Instacart (CART)

We love companies like Instacart. Its efficient marketing engine and robust unit economics tee it up for immense long-term profits.― StockStory Analyst Team

1. News

2. Summary

Why We Like Instacart

Powering more than one billion grocery orders since its founding, Instacart (NASDAQ:CART) is an online grocery shopping and delivery platform that partners with retailers to help customers shop from local stores through its app or website.

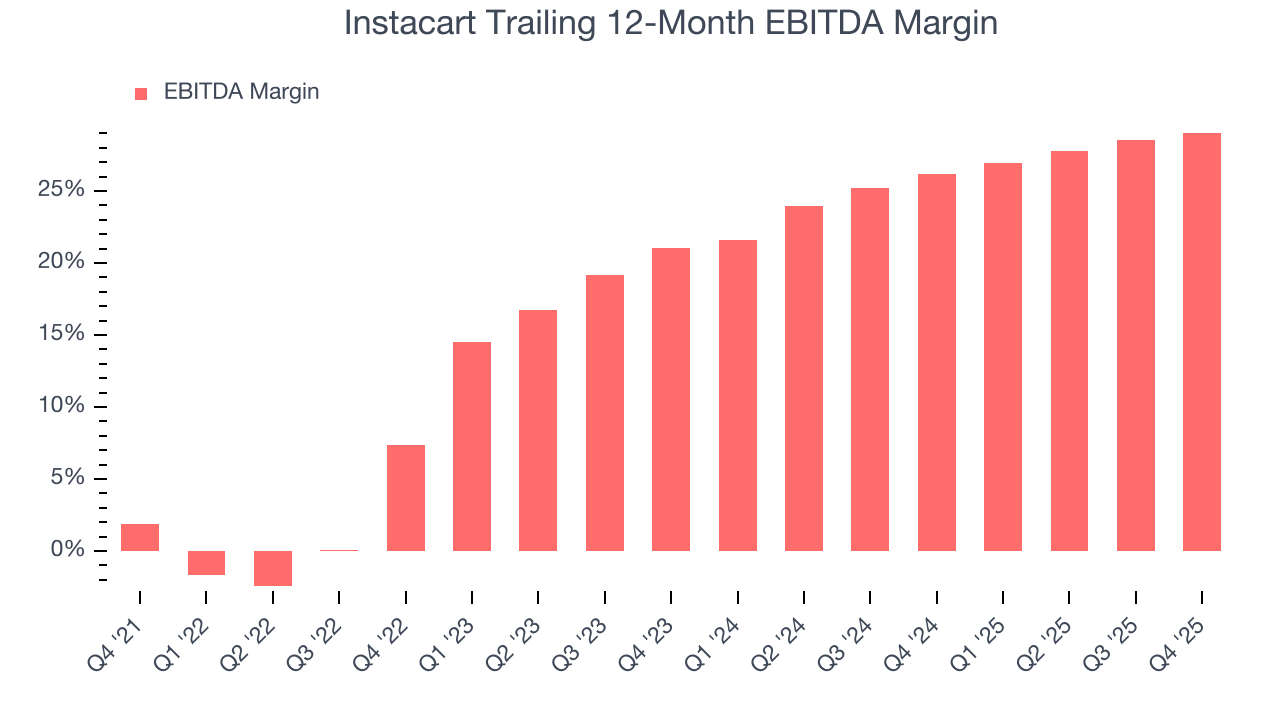

- Disciplined cost controls and effective management have materialized in a strong EBITDA margin, and its rise over the last few years was fueled by some leverage on its fixed costs

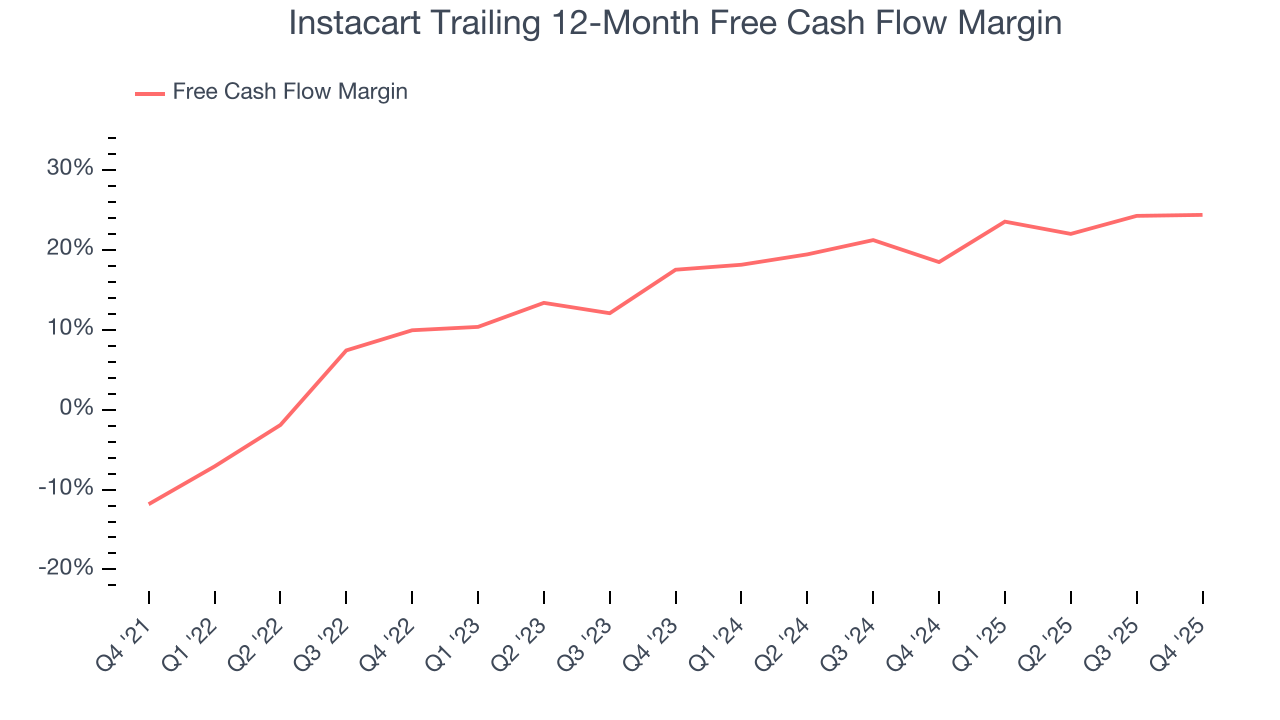

- Impressive free cash flow profitability enables the company to fund new investments or reward investors with share buybacks/dividends, and its improved cash conversion implies it’s becoming a less capital-intensive business

- Platform is difficult to replicate at scale and leads to a stellar gross margin of 74.4%

Instacart is a top-tier company. The price looks reasonable in light of its quality, so this might be a prudent time to invest in some shares.

Why Is Now The Time To Buy Instacart?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Instacart?

Instacart is trading at $38.28 per share, or 6.7x forward EV/EBITDA. The valuation sure appears attractive, and we suspect the stock is trading below its intrinsic value when factoring in its business quality.

We at StockStory love when high-quality companies go on sale because it enables investors to profit from earnings growth and a potential re-rating - the coveted “double play”.

3. Instacart (CART) Research Report: Q4 CY2025 Update

Online grocery delivery platform Instacart (NASDAQ:CART) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 12.3% year on year to $992 million. Its GAAP profit of $0.30 per share was 41.3% below analysts’ consensus estimates.

Instacart (CART) Q4 CY2025 Highlights:

- Revenue: $992 million vs analyst estimates of $972.2 million (12.3% year-on-year growth, 2% beat)

- EPS (GAAP): $0.30 vs analyst expectations of $0.51 (41.3% miss)

- Adjusted EBITDA: $303 million vs analyst estimates of $292.4 million (30.5% margin, 3.6% beat)

- Operating Margin: 9.9%, down from 17.6% in the same quarter last year

- Free Cash Flow Margin: 17.3%, down from 29% in the previous quarter

- Market Capitalization: $8.65 billion

Company Overview

Powering more than one billion grocery orders since its founding, Instacart (NASDAQ:CART) is an online grocery shopping and delivery platform that partners with retailers to help customers shop from local stores through its app or website.

Instacart serves as a technology bridge connecting retailers, customers, brands, and shoppers across North America. The company's platform reaches over 95% of North American households and partners with more than 1,500 retail banners, from national chains to local grocers. Its technology suite consists of three main pillars: Instacart Marketplace, Instacart Enterprise Platform, and Instacart Ads.

The Instacart Marketplace allows customers to browse and purchase groceries from their favorite local stores, with items picked and delivered by Instacart's community of approximately 600,000 shoppers. For retailers, the Enterprise Platform provides modular technology solutions including eCommerce storefronts, fulfillment capabilities, in-store technologies like smart carts and scan-and-pay systems, advertising tools, and analytics dashboards.

The company's advertising business serves as a significant revenue stream, connecting over 5,500 brands with consumers at the point of purchase. These ads appear throughout the shopping journey, from product discovery to checkout, allowing brands to influence purchase decisions and measure return on investment.

Instacart's business model generates revenue through multiple channels: delivery and service fees paid by customers, membership fees from its Instacart+ subscription service, advertising revenue from brands, and technology licensing fees from retailers using its Enterprise Platform. The company's machine learning algorithms process billions of data points daily to optimize everything from personalized product recommendations to shopper routing and delivery logistics.

4. Online Marketplace

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

Instacart competes with other grocery delivery services like DoorDash (NYSE:DASH), Uber Eats (NYSE:UBER), Amazon Fresh (NASDAQ:AMZN), and Walmart's (NYSE:WMT) delivery options, as well as retailers' own delivery services.

5. Revenue Growth

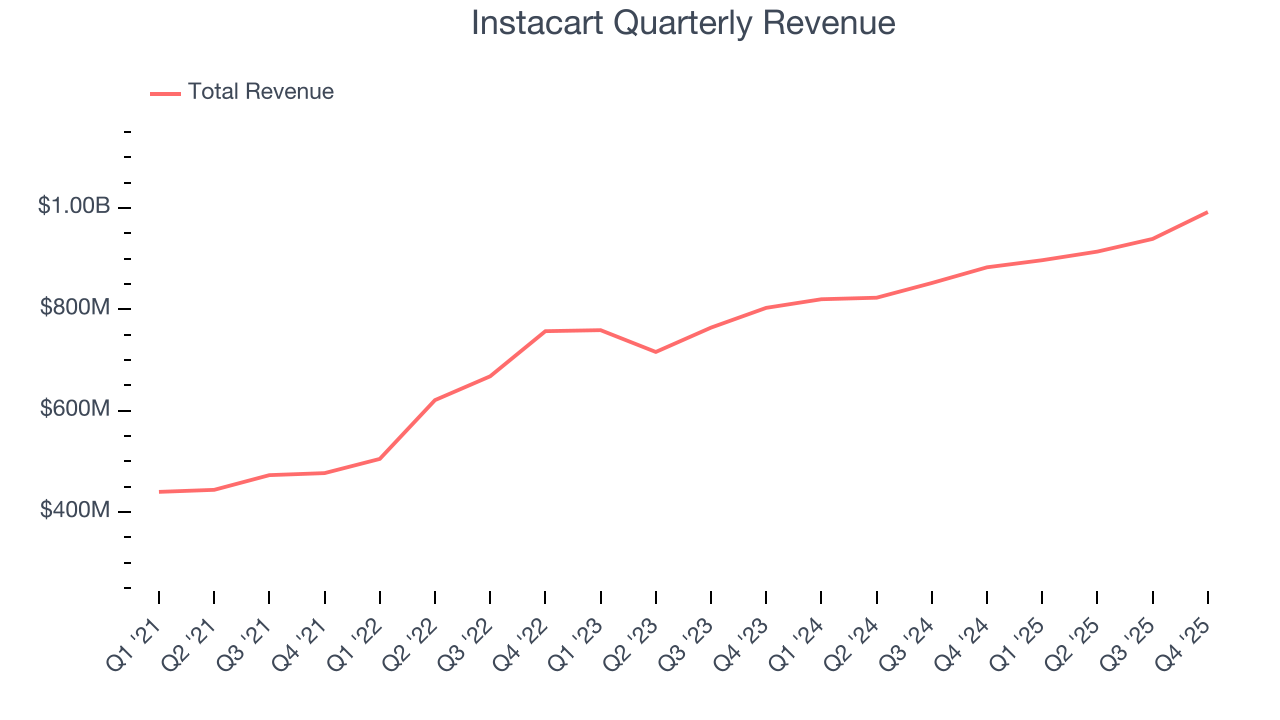

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last three years, Instacart grew its sales at a decent 13.6% compounded annual growth rate. Its growth was slightly above the average consumer internet company and shows its offerings resonate with customers.

This quarter, Instacart reported year-on-year revenue growth of 12.3%, and its $992 million of revenue exceeded Wall Street’s estimates by 2%.

Looking ahead, sell-side analysts expect revenue to grow 8.8% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and implies its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

6. Gross Margin & Pricing Power

A company’s gross profit margin has a significant impact on its ability to exert pricing power, develop new products, and invest in marketing. These factors can determine the winner in a competitive market.

For online marketplaces like Instacart, gross profit tells us how much money the company gets to keep after covering the base cost of its products and services, which typically include payment processing, hosting, and bandwidth fees in addition to the costs necessary to onboard buyers and sellers, such as identity verification.

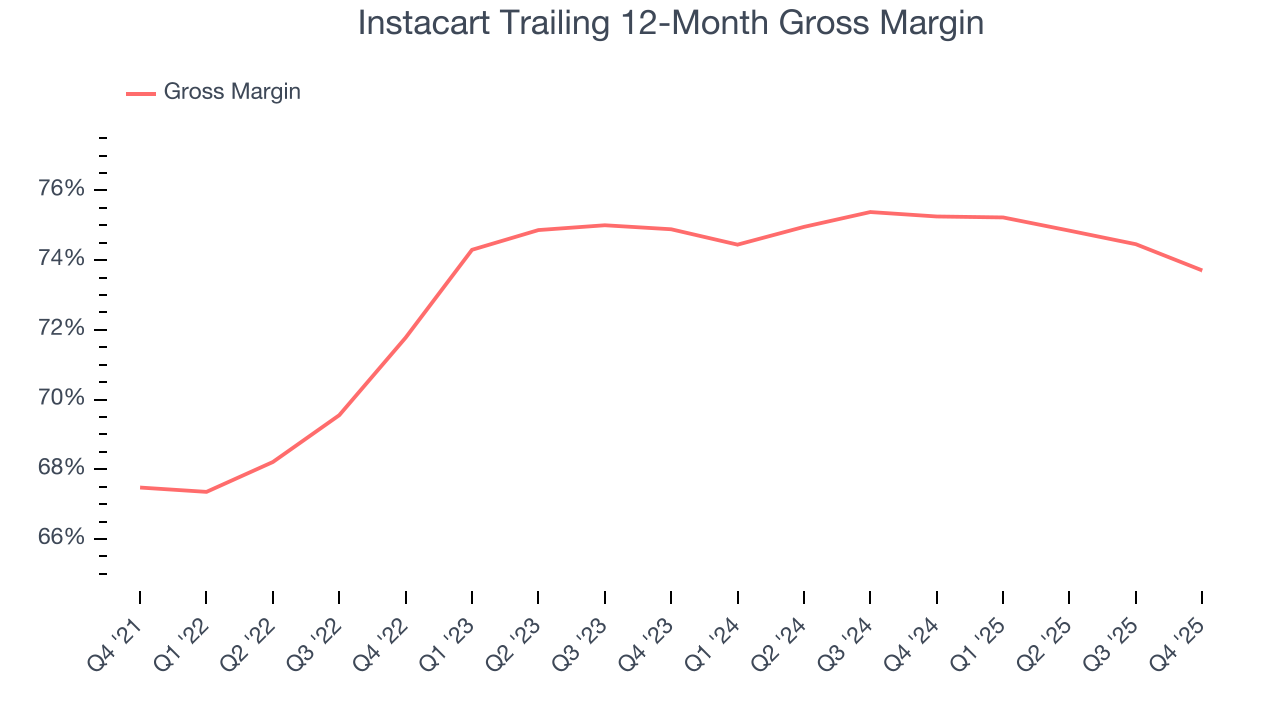

Instacart has robust unit economics, an output of its asset-lite business model and pricing power. Its margin is better than the broader consumer internet industry and enables the company to fund large investments in new products and marketing during periods of rapid growth to achieve higher profits in the future. As you can see below, it averaged an excellent 74.4% gross margin over the last two years. That means Instacart only paid its providers $25.56 for every $100 in revenue.

This quarter, Instacart’s gross profit margin was 72.3%, down 2.9 percentage points year on year. Instacart’s full-year margin has also been trending down over the past 12 months, decreasing by 1.5 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs.

7. User Acquisition Efficiency

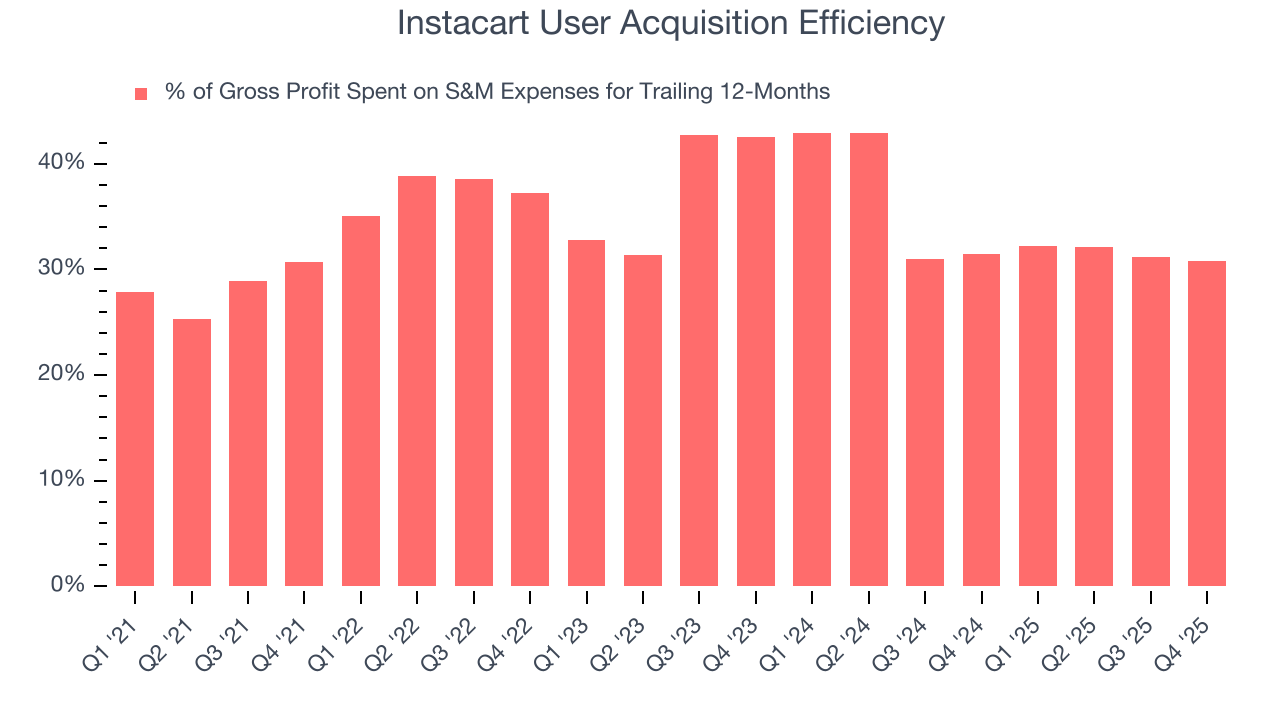

Unlike enterprise software that’s typically sold by dedicated sales teams, consumer internet businesses like Instacart grow from a combination of product virality, paid advertisement, and incentives.

Instacart is quite efficient at acquiring new users, spending only 30.8% of its gross profit on sales and marketing expenses over the last year. This efficiency indicates that Instacart has a highly differentiated product offering, giving it the freedom to invest its resources into new growth initiatives.

8. EBITDA

Instacart has been a well-oiled machine over the last two years. It demonstrated elite profitability for a consumer internet business, boasting an average EBITDA margin of 27.7%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Instacart’s EBITDA margin rose by 21.7 percentage points over the last few years, as its sales growth gave it immense operating leverage.

This quarter, Instacart generated an EBITDA margin profit margin of 30.5%, up 2 percentage points year on year. The increase was encouraging, and because its gross margin actually decreased, we can assume it was more efficient because its operating expenses like marketing, R&D, and administrative overhead grew slower than its revenue.

9. Earnings Per Share

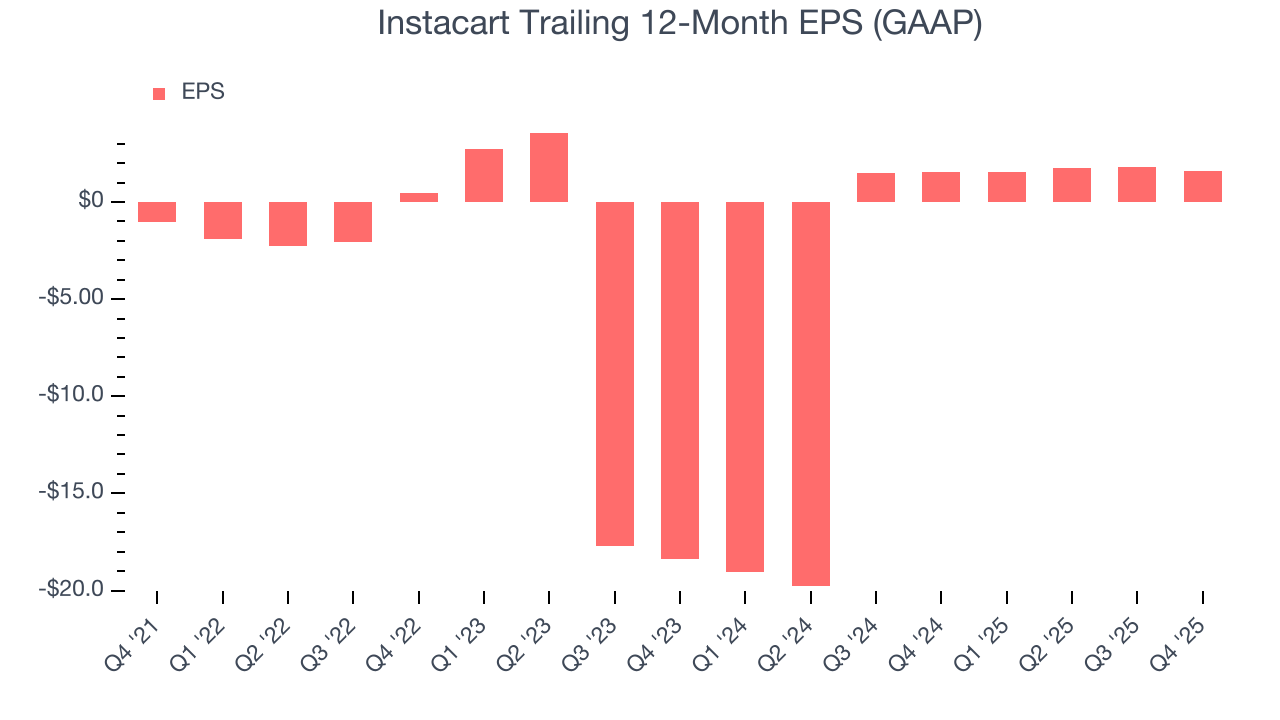

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Instacart’s EPS grew at an astounding 49.9% compounded annual growth rate over the last three years, higher than its 13.6% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Instacart’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, Instacart’s EBITDA margin expanded by 21.7 percentage points over the last three years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Instacart reported EPS of $0.30, down from $0.52 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Instacart’s full-year EPS of $1.60 to grow 39.2%.

10. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Instacart has shown terrific cash profitability, driven by its lucrative business model and cost-effective customer acquisition strategy that enable it to stay ahead of the competition through investments in new products rather than sales and marketing. The company’s free cash flow margin was among the best in the consumer internet sector, averaging 21.5% over the last two years.

Taking a step back, we can see that Instacart’s margin expanded by 14.4 percentage points over the last few years. This is encouraging because it gives the company more optionality.

Instacart’s free cash flow clocked in at $172 million in Q4, equivalent to a 17.3% margin. This result was good as its margin was 1.4 percentage points higher than in the same quarter last year, building on its favorable historical trend.

11. Balance Sheet Assessment

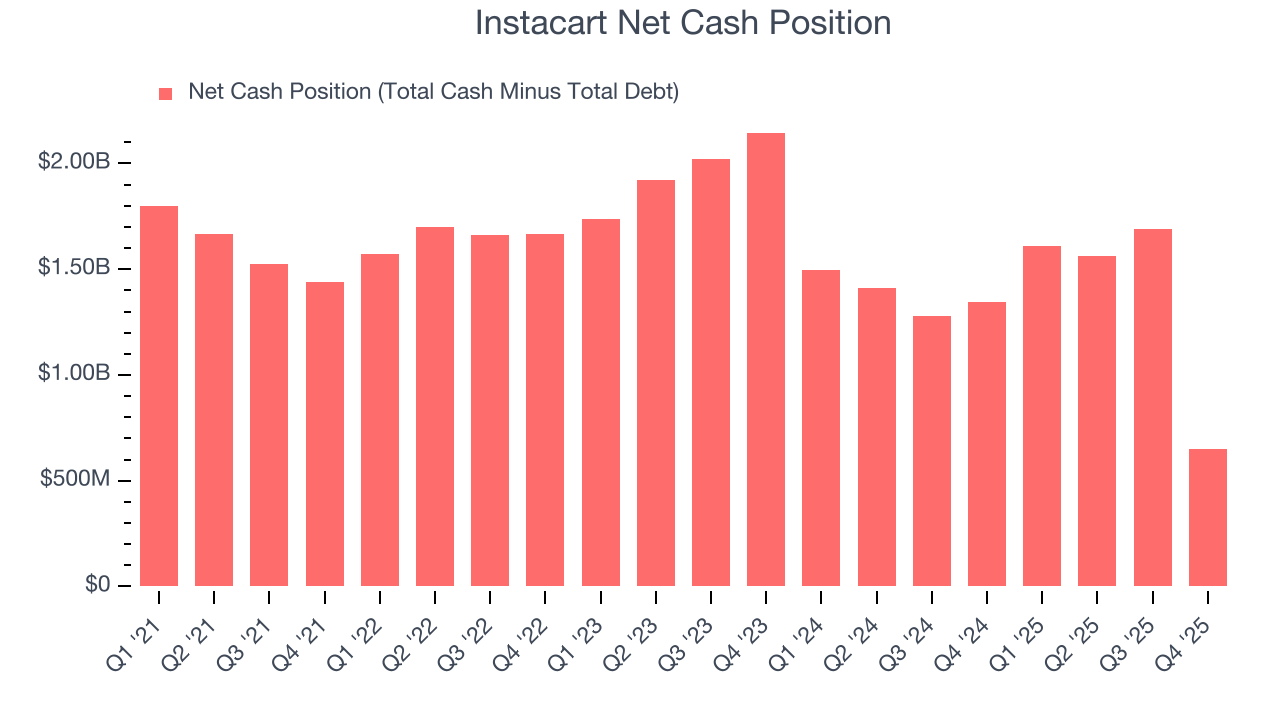

Businesses that maintain a cash surplus face reduced bankruptcy risk.

Instacart is a profitable, well-capitalized company with $687 million of cash and $36 million of debt on its balance sheet. This $651 million net cash position is 7.5% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Instacart’s Q4 Results

It was encouraging to see Instacart beat analysts’ revenue and EBITDA expectations this quarter. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 14.6% to $38.27 immediately after reporting.

13. Is Now The Time To Buy Instacart?

Updated: February 12, 2026 at 11:21 PM EST

Are you wondering whether to buy Instacart or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

Instacart is a high-quality business worth owning. First of all, the company’s revenue growth was good over the last three years. And while its declining EPS over the last two years makes it a less attractive asset to the public markets, its impressive EBITDA margins show it has a highly efficient business model. On top of that, Instacart’s rising cash profitability gives it more optionality.

Instacart’s EV/EBITDA ratio based on the next 12 months is 6.7x. Looking across the spectrum of consumer internet businesses, Instacart’s fundamentals shine bright. We like the stock at this bargain price.

Wall Street analysts have a consensus one-year price target of $49.96 on the company (compared to the current share price of $38.28), implying they see 30.5% upside in buying Instacart in the short term.