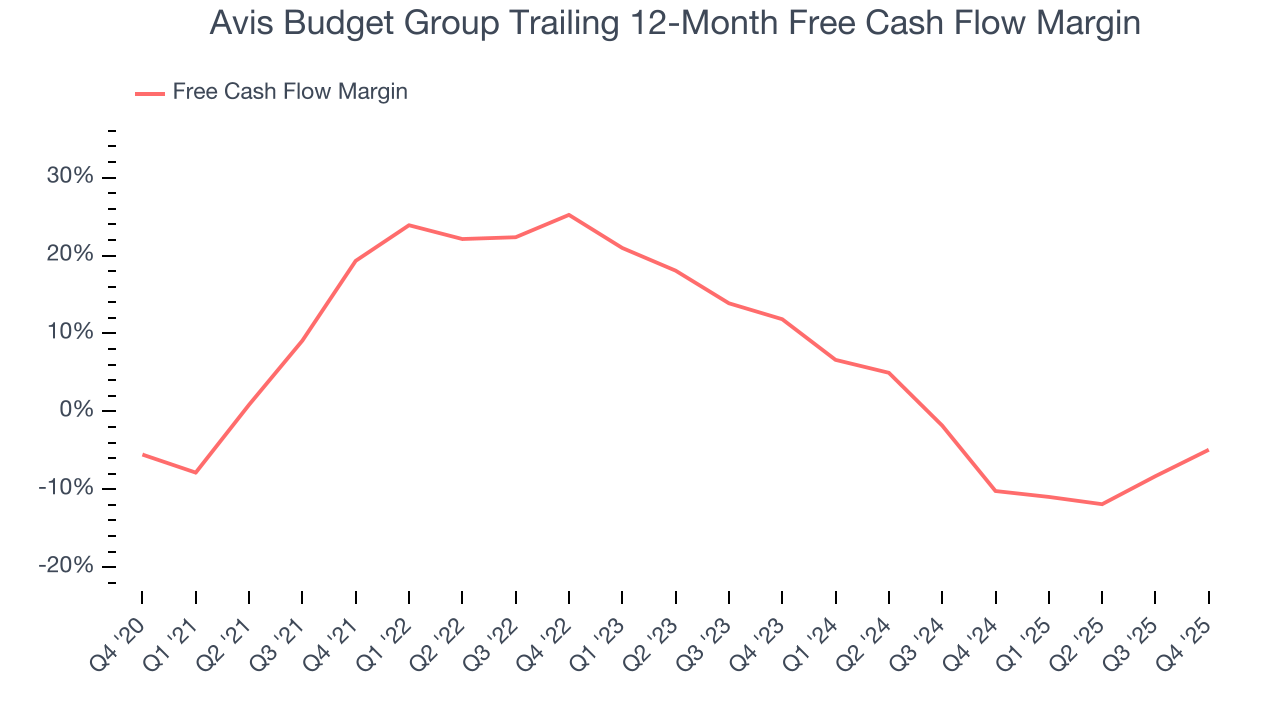

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Avis Budget Group has shown impressive cash profitability, enabling it to ride out cyclical downturns more easily while maintaining its investments in new and existing offerings. The company’s free cash flow margin averaged 7.9% over the last five years, better than the broader industrials sector.

Taking a step back, we can see that Avis Budget Group’s margin dropped by 24.2 percentage points during that time. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. If the longer-term trend returns, it could signal increasing investment needs and capital intensity.

Avis Budget Group burned through $181 million of cash in Q4, equivalent to a negative 6.8% margin. The company’s cash burn slowed from $579.3 million of lost cash in the same quarter last year. These numbers deviate from its longer-term margin, indicating it is a seasonal business that must build up inventory during certain quarters.

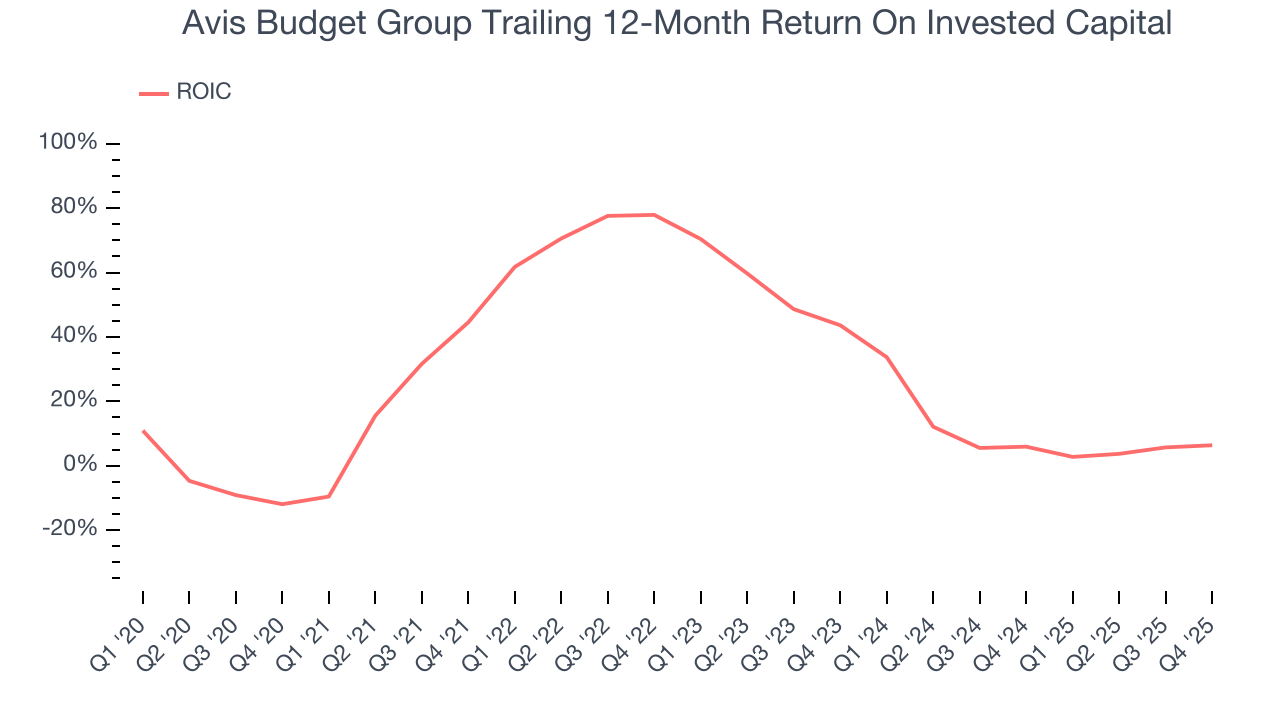

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although Avis Budget Group hasn’t been the highest-quality company lately because of its poor bottom-line (EPS) performance, it found a few growth initiatives in the past that worked out wonderfully. Its five-year average ROIC was 35.7%, splendid for an industrials business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Avis Budget Group’s ROIC has decreased significantly over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

11. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

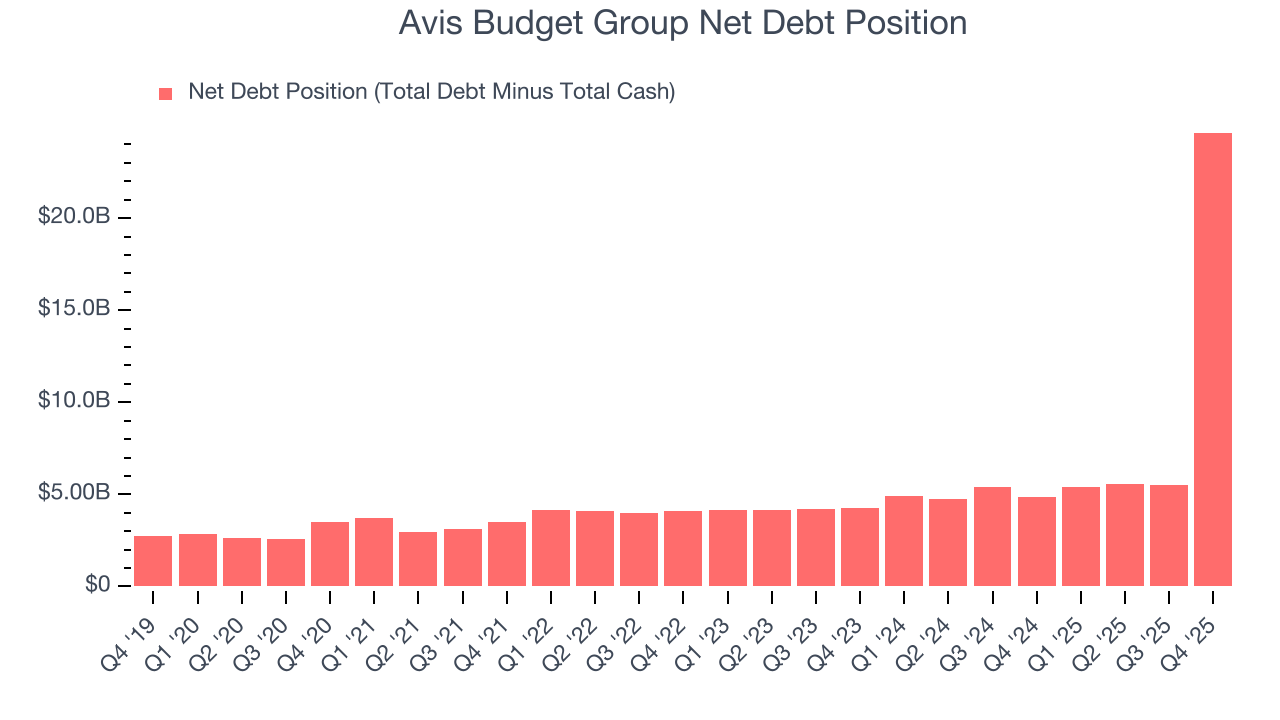

Avis Budget Group burned through $573.9 million of cash over the last year, and its $25.26 billion of debt exceeds the $618 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

Unless the Avis Budget Group’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.

We remain cautious of Avis Budget Group until it generates consistent free cash flow or any of its announced financing plans materialize on its balance sheet.

12. Key Takeaways from Avis Budget Group’s Q4 Results

We struggled to find many positives in these results. Its revenue missed and its EBITDA fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 5.3% to $109.26 immediately after reporting.

13. Is Now The Time To Buy Avis Budget Group?

Updated: February 18, 2026 at 4:13 PM EST

Before making an investment decision, investors should account for Avis Budget Group’s business fundamentals and valuation in addition to what happened in the latest quarter.

Avis Budget Group falls short of our quality standards. Although its revenue growth was exceptional over the last five years, it’s expected to deteriorate over the next 12 months and its diminishing returns show management's prior bets haven't worked out. And while the company’s projected EPS for the next year implies the company’s fundamentals will improve, the downside is its declining EPS over the last five years makes it a less attractive asset to the public markets.

Avis Budget Group’s P/E ratio based on the next 12 months is 13.5x. While this valuation is reasonable, we don’t see a big opportunity at the moment. There are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $139.43 on the company (compared to the current share price of $109.26).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.